Farmers & Merchants Bank of Long Beach (OTCBB:FMBL) today

reported financial results for the third quarter ended September

30, 2012.

“We continued to achieve profitability in the third quarter and

nine-month period, while focusing on the long-term strength of the

Bank by maintaining the asset quality of our loan portfolio,” said

Henry Walker, president of Farmers & Merchants Bank of Long

Beach. “In an increasingly competitive lending environment, we

remain committed to forming relationships that are in the best

interest of the Bank, shareholders and community we’ve been serving

for more than a century.”

Income Statement

For the 2012 third quarter, interest income decreased to $41.5

million from $44.6 million earned in the 2011 third quarter.

Interest income for the nine-month period ended September 30, 2012

was $130.7 million, compared with $135.3 million reported for the

same period in 2011. These results were impacted by the mix of

securities and loans with lower yields available for

securities.

Interest expense for the 2012 third quarter declined to $1.7

million from $2.3 million in last year’s third quarter. Interest

expense for the nine-month period ended September 30, 2012 declined

to $5.4 million from $7.5 million reported for the same period last

year. The Bank’s overall cost of funds continues to reflect the low

interest rate environment and the impact of non-interest bearing

deposits.

Net interest income for the 2012 third quarter decreased to

$39.8 million from $42.2 million for the third quarter of 2011, and

to $125.3 million for the first nine months of 2012 from $127.8

million for the same period in 2011.

The Bank did not have a provision for loan losses in the third

quarter of 2012 or during the first nine months of the year amid

improving economic conditions. Provision for loan losses in the

third quarter of 2011 totaled $2.0 million and $8.8 million for the

first nine months of 2011. The Bank’s allowance for loan losses as

a percentage of loans outstanding was 2.91% at September 30, 2012,

compared with 2.80% at December 31, 2011.

Non-interest income increased to $3.4 million for the 2012 third

quarter from $3.3 million in the third quarter a year ago.

Non-interest income was $12.0 million for the nine-month period

ended September 30, 2012, compared with $9.9 million for the same

period in 2011.

Non-interest expense for the 2012 third quarter was $22.0

million, versus $18.8 million for the same period last year.

Non-interest expense for the first nine months of 2012 was $63.7

million, compared with $58.6 million last year.

The Bank's net interest margin was 3.51% for the third quarter

ended September 30, 2012 and 3.76% for the first nine months of

2012.

Net income for the 2012 third quarter decreased to $14.9

million, or $113.67 per diluted share, from $16.0 million, or

$121.85 per diluted share, in the year-ago period. The Bank’s net

income for the first nine months of 2012 rose to $50.1 million, or

$383.02 per diluted share, from $45.3 million, or $346.23 per

diluted share, for the same period in 2011.

Balance Sheet

At September 30, 2012, net loans totaled $1.92 billion, compared

with $2.03 billion at December 31, 2011. The Bank’s deposits

totaled $3.53 billion at the end of the 2012 third quarter,

compared with $3.39 billion at December 31, 2011. Non-interest

bearing deposits represented 38.0% of total deposits at September

30, 2012, versus 37.2% of total deposits at December 31, 2011.

Total assets increased to $4.87 billion at the close of the 2012

third quarter, compared with $4.66 billion at the close of the

prior year.

At September 30, 2012, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 29.89%, a Tier 1 risk-based capital

ratio of 28.62%, and a Tier 1 leverage ratio of 14.46%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“We reported solid year-to-date deposit growth in the third

quarter, as the strength and reputation of the Bank continued to

resonate with customers amid economic uncertainty,” said Daniel

Walker, chief executive officer and chairman of the board.

“Additionally, as the Bank moves forward in its 105th year of

serving Southern California, we believe the investments we have

made in our infrastructure in 2012 position us well for the

future.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 21 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG

BEACH

Income Statements (Unaudited)

(In Thousands)

Three Months Ended Sept

30, Nine Months Ended Sept 30,

2012 2011

2012 2011

Interest income: Loans $ 26,741 $ 28,892 $ 86,097 $

86,728 Securities held-to-maturity 11,848 11,997 35,392 37,431

Securities available-for-sale 2,639 3,521 8,430 10,862 Deposits

with banks 294 162 764 273 Total interest income 41,522

44,572 130,683 135,294

Interest expense:

Deposits 1,433 1,971 4,512 6,211 Securities sold under agreement to

repurchase 305 373 854 1,241 Total interest expense 1,738

2,344 5,366 7,452 Net interest income 39,784 42,228 125,317

127,842

Provision for loan losses - 2,000 - 8,750

Net interest income after provision for loan losses 39,784

40,228 125,317 119,092

Non-interest income:

Service charges on deposit accounts 1,110 1,281 3,462 3,633 Gains

on sale of securities 41 103 42 103 Merchant bankcard fees 433 348

1,334 903 Escrow fees 201 227 631 704 Other income 1,585 1,293

6,500 4,548 Total non-interest income 3,370 3,252 11,969

9,891

Non-interest expense: Salaries and employee

benefits 11,695 10,925 35,259 31,963 FDIC and other insurance

expense 1,634 1,208 4,813 3,029 Occupancy expense 1,383 1,464 4,119

4,127 Equipment expense 1,366 1,381 4,082 4,112 Other real estate

owned expense, net 401 318 939 2,360 Amortization of investments in

low-income communities 1,866 450 5,897 1,353 Legal and professional

fees 883 962 1,929 2,575 Marketing and promotional expense 1,374

933 2,607 2,838 Other expense 1,310 1,156 4,057 6,206 Total

non-interest expense 21,912 18,797 63,702 58,563 Income

before income tax expense 21,242 24,683 73,584 70,420

Income tax expense 6,359 8,729 23,436 25,088

Net

income $ 14,883 $ 15,954 $

50,148 $ 45,332 Basic and diluted

earnings per common share $ 113.67 $ 121.85 $ 383.02 $ 346.23

FARMERS & MERCHANTS BANK OF LONG

BEACH

Balance Sheets (Unaudited)

(In Thousands)

Sept. 30, 2012

Dec. 31, 2011

Assets Cash and due from banks: Non-interest-bearing

balances $ 55,474 $ 57,394 Interest-bearing balances 306,778

278,525 Securities held-to-maturity 1,786,848 1,564,841 Securities

available-for-sale 629,253 548,289 Gross loans 1,975,505 2,087,388

Less allowance for loan losses (57,530 ) (58,463 ) Less unamortized

deferred loan fees, net (330 ) (418 ) Net loans 1,917,645

2,028,507 Other real estate owned, net 22,586 23,036

Investments in low-income communities 37,669 43,566 Bank premises

and equipment, net 60,077 55,155 Accrued interest receivable 18,161

16,464 Net deferred tax assets 28,210 28,583 Other assets 8,901

14,985

Total assets $

4,871,602 $ 4,659,345

Liabilities and stockholders' equity

Liabilities: Deposits: Demand, non-interest bearing $

1,341,647 $ 1,263,162 Demand, interest bearing 314,979 300,984

Savings and money market savings 993,621 909,794 Time deposits

878,100 919,538 Total deposits 3,528,347

3,393,478 Securities sold under agreements to repurchase

595,173 555,992 Other liabilities 36,182 39,659

Total liabilities 4,159,702

3,989,129 Stockholders' Equity:

Common Stock, par value $20;

authorized250,000 shares; issued and outstanding130,928 shares

2,619 2,619 Surplus 12,044 12,044 Retained earnings 688,607 646,708

Accumulated other comprehensive income 8,630 8,845

Total stockholders' equity 711,900

670,216 Total liabilities and stockholders'

equity $ 4,871,602 $

4,659,345

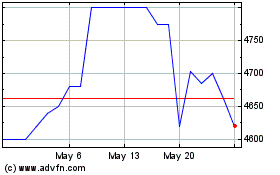

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025