Farmers & Merchants Bank of Long Beach (OTCBB: FMBL) today

announced financial results for the fourth quarter and full year

ended December 31, 2012.

“We achieved solid financial results for 2012, including another

year of record earnings, despite an increasingly challenging

regulatory and interest rate environment,” said Henry Walker,

president of Farmers & Merchants Bank of Long Beach. “We also

made several key hires during the year, including a new chief

credit officer, chief auditor, chief information officer and

supporting staff, which will further enhance our position of

strength as we enter 2013.”

Income Statement

For the 2012 fourth quarter, total interest income was $40.4

million, compared with $43.3 million in the fourth quarter of 2011.

Total interest income for the year ended December 31, 2012 was

$171.1 million, compared with $178.6 million reported for 2011.

Interest expense for the 2012 fourth quarter fell to $1.6

million from $2.0 million in the same quarter of 2011. Interest

expense for the full 2012 year declined to $7.0 million from $9.5

million in 2011. The Bank’s overall cost of funds continued to

reflect the low interest rate environment and the impact of

non-interest bearing deposits.

The Bank’s net interest income for the 2012 fourth quarter was

$38.8 million, compared with net interest income of $41.3 million

for the same quarter of 2011. Net interest income for 2012 was

$164.1 million, versus $169.2 million in 2011. Farmers &

Merchant’s net interest margin was 3.65% for the year ended

December 31, 2012, compared with 4.08% in the previous year.

The Bank did not have a provision for loan losses in the fourth

quarter of 2012 or for the year ended December 31, 2012, reflecting

stabilization of the asset quality of the Bank’s loan portfolio.

Provision for loan losses in the fourth quarter of 2011 totaled

$5.5 million and was $14.2 for the full 2011 year. The Bank’s

allowance for loan losses as a percentage of loans outstanding was

2.85% at December 31, 2012, compared with 2.80% at December 31,

2011.

Non-interest income was $3.9 million for the 2012 fourth

quarter, compared with $4.0 million in the 2011 fourth quarter.

Non-interest income for the full 2012 year totaled $15.9 million,

versus $13.9 million for 2011.

Non-interest expense for the 2012 fourth quarter was $24.1

million, compared with $19.9 million for the same period last year.

Non-interest expense for the year ended December 31, 2012 was $87.8

million, compared with $78.4 million last year.

The Bank’s net income for the 2012 fourth quarter was $13.2

million, or $101.12 per diluted share, compared with $13.8 million,

or $105.30 per diluted share, in the 2011 fourth quarter. The

Bank’s net income for 2012 rose to $63.4 million, or $484.14 per

diluted share, from $59.1 million, or $451.53 per diluted share,

for 2011.

Balance Sheet

At December 31, 2012, net loans totaled $1.93 billion, compared

with $2.03 billion at December 31, 2011. The Bank’s deposits grew

to $3.69 billion at the end of 2012, from $3.39 billion at December

31, 2011. Non-interest bearing deposits represented 40.0% of total

deposits at December 31, 2012, versus 37.2% of total deposits at

December 31, 2011. Total assets increased to $4.99 billion at the

close of 2012 from $4.66 billion at December 31, 2011.

At December 31, 2012, Farmers & Merchants Bank remained

“well-capitalized” under all regulatory categories, with a total

risk-based capital ratio of 29.61%, a Tier 1 risk-based capital

ratio of 28.35%, and a Tier 1 leverage ratio of 14.24%. The minimum

ratios for capital adequacy for a well-capitalized bank are 10.00%,

6.00% and 5.00%, respectively.

“We continued to build on the asset quality of our loan

portfolio and experienced solid deposit growth in 2012 – two

characteristics that reflect Farmers & Merchants’ commitment to

the long-term success of the Bank,” said Daniel Walker, chief

executive officer and chairman of the board. “Additionally, we

believe the strategic investments we made in 2012, in both

personnel and technology enhancements, will help continue to

distinguish Farmers & Merchants Bank as one of the strongest

banks in the region.”

About Farmers & Merchants Bank of Long Beach

Farmers & Merchants Bank of Long Beach provides personal and

business banking services through 21 offices in Los Angeles and

Orange Counties. Founded in 1907 by C.J. Walker, the Bank

specializes in commercial and small business banking along with

business loan programs.

FARMERS & MERCHANTS BANK OF LONG BEACH Income

Statements (Unaudited) (In Thousands)

Three Months Ended Dec.

31, Twelve Months Ended Dec. 31, 2012

2011 2012 2011

Interest income: Loans $ 26,060 $ 28,667 $

112,157 $ 115,395 Securities held-to-maturity 11,678 11,303 47,112

48,734 Securities available-for-sale 2,406 3,118 10,794 13,980

Deposits with banks 287 224 1,051

497 Total interest income 40,431 43,312

171,114 178,606

Interest

expense: Deposits 1,328 1,709 5,840 7,920 Securities

sold under agreement to repurchase 293 294

1,147 1,535 Total interest expense

1,621 2,003 6,987 9,455 Net

interest income 38,810 41,309 164,127 169,151

Provision

for loan losses - 5,450 -

14,200 Net interest income after provision for loan losses

38,810 35,859 164,127 154,951

Non-interest income: Service charges on

deposit accounts 1,136 1,481 4,598 5,114 Gains on sale of

securities 303 71 345 174 Merchant bankcard fees 376 354 1,710

1,257 Escrow fees 227 220 858 924 Other income 1,867

1,888 8,366 6,436 Total non-interest

income 3,909 4,014 15,877 13,905

Non-interest expense: Salaries and employee

benefits 13,012 9,850 48,271 41,814 FDIC and other insurance

expense 1,667 1,643 6,479 4,671 Occupancy expense 1,368 1,374 5,487

5,501 Equipment expense 1,718 1,322 5,800 5,435 Other real estate

owned expense,net 740 1,081 1,679 3,441 Amortization of investments

in LIC 1,866 2,541 7,762 3,894 Legal and professional fees 953

1,321 2,882 3,896 Marketing and promotional expense 1,067 1,096

3,674 3,934 Other expense 1,669 (364 ) 5,727

5,842 Total non-interest expense 24,060

19,864 87,761 78,428 Income before

income tax expense 18,659 20,009 92,243 90,428

Income tax

expense 5,420 6,223 28,856

31,310

Net income $ 13,239 $

13,786 $ 63,387 $ 59,118

Basic and diluted earnings per common share $ 101.12 $

105.30 $ 484.14 $ 451.53

FARMERS & MERCHANTS

BANK OF LONG BEACH Balance Sheets (Unaudited) (In

Thousands) Dec. 31,

2012 Dec. 31, 2011 Assets Cash and due

from banks: Noninterest-bearing balances $ 60,914 $ 57,394

Interest-bearing balances 253,087 278,525 Securities

held-to-maturity 1,942,085 1,564,841 Securities available for sale

630,055 548,289 Gross loans 1,990,146 2,087,388 Less allowance for

loan losses (56,700 ) (58,463 ) Less unamortized deferred loan

fees, net (364 ) (418 ) Net loans 1,933,082

2,028,507 Other real estate owned, net 17,696

23,036 Investments in low-income communities (LIC) 35,804 43,566

Bank premises and equipment, net 60,504 55,155 Accrued interest

receivable 18,542 16,464 Net deferred tax assets 28,302 28,583

Other assets 8,890 14,985

Total assets $ 4,988,961 $

4,659,345 Liabilities and stockholders'

equity Liabilities: Deposits: Demand,

non-interest bearing $ 1,474,215 $ 1,263,162 Demand, interest

bearing 346,991 300,984 Savings and money market savings 1,011,029

909,794 Time deposits 853,631 919,538

Total deposits 3,685,866 3,393,478 Securities sold

under agreements to repurchase 551,293 555,992 Other liabilities

34,543 39,659

Total

liabilities 4,271,702

3,989,129 Stockholders' Equity:

Common Stock, par value $20; authorized 250,000 shares; issued and

outstanding 130,928 shares 2,619 2,619 Surplus 12,044 12,044

Retained earnings 695,169 646,708 Accumulated other comprehensive

income 7,427 8,845

Total stockholders'

equity 717,259 670,216

Total liabilities and stockholders' equity

$ 4,988,961 $ 4,659,345

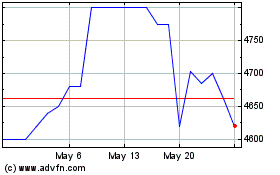

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Farmers and Merchants Bank (QX) (USOTC:FMBL)

Historical Stock Chart

From Jan 2024 to Jan 2025