CERTIFICATE OF DESIGNATION, PREFERENCE AND RIGHTS OF SERIES A PREFERRED STOCK OF GOLD ENTERTAINMENT GROUP, INC.

Pursuant to the Business Organizations Law of the State of Wyoming

GOLD ENTERTAINMENT GROUP, Inc., a corporation organized and existing under the laws of the State of Wyoming (the "Corporation"), hereby certifies that the following resolutions were duly adopted by the Board of Directors of the Corporation by unanimous written consent on 1st February, 2023, pursuant to the authority vested in the Board of Directors by Article V of the Certificate of Incorporation of the Corporation which creates and authorizes five million (5,000,000) shares of Preferred SERIES A Stock of the Corporation, no par value (the Preferred SERIES A Shares):

Resolved, that pursuant to the authority vested in the Board of Directors by Article V of the Certificate of Incorporation of the Corporation, a series of Preferred Stock is hereby established, the distinctive designation of which shall be "Series A Preferred Shares" (such series being hereinafter called "Series A Preferred Shares"), and the preferences and relative, participating, optional or other special rights of the Series A Preferred Shares, and the qualifications, limitations or restrictions thereof (in addition to the relative powers, preferences and rights, and qualifications, limitations or restrictions thereof, set forth in the Corporation's Certificate of Incorporation which are applicable to shares of Preferred Stock of all series) shall be as follows:

1. Number of Shares; Stated Value and Dividends. The Corporation hereby designates one (1) share of the authorized shares of preferred stock as Series A Preferred Stock. The stated value of the Series A Preferred Stock shall be no par value. The holder of share of Series A Preferred Stock shall not be entitled to receive dividends.

2. Ranking The Series B Preferred Stock shall rank on parity with the Corporation's Common Stock and any class or series of capital stock of the Corporation hereafter created (the Parity Securities), in each case as to the distribution of assets upon liquidation, dissolution or winding up of the Corporation.

3. Liquidation Preference. In the event of any liquidation, dissolution or winding up of this Corporation, either voluntary or involuntary, the holder of Series A Preferred Shares may at his sole option elect to receive, prior and in preference to any distribution of any of the assets of this Corporation to the holders of common stock by reason of their ownership thereof, an amount per share equal to $0.001 for the outstanding share of Series A Preferred Stock. Upon the completion of this distribution and any other distribution that may be required with respect to series of preferred stock of this Corporation that may from time to time come into existence, if assets remain in this Corporation the holders of the common stock of this Corporation shall receive all of the remaining assets of this Corporation.

For purposes of this Section 3, a liquidation, dissolution or winding up of this Corporation shall be deemed to be occasioned by, or to include, (i) the acquisition of the Corporation by another entity by means of any transaction or series of related transactions including, without limitation, any reorganization, merger or consolidation but, excluding any merger effected exclusively for the purpose of changing the domicile of the Corporation or any transaction in which the Corporation is the surviving entity or (ii) a sale of all or substantially all of the assets of the Corporation unless the Corporation's shareholders of record as constituted immediately prior to such transaction will, immediately after such transaction (by virtue of securities issued as consideration in the transaction) hold at least 50% of the voting power of the surviving or acquiring entity. Whenever a distribution provided for in this Section 2 shall be payable in securities or property other than cash, the value of such distribution shall be the fair market value of such securities or other property as determined and agreed to by the Board of Directors of this Corporation.

4. Redemption. The Series A Preferred Stock is not redeemable without the prior written consent of the holder of such Series A Preferred Stock.

5. Conversion. The shares of Series A Preferred Stock are not convertible.

6. Voting Rights. The holder of the share of Series A Preferred Stock shall have the following voting rights:

(a) The holder of each share of Series A Preferred Stock shall be vote with the equivalent of one hundred (100) shares of Common Stock, in all voting matters. The holder of the share of Series A Preferred Stock shall be entitled to vote on all matters submitted to a vote of the shareholders of the Corporation, voting together with the holders of the common stock and of any other shares of capital stock of the Corporation entitled to vote at a meeting of shareholders as one class, except in cases where a separate or additional vote or consent of the holders of any class or series of capital stock or other equity securities of the Corporation shall be required by these Articles or applicable law, in which case the requirement for any such separate or additional vote or consent shall apply in addition to the single class vote or consent otherwise required by this paragraph.

(b) As of each record date for the determination of the Corporation's shareholders entitled to vote on any matter (a Record Date), the share of Series A Preferred Stock shall have votingrights and powers equal to the number of votes thatentitlethe holder of the shares of Series A Preferred Stock to exercise one vote to be cast as of such Record Date by all holders of capital stock of the Corporation so as toensure that the votes entitled to be cast by the holder of the shares of Series A Preferred Stock shall be equal to at least fifty-one percent (51%) of all votes entitled to be cast.

(c) Without the written consent of the holder of the share of Series A Preferred Stock at a meeting of the shareholders of this Corporation called for such purpose, the Corporation will not amend, alter or repeal any provision of the Articles of Incorporation (by merger or otherwise) so as to adversely affect the preferences, rights or powers of the Series A Preferred Stock.

7. Status of Redeemed Stock. In the event the share of Series A Preferred Stock shall be redeemed pursuant to Section 4 hereof, or converted pursuant to Section 5 hereof, the share shall be cancelled and returned to the status of authorized but unissued shares of preferred stock.

8. Taxes. This Corporation will pay all taxes (other than taxes based upon income) and other governmental charges that may be imposed with respect to the issue or delivery of the share of Series A Preferred Stock.

EX3.2

EX33

BYLAWS OF GOLD ENTERTAINMENT GROUP, INC.

(the "Corporation")

ARTICLE I: MEETINGS OF SHAREHOLDERS

Section 1 - Annual Meetings

The annual meeting of the shareholders of the Corporation shall be held at the time fixed, from time to time, by the Board of Directors.

Section 2 - Special Meetings

Special meetings of the shareholders may be called by the Board of Directors or such person or persons authorized by the Board of Directors.

Section 3 - Place of Meetings

Meetings of shareholders shall be held at the registered office of the Corporation, or at such other places, within or without the State of Wyoming as the Board of Directors may from time to time

fix.

Section 4 - Notice of Meetings

A notice convening an annual or special meeting which specifies the place, day, and hour of the meeting, and the general nature of the business of the meeting, must be faxed, personally delivered or mailed postage prepaid to each shareholder of the Corporation entitled to vote at the meeting at the address of the shareholder as it appears on the stock transfer ledger of the Corporation, at least ten (10) days prior to the meeting. Accidental omission to give notice of a meeting to, or the non-receipt of notice of a meeting by, a shareholder will not invalidate the proceedings at that meeting.

Section 5 - Action Without a Meeting

Unless otherwise provided by law, any action required to be taken at a meeting of the shareholders, or any other action which may be taken at a meeting of the shareholders, may be taken without a meeting, without prior notice and without a vote if written consents are signed by shareholders representing a majority of the shares entitled to vote at such a meeting, except however, if a different proportion of voting power is required by law, the Articles of Incorporation or these Bylaws, than that proportion of written consents is required. Such written consents must be filed with the minutes of the proceedings of the shareholders of the

Corporation.

Section 6 - Quorum

a) No business, other than the election of the chairman or the adjournment of the meeting, will be transacted at an annual or special meeting unless a quorum of shareholders, entitled to attend and vote, is present at the commencement of the meeting, but the quorum need not be present throughout the meeting.

b) Except as otherwise provided in these Bylaws, a quorum is two persons present and being, or representing by proxy, shareholders of the Corporation.

c) If within half an hour from the time appointed for an annual or special meeting a quorum is not present, the meeting shall stand adjourned to a day, time and place as determined by the chairman of the meeting.

Section 7 - Voting

Subject to a special voting rights or restrictions attached to a class of shares, each shareholder shall be entitled to one vote for each share of stock in his or her own name on the books of the corporation, whether represented in person or by proxy.

Section 8 - Motions

No motion proposed at an annual or special meeting need be seconded.

Section 9 - Equality of Votes

In the case of an equality of votes, the chairman of the meeting at which the vote takes place is not entitled to have a casting vote in addition to the vote or votes to which he may be entitled as a shareholder of proxy holder.

Section 10 - Dispute as to Entitlement to Vote

In a dispute as to the admission or rejection of a vote at an annual or special meeting, the decision of the chairman made in good faith is conclusive.

Section 11 - Proxy

|

a)

Each shareholder entitled to vote at an annual or special meeting may do so either in person or by proxy.

b)

A form of proxy must be in writing under the hand of the appointor or of his or her attorney

duly authorized in writing, or, if the appointor is a corporation, either under the seal of the

corporation or under the hand of a duly authorized officer or attorney.

c)

A proxy holder need not be a shareholder of the Corporation.

|

b) A form of proxy and the power of attorney or other authority, if any, under which it is signed or a facsimiled copy thereof must be deposited at the registered office of the Corporation or at such other place as is specified for that purpose in the notice convening the meeting. In addition to any other method of depositing proxies provided for in these Bylaws, the Directors may from time to time by resolution make regulations relating to the depositing of proxies at a place or places and fixing the time or times for depositing the proxies not exceeding 48 hours (excluding Saturdays, Sundays and holidays) preceding the meeting or adjourned meeting specified in the notice calling a meeting of shareholders.

ARTICLE II: BOARD OF DIRECTORS

Section 1 - Number, Term, Election and Qualifications

a) The first Board of Directors of the Corporation, and all subsequent Boards of the Corporation, shall consist of not less than one (1) and not more than nine (9) directors. The number of Directors may be fixed and changed from time to time by ordinary resolution of the shareholders of the Corporation.

b) The first Board of Directors shall hold office until the first annual meeting of shareholders and until their successors have been duly elected and qualified or until there is a decrease in the number of directors. Thereinafter, Directors will be elected at the annual meeting of shareholders and shall hold office until the annual meeting of the shareholders next succeeding his or her election, or until his or her prior death, resignation or removal. Any Director may resign at any time upon written notice of such resignation to the Corporation.

c) A casual vacancy occurring in the Board may be filled by the remaining Directors.

d) Between successive annual meetings, the Directors have the power to appoint one or more additional Directors. A Director so appointed holds office only until the next following annual meeting of the Corporation, but is eligible for election at that meeting. So long as he or she is an additional Director, the number of Directors will be increased accordingly.

e) A Director is not required to hold a share in the capital of the Corporation as qualification for his or her office.

Section 2 - Duties, Powers and Remuneration

a) The Board of Directors shall be responsible for the control and management of the business and affairs, property and interests of the Corporation, and may exercise all powers of the Corporation including opening bank accounts, except for those powers conferred upon or reserved for the shareholders or any other persons as required under Wyoming state law, the Corporation's Articles of Incorporation or by these Bylaws.

b) The remuneration of the Directors may from time to time be determined by the Directors or, if the Directors decide, by

the shareholders.

Section 3 - Meetings of Directors

a) The President of the Corporation shall preside as chairman at every meeting of the Directors, or if the President is not present or is willing to act as chairman, the Directors present shall choose one of their number to be chairman of the meeting.

b) The Directors may meet together for the dispatch of business, and adjourn and otherwise regulate their meetings as they think fit. Questions arising at a meeting must be decided by a majority of votes. In case of an equality of votes the chairman does not have a second or casting vote. Meetings of the Board held at regular intervals may be held at the place and time upon the notice (if any) as the Board may by resolution from time to time determine.

c) A Director may participate in a meeting of the Board or of a committee of the Directors using conference telephones or other communications facilities by which all Directors participating in the meeting can hear each other and provided that all such Directors agree to such participation. A Director participating in a meeting in accordance with this Bylaw is deemed to be present at the meeting and to have so agreed. Such Director will be counted in the quorum and entitled to speak and vote at the meeting.

d) A Director may, and the Secretary on request of a Director shall, call a meeting of the Board. Reasonable notice of the meeting specifying the place, day and hour of the meeting must be given by mail, postage prepaid, addressed to each of the Directors and alternate Directors at his or her address as it appears on the books of the Corporation or by leaving it at his or her usual business or residential address or by telephone, facsimile or other method of transmitting legibly recorded messages. It is not necessary to give notice of a meeting of Directors to a Director immediately following a shareholder meeting at which the Director has been elected, or is the meeting of Directors at which the Director is appointed.

e) A Director of the Corporation may file with the Secretary a document executed by him waiving notice of a past, present or future meeting or meetings of the Directors being, or required to have been, sent to him and may at any time withdraw the waiver with respect to meetings held thereafter. After filing such waiver with respect to future meetings and until the waiver is withdrawn no notice of a meeting of Directors need be given to the Director. All meetings of the Directors so held will be deemed not to be improperly called or constituted by reason of notice not having been given to the Director.

f) The quorum necessary for the transaction of the business of the Directors may be fixed by the Directors and if not so fixed is a majority of the Directors or, if the number of Directors is fixed at one, is one Director.

g) The continuing Directors may act notwithstanding a vacancy in their body but, if and so long as their number is reduced below the number fixed pursuant to these Bylaws as the necessary quorum of Directors, the continuing Directors may act for the purpose of increasing the number of Directors to that number, or of summoning a shareholder meeting of the Corporation, but for no other purpose.

h) All acts done by a meeting of the Directors, a committee of Directors, or a person acting as a Director, will, notwithstanding that it be afterwards discovered that there was some defect in the qualification, election or appointment of the Directors, shareholders of the committee or person acting as a Director, or that any of them were disqualified, be as valid as if the person had been duly elected or appointed and was qualified to be a Director.

i) A resolution consented to in writing, whether by facsimile or other method of transmitting legibly recorded messages, by all of the Directors is as valid as if it had been passed at a meeting of the Directors duly called and held. A resolution may be in two or more counterparts which together are deemed to constitute one resolution in writing. A resolution must be filed with the minutes of the proceedings of the directors and is effective on the date stated on it or on the latest date stated on a counterpart.

j) All Directors of the Corporation shall have equal voting power.

Section 4 – Removal

One or more or all the Directors of the Corporation may be removed with or without cause at any time by a vote of two-thirds of the shareholders entitled to vote thereon, at a special meeting of the shareholders called for that purpose.

Section 5 - Committees

a) The Directors may from time to time by resolution designate from among its members one or more committees, and alternate members thereof, as they deem desirable, each consisting of one or more members, with such powers and authority (to the extent permitted by law and these Bylaws) as may be provided in such resolution. Each such committee shall serve at the pleasure of the Board of Directors and unless otherwise stated by law, the Certificate of Incorporation of the Corporation or these Bylaws, shall be governed by the rules and regulations stated herein regarding the Board of Directors.

b) Each Committee shall keep regular minutes of its transactions, shall cause them to be recorded in the books kept for that purpose, and shall report them to the Board at such times as the Board may from time to time require. The Board has the power at any time to revoke or override the authority given to or acts done by any Committee.

ARTICLE III: OFFICERS

Section 1 - Number, Qualification, Election and Term of Office

a) The Corporation's officers shall have such titles and duties as shall be stated in these Bylaws or in a resolution of the Board of Directors which is not inconsistent with these Bylaws. The officers of the Corporation shall consist of a president, secretary, treasurer, and also may have one or more vice presidents, assistant secretaries and assistant treasurers and such other officers as the Board of Directors may from time to time deem advisable. Any officer may hold two or more offices in the Corporation, and may or may not also act as a Director.

b) The officers of the Corporation shall be elected by the Board of Directors at the regular annual meeting of the Board following the annual meeting of shareholders.

c) Each officer shall hold office until the annual meeting of the Board of Directors next succeeding his or her election, and until his or her successor shall have been duly elected and qualified, subject to earlier termination by his or her death, resignation or removal.

Section 2 - Resignation

Any officer may resign at any time by giving written notice of such resignation to the Corporation.

Section 3 - Removal

Any officer appointed by the Board of Directors may be removed by a majority vote of the Board, either with or without cause, and a successor appointed by the Board at any time, and any officer or assistant officer, if appointed by another officer, may likewise be removed by such officer.

Section 4 - Remuneration

The remuneration of the Officers of the Corporation may from time to time be determined by the Directors or, if the Directors decide, by the shareholders.

Section 5 - Conflict of Interest

Each officer of the Corporation who holds another office or possesses property whereby, whether directly or indirectly, duties or interests might be created in conflict with his or her duties or interests as an officer of the Corporation shall, in writing, disclose to the President the fact and the nature, character and extent of the conflict and abstain from voting with respect to any resolution in which the officer has a personal interest.

ARTICLE IV: SHARES OF STOCK

Section 1 - Certificate of Stock

a) The shares of the Corporation shall be represented by certificates or shall be uncertificated shares.

b) Certificated shares of the Corporation shall be signed, either manually or by facsimile, by officers or agents designated by the Corporation for such purposes, and shall certify the number of shares owned by the shareholder in the Corporation. Whenever any certificate is countersigned or otherwise authenticated by a transfer agent or transfer clerk, and by a registrar, then a facsimile of the signatures of the officers or agents, the transfer agent or transfer clerk or the registrar of the Corporation may be printed or lithographed upon the certificate in lieu of the actual signatures. If the Corporation uses facsimile signatures of its officers and agents on its stock certificates, it cannot act as registrar of its own stock, but its transfer agent and registrar may be identical if the institution acting in those dual capacities countersigns or otherwise authenticates any stock certificates in both capacities. If any officer who has signed or whose facsimile signature has been placed upon such certificate, shall have ceased to be such officer before such certificate is issued, it may be issued by the Corporation with the same effect as if he were such officer at the date of its issue.

c) If the Corporation issued uncertificated shares as provided for in these Bylaws, within a reasonable time after the issuance or transfer of such uncertificated shares, and at least annually thereafter, the Corporation shall send the shareholder a written statement certifying the number of shares owned by such shareholder in the Corporation.

d) Except as otherwise provided by law, the rights and obligations of the holders of uncertificated shares and the rights and obligations of the holders of certificates representing shares of the same class and series shall be identical.

e) If a share certificate:

(i) is worn out or defaced, the Directors shall, upon production to them of the certificate and upon such other terms, if any, as they may think fit, order the certificate to be cancelled and issue a new certificate;

(ii) is lost, stolen or destroyed, then upon proof being given to the satisfaction of the Directors and upon and indemnity, if any being given, as the Directors think adequate, the Directors shall issue a new certificate; or

(iii) represents more than one share and the registered owner surrenders it to the Corporation with a written request that the Corporation issue in his or her name two or more certificates, each representing a specified number of shares and in the aggregate representing the same number of shares as the certificate so surrendered, the Corporation shall cancel the certificate so surrendered and issue new certificates in accordance with such request.

Section 2 - Transfers of Shares

a) Transfers or registration of transfers of shares of the Corporation shall be made on the stock transfer books of the Corporation by the registered holder thereof, or by his or her attorney duly authorized by a written power of attorney; and in the case of shares represented by certificates, only after the sun-ender to the Corporation of the certificates representing such shares with such shares properly endorsed, with such evidence of the authenticity of such endorsement, transfer, authorization and other matters as the Corporation may reasonably require, and the payment of all stock transfer taxes due thereon.

b) The Corporation shall be entitled to treat the holder of record of any share or shares as the absolute owner thereof for all purposes and, accordingly, shall not be bound to recognize any legal, equitable or other claim to, or interest in, such share or shares on the part of any other person, whether or not it shall have express or other notice thereof, except as otherwise expressly provided by law.

Section 3 - Record Date

a) The Directors may fix in advance a date, which must not be more than 60 days permitted by the preceding the date of a meeting of shareholders or a class of shareholders, or of the payment of a dividend or of the proposed taking of any other proper action requiring the determination of shareholders as the record date for the determination of the shareholders entitled to notice of, or to attend and vote at, a meeting and an adjournment of the meeting, or entitled to receive payment of a dividend or for any other proper purpose and, in such case, notwithstanding anything in these Bylaws, only shareholders of records on the date so fixed will be deemed to be the shareholders for the purposes of this Bylaw.

b) Where no record date is so fixed for the determination of shareholders as provided in the preceding Bylaw, the date on which the notice is mailed or on which the resolution declaring the dividend is adopted, as the case may be, is the record date for such determination.

Section 4 - Fractional Shares

Notwithstanding anything else in these Bylaws, the Corporation, if the Directors so resolve, will not be required to issue fractional shares in connection with an amalgamation, consolidation, exchange or conversion. At the discretion of the Directors, fractional interests in shares may be rounded to the nearest whole number, with fractions being rounded to the next highest whole number, or may be purchased for cancellation by the Corporation for such consideration

as the Directors determine. The Directors may determine the manner in which fractional interests in shares are to be transferred and delivered to the Corporation in exchange for consideration and a determination so made is binding upon all shareholders of the Corporation. In case shareholders having fractional interests in shares fail to deliver them to the Corporation in accordance with a determination made by the Directors, the Corporation may deposit with the Corporation's Registrar and Transfer Agent a sum sufficient to pay the consideration payable by the Corporation for the fractional interests in shares, such deposit to be set aside in trust for such shareholders. Such setting aside is deemed to be payment to such shareholders for the fractional interests in shares not so delivered which will thereupon not be considered as outstanding and such shareholders will not be considered to be shareholders of the Corporation with respect thereto and will have no right except to receive payment of the money so set aside and deposited upon delivery of the certificates for the shares held prior to the amalgamation, consolidation, exchange or conversion which result in fractional interests in shares.

ARTICLE V: DIVIDENDS

a) Dividends may be declared and paid out of any funds available therefor, as often, in such amounts, and at such time or times as the Board of Directors may determine and shares may be issued pro rata and without consideration to the Corporation's shareholders or to the shareholders of one or more classes or series.

b) Shares of one class or series may not be issued as a share dividend to shareholders of another class or series unless such issuance is in accordance with the Articles of Incorporation and:

(i) a majority of the current shareholders of the class or series to be issued approve the issue; or

(ii) there are no outstanding shares of the class or series of shares that are authorized to be issued as a dividend.

ARTICLE VI: BORROWING POWERS

a) The Directors may from time to time on behalf of the Corporation:

(i) borrow money in such manner and amount, on such security, from such sources and upon such terms and conditions as they think fit,

(ii) issue bonds, debentures and other debt obligations either outright or as security for liability or obligation of the Corporation or another person, and

(iii) mortgage, charge, whether by way of specific or floating charge, and give other security on the undertaking, or on the whole or a part of the property and assets of the Corporation (both present and future).

b) A bond, debenture or other debt obligation of the Corporation may be issued at a discount, premium or otherwise, and with a special privilege as to redemption, surrender, drawing, allotment of or conversion into or exchange for shares or other securities, attending and voting at shareholder meetings of the Corporation, appointment of Directors or otherwise, and may by its terms be assignable free from equities between the Corporation and the person to whom it was issued or a subsequent holder thereof, all as the Directors may determine.

ARTICLE VII: FISCAL YEAR

The fiscal year end of the Corporation shall be December 31st, and shall be subject to change, by the Board of Directors from time to time, subject to applicable law.

ARTICLE VIII: CORPORATE SEAL

The corporate seal, if any, shall be in such form as shall be prescribed and altered, from time to time, by the Board of Directors. The use of a seal or stamp by the Corporation on corporate documents is not necessary and the lack thereof shall not in any way affect the legality of a corporate document.

ARTICLE IX: AMENDMENTS

Section 1 - By Shareholders

All Bylaws of the Corporation shall be subject to alteration or repeal, and new Bylaws may be made by a majority vote of the shareholders at any annual meeting or special meeting called for that purpose.

Section 2 - By Directors

The Board of Directors shall have the power to make, adopt, alter, amend and repeal, from time to time, Bylaws of the Corporation.

ARTICLE X: DISCLOSURE OF INTEREST OF DIRECTORS

a) A Director who is, in any way, directly or indirectly interested in an existing or proposed contract or transaction with the Corporation or who holds an office or possesses property whereby, directly or indirectly, a duty or interest might be created to conflict with his or her duty or interest as a Director, shall declare the nature and extent of his or her interest in such contract or transaction or of the conflict with his or her duty and interest as a Director, as the case may be.

b) A Director shall not vote in respect of a contract or transaction with the Corporation in which he is interested and if he does so his or her vote will not be counted, but he will be counted in the quorum present at the meeting at which the vote is taken. The foregoing prohibitions do not

apply to:

(i) a contract or transaction relating to a loan to the Corporation, which a Director or a specified corporation or a specified firm in which he has an interest has guaranteed or joined in guaranteeing the repayment of the loan or part of the loan;

(ii) a contract or transaction made or to be made with or for the benefit of a holding corporation or a subsidiary corporation of which a Director is a director or officer;

(iii) a contract by a Director to subscribe for or underwrite shares or debentures to be issued by the Corporation or a subsidiary of the Corporation, or a contract, arrangement or transaction in which a Director is directly or indirectly interested if all the other Directors are also directly or indirectly interested in the contract, arrangement or transaction;

(iv) determining the remuneration of the Directors;

(v) purchasing and maintaining insurance to cover Directors against liability incurred by them as Directors; or

(vi) the indemnification of a Director by the Corporation.

c) A Director may hold an office or place of profit with the Corporation (other than the office of Auditor of the Corporation) in conjunction with his or her office of Director for the period and on the terms (as to remuneration or otherwise) as the Directors may determine. No Director or intended Director will be disqualified by his or her office from contracting with the Corporation either with regard to the tenure of any such other office or place of profit, or as vendor, purchaser or otherwise, and, no contract or transaction entered into by or on behalf of the Corporation in which a Director is interested is liable to be voided by reason thereof.

d) A Director or his or her firm may act in a professional capacity for the Corporation (except as Auditor of the Corporation), and he or his or her firm is entitled to remuneration for professional services as if he were not a Director.

e) A Director may be or become a director or other officer or employee of, or otherwise interested in, a corporation or firm in which the Corporation may be interested as a shareholder or otherwise, and the Director is not accountable to the Corporation for remuneration or other benefits received by him as director, officer or employee of, or from his or her interest in, the other corporation or firm, unless the shareholders otherwise direct.

ARTICLE XI: ANNUAL LIST OF OFFICERS, DIRECTORS AND REGISTERED AGENT

The Corporation shall, within thirty days after the filing of its Articles of Incorporation with the Secretary of State, and annually thereafter on or before the last day of the month in which the anniversary date of incorporation occurs each year, file with the Secretary of State a list of its president, secretary and treasurer and all of its Directors, along with the post office box or street address, either residence or business, and a designation of its resident agent in the state of Wyoming. Such list shall be certified by an officer of the Corporation.

ARTICLE XII: INDEMNITY OF DIRECTORS, OFFICERS, EMPLOYEES AND AGENTS

a) The Directors shall cause the Corporation to indemnify a Director or former Director of the Corporation and the Directors may cause the Corporation to indemnify a director or former director of a corporation of which the Corporation is or was a shareholder and the heirs and personal representatives of any such person against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, actually and reasonably incurred by him or them including an amount paid to settle an action or satisfy a judgment inactive criminal or administrative action or proceeding to which he is or they are made a party by reason of his or her being or having been a Director of the Corporation or a director of such corporation, including an action brought by the Corporation or corporation. Each Director of the Corporation on being elected or appointed is deemed to have contracted with the Corporation on the terms of the foregoing indemnity.

b) The Directors may cause the Corporation to indemnify an officer, employee or agent of the Corporation or of a corporation of which the Corporation is or was a shareholder (notwithstanding that he is also a Director), and his or her heirs and personal representatives against all costs, charges and expenses incurred by him or them and resulting from his or her acting as an officer, employee or agent of the Corporation or corporation. In addition the Corporation shall indemnify the Secretary or an Assistance Secretary of the Corporation (if he is not a full time employee of the Corporation and notwithstanding that he is also a Director), and his or her respective heirs and legal representatives against all costs, charges and expenses incurred by him or them and arising out of the functions assigned to the Secretary by the Corporation Act or these Articles and each such Secretary and Assistant Secretary, on being appointed is deemed to have contracted with the Corporation on the terms of the foregoing indemnity.

c) The Directors may cause the Corporation to purchase and maintain insurance for the benefit of a person who is or was serving as a Director, officer, employee or agent of the Corporation or as a director, officer, employee or agent of a corporation of which the Corporation is or was a shareholder and his or her heirs or personal representatives against a liability incurred by him as a Director, officer, employee or agent.

EX3.1

CERTIFICATE OF DESIGNATION, PREFERENCE AND RIGHTS OF SERIES B PREFERRED STOCK OF GOLD ENTERTAINMENT GROUP, INC.

Pursuant to the Business Organizations Law of the State of Wyoming

GOLD ENTERTAINMENT GROUP, Inc., a corporation organized and existing under the laws of the State of Wyoming (the "Corporation"), hereby certifies that the following resolutions were duly adopted by the Board of Directors of the Corporation by unanimous written consent on 1st February, 2023, pursuant to the authority vested in the Board of Directors by Article V of the Certificate of Incorporation of the Corporation which creates and authorizes one million (1,000,000) shares of Preferred SERIES B Shares of the Corporation, one dollar ($1.00) par value (the " Preferred SERIES B Shares"):

Resolved, that pursuant to the authority vested in the Board of Directors by Article V of the Certificate of Incorporation of the Corporation, a series of Preferred Stock is hereby established, the distinctive designation of which shall be "SERIES B Preferred Shares" (such series being hereinafter called "SERIES B Preferred Shares"), and the preferences and relative, participating, optional or other special rights of the SERIES B Preferred Shares, and the qualifications, limitations or restrictions thereof (in addition to the relative powers, preferences and rights, and qualifications, limitations or restrictions thereof, set forth in the Corporations Certificate of Incorporation which are applicable to shares of Preferred Stock of all series) shall be as follows:

Number of Shares; Stated Value and Dividends. The Corporation hereby designates one (1) share of the authorized shares of preferred stock as SERIES B Preferred Shares. The stated value of the SERIES B Preferred Shares shall be one dollar ($1.00) par value. The holder of share of SERIES B Preferred Stock shall not be entitled to receive dividends.

2. Ranking. The Series B Preferred Stock shall rank on parity with the Corporation's Common Stock and any class or series of capital stock of the Corporation hereafter created (the "Parity Securities"), in each case as to the distribution of assets upon liquidation, dissolution or winding up of the Corporation.

3. Liquidation Preference. In the event of any liquidation, dissolution or winding up of this Corporation, either voluntary or involuntary, the holder of SERIES B Preferred Stock may at his sole option elect to receive, prior and in preference to any distribution of any of the assets of this Corporation to the holders of common stock by reason of their ownership thereof, an amount per share equal to $1.00 for the outstanding share of SERIES B Preferred Shares. Upon the completion of this distribution and any other distribution that may be required with respect to series of preferred stock of this Corporation that may from time to time come into existence, if assets remain in this Corporation the holders of the common stock of this Corporation shall receive all of the remaining assets of this Corporation.

For purposes of this Section 3, a liquidation, dissolution or winding up of this Corporation shall be deemed to be occasioned by, or to include, (i) the acquisition of the Corporation by another entity by means of any transaction or series of related transactions including, without limitation, any reorganization, merger or consolidation but, excluding any merger effected exclusively for the purpose of changing the domicile of the Corporation or any transaction in which the Corporation is the surviving entity or (ii) a sale of all or substantially all of the assets of the Corporation unless the Corporation's shareholders of record as constituted immediately prior to such transaction will, immediately after such transaction (by virtue of securities issued as consideration in the transaction) hold at least 50% of the voting power of the surviving or acquiring entity. Whenever a distribution provided for in this Section 2 shall be payable in securities or property other than cash, the value of such distribution shall be the fair market value of such securities or other property as determined and agreed to by the Board of Directors of this Corporation.

4. Redemption.The SERIES B Preferred Shares are not redeemable without the prior written consent of the holder of such SERIES B Preferred Shares.

5. Conversion.

Conversion. At any time, or until revised, each share of the Series B Preferred Stock shall convert into the Common Stock of the Corporation, on a fully diluted basis at the time of conversion according to the following formula (the Conversion Formula) as of the conversion date.

Each Series B Preferred Shares shall be Convertible into the same dollar value of common shares, rounded up to nearest whole share, at a price calculated to be 50% of the ten-day (10 day) average trading price prior to conversion. Example: The ten-day (10 day) average trading price is $1.30 and 75,000 Series B Preferred Shares are being converted. The conversion formula is (75,000.00 / 1.30) X 2 = 115,385 common shares. All calculations are rounded up to the next whole share.

These converted shares shall be issued in the name of the Series B Preferred Shareholder or their appointees. The conversion shall take place at the sole discretion of the Holder of the Series B Preferred Shares. The Series B Preferred Shares, and the resulting Common Shares following Conversion, shall be included in the Company's next registration statement (SEC Registration, exemption or equivalent) following the date of Conversion.

b) Mechanics of Conversion.

(i) Holders of Series B Preferred Stock shall only be entitled to convert the shares of Series B Preferred Stock into shares of Common Stock upon the approval of holders, and shall surrender the certificate or certificates therefore, duly endorsed, at the office of the Corporation or of any transfer agent for the Series B Preferred Stock, and shall state therein the name or names in which the certificate or certificates for shares of Common Stock are to be issued. The Corporation shall, within ten (10) business days, issue and deliver at such office to the holders of Series B Preferred Stock, or to the nominee or nominees of such holder, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled as aforesaid. If any holder fails to surrender the certificate, the holder's Series B Preferred Stock shall automatically convert and shares of Common Stock will be issued in the holder's name.

(ii) All Common Stock, which may be issued upon conversion of the Series B Preferred Stock, will, upon issuance, be duly issued, fully paid and non-assessable and free from all taxes, liens, and charges with respect to the issuance thereof.

6. Anti-Dilution Provisions.

During the period in which any shares of Series B Preferred Stock remain outstanding, the Conversion Formula in effect at any time and the number and kind of securities issuable upon the conversion of the Series B Preferred Stock shall be subject to adjustment from time to time following the date of the original issuance of the Series B Preferred Stock upon the happening of certain events as follows:

a) Consolidation, Merger or Sale. If any consolidation or merger of the Corporation with an unaffiliated third-party, or the sale, transfer or lease of all or substantially all of its assets to an unaffiliated third-party shall be effected in such a way that holders of shares of Common Stock shall be entitled to receive stock, securities or assets with respect to or in exchange for their shares of Common Stock, then provision shall be made, in accordance with this Section 6(a), whereby each holder of shares of Series B Preferred Stock shall thereafter have the right to receive such securities or assets as would have been issued or payable with respect to or in exchange for the shares of Common Stock into which the shares of Series B Preferred Stock held by such holder were convertible immediately prior to the closing of such merger, sale, transfer or lease, as applicable.

The Corporation will not effect any such consolidation, merger, sale, transfer or lease unless prior to the consummation thereof the successor entity (if other than the Corporation) resulting from such consolidation or merger or the entity purchasing or leasing such assets shall assume by written instrument (i) the obligation to deliver to the holders of Series B Preferred Stock such securities or assets as, in accordance with the foregoing provisions, such holders may be entitled to purchase, and (ii) all other obligations of the Corporation hereunder. The provisions of this Section 6(a) shall similarly apply to successive mergers, sales, transfers or leases. Holders shall not be required to convert Series B stock pursuant to this Section 6(a).

b) Notice of Adjustment. Whenever the Conversion Formula is adjusted as herein provided, the Corporation shall promptly but no later than 10 days after any request for such an adjustment by the holder, cause a notice setting forth the adjusted Conversion Formula issuable upon exercise of each share of Series B Preferred Stock, and, if requested, information describing the transactions giving rise to such adjustments, to be mailed to the holders at their last addresses appearing in the share register of the Corporation, and shall cause a certified copy thereof to be mailed to its transfer agent, if any. The Corporation may retain a firm of independent certified public accountants selected by the Board of Directors (who may be the regular accountants employed by the Corporation) to make any computation required by this Section 6, and a certificate signed by such firm shall be conclusive evidence of the correctness of such adjustment.

7. Voting Rights. The Shares of Series B Preferred Stock shall have no voting rights until converted into the Corporations Common Stock, except as otherwise required by law. The number of votes for the Series B Preferred Stock upon conversion, shall be the same number as the amount of shares of Common Stock that would be issued upon conversion of the Series B Preferred Stock pursuant to the Conversion Formula.

8. Status of Redeemed Stock. In the event the share of SERIES B Preferred Stock shall be redeemed pursuant to Section 4 hereof, or converted pursuant to Section 5 hereof, the share shall be cancelled and returned to the status of authorized but unissued shares of preferred stock.

9. Taxes. This Corporation will pay all taxes (other than taxes based upon income) and other governmental charges that may be imposed with respect to the issue or delivery of the share of SERIES B Preferred Stock.

AGREEMENT FOR THE EXCHANGE OF CAPITAL STOCK

This AGREEMENT FOR THE EXCHANGE OF CAPITAL STOCK (this "Agreement"), by and between GOLD ENTERPRISE GROUP (formerly GOLD ENTERTAINMENT GROUP, INC. as a Florida corporation), now a Wyoming corporation ("GEGP"), and MEDIWORX, llc, a Pennsylvania limited liability corporation ("MEDIWORX"), upon the terms and conditions as herein further described. GEGP and MEDIWORX are collectively referred to the "Parties" or as a "Party" herein as context may require.

Recitals

WHEREAS, GEGP and MEDIWORX desire to complete the share exchange through a transaction pursuant to which MEDIWORX will undertake to become a partially owned subsidiary of GEGP; and

WHEREAS, GEGP agrees to provide services to MEDIWORX's shareholders, in exchange for (i) the sum THREE BILLION FIVE HUNDRED THOUSAND (3,500,000,000) Shares of GEGP's Common Stock to MEDIWORX's shareholders or their assignees, for the purchase of TWENTY PERCENT (20%) of MEDIWORXS's Common Shares or equivalent LLC membership interests) ; and (ii) that GEGP's Management shall perform a registration of the Common Stock as supplied to MEDIWORX's shareholders on the terms and subject to the conditions set forth herein (the "Exchange"); and

WHEREAS, GEGP and MEDIWORX agree that the expenses for the execution of this Agreement are to be paid as per EXHIBIT A; and

WHEREAS, The Board of Directors of the Company has unanimously determined that the delay in securing shareholder approval of the exchange contemplated hereby would seriously jeopardize the financial viability of the Company and has expressly approved the reliance by the Company on the exception under the Wyoming Business Corporation Act.

Terms of Agreement

In consideration of the mutual covenants and agreements contained in this Agreement, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound, the Parties hereby agree as follows:

ARTICLE I,

THE SHARES AND THE EXCHANGE SHARES.

Section 1.1. The Shares. The Shares shall be issued to GEGP and the Exchange Shares shall be issued to MEDIWORX, pursuant to Article II hereof, and as further described herein.

ARTICLE II,

SHARE EXCHANGE.

Section 2.1. Share Exchange. Upon the terms and subject to the conditions of this Agreement, GEGP agrees to issue and sell to MEDIWORX, the Exchange Shares, and in exchange for the Shares and the Closing (as defined below).

Section 2.2. Share Exchange Closing.

(a) GEGP will deliver a certificate representing the Exchange Shares and registered in the name of MEDIWORX (and its shareholders), and MEDIWORX will deliver certificate(s) representing the Shares and registered in the name of GEGP. Subject to the satisfaction of the conditions set forth in Article VI, the time and date of such deliveries shall be 4:00 p.m., Eastern Standard Time, on a date and at a place to be specified by the Parties (the "Share Exchange Closing"), which date shall be no later than the day after satisfaction or waiver of the latest to occur of the conditions set forth in Article VI hereof.

(b) The documents to be delivered at the Share Exchange Closing by or on behalf of the Parties hereto pursuant to this Article II and any additional documents requested by MEDIWORX pursuant to Section 9.2, will be delivered at the Share Exchange Closing by digital delivery to the offices of GEGP and acknowledgment by all Parties.

ARTICLE III,

CONSIDERATION.

Section 3. Consideration.

Following the Share Exchange Closing, GEGP will undertake the following:

(1) THREE BILLION FIVE HUNDRED THOUSAND (3,500,000,000) Shares of GEGP's Common Stock;

(2) the newly issued Common Shares shall be included in the next registration statement that GEGP files with the SEC;

(3) GEGP to guarantee that the authorized COMMON shares of GEGP are sufficient to accommodate issuance of these shares;

(4) This Agreement is dependent and contingent on the transfer of the SERIES A Preferred shares being transferred in accordance with the SERIES A TRANSFER AGREEMENT (the "SERIES A TRANSFER AGREEMENT"), between IceLounge, Inc the registered owners of all of the SERIES A shares, and the management of MEDIWORKX.

ARTICLE IV,

REPRESENTATIONS AND WARRANTIES OF GEGP.

GEGP represents and warrants to MEDIWORX, as of the date hereof that:

Section 4.1. Existence and Power. GEGP is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Wyoming. The Company has the requisite corporate power and authority to own or lease all of its properties and assets and to carry on its business as it is now being conducted and is duly licensed or qualified to do business in each jurisdiction in which the nature of the business conducted by it or the character or location of the properties and assets owned or leased by it makes such licensing or qualification necessary.

Section 4.2. Capitalization. The authorized capital stock GEGP consists of twenty-five billion (25,000,000,000) shares of Common Stock, and six million (6,000,000) shares of Preferred Stock, including SERIES A and B, which, is the total authorized shares of Preferred Stock issued and outstanding. As of the Capitalization Date, there were no outstanding Stock Options nor any outstanding Stock Awards. All of the issued and outstanding shares of Common Stock have been duly authorized, validly issued and are fully paid, non-assessable and free of preemptive rights, with no personal liability attaching to the ownership thereof.

Section 4.3. Authorization. The execution, delivery, and performance of this Agreement has been duly authorized by all necessary action on the part of GEGP, and this Agreement is a valid and binding obligation of GEGP and is enforceable against it in accordance with their terms.

Section 4.4. Board Approvals. The transactions contemplated by this Agreement, including, without limitation, the issuance of the Shares and the compliance with the terms of this Agreement, have been unanimously adopted, approved, and declared advisable unanimously by the Board of Directors of GEGP.

Section 4.5. Valid Issuance of Series A Preferred Stock. The Shares have been duly authorized by all necessary corporate actions. When issued and sold against receipt of the consideration therefor, the Shares will be validly issued, fully paid and non-assessable, will not subject the holders thereof to personal liability, and will not be issued in violation of preemptive rights. The voting rights provided for in the terms of the Shares are validly authorized and shall not be subject to restriction or limitation in any respect.

Section 4.6. Non-Contravention. The execution, delivery, and performance of this Agreement, and the consummation by GEGP of the transactions contemplated hereby, will not conflict with, violate, or result in a breach of any provision of, or constitute a default (or an event which, with notice or lapse of time or both would constitute a default) under, or result in the termination of or accelerate the performance required by, or result in a right of termination or acceleration under, any provision of the Articles of Incorporation or Bylaws, as amended, respectively, of GEGP or the articles of incorporation, charter, bylaws or other governing instrument of any subsidiary of the GEGP.

Section 4.7. Purchase for Own Account. GEGP is acquiring the Shares for its own account and not with a view to the distribution thereof in violation of the Securities Act of 1933, as amended, and the rules and regulations of the Securities and Exchange Commission (the "SEC") promulgated thereunder (the "Securities Act"").

Section 4.8. Private Placement. GEGP understands that (i) the Shares have not been registered under the Securities Act or any State Securities Laws, by reason of their issuance by MEDIWORX in a transaction exempt from the registration requirements thereof and (ii) the Shares may not be sold unless such disposition is registered under the Securities Act and applicable state securities laws or is exempt from registration thereunder.

Section 4.9. Legend. Each certificate representing the Exchange Shares will bear a legend to the following effect unless MEDIWORX determines otherwise in compliance with applicable law:

"THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. THE SHARES HAVE BEEN ACQUIRED FOR INVESTMENT AND NEITHER THIS SHARE NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD, ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF SUCH REGISTRATION OR UNLESS SUCH TRANSACTION IS EXEMPT FROM, OR NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT."

Section 4.10. Later Registration. GEGP understands that the MEDIWORX Shares may, at a later date, be registered or made subject to an exemption from registration by MEDIWORX, under the Securities Act or any State Securities Laws, such that these Shares may later be sold, transferred or disposed of in any manner the Management of GEGP sees fit.

ARTICLE V,

REPRESENTATIONS AND WARRANTIES OF MEDIWORX.

MEDIWORX represents and warrants to GEGP as of the date hereof that:

Section 5.1. Existence and Power. MEDIWORX is duly organized and validly existing under the laws of the State of Pennsylvania and has all requisite power and authority to enter into and perform its obligations under this Agreement.

Section 5.2. Authorization. The execution, delivery, and performance of this Agreement has been duly authorized by all necessary action on the part of MEDIWORX, and this Agreement is a valid and binding obligation of MEDIWORX, enforceable against it in accordance with its terms.

Section 5.3. Valid Issuance. The Shares have been duly authorized by all necessary corporate action. When issued and sold against receipt of the consideration therefor, the Shares will be validly issued, fully paid, and non-assessable, will not subject the holders thereof to personal liability and will not be issued in violation of preemptive rights.

Section 5.4. Non-Contravention. The execution, delivery, and performance of this Agreement will not conflict with, violate, or result in a breach of any provision of, or constitute a default (or an event which, with notice or lapse of time or both, would constitute a default) under, or result in, the termination of or accelerate the performance required by, or result in a right of termination or acceleration under, any provision of the organizational or governing documents of MEDIWORX.

Section 5.5. Purchase for Own Account. MEDIWORX is acquiring the Shares for its own account and not with a view to the distribution thereof in violation of the Securities Act.

Section 5.6. Private Placement. MEDIWORX understands that (i) the Shares have not been registered under the Securities Act or any state securities laws, by reason of their issuance by the Company in a transaction exempt from the registration requirements thereof and (ii) the Shares may not be sold unless such disposition is registered under the Securities Act and applicable state securities laws or is exempt from registration thereunder.

Section 5.7. Legend. Each certificate representing an Exchange Share will bear a legend to the following effect unless the Company determines otherwise in compliance with applicable law:

"THE SHARES REPRESENTED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "SECURITIES ACT"), OR THE SECURITIES LAWS OF ANY STATE OR OTHER JURISDICTION. THE SHARES HAVE BEEN ACQUIRED FOR INVESTMENT AND NEITHER THIS SHARE NOR ANY INTEREST OR PARTICIPATION HEREIN MAY BE REOFFERED, SOLD, ASSIGNED, TRANSFERRED, PLEDGED, ENCUMBERED OR OTHERWISE DISPOSED OF IN THE ABSENCE OF SUCH REGISTRATION OR UNLESS SUCH TRANSACTION IS EXEMPT FROM, OR NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT."

Section 5.8. Later Registration. MEDIWORX undertakes that these Shares will be, at a later date, be registered or made subject to an exemption from registration by MEDIWORX, under the Securities Act or any State Securities Laws, such that these Shares may later be sold, transferred or disposed of in any manner the Management of GEGP sees fit.

ARTICLE VI,

ADDITIONAL AGREEMENTS.

Section 6.1. Action by Written Consent by Holders of Series A Preferred Stock. The Merger Agreement and the Exchange contemplated by this Agreement are the result of corporate actions authorized by the written consent of all of the holders of Series A Preferred Stock, as such actions are permitted by the Wyoming Business Corporation Act and the Articles of Incorporation of the Company.

ARTICLE VII,

CONDITIONS TO SHARE EXCHANGE CLOSING.

Section 7.1. Conditions to Each Party's Obligation To Effect the Exchange. The respective obligations of the Parties hereunder to effect the Exchange shall be subject to the following condition:

(a) No Injunctions or Restraints; Illegality. No order, injunction, or decree issued by any court or agency of competent jurisdiction or other law preventing or making illegal the consummation of the Exchange shall be in effect.

Section 7.2. Conditions to the Obligations of MEDIWORX. The obligations of MEDIWORX hereunder to effect the Exchange shall be subject to the satisfaction, or waiver by MEDIWORX, of the following conditions:

No Injunctions or Restraints; Illegality. No order, injunction, or decree issued by any court or agency of competent jurisdiction or other law preventing or making illegal MEDIWORX's unrestricted and unlimited right to vote the Shares shall be in effect.

ARTICLE VIII,

TERMINATION.

Section 8.1. Injunction; Illegality. This Agreement may be terminated at any time prior to the Share Exchange Closing by MEDIWORX if (a) an order, injunction or decree shall have been issued by any court or agency of competent jurisdiction and shall be non-appealable, or other law shall have been issued preventing or making illegal either (i) the completion of the Exchange or the other transactions contemplated by this Agreement, or (ii) MEDIWORX's unrestricted and unlimited right to vote the Shares or (b) the Merger Agreement terminates pursuant to its terms.

ARTICLE IX,

MISCELLANEOUS.

Section 9.1. Notices. All notices and other communications required or permitted to be given under this Agreement shall be in writing and shall be deemed to have been given if delivered personally or seven days after having been sent by certified mail, return receipt requested, postage prepaid, to the parties to this Agreement at the following address or to such other address either Party to this Agreement shall specify by notice to the other Party:

Section 9.2. Further Assurances. Each Party hereto shall do and perform or cause to be done and performed all further acts and shall execute and deliver all other agreements, certificates, instruments, and documents as any other Party hereto reasonably may request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

Section 9.3. Amendments and Waivers. Any provision of this Agreement may be amended or waived if, but only if, such amendment or waiver is in writing and is duly executed and delivered by the Company and MEDIWORX. No failure or delay by any Party in exercising any right, power, or privilege hereunder shall operate as a waiver thereof nor shall any single or partial exercise thereof preclude any other or further exercise thereof or the exercise of any other right, power or privilege. The rights and remedies herein provided shall be cumulative and not exclusive of any rights or remedies provided by law.

Section 9.4. Fees and Expenses. Each Party hereto shall pay all of its own fees and expenses (including attorneys fees) incurred in connection with this Agreement and the transactions contemplated hereby.

Section 9.5. Successors and Assigns. The provisions of this Agreement shall be binding upon and inure to the benefit of the Parties hereto and their respective successors and assigns, provided that neither party may assign, delegate, or otherwise transfer any of its rights or obligations under this Agreement without the consent of the other Party hereto.

Section 9.6. Governing Law. This Agreement shall be governed and construed in accordance with the internal laws of the State of Wyoming applicable to contracts made and wholly performed within such state, without regard to any applicable conflicts of law principles. The Parties hereto agree that any suit, action or proceeding brought by either Party to enforce any provision of, or based on any matter arising out of or in connection with, this Agreement or the transactions contemplated hereby shall be brought in any federal or state court located in the State of Wyoming. Each of the Parties hereto submits to the jurisdiction of any such court in any suit, action, or proceeding seeking to enforce any provision of, or based on any matter arising out of, or in connection with, this Agreement or the transactions contemplated hereby and hereby irrevocably waives the benefit of jurisdiction derived from present or future domicile or otherwise in such action or proceeding. Each Party hereto irrevocably waives, to the fullest extent permitted by law, any objection that it may now or hereafter have to the laying of venue of any such suit, action or proceeding in any such court or that any such suit, action or proceeding brought in any such court has been brought in an inconvenient forum.

Section 9.7. Waiver Of Jury Trial. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 9.8 Entire Agreement. This Agreement constitutes the entire agreement between the Parties with respect to the subject matter of this Agreement and supersedes all prior agreements and understandings, both oral and written, between the Parties and/or their affiliates with respect to the subject matter of this Agreement.

Section 9.9. Effect of Headings. The article and section headings herein are for convenience only and shall not affect the construction hereof.

Section 9.10. Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, such provision shall be deemed to be excluded from this Agreement and the balance of this Agreement shall be interpreted as if such provision were so excluded and shall be enforced in accordance with its terms to the maximum extent permitted by law.

Section 9.11. Counterparts; Third Party Beneficiaries. This Agreement may be signed in any number of counterparts, each of which shall be an original, with the same effect as if the signatures were upon the same instrument. No provision of this Agreement shall confer upon any person other than the parties hereto any rights or remedies hereunder. Facsimile or electronic signatures are acceptable to the Parties.

Section 9.12. Specific Performance. The Parties agree that irreparable damage would occur in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms. It is accordingly agreed that the Parties shall be entitled to seek specific performance of the terms hereof, this being in addition to any other remedies to which they are entitled at law or equity.

This Agreement is dependent and contingent on the transfer of the SERIES A Preferred shares being transferred in accordance with the SERIES A TRANSFER AGREEMENT (the "SERIES A TRANSFER AGREEMENT"), between IceLounge, Inc the registered owners of all of the SERIES A shares, and the management of MEDIWORKX.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their respective authorized officers as of the day and year first above written.

MEDIWORX, llc

A Pennsylvania limited liability corporation

By: /s/ Mark Julian

Its: Managing Member

Date: APRIL 23, 2023

GOLD ENTERTAINMENT GROUP, INC.

A Wyoming corporation

By: /s/ Hamon Francis Fytton

Date: APRIL 23, 2023

Its: Chief Executive Officer and Director

EXHIBIT A - Closing and Expenses

A. GEGP, including its acquisitions and subsidiaries, shall be responsible for the State filing fees, amendments and business licenses for their respective companies.

B. Application and annual listing fees for a Listed Securities Exchange (the "EXCHANGE") will be paid by GEGP.

C. Both GEGP, including its acquisitions and subsidiaries, and MEDIWORX shall be responsible for their accounting and legal fees for their respective companies.

D. GEGP, including its acquisitions and subsidiaries, shall be responsible for their PCAOB Audit Fees for their respective companies.

E. GEGP, shall be responsible for the Transfer Agent fees following the closing.

F. Both GEGP , including its acquisitions and subsidiaries, and MEDIWORX shall be responsible for any miscellaneous fees for their respective companies.

G. To become effective as of April 30th, 2023, being the current quarterly end for GEGP.

PART II – PRELIMINARY OFFERING CIRCULAR - FORM 1-A/A: TIER I Amendment 1

An Offering statement pursuant to Regulation A relating

to these securities has been filed with the Securities and Exchange Commission. Information contained in this Preliminary Offering

Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the

Offering statement filed with the Securities and Exchange Commission

is qualified. This Preliminary Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy

nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before

registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a Final Offering

circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where

the Final Offering Circular or the Offering statement in which such Final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR

Dated: September 15, 2024

Subject to Completion

PURSUANT TO REGULATION A OF THE SECURITIES ACT OF 1933

GOLD ENTERTAINMENT GROUP, INC.

2412 Irwin St.

Melbourne, FL 32901

Best Efforts Offering of up to Five Billion (5,000,000,000) Shares of Common Stock

Including Two Billion One hundred million (2,100,000,000) from selling shareholders and;

One hundred thousand PREFERRED SERIES B (100,000) convertible shares from a selling shareholder.

at an offering price of $0.00015 per Share

Minimum Investment: $15,000 (100,000,000 Shares)

Maximum Offering: $435,000

See The Offering - Page 9 and Securities Being Offered - Page 44. For Further Details and ITEM 14. SECURITIES BEING OFFERED with respect to the Selling Shareholders. Existing shareholders, including PREFERRED SERIES convertible shareholders, are free to sell their shares at any price they want. This Offering Will Commence Upon Qualification of this Offering by the Securities

and Exchange Commission and Will Terminate 365 days from the date of qualification by the Securities And Exchange Commission, Unless Extended or Terminated Earlier By The Issuer

PLEASE REVIEW ALL RISK FACTORS ON

PAGES 10 THROUGH PAGE 20 BEFORE MAKING AN INVESTMENT IN THIS COMPANY. AN INVESTMENT IN THIS COMPANY SHOULD ONLY BE MADE

IF YOU ARE CAPABLE OF EVALUATING THE RISKS AND MERITS OF THIS INVESTMENT AND IF YOU HAVE SUFFICIENT RESOURCES TO BEAR THE ENTIRE

LOSS OF YOUR INVESTMENT, SHOULD THAT OCCUR.

THE UNITED STATES SECURITIES AND EXCHANGE

COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES

IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE OFFERED PURSUANT

TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE

SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Because these securities are being offered on a “best

efforts” basis, the following disclosures are hereby made:

| | |

Price to Public | |

Commissions (1) | |

Proceeds to

Company (2) | |

Proceeds to

Other Persons (3) |

| Per Share | |

$ | 0.00015 | | |

$ | 0 | | |

$ | 0.00015 | | |

| None | |

| Minimum Investment | |

$ | 15,000 | | |

$ | 0 | | |

$ | 15,000 | | |

| None | |

| Maximum Offering | |

$ | 750,000 | | |

$ | 0 | | |

$ | 435,000 | | |

$ | 315,000 | |

| (1) | The Company shall pay no commissions to underwriters

for the sale of securities under this Offering. |

| | | |

| | (2) | Does not reflect payment of expenses of this Offering, which are estimated to not exceed $50,000.00 and which include, among other

things, legal fees, accounting costs, reproduction expenses, due diligence, marketing, consulting, administrative services other

costs of blue sky compliance, and actual out-of-pocket expenses incurred by the Company selling the Shares. This amount represents

the proceeds of the offering to the Company, which will be used as set out in “USE OF PROCEEDS TO ISSUER.” |

| | | |

| | (3) | There are no finder’s fees or other fees being paid to third parties from the proceeds of shares sold by the Company. The

Company shall receive no proceeds from the sale of 2,100,000,000 shares, nor the one hundred thousand PREFERRED SERIES B (100,000) convertible shares, being offered by the Selling Shareholders. |

This Offering (the “Offering”)

consists of Common Stock (the “Shares” or individually, each a “Share”) that is being offered on a “best

efforts” basis, which means that there is no guarantee that any minimum amount will be sold. The Shares are being offered

and sold by Gold Entertainment Group, Inc. a Wyoming Corporation (the “Company”) and certain shareholders of the Company (the

“Selling Shareholders”). There are 2,900,000,000 Shares being offered by the Company at a price of $0.00015 per Share with

a minimum purchase of 100,,000,000 shares per investor. We may waive the minimum purchase requirement on a case-by-case basis in our sole discretion. There are an additional 2,100,000,000 shares of Common Stock being offered and a further one hundred thousand PREFERRED SERIES B (100,000) convertible shares by the Selling Shareholders. Under Rule 251(d)(2)(i)(C) of Regulation of Regulation A+, non-accredited, non-natural investors are subject to the investment limitation and may only invest funds which do not exceed 10% of the greater of the purchaser’s revenue or net assets (as of the purchaser’s most recent fiscal year end). A non-accredited, natural person may only invest funds which do not exceed

10% of the greater of the purchaser’s annual income or net worth (please see below on how to calculate your net worth). The maximum aggregate amount of the Shares offered 5,000,000,000 Shares of Common Stock, and a further one hundred thousand PREFERRED SERIES B (100,000) convertible shares, is seven hundred and fifty-thousand dollars ($750,000). There is no minimum number of Shares that needs to be sold in order for funds to be released to the Company and for this Offering to close. The Company will retain all proceeds received from the shares sold on their account in this offering. The Company will not receive any proceeds from sales by the Selling Shareholders.

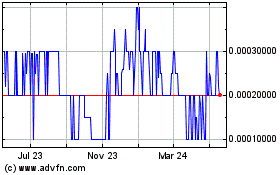

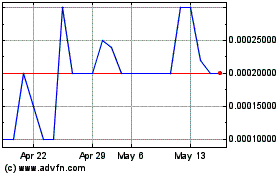

Our Common Stock is currently quoted

on the OTC Pink tier of the OTC Market Group, Inc. under the symbol “GEGP” On September 15, 2024, the last reported sale price of our common stock was $0.0002 (made on September 9, 2024).

The Shares are being offered pursuant

to Regulation A of Section 3(b) of the Securities Act of 1933, as amended, for Tier I offerings. The Shares will only be issued

to purchasers who satisfy the requirements set forth in Regulation A. The offering is expected to expire on the first of: (i) all

of the Shares offered are sold; or (ii) the close of business 365 days from the date of qualification by the Commission, unless

sooner terminated or extended by the Company’s CEO. Pending each closing, payments for the Shares will be paid directly to

the Company. Funds will be immediately transferred to the Company where they will be available for use in the operations of the

Company’s business in a manner consistent with the “USE OF PROCEEDS TO ISSUER” in this Offering Circular.

VOTING RIGHTS OF PREFERRED SHARES

There are two classes of PREFERRED SHARES, A and B.

-

PREFERRED SERIES A - Vote as Common Shares at the ratio of one PREFERRED SERIES A share equals 5,000 Common Shares.

These shares are designated as non-convertible, therefore they act solely as a voting control class of shares only. Each SERIES A Preferred Share votes at 1:5,000 to Common Stock. Therefore this represents majority voting control of the Company.

-

PREFERRED SERIES B - PREFERRED SERIES B Shares are convertible to Common Shares, at the shareholders discretion, at 50% of 5-day trading average prior to conversion. When converted, these common shares have the same voting rights as others in the same class of securities. The PREFERRED SERIES B Shares do not have specific voting rights prior to conversion into Common Shares.

THIS OFFERING CIRCULAR DOES NOT CONSTITUTE

AN OFFER OR SOLICITATION IN ANY JURISDICTION IN WHICH SUCH AN OFFER OR SOLICITATION WOULD BE UNLAWFUL. NO PERSON HAS BEEN AUTHORIZED

TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATIONS CONCERNING THE COMPANY OTHER THAN THOSE CONTAINED IN THIS OFFERING CIRCULAR,

AND IF GIVEN OR MADE, SUCH OTHER INFORMATION OR REPRESENTATION MUST NOT BE RELIED UPON.

PROSPECTIVE INVESTORS ARE NOT TO

CONSTRUE THE CONTENTS OF THIS OFFERING CIRCULAR, OR OF ANY PRIOR OR SUBSEQUENT COMMUNICATIONS FROM THE COMPANY OR ANY OF ITS EMPLOYEES,