Auto makers reported lower customer demand and results Thursday

in the first full quarter to show the global effects of the new

coronavirus.

Daimler AG's net loss widened and revenue fell in the second

quarter as a result of the closure of sales centers in its core

markets due to the Covid-19 pandemic.

The German premium car maker said it is now seeing the first

signs of recovery, especially at Mercedes-Benz passenger cars, with

strong demand for its top-end models and electrified vehicles.

Still, Daimler expects a significant contraction of the global car

market in 2020 and assumes that coronavirus-related unit sales

decreases won't be offset in the rest of the year.

South Korean car makers Hyundai Motor Co. and Kia Motors Corp.

saw sharp falls in their second-quarter profits, weighed mainly by

the pandemic suppressing demand for vehicles overseas.

Great Wall Motor Co. also had lower sales during the pandemic.

The Chinese car maker said its first-half net profit fell 24% from

a year earlier.

Other earnings reported Thursday:

Air Products & Chemicals Inc.: The gas and chemical company

reported an 8.5% fall in third-quarter profit, largely due to the

negative effects of the pandemic on the business.

American Airlines Group Inc.: The airline posted a big loss for

the second quarter. "COVID-19 and the resulting shutdown of the

U.S. economy have caused severe disruptions to global demand for

air travel," CEO Doug Parker said. The airline ended the quarter

with $10.2 billion in available liquidity, after receiving bailout

funds from the U.S. government and issuing $1.2 billion of

debt.

AT&T Inc.: The telecom and media company's second-quarter

profit fell as the pandemic and an already unhealthy satellite-TV

business overshadowed the launch of its make-or-break streaming

video service.

Beazley PLC: The U.K. specialty insurer reported a swing to

pretax loss for the first half as the pandemic boosted claims.

CapitaLand Commercial Trust: The company's second-quarter

distribution per unit fell 23% on year due to fall in income from

Singapore properties caused by lower occupancies and rental waivers

to tenants affected by pandemic.

Croda International PLC: The FTSE-100 chemicals company said

pretax profit for the first half of 2020 fell after booking higher

costs, and, although trading has stabilized, visibility is limited

and the timing of recovery remains unclear due to the pandemic.

Daily Mail & General Trust PLC: The U.K. media group said it

swung to an adjusted operating loss for the third quarter of its

fiscal 2020, as the pandemic disrupted its U.K. property

information, events and consumer media operations.

Dow Inc.: The materials company swung to a second-quarter loss

as revenue declined amid lower volumes during the continuing

pandemic.

Getlink SE: The French operator of the Channel Tunnel between

the U.K. and France said it swung to a net loss in the first half

of the year, while revenue suffered the consequences of the

pandemic.

G4S PLC: The FTSE-250 security services company posted a higher

profit before tax for the first half of the year, but its

underlying performance was hit by the pandemic and the company

suspended its interim dividend.

Hershey Co.: The candy maker reported a weaker profit and

falling sales for the second quarter, as retailers, struggling with

the effects of the pandemic on their businesses, pulled back on

candy orders.

Howden Joinery Group PLC: The U.K. maker of kitchen and joinery

products swung to a pretax loss for the first half of the year

after it booked higher costs and revenue fell. Howden Joinery said

predictions of future demand levels are difficult due to the effect

of the pandemic.

Immunodiagnostic Systems Holdings PLC: The diagnostic testing

kit provider said revenue in the first quarter of fiscal 2021 has

been hurt by the pandemic, with April suffering the hardest hit and

June seeing some recovery.

Kimberly-Clark Corp.: The home-goods company reported a higher

profit in the latest quarter, driven in part by cost-saving efforts

and by higher consumer-tissue sales during the Covid-19

pandemic.

Learning Technologies Group PLC: The U.K. provider of services

and technologies for digital learning said first-half trading rose

in line with management views despite a limited coronavirus hit on

the underlying business.

Loblaw Cos. Ltd.: The food retailer company reported a 40% fall

in second-quarter profit despite higher revenue in the period and

said Covid-19-related expenses negatively affected earnings.

Mapletree Commercial Trust: The Singapore-based trust's net

property income fell almost 11% in its fiscal first quarter,

largely due to rental rebates granted to retail tenants hard hit by

the pandemic.

Maxis Bhd.: The Malaysian cellular service provider's net profit

for the second quarter dropped 14% from a year earlier, mainly due

to its weaker wholesale business and higher impairment of

receivables amid the pandemic.

Novolipetsk Steel: The London-listed Russian steelmaker reported

a fall in net profit and revenue for the second quarter as the

pandemic dented demand.

Property Franchise Group PLC: The estate and lettings agency

said its overall performance in the first half was strong despite

the coronavirus and it returned to growth in June, reinstating its

interim dividend.

Publicis Groupe SA: The major advertising agency conglomerate

reported a 2.6% increase in net revenue in the second quarter, but

organic revenue -- a key industry measure that strips out currency

effects, acquisitions and disposals -- fell 13%. Chairman and CEO

Arthur Sadoun said the wider economic upheaval prompted by the

coronavirus was proving to be at least as bad as he anticipated

after the first quarter. The social unrest following the police

killing of George Floyd has added another layer of challenges, he

said.

Quest Diagnostics Inc.: The diagnostics company reported a

smaller second-quarter profit than last year's amid a 6.4% revenue

decline as the pandemic skewed the demand for health-care

services.

RELX PLC: The FTSE 100 information and analytics group said net

profit for the first half fell 30% as the pandemic hit revenue, and

its full-year outlook for its events division is highly

uncertain.

Repsol SA: The Spanish energy company swung to a loss in the

second quarter due to the historic fall in oil and gas prices

caused by the pandemic.

Roche Holding AG: The Swiss pharm giant reported a 6.3% fall in

first-half net profit as the pandemic hurt sales across its whole

business. Roche cited travel restrictions, canceled or delayed

patient visits, and minimized visits to pharmacies by

consumers.

Severstal PAO: The Russian steelmaker reported a sharp rise in

second-quarter net profit on foreign exchange gains but said

first-half results were hurt by the pandemic and weak steel

prices.

Southwest Airlines Co.: The carrier posted a loss for the second

quarter and said improvements in passenger traffic stalled in July

as some states saw a resurgence in Covid-19.

Suntec Real Estate Investment Trust: The Singapore-based trust's

first-half distribution to unitholders fell 31% from a year earlier

as it retained capital to guard against financial stresses from the

pandemic.

Twitter Inc.: The social media company reported strong user

growth but experienced lingering impacts from the pandemic in its

latest quarter, as the platform will have to navigate a rocky

advertising climate and the fallout from a major security breach in

the weeks ahead.

Unilever PLC: The consumer-goods company reported

better-than-expected second-quarter sales as a strong performance

in the U.S. outweighed coronavirus-related declines elsewhere in

the world.

Union Pacific Corp.: The U.S. railroad reported a weaker

second-quarter profit, reflecting how demand for shipments across

the company's business lines fell off amid coronavirus-related

shutdowns earlier this year.

Vodacom Group Ltd.: The telecommunications company's revenue

rose 5.6% in the first quarter, as the coronavirus lockdown boosted

mobile and fixed traffic in South Africa. As a result of increased

demand, the company accelerated network infrastructure spending by

22% and used a temporary assignment of spectrum to increase its

network capacity and fast-track the launch of its 5G network.

W.W. Grainger Inc.: The company reported a smaller

second-quarter profit amid an estimated decline in its primary

market for maintenance, repair and operating products during the

pandemic.

Write to Rose Manzo at rose.manzo@wsj.com

(END) Dow Jones Newswires

July 23, 2020 11:41 ET (15:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

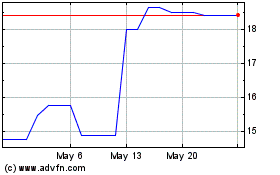

Great Wall Motor (PK) (USOTC:GWLLY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Great Wall Motor (PK) (USOTC:GWLLY)

Historical Stock Chart

From Nov 2023 to Nov 2024