UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____ to ____

Commission file number: 333-60608

JANEL CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | | 86-1005291 |

| (State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| 80 Eighth Avenue | | |

| New York, New York | | 10011 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 373-5895

Former name, former address and former fiscal year, if changed from last report: N/A

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbols(s)

|

|

Name of each exchange

on which registered

|

|

None

|

|

None

|

|

None

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of

Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer | ☐ |

| Non-accelerated filer ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ☐ No ☒

The number of shares of Common Stock outstanding as of February 7, 2025 was 1,186,354.

JANEL CORPORATION

QUARTERLY REPORT ON FORM 10-Q

For Quarterly Period Ended December 31, 2024

TABLE OF CONTENTS

| |

|

|

Page

|

| |

|

|

|

|

|

3

|

| |

|

|

|

| |

Item 1.

|

|

3

|

| |

|

|

|

| |

|

|

3

|

| |

|

|

|

| |

|

|

4

|

| |

|

|

|

| |

|

|

5

|

| |

|

|

|

| |

|

|

6

|

| |

|

|

|

| |

|

|

7

|

| |

|

|

|

| |

Item 2.

|

|

19

|

| |

|

|

|

| |

Item 4.

|

|

27

|

| |

|

|

|

|

|

28

|

| |

|

|

|

| |

Item 1.

|

|

28

|

| |

|

|

|

| |

Item 1A.

|

|

28

|

| |

|

|

|

| |

Item 2.

|

|

28

|

| |

|

|

|

| |

Item 6.

|

|

28

|

| |

|

|

|

| |

|

|

29

|

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

JANEL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(Unaudited)

| | | December 31, 2024 | | September 30,

2024 |

ASSETS | | | | | | |

Current Assets: | | | | | | |

Cash | | $ | 2,350 | | | $ | 2,832 | |

Accounts receivable, net of allowance for doubtful accounts | | | 33,697 | | | | 33,815 | |

Inventory, net | | | 4,635 | | | | 4,478 | |

Prepaid expenses and other current assets | | | 4,642 | | | | 4,829 | |

Total current assets | | | 45,324 | | | | 45,954 | |

Property and Equipment, net | | | 5,425 | | | | 5,492 | |

Other Assets: | | | | | | | | |

Intangible assets, net | | | 24,475 | | | | 25,117 | |

Goodwill | | | 23,227 | | | | 23,030 | |

Restricted cash | | | 2,414 | | | | 250 | |

Investment in marketable securities at fair value | | | 1,913 | | | | 1,574 | |

Operating lease right of use asset | | | 7,861 | | | | 8,621 | |

Security deposits and other long-term assets | | | 607 | | | | 572 | |

Total other assets | | | 60,497 | | | | 59,164 | |

Total assets | | $ | 111,246 | | | $ | 110,610 | |

LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | | | |

Current Liabilities: | | | | | | | | |

Lines of credit | | $ | 19,687 | | | $ | 23,013 | |

Accounts payable - trade | | | 33,151 | | | | 32,000 | |

Accrued expenses and other current liabilities | | | 6,257 | | | | 7,489 | |

Dividends payable | | | 2,274 | | | | 2,271 | |

Current portion of earnout | | | 1,262 | | | | 1,262 | |

Current portion of long-term debt | | | 1,452 | | | | 1,276 | |

Current portion of subordinated promissory notes-related party | | | 1,574 | | | | 1,628 | |

Current portion of operating lease liabilities | | | 2,198 | | | | 2,419 | |

Total current liabilities | | | 67,855 | | | | 71,358 | |

Other Liabilities: | | | | | | | | |

Long-term debt | | | 7,263 | | | | 3,028 | |

Long-term portion of earnout | | | 2,165 | | | | 2,119 | |

Subordinated promissory notes-related party | | | 3,100 | | | | 3,445 | |

Mandatorily redeemable non-controlling interest | | | 1,529 | | | | 1,529 | |

Deferred income taxes | | | 2,514 | | | | 2,514 | |

Long-term operating lease liabilities | | | 6,338 | | | | 6,585 | |

Other liabilities | | | 529 | | | | 531 | |

Total other liabilities | | | 23,438 | | | | 19,751 | |

Total liabilities | | | 91,293 | | | | 91,109 | |

Stockholders' Equity: | | | | | | | | |

Preferred Stock, $0.001 par value; 100,000 shares authorized | | | | | | | | |

Series C 30,000 shares authorized and 11,368 shares issued and outstanding at

December 31, 2024 and September 30, 2024, liquidation value of $7,959

and $7,957 at December 31, 2024 and September 30, 2024, respectively | | | — | | | | — | |

Common stock, $0.001 par value; 4,500,000 shares authorized, 1,206,354 issued

and 1,186,354 outstanding as of December 31, 2024 and September 30,

2024 | | | 1 | | | | 1 | |

Paid-in capital | | | 16,877 | | | | 17,084 | |

Common treasury stock, at cost, 20,000 shares | | | (240 | ) | | | (240 | ) |

Accumulated earnings | | | 3,315 | | | | 2,656 | |

Total stockholders' equity | | | 19,953 | | | | 19,501 | |

Total liabilities and stockholders' equity | | $ | 111,246 | | | $ | 110,610 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

JANEL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(Unaudited)

| | | Three Months Ended December 31, |

| | | 2024 | | 2023 |

Revenues: | | | | | | |

Logistics | | $ | 46,086 | | | $ | 35,215 | |

Life Sciences and Manufacturing | | | 5,268 | | | | 5,820 | |

Total Revenues | | | 51,354 | | | | 41,035 | |

Forwarding expenses and cost of revenues: | | | | | | | | |

Forwarding expenses - Logistics | | | 34,708 | | | | 25,214 | |

Cost of revenues - Life Sciences and Manufacturing | | | 1,504 | | | | 1,676 | |

Total forwarding expenses and cost of revenues | | | 36,212 | | | | 26,890 | |

Gross profit | | | 15,142 | | | | 14,145 | |

Operating Expenses: | | | | | | | | |

Selling, general and administrative | | | 13,292 | | | | 12,605 | |

Amortization of intangible assets | | | 641 | | | | 538 | |

Total Operating Expenses | | | 13,933 | | | | 13,143 | |

Income from Operations | | | 1,209 | | | | 1,002 | |

Other Items: | | | | | | | | |

Interest expense | | | (666 | ) | | | (524 | ) |

Other income (expense) | | | 314 | | | | (10 | ) |

Income Before Income Taxes | | | 857 | | | | 468 | |

Income tax expense | | | (198 | ) | | | (192 | ) |

Net Income | | | 659 | | | | 276 | |

Preferred stock dividends | | | (86 | ) | | | (72 | ) |

Non-controlling interest dividends | | | (243 | ) | | | — | |

Net Income Available to Common Stockholders | | $ | 330 | | | $ | 204 | |

Net income per share: | | | | | | | | |

Basic | | $ | 0.56 | | | $ | 0.23 | |

Diluted | | $ | 0.55 | | | $ | 0.23 | |

Net income per share attributable to common stockholders: | | | | | | | | |

Basic | | $ | 0.29 | | | $ | 0.17 | |

Diluted | | $ | 0.28 | | | $ | 0.17 | |

Weighted average number of shares outstanding: | | | | | | | | |

Basic | | | 1,186.3 | | | | 1,186.3 | |

Diluted | | | 1,205.4 | | | | 1,202.1 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

JANEL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF

STOCKHOLDERS’ EQUITY

(in thousands, except share and per share data)

(Unaudited)

| | | PREFERRED STOCK | | COMMON STOCK | | PAID-IN CAPITAL | | COMMON TREASURY STOCK | | ACCUMULATED EARNINGS | | TOTAL EQUITY |

| | | SHARES | | $ | | SHARES | | $ | | $ | | SHARES | | $ | | $ | | $ |

Balance - September 30, 2024 | | | 11,368 | | | $ | — | | | | 1,206,354 | | | $ | 1 | | | $ | 17,084 | | | | 20,000 | | | $ | (240 | ) | | $ | 2,656 | | | $ | 19,501 | |

Net Income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 659 | | | | 659 | |

Dividends to preferred stockholders | | | — | | | | — | | | | — | | | | — | | | | (86 | ) | | | — | | | | — | | | | — | | | | (86 | ) |

Dividends to non-controlling interest | | | — | | | | — | | | | — | | | | — | | | | (243 | ) | | | — | | | | — | | | | — | | | | (243 | ) |

Stock based compensation | | | — | | | | — | | | | — | | | | — | | | | 122 | | | | — | | | | — | | | | — | | | | 122 | |

Balance - December 31, 2024 | | | 11,368 | | | $ | — | | | | 1,206,354 | | | | 1 | | | $ | 16,877 | | | | 20,000 | | | $ | (240 | ) | | $ | 3,315 | | | $ | 19,953 | |

| | | PREFERRED

STOCK | | COMMON STOCK | | PAID-IN CAPITAL | | COMMON TREASURY STOCK | | ACCUMULATED EARNINGS | | TOTAL EQUITY |

| | SHARES | | $ | | SHARES | | $ | | $ | | SHARES | | $ | | $ | | $ |

Balance - September 30, 2023 | | | 11,368 | | | $ | — | | | | 1,206,354 | | | $ | 1 | | | $ | 17,107 | | | | 20,000 | | | $ | (240 | ) | | $ | 2,105 | | | $ | 18,973 | |

Net Income | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | — | | | | 276 | | | | 276 | |

Dividends to preferred stockholders | | | — | | | | — | | | | — | | | | — | | | | (72 | ) | | | — | | | | — | | | | — | | | | (72 | ) |

Stock based compensation | | | — | | | | — | | | | — | | | | — | | | | 68 | | | | — | | | | — | | | | — | | | | 68 | |

Balance - December 31, 2023 | | | 11,368 | | | $ | — | | | | 1,206,354 | | | $ | 1 | | | $ | 17,103 | | | | 20,000 | | | $ | (240 | ) | | $ | 2,381 | | | $ | 19,245 | |

The accompanying notes are an integral part of these condensed

consolidated financial statements.

JANEL CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS

(in thousands)

(Unaudited)

| | | Three Months Ended December 31, |

| | | 2024 | | 2023 |

Cash flows from operating activities: | | | | | | |

Net income | | $ | 659 | | | $ | 276 | |

Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | | |

(Recovery of) Provision for uncollectible accounts | | | 36 | | | | (153 | ) |

Depreciation | | | 159 | | | | 130 | |

Amortization of intangible assets | | | 641 | | | | 538 | |

Amortization of acquired inventory valuation | | | 69 | | | | 83 | |

Amortization of loan costs | | | 57 | | | | 26 | |

Stock-based compensation | | | 122 | | | | 71 | |

Unrealized (gain) loss on marketable securities | | | (303 | ) | | | 709 | |

Change in fair value of mandatorily redeemable noncontrolling interest | | | — | | | | 146 | |

Fair value adjustments of contingent earnout liabilities | | | 94 | | | | 405 | |

Gain on extinguishment | | | — | | | | (21 | ) |

Changes in operating assets and liabilities, net of effects of acquisitions: | | | | | | | | |

Accounts receivable | | | 82 | | | | 1,706 | |

Inventory | | | (225 | ) | | | 139 | |

Prepaid expenses and other current assets | | | 187 | | | | 616 | |

Security deposits and other long-term assets | | | (36 | ) | | | 130 | |

Accounts payable and accrued expenses | | | (79 | ) | | | (1,876 | ) |

Other liabilities | | | 291 | | | | 81 | |

Net cash provided by operating activities | | | 1,754 | | | | 3,006 | |

Cash flows from investing activities: | | | | | | | | |

Acquisition of property and equipment, net of disposals | | | (91 | ) | | | (53 | ) |

Investment in marketable securities (net of dividends) | | | (36 | ) | | | — | |

Acquisitions | | | (197 | ) | | | — | |

Net cash used in investing activities | | | (324 | ) | | | (53 | ) |

Cash flows from financing activities: | | | | | | | | |

Proceeds from (Repayments) of term loan | | | 4,397 | | | | (612 | ) |

Proceeds from (Payments to) Lines of credit, net | | | 330 | | | | (2,707 | ) |

Repayment of subordinate promissory notes, net | | | (448 | ) | | | (516 | ) |

Repayment of acquisition loan | | | (3,700 | ) | | | — | |

Dividends paid to non-controlling interest | | | (243 | ) | | | — | |

Dividends paid to preferred shareholders | | | (84 | ) | | | — | |

Net cash provided by (used in) financing activities | | | 252 | | | | (3,835 | ) |

Net increase (decrease) in cash | | | 1,682 | | | | (882 | ) |

Cash at beginning of the period | | | 3,082 | | | | 2,461 | |

Cash and restricted cash at end of period | | | 4,764 | | | | 1,579 | |

| | | | | | | | |

Supplemental disclosure of cash flow information: | | | | | | | | |

Cash paid during the period for: | | | | | | | | |

Interest | | | 503 | | | | 511 | |

Income taxes | | | (20 | ) | | | 156 | |

Non-cash financing activities: | | | | | | | | |

Dividends declared to preferred stockholders | | | 86 | | | | 72 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

JANEL CORPORATION AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (in thousands, except per share data)

(Unaudited)

1. BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The accompanying interim unaudited condensed consolidated financial statements have been prepared pursuant to the rules and regulations of Article 8 of

Regulation S-X and the instructions to Form 10-Q of the Securities and Exchange Commission. As a result, certain information and footnote disclosures normally included in audited financial statements prepared in accordance with generally accepted

accounting principles have been condensed or omitted. Janel Corporation (the “Company” or “Janel”) believes that the disclosures made are adequate to make the information presented not misleading. The condensed consolidated financial statements

reflect all adjustments which are, in the opinion of management, necessary to a fair statement of the results for the interim periods presented. The results of operations for the periods presented are not necessarily indicative of the results to be

expected for a full fiscal year, or any other period. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and related notes included in the Company’s Form 10-K as filed

with the Securities and Exchange Commission.

Business Description

Janel is a holding company with subsidiaries in three business segments: Logistics, Life Sciences and Manufacturing. The Company strives to create shareholder value primarily through three strategic priorities: supporting its businesses’ efforts to make investments and to build long-term profits; allocating Janel’s capital at high risk-adjusted rates of return; and attracting and retaining exceptional talent.

Management at the holding company focuses on significant capital allocation decisions, corporate governance and supporting Janel’s subsidiaries where appropriate. Janel expects to grow through

its subsidiaries’ organic growth and by completing acquisitions. We plan to either acquire businesses within our existing segments or expand our portfolio into new strategic segments. Our acquisition strategy focuses on reasonably-priced

companies with strong and capable management teams, attractive existing business economics and stable and predictable earnings power.

Restricted Cash

Commencing in the second half of 2024, the Company insures certain risks through a newly formed wholly-owned captive insurance company, Gainesville Insurance Company, Inc. (“Gainesville”). In addition, we also maintain some of our normal, historical insurance policies with third-party insurers. $250 in restricted cash deposits are held by Gainesville as required by state insurance regulations to remain in the captive insurance company as cash or cash equivalents.

During

the first quarter of

2025, as part of the Eighth Amendment (the “Eighth Santander Amendment”) to the Santander Loan Agreement (as defined

herein), the

Company deposited $2,164 into a restricted cash account.

The Company considers all highly liquid investments with an original maturity of three months or less, when purchased, to be cash equivalents.

Revenues and revenue recognition

Logistics

Revenues are recognized upon transfer of control of promised services to customers. With respect to its Logistics segment, the Company has determined

that, in general, each shipment transaction or service order constitutes a separate contract with the customer. When the Company provides multiple services to a customer, different contracts may be present for different services.

The Company typically satisfies its performance obligations as services are rendered at a point in time. A typical shipment would include services

rendered at origin, such as pick-up and delivery to port, freight services from origin to destination port and destination services, such as customs clearance and final delivery. The Company measures the performance of its obligations as services

are completed at a point in time during the life of a shipment, including services at origin, freight and destination. The Company fulfills nearly all of its performance obligations within a one- to two-month period.

The Company evaluates whether amounts billed to customers should be reported as gross or net revenues. Generally, revenues are recorded on a gross

basis when the Company is acting as principal and is primarily responsible for fulfilling the promise to provide the services, when it has discretion in setting the prices for the services to the customers, and the Company has the ability to direct

the use of the services provided by the third party. Revenues are recognized on a net basis when the Company is acting as agent, and we do not have latitude in carrier selection or in establishing rates with the carrier.

In the Logistics segment, the Company disaggregates its revenues by its four primary service categories: trucking, ocean freight, air freight, and customs brokerage and other. A summary of the Company’s revenues disaggregated by major service lines for the three months ended December 31, 2024 and 2023 was as follows (in thousands):

| | | Three Months Ended December 31, |

| | | 2024 | | 2023 |

Service Type | | | | | | |

Trucking | | $ | 17,720 | | | $ | 17,997 | |

Ocean | | | 13,163 | | | | 6,448 | |

Air | | | 7,676 | | | | 6,711 | |

Customs brokerage and other | | | 7,527 | | | | 4,059 | |

Total | | | 46,086 | | | | 35,215 | |

Life Sciences and Manufacturing

Revenues from the Life Sciences segment are derived from the sale of high-quality monoclonal and polyclonal antibodies, diagnostic reagents and

diagnostic kits and other immunoreagents for biomedical research and antibody manufacturing. Revenues from the Company’s Manufacturing segment, which is comprised of Indco, Inc. (“Indco”), a majority-owned subsidiary of the Company that manufactures and

distributes mixing equipment and apparatus for specific applications within various industries, are derived from the engineering, manufacture and delivery of specialty mixing equipment and accessories. Revenues for Life Sciences and Manufacturing

are recognized when products are shipped and risk of loss is transferred to the carrier(s) used.

2. ACQUISITIONS AND INVESTMENTS

Fiscal 2024 Acquisitions

On

June 5, 2024, the Company completed a business combination whereby it acquired

a majority ownership position in Airschott, Inc. (“Airschott”), a

non-asset-based freight forwarder and customs broker, for an aggregate purchase

price of $5,810. At closing, the Company purchased 80% of the

outstanding stock of Airschott for $3,600 in cash, a

$1,200 floating-rate seller’s note, and net liabilities assumed of

$170. The Company also agreed to purchase the remaining 20% of

Airschott stock in three years for deferred consideration of the greater

of 20% of 1.25 times the trailing twelve months gross

profit of Airschott and $1,200. The acquisition was funded by our

existing acquisition draw facility with First Merchants Bank (“First

Merchants”) and through our existing asset-backed facility with Santander Bank,

N.A. (“Santander”). In connection with the combination, the Company recorded an

aggregate of $1,661 in goodwill and $4,320 in other identifiable

intangibles. Subsequently, the Company recorded a deferred tax liability of $977. In the three months ended December 31, 2024, an

additional payment of $197 made on liabilities that

existed prior to the date of acquisition, increasing the goodwill related to the

acquisition by the same amounts. Supplemental

pro forma information has not been provided as the acquisition did not have a

significant impact on Janel’s consolidated results of operations, individually

or in aggregate. Airschott was founded in 1977 and is headquartered in Dulles,

Virginia. The acquisition of Airschott was completed to expand our service

offerings in our Logistics segment.

Life Sciences

On February 1, 2024, the Company completed a business combination whereby it acquired all the outstanding stock of ViraQuest, Inc. (“ViraQuest”) for an aggregate purchase price of $635, net of $29 cash received. At closing, $600 was paid in cash and $64 was recorded as a preliminary earnout consideration. The acquisition was funded with cash provided by operating activities, and the results of operations of ViraQuest are included in Janel’s consolidated results of operations since the date of the acquisition. In connection with the combination, the Company recorded an aggregate of $74 in goodwill and $412 in other identifiable intangibles. Supplemental pro forma information has not been provided as the acquisition did not have a significant impact on Janel’s consolidated results of operations, individually or in aggregate. ViraQuest is a biotechnology custom service provider specializing in adenovirus production services. ViraQuest was founded in 2000 and was headquartered in North Liberty, Iowa. The acquisition of ViraQuest was completed to expand our service offerings in our Life Sciences segment.

Fiscal 2023 Acquisitions

On March 2, 2023, the Company completed a business combination whereby it acquired all of the outstanding stock of Stephen Hall PhD, Ltd. (“SH”) for an aggregate purchase price of $600. At closing, $500 was paid in cash and $100 was due to the former stockholder of SH as a deferred acquisition payment upon integration. The acquisition was funded with cash provided by normal operations, and the results of operations of SH are included in Janel’s consolidated results of operations since the date of the acquisition. In connection with the combination, the Company recorded an aggregate of $181 in goodwill and $202 in other identifiable intangibles. SH is a developer and manufacturer of antibodies and cell culture media for research and diagnostic uses. SH was founded in 2011 and is headquartered in Lafayette, Indiana. The acquisition of SH was completed to expand our product offerings in our Life Sciences segment.

On May 22, 2023, the Company acquired all the rights, title and interests to a royalty agreement for certain antibody products for a purchase price of $500. The Company recorded this acquisition as a royalty asset, which is included in intangible assets in the accompanying consolidated balance sheet (reclassed from Security deposits and other long-term assets in fiscal year 2024) and will be amortized over the estimated life of ten years.

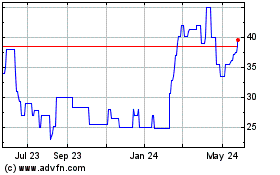

Investment in Marketable Securities at fair value

As of each of December

31,

2024 and September 30,

2024, the Company owned 1,108,000 shares, or

approximately 46.6%, of the common stock of Rubicon Technology, Inc.

(“Rubicon”). Rubicon is an advanced materials provider specializing in

monocrystalline sapphire for applications in optical and industrial systems.

The purpose of our investment in Rubicon was for Janel to acquire a significant

ownership interest in Rubicon, together with representation on Rubicon’s Board,

in an attempt to (i) restructure the Rubicon business to achieve profitability

and (ii) assist Rubicon in utilizing its net operating loss carry-forward

assets.

Inventories consisted of the following (in thousands):

| | | December 31, 2024 | | September 30,

2024 |

Finished goods | | $ | 1,914 | | | $ | 1,860 | |

Work-in-process | | | 1,193 | | | | 1,236 | |

Raw materials | | | 1,926 | | | | 1,884 | |

Gross inventory | | | 5,033 | | | | 4,980 | |

Less – reserve for inventory valuation | | | (398 | ) | | | (502 | ) |

Inventory net | | $ | 4,635 | | | $ | 4,478 | |

A summary of intangible assets and the estimated useful lives used in the computation of amortization is as follows (in thousands):

| | | December 31,

2024 | | September 30,

2024 | | Life |

Customer relationships | | $ | 29,790 | | | $ | 29,790 | | | | 10-24 Years | |

Trademarks/names | | | 4,661 | | | | 4,661 | | | | 1-20 Years | |

Trademarks/names | | | 521 | | | | 521 | | | |

Indefinite | |

Other | | | 2,007 | | | | 2,007 | | | | 2-22 Years | |

| | | 36,979 | | | | 36,979 | | | | | |

Less: Accumulated Amortization | | | (12,504 | ) | | | (11,862 | ) | | | | |

Intangible assets, net | | $ | 24,475 | | | $ | 25,117 | | | | | |

The composition of the intangible assets balance at December 31, 2024 and September 30, 2024 is as follows (in thousands):

| | | December 31,

2024 | | September 30,

2024 |

Logistics | | $ | 22,494 | | | $ | 22,494 | |

Life Sciences | | | 6,785 | | | | 6,785 | |

Manufacturing | | | 7,700 | | | | 7,700 | |

| | | 36,979 | | | | 36,979 | |

Less: Accumulated Amortization | | | (12,504 | ) | | | (11,862 | ) |

Intangible assets, net | | $ | 24,475 | | | $ | 25,117 | |

Amortization expense for the three months ended December 31, 2024 and 2023 was $641 and $538, respectively.

5. GOODWILL

The Company’s goodwill carrying amounts relate to acquisitions in the Logistics, Life Sciences and Manufacturing business segments.

The composition of the goodwill balance at December 31, 2024 and September 30, 2024 was as follows (in thousands):

| | | December 31,

2024 | | September 30,

2024

|

Logistics | | $ | 12,010 | | | $ | 11,813 | |

Life Sciences | | | 6,171 | | | | 6,171 | |

Manufacturing | | | 5,046 | | | | 5,046 | |

Total | | $ | 23,227 | | | $ | 23,030 | |

The wholly-owned subsidiaries that comprise the

Company’s Logistics segment (collectively, the “Janel Group Borrowers”), with

the Company as a guarantor, have a Loan and Security Agreement (as amended, the

“Santander Loan Agreement”) with Santander Bank, N.A. (“Santander”) with

respect to a revolving line of credit facility (the “Santander Facility”).

The Santander Loan Agreement matures on September 21, 2026. The Janel Group Borrowers’ obligations under the Santander Facility are secured by all of the assets of the Janel Group Borrowers, while the Santander Loan Agreement contains customary terms and covenants. As a result of its terms, the Santander Facility is classified as a current liability on the consolidated balance sheet.

On January 30, 2023, the Santander Loan Agreement was further amended by the Third Amendment to the Amended and Restated Loan and Security Agreement (the “Third Santander Amendment”). As amended by the terms of the Third Santander Amendment, the percentage of the Borrowers’ eligible accounts receivable used to calculate the borrowing base under the Loan Agreement was increased from 85% to 90% for Domestic Insured Accounts (as defined in the Amendment), subject to adjustments set forth in the Loan Agreement.

On April 25, 2023, in connection with an amendment to the Credit Agreement entered into with First Merchants Bank (“First Merchants”) as described further below, we entered into the Fourth

Amendment to the Amended and Restated Loan and Security Agreement (the “Fourth Santander Amendment”). The Fourth Santander Amendment (i) included modifications to address the amendments made to the First Merchants Credit Facilities (as defined

below) and the consolidation of the debt thereunder and (ii) terminated the subordination agreement relating to the Company’s guarantee of the First Merchant’s Credit Facilities.

On August 22, 2023, we entered into the Fifth Amendment to the Amended and Restated Loan and Security Agreement (the “Fifth Santander Amendment”). The Fifth Santander Amendment permitted certain unsecured guaranties by the Company in the ordinary course of business guarantying obligations of subsidiaries in an aggregate amount not to exceed $4,000 and related modifications to certain negative covenants.

On December 1, 2023, in connection with an amendment (the “Purchase Agreement Amendment”) to that certain Membership Interest Purchase Agreement dated as of September 21, 2021 (the “Purchase

Agreement”) among Janel Group, Inc. (“Janel Group”), a wholly-owned subsidiary of the Company, Expedited Logistics and Freight Services, LLC (“ELFS”) and former shareholders of ELFS (the “ELFS Sellers”), (i) the Janel Group Borrowers and

Santander entered into an Acknowledgment and Consent Agreement pursuant to which Santander consented to the Purchase Agreement Amendment and the effect of the modifications thereunder on the Santander Loan Agreement and (ii) the ELFS Sellers and

Santander entered into an Acknowledgment and Consent Agreement pursuant to which Santander consented to the Purchase Agreement Amendment and the effect of the modifications thereunder on the Subordination Agreement (as defined in the Santander

Loan Agreement) between Santander and the ELFS Sellers.

On December 21, 2023, we entered into the Sixth Amendment to the Santander Loan Agreement (the “Sixth Santander Amendment”). The Sixth Santander Amendment modified the reporting due date of the

monthly borrowing base calculation from the fifth day to the fifteenth day of each month.

On June 5, 2024, we entered into the Seventh Amendment to the Santander Loan Agreement (the “Seventh Santander Amendment”). The Seventh Santander

Amendment added Airschott as a loan party obligor and borrower.

On November 1, 2024, we entered into the Eighth Amendment to the Santander Loan Agreement. The Eighth Santander

Amendment changed terms to modify

the structure of our debt covenant and borrowing base calculation, including:

(i) the maximum revolving facility amount available was modified to $35,000

(limited to 90% of the Janel Group Borrowers’ eligible accounts receivable

borrowing base and reserves, subject to adjustments set forth in the Santander

Loan Agreement); (ii) the LIBOR basis on which interest under the Santander

Loan Agreement was calculated under certain circumstances was changed to the

Secured Overnight Financing Rate (“SOFR”) and interest on the Santander

Facility accrues at an annual rate equal to the one-month SOFR plus 2.75%;

(iii) the amount the Company is permitted to distribute to holders of the

Company’s Series C Preferred Stock if specified conditions are met received a

one-time increase from $1,000 to $3,000; and (iv) the amount of indebtedness of

the Company’s Antibodies Incorporated subsidiary that the Company was permitted

to guaranty was increased from $2,920 to $5,000.

At December 31, 2024, outstanding borrowings under the Santander Facility were $18,094, representing 51.7% of the $35,000 available subject to limitations thereunder, and interest was accruing at an effective interest rate of 7.05%.

At September 30, 2024, outstanding borrowings under the Santander Facility were $19,313, representing 55.2% of the $35,000 available thereunder, and interest was accruing at an effective interest rate of 7.65%.

The Company was in compliance with the financial covenants defined in the Santander Loan Agreement at both December 31, 2024 and September 30, 2024.

Life Sciences and Manufacturing

First Merchants Bank Credit Facility

On February 29, 2016, Indco entered into a Credit Agreement (as amended, the “Prior First Merchants Credit Agreement”) with First Merchants.

On April 25, 2023, Indco and certain other Subsidiaries of the Company that are part of the Life Science and Manufacturing segments (together with Indco, the “Borrowers” and each, a “Borrower”), entered into a Credit Agreement (the “Credit Agreement”) with First Merchants. The Credit Agreement constituted an amendment and restatement of the Prior First Merchants Credit Agreement. The credit facilities provided under the Credit Agreement (the “First Merchants Credit Facilities”) consisted of a $3,000 revolving loan (limited to the borrowing base and reserves), a $5,000 Acquisition A loan, a $6,905 Term A loan and a $620 Term B loan as a continuation of the mortgage loan under the Prior First Merchants Credit Agreement.

On January 10, 2024, the First Merchants Credit Facilities was amended to provide for, among other changes, permitted affiliate loans provided availability on its revolving loan both before and after giving effect to any such loan, is not less than $1,000 and maturity of such permitted affiliate loans are not to exceed fourteen days from disbursement.

On November 22, 2024, the First Merchants Credit Facilities was amended to provide for, among other changes, the conversion and extinguishment of the $3,700 under the existing Acquisition A loan into the Term A loan, an incremental increase to the Term A loan of $1,000, and the establishment of a new Acquisition B loan with a borrowing capacity of $7,000.

Interest accrues on the outstanding revolving loan, Term A loan

and acquisition loan at an annual rate equal to one-month adjusted term SOFR

plus either (i) 2.75% (if the Borrowers’ total funded debt to EBITDA ratio is

less or equal to 1.75:1.00) or (ii) 3.50% (if the Borrowers’ total funded debt

to EBITDA ratio is greater than to 1.75:1.00). Interest accrues on the

Term B loan at an annual rate of 4.19%. The Borrowers’ obligations under

the First Merchants Credit Facilities are secured by all of the Borrowers’ real

property and other assets, and are guaranteed by the Company, and the Company’s

guarantee of the Borrowers’ obligations is secured by a pledge of the Company’s

equity interests in certain of the Borrowers. Pursuant to the November 22, 2024 amendment, the revolving loan

portion will expire on November 22, 2029, the Term A loan

portion will mature on November 22, 2029, the Term B loan portion will mature on July 1, 2025 and the Acquisition B loan will permit

multiple draws until November 22, 2026, at which point the outstanding principal amount will amortize,

with all remaining amounts due at maturity of the Acquisition B loan on November 22, 2031; each of the foregoing maturities are subject

to earlier termination as provided in the Credit Agreement and unless renewed

or extended.

As of December 31, 2024, there were no outstanding borrowings under the Acquisition A loan and Acquisition B loan, $8,540 of outstanding borrowings under the Term A loan, $579 of outstanding borrowings under the Term B loan, $1,593 of outstanding borrowings on the revolving loan, with interest accruing on revolving loan, Acquisition B loan and the Term A loan at an effective interest rate of 7.87% and on the Term B loan at an effective interest rate of 4.19%.

As of September 30, 2024, there were $3,700 of outstanding borrowings under the Acquisition A loan, $4,028 of outstanding borrowings under the Term A loan and $585 of outstanding borrowings under the Term B loan, with interest accruing on the Acquisition A loan and revolving loan at an effective interest rate of 7.82% each, and on the Term A loan and Term B loan at an effective interest rate of 7.82% and 4.19%, respectively.

The Company was in compliance with the financial covenants defined in the First Merchants Credit Agreement at both December 31, 2024 and September 30,

2024.

The table below sets forth the total long-term debt, net of capitalized loan fees of $404 and $309 for the First Merchants Credit Agreement as of December 31, 2024 and September 30, 2024, respectively (in thousands):

(in thousands) | | December 31, 2024 | | September 30,

2024

|

Total Debt | | $ | 8,715 | | | $ | 4,304 | |

Less Current Portion | | | (1,452 | ) | | | (1,276 | ) |

Long-term Portion | | $ | 7,263 | | | $ | 3,028 | |

7. SUBORDINATED PROMISSORY NOTES - RELATED PARTY

(A) ICT Subordinated Promissory Note

Aves Labs, Inc., a wholly-owned subsidiary of the

Company, was the obligor on a fixed 0.5% subordinated promissory note in the

amount of $1,850 (the “ICT Subordinated Promissory Note”) issued to the former

owner of ImmunoChemistry Technologies, LLC (“ICT”), in connection with a

business combination whereby the Company acquired all of the membership

interests of ICT. The ICT Subordinated Promissory Note was payable in sixteen

scheduled quarterly installments of principal and interest beginning March 4,

2021, matured on December 4, 2024. As of December 31, 2024, the amount outstanding under the ICT

Subordinated Promissory Note matured and was fully paid.

The ICT Subordinated Promissory Note was subordinated to and junior in

right of payment for principal interest premiums and other amounts payable to

Santander and First Merchants.

As of September 30, 2024, the amount outstanding under the ICT Subordinated Promissory Note was $55, all of which is included in the current portion of subordinated promissory notes.

(B) ELFS Subordinated Promissory Notes

Janel Group is the obligor on four fixed 4% subordinated promissory notes totaling $6,000 in the aggregate (together, the “ELFS Subordinated Promissory Notes”), payable to certain former shareholders of ELFS, in connection with the Company’s business combination whereby it acquired all the membership interest of ELFS and its related subsidiaries. All of the ELFS Subordinated Promissory Notes are guaranteed by the Company and are subordinate to and junior in right of payment for principal, interest, premiums and other amounts payable to the Santander Facility and the First Merchants Credit Facility. The ELFS Subordinated Promissory Notes are payable in twelve equal consecutive quarterly installments of principal together with accrued interest. Beginning October 15, 2021 and on the same day of the next eight consecutive calendar quarters, thereafter payment of accrued interest and unpaid interest is due to the former shareholders. Beginning October 15, 2023, and on the same day of the next twelve consecutive calendar quarters thereafter payment of principal together with accrued interest and unpaid interest is due to the former shareholders. In June 2022, the principal amount of the ELFS Subordinated Promissory Notes was adjusted to $5,100 due to a revised working capital adjustment of $900.

On December 1, 2023, in connection with the Purchase Agreement Amendment among Janel Group and the ELFS Sellers, the Company extended the ELFS Subordinated Promissory Notes maturity by two years and restored the working capital adjustment (as defined in the Purchase Agreement) by $900 which increased the principal amount of the ELFS Subordinated Promissory Notes to $6,000. The Company evaluated the accounting treatment related to the amendment and determined the agreements are substantially different and extinguished the original subordinated promissory notes and recorded the amended subordinated promissory notes at fair value of $4,654. As a result, the Company recorded a debt discount of approximately $921 and a $21 gain on extinguishment.

As of December 31, 2024, the gross amount outstanding under the ELFS Subordinated Promissory Notes was $3,674, of which $1,174 was included in the current portion of subordinated promissory notes and $2,500 was included in the long-term portion of subordinated promissory notes.

As of September 30, 2024, the amount outstanding under the ELFS Subordinated Promissory Notes was $3,918, of which $1,173 was included in the current portion of subordinated promissory notes and $2,745 was included in the long-term portion of subordinated promissory notes.

(C) Airschott Subordinated Promissory Note

Janel Group is the obligor on a floating rate (Prime Rate plus 2%)

subordinated promissory note in the amount of $1,200 issued (the "Airschott Subordinated Promissory Note"), to a former owner

of Airschott, in connection with the business

combination whereby Janel Group acquired Airschott. The note is payable

in twelve consecutive quarterly payments, commencing July 2024, of $100

together with accrued interest on the outstanding principal balance.

As of December 31, 2024, the amount outstanding under the Airschott Subordinated Promissory Note was $1,000, of which $400 was included in the current portion of subordinated promissory notes and $600 was

included in the long-term portion of subordinated promissory notes.

As of September 30, 2024, the amount outstanding under the Airschott Subordinated Promissory Note was $1,100, of which $400 was included in the current portion of subordinated promissory notes and $700 was included in the long-term portion of subordinated promissory notes.

The table below sets forth the total long-term portion of subordinated promissory notes (in thousands):

(in thousands) | | December 31, 2024 | | September 30,

2024 |

Total subordinated promissory notes | | $ | 4,674 | | | $ | 5,073 | |

Less current portion of subordinated promissory notes | | | (1,574 | ) | | | (1,628 | ) |

Long-term portion of subordinated promissory notes | | $ | 3,100 | | | $ | 3,445 | |

(in thousands, except share and per share data)

Janel is authorized to issue 4,500,000 shares of common stock, par value $0.001. In addition, the Company is authorized to issue 100,000 shares of preferred stock, par value $0.001. The preferred stock is issuable in series with such voting rights, if any, designations, powers, preferences and other rights and such qualifications, limitations and restrictions as may be determined by the Company’s Board of Directors or a duly authorized committee thereof, without stockholder approval. The Board of Directors may fix the number of shares constituting each series and increase or decrease the number of shares of any series.

Series C Cumulative Preferred Stock

Shares of the Company’s Series C Cumulative

Preferred Stock (the “Series C Stock”) are entitled to receive annual dividends

at a rate of 5% per annum of the original issuance price of $500, when

and if declared by the Company’s Board of Directors, and increased by 1%

on January 1, 2024. Such rate is to increase on each January 1 thereafter

for four years to a maximum rate of 9%. The dividend

rate of the Series C Stock as of December 31, 2024 and September 30, 2024 was 6%. In

the event of liquidation, holders of Series C

Stock shall be paid an amount equal to the original issuance price, plus any

accrued dividends thereon. Shares of Series C Stock may be redeemed by the

Company at any time upon notice and payment of the original issuance price,

plus any accrued dividends thereon. The liquidation value of Series C

Stock was $7,959 and $7,957 as of December 31, 2024 and September 30, 2024, respectively.

For the three months ended December 31, 2024 and 2023, the Company declared dividends

on Series C Stock of $86 and $72, respectively. At December 31, 2024 and September 30, 2024, the Company had accrued dividends of $2,274 and $2,271, respectively.

(B) Equity Incentive Plan

On October 30, 2013, the board of directors of the Company adopted the Company’s 2013 Non-Qualified

Stock Option Plan (the “2013 Option Plan”) providing for options to purchase up

to 100,000 shares of common stock for issuance to directors, officers,

employees of and consultants to the Company and its subsidiaries.

On May 12, 2017, the Company adopted the 2017

Equity Incentive Plan (the “2017 Plan”) pursuant to which the Company may grant

(i) incentive stock options, (ii) non-statutory stock options, (iii) restricted

stock awards and (iv) stock appreciation rights with respect to shares of the

Company’s common stock, par value of $0.001 per share (“Common Stock”), to

directors, officers, employees of and consultants to the Company. On September

21, 2021, the Board of Directors of the Company adopted the Amended and

Restated 2017 Janel Corporation Equity Incentive Plan (the “Amended Plan”)

pursuant to which the Company may grant non-statutory stock options, restricted

stock awards and stock appreciation rights of Common Stock to employees,

directors and consultants to the Company and its subsidiaries.

The Amended Plan increased the number of shares of Common Stock that may be issued pursuant to the Amended Plan from 100,000 to 200,000 shares of Common Stock of the Company and reflected certain other non-substantive amendments.

Participants and all terms of any grant under the Amended Plan are in the discretion of the Company’s Compensation Committee.

9. STOCK-BASED COMPENSATION

(in thousands, except share and per share data)

Total stock-based compensation for the three months ended December 31, 2024 and 2023 amounted to $122 and $68, respectively, and is included in selling, general and administrative expense in the Company’s statements of operations.

Options

| | | Number of Options | | Weighted Average Exercise Price | | Weighted Average Remaining Contractual Term (in years) | | Aggregate Intrinsic Value (in thousands) |

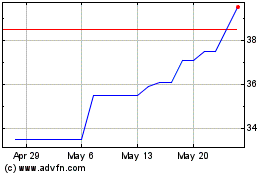

Outstanding balance at September 30, 2024 | | | 49,993 | | | $ | 25.31 | | | | 6.9 | | | $ | 864.92 | |

Granted | | | 12,500 | | | $ | 40.50 | | | | 5.5 | | | $ | — | |

Outstanding balance at December 31, 2024 | | | 62,493 | | | $ | 28.35 | | | | 7.2 | | | $ | 864.92 | |

Exercisable at December 31, 2024 | | | 27,493 | | | $ | 13.88 | | | | 5.2 | | | $ | 718.04 | |

The aggregate intrinsic value in the above table was calculated as the difference between the closing price of the Company’s common stock at December 31, 2024 of $40.00 per share and the exercise price of the stock options that had strike prices below such closing price.

As of December 31, 2024, there was approximately $367 of total unrecognized compensation expense related to the unvested employee stock options, which is expected to be recognized in fiscal year 2025.

Liability classified share-based awards

During the three months ended December 31, 2024 and fiscal year ended September 30, 2024, there were no options granted and no options were exercised with respect to Indco’s common stock.

10. INCOME PER COMMON SHARE

The following table provides a reconciliation of the basic and diluted earnings per share (“EPS”) computations for the three months ended December 31, 2024 and 2023:

| | | Three Months Ended December 31, |

(in thousands, except per share data) | | 2024 | | 2023 |

Income: | | | | | | |

Net income | | $ | 659 | | | $ | 276 | |

Preferred stock dividends | | | (86 | ) | | | (72 | ) |

Non-controlling interest dividends | | | (243 | ) | | | — | |

Net income available to common stockholders | | $ | 330 | | | $ | 204 | |

| | | | | | | | |

Common Shares: | | | | | | | | |

Basic - weighted average common shares | | | 1,186.3 | | | | 1,186.3 | |

Effect of dilutive securities: | | | | | | | | |

Stock options | | | 19.1 | | | | 15.8 | |

Diluted - weighted average common stock | | | 1,205.4 | | | | 1,202.1 | |

| | | | | | | | |

Income per Common Share: | | | | | | | | |

Basic - | | | | | | | | |

Net income | | $ | 0.56 | | | $ | 0.23 | |

Preferred stock dividends | | | (0.07 | ) | | | (0.06 | ) |

Non-controlling interest dividends | | | (0.20 | ) | | | — | |

Net income available to common stockholders | | $ | 0.29 | | | $ | 0.17 | |

Diluted - | | | | | | | | |

Net income | | $ | 0.55 | | | $ | 0.23 | |

Preferred stock dividends | | | (0.07 | ) | | | (0.06 | ) |

Non-controlling interest dividends | | | (0.20 | ) | | | — | |

Net income available to common stockholders | | $ | 0.28 | | | $ | 0.17 | |

The computation for the diluted number of shares excludes unexercised stock options that are anti-dilutive. There were 22.5 anti-dilutive shares for

each of the three-month period ended December 31, 2024 and 2023.

The reconciliation of income tax computed at the Federal statutory rate to the provision for income taxes from continuing operations for the three-month periods ended December 31, 2024 and 2023 is as follows (in thousands):

| | | Three Months Ended December 31, |

| | | 2024 | | 2023 |

Federal taxes at statutory rates | | $ | (180 | ) | | $ | (98 | ) |

Permanent differences | | | 50 | | | | (58 | ) |

State and local taxes, net of Federal benefit | | | (68 | ) | | | (36 | ) |

Total Income tax expense | | $ | (198 | ) | | $ | (192 | ) |

12. BUSINESS SEGMENT INFORMATION

As referenced above in Note 1, the Company operates in three reportable segments: Logistics, Life Sciences and Manufacturing.

The Company’s Chief Executive Officer regularly reviews financial information at the reporting segment level in order to make decisions about resources

to be allocated to the segments and to assess their performance.

The following tables present selected financial information about the Company’s reportable segments and Corporate for the purpose of reconciling to the consolidated totals for the three months ended December 31, 2024:

For the three months ended December 31, 2024 (in thousands) | | Consolidated | | Logistics | | Life Sciences | | Manufacturing | | Corporate |

Revenues | | $ | 51,354 | | | $ | 46,086 | | | $ | 2,983 | | | $ | 2,285 | | | $ | — | |

Forwarding expenses and cost of revenues | | | 36,212 | | | | 34,708 | | | | 450 | | | | 1,054 | | | | — | |

Gross profit | | | 15,142 | | | | 11,378 | | | | 2,533 | | | | 1,231 | | | | — | |

Selling, general and administrative | | | 13,292 | | | | 9,368 | | | | 1,999 | | | | 941 | | | | 984 | |

Amortization of intangible assets | | | 641 | | | | — | | | | — | | | | — | | | | 641 | |

Income (loss) from operations | | | 1,209 | | | | 2,010 | | | | 534 | | | | 290 | | | | (1,625 | ) |

Interest expense | | | 666 | | | | 484 | | | | 117 | | | | 65 | | | | — | |

Identifiable assets | | | 111,246 | | | | 43,491 | | | | 11,358 | | | | 3,914 | | | | 52,483 | |

Capital expenditures, net of disposals | | $ | 91 | | | $ | 11 | | | $ | 78 | | | $ | 2 | | | $ | — | |

The following tables present selected financial information about the Company’s reportable segments and Corporate for the purpose of reconciling to the consolidated totals for the three months ended December 31, 2023:

For the three months ended December 31, 2023 (in thousands) | | Consolidated | | Logistics | | Life Sciences | | Manufacturing | | Corporate |

Revenues | | $ | 41,035 | | | $ | 35,215 | | | $ | 3,481 | | | $ | 2,339 | | | $ | — | |

Forwarding expenses and cost of revenues | | | 26,890 | | | | 25,214 | | | | 606 | | | | 1,070 | | | | — | |

Gross profit | | | 14,145 | | | | 10,001 | | | | 2,875 | | | | 1,269 | | | | — | |

Selling, general and administrative | | | 12,605 | | | | 8,865 | | | | 1,750 | | | | 784 | | | | 1,206 | |

Amortization of intangible assets | | | 538 | | | | — | | | | — | | | | — | | | | 538 | |

Income (loss) from operations | | | 1,002 | | | | 1,136 | | | | 1,125 | | | | 485 | | | | (1,744 | ) |

Interest expense | | | 524 | | | | 357 | | | | 78 | | | | 89 | | | | — | |

Identifiable assets | | | 91,502 | | | | 31,128 | | | | 11,786 | | | | 3,875 | | | | 44,713 | |

Capital expenditures, net of disposals | | $ | 53 | | | $ | 18 | | | $ | 35 | | | $ | — | | | $ | — | |

13. FAIR VALUE MEASUREMENTS

Recurring Fair Value Measurements

The following table presents the Company’s assets that are measured at fair value on a recurring basis based on the three-level valuation hierarchy (in thousands):

Assets | | December 31,

2024 | | September 30,

2024 |

Level 1 Investment in Rubicon at fair value | | $ | 1,828 | | | $ | 1,518 | |

Level 1 Investment in other

marketable securities at fair value | | | 85 | | | | 56 | |

Total Investment in marketable securities at fair value | | | 1,913 | | | | 1,574 | |

On August 19, 2022, the Company acquired 1,108,000 shares of the common stock, par value $0.001 per share, of Rubicon at a price per share of $20.00, in a cash tender offer. As of each of December 31, 2024 and September 30, 2024, the Company held 46.6% of the total issued and outstanding shares of Rubicon and reported its investment under the fair value method pursuant to ASC 320. Management determined that it was appropriate to carry its investment in Rubicon at fair value because the investment was traded on the NASDAQ stock exchange through January 2, 2023, began trading on the OTCQB Capital Market on January 3, 2023 and had daily trading activity, the combination of which provide a better indicator of value. The investment in Rubicon is re-measured at the end of each quarter based on the trading price and any change in the value is reported on the income statement as an unrealized gain or loss on marketable securities in other income (expense).

On October 4, 2023, Rubicon announced that it had authorized a cash dividend of $1.10 per share of common stock of Rubicon and set October 16, 2023 as the record date for the distribution. On October 23, 2023, the Company received $1,219 in dividends and recorded a fair value adjustment to its investment in Rubicon of $709, which is included in other income and expense.

The following table sets forth a summary of the changes in the fair value of the Company’s investment in Rubicon, which is measured at fair value on a recurring basis utilizing Level 1 assumptions in its valuation (in thousands):

| | | December 31, 2024 | | September 30, 2024 |

Balance beginning of period | | $ | 1,518 | | | $ | 1,573 | |

Fair value adjustment to Rubicon investment | | | 310 | | | | (55 | ) |

Balance end of period | | $ | 1,828 | | | $ | 1,518 | |

The following table presents the Company’s liabilities that are measured at fair value on a recurring basis based on the three-level valuation hierarchy (in thousands):

Contingent earnout liabilities | | December 31, 2024 | | September 30,

2024 |

Level 1 Contingent earnout liabilities | | $ | 2,130 | | | $ | 2,100 | |

Level 3 Contingent earnout liabilities | | | 1,297 | | | | 1,281 | |

Total | | $ | 3,427 | | | $ | 3,381 | |

These liabilities relate to the

estimated fair value of earnout payments to former ImmunoBioScience Corp. (“IBSC”), ViraQuest, ELFS, and Airschott owners for

the periods ending December 31, 2024 and September

30, 2024.

On December 1, 2023, in connection with the Purchase Agreement Amendment among Janel Group and the ELFS Sellers described above, the parties agreed to certain modifications fixing the amount of the remaining earnout payments to ELFS in earnout years three and four to $1,078 each year. As a result, the measurement of the earnout liability became a Level 1 fair value measurement based on the present value of the negotiated payments.

On June 5, 2024, the Company completed a business combination whereby it acquired a majority ownership position in Airschott, a non-asset-based freight forwarder and customs broker. As part of the business combination, the Company agreed to purchase the remaining 20% of Airschott stock in three years for deferred consideration of the greater of 20% of 1.25 times the trailing twelve months gross profit of Airschott and $1,200.

The current and non-current portions of the fair value of the contingent earnout liabilities at December 31, 2024 were $1,262 and $2,165, respectively. The current and non-current portions of the fair value of the contingent earnout liabilities at September 30, 2024 were $1,262 and $2,119, respectively.

The following table sets forth a summary of the changes in the fair value of the Company’s contingent earnout liabilities, which are measured at fair value on a recurring basis utilizing Level 1 and Level 3 assumptions in their valuation (in thousands):

| | | December 31, 2024 | | September 30,

2024 |

Balance beginning of period | | $ | 3,381 | | | $ | 2,330 | |

Fair value of contingent consideration recorded in connection with business combinations | | | — | | | | 1,017 | |

Earnout payment | | | — | | | | (740 | ) |

Fair value adjustment of

contingent earnout liabilities | | | 46 | | | | 774 | |

Balance end of period | | $ | 3,427 | | | $ | 3,381 | |

The Company determined the fair value of the Level 3 contingent earnout liability using forecasted results through the expected earnout periods. The

principal inputs to the approach include expectations of the specific business’s revenues in fiscal years 2024 through 2025 using an appropriate discount rate. Given the use of significant inputs that are not observable in the market, the

contingent earnout liability is classified within Level 3 of the fair value hierarchy.

The Company determines if an arrangement is a lease at inception. Assets and obligations related to operating leases are included in operating lease

right-of-use (“ROU”) assets; current portion of operating lease liability; and operating lease liability, net of current portion in our consolidated balance sheets. Assets and obligations related to finance leases are included in property,

technology and equipment, net; current portion of finance lease liability; and finance lease liability, net of current portion in our consolidated balance sheets.

ROU assets represent our right to use an underlying asset for the lease term, and lease liabilities represent our obligation to make lease payments

arising from the lease. Operating lease ROU assets and liabilities are recognized at commencement date based on the present value of lease payments over the lease term. As most of the Company’s leases do not provide an implicit rate, the

incremental borrowing rate based on the information available at commencement date is used in determining the present value of lease payments. We use the implicit rate when readily determinable. Our lease terms may include options to extend or

terminate the lease when it is reasonably certain that we will exercise that option.

The Company’s agreements with lease and non-lease components are all each accounted for as a single lease component.

For leases with an initial term of twelve months or less, the Company elected the exemption from recording right of use assets and lease liabilities

for all leases that qualify and records rent expense on a straight-line basis over the lease term.

The Company has operating leases for office and warehouse space in certain locations where it conducts business. As of December 31, 2024, the remaining terms of the Company’s operating leases were between one and 110 months and certain lease agreements contain provisions for future rent increases. Payments due under the lease contracts include the minimum lease payments that the Company is obligated to make under the non-cancelable initial terms of the leases as the renewal terms are at the Company’s option and the Company is not reasonably certain to exercise those renewal options at lease commencement.

The components of lease cost for the three-month periods ended December 31, 2024 and 2023 are as follows (in thousands):

| | | Three Months Ended December 31, |

| | | 2024 | | 2023 |

Operating lease cost | | $ | 655 | | | $ | 599 | |

Short-term lease cost | | | 52 | | | | 100 | |

Total lease cost | | $ | 707 | | | $ | 699 | |

Rent expense for the three months ended December 31, 2024 and 2023 was $707 and $699, respectively.

Operating lease right of use assets, current portion of operating lease liabilities and long-term operating lease liabilities reported in the condensed consolidated balance sheets for operating leases as of December 31, 2024 were $7,861, $2,198 and $6,338, respectively.

Operating lease right of use assets, current portion of operating lease liabilities and long-term operating lease liabilities reported in the condensed consolidated balance sheets for operating leases as of September 30, 2024 were $8,621, $2,419 and $6,585, respectively.

During the three months ended December 31, 2024, the Company entered into one new operating lease and recorded an additional $59 in both operating lease right of use assets and corresponding lease liabilities.

As of December 31, 2024 and September 30, 2024, the weighted-average remaining lease term and the weighted-average discount rate related to the Company’s operating leases were 5.2 years and 6.23% and 5.3 years and 5.72%, respectively.

Future minimum lease payments under non-cancelable operating leases as of December 31, 2024 are as follows (in thousands):

2025 | | $ | 2,767 | |

2026 | | | 2,416 | |

2027 | | | 1,650 | |

2028 | | | 1,367 | |

2029 | | | 624 | |

Thereafter | | | 1,200 | |

Total undiscounted loan payments | | | 10,024 | |

Less: imputed interest | | | (1,488 | ) |

Total lease obligation | | $ | 8,536 | |

15. SUBSEQUENT EVENTS

On January 14, 2025, two

minority owners of Indco exercised 21,778 and 13,829 options to purchase

Indco’s common stock at an average exercise price of $11.60 and $13.19, respectively for an

aggregate purchase price of $253 and $182, respectively. In conjunction with

the exercise, Indco issued related party promissory notes to the two minority

owners for amounts totaling the aggregate purchase price. The notes will be included

in other long-term assets. As a result of the exercise of options to purchase

Indco’s stock, the mandatorily redeemable non-controlling interest percentage

was 14.35% as of the exercise

date.

On January 16, 2025 Antibodies Incorporated, a subsidiary of the Company, issued a Promissory Note to a third-party borrower for principal of $450 at an effective interest rate of 8.00% with a maturity date of January 16, 2027. The borrower has the option to borrow an additional $490.

ITEM 2.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with our unaudited interim condensed consolidated financial

statements and related notes thereto as of and for the three months ended December 31, 2024, which have been prepared in accordance with generally accepted accounting principles in the United States (“U.S. GAAP”). Amounts presented in this section

are in thousands, except share and per share data.

As used throughout this Report, “we,” “us”, “our,” “Janel,” “the Company,” “Registrant” and similar words refer to Janel Corporation and its

subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (the “Report”) contains certain

statements that are, or may deemed to be, “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the

Securities Exchange Act of 1934 and that reflect management’s current

expectations with respect to our operations, performance, financial condition,

and other developments. These forward – looking statements may generally be

identified using the words “may,” “will,” “intends,” “plans,” projects,”

“believes,” “should,” “expects,” “predicts,” “anticipates,” “estimates,” and

similar expressions or the negative of these terms or other comparable

terminology. These statements are necessarily estimates reflecting management’s

best judgment based upon current information and involve several risks,

uncertainties and assumptions. We caution readers not to place undue reliance

on any such forward-looking statements, which speak only as of the date made,

and readers are advised that various factors, including, but not limited to,

those set forth elsewhere in this Report, could affect our financial

performance and could cause our actual results for future periods to differ

materially from those anticipated or projected. While it is impossible to identify

all such factors, such factors include, but are not limited to, our strategy of

expanding our business through acquisitions of other businesses; we may be

required to record a significant charge to earnings related to the impairment

of acquired assets; we may fail to realize the expected benefits or strategic

objectives of any acquisition, or that we spend resources exploring

acquisitions that are not consummated; risks associated with litigation,

including contingent auto liability and insurance coverage, and indemnification

claims and other unforeseen claims and liabilities that may arise from an

acquisition; changes in tax rates, laws or regulations and our acquired

companies and subsidiaries’ ability to utilize anticipated tax benefits; the

impact of rising interest rates on our investments, business and operations;

conflicts of interest with the minority shareholders of our business; we may

not have sufficient working capital to continue operations; we may lose

customers who are not obligated to long-term contracts to transact with us;

instability in the financial markets; changes or developments in U.S. laws or

policies; competition from companies with greater financial resources and from

companies that operate in areas in which we plan to expand; our dependence on

technically skilled employees; impacts from climate change, including the

increased focus by third-parties on sustainability issues and our ability to

comply therewith; competition from parties who sell their businesses to us and

from professionals who cease working for us; the level of our insurance

coverage, including related to product and other liability risks; our

compliance with applicable privacy, security and data laws; risks related to

the diverse platforms and geographies which host our management information and

financial reporting systems; our dependence on the availability of cargo space

from third parties; the impact of claims arising from transportation of freight

by the carriers with which we contract, including an increase in premium costs;

higher carrier prices may result in decreased adjusted gross profit; risks

related to the classification of owner-operators in the transportation

industry; recessions and other economic developments that reduce freight

volumes; other events affecting the volume of international trade and

international operations; risks arising from our ability to comply with

governmental permit and licensing requirements or statutory and regulatory

requirements; the impact of seasonal trends and other factors beyond our

control on our Logistics business; changes in governmental regulations applicable

to our Life Sciences business; the ability of our Life Sciences business to

continually produce products that meet high-quality standards such as purity,

reproducibility and/or absence of cross-reactivity; the ability of our Life

Sciences business to maintain, determine the scope of and defend its and its

competitors’ intellectual property rights; the impact of pressures in the life

sciences industry to increase the predictability of or reduce healthcare costs;

any decrease in the availability, or increase in the cost or supply shortages,

of raw materials used by Indco; risks arising from the environmental, health

and safety regulations applicable to Indco; the reliance of our Indco business

on a single location to manufacture their products; the controlling influence

exerted by our officers and directors and one of our stockholders; the

unlikelihood that we will issue dividends in the foreseeable future; and risks

related to ownership of our common stock, including share price volatility, our

ability to issue shares of preferred stock with greater rights than our common

stock, the lack of a guaranteed continued public trading market for our common

stock, and costs related to maintaining our status as a public company; terrorist

attacks and other acts of violence or war and such other factors that may be

identified from time to time in our Securities and Exchange Commission (“SEC”)

filings. Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual outcomes may vary

materially from those projected. You should not place undue reliance on any of

our forward-looking statements which speak only as of the date they are made.

We undertake no obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events or otherwise.

For a more detailed discussion of these factors, see our periodic reports filed

with the SEC, including our most recent Annual Report on Form 10-K for the

fiscal year ended September 30,

2024.

OVERVIEW

Janel Corporation ("Janel," the "Company," or the "Registrant") is a holding company with subsidiaries in three business segments: Logistics, Life

Sciences and Manufacturing. The Company strives to create shareholder value primarily through three strategic priorities: supporting its businesses’ efforts to make investments and to build long-term profits; allocating Janel's capital at high

risk-adjusted rates of return; and attracting and retaining exceptional talent.

Management at the Janel holding company focuses on significant capital allocation decisions, corporate governance and supporting Janel’s subsidiaries

where appropriate. Janel expects to grow through its subsidiaries’ organic growth and by completing acquisitions. We plan to either acquire businesses within our existing segments or expand our portfolio into new strategic segments. Our acquisition

strategy focuses on reasonably priced companies with strong and capable management teams, attractive existing business economics and stable and predictable earnings power.

Our Business Segments

Logistics

The Company’s Logistics segment is comprised of several subsidiaries. The Logistics segment is a non-asset based, full-service provider of cargo

transportation logistics management services, including freight forwarding via air, ocean and land-based carriers; customs brokerage services; warehousing and distribution services; trucking and other value-added logistics services. In addition to

these revenue streams, the Company earns accessorial revenues in connection with its core services. Accessorial revenues include, but are not limited to, fuel service charges, wait time fees, hazardous cargo fees, labor charges, handling, cartage,

bonding and additional labor charges.

On June 5, 2024, the Company completed a business combination whereby it acquired a

majority ownership position in Airschott, a non-asset-based freight forwarder and customs broker. At closing, the Company purchased 80% of the outstanding

stock of Airschott. The Company also agreed to purchase the remaining 20% of Airschott stock in three years.

Life Sciences

The Company’s Life Sciences segment is comprised of several wholly-owned subsidiaries. The Company’s Life Sciences segment manufactures and distributes

high-quality monoclonal and polyclonal antibodies, diagnostic reagents and other immunoreagents for biomedical research and provides antibody manufacturing for academic and industry research scientists. Our Life Sciences segment also produces

products for other life sciences companies on an original equipment manufacturer (OEM) basis.

On March 2, 2023, the Company completed a business combination whereby it acquired all of the outstanding stock of Stephen Hall, PhD Ltd., which we

include in our Life Sciences segment.

On May 22, 2023, the Company acquired all the rights, title and interests to a royalty agreement for certain antibody products, which we include in our

Life Sciences segment.

On February 1, 2024, the Company completed a business combination whereby it acquired all of the outstanding stock of ViraQuest Inc., which we include

in our Life Sciences segment.

Manufacturing

The Company’s Manufacturing segment is comprised of Indco, Inc. (“Indco”). Indco is a majority-owned subsidiary of the Company that manufactures and

distributes mixing equipment and apparatus for specific applications within various industries. Indco’s customer base is comprised of small- to mid-sized businesses as well as other larger customers for which Indco fulfills repetitive production

orders.

Investment in Marketable Securities at fair value

On August 19, 2022, the Company acquired 1,108,000 shares of the common stock, par value $0.001 per share, of Rubicon Technology, Inc. (“Rubicon”), at

a price per share of $20.00, in a cash tender offer made pursuant to the Stock Purchase and Sale Agreement, dated July 1, 2022, between the Company and Rubicon (the “Rubicon Purchase Agreement”). Pursuant to the terms of the Rubicon Purchase

Agreement, the acquired shares represented 45.0% of Rubicon’s issued and outstanding shares of common stock as of August 3, 2022, as reported in Rubicon’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2022, filed with the

SEC on August 12, 2022. The Company owned approximately 46.6% of Rubicon’s total issued and outstanding shares of common stock as of December 31, 2024 and September 30, 2024.

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

Our Condensed Consolidated Financial Statements have been prepared in accordance with generally accepted accounting principles in the United States.

These generally accepted accounting principles require management to make estimates and assumptions that affect the reported amounts of assets, liabilities, net sales and expenses during the reporting period.

Our senior management has reviewed the critical accounting policies and estimates with the Audit Committee of our board of directors. For a description

of the Company’s critical accounting policies and estimates, refer to “Part II—Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations—Critical Accounting Estimates” in our Annual Report on Form 10-K filed with