Sainsbury(J) PLC Statement re proposed merger with Asda Group Ltd

March 19 2019 - 5:30AM

Dow Jones News

TIDMSBRY

RNS Number : 3026T

Sainsbury(J) PLC

19 March 2019

19 March 2019

J Sainsbury plc

Statement re proposed merger of J Sainsbury plc and Asda Group

Ltd

J Sainsbury plc (Sainsbury's) and Asda Group Limited (Asda) have

recently submitted to the Competition and Markets Authority (CMA)

their responses to the CMA's Provisional Findings and Notice of

Proposed Remedies.

Sainsbury's and Asda strongly disagree with the CMA's

Provisional Findings and have found the CMA's analysis of their

proposed merger to contain significant errors. This is compounded

by the CMA's choice of a threshold for identifying competition

problems that does not fit the facts and evidence in the case and

that is set at an unprecedentedly low level, therefore generating

an unreasonably high number of areas of concern. In their detailed

response to the Provisional Findings, Sainsbury's and Asda have

sought to address these economic and legal errors.

Sainsbury's and Asda have also responded to the Notice of

Proposed Remedies by outlining supermarket and petrol forecourt

divestments across both brands that would satisfy reasonable

concerns regarding any substantial lessening of competition as a

result of the merger by applying a conservative yet reasonable

threshold.

In addition, Sainsbury's and Asda have made the following

post-merger commitments:

-- To deliver GBP1 billion of lower prices annually by the third

year post-completion. To invest GBP300 million in the first year of

the combination and a further GBP700 million over the following two

years as the cost savings flow through. This would reduce prices by

around 10% on everyday items

-- Sainsbury's will cap its fuel gross profit margin to no more

than 3.5 pence per litre for five years; Asda will guarantee its

existing fuel pricing strategy

-- The price commitments will be independently reviewed by a

third party and the Parties will publish the performance each year,

holding them to public account

-- Sainsburys will move to pay small suppliers (turnover with

the business of <GBP250k) within 14 days; Asda will continue to

pay its small suppliers within 14 days, in line with existing

commitments

The two businesses are proposing to merge so that they can lower

prices for customers in an increasingly competitive market, while

improving quality and service. They will create cost savings in

three ways:

1. By securing lower purchasing prices from suppliers,

predominantly by paying the lower of the two prices that

Sainsbury's and Asda currently pay large suppliers for identical

products

2. By putting Argos stores into Asda

3. By jointly buying shared goods and services and reducing central costs

Sainsbury's and Asda have given the detail of their estimated

GBP1.6 billion cost savings to the CMA. This allows them to fund

the GBP1 billion customer price commitment while also delivering on

the commitments to shareholders of GBP500m of net synergies, low

double digit ROIC (return on invested capital) and double digit EPS

accretion by the end of the second full financial year.

Sainsbury's and Asda strongly encourage the CMA to recognise

that there is a clear benefit to consumers from combining the two

companies, improving the cost of living for millions of UK

households to the tune of GBP1 billion pounds annually.

Sainsbury's Chief Executive, Mike Coupe and Asda Chief

Executive, Roger Burnley said:

"We are trying to bring our businesses together so that we can

help millions of customers make significant savings on their

shopping and their fuel costs, two of their biggest regular

outgoings.

"We are committing to reducing prices by GBP1 billion per year

by the third year which would reduce prices by around 10% on

everyday items. We are happy to be held to account for delivering

on this commitment and to have our performance independently

reviewed and to publish this annually.

"We hope that the CMA will properly take account of the evidence

we have presented and correct its errors. We have proposed a

reasonable yet conservative remedy package and hope the CMA

considers this so that we can deliver the cost savings for

customers."

The CMA is expected to publish Sainsbury's and Asda's responses

to the Provisional Findings and Notice of Possible Remedies in due

course. Final Report is expected by 30(th) April.

For further information please contact:

Investor Relations, J Sainsbury plc

James Collins +44 (0) 7801 813074

Media Relations, J Sainsbury plc

Rebecca Reilly +44 (0) 20 7695 7295

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

STRLIFEAVEIALIA

(END) Dow Jones Newswires

March 19, 2019 06:15 ET (10:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

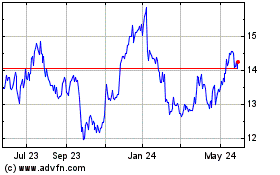

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

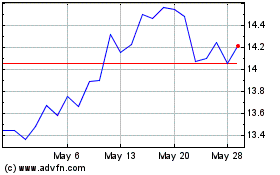

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jan 2024 to Jan 2025