Walmart's British Arm Is Blocked From Merging With U.K. Supermarket J Sainsbury

April 25 2019 - 3:40AM

Dow Jones News

By Saabira Chaudhuri

Regulators blocked the proposed merger between Walmart Inc.'s

British grocery unit and rival J Sainsbury PLC citing competition

concerns, meaning the U.S. retail giant must now find ways to drive

stand-alone growth for Asda Group in the U.K.'s highly competitive

retail market.

Britain's Competition and Markets Authority said Thursday the

merger would reduce competition in the market and was more likely

to lead to price rises for shoppers. The decision is a major

disappointment for both retailers for whom the uncertainty about

the deal has proved a distraction since it was proposed.

One year ago, Walmart agreed to merge its British arm Asda into

Sainsbury in a deal that valued the U.K. business at about GBP7.3

billion, or $9.4 billion. Walmart agreed to keep a 42% stake in the

combined company, which would become Britain's largest grocery

chain. The deal would have given it greater heft here while

simultaneously freeing it from making daily decisions about

competing in an increasingly difficult environment.

The move was made as part of a broader shift by Walmart to form

joint ventures in competitive, overseas markets. Asda has been one

of Walmart's most profitable foreign forays since it bought the

chain in 1999 but growth slowed amid intense competition in the

U.K., both from traditional rivals such as Tesco PLC, new online

players and discounters including German chains Aldi and Lidl.

The regulatory hurdles were high from the start given the highly

consolidated nature of the U.K. grocery market where the top four

players command over a 60% share. But the companies insisted they

were confident of approval, saying the landscape is now far more

fractured with the advent of online shopping and the rise in

popularity of Aldi and Lidl who have been rapidly expanding in the

U.K.

British regulators disagreed. After factoring in competition

from discount stores and how new and expanding competitors could

impact the landscape, their concerns about the merger hadn't been

allayed, it said in a statement.

"We have found this deal would lead to increased prices, reduced

quality and choice of products, or a poorer shopping experience for

all of their U.K. shoppers," said Stuart McIntosh, chair of the

group carrying out the investigation.

The collapse of the impending merger puts both companies in a

tough spot but more so Sainsbury, which lacks the financial backing

of a larger parent company. Sainsbury has been losing share to

larger rival Tesco and analysts said its profit margin would likely

decrease as it is forced to up investment.

Sainsbury didn't immediately respond to a request for comment.

The company's shares were down 6.1% in morning trading in

London.

Walmart said it was disappointed by the decision but plans to

invest behind Asda to ensure the company can compete effectively in

the U.K.

"Our focus now is continuing to position Asda as a strong U.K.

retailer delivering for customers," said Judith McKenna, head of

Walmart's international arm. "Walmart will ensure Asda has the

resources it needs to achieve that."

Analysts have previously suggested that Walmart could look to

sell Asda to a private equity business if the deal collapsed, but

lately the U.K. unit has performed consistently well with some

analysts saying its turnaround strategy had begun to work.

Earlier this month research firm Kantar said Asda -- which has

historically wooed lower-income customers -- had overtaken

Sainsbury to become the U.K.'s number two firm with a 15.4% market

share. The company has grown sales for two years, in part by

attracting new shoppers from affluent households.

"We do not think that Walmart is in rush to dispose of Asda.

Asda was never considered a problem business," said Bernstein

analyst Bruno Monteyne who described the potential Sainsbury deal

as a unique opportunity the company had to explore. "They will go

back to good retailing."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

April 25, 2019 04:25 ET (08:25 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

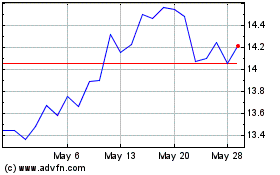

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Dec 2024 to Jan 2025

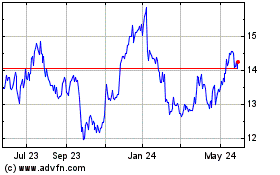

J Sainsbury (QX) (USOTC:JSAIY)

Historical Stock Chart

From Jan 2024 to Jan 2025