DALLAS, TX , Jan. 04, 2018 (InvestorsHub NewsWire) -- LIG Assets,

Inc. (OTC PINK: LIGA) (also known as the "Leader in Green Assets"

or "LIGA"), announces it has signed additional new and revised

board resolutions as well as officially confirming and further

recognizing several terms previously agreed to in the Company’s

Restructuring Agreement dated June 1, 2016. In addition to these

resolutions, LIGA reviews its primary accomplishments in 2017, and

provides an operational and corporate outlook for 2018.

New and Revised Board Resolutions signed January 3,

2018:

1. LIGA will be launching a new subsidiary in early 2018 that

will avail LIGA of a highly significant business opportunity that

we anticipate will result in a material and substantial positive

impact on our bottom line.

2. LIG Assets is currently finalizing plans to issue a stock

dividend for all LIGA shareholders of record in 2018. The

stock dividend will not increase nor dilute the outstanding

share count.

3. We are committed to the existing share structure; the total

authorized common share count will not increase above the current

level of 2.4 billion shares for at least two years or December 31,

2019 unless the Company’s common stock share price trades above .05

per share for at least 30 calendar days.

4. By means of Corporate Resolution, there will be no reverse

split of LIGA common stock before December 31, 2019 unless the

common stock trades above .05 per share for at least 30 calendar

days or in the event that LIGA is converted to list on NASDAQ

exchange for compliance with the minimum share price required by

NASDAQ to maintain active listing status.

5. We resolve to maintain that each share of Preferred Stock

will have only one voting share - the same that is currently set

for each share of common stock.

2017 Highlights:

1. LIGA launched a new subsidiary, LIG Developments,

LLC. and opened an office in Roanoke, Texas. LIGD was

awarded approximately $5.5 million in contracts in 2017. Some

of these projects are already near completion while others are

slated to commence in 2018.

2. The acquisition of BGTV Direct gave Lig Assets financial

stability to help expand the company into other sectors. BGTV

has been instrumental in the revenue growth of LIGA in 2017.

This allowed us us to take our time in establishing our new

subsidiaries, which will commence in 2018.

3. In 2017, LIGA completed the updating of financial reporting

to the OTC Markets, implemented several strategic management

changes, successfully resolved significant and burdensome

indebtedness issues, limited and in some cases cancelled share

issuances, and implemented shareholder protection restrictions on

preferred and restricted LIGA stock.

4. As reported on the OTC Markets website, LIGA has

continued to maintain the existing share status, A/S & O/S are

the same since the new management has taken control and is

preparing to file audited financials as soon as possible.

Also, LIG Assets, Inc. has updated all pertaining corporate

documentation and resolutions to the OTC Markets and the Secretary

of State in Nevada.

5. LIG Assets successfully settled a lawsuit with TCA Global

Credit Fund that reduced the Company’s outstanding debt incurred by

previous management by more than $750,000 with no dilution to

shareholders. It is important to note that in 2017 the

jurisdictional court has dismissed (with prejudice by consent

decree) the lawsuit. The old management agreed to pay over

half of the reduced settled amount leaving LIGA with only $220,000

in debt to be paid over the next two years. This settlement was

considered a win-win for all parties and allows LIGA to move

forward aggressively on its new business plan. LIGA has

successfully made every monthly settlement payment in 2017 and in

full, and as of January 2018 currently reduced its obligation to

TCA Global, the remaining balance is now $180,000.

6. LIGA has continued the Company’s collaboration with famed

environmental pioneer and visionary, Mr. Robert Plarr, to deliver

affordable, sustainable homes in select communities throughout the

United States. It is further noted that Mr. Plarr maintains a large

active database of interested parties that wish to purchase and

place non-refundable deposits for homes constructed by LIGA

that utilize Plarr approved green technologies and building

materials.

7. In June 2017, LIGA held its second Sustainability Impact

Conference in Nashville, TN where senior management and corporate

advisors detailed the Company’s technologies, products and vision

for the future.

8. Due in large part to LIGA’s new management team and expanded

operating structure, the Company in the 3rd quarter of 2017

reported double the Company’s revenues from the 2nd quarter of 2017

and surpassed $1 million in revenue for the first time in many

years.

9. In November, 2017, the Securities and Exchange Commission

filed indictments against an individual and corporation for

unlawful manipulation of LIG Assets and several other OTC

companies’ stock. LIGA plans to use a significant portion of

the proceeds to be returned to the Company to enact an open market

stock buy-back plan. You can read the full SEC indictment

@ https://www.sec.gov/litigation/complaints/2017/comp23992.pdf

10. LIGA reduced the conversion rate of the entire 50

million shares of Preferred Stock. The previous conversion rate was

one share of Preferred would convert to 50 shares of common stock.

Now, the conversion rate is one share of Preferred stock converts

to one share of common stock. This cancellation in potential

issuance of nearly 2.5 billion shares now protects the Company’s

shareholders and current share structure from potential and

substantial dilution.

11. LIGA has frozen over 100 million shares of stock in

reference to the SEC Indictments and will do so for the next 2

years and plan on retiring these shares and possibly others

once the SEC finishes their investigation. Any monies

received from ill-begotten gains, will be applied to share

buybacks, dividend and/or reinvesting in fiscally prudent new

projects that would produce a guaranteed minimum return of

investment

12. LIGA's stock price rose 600%, six-fold, in 2017.

On January 5, 2017, LIGA's share price started the year at a share

price of $0.0005 and ended the year at $0.003.

Doug Vaughn, Lig Assets CFO, states “In 2017, we acquired BGTV

as our first revenue producing entity to provide revenues not only

for the parent company LIGA, but also to help fund our second

subsidiary LIG Developments (LIGD based in the Dallas

Metroplex). This has been successful, and LIGD is now ready

to fulfill a $5.5 million backlog of light gauge steel framing

projects. Our Twitter feed (www.twitter.com/ligassets) shows the

start of the first two projects, and in 2018 other larger

contracts will commence. BGTV has recently landed new

contracts of approximately $5 million, and LIGD no longer needs the

‘startup funding’ from BGTV. Therefore we expect free cash flow to

be substantially better going forward. These developments have led

to serious opportunities for funding that will not require diluting

the common stock or give up any portion of the company. Any direct

investments will be into a specific project or future subsidiary,

and best of all, without any dilution of the stock.

“Due to the opportunities in other areas of the country that

Mother Nature presented to us, we decided to allocate our assets to

projects that offered the most revenue and profit for LIGA in the

shortest period of time. Long story short, we went with the

best revenue and profit opportunities that were in front of

us. Panama City is still a priority, but revenue and

profitability are the utmost importance to LIGA and to the benefit

of our shareholders. The Panama City beach home is still scheduled

to get started shortly, which should lead to significant

non-refundable deposits for Robert Plarr designed homes. We

appreciate Robert's understanding in this process, and he has a

large list of interested parties who will be touring the home upon

its completion. Nevertheless, LIGA is in discussions for multiple

developments utilizing Mr. Plarr’s technologies.” Doug Vaughn

continues, "We are grateful to all of our shareholders that have

realized that our company is different from other companies in the

OTC Market. Thanks to your support of our vision in building this

company, we expect a great return on investment to our

shareholders in 2018."

2018 Goals and Plans:

1. LIGA launched LIG Developments, LLC., headquartered in

Roanoke, Texas, and has been awarded approximately $5.5 million in

contracts. Some of these projects are already near completion

while others are slated to commence in the near future. LIGD has

received requests to bid on several other substantial projects and

expects to be awarded projects with additional gross revenues

exceeding $10M.

2. LIGA’s other subsidiary BGTV Direct is on par to report

record revenues for the month of January and has booked almost $5

million in contracts for 2018 and has launched a new west coast

sales office in Las Vegas, Nevada. If projections pan

out, the new sales office in Las Vegas could double the

companies current projected revenues in 2018.

3. LIGA aims to deploy state-of-the-art technology and

methodologies to bring sustainable and disaster resistant housing

and commercial developments to a price level that is competitive

with traditional construction. LIGA’s business plan is to provide

the average homeowner the ability to purchase a home in one of its

developments that is sustainable; thus significantly reducing

expenses for water and power. Additionally, LIGA will utilize

construction materials that exhibit the highest ratings of

moisture, mold, wind, earthquake, and fire resistance - and are far

less susceptible to aging decay associated with traditional

building materials. The Company's designs are not necessarily

intended for a niche market, but scalable for mass development

nationwide.

4. LIGA will begin construction of its first model home on the

Panama City Beach property and will serve to demonstrate and

incorporate all elements of the Company's innovative construction,

design, and technology. LIGA's architectural and design team has

produced renderings of many homes that are now being used to secure

new development projects.

5. LIGA is currently working to secure Agreements to participate

as a developer, in multiple real estate development projects across

the nation in 2018 for LIGA’s exclusive and revolutionary brand of

homes and structures. In addition, LIGA is entering into strategic

partnerships with material suppliers and manufacturers that will

greatly enhance corporate capabilities, operational efficiency and

net profitability as well as provide opportunities for rapid

Company expansion. This will be accomplished by acting not just as

a builder but more importantly as a developer of sustainable

communities, homes and "Post-Construct" upgrades for those who want

to make their current homes more sustainable and disaster

resistant.

6. LIGA is actively pursuing and developing projects in at least

six states that range from small scale high performance showcase

homes like the one in Panama City Beach, to much larger

residential/commercial community developments that involve

construction plans of over 1000 homes and ancillary structures

beyond those six states. LIGA is working with its partners and

advisors to value engineer its own brand of energy efficient, high

performance, disaster resistant residential and commercial units

that are priced and built for developing mass markets.

7. LIGA plans to continue working closely with Robert Plarr to

demonstrate, market and sell to his large database of interested

buyers as well as the general public, homes and commercial

developments that are truly sustainable, disaster resistant and

green – a first in the United States, while implementing many of

Mr. Plarr's most highly recommended and approved technologies and

building materials.

8. Through successful implementation of the Company’s business

plan and expanded management team of experienced sector

professionals, LIGA share value has increased from our original

starting point of $0.0001 to its current share price of

approximately $0.003 and LIGA will continue the Company’s

aggressive efforts to deliver additional significant gains to our

loyal shareholders that exceed even our wildest dreams.

Aric Simons, LIGA Chairman and Corporate Counsel, states, "The

ambitious plans for LIGA in 2017 have already commenced to become a

reality in 2018. This past year has seen our plans for growth

transform into tangible, revenue producing reality. 2018 will mark

the transformation of LIGA from a developmental company into a high

growth, profitable company that employs vertical and horizontal

integration to maximize operating efficiencies. The result will be

realized by the enhanced value of our shareholders equity and make

LIGA a household name and industry leader in the months and years

ahead. I would like to personally express my gratitude to our

shareholders, many of whom have actively participated in the growth

of our Company by presenting valuable opportunities and

resources. I truly believe we have the greatest base of

investors in the OTC market and we will continue to work tirelessly

to ensure that investment is rewarded beyond that of any company in

the OTC market."

On behalf of Lig Assets, Inc's management, we plan on fulfilling

our vision of building Lig Assets into the leader of sustainable

building that will benefit our shareholders in 2018 and beyond.

Sincerely,

Aric Simons - Chairman

Allan Gillis - CEO

Charles Gambino - President

Doug Vaughn - CFO

About LIG Assets, Inc.:

LIG Assets, Inc. in association with Robert Plarr is the

emerging "Leader in Green Assets" -- focused on exclusive green,

renewable energy and sustainable and disaster resistant homes,

living systems, technologies and components to be utilized in the

residential and commercial real estate acquisition and development

projects currently under way and now individual product sales, as

well as rapid expansion into other sectors via acquisitions,

mergers and joint venture partnerships. LIG Assets, Inc. trades on

the pink sheets under the ticker symbol "LIGA."

For additional information about LIG Assets, Inc., Robert Plarr,

and/or how to purchase our exclusive homes, structures, products

and technologies or to subscribe online to LIGA's free Shareholder

Newsletter for regular updates and alerts regarding important

Company developments Please visit the Company's website

at www.LeaderInGreenAssets.com -- also follow LIGA at

Twitter.com/LIGAssets.

Forward-Looking Statements:

This press release may contain forward-looking statements. The

words "believe," "expect," "should," "intend," "estimate,"

"projects," variations of such words and similar expressions

identify forward-looking statements, but their absence does not

mean that a statement is not a forward-looking statement. These

forward-looking statements are based upon the Company's current

expectations and are subject to a number of risks, uncertainties

and assumptions. The Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise. Among the important factors that could

cause actual results to differ significantly from those expressed

or implied by such forward-looking statements are risks that are

detailed in the Company's filings on file

at www.OTCMarkets.com.

Shareholder/Investor inquiries can be directed to:LIG Assets, Inc.Aric SimonsCEOEmail: Aric@LIGAssets.net

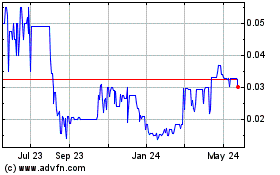

LIG Assets (PK) (USOTC:LIGA)

Historical Stock Chart

From Nov 2024 to Dec 2024

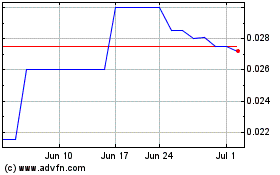

LIG Assets (PK) (USOTC:LIGA)

Historical Stock Chart

From Dec 2023 to Dec 2024