0001414953false--12-31Q12024200000000.0011713434616933346000014149532024-01-012024-03-310001414953mojo:SimpsonMember2023-03-310001414953mojo:SimpsonMember2024-03-310001414953us-gaap:RestrictedStockMembermojo:JeffreyDevlinMember2023-01-012023-03-310001414953us-gaap:RestrictedStockMembermojo:JeffreyDevlinMember2024-01-012024-03-310001414953us-gaap:RestrictedStockMembermojo:GlennSimpsonMember2024-01-012024-03-310001414953us-gaap:RestrictedStockMembermojo:GlennSimpsonMember2023-01-012023-03-310001414953mojo:GlennSimpsonMembermojo:NonTradingRestrictedCommonStocksMembermojo:EmploymentAgreementsMember2024-01-012024-03-310001414953mojo:GlennSimpsonMembermojo:EmploymentAgreementsMember2022-01-012022-01-020001414953us-gaap:RetainedEarningsMember2024-03-310001414953us-gaap:AdditionalPaidInCapitalMember2024-03-310001414953us-gaap:CommonStockMember2024-03-310001414953us-gaap:RetainedEarningsMember2024-01-012024-03-310001414953us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001414953us-gaap:CommonStockMember2024-01-012024-03-310001414953us-gaap:RetainedEarningsMember2023-12-310001414953us-gaap:AdditionalPaidInCapitalMember2023-12-310001414953us-gaap:CommonStockMember2023-12-310001414953us-gaap:RetainedEarningsMember2023-03-310001414953us-gaap:AdditionalPaidInCapitalMember2023-03-310001414953us-gaap:CommonStockMember2023-03-310001414953us-gaap:RetainedEarningsMember2023-01-012023-03-310001414953us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001414953us-gaap:CommonStockMember2023-01-012023-03-310001414953us-gaap:RetainedEarningsMember2022-12-310001414953us-gaap:AdditionalPaidInCapitalMember2022-12-310001414953us-gaap:CommonStockMember2022-12-3100014149532023-03-3100014149532022-12-3100014149532023-01-012023-03-3100014149532023-12-3100014149532024-03-31iso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:pure

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Quarterly Period Ended: March 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to _______________

Commission file number: 000-55269

EQUATOR Beverage Company |

(Exact name of registrant as specified in its charter) |

Delaware | | 26-0884348 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

185 Hudson Street, Floor 25 Jersey City, New Jersey | | 07302 |

(Address of principal executive offices) | | (Postal Code) |

Registrant’s telephone number: 929-264-7944

Securities registered pursuant to Section 12(b) of the Act: None

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large Accelerated Filer | ☐ | Accelerated Filer | ☐ |

Non-accelerated Filer | ☐ | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

On March 31, 2024, there were 17,134,346 shares of the registrant’s common stock, par value $0.001, issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

TABLE OF CONTENTS

| | | Page | |

| PART I - FINANCIAL INFORMATION | | | |

ITEM 1. | FINANCIAL STATEMENTS (Unaudited) | | F-1 | |

| Condensed Balance Sheets as of March 31, 2024 and December 31, 2023 | | F-1 | |

| Condensed Statements of Operations for the three months ended March 31, 2024 and March 31, 2023 | | F-2 | |

| Condensed Statements of Cash Flows for the three months ended March 31, 2024 and March 31, 2023 | | F-3 | |

| Condensed Statements of Changes in Stockholders’ Equity for the three months ended March 31, 2024 and March 31, 2023 | | F-4 | |

| Notes to the Condensed Financial Statements | | F-5 | |

| | | | |

ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 3 | |

ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | | 5 | |

ITEM 4. | CONTROLS AND PROCEDURES | | 5 | |

| PART II | | | |

ITEM 1. | LEGAL PROCEEDINGS | | 6 | |

ITEM 1a. | RISK FACTORS | | 6 | |

ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | | 13 | |

ITEM 3. | UNRESOLVED STAFF COMMENTS | | 13 | |

ITEM 4. | MINE SAFETY DISCLOSURE | | 13 | |

ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | | 14 | |

ITEM 6. | SELECTED FINANCIAL DATA | | 14 | |

| PART III | | | |

ITEM 7. | Directors, Executive Officer and Corporate Governance | | 15 | |

ITEM 8. | Executive Compensation | | 16 | |

ITEM 9. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | | 17 | |

| PART IV | | | |

ITEM 10. | Exhibits, Financial Statement Schedules | | 18 | |

| | | |

SIGNATURES | | 19 | |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (Unaudited)

EQUATOR BEVERAGE COMPANY

Condensed Balance Sheets (Unaudited)

As of March 31, 2024 and December 31, 2023

| | March 31, 2024 | | | December 31, 2023 | |

Assets | | | | | | |

Current Assets | | | | | | |

Cash and cash equivalents | | $ | 55,098 | | | $ | 87,339 | |

Accounts receivable, net | | | 271,377 | | | | 135,061 | |

Inventory | | | 491,011 | | | | 270,788 | |

Supplier deposits | | | - | | | | 52,655 | |

Prepaid expenses | | | 23,196 | | | | 35,650 | |

Total Current Assets | | $ | 840,682 | | | $ | 581,493 | |

Total Assets | | $ | 840,682 | | | $ | 581,493 | |

Liabilities and Stockholders’ Equity | | | | | | | | |

Current Liabilities | | | | | | | | |

Accounts payable and accrued expenses | | $ | 190,220 | | | $ | 80,621 | |

Related party loans | | | 360,000 | | | | 230,000 | |

Total Current Liabilities | | | 550,220 | | | | 310,621 | |

Commitments and Contingencies – Refer to Note 3 | | | | | | | | |

Stockholders’ Equity | | | | | | | | |

Common stock, 20,000,000 shares authorized at $0.001 par value, 17,134,346 and 16,933,346 shares issued and outstanding, at March 31, 2024 and December 31, 2023, respectively | | | 17,135 | | | | 16,934 | |

Additional paid-in capital | | | 24,185,585 | | | | 24,063,176 | |

Accumulated deficit | | | (23,912,258 | ) | | | (23,809,238 | ) |

Total Stockholders’ Equity | | | 290,462 | | | | 270,872 | |

Total Liabilities and Stockholders’ Equity | | $ | 840,682 | | | $ | 581,493 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Operations (Unaudited)

For the Three Months Ended March 31, 2024 and March 31, 2023

| | 2024 | | | 2023 | |

Revenue | | $ | 640,653 | | | $ | 515,633 | |

Cost of Revenue | | | 370,070 | | | | 313,457 | |

Gross Profit | | | 270,583 | | | | 202,176 | |

| | | | | | | | |

Operating Expenses | | | | | | | | |

Selling, general and administrative | | | 368,743 | | | | 194,912 | |

Total Operating Expenses | | | 368,743 | | | | 194,912 | |

Income / (Loss) from Operations | | | (98,160 | ) | | | 7,264 | |

Interest Expense | | | (4,219 | ) | | | (2,780 | ) |

Income / (Loss) Before Provision for Income Taxes | | $ | (102,379 | ) | | $ | 4,485 | |

Provision for Income Taxes | | | (10,682 | ) | | | - | |

Benefit from Deferred Tax Asset | | | 10,041 | | | | - | |

Net Income / (Loss) | | $ | (103,020 | ) | | $ | 4,485 | |

Net Income / (Loss) Per Common Share, Basic and Diluted | | $ | (0.01 | ) | | $ | 0.00 | |

Weighted Average Number of Common Shares Outstanding, Basic and Diluted | | | 17,129,928 | | | | 16,461,165 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Cash Flows (Unaudited)

For the Three Months Ended March 31, 2024 and 2023

| | 2024 | | | 2023 | |

Cash Flows from Operating Activities: | | | | | | |

Net income / (loss) | | $ | (103,020 | ) | | $ | 4,485 | |

Adjustments to Reconcile Net Income / (Loss) to Net Cash Provided by / (Used In) Operating Activities: | | | | | | | | |

Restricted, non-trading common stock issued to directors and employees | | | 122,610 | | | | 13,992 | |

| | | | | | | | |

Changes in Assets and Liabilities: | | | | | | | | |

Increase in accounts receivable | | | (136,316 | ) | | | (66,268 | ) |

(Increase) / decrease in inventory | | | (220,223 | ) | | | 38,879 | |

Decrease in supplier deposits | | | 52,655 | | | | 14,352 | |

Decrease in prepaid expenses | | | 12,454 | | | | 6,475 | |

Increase in accounts payable and accrued expenses | | | 109,599 | | | | 7,993 | |

Net Cash Provided by / (Used in) Operating Activities | | | (162,241 | ) | | | 19,908 | |

Net Cash Provided by / (Used in) Financing Activities: | | | | | | | | |

Proceeds from related party loan | | | 130,000 | | | | 70,000 | |

Repayments of related party loan | | | - | | | | (60,000 | ) |

Net Cash Provided by Financing Activities | | | 130,000 | | | | 10,000 | |

| | | | | | | | |

Net Increase / (Decrease) in Cash and Cash Equivalents | | | (32,241 | ) | | | 29,908 | |

Cash and Cash Equivalents at Beginning of Period | | | 87,339 | | | | 10,738 | |

Cash and Cash Equivalents at End of Periods | | $ | 55,098 | | | $ | 40,646 | |

Supplemental Disclosure of Cash Flow Information: | | | | | | | | |

Cash Paid for Interest | | $ | 4,219 | | | $ | 2,780 | |

Summary of non-cash investing and financing activity: During the three-month period ended March 31, 2024 the Company issued a total of 201,000 restricted and non-trading shares with an implied value of $122,610 to directors and officers as a result of contractual stock awards. During the three-month period ended March 31, 2023 the Company issued a total of 238,500 restricted and non-trading shares with an implied value of $13,992 to directors and officers as a result of contractual stock awards.

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Condensed Statements of Changes in Stockholders’ Equity (Unaudited)

For the Three Months Ended March 31, 2024 and 2023

| | Common Stock | | | Additional Paid-In | | | Accumulated | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

Balance, December 31, 2023 | | | 16,933,346 | | | $ | 16,934 | | | $ | 24,063,176 | | | $ | (23,809,238 | ) | | $ | 270,872 | |

Restricted, Non-Trading Stock issued to Directors and employees | | | 201,000 | | | | 201 | | | | 122,409 | | | | | | | | 122,610 | |

Stock Retired to Treasury | | | | | | | | | | | | | | | | | | | - | |

Net Loss | | | | | | | | | | | | | | | (103,020 | ) | | | (103,020 | ) |

Balance, March 31, 2024 | | | 17,134,346 | | | $ | 17,135 | | | $ | 24,185,585 | | | $ | (23,912,258 | ) | | $ | 290,462 | |

| | Common Stock | | | Additional Paid-In | | | Accumulated | | | | |

| | Shares | | | Amount | | | Capital | | | Deficit | | | Total | |

Balance, December 31, 2022 | | | 16,230,615 | | | $ | 16,231 | | | $ | 23,758,917 | | | $ | (23,629,281 | ) | | $ | 145,867 | |

Restricted, Non-Trading Stock issued to Directors and employees | | | 238,500 | | | | 239 | | | | 13,753 | | | | | | | | 13,992 | |

Stock Retired to Treasury | | | | | | | | | | | | | | | | | | | - | |

Net Income | | | | | | | | | | | | | | | 4,485 | | | | 4,485 | |

Balance, March 31, 2023 | | | 16,469,115 | | | $ | 16,470 | | | $ | 23,772,670 | | | $ | (23,624,796 | ) | | $ | 164,344 | |

The accompanying notes are an integral part of these condensed financial statements.

EQUATOR BEVERAGE COMPANY

Notes to Condensed Financial Statements (Unaudited)

March 31, 2024

NOTE 1 – BUSINESS

Overview

EQUATOR Beverage Company, headquartered in Jersey City, NJ, is a Delaware corporation that specializes in developing, producing, distributing, and marketing new beverage products.

Our beverages have been certified Non-GMO Project Verified and USDA Organic, and we offer both nonalcoholic and ready-to-drink alcoholic options. In addition, we have a line of sparkling energy beverages. Our beverages can be found in North America, the Caribbean, and Bermuda.

We are committed to sustainability and use 100% recyclable, eco-friendly packaging that has a minimal impact on the environment. Furthermore, our products are plant-based, renewable, and eco-friendly.

Coconut water is nature's super hydration drink for skin and body. In each 11 oz serving, there are five essential electrolytes totaling 1043 mg more than other sports drinks. It is a fast rehydration recovery drink which performs faster than water. Coconut water has natural nutrients for skin and hair and vitamins B & C natural - not added. Coconut water is plant based and renewable; great for vegan, kosher, paleo keto and low carb diets. All this comes with a fresh crisp coconut taste. There are no preservatives in this coconut water and it is packaged in an eco-friendly container.

CURRENT OPERATIONS

Sales and Distribution

The Company’s main product is MOJO Coconut Water. In addition to Coconut Water, the Company produces Coconut Water + Pineapple Juice, Coconut Water + Mango Juice, Organic Coconut Water, Sparkling Coconut Water Citrus, Sparkling Coconut Water Blood Orange, Sparkling Coconut Water Pink Grapefruit, Energy Sparkling Citrus, Energy Sparkling Blood Orange, Energy Sparkling Pink Grapefruit, Cubano Blue Agave Tequila Organic Sparkling Coconut Water Citrus and Cubano Blue Agave Tequila Organic Sparkling Coconut Water Blood Orange. We seek to grow the market share of our products by expanding our hybrid distribution network through the relationships and efforts of our management and third-party partners and broker network, and new products and packaging. The Company packages its beverages in 100% recyclable, Eco-Friendly packaging that can be recycled infinite times and is not made from carbon oil-based packaging. The packaging has a very low impact on the environment, and does not contribute to landfills and the pollution of our bodies of water. Also, our products are plant-based, Eco-friendly and renewable.

Production

The Company has multiple sources for its production. The Company’s fruit sources are of high quality. The fruit is part of the overall taste and quality of our products. Currently, the Company has multiple production facilities that it could source products from, each of the facilities could supply our forecasted demand.

Competition

The beverage industry is competitive. Competitors in our market compete for brand recognition, ingredient sourcing, product shelf space, and e-commerce page rankings. Our competitors have similar distribution channels and retailers to deliver and sell their products.

Government Regulation

Within the United States, beverages are governed by the U.S. Food and Drug Administration (the “FDA”). As such, it is necessary for the Company to establish, maintain and make available for inspection records as well as to develop labels (including nutrition information) that meet FDA requirements. The Company’s production facilities are subject to FDA regulation.

Employees

As of March 31, 2024, the Company had two employees. The Company also uses the services of contractors, consultants and other third-parties. The Company uses third party bottlers to produce its products which is standard industry practice for every beverage company. We also use trucking and logistics companies to transport and store our products. We use brokers to sell our product and other professionals for accounting, legal and marketing support, to do all these functions internally would take hundreds of employees and not be cost effective.

CORPORATE HISTORY AND DEVELOPMENT

The Company began producing MOJO branded products in 2015. EQUATOR Beverage Company is headquartered in Jersey City, New Jersey and our internet site is www.EquatorBeverage.com. EQUATOR’s stock is traded on the OTCQB under the symbol MOJO.

Interim Financial Statements

The accompanying unaudited interim condensed financial statements have been prepared pursuant to the rules and regulations for reporting on Form 10-Q and article 10 of Regulation S-X and the related rules and regulations of the Securities and Exchange Commission (“SEC”). Accordingly, certain information and disclosures required by accounting principles generally accepted in the United States of America (“GAAP”) for complete financial statements have been condensed or omitted pursuant to such rules and regulations. However, the Company believes that the disclosures included in these financial statements are adequate to make the information presented not misleading. The unaudited interim condensed financial statements included in this document have been prepared on the same basis as the annual audited financial statements, and in the Company’s opinion, reflect all adjustments necessary for a fair presentation in accordance with GAAP and SEC regulations for interim financial statements. The results for the three months ended March 31, 2024 are not necessarily indicative of the results that the Company will have for any subsequent period. These unaudited condensed financial statements should be read in conjunction with the audited financial statements and the notes to those statements for the year ended December 31, 2023 included in the Company’s Annual Report on Form 10-K.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The financial statements are prepared in conformity with accounting principles generally accepted in the United States (“GAAP”). Management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Cash and Cash Equivalents

Cash equivalents include investment instruments and time deposits purchased with a maturity of three months or less. As of March 31, 2024, and March 31, 2023, the Company did not have any cash equivalents.

Accounts Receivable

Accounts receivable are stated at the amount management expects to collect from outstanding balances. The Company provides for probable uncollectible amounts based upon its assessment of the current status of the individual receivables and after using reasonable collection efforts. The allowance for doubtful accounts as of March 31, 2024 and 2023 was zero.

Inventory

Inventory, consisting solely of finished goods, are stated at the lower of cost (first-in, first-out method) or net realizable value (“NRV”). If necessary, the Company provides allowances to adjust the carrying value of its inventories to NRV when NRV is below cost. There were no such adjustments in 2024 or 2023.

Revenue Recognition

Revenue from sales of products is recognized when the related performance obligation is satisfied. The Company’s performance obligation is satisfied upon the shipment or delivery of products to customers. The Company’s products are sold on cash and credit terms which are established in accordance with standardized industry practices and typically require payment within 30 days of delivery.

Shipping and Handling Costs

Shipping and Handling Costs incurred to move finished goods from our distribution center to customer locations are included in the line Selling, General and Administrative Expenses in our Statements of Operations.

Net Income/(Loss) Per Common Share

The Company computes per share amounts in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 260, “Earnings per Share”. ASC Topic 260 requires presentation of basic and diluted EPS. Basic EPS is computed by dividing the income/(loss) available to common stockholders by the weighted-average number of common shares outstanding for the period. Diluted EPS is based on the weighted average number of shares of common stock and common stock equivalents outstanding during the periods.

Income Taxes

The Company provides for income taxes using the asset and liability approach in accounting for income taxes. Deferred tax assets and liabilities are recorded based on the differences between the financial statement and tax bases of assets and liabilities and the tax rates in effect when these differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance if, based on the weight of available evidence, it is more likely than not that some or all of the deferred tax assets will not be realized. The Company did not have a deferred tax liability at March 31, 2024 and 2023.

As of March 31, 2024, and March 31, 2023, the Company had no accrued interest or penalties. The Company had no Federal or State tax examinations in the past nor does it have any at the current time.

The table below shows the details of the Net Operating Loss Carryforward and Deferred Tax Assets for 2024 and 2023:

| | 2024 | | | 2023 | |

Net Operating Loss Carryforward, January 1 | | $ | 3,616,513 | | | $ | 3,796,573 | |

Taxable Income, January 1 to March 31 | | | 35,607 | | | | 18,477 | |

Net Operating Loss Carryforward, March 31 | | $ | 3,580,906 | | | $ | 3,778,096 | |

Federal Deferred Tax Asset, January 1 | | | 759,468 | | | | 797,280 | |

Federal Tax Expense as of March 31 (21% Tax Rate) | | | (7,477 | ) | | | (3,880 | ) |

Federal Deferred Tax Asset, March 31 | | $ | 751,991 | | | $ | 793,400 | |

State of New Jersey Deferred Tax Asset, January 1 | | | 324,678 | | | | 341,692 | |

State of New Jersey Tax Expense as of March 31 (9% Tax Rate) | | | (3,205 | ) | | | (1,663 | ) |

State of New Jersey Deferred Tax Asset, March 31 | | $ | 321,473 | | | $ | 340,029 | |

Total Deferred Tax Asset, March 31 | | $ | 1,073,464 | | | $ | 1,133,429 | |

Total Tax Expense | | $ | 10,682 | | | | 5,543 | |

The table below shows the reconciliation of Net Income / (Loss) per Books to Taxable Income:

| | 2024 | | | 2023 | |

Net Income/(Loss) before Taxes | | $ | (102,378 | ) | | $ | 4,485 | |

Stock Awards | | | 137,985 | | | | 13,992 | |

Taxable Net Income | | $ | 35,607 | | | $ | 18,477 | |

Fair value of financial instruments

The carrying amounts of financial instruments, which include cash, accounts receivable, accounts payable and accrued expense, approximate their fair values due to their short-term nature.

NOTE 3 – COMMITMENTS AND CONTINGENCIES

Employment Agreement

Pursuant to Mr. Simpson’s Employment Agreement (“the Agreement”) dated January 1, 2024 Mr. Simpson is paid a salary of $9,000 per month and a stock award of 67,000 shares of non-trading, restricted Common Stock. The employment agreement expires on December 31, 2029.

Pursuant to the Agreement, should Mr. Simpson’s employment be terminated without cause, the Company is obligated to pay Mr. Simpson all amounts from the contract immediately for the remaining term of 69 months. At March 31, 2024, the potential liability to EQUATOR Beverage Company was $621,000 and 4,623,000 shares of non-trading, restricted Common Stock.

NOTE 4 – STOCKHOLDERS’ EQUITY

The Company has authorized 20,000,000 shares of Common Stock having a par value of $0.001.

Restricted Stock Issuances

The table below summarizes the restricted, non-trading stock awards during the first three months of 2024 and 2023:

Restricted, Non-trading Stock Awards |

Officers and Directors |

January 1 to March 31 |

2024 | | | 2023 | |

| | Price | | | Shares | | | Amount | | | | | Price | | | Shares | | | Amount | |

Glenn Simpson | | $ | 0.61 | | | | 201,000 | | | $ | 122,610 | | | Glenn Simpson | | $ | 0.06 | | | | 201,000 | | | $ | 11,792 | |

- | | $ | - | | | | - | | | | - | | | Jeffrey Devlin | | $ | 0.06 | | | | 37,500 | | | | 2,200 | |

Total | | | | | | | 201,000 | | | $ | 122,610 | | | Total | | | | | | | 276,000 | | | $ | 13,992 | |

Stock Purchased for Cancellation

During the quarter ended March 31, 2024, the Company did not purchase any shares of its Common Stock from shareholders.

During the year ended December 31, 2023, the Company purchased 401,269 shares of its Common Stock from shareholders at a cost of $51,814.

NOTE 5 – RELATED PARTY TRANSACTIONS

Mr. Simpson lent funds to the Company for a revolving loan with a principal amount up to $300,000. The loan bears a 6% simple interest per year. The principal and any accrued interest are due and payable on demand, and the Company has the right to pay back the loan in full or make payments without penalty.

As of March 31, 2024, the loan payable to Mr. Simpson was $360,000.

As of March 31, 2023, the loan payable to Mr. Simpson was $235,000.

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Our Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is provided in addition to the accompanying financial statements and notes to assist readers in understanding our results of operations, financial condition and cash flows. MD&A is organized as follows:

| ● | Significant Accounting Policies — Accounting policies that we believe are important to understanding the assumptions and judgments incorporated in our reported financial results and forecasts. |

| | |

| ● | Results of Operations — Analysis of our financial results comparing the quarter ended March 31, 2024 to March 31, 2023. |

| | |

| ● | Liquidity and Capital Resources — Analysis of changes in our cash flows, and discussion of our financial condition and potential sources of liquidity. |

This report includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward looking statements are often identified by words like: believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. You should not place undue certainty on these forward-looking statements, which apply only as of the date of this annual report. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from historical results or our predictions.

Significant Accounting Policies

We have prepared our financial statements in conformity with accounting principles generally accepted in the United States, which requires management to make significant judgments and estimates that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of expenses during the reporting period. We base these significant judgments and estimates on historical experience and other applicable assumptions we believe to be reasonable based upon information presently available. These estimates may change as new events occur, as additional information is obtained and as our operating environment changes. These changes have historically been minor and have been included in the financial statements as soon as they became known. Actual results could materially differ from our estimates under different assumptions, judgments or conditions.

All of our significant accounting policies are discussed in Note 2, Summary of Significant Accounting Policies, to our financial statements, included elsewhere in this Annual Report. We have identified the following as our critical accounting policies and estimates, which are defined as those that are reflective of significant judgments and uncertainties, are the most pervasive and important to the presentation of our financial condition and results of operations and could potentially result in materially different results under different assumptions, judgments or conditions.

We believe the following critical accounting policies reflect our more significant estimates and assumptions used in the preparation of our financial statements:

Use of Estimates — The financial statements are prepared in conformity with accounting principles generally accepted in the United States (“GAAP”). Management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments — Our short-term financial instruments, including cash, accounts receivable, accounts payable and other liabilities, consist primarily of instruments without extended maturities. We believe that the fair values of our current assets and current liabilities approximate their reported carrying amounts.

COMPANY OVERVIEW

EQUATOR Beverage Company, headquartered in Jersey City, NJ, is a Delaware corporation that specializes in developing, producing, distributing, and marketing new beverage products.

Our beverages have been certified Non-GMO Project Verified and USDA Organic, and we offer both nonalcoholic and ready-to-drink alcoholic options. In addition, we have a line of sparkling energy beverages. Our beverages can be found in North America, the Caribbean, and Bermuda.

We are committed to sustainability and use 100% recyclable, eco-friendly packaging that has a minimal impact on the environment. Furthermore, our products are plant-based, renewable, and eco-friendly.

Coconut water is nature's super hydration drink for skin and body. In each 11 oz serving, there are five essential electrolytes totaling 1043 mg more than other sports drinks. It is a fast rehydration recovery drink which performs faster than water. Coconut water has natural nutrients for skin and hair and vitamins B & C natural - not added. Coconut water is plant based and renewable; great for vegan, kosher, paleo keto and low carb diets. All this comes with a fresh crisp coconut taste. There are no preservatives in this coconut water and it is packaged in an eco-friendly container.

Results of Operations

Three Months Ended March 31, 2024 and 2023

Revenue

For the quarter ended March 31, 2024, the Company reported revenue of $640,653 an increase of $125,020 or 24% from revenue of $515,633 for the quarter ended March 31, 2023. The increase in revenue was due to strong demand for all products.

Cost of Revenue

Cost of revenue includes finished goods purchase costs and freight in costs.

For the quarter ended March 31, 2024, cost of revenue was $370,070 or 58% of revenue, an improvement of 3 percentage points from the same period in 2023. For the quarter ended March 31, 2023, cost of revenue was $313,457 or 61% of revenue. The improvement in the operating margin was the result of improved sales of higher margin products.

Operating Expenses

Operating expenses for the first quarter of 2024 were $230,758 compared to $178,720 for the same period in 2023 excluding restricted, non-trading stock awards issued to officers and directors. This $52,038 or 29% increase was primarily due to increased revenue of 24%.

During the first quarter of 2023, 201,000 shares of restricted, non-trading common stock were issued to officers and directors compared to 276,000 shares issued during the same period in 2023 which is a reduction of 75,000 shares. For the first quarter of 2024, the implied cost of the restricted, non-trading common shares was $0.61 per share compared to $0.06 per share for the first quarter of 2023. The increase was due to a higher stock price of the publicly traded shares in 2024.

Liquidity and Capital Resources

Liquidity

As of March 31, 2024, the Company had working capital of $290,462 compared to $164,342 for the first quarter of 2023. Net cash used in operating activities was $162,241 for the quarter ended March 31, 2024, a $182,149 decline compared to net cash from operating activities for the quarter ended March 31, 2023 of $19,908. Net cash provided by financing activities was $130,000 for the quarter ended March 31, 2024 compared to $10,000 net cash provided by financing activities for the quarter ended March 31, 2023. Net cash provided by financing activities was used for operations for the quarter ended March 31, 2024.

Working Capital Needs

Our working capital requirements increase as revenue grows for our products. During the quarter ended March 31, 2024, the Company had net borrowings of $130,000. In the first quarter of 2023, net borrowings were $235,000. Should the Company require additional working capital during the next twelve months, it may seek to raise additional funds. Financing transactions may include debt securities and obtaining credit facilities.

OFF BALANCE SHEET ARRANGEMENTS

None

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISKS

None

ITEM 4. CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Evaluation of Disclosure Controls and Procedures

Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act of 1934 (the “Exchange Act”) is accumulated and communicated to the issuer’s management, including its principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure. It should be noted that the design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions, regardless of how remote.

Under the supervision and with the participation of the Company’s senior management, consisting of the Company’s principal executive and financial officer and the Company’s principal accounting officer, the Company conducted an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures, as defined in Rules 13a-15€ and 15d-15(e) under the Exchange Act as of the end of the period covered by this report (the “Evaluation Date”). Based on this evaluation, the Company’s principal executive and financial officer concluded, as of the Evaluation Date, that the Company’s disclosure controls and procedures were effective.

Management’s Annual Report on Internal Control over Financial Reporting

The management of EQUATOR Beverage Company is responsible for establishing and maintaining an adequate system of internal control over financial reporting (as defined in Rule 13a-15(f)) under the Exchange Act. Our internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes of accounting principles generally accepted in the United States. Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements.

Therefore, even those systems determined to be effective can provide only reasonable assurance of achieving their control objectives. In evaluating the effectiveness of our internal control over financial reporting, our management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (COSO) in Internal Control-Integrated Framework (2013). Based on this evaluation, our officers concluded that, during the period covered by this annual report, our internal controls over financial reporting were not operating effectively.

As previously reported, the Company does not have an audit committee and is not currently obligated to have one. Management does not believe that the lack of an audit committee is a material weakness.

Changes in Internal Control over Financial Reporting

There was no change in our internal controls over financial reporting during the quarter ended March 31, 2024 that have materially affected, or are reasonably likely to materially affect, our internal controls over financial reporting.

PART II – OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

We are not a party to any legal or administrative proceedings and are not aware of any pending or threatened legal or administrative proceedings against the Company in all material aspects. We could from time to time become a party to various legal or administrative proceedings arising in the course of our business.

ITEM 1A. RISK FACTORS

In addition to the other information set forth in this report, you should consider the following factors, which could materially affect our business, financial condition or results of operations in future periods. The risks described below are not the only risks facing our Company. Additional risks not currently known to us or that we currently deem to be immaterial also may materially adversely affect our business, financial condition or results of operations in future periods.

RISKS RELATED TO OUR OPERATIONS

Unfavorable general economic and geopolitical conditions could negatively impact our financial results.

Our business, operating results, financial condition and liquidity may be adversely affected by changes in global economic conditions, including inflation, credit market conditions, increased unemployment, levels of consumer and business confidence, commodity (including energy) prices and supply, a recession or economic slowdown, trade policies, foreign currency exchange rates, changing policy positions or priorities, levels of government spending and deficits, and actual or anticipated default on sovereign debt. Many of the locations in which our products are sold have experienced, and could continue to experience, unfavorable changes in economic conditions, which could negatively affect the affordability of, and consumer demand for, our beverages. Under difficult economic conditions, consumers may seek to reduce discretionary spending by forgoing purchases of our products or by shifting away from our beverages to lower-priced products offered by other companies, including private-label brands, which could reduce our profitability and negatively affect our overall financial performance.

Other financial uncertainties in our major markets and unstable geopolitical conditions or events in certain markets, including civil unrest, acts of war, terrorism or governmental changes, or changes in international relations could undermine global consumer confidence and reduce consumers’ purchasing power, thereby reducing demand for our products.

Increased competition could hurt our business.

We operate in a highly competitive commercial beverage industry. Our ability to maintain or gain share of sales may be limited as a result of actions by competitors. Competitive pressures may cause the Company to reduce prices we charge customers or may restrict our ability to increase prices, as may be necessary in response to commodity and other cost increases. Such pressures may also increase marketing costs along with in-store placement, slotting and other marketing fees. In addition, the rapid growth of e‑commerce may create additional consumer price deflation by, among other things, facilitating comparison shopping, and could potentially threaten the value of some of our legacy route-to-market strategies and thus negatively affect revenues. If we do not continuously strengthen our capabilities in marketing and innovation to maintain consumer interest, brand loyalty and market share while strategically expanding into other profitable categories of the commercial beverage industry, our business could be negatively affected.

If we are not successful in our innovation activities, our financial results may be negatively affected.

Achieving our business growth objectives depends in part on our ability to evolve and improve our existing beverage products through innovation and to successfully develop, introduce and market new beverage products. The success of our innovation activities depends on our ability to correctly anticipate customer and consumer acceptance and trends; obtain, maintain and enforce necessary intellectual property rights; and avoid infringing on the intellectual property rights of others. If we are not successful in our innovation activities, we may not be able to achieve our growth objectives, which may have a negative impact on our financial results.

Changes in the retail landscape or the loss of key retail or foodservice customers could adversely affect our financial results.

Our industry is being affected by the trend toward consolidation in, and the blurring of the lines between, retail channels in the United States. Retailers may seek lower prices from us, may demand increased marketing or promotional expenditures in support of their businesses, and may be more likely to use their distribution networks to introduce and develop private-label brands, any of which could negatively affect the Company’s profitability. In addition, in developed markets, discounters and value stores are growing at a rapid pace, while in emerging and developing markets, modern trade is growing at a faster pace than traditional trade outlets. Our industry is also being affected by the rapid growth in sales through e-commerce retailers, e-commerce websites, mobile commerce applications and subscription services, which may result in a shift away from physical retail operations to digital channels. As we build e-commerce capabilities, we may not be able to develop and maintain successful relationships with existing and new e-commerce retailers without experiencing a deterioration of our relationships with key customers operating physical retail channels. If we are unable to successfully adapt to the rapidly changing retail landscape, including the rapid growth in digital commerce, our share of sales, volume growth and overall financial results could be negatively affected. In addition, our success depends in part on our ability to maintain good relationships with key retail and foodservice customers. The loss of one or more of our key retail or foodservice customers could have an adverse effect on our financial performance.

If we do not successfully manage the potential negative consequences of our productivity initiatives, our business operations could be adversely affected.

We believe that improved productivity is essential to achieving our long-term growth objectives and, therefore, a leading priority of our Company is to design and implement the most effective and efficient business model possible. Consequently, we continuously search for productivity opportunities in our business. Some of the actions we may take from time to time in pursuing these opportunities may become a distraction for our employees and may disrupt our ongoing business operations; cause deterioration in employee morale, which may make it more difficult for us to retain or attract qualified employees; disrupt or weaken the internal control structures of the affected business operations; and give rise to negative publicity, which could affect our corporate reputation. If we are unable to successfully manage the potential negative consequences of our productivity initiatives, our business operations could be adversely affected.

Disruption of our supply chain, including increased commodity, raw material, packaging, energy, transportation and other input costs may adversely affect our financial condition or results of operations.

We have experienced, and could continue to experience, disruptions in our supply chain. In connection with our manufacturing operations, we and our bottling partners are dependent upon, among other things, various ingredients and other raw materials and packaging materials. Some of the raw materials and supplies used in the production of our products are available from a limited number of suppliers or from a sole supplier or are in short supply when seasonal demand is at its peak. Furthermore, some of our suppliers are located in countries experiencing political or other risks and/or unfavorable economic conditions. We and our bottling partners may not be able to maintain favorable arrangements and relationships with these suppliers, and our contingency plans may not be effective in preventing disruptions that may arise from shortages of any ingredients or other raw materials. In addition, adverse weather conditions may affect the supply of agricultural commodities from which key ingredients for our products are derived. Any sustained or significant disruption to the manufacturing or sourcing of products or materials could increase our costs and interrupt product supply, which could adversely impact our business.

The raw materials and other supplies, including ingredients, agricultural commodities, energy, fuel, packaging materials, transportation, labor and other supply chain inputs that we use for the production and distribution of our products, are subject to price volatility and fluctuations in availability caused by many factors. These factors include changes in supply and demand; supplier capacity constraints; a deterioration of our or our bottling partners’ relationships with suppliers; inflation; weather conditions (including the effects of climate change); wildfires and other natural disasters; disease or pests (including the impact of citrus greening disease on the citrus industry); agricultural uncertainty; health epidemics, pandemics or other contagious outbreaks; labor shortages, strikes or work stoppages; changes in or the enactment of new laws and regulations; governmental actions or controls (including import/export restrictions, such as new or increased tariffs, sanctions, quotas or trade barriers); port congestion or delays; transport capacity constraints; cybersecurity incidents or other disruptions; political uncertainties; acts of terrorism; governmental instability; or fluctuations in foreign currency exchange rates.

Our attempts to offset these cost pressures, such as through price increases of some of our products, may not be successful. Higher product prices may result in reductions in sales volume. Consumers may be less willing to pay a price differential for our branded products and may increasingly purchase lower-priced offerings, or may forgo some purchases altogether. To the extent that price increases are not sufficient to offset higher costs adequately or in a timely manner, and/or if they result in significant decreases in sales volume, our financial condition or results of operations may be adversely affected. Furthermore, we may not be able to offset cost increases through productivity initiatives or through our commodity hedging activity.

If our third-party service providers and business partners do not satisfactorily fulfill their commitments and responsibilities, our financial results could suffer.

In the conduct of our business, we rely on relationships with third parties, including suppliers, distributors, contractors, and other external business partners, for certain services in support of key portions of our operations. These third parties are subject to similar risks as we are relating to cybersecurity, privacy violations, business interruption, and systems and employee failures, and are subject to legal, regulatory and market risks of their own. Our third-party service providers and business partners may not fulfill their respective commitments and responsibilities in a timely manner and in accordance with the agreed-upon terms or applicable laws. In addition, while we have procedures in place for assessing risk along with selecting, managing and monitoring our relationships with third-party service providers and other business partners, we do not have control over their business operations or governance and compliance systems, practices and procedures, which increases our financial, legal, reputational and operational risk. If we are unable to effectively manage our third-party relationships, or for any reason our third-party service providers or business partners fail to satisfactorily fulfill their commitments and responsibilities, our financial results could suffer.

RISKS RELATED TO CONSUMER DEMAND FOR OUR PRODUCTS

If we do not address evolving consumer product and shopping preferences, our business could suffer.

Consumer product preferences have evolved and continue to evolve as a result of, among other things, health, wellness and nutrition considerations, concerns regarding the perceived health effects of, or location of origin of, ingredients, raw materials or substances in our products or packaging, including due to the results of third-party studies (whether or not scientifically valid); shifting consumer demographics; changes in consumer tastes and needs coupled with a rapid expansion of beverage options and delivery methods; changes in consumer lifestyles; concerns regarding the environmental, social and sustainability impact of ingredient sources and the product manufacturing process; consumer emphasis on transparency related to ingredients we use in our products and collection and recyclability of, and amount of recycled content contained in, our packaging containers and other materials; and competitive product and pricing pressures. In addition, in many of our markets, shopping patterns are being affected by the digital evolution, with consumers rapidly embracing shopping by way of mobile device applications, e-commerce retailers and e-commerce websites or platforms. If we fail to address changes in consumer product and shopping preferences, do not successfully anticipate and prepare for future changes in such preferences, or are ineffective or slow in developing and implementing appropriate digital transformation initiatives, our share of sales, revenue growth and overall financial results could be negatively affected.

RISKS RELATED TO REGULATORY AND LEGAL MATTERS

Changes in laws and regulations relating to beverage containers and packaging could increase our costs and reduce demand for our products.

We offer nonrefillable containers in the United States. Legal requirements have been enacted in various jurisdictions requiring that deposits or certain ecotaxes or fees be charged in connection with the sale, marketing and use of certain beverage containers. Other proposals relating to beverage container deposits, recycling, recycling content, tethered bottle caps, ecotax and/or product stewardship, or prohibitions on certain types of plastic products, packages and cups (including packaging containing PFAS) have been introduced and/or adopted in various jurisdictions, and we anticipate that similar legislation or regulations may be proposed in the future at federal, state and local levels, both in the United States and elsewhere. Consumers’ increased concerns and changing attitudes about solid waste streams and environmental responsibility and the related publicity could result in the adoption of additional such legislation or regulations in the future. If these types of requirements are adopted and implemented on a large scale, they could affect our costs or require changes in our distribution model, which could reduce our net operating revenues and profitability.

Significant additional labeling or warning requirements or limitations on the marketing or sale of our products may inhibit sales of affected products.

Various jurisdictions have adopted and may seek to adopt significant additional product labeling or warning requirements or limitations on the marketing or sale of our products because of what they contain or allegations that they cause adverse health effects. If these types of requirements become applicable to one or more of our products under current or future environmental or health laws or regulations, they may inhibit sales of such products.

For example, under one such law in California, known as Proposition 65, if the state has determined that a substance causes cancer or harms human reproduction or development, a warning must be provided for any product sold in the state that exposes consumers to that substance, unless the exposure falls under an established safe harbor level or another exemption is applicable. If we were required to add Proposition 65 warnings on the labels of one or more of our beverage products produced for sale in California, the resulting consumer reaction to the warnings and potential adverse publicity could negatively affect our sales both in California and in other markets.

Litigation or legal proceedings could expose us to significant liabilities and damage our reputation.

We are party to various litigation claims and legal proceedings in the ordinary course of business, including, but not limited to, those arising out of our advertising and marketing practices, product claims and labels, competition, distribution and pricing, intellectual property and commercial disputes, tax disputes, and environmental and employment matters. We evaluate these litigation claims and legal proceedings to assess the likelihood of unfavorable outcomes and to estimate, if possible, the amount of potential losses. Based on these assessments and estimates, we establish reserves and/or disclose the relevant litigation claims or legal proceedings, as appropriate. These assessments and estimates are based on the information available to management at the time and involve a significant amount of management judgment. Actual outcomes or losses may differ materially from our current assessments and estimates.

We conduct business in markets with high-risk legal compliance environments, which exposes us to increased legal and reputational risk.

We have bottling and other business operations in markets with high-risk legal compliance environments. Our policies and procedures require strict compliance by our employees and agents with all United States and local laws and regulations and consent orders applicable to our business operations, including those prohibiting improper payments to government officials. Nonetheless, our policies, procedures and related training programs may not always ensure full compliance by our employees and agents with all applicable legal requirements. Improper conduct by our employees or agents could damage our reputation in the United States and internationally or lead to litigation or legal proceedings that could result in civil or criminal penalties, including substantial monetary fines as well as disgorgement of profits.

Failure to adequately protect, or disputes relating to, trademarks, formulas and other intellectual property rights could harm our business.

Our trademarks, formulas and other intellectual property rights are essential to the success of our business. We cannot be certain that the legal steps we are taking are sufficient to protect our intellectual property rights or that, notwithstanding legal protection, others do not or will not infringe or misappropriate our intellectual property rights. If we fail to adequately protect our intellectual property rights, or if changes in laws diminish or remove the current legal protections available to them, the competitiveness of our products may be eroded and our business could suffer. In addition, we could come into conflict with third parties over intellectual property rights, which could result in disruptive and expensive litigation. Any of the foregoing could harm our business.

RISKS RELATED TO FINANCE, ACCOUNTING AND INVESTMENTS

If we are unable to achieve our overall long-term growth objectives, the value of an investment in our Company could be negatively affected.

We have established and publicly announced certain long-term growth objectives. These objectives are based on, among other things, our evaluation of our growth prospects, which are generally driven by the sales potential of our many beverage products, some of which are more profitable than others, and on an assessment of the potential price and product mix. We may not be able to realize the sales potential and the price and product mix necessary to achieve our long-term growth objectives.

RISKS RELATED TO INFORMATION TECHNOLOGY AND DATA PRIVACY

If we are unable to protect our information systems against service interruption, misappropriation of data or cybersecurity incidents, our operations could be disrupted, we may suffer financial losses and our reputation may be damaged.

We rely on networks and information systems and other technology (“information systems”), including the Internet and third-party hosted services, to support a variety of business processes and activities, including procurement and supply chain, manufacturing, distribution, invoicing and collection of payments, employee processes, consumer marketing, mergers and acquisitions, and research and development. We use information systems to process financial information and results of operations for internal reporting purposes and to comply with regulatory financial reporting and legal and tax requirements. In addition, we depend on information systems for digital marketing activities and electronic communications among between Company employees and our bottlers, customers, suppliers, consumers and other third parties. Because information systems are critical to many of the Company’s operating activities, our business may be impacted by system shutdowns, service disruptions or cybersecurity incidents. These incidents may be caused by failures during routine operations, such as system upgrades, or by user errors, as well as network or hardware failures, malicious or disruptive software, unintentional or malicious actions of employees or contractors, cyberattacks by hackers, criminal groups or nation-state organizations (which may include social engineering, business email compromise, cyber extortion, denial of service, or attempts to exploit vulnerabilities), geopolitical events, natural disasters, failures or impairments of telecommunications networks, or other catastrophic events. In addition, such cybersecurity incidents could result in unauthorized or accidental access to or disclosure of material confidential information or regulated personal data. If our information systems or third-party information systems on which we rely suffer severe damage, disruption or shutdown and our business continuity plans do not effectively resolve the issues in a timely manner, we could experience delays in reporting our financial results, and we may lose revenue and profits as a result of our inability to timely manufacture, distribute, invoice and collect payments for concentrates or finished products. Unauthorized or accidental access to, or destruction, loss, alteration, disclosure, falsification or unavailability of, information, or unauthorized access to machines and equipment could result in violations of data protection laws and regulations, misuse or malfunction of machines and equipment, damage to the reputation and credibility of the Company, loss of opportunities to acquire or divest of businesses or brands, and loss of ability to commercialize products developed through research and development efforts and, therefore, could have a negative impact on net operating revenues. In addition, we may suffer financial and reputational damage because of lost or misappropriated confidential information belonging to us, our current or former employees, our bottling partners, other customers or suppliers, or consumers or other data subjects, and may become exposed to legal action and increased regulatory oversight, including governmental investigations, enforcement actions and regulatory fines. The Company could also be required to spend significant financial and other resources to remedy the damage caused by a cybersecurity incident or to repair or replace networks and information systems. These risks also may be present to the extent any of our bottling partners, distributors or suppliers using separate information systems, not integrated with the information systems of the Company, suffers a cybersecurity incident and could result in increased costs related to involvement in investigations or notifications conducted by these third parties. These risks may also be present to the extent a business we have acquired, but which does not use our information systems, experiences severe damage, a system shutdown, service disruption, or a cybersecurity incident.

Like most major corporations, the Company’s information systems are a target of attacks. In addition, third-party providers of data hosting or cloud services, as well as our bottling partners, distributors, joint venture partners, suppliers or acquired businesses that use separate information systems, may experience cybersecurity incidents that may involve data we share with them. Although the cybersecurity incidents that we have experienced to date, as well as those reported to us by our third-party partners, have not had a material effect on our business, financial condition or results of operations, such incidents could have a material adverse effect on us in the future. In order to address risks to our information systems, we continue to make investments in technologies and training. Data protection laws and regulations around the world often require “reasonable,” “appropriate” or “adequate” technical and organizational security measures, and the interpretation and application of those laws and regulations are often uncertain and evolving; there can be no assurance that our security measures will be deemed adequate, appropriate or reasonable by a regulator or court. Moreover, even security measures that are deemed adequate, appropriate, reasonable or in accordance with applicable legal requirements may not protect the information we maintain against increasingly sophisticated attacks. In addition to potential fines, we could be subject to mandatory corrective action due to a cybersecurity incident, which could adversely affect our business operations and result in substantial costs for years to come. While we have purchased cybersecurity insurance, there are no assurances that the coverage would be adequate in relation to any incurred losses. Moreover, as cyberattacks increase in frequency and magnitude, we may be unable to obtain cybersecurity insurance in amounts and on terms we view as appropriate for our operations.

If we fail to comply with privacy and data protection laws, we could be subject to adverse publicity, business disruption, data loss, government enforcement actions and/or private litigation, any of which could negatively affect our business and operating results.

In the ordinary course of our business, we receive, process, transmit and store information relating to identifiable individuals (“personal data”), including employees, former employees, vendors, third-party personnel, customers and consumers with whom we interact. As a result, we are subject to a variety of continuously evolving and developing laws and regulations in numerous jurisdictions regarding privacy and data protection. These privacy and data protection laws may be interpreted and applied differently from jurisdiction to jurisdiction and may create inconsistent or conflicting requirements. In addition, new legislation in this area may be enacted in other jurisdictions at any time. These laws impose operational requirements for companies receiving or processing personal data, and many provide for significant penalties for noncompliance. Some laws and regulations also impose obligations regarding cross-border data transfers of personal data. These requirements with respect to personal data have subjected and may continue in the future to subject the Company to, among other things, additional costs and expenses and have required and may in the future require costly changes to our business practices and information technology and security systems, policies, procedures and practices. Our security controls over personal data, the training of employees and vendors on data privacy and data security, and the policies, procedures and practices we have implemented or may implement in the future may not prevent the improper disclosure of personal data by us or the third-party service providers and vendors whose technology, systems and services we use in connection with the receipt, storage and transmission of personal data. Unauthorized access to or improper disclosure of personal data in violation of privacy and data protection laws could harm our reputation, cause loss of consumer confidence, subject us to regulatory enforcement actions (including penalties, fines and investigations), and result in private litigation against us, which could result in loss of revenue, increased costs, liability for monetary damages, fines and/or criminal prosecution, all of which could negatively affect our business and operating results. We have incurred, and will continue to incur, expenses to comply with privacy and data protection standards and protocols imposed by law, regulation, industry standards and contractual obligations. Increased regulation of data collection, use, disclosure and retention practices, including self-regulation and industry standards, changes in existing laws and regulations, enactment of new laws and regulations, increased enforcement activity, and changes in interpretation of laws, could increase our cost of compliance and operation, limit our ability to grow our business or otherwise harm our business.

RISKS RELATED TO ENVIRONMENTAL AND SOCIAL FACTORS

Our ability to achieve our sustainability goals and targets is subject to risks, many of which are outside of our control, and our reputation and brands could be harmed if we fail to meet such goals.

Companies across all industries are facing increasing scrutiny from stakeholders related to sustainability, including practices and disclosures related to sustainable packaging; water stewardship; climate; health and nutrition; human rights; and diversity, equity and inclusion. Our ability to achieve our sustainability goals and targets and to accurately and transparently report our progress presents numerous operational, financial, legal and other risks, and is dependent on the actions of our bottling partners, suppliers and other third parties, all of which are outside of our control. If we are unable to meet our sustainability goals or evolving stakeholder expectations and industry standards, or if we are perceived to have not responded appropriately to the growing concern for sustainability issues, our reputation, and therefore our ability to sell products, could be negatively impacted. In addition, in recent years, investor advocacy groups and certain institutional investors have placed increasing importance on sustainability. If, as a result of their assessment of our sustainability practices, certain investors are unsatisfied with our actions or progress, they may reconsider their investment in our Company.

As the nature, scope and complexity of sustainability reporting, due diligence and disclosure requirements expand, we may have to incur additional costs to control, assess and report on sustainability metrics. Any failure or perceived failure, whether or not valid, to pursue or fulfill our sustainability goals and targets or to satisfy various sustainability reporting standards within the timelines we announce, or at all, could increase the risk of litigation.

Increasing concerns about the environmental impact of plastic bottles and other packaging materials could result in reduced demand for our beverage products and increased production and distribution costs.

There are increasing concerns among consumers, governments and other stakeholders about the damaging impact of the accumulation of plastic bottles and other packaging materials in the environment, particularly in the world’s waterways, lakes and oceans, as well as inefficient use of resources when packaging materials are not included in a circular economy. We sell certain of our beverage products in plastic bottles and use other packaging materials that, while largely recyclable, may not be regularly recovered and recycled due to lack of collection and recycling infrastructure. If we do not, or are perceived not to, act responsibly to address plastic materials recoverability and recycling concerns and associated waste management issues, our corporate image and brand reputation could be damaged, which may cause some consumers to reduce or discontinue consumption of some of our beverage products. In addition, from time to time we establish goals and targets to reduce the Company’s impact on the environment by, for example, increasing our use of recycled content in our packaging materials; increasing our use of packaging materials that are made in part of plant-based renewable materials; expanding our use of reusable packaging (including refillable or returnable glass and plastic bottles, as well as dispensed and fountain delivery models where consumers use refillable containers for our beverages); participating in programs and initiatives to reclaim or recover bottles and other packaging materials that are already in the environment; and taking other actions and participating in other programs and initiatives organized or sponsored by nongovernmental organizations and other groups. If we fail to achieve or improperly report on our progress toward achieving our announced environmental goals and targets, the resulting negative publicity could adversely affect consumer preference for our products. In addition, in response to environmental concerns, governmental entities in the United States and in many other jurisdictions around the world have adopted, or are considering adopting, regulations and policies designed to mandate or encourage plastic packaging waste reduction and an increase in recycling rates and/or recycled content minimums, or, in some cases, restrict or even prohibit the use of certain plastic containers or packaging materials. These regulations and policies, whatever their scope or form, could increase the cost of our beverage products or otherwise put the Company at a competitive disadvantage. In addition, our increased focus on reducing plastic containers and other packaging materials waste has in the past and may continue to require us or our bottling partners to incur additional expenses and to increase our capital expenditures. A reduction in consumer demand for our products and/or an increase in costs and expenditures relating to production and distribution as a result of these environmental concerns regarding plastic bottles and other packaging materials could have an adverse effect on our business and results of operations.

Increased demand for food products, decreased agricultural productivity and increased regulation of ingredient sourcing due diligence may negatively affect our business.

As part of the manufacture of our beverage products, we use a number of key ingredients that are derived from agricultural commodities such as coconut water and fruit juice. Increased demand for food products; decreased agricultural productivity in certain regions of the world as a result of changing weather patterns; increased agricultural regulations, including regulation of ingredient sourcing due diligence; and other factors have in the past, and may in the future, limit the availability and/or increase the cost of such agricultural commodities and could impact the food security of communities around the world. If we are unable to implement programs focused on economic opportunity and environmental sustainability to address these agricultural challenges and fail to make a strategic impact on food security through joint efforts with bottlers, farmers, communities, suppliers and key partners, as well as through our increased and continued investment in sustainable agriculture, our ability to source raw materials for use in our manufacturing processes and the affordability of our products and ultimately our business and results of operations could be negatively impacted.

Climate change and legal or regulatory responses thereto may have a long-term adverse impact on our business and results of operations.

There is increasing concern that a gradual increase in global average temperatures due to increased concentration of carbon dioxide and other greenhouse gases in the atmosphere is causing significant changes in weather patterns around the globe and an increase in the frequency and severity of natural disasters. Decreased agricultural productivity in certain regions of the world as a result of changing weather patterns may limit the availability or increase the cost of key agricultural commodities, such as coconut water and fruit juice, which are important ingredients for our products, and could impact the food security of communities around the world. Climate change may also exacerbate extreme weather, resulting in water scarcity or flooding, and cause a further deterioration of water quality in affected regions, which could limit water availability for the Company’s production operations. Increased frequency or duration of extreme weather conditions could also impair production capabilities, disrupt our supply chain or impact demand for our products. Increasing concern over climate change also may result in additional legal or regulatory requirements designed to reduce or mitigate the effects of carbon dioxide and other greenhouse gas emissions on the environment, and/or may result in increased disclosure obligations. Increased energy or compliance costs and expenses due to increased legal or regulatory requirements may cause disruptions in, or an increase in the costs associated with, the manufacturing and distribution of our beverage products. The effects of climate change and legal or regulatory initiatives to address climate change could have a long-term adverse impact on our business and results of operations. In addition, from time to time we establish goals and targets to reduce the Company’s carbon footprint by increasing our use of recycled packaging materials, expanding our renewable energy usage, and participating in environmental and sustainability programs and initiatives organized or sponsored by nongovernmental organizations and other groups to reduce greenhouse gas emissions industrywide. If we fail to achieve or improperly report on our progress toward achieving our carbon footprint reduction goals and targets, the resulting negative publicity could adversely affect consumer preference for our beverage products.

Adverse weather conditions could reduce the demand for our products.

The sales of our products are influenced to some extent by weather conditions in the markets in which we operate. Unusually cold or rainy weather during the summer months may have a temporary effect on the demand for our products and contribute to lower sales, which could have an adverse effect on our results of operations for such periods

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

None

ITEM 3. UNRESOLVED STAFF COMMENTS

None

ITEM 4. LEGAL PROCEEDINGS

We are not a party to any legal or administrative proceedings and are not aware of any pending or threatened legal or administrative proceedings against the Company in all material aspects. We could from time to time become a party to various legal or administrative proceedings arising in the course of our business.

ITEM 5. MINE SAFETY DISCLOSURE

None

ITEM 6. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

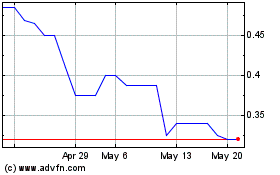

The Company’s Common Stock is currently quoted on the OTCQB under the symbol MOJO.

For the period January 1, 2023 to March 1, 2024, the following table sets forth the high, low and closing stock prices by quarter, based upon information obtained from inter-dealer quotations without retail markup, markdown, or commission and may not necessarily represent actual transactions:

Period | | Close | | | High | | | Low | | | VWAP* | | | Shares Traded | |

First Quarter 2024 | | $ | 0.52 | | | $ | 0.70 | | | $ | 0.37 | | | $ | 0.53 | | | | 260,716 | |

Fourth Quarter 2023 | | $ | 0.64 | | | $ | 0.80 | | | $ | 0.34 | | | $ | 0.63 | | | | 252,385 | |

Third Quarter 2023 | | $ | 0.70 | | | $ | 0.74 | | | $ | 0.17 | | | $ | 0.45 | | | | 618,921 | |

Second Quarter 2023 | | $ | 0.30 | | | $ | 0.35 | | | $ | 0.05 | | | $ | 0.10 | | | | 768,189 | |

First Quarter 2023 | | $ | 0.05 | | | $ | 0.06 | | | $ | 0.05 | | | $ | 0.06 | | | | 301,445 | |

*Volume-Weighted Average Price

Holders

As of March 31,2024, there were 17,134,346 shares of Common Stock issued and outstanding.

Dividends