00015227672023FYfalseP39YP7YP7YP5YP20D2.5http://fasb.org/us-gaap/2023#RevenueFromContractWithCustomerExcludingAssessedTaxhttp://fasb.org/us-gaap/2023#RevenueFromContractWithCustomerExcludingAssessedTax73974500015227672023-01-012023-12-3100015227672023-06-30iso4217:USD00015227672024-03-01xbrli:shares00015227672023-12-3100015227672022-12-310001522767mrmd:SeriesBConvertiblePreferredStockMember2022-12-31iso4217:USDxbrli:shares0001522767mrmd:SeriesBConvertiblePreferredStockMember2023-12-310001522767mrmd:SeriesCConvertiblePreferredStockMember2022-12-310001522767mrmd:SeriesCConvertiblePreferredStockMember2023-12-3100015227672022-01-012022-12-310001522767us-gaap:CommonStockMember2021-12-310001522767mrmd:CommonStockSubscribedButNotIssuedMember2021-12-310001522767us-gaap:AdditionalPaidInCapitalMember2021-12-310001522767us-gaap:RetainedEarningsMember2021-12-310001522767us-gaap:NoncontrollingInterestMember2021-12-3100015227672021-12-310001522767us-gaap:CommonStockMember2022-01-012022-12-310001522767us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001522767us-gaap:CommonStockMembermrmd:GreenGrowthGroupIncMember2022-01-012022-12-310001522767us-gaap:AdditionalPaidInCapitalMembermrmd:GreenGrowthGroupIncMember2022-01-012022-12-310001522767mrmd:GreenGrowthGroupIncMember2022-01-012022-12-310001522767mrmd:GreenhouseNaturalsLLCMemberus-gaap:CommonStockMember2022-01-012022-12-310001522767us-gaap:AdditionalPaidInCapitalMembermrmd:GreenhouseNaturalsLLCMember2022-01-012022-12-310001522767mrmd:GreenhouseNaturalsLLCMember2022-01-012022-12-310001522767us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001522767mrmd:CommonStockSubscribedButNotIssuedMember2022-01-012022-12-310001522767us-gaap:RetainedEarningsMember2022-01-012022-12-310001522767us-gaap:CommonStockMember2022-12-310001522767mrmd:CommonStockSubscribedButNotIssuedMember2022-12-310001522767us-gaap:AdditionalPaidInCapitalMember2022-12-310001522767us-gaap:RetainedEarningsMember2022-12-310001522767us-gaap:NoncontrollingInterestMember2022-12-310001522767mrmd:CommonStockSubscribedButNotIssuedMember2023-01-012023-12-310001522767us-gaap:CommonStockMember2023-01-012023-12-310001522767us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001522767mrmd:ErmontIncMemberus-gaap:CommonStockMember2023-01-012023-12-310001522767us-gaap:AdditionalPaidInCapitalMembermrmd:ErmontIncMember2023-01-012023-12-310001522767mrmd:ErmontIncMember2023-01-012023-12-310001522767us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001522767us-gaap:RetainedEarningsMember2023-01-012023-12-310001522767us-gaap:CommonStockMember2023-12-310001522767mrmd:CommonStockSubscribedButNotIssuedMember2023-12-310001522767us-gaap:AdditionalPaidInCapitalMember2023-12-310001522767us-gaap:RetainedEarningsMember2023-12-310001522767us-gaap:NoncontrollingInterestMember2023-12-31mrmd:acquisition0001522767mrmd:GreenGrowthGroupIncMember2022-05-05xbrli:pure0001522767mrmd:MariMedAdvisorsIncMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MiaDevelopmentLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariHoldingsILLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariHoldingsMDLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariHoldingsNJLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariHoldingsMetropolisLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariHoldingsMountVernonLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:HartwellRealtyHoldingsLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:KindTherapeuticsUSALLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:ARLHealthcareIncMembersrt:SubsidiariesMember2023-12-310001522767mrmd:KPGOfAnnaLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:KPGofHarrisburgLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariMedOHLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MariMedHempIncMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MeditaurusLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:MMMOLLCMembersrt:SubsidiariesMember2023-12-310001522767mrmd:GreenGrowthGroupIncMembersrt:SubsidiariesMember2023-12-310001522767srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001522767srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310001522767srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001522767srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001522767srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001522767srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2023-12-310001522767us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MinimumMember2023-12-310001522767us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2023-12-310001522767mrmd:ErmontAcquisitionMember2023-03-092023-03-090001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-03-090001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-03-092023-03-090001522767mrmd:ErmontAcquisitionMember2023-03-102023-12-310001522767mrmd:ErmontAcquisitionMember2023-03-090001522767mrmd:ErmontAcquisitionMemberus-gaap:TrademarksAndTradeNamesMember2023-03-090001522767us-gaap:CustomerRelationshipsMembermrmd:ErmontAcquisitionMember2023-03-090001522767mrmd:ErmontAcquisitionMemberus-gaap:LicenseMember2023-03-090001522767mrmd:ErmontAcquisitionMember2023-01-012023-12-310001522767mrmd:ErmontAcquisitionMember2022-01-012022-12-310001522767mrmd:KindTherapeuticsUSAIncMember2021-12-310001522767mrmd:KindTherapeuticsUSAIncMember2022-04-012022-04-3000015227672022-04-012022-04-300001522767mrmd:KindNotesMembermrmd:KindTherapeuticsUSAIncMembermrmd:PromissoryNotesMember2022-04-012022-04-300001522767mrmd:KindNotesMembermrmd:KindTherapeuticsUSAIncMembermrmd:PromissoryNotesMember2022-04-300001522767mrmd:KindTherapeuticsUSAIncMember2022-01-012022-12-310001522767mrmd:KindTherapeuticsUSALLCMember2022-04-012022-04-300001522767mrmd:KindTherapeuticsUSALLCMember2022-04-300001522767us-gaap:TrademarksAndTradeNamesMembermrmd:KindTherapeuticsUSALLCMember2022-04-300001522767mrmd:LicensesAndCustomerBaseMembermrmd:KindTherapeuticsUSALLCMember2022-04-300001522767mrmd:KindTherapeuticsUSALLCMemberus-gaap:NoncompeteAgreementsMember2022-04-300001522767mrmd:MariHoldingsMDLLCAndMiaDevelopmentLLCMember2022-04-012022-04-30mrmd:member0001522767mrmd:MariHoldingsMDLLCAndMiaDevelopmentLLCMember2022-09-012022-09-300001522767mrmd:MariHoldingsMDLLCMember2022-09-300001522767mrmd:MiaDevelopmentLLCMember2022-09-300001522767mrmd:GreenGrowthGroupIncMember2022-01-310001522767mrmd:GreenGrowthGroupIncMember2022-01-012022-01-310001522767mrmd:GreenGrowthGroupIncMember2022-05-052022-05-05utr:sqft0001522767mrmd:GreenhouseNaturalsLLCBeverlyAssetPurchaseMember2021-11-012021-11-300001522767mrmd:GreenhouseNaturalsLLCBeverlyAssetPurchaseMember2022-12-302022-12-300001522767mrmd:AllgreensDispensaryLLCMember2022-08-310001522767mrmd:AllgreensDispensaryLLCMember2022-08-012022-08-31mrmd:license0001522767mrmd:AllgreensDispensaryLLCMember2023-01-012023-12-31mrmd:dispensary0001522767mrmd:AllgreensDispensaryLLCMember2023-12-310001522767mrmd:AllgreensDispensaryLLCMember2023-12-310001522767mrmd:RobustMissouriProcessAndManufacturing1LLCMember2022-09-300001522767mrmd:RobustMissouriProcessAndManufacturing1LLCMember2022-09-012022-09-300001522767mrmd:RobustMissouriProcessAndManufacturing1LLCMember2023-01-012023-12-310001522767mrmd:TheHarvestFoundationLLCMember2019-12-310001522767us-gaap:CommonStockMembermrmd:TheHarvestFoundationLLCMember2019-01-012019-12-31mrmd:owner0001522767mrmd:TwoOwnersMembermrmd:TheHarvestFoundationLLCMember2019-12-310001522767us-gaap:RelatedPartyMember2022-01-012022-12-31mrmd:property0001522767stpr:DEmrmd:CultivationAndProcessingFacilityMember2023-12-31mrmd:optionToRenew0001522767mrmd:FirstStateCompassionCenterMembermrmd:FSCCInitialNoteMember2023-12-310001522767mrmd:FirstStateCompassionCenterMembermrmd:FSCCInitialNoteMember2022-12-310001522767mrmd:FirstStateCompassionCenterMembermrmd:FSCCSecondaryNoteMember2023-12-310001522767mrmd:FirstStateCompassionCenterMembermrmd:FSCCSecondaryNoteMember2022-12-310001522767mrmd:FirstStateCompassionCenterMembermrmd:FSCCNewNoteMember2023-12-310001522767mrmd:FirstStateCompassionCenterMembermrmd:FSCCNewNoteMember2022-12-310001522767mrmd:HealerLLCMembermrmd:RevisedHealerNoteMember2023-12-310001522767mrmd:HealerLLCMembermrmd:RevisedHealerNoteMember2022-12-310001522767mrmd:FSCCConsolidatedNoteMembermrmd:FirstStateCompassionCenterMember2023-07-310001522767mrmd:FirstStateCompassionCenterMember2023-07-012023-07-310001522767mrmd:FSCCConsolidatedNoteMembermrmd:FirstStateCompassionCenterMember2023-07-012023-07-310001522767mrmd:FirstStateCompassionCenterMember2016-05-012016-05-310001522767mrmd:FirstStateCompassionCenterMember2016-05-310001522767mrmd:FirstStateCompassionCenterMember2022-12-310001522767mrmd:ConvertiblePromissoryNoteMembermrmd:FirstStateCompassionCenterMember2021-12-310001522767mrmd:ConvertiblePromissoryNoteMembermrmd:FirstStateCompassionCenterMember2022-12-310001522767mrmd:FSCCNewNoteMember2022-12-310001522767mrmd:FSCCSecondNewNoteMember2023-06-300001522767mrmd:HealerLLCMembermrmd:RevisedHealerNoteMember2021-03-310001522767mrmd:HealerLLCMember2021-03-310001522767mrmd:HealerLLCMember2021-01-012021-12-310001522767mrmd:HealerLLCMembermrmd:RevisedHealerNoteMember2021-12-310001522767mrmd:WMTechnologyIncMember2023-12-310001522767mrmd:WMTechnologyIncMember2022-12-310001522767mrmd:ArtisLLCDbaLittleDogMember2023-12-310001522767mrmd:ArtisLLCDbaLittleDogMember2022-12-310001522767mrmd:AllgreensDispensaryLLCMember2022-12-310001522767mrmd:WMTechnologyIncFormerlyMembersRSVPLLCMember2022-02-012022-02-280001522767mrmd:WMTechnologyIncFormerlyMembersRSVPLLCMember2023-01-012023-12-310001522767mrmd:WMTechnologyIncFormerlyMembersRSVPLLCMember2022-01-012022-12-310001522767mrmd:ArtisLLCDbaLittleDogMember2023-04-300001522767mrmd:ArtisLLCDbaLittleDogMember2023-04-012023-04-300001522767mrmd:LittleDogInvestmentMember2023-01-012023-12-310001522767mrmd:TerraceIncMember2022-01-012022-12-310001522767us-gaap:LandMember2023-12-310001522767us-gaap:LandMember2022-12-310001522767mrmd:BuildingsandBuildingImprovementsMember2023-12-310001522767mrmd:BuildingsandBuildingImprovementsMember2022-12-310001522767mrmd:TenantImprovementsMember2023-12-310001522767mrmd:TenantImprovementsMember2022-12-310001522767us-gaap:FurnitureAndFixturesMember2023-12-310001522767us-gaap:FurnitureAndFixturesMember2022-12-310001522767us-gaap:MachineryAndEquipmentMember2023-12-310001522767us-gaap:MachineryAndEquipmentMember2022-12-310001522767us-gaap:ConstructionInProgressMember2023-12-310001522767us-gaap:ConstructionInProgressMember2022-12-310001522767us-gaap:TrademarksAndTradeNamesMember2023-01-012023-12-310001522767us-gaap:TrademarksAndTradeNamesMember2023-12-310001522767mrmd:LicensesAndCustomerBaseMember2023-01-012023-12-310001522767mrmd:LicensesAndCustomerBaseMember2023-12-310001522767us-gaap:NoncompeteAgreementsMember2023-01-012023-12-310001522767us-gaap:NoncompeteAgreementsMember2023-12-310001522767us-gaap:TrademarksAndTradeNamesMember2022-01-012022-12-310001522767us-gaap:TrademarksAndTradeNamesMember2022-12-310001522767mrmd:LicensesAndCustomerBaseMember2022-01-012022-12-310001522767mrmd:LicensesAndCustomerBaseMember2022-12-310001522767us-gaap:NoncompeteAgreementsMember2022-01-012022-12-310001522767us-gaap:NoncompeteAgreementsMember2022-12-310001522767mrmd:KindAcquisitionMember2023-01-012023-12-310001522767mrmd:KindAcquisitionMember2022-01-012022-12-310001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:LineOfCreditMemberus-gaap:SecuredDebtMember2023-01-240001522767us-gaap:SecuredDebtMemberus-gaap:SecuredDebtMembermrmd:LoanAndSecurityAgreementIncrementalTermLoanMember2023-01-240001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMemberus-gaap:SecuredDebtMember2023-01-242023-01-240001522767us-gaap:SecuredDebtMemberus-gaap:SecuredDebtMembermrmd:LoanAndSecurityAgreementIncrementalTermLoanMember2023-01-242023-01-240001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMemberus-gaap:SecuredDebtMember2023-01-240001522767us-gaap:SecuredDebtMember2023-01-242023-01-240001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMemberus-gaap:PrimeRateMemberus-gaap:SecuredDebtMember2023-01-242023-01-240001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMember2023-01-242023-01-240001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMember2023-01-240001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMember2023-01-012023-12-310001522767us-gaap:MortgagesMembermrmd:CREMLoanMember2023-11-160001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMember2023-11-162023-11-160001522767us-gaap:MortgagesMembermrmd:CREMLoanMember2023-12-310001522767us-gaap:MortgagesMembermrmd:CREMLoanMember2022-12-310001522767mrmd:BankOfNewEnglandNewBedfordMAAndMiddleboroughMAPropertyMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:BankOfNewEnglandNewBedfordMAAndMiddleboroughMAPropertyMemberus-gaap:MortgagesMember2022-12-310001522767us-gaap:MortgagesMembermrmd:BankOfNewEnglandWilmingtonDEPropertyMember2023-12-310001522767us-gaap:MortgagesMembermrmd:BankOfNewEnglandWilmingtonDEPropertyMember2022-12-310001522767mrmd:DuQuoinStateBankAnnaILandHarrisburgILPropertiesMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:DuQuoinStateBankAnnaILandHarrisburgILPropertiesMemberus-gaap:MortgagesMember2022-12-310001522767mrmd:DuQuoinStateBankMetropolisILPropertiesMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:DuQuoinStateBankMetropolisILPropertiesMemberus-gaap:MortgagesMember2022-12-310001522767mrmd:DuQuoinStateBankMtVernonILPropertyMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:DuQuoinStateBankMtVernonILPropertyMemberus-gaap:MortgagesMember2022-12-310001522767mrmd:SouthPorteBankMtVenonILPropertyMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:SouthPorteBankMtVenonILPropertyMemberus-gaap:MortgagesMember2022-12-310001522767mrmd:ErmontAcquisitionMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:ErmontAcquisitionMemberus-gaap:MortgagesMember2022-12-310001522767us-gaap:MortgagesMembermrmd:GreenhouseNaturalsAcquisitionMember2023-12-310001522767us-gaap:MortgagesMembermrmd:GreenhouseNaturalsAcquisitionMember2022-12-310001522767mrmd:KindAcquisitionMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:KindAcquisitionMemberus-gaap:MortgagesMember2022-12-310001522767mrmd:PromissoryNotesIssuedToPurchaseMotorVehiclesMemberus-gaap:MortgagesMember2023-12-310001522767mrmd:PromissoryNotesIssuedToPurchaseMotorVehiclesMemberus-gaap:MortgagesMember2022-12-310001522767us-gaap:MortgagesMember2023-12-310001522767us-gaap:MortgagesMember2022-12-310001522767mrmd:FHLBRateMemberus-gaap:MortgagesMembermrmd:CREMLoanMember2023-11-162023-11-160001522767us-gaap:MortgagesMembermrmd:CREMLoanMember2023-11-162023-11-160001522767mrmd:LoanAndSecurityAgreementMemberus-gaap:SecuredDebtMemberus-gaap:SecuredDebtMember2023-11-162023-11-160001522767mrmd:BankOfNewEnglandNewBedfordMAInitialMortgageMemberus-gaap:MortgagesMember2023-11-162023-11-160001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-11-162023-11-160001522767us-gaap:MortgagesMembermrmd:CREMLoanMember2023-01-012023-12-310001522767mrmd:RefinancedMortgageMemberus-gaap:MortgagesMember2020-07-310001522767mrmd:RefinancedMortgageMemberus-gaap:MortgagesMember2022-12-310001522767mrmd:RefinancedMortgageMemberus-gaap:MortgagesMember2023-11-162023-11-160001522767mrmd:RefinancedMortgageMemberus-gaap:MortgagesMember2023-01-012023-12-310001522767us-gaap:MortgagesMembermrmd:BankOfNewEnglandWilmingtonDEPropertyMember2016-12-310001522767us-gaap:PrimeRateMembermrmd:BankOfNewEnglandWilmingtonDEPropertyMemberus-gaap:MortgagesMember2016-12-310001522767us-gaap:MortgagesMembermrmd:BankOfNewEnglandWilmingtonDEPropertyMember2016-01-012016-12-310001522767mrmd:DuQuoinStateBankAnnaILandHarrisburgILPropertiesMemberus-gaap:MortgagesMember2016-05-310001522767mrmd:DuQuoinStateBankAnnaILandHarrisburgILPropertiesMemberus-gaap:MortgagesMember2022-05-310001522767mrmd:DuQuoinStateBankAnnaILandHarrisburgILPropertiesMember2023-12-310001522767mrmd:DuQuoinStateBankAnnaILandHarrisburgILPropertiesMember2022-12-310001522767mrmd:DuQuoinStateBankMetropolisILPropertiesMemberus-gaap:MortgagesMember2021-07-012021-07-310001522767mrmd:MetropolisILFacilityMemberus-gaap:MortgagesMember2021-07-012021-07-310001522767mrmd:DuQuoinStateBankMetropolisILPropertiesMemberus-gaap:MortgagesMember2021-07-310001522767mrmd:MariHoldingsMetropolisLLCMembermrmd:MetropolisILFacilityMember2021-07-012021-07-310001522767mrmd:MariMedIncMembermrmd:MetropolisILFacilityMember2021-07-310001522767mrmd:DuQuoinStateBankMetropolisILPropertiesMember2023-12-310001522767mrmd:DuQuoinStateBankMetropolisILPropertiesMember2022-12-310001522767mrmd:MariHoldingsMtVernonLLCMembermrmd:DuQuoinMountVernonMortgageMemberus-gaap:SecuredDebtMember2022-07-310001522767mrmd:DuQuoinMountVernonMortgageMemberus-gaap:MortgagesMember2022-07-310001522767mrmd:DuQuoinMountVernonMortgageMemberus-gaap:PrimeRateMemberus-gaap:MortgagesMember2022-07-310001522767mrmd:FloorRateMembermrmd:DuQuoinMountVernonMortgageMemberus-gaap:MortgagesMember2022-07-012022-07-310001522767mrmd:SouthPorteBankMortgageMemberus-gaap:MortgagesMember2020-02-012020-02-290001522767mrmd:SouthPorteBankMortgageMemberus-gaap:MortgagesMember2023-05-262023-05-260001522767mrmd:SouthPorteBankMortgageMemberus-gaap:SubsequentEventMemberus-gaap:MortgagesMember2024-01-310001522767mrmd:ThreePointTwoMillionMemberus-gaap:NotesPayableOtherPayablesMember2022-03-310001522767mrmd:ThreePointTwoMillionMemberus-gaap:NotesPayableOtherPayablesMember2022-01-012022-03-310001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-02-212023-02-210001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-02-210001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-11-262023-11-260001522767mrmd:ErmontAcquisitionMembermrmd:PromissoryNotesMember2023-12-310001522767mrmd:GreenhouseNaturalsLLCBeverlyAssetPurchaseMember2022-12-302022-12-300001522767mrmd:GreenhouseNaturalsLLCBeverlyAssetPurchaseMembermrmd:BeverlyNoteMembermrmd:PromissoryNotesMember2022-12-300001522767mrmd:GreenhouseNaturalsLLCBeverlyAssetPurchaseMembermrmd:PromissoryNotesMember2023-12-310001522767mrmd:GreenhouseNaturalsLLCBeverlyAssetPurchaseMembermrmd:PromissoryNotesMember2022-12-310001522767mrmd:KindAcquisitionMembermrmd:KindNotesMembermrmd:PromissoryNotesMember2022-12-310001522767mrmd:KindAcquisitionMembermrmd:KindNotesMembermrmd:PromissoryNotesMember2023-01-242023-01-24mrmd:note0001522767us-gaap:SecuredDebtMembermrmd:ThreeVehicleNotesMember2023-12-310001522767us-gaap:SecuredDebtMembermrmd:ThreeVehicleNotesMember2022-12-310001522767mrmd:SeriesBConvertiblePreferredStockMember2023-01-012023-12-310001522767mrmd:HadronHealthcareMasterFundMembermrmd:SeriesCConvertiblePreferredStockMember2021-03-310001522767mrmd:MixedUnitWithConvertiblePreferredStockAndWarrantMember2021-03-012021-03-310001522767mrmd:MixedUnitWithConvertiblePreferredStockAndWarrantMember2021-03-3100015227672021-03-012021-03-310001522767us-gaap:WarrantMember2021-03-310001522767mrmd:HadronHealthcareMasterFundMembersrt:MaximumMemberus-gaap:CommonStockMember2021-03-310001522767us-gaap:CommonStockMember2021-03-310001522767us-gaap:WarrantMembermrmd:HadronHealthcareMasterFundMember2021-03-310001522767mrmd:SeriesCConvertiblePreferredStockMembersrt:MinimumMember2021-03-012021-03-310001522767mrmd:HadronHealthcareMasterFundMembermrmd:SeriesCConvertiblePreferredStockMember2021-03-012021-03-31mrmd:observer0001522767mrmd:SeriesCConvertiblePreferredStockMember2023-01-012023-12-310001522767us-gaap:CommonStockMember2023-01-012023-12-310001522767us-gaap:CommonStockMember2023-12-3100015227672021-03-310001522767mrmd:AmendedAndRestatedTwoThousandEighteenStockAwardAndIncentivePlanMemberus-gaap:CommonStockMember2023-12-310001522767mrmd:AmendedAndRestatedTwoThousandEighteenStockAwardAndIncentivePlanMember2022-01-012022-12-310001522767srt:MinimumMember2023-01-012023-12-310001522767srt:MaximumMember2023-01-012023-12-310001522767us-gaap:RestrictedStockUnitsRSUMember2022-12-310001522767us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001522767us-gaap:RestrictedStockUnitsRSUMember2023-12-310001522767mrmd:MinorityInterestHolderMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001522767mrmd:MinorityInterestHolderMemberus-gaap:WarrantMember2023-12-310001522767mrmd:MinorityInterestHolderMember2023-12-310001522767us-gaap:RestrictedStockMembermrmd:GreenGrowthGroupIncAndGreenhouseNaturalsLLCMember2023-01-012023-12-310001522767us-gaap:RestrictedStockMembermrmd:GreenGrowthGroupIncAndGreenhouseNaturalsLLCMember2023-12-310001522767us-gaap:RestrictedStockMemberus-gaap:CommonStockMember2023-01-012023-12-310001522767mrmd:MariHoldingsMDLLCMember2023-12-310001522767us-gaap:ShareBasedPaymentArrangementEmployeeMemberus-gaap:CommonStockMember2023-01-012023-12-31mrmd:employee0001522767mrmd:ProductSalesMember2023-01-012023-12-310001522767mrmd:ProductSalesMember2022-01-012022-12-310001522767mrmd:ProductSalesWholesaleMember2023-01-012023-12-310001522767mrmd:ProductSalesWholesaleMember2022-01-012022-12-310001522767mrmd:ProductSalesRetailAndWholesaleMember2023-01-012023-12-310001522767mrmd:ProductSalesRetailAndWholesaleMember2022-01-012022-12-310001522767mrmd:SupplyProcurementMember2023-01-012023-12-310001522767mrmd:SupplyProcurementMember2022-01-012022-12-310001522767us-gaap:ManagementServiceMember2023-01-012023-12-310001522767us-gaap:ManagementServiceMember2022-01-012022-12-310001522767us-gaap:LicenseAndServiceMember2023-01-012023-12-310001522767us-gaap:LicenseAndServiceMember2022-01-012022-12-310001522767mrmd:OtherMember2023-01-012023-12-310001522767mrmd:OtherMember2022-01-012022-12-31mrmd:lease0001522767srt:ChiefOperatingOfficerMember2023-01-012023-12-310001522767srt:ChiefOperatingOfficerMember2022-01-012022-12-310001522767srt:ExecutiveOfficerMembermrmd:BettysEddiesProductsMemberus-gaap:SalesChannelDirectlyToConsumerMember2021-01-012021-01-010001522767srt:ExecutiveOfficerMembermrmd:BettysEddiesProductsMembersrt:MinimumMemberus-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-01-010001522767srt:MaximumMembersrt:ExecutiveOfficerMembermrmd:BettysEddiesProductsMemberus-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-01-010001522767srt:ExecutiveOfficerMemberus-gaap:SalesChannelDirectlyToConsumerMembermrmd:FutureDevelopedProductsMember2021-01-012021-01-010001522767srt:ExecutiveOfficerMembersrt:MinimumMembermrmd:FutureDevelopedProductsMemberus-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-01-010001522767srt:MaximumMembersrt:ExecutiveOfficerMembermrmd:FutureDevelopedProductsMemberus-gaap:SalesChannelThroughIntermediaryMember2021-01-012021-01-010001522767mrmd:RoyaltyAgreementMembermrmd:BettysEddiesProductsMember2023-12-310001522767mrmd:RoyaltyAgreementMembermrmd:BettysEddiesProductsMember2022-12-310001522767mrmd:CEOandCAOMember2023-01-012023-12-310001522767mrmd:CEOandCFOMember2022-01-012022-12-310001522767mrmd:CEOandCFOMember2022-12-310001522767mrmd:FirstStateCompassionCenterMember2023-01-012023-12-310001522767mrmd:FirstStateCompassionCenterMember2022-01-012022-12-310001522767us-gaap:DomesticCountryMember2023-12-310001522767us-gaap:DomesticCountryMember2022-12-310001522767us-gaap:OtherCurrentAssetsMember2023-12-310001522767us-gaap:OtherCurrentAssetsMember2022-12-310001522767mrmd:GenCannaGlobalIncMembermrmd:OwnershipInterestMember2019-12-310001522767mrmd:GenCannaGlobalIncMember2019-12-310001522767mrmd:MariMedHempIncMembermrmd:OGGUSABankruptcyProceedingsMember2022-04-300001522767mrmd:MariMedHempIncMembermrmd:OGGUSABankruptcyProceedingsMember2022-04-012022-04-300001522767us-gaap:RelatedPartyMembermrmd:OGGUSABankruptcyProceedingsMember2023-07-012023-07-3100015227672023-07-012023-09-300001522767mrmd:NonOfficerDirectorShareholderMember2023-09-300001522767mrmd:NonOfficerDirectorShareholderMember2021-01-012023-09-300001522767mrmd:NonOfficerDirectorShareholderMember2023-07-012023-09-300001522767mrmd:MedleafMemberus-gaap:SubsequentEventMember2024-02-012024-02-010001522767mrmd:MedleafMemberus-gaap:SubsequentEventMember2024-02-010001522767us-gaap:CommonStockMemberus-gaap:SubsequentEventMember2024-01-012024-03-0700015227672023-10-012023-12-310001522767mrmd:JonLevineMember2023-01-012023-12-310001522767mrmd:JonLevineMember2023-10-012023-12-310001522767mrmd:TimothyShawMember2023-01-012023-12-310001522767mrmd:TimothyShawMember2023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _________________ to _________________

Commission File number 0-54433

MARIMED INC.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | | 27-4672745 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

10 Oceana Way

Norwood, MA 02062

(Address of Principal Executive Offices)

781-277-0007

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name Of Each Exchange On Which Registered |

| None | | Not Applicable | | Not Applicable |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| | | | | |

o Large Accelerated Filer | x Accelerated Filer |

o Non-Accelerated Filer | x Smaller reporting company |

| x Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. o

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act.): Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the closing price as of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, was $110.4 million.

At March 1, 2024, the issuer had outstanding 375,129,966 shares of Common Stock, par value $0.001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive Proxy Statement for the 2024 Annual Meeting of Stockholders are incorporated herein by reference into Part III of this Annual Report on Form 10-K. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant's fiscal year ended December 31, 2023.

TABLE OF CONTENTS

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING INFORMATION

This Annual Report on Form 10-K includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934 as amended. These statements involve risks and uncertainties, and our actual results could differ significantly from those discussed herein. These include statements about our expectations, beliefs, intentions or strategies for the future, which the Company indicates by words or phrases such as “anticipate,” “expect,” “estimate,” “could,” “should,” “would,” “project,” “predict,” “intend,” “plan,” “will,” “believe,” and similar language, including those set forth in the discussion under “Description of Business,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as those discussed elsewhere in this Annual Report on Form 10-K. The Company bases its forward-looking statements on information currently available to it, and the Company believes that the assumption and expectations reflected in such forward-looking statements are reasonable. The Company assumes no obligation to revise or update any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Statements contained in this Form 10-K that are not historical facts are forward-looking statements that are subject to the “safe harbor” created by the Private Securities Litigation Reform Act of 1995.

Unless expressly indicated or the context requires otherwise, the terms "MariMed", "company", "we", "us", "our", and "Company" in this document refer to MariMed Inc., a Delaware corporation, and, where appropriate, its subsidiaries.

PART I

Item 1. Business

Company Overview

We are a multi-state cannabis operator in the United States, headquartered in Norwood, Massachusetts, dedicated to improving lives every day through our high-quality products, our actions, and our values. We develop, own, and manage seed to sale state-licensed, state-of-the-art, regulatory-compliant facilities for the cultivation, production, and dispensing of medicinal and adult-use cannabis. We have created and continue to develop our own brands of premium cannabis flower, concentrates, edibles, and other precision-dosed products utilizing our proprietary strains and formulations. We also license our proprietary brands, along with other top cannabis products, in domestic markets.

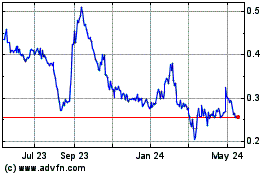

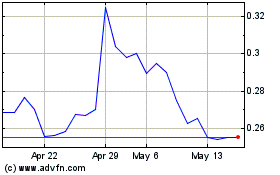

Our common stock trades on both the OTCQX and the Canadian Securities Exchange under the ticker symbol MRMD.

Company History

In 2014, we entered the cannabis industry as an advisory and real estate management firm that procured state-issued cannabis licenses on behalf of our clients, developed cannabis facilities that we leased to these newly licensed companies, and provided industry-leading expertise and oversight in all aspects of their cannabis operations.

In 2018, we made the strategic decision to transition from an advisory business to a direct owner and operator of cannabis licenses in high-growth states. Key to this transition was the acquisition and consolidation of our clients for whom we had played a key role in their success, including securing their cannabis licenses, developing facilities that are models of excellence, funding their operations, and providing operational and corporate guidance. We have successfully acquired and integrated certain client businesses in several states and believe that our prior experience in managing these businesses has provided us with the skills and expertise required to manage the continuing growth of these operations.

Throughout our history, we have created our own brands of craft-quality cannabis flower, concentrates, edibles, and other precision-dosed products, which have been award winners and top sellers in multiple states. Applying proprietary cultivation and processing procedures and following the strictest quality standards, our portfolio of brands was developed to fill gaps in the marketplace and meet specific effects desired by today’s cannabis consumer. We invest in ongoing research and development and intend to continue to introduce new and innovative products in the future.

Today, we operate state-of-the-art, regulatory compliant cannabis cultivation and processing facilities that grow and manufacture our proprietary, high quality, branded cannabis consumer products. We distribute our products via the wholesale market to hundreds of dispensaries operated by other cannabis license holders. We also operate our own dispensaries, which are recognized for their excellent customer service and product selection. Revenue is generated at these dispensaries through the sales of our own products and those marketed by other cannabis license holders.

We utilize dedicated sales teams to sell our products to wholesale buyers representing the dispensaries operated by other cannabis license holders. Customers at our own dispensaries purchase cannabis for, among other reasons, the relief of pain and stress, to promote better sleep, and to address other health and wellness needs. We deploy a variety of marketing strategies to drive the sales of our products, including customer loyalty programs, digital advertising, in-store displays and public relations.

We generate additional revenue from licensing, management fees, and real estate income. This revenue accounted for approximately 3% and 6% of our total revenue in the years ended December 31, 2023 and 2022, respectively. This revenue has declined in recent years as we have acquired and consolidated the client businesses that had previously paid us licensing, management, and facility rental fees.

Our Strategic Growth Plan

We continue to focus on executing our strategic growth plan, with priority on activities that include the following:

•completing the acquisition and consolidation of the client cannabis businesses the Company developed, managed, and advised prior to becoming a seed to sale multi-state operator. There is one remaining client business that MariMed continues to manage and intends to acquire, Delaware operator First State Compassion Center

("FSCC"). Delaware's current cannabis regulations prevent such an acquisition.

•increasing revenue organically in states where we currently do business by developing additional assets and increasing our product distribution within those states;

•expanding our footprint into high-growth legal cannabis states through new license applications and/or acquisitions of existing cannabis businesses; and

•increasing product brand revenue by introducing new, innovative products that consumers want, expanding our award-winning brands to include new effects or to fill additional need-state opportunities, and by identifying qualified licensing partners that will expand our distribution into new markets.

In November 2023 we announced the closing of a $58.7 million secured credit facility with a United States chartered bank at a lower rate relative to both our previous outstanding debt with Chicago Atlantic Admin, LLC (“Chicago Atlantic”) and recent transactions announced by other cannabis companies. This debt refinancing enabled us to pay off our term loan with Chicago Atlantic, pay off the mortgage on our New Bedford and Middleborough, Massachusetts facilities with Bank of New England, and reduce the principal outstanding on the note we issued to the sellers in connection with our acquisition of the operating assets of Ermont, Inc. Our new credit facility has allowed us to unencumber our operating assets in Illinois, Ohio, and Delaware, as well as our branded products, providing additional levers for future loans at attractive rates if we choose to increase our borrowings. Additionally, the credit facility bolsters our ability to continue to execute our strategic plan, particularly as it relates to growing the Company through mergers and acquisitions.

Our Competitive Strengths

We believe that our strengths in the following areas provide us with certain competitive advantages and the tools necessary to successfully implement our strategic plans:

Experienced Management

Our management is one of the most experienced and longest tenured in the cannabis industry. Several of our executive team members, including our President and Chief Executive Officer, our Chief Operating Officer, and our Chief Revenue Officer, have each worked in the industry for a decade or more. Our leadership team has achieved considerable success creating and growing businesses in the industry by successfully applying for cannabis licenses, overseeing the development of cannabis operations and facilities, raising capital to purchase and develop facilities, and conducting operations in adherence with regulations established by individual state governments, including all environmental and social governance requirements. The strength of our executive team is further enhanced by other members who have significant senior management experience and expertise working in the beer and alcohol, retail, consumer products, and marketing industries.

Craft Cannabis at Scale

We own an expansive library of world-class genetics and utilize a hands-on “craft cultivation” approach, blended with the latest technologies, to grow high-quality cannabis flower and create premium infused cannabis products. Every one of our plants is individually cared for by our trained staff and grown in dedicated rooms featuring customized HVAC, lighting, and nutrients that are designed for growing particular flower strains consistently. At a time when price compression in many cannabis markets has become a challenge for licensed operators, our proprietary approach to cultivation, curing, and processing has enabled us to continue to sell our products at higher price points than most wholesale competitors.

Exceptional Retail Customer Service

We believe today’s cannabis consumer seeks a shopping experience that is comfortable, educational, and easy. Our dispensaries are models of excellence in this regard. We carefully curate a menu of the highest quality brands and products, and merchandise them in beautifully designed, upscale environments. We invest in budtender and retail personnel training, as well as product programming displayed on in-store monitors to help deliver exceptional customer service throughout the shopping experience. In Massachusetts and Delaware, we complement our in-store operations with a home delivery option. We intend to do the same in other markets once permitted by state regulations.

Technological and Scientific Innovation

We are diligent in identifying and reviewing the latest science and processes applicable to the cultivation, distillation, production, packaging, securing, and distribution of cannabis and cannabis-infused products. We have obtained the highest quality cannabis strains and genetics to use in both our existing products and our new product development. We utilize proven consumer products goods (“CPG”) research and development methodologies and proprietary processing techniques to create innovative products that fill gaps in the marketplace and ensure consistency from market to market.

Portfolio of Proprietary, Premium Brands

We have developed unique premium brands of precision-dosed cannabis-infused products, which are currently distributed in cannabis-legal states. Our products are available in the most popular consumption formats, including whole flower, pre-rolled flower, vape cartridges, concentrates, and edibles. We intend to continue expanding our brand portfolio to meet the effects that today’s cannabis consumers seek.

Our portfolio includes several award-winning brands that are among the top sellers in markets where they are available. They include:

•Nature’s Heritage™, a premium brand of cannabis flower and concentrates;

•Betty’s Eddies™, cannabis-, supplement-, and nutrient-infused fruit chews that deliver better sleep, pain relief, stress relief, and more. The Betty’s Eddies line also includes a limited collection of cannabis infused ice creams created in partnership with ice cream brand Emack & Bolio’s®;

•Bubby’s Baked™, soft and chewy baked goods and a hot chocolate mix;

•Vibations™, a cannabis-infused hydrating drink mix for discrete, on-the-go consumption;

•Kalm Fusion™ and K Fusion™, chewable cannabis-infused mint tablets; and

•InHouse™, a value-priced brand of flower, vapes, and edibles.

Current and Pending Operations

During the past several years, we have invested in our own operating facilities, applied for and secured new licenses, and acquired new assets to strengthen and expand our brand portfolio and our retail and wholesale networks. We currently hold a total of 23 cannabis licenses in six states. We believe our investment and expansion initiatives will enable us to capture additional market share and provide us with a stronger presence in the states where we conduct business.

We believe that operating as a fully vertical, seed to sale cannabis company provides us the greatest opportunity to maximize revenue and profits in each state where we operate. To date, we are fully vertical through businesses we either own or manage in Illinois, Maryland, Massachusetts, and Delaware.

Our current and pending operations are as follows:

Massachusetts

Massachusetts operates both adult-use and medical cannabis programs. According to the Massachusetts Cannabis Control Commission (the "CCC"), the state’s cannabis market was expected to total nearly $1.8 billion in sales in 2023, a number that is expected to increase to $2.6 billion by 2025 (source: MJ Biz Factbook).

We operate three Panacea Wellness-branded dispensaries in the Boston area:

•a dispensary in Middleborough that is licensed for both medical and adult-use cannabis sales;

•an adult-use dispensary in Beverly that opened in 2023; and

•a medical dispensary in Quincy, for which we have applied to also conduct adult-use cannabis sales.

The Quincy dispensary was the result of the March 2023 acquisition of the operating assets of vertical cannabis operator Ermont, Inc. ("Ermont"). The acquisition and subsequent re-branding of the dispensary substantially completed our expansion to the maximum allowable by state regulations.

Our three retail stores are easily accessible to all cannabis consumers in eastern Massachusetts. We increased access further by introducing home delivery as the result of our April 2023 investment in Artis LLC (d/b/a Little Dog Delivery).

We also operate a 70,000 square foot cultivation and production facility in New Bedford, as well as an approximately 6,700 square foot grow facility in Quincy. We intend to expand the facility in New Bedford to increase our production capacity to meet the high demand for our products. Our Nature’s Heritage flower and concentrates brand, for example, is among the top selling brands in the state, and we regularly sell out of our available inventory.

Illinois

Illinois operates both adult-use and medical cannabis programs. According to the Illinois Department of Financial and Professional Regulation, the state reported $1.9 billion in total legal cannabis sales in 2023. With a population of nearly 13 million, Illinois is one of the largest, fastest-growing cannabis markets in the United States.

We operate five Thrive-branded dispensaries in the state, including an adult-use dispensary in Metropolis, near the Kentucky border, an adult-use dispensary in Casey, near the Indiana border, and an adult-use dispensary in Mt. Vernon. We also operate dispensaries in Anna and Harrisburg that each serve both medical and adult-use customers. These five locations provide easy access for most residents in southern Illinois and surrounding states, including Missouri, Kentucky, Indiana and Tennessee.

In December 2023, we completed construction of and received regulatory approval to commence operations of our processing facility in Mt. Vernon. We expect to receive final approval for cultivation in the Mt. Vernon facility in mid-2024, at which time our Illinois operations will be fully vertical. The facility is housed in a building that we acquired following the 2022 acquisition of a craft cultivation wholesale license. We began selling certain of our award-winning branded edibles products and InHouse vape products in our own dispensaries and in certain other dispensaries in the state during the final weeks of 2023. We expect to significantly increase distribution of our core products throughout the state in 2024, including our Nature’s Heritage flower and concentrates brand.

Maryland

Maryland’s successful medical cannabis program expanded to include adult-use sales on July 1, 2023. According to the Maryland Cannabis Administration, the state reported $787 million in medical and adult-use cannabis sales in 2023, positioning it among the top legal cannabis markets in the United States.

Following our acquisition of our client, Kind Therapeutics USA Inc. (“Kind”) in April 2022, we became fully vertical in Maryland. We operate a 180,000-square foot cultivation and processing facility in Hagerstown which produces and distributes all of our premium branded cannabis flower, concentrates, vapes, and edibles. In 2023 we began an expansion of the facility to increase our cultivation capacity by nearly 17,000 square feet to meet the increased demand for all of our products.

We also operate a Thrive-branded medical and adult-use dispensary in Annapolis, which commenced operations in October 2022.

Delaware

Delaware’s medical cannabis program has approximately 17,000 registered patients, according to the Delaware Department of Health and Social Services 2023 annual report. It became the 22nd state to legalize recreational cannabis in 2023 and adult-use sales are expected to commence in late 2024.

We provide comprehensive management and real estate services to First State Compassion Center (“FSCC”), our longstanding client in Delaware. We were instrumental in helping FSCC obtain Delaware’s first-ever seed to sale medical cannabis license in 2014. Today, FSCC operates under two of only eleven cannabis licenses in the state.

We developed and currently lease to FSCC a number of facilities in the state, including:

•a cultivation facility, production kitchen, and dispensary in Wilmington;

•a cultivation facility in Milford; and

•a dispensary in Lewes.

FSCC licenses and distributes a selection of our top selling edibles brands in the state.

Missouri

Missouri operates a successful medical cannabis program, which expanded to include adult-use sales in February 2023 following a November 2022 ballot referendum. According to the Missouri Department of Health and Senior Services, $1.3 billion worth of legal cannabis was sold in Missouri in 2023.

As the result of a management contract that we announced in September 2022, we expect to distribute our award-winning portfolio of cannabis-infused edibles in Missouri beginning in 2024. We plan to produce our branded products at a recently constructed production kitchen that we will own and operate. We have entered into an agreement to obtain all requisite approvals from the State of Missouri, which we expect to occur in 2024.

Ohio

Ohio operates a successful medical cannabis program. In November 2023, Ohio citizens approved a measure to legalize adult-use cannabis sales, which are anticipated to begin in 2024. BDSA, a leading provider of market intelligence for the cannabis industry, estimates that total cannabis sales in Ohio will reach $802 million in 2025.

We expect that our Thrive-branded medical cannabis dispensary in Tiffin, which we opened in 2023, will achieve expanded sales from the new adult-use program.

Recent Developments

We have had several recent developments since December 31, 2023 that we believe are critical to the implementation of our strategic growth plan:

•On February 26, 2024, we received our Certificate of Occupancy from the Illinois Cannabis Control Commission to commence operations in our permanent brick-and-mortar facility for our Casey, Illinois adult-use dispensary. We anticipate transition from our temporary facility at the same location and commencing operations in the new facility during the first quarter of 2024.

•On February 1, 2024, we entered into an agreement to acquire the medical cannabis retail license and certain assets of Our Community Wellness & Compassionate Care Center, Inc. ("Medleaf") in Prince George's County, Maryland in exchange for $5.25 million, adjusted for certain items. The purchase consideration is comprised of $2.0 million of cash in the aggregate, a $2.0 million note to be issued to the sellers of Medleaf (the "Medleaf Sellers") at the time of closing, and shares of our common stock with a fair value of $1.25 million based on a formulaic calculation, to be issued at the time of closing. As of the date of this report, we have made advance payments to the Medleaf Sellers totaling $0.5 million. Completion of the acquisition is dependent upon certain conditions, including regulatory approval of the acquisition. We expect this acquisition to be completed in 2024; however, there is no assurance that the required regulatory approvals will be obtained.

Competition

In the markets where we currently operate, we compete against other fully vertical multi-state operators (“MSOs”). We believe that our experience in building our business organically from the ground up is a key factor that differentiates us from the majority of other MSOs. We successfully developed and managed our clients' businesses, which we subsequently acquired and consolidated, created our own brands and branded products, and have retained our core management team since inception. While other MSOs have raised significantly more capital, they have generally acquired licensed businesses from sellers with whom they had no prior direct operating relationship. We believe our approach is

significantly more cost-efficient, carries less risks, and results in a more seamless integration of processes, personnel, operating philosophies, and culture.

In addition to MSOs, we face competition from companies of varying sizes and geographic reach. Some, called Single State Operators, are fully vertical in just one state, others focus solely on producing and selling similar products and others solely operate dispensaries and sell the goods of other businesses. Some of our competitors that create and sell their own products have offerings that are on par with those we offer. We believe that by utilizing our own best practices and operational expertise, we are able to produce premium cannabis products at one of the lowest cost structures in the industry, which enables us to remain competitive in our markets. However, our sales could decline significantly if our competitors develop and market products that are more effective, more convenient, or less expensive than our products.

As cannabis products become more mainstream and gain greater acceptance, it is likely that larger and more established companies with greater available resources, including name recognition and national distribution networks, will enter the market. However, we believe that there are many barriers to entry, and to duplicate our licenses, knowledge, and facilities would be costly and time-consuming. We have upgraded our marketing efforts to expand branding and distribution, as well as implemented home delivery, where permissible, and other business strategies developed by more conventional industries. As a result, we have successfully increased both the number of retail transactions and the average amount of sales underlying those transactions. We have also developed a loyal customer base at our retail locations and improved product visibility and sales of our proprietary portfolio of cannabis products.

Intellectual Property

We own registered trademarks for Betty’s Eddies and Nature’s Heritage and are pursuing registration of the Bubby’s Baked, InHouse, K Fusion, Kalm Fusion, and Vibations trademarks with the United States Patent and Trademark Office.

Our proprietary processing and manufacturing techniques and technologies, while not patented, are kept strictly confidential. We enter into and enforce confidentiality agreements with key employees and consultants to protect our intellectual property, trade secrets, and general know-how.

Our Employees

At December 31, 2023, we had a total of 721 employees, of which 643 were full-time, plus an additional 99 employees, primarily full-time, who are employed by our managed cannabis-licensed client.

Website Access to Company Reports

Our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Definitive Proxy Statements, Current Reports on Form 8-K and all amendments to those reports are available free of charge on the Company’s website at www.marimedinc.com as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC, or as filed with the Canadian securities regulatory authorities on the SEDAR website.

In addition, copies of our annual report will be made available, free of charge, on written request.

Item 1A. Risk Factors

Our business faces significant risks and uncertainties. Certain important factors may have a material adverse effect on our business prospects, financial condition and results of operations, and they should be carefully considered. Accordingly, in evaluating our business, and a potential investment in our shares, we encourage you to consider the following discussion of risk factors in its entirety in addition to other information contained in or incorporated by reference into this Annual Report on Form 10-K and our other public filings with the United States Securities and Exchange Commission (“SEC”). Other events that we do not currently anticipate or that we currently deem immaterial may also affect our business, prospects, financial condition and results of operations.

Risks Related to the Industry in Which We Operate

Cannabis remains illegal under United States federal law.

In the United States, cannabis is largely regulated at the state level. Each state in which we operate or that we are currently proposing to operate authorizes, as applicable, medical and/or adult use cannabis production and distribution by licensed or registered entities. More than 40 states have legalized cannabis in some form. However, under United States federal law, the possession, use, cultivation, and transfer of cannabis and any related drug paraphernalia are illegal, and any such acts are criminalized under the Controlled Substances Act, as amended, which we refer to as the “CSA.” Cannabis remains illegal under United States federal law and is considered a Schedule I controlled substance under the CSA. As a result, cannabis is deemed to have a high potential for abuse and is not approved or accepted for medical use.

The concepts of “medical cannabis,” “retail cannabis” and “adult-use cannabis” do not exist under United States federal law. While we believe that our business activities are compliant with applicable state and local laws, strict compliance with state and local cannabis laws would not provide a defense to any federal proceeding that may be brought against us. The enforcement of applicable United States federal laws poses a significant risk to us.

Violations of any United States federal laws and regulations could result in significant fines, penalties, administrative sanctions, or settlements arising from civil proceedings conducted either by the United States federal government or private citizens. We may also be subject to criminal charges under the CSA and, if convicted, could face a variety of penalties including, but not limited to, disgorgement of profits, cessation of business activities, or divestiture. Any of these penalties could have a material adverse effect on our reputation and ability to conduct our business, our holding (directly or indirectly) of medical and adult-use cannabis licenses in the United States; our financial position; operating results; profitability; liquidity; or the market price of our publicly-traded shares. In addition, it is difficult for us to estimate the time or resources that would be needed for the investigation, settlement, or trial of any such proceedings or charges, and such time or resources could be substantial.

The cannabis industry is relatively new.

We are operating in a relatively new industry and in a new market. We not only are subject to general business risks, but we must also build brand awareness in this industry and market share through significant investments in our strategy, production capacity, quality assurance, and compliance with regulations. Research in Canada, the United States and internationally regarding the medical benefits, viability, safety, efficacy, and dosing of cannabis or isolated cannabinoids (such as cannabidiol, or “CBD,” and tetrahydrocannabinol, or “THC”) remains in early stages. Few clinical trials on the benefits of cannabis or isolated cannabinoids have been conducted. Although we believe that the articles, reports and studies support our beliefs regarding the medical benefits, viability, safety, efficacy, and dosing of cannabis, future research and clinical trials may result in opposing conclusions to statements contained in articles, reports, and studies currently favored or could reach different or negative conclusions regarding the medical benefits, viability, safety, efficacy, dosing, or other facts and perceptions related medical cannabis, which could adversely affect social acceptance of cannabis and/or the demand for our products and dispensary services.

Accordingly, there is no assurance that the cannabis industry and the market for medicinal and/or adult-use cannabis will continue to exist and grow as currently anticipated or function and evolve in a manner consistent with our expectations and assumptions. Any event or circumstance that adversely affects the cannabis industry, such as the imposition of further restrictions on sales and marketing or further restrictions on sales in certain areas and markets, could have a material adverse effect on our business, financial condition, and results of operations.

We operate in a highly regulated sector and may not always succeed in complying fully with applicable regulatory requirements in all jurisdictions where we carry on business.

Our business and activities are heavily regulated in all jurisdictions where we conduct business. Our operations are subject to various laws, regulations and guidelines by state and local governmental authorities relating to the manufacture, marketing, management, transportation, storage, sale, pricing and disposal of cannabis and cannabis oil, and also including laws and regulations relating to health and safety, insurance coverage, the conduct of operations and the protection of the environment. Laws and regulations, applied generally, grant government agencies and self-regulatory bodies broad administrative discretion over our activities, including the power to limit or restrict business activities as well as impose additional disclosure requirements on our products and services. Achievement of our business objectives is contingent, in part, upon compliance with regulatory requirements enacted by these governmental authorities and obtaining all necessary

regulatory approvals for the manufacture, production, storage, transportation, sale, import and export, as applicable, of our products. The commercial cannabis industry is still a new industry at the state and local level. The effect of relevant governmental authorities’ administration, application and enforcement of their respective regulatory regimes and delays in obtaining, or failure to obtain, applicable regulatory approvals which may be required may significantly delay or impact the development of markets, products and sales initiatives and could have a material adverse effect on our business, prospects, revenue, results of operation and financial condition. Any failure to comply with the regulatory requirements applicable to our operations may lead to possible sanctions including the revocation or imposition of additional conditions on licenses to operate our business; the suspension or expulsion from a particular market or jurisdiction or of our key personnel; the imposition of additional or more stringent inspection, testing and reporting requirements; and the imposition of fines and censures. In addition, changes in regulations, more vigorous enforcement thereof or other unanticipated events could require extensive changes to our operations, increase compliance costs or give rise to material liabilities and/or revocation of our licenses and other permits, which could have a material adverse effect on our business, results of operations and financial condition. Furthermore, governmental authorities may change their administration, application or enforcement procedures at any time, which may adversely impact our ongoing costs relating to regulatory compliance. Maintaining compliance with complex and ever-changing regulations, including sometimes unclear regulations and laws, can be a difficult task, and a materially compliant business can be found in violation of one or more laws, rules or regulations while remaining materially or substantially compliant with applicable state cannabis laws.

The re-classification of cannabis or changes in United States controlled substance laws and regulations could have a material adverse effect on our business, financial condition, and results of operations.

If cannabis is re-classified as a Schedule II or lower controlled substance under the CSA, the ability to conduct research on the medical benefits of cannabis would most likely be more accessible. However, if cannabis is re-categorized as a Schedule II or lower controlled substance, the resulting re-classification would result in the need for approval by the United States Food and Drug Administration, or “FDA,” if medical claims are made about our medical cannabis products. Moreover, any such reclassification could result in a significant degree of regulation relating to the manufacture, importation, exportation, domestic distribution, storage, sale, and use of such products by the United States Drug Enforcement Administration, or the “DEA.” If so, we may be required to be registered to perform these activities and have the security, control, recordkeeping, reporting, and inventory mechanisms required by the DEA to prevent drug loss and diversion. Obtaining the necessary registrations may result in the delay in the manufacturing or distribution of our products. The DEA conducts periodic inspections of registered establishments that handle controlled substances. Failure to maintain compliance could have a material adverse effect on our business, financial condition, and results of operations. The DEA may seek civil penalties, refuse to renew necessary registrations, or initiate proceedings to restrict, suspend, or revoke those registrations. In certain circumstances, violations could lead to criminal proceedings.

Potential regulation by the FDA could have a material adverse effect on our business, financial condition, and results of operations.

If the United States federal government legalizes cannabis, it is possible that the FDA would seek to regulate it under the Food, Drug and Cosmetics Act of 1938. Moreover, the FDA may issue rules and regulations, including good manufacturing practices related to the growth, cultivation, harvesting, and processing of medical cannabis. Clinical trials may be needed to verify efficacy and safety of our medical cannabis products. It is also possible that the FDA would require that facilities where medical-use cannabis is grown register with the agency and comply with certain federally prescribed regulations. In the event that some or all of these regulations are imposed, the impact on the cannabis industry is uncertain and could include the imposition of new costs, requirements, and prohibitions. If we are unable to comply with the regulations and/or registration as required by the FDA, it may have an adverse effect on our business, operating results, and financial condition.

As a cannabis business, we are subject to certain tax provisions that have a material adverse effect on our business, financial condition, and results of operations.

Under Section 280E of the United States Internal Revenue Code of 1986, or the “IRC,” “no deduction or credit shall be allowed for any amount paid or incurred during the taxable year in carrying on any trade or business if such trade or business (or the activities that comprise such trade or business) consists of trafficking in controlled substances within the meaning of Schedule I and II of the Controlled Substances Act, which is prohibited by federal law or the law of any state in which such trade or business is conducted,” This provision has been applied by the United States Internal Revenue Service, or the “IRS,” to cannabis operations, prohibiting them from deducting expenses directly associated with cannabis businesses. Section 280E may have a lesser impact on cannabis cultivation and manufacturing operations than on sales

operations. Section 280E and related IRS enforcement activity has had a significant impact on the operations of cannabis companies. Accordingly, an otherwise profitable business may, in fact, operate at a loss, after taking into account its United States income tax expenses.

As a cannabis business, we may lack access to United States bankruptcy protections.

Many courts have denied cannabis businesses bankruptcy protections because the use of cannabis is illegal under federal law. In the event of a bankruptcy, it would be very difficult for lenders to recoup their investments in the cannabis industry. If the Company were to experience a bankruptcy, there is no guarantee that United States federal bankruptcy protections would be available to us, which would have a material adverse effect on us.

Cannabis businesses may be subject to civil asset forfeiture.

Any property owned by participants in the cannabis industry used in the course of conducting such business, or that is the proceeds of such business, could be subject to seizure by law enforcement and subsequent civil asset forfeiture because of the illegality of the cannabis industry under federal law. Even if the owner of the property is never charged with a crime, the property in question could still be seized and subject to an administrative proceeding by which, with minimal due process, it could be subject to forfeiture.

Risks Related to Our Current Operations and Our Expansion Plan

Our future growth is dependent on additional states legalizing cannabis.

Continued development of the cannabis market and our opportunities to expand into new markets is dependent upon continued legislative authorization of cannabis at the state and local level for medical and adult recreational use of cannabis. Any number of factors could slow or halt the growth of the cannabis market. Additionally, progress, while encouraging, is not assured and the process to authorize the sale of cannabis at the state and local levels normally encounters set-backs before achieving success, if at all. While there may be ample public support for legislative proposal to legalize the sale of cannabis on a state level, key support must be created in the legislative process. Any one of these factors could slow or halt the progress and adoption of cannabis for medical and/or recreational purposes, which would limit the market for our products and negatively impact our ability to expand into new markets.

Our consolidation plan and growth strategy are subject to regulatory hurdles.

Our strategy to expand our footprint into additional legal cannabis states through new applications and acquisitions of existing cannabis businesses is subject, in each respective jurisdiction, to the approval of a new license application or license transfer application. Such approvals are subject to numerous delays and uncertainties based upon administrative and legislative changes in what are typically, in light of the recent cannabis legalization status in most jurisdictions, new and untested rules and regulations. There is little interpretative guidance on how states will apply their respective licensing regulations and limited control over when an application will be acted upon. As a result, there is no assurance that our expansion plan will not be frustrated by regulatory delays, and no assurance that any license application or transfer application will be approved.

We face increasing competition that may materially and adversely affect our business, financial condition and results of operations.

We face competition from companies that may have greater capitalization, access to public equity markets, more experienced management or more maturity as a business. The vast majority of both manufacturing and retail competitors in the cannabis market consists of localized businesses (those doing business in a single state) as well as multistate operators, with which we compete directly. Aside from this direct competition, out-of-state operators that are capitalized well enough to enter markets through acquisitions are also part of the competitive landscape. As we plan to grow our business, operators in future state markets will inevitably become direct competitors. We are likely to continue to face increasing and intense competition from these companies. Moreover, acquisitions and other consolidating transactions could harm us in a number of ways, including losing customers, revenue and market share, or forcing us to expend greater resources to meet new or additional competitive threats all of which could harm our operating results. Increased competition by larger and better financed competitors could materially and adversely impact our business, financial condition and results of operations. Such competition could also intensify and place downward pressure on retail prices of our products and services, which could negatively impact our profitability.

If the number of users of adult-use and medical marijuana in the United States increases, the demand for products will increase. As a result, we believe that competition could become more intense as current and future competitors begin to offer an increasing number of diversified products to respond to such increased demand. To remain competitive, we will need to continue to invest in research and development, marketing, sales, and client support. We may not have sufficient resources to maintain sufficient levels of investment in these areas to remain competitive, which could materially and adversely affect our business, financial condition, and results of operations.

We are subject to limits on our ability to own the licenses necessary to operate our business, which could adversely affect our ability to grow our business and market share in certain states.

In certain states, the cannabis laws and regulations limit both the number of cannabis licenses issued as well as the number of cannabis licenses that one person or entity may own in that state. Such limitations on the acquisition of ownership of additional licenses within certain states may limit our ability to grow organically or to increase market share in such states.

We may not be able to obtain or maintain necessary permits and authorizations.

We may not be able to maintain the necessary licenses, permits, certificates, authorizations, or accreditations to operate our businesses, or may only be able to do so at great cost. Additionally, we may not be able to comply fully with the wide variety of laws and regulations applicable to the cannabis industry. Failure to comply with or to obtain the necessary licenses, permits, certificates, authorizations, or accreditations could result in restrictions on our ability to operate in the cannabis industry, which could have a material adverse effect on our business, financial condition or results of operations.

We may have difficulty accessing the service of banks, which may make it difficult for us to operate in certain markets.

As discussed above, the use of cannabis is illegal under United States federal law. Therefore, there are banks that will not accept for deposit funds from the sale of cannabis and may choose not to do business with the us. While there is pending legislation in the United States Senate that will allow banks to transact business with state-authorized medical cannabis businesses, there can be no assurance his legislation will be successful, that banks will decide to do business with medical cannabis retailers, or that in the absence of legislation state and federal banking regulators will not create issues on banks handling funds generated from an activity that is illegal under federal law. Notwithstanding, we have been able to secure state-chartered banks that are in compliance with federal law and provide certain banking services to companies in the cannabis industry. Our inability to open accounts in our target market and otherwise use the service of banks may make it difficult for us to operate in those markets.

We may be subject to constraints on and differences in marketing our products under varying state laws.

Certain of the states in which we operate have enacted strict regulations regarding marketing and sales activities on cannabis products. There may be restrictions on sales and marketing activities imposed by government regulatory bodies that could hinder the development of our business and operating results. Restrictions may include regulations that specify what, where and to whom product information and descriptions may appear and/or be advertised. Marketing, advertising, packaging, and labeling regulations also vary from state to state, potentially limiting the consistency and scale of consumer branding communication and product education efforts. The regulatory environment in the United States limits our ability to compete for market share in a manner similar to other industries. If we are unable to effectively market our products and compete for market share, or if the costs of compliance with government legislation and regulation cannot be absorbed through increased pricing of our products, our sales and operating results could be adversely affected.

We face risks relating to our products.

We are committed and expect to continue to commit significant resources and capital to develop and market existing products and new products. These products are relatively untested in the marketplace, and we cannot assure stockholders and investors that we will achieve market acceptance for these products, or other new products that we may offer in the future will gain acceptance. These existing and new products may be subject to significant competition with offerings by new and existing competitors in the industry. The failure to successfully develop, manage, and market new products could seriously harm our business, prospects, revenue, results of operation and financial condition.

Our insurance coverage may be inadequate to cover all significant risk exposures.

We are exposed to liabilities that are unique to the products and services we provide. While we intend to maintain insurance for certain risks, the amount of our insurance coverage may not be adequate to cover all claims or liabilities, and we may be forced to bear substantial costs resulting from risks and uncertainties in our business. It is also not possible to obtain insurance to protect against all operational risks and liabilities. Due to the nature of our business, we may have difficulty obtaining insurance because, compared to non-cannabis industries, (i) there are only a limited number of insurers willing to insure companies involved in the cannabis industry, (ii) there are fewer insurance products available to companies involved in the cannabis industry, (iii) insurance coverage generally is more expensive for companies involved in the cannabis industry, and (iv) available insurers, insurance products, and cost of coverage fluctuates frequently. Failure to obtain adequate insurance coverage on terms favorable to us, or at all, could have a material adverse effect on our prospects, business, financial condition and results of operations. We do not maintain business interruption insurance for most of our properties and operations. Any business disruption or natural disaster could result in substantial costs and diversion of resources.

It may be difficult to evaluate us based on our past performance because we are transitioning our business into that of an owner of cannabis licenses and an operator of cannabis operations.

We have been actively engaged in the cannabis industry as an MSO for a relatively short period of time and, accordingly, have only limited financial results on which it can be evaluated. In addition, the components of our revenue and costs are changing as we continue to move away from a fee-based-only business to a multi-state seed to sale operation. We are subject to, and must be successful in addressing, the risks typically encountered by companies operating in the rapidly evolving cannabis marketplace, including those risks relating to:

•the failure to develop brand name recognition and reputation;

•the failure to achieve market acceptance of our products;

•a slowdown in general consumer acceptance of legalized cannabis; and

•an inability to grow and adapt our business to evolving consumer demand.

Our medical marijuana business may be impacted by consumer perception of the cannabis industry, which we cannot control or predict.