Miami, FL -- December

19, 2017 -- InvestorsHub NewsWire -- EmergingGrowth.com, a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies, reports on The Movie Studio, Inc. (OTC

Pink: MVES).

MVES may

not be at these levels much longer.

See the Press Release and more on The Movie Studio, Inc. (OTC

Pink: MVES) at EmergingGrowth.com

http://emerginggrowth.com/?s=mves

The Movie Studio, Inc.

(OTC

Pink: MVES) is positioned to be a great acquisition target for

streaming providers that continue to invest billions of dollars in

original content. Netflix, Inc. (NASDAQ: NFLX)’s content

chief, Ted Sarandos, told Variety in an interview in August

that the company “will spend $7 billion to $8 billion on content in

2018.” After successfully launching “Exposure” and “Bad Actress” on

Amazon Prime, The Movie Studio, Inc. (OTC

Pink: MVES) has a proof of concept and launch pad for further

original content distribution.

According to analysts

at Statista, the global video streaming market is

forecast to see revenues grow from $12.57 billion in 2017 to $18.65

billion by 2022, representing a compound annual growth rate (CAGR)

of 8.30%.

Through the acquisition of

Emerging Pictures, The Movie Studio, Inc. (OTC

Pink: MVES) gained a network of 130 theaters and is working to

secure licensing rights to distribute “up to” 1,800 movies in the

catalog. This is a major step for the company, in what appears to

be a potential parallel to Helios & Matherson’s (NASDAQ: HMNY)

MoviePass, however The Movie Studio has access to legacy content,

library content or new content “Owned” by The Movie Studio,

Inc.

Helios and Matheson

Analytics, Inc. (NASDAQ: HMNY): The company, which also owns and operates

the popular MoviePass app, utilizes a subscription-based model

that allows consumers to see one movie per 24 hours. The technology

is available in 91% of the almost 40,000 theaters across the United

States.

MoviePass is a relatively

similar concept to The Movie Studio, Inc.’s (OTC

Pink: MVES) recent acquisition, Emerging Pictures and its

ability to deliver commercial-grade video on demand services. The

Movie Studio, Inc. (OTC

Pink: MVES) now has a network of over 130 theaters in the US,

with the rights to distribute over 1,800 movies. As of December

2017, Helios and Matheson Analytics,

Inc. (NASDAQ:

HMNY) has a market cap of $113.6 million and a share structure

consisting of 12.44 million shares outstanding and a float of 5.02

million shares. During the third quarter 2017, the company reported

total revenue of $1.17 million and a net loss of $43.46

million.

Overall, The

Movie Studio, Inc. (OTC

Pink: MVES) is well positioned to be acquired by one of the

larger streaming entertainment companies, as they bolster their

budgets in an effort to compete for top original

content.

RLJ

Entertainment, Inc. (NASDAQ:

RLJE): The

diversified digital content channel company is engaged within the

acquisition, development, production, and distribution of digital

content and TV programming. The company operates three main

subsidiaries: Proprietary Subscription-Based Digital Channels,

Intellectual Property Licensing, and Wholesale Distribution. RLJ

Entertainment, Inc. provides original and third party licensed

programming to its content channels: Acorn, RLJE Films, Urban Movie

Channel, Acacia, and Athena. As of December

2017, RLJ Entertainment,

Inc. has a

market cap of $53.46 million and a share structure consisting of

14.07 million shares outstanding and a float consisting of 3.43

million shares. During the third quarter, the company reported

total revenue of $20.9 million and a net loss of $2.72

million.

Lions Gate

Entertainment Corp. (NYSE: LGF): The company operates within the production

and distribution of motion pictures, TV programming, home

entertainment, and more. Lions Gate Entertainment Corp. operates

three main segments: Motion Pictures, Television Production, and

Media Networks. Furthermore, the company has become a household

name after successful producing “The Hunger Games” series, “La La

Land,” “The Expendables,” and the “John Wick”

series. Lions Gate Entertainment

Corp. has a

market cap of $6.39 billion and maintains a share structure

consisting of 81.27 million shares outstanding and a float of 67.50

million shares, as of December 2017. During the third quarter 2017,

the company reported total revenue of $940 million and net income

of $15.5 million.

Twenty-First Century Fox, Inc. (NASDAQ:

FOXA): The

film and television production giant is responsible for some of the

greatest movies of last decades: “Star Wars,” “Independence Day,”

“Avatar,” “Home Alone,” “Planet of the Apes” series, and countless

others. The company’s television unit also produces some of the

most well known shows on TV: “Empire,” “This Is Us,” “Modern

Family,” “American Horror Story,” and many

more. Twenty-First Century Fox,

Inc. has a

market cap of $61.53 billion and maintains a share structure

consisting of 2.32 billion shares outstanding and a float of 1.04

billion shares, as of December 2017. During the third quarter 2017,

Twenty-First Century Fox, Inc. reported total revenue of $7 billion

and net income of $855 million.

The

Walt Disney Company (NYSE:

DIS): The diversified entertainment company

operates three main business segments: Media Networks, Parks and

Resorts, and Studio Entertainment. Within its Media Network

business, The Walt Disney Company operates cable networks, such as

ABC, ESPN, Disney Channel, Freeform, and various radio broadcasting

outlets. The company’s Studio Entertainment business produces and

acquires animated and traditional motion pictures through its

well-known subsidiaries: Walt Disney Pictures, Marvel, Lucasfilm,

Pixar, and Touchstone. As of December 2017, The Walt Disney

Company has a

market cap of $157.98 billion and maintains a share structure

consisting of 1.51 billion shares outstanding and a float of 1.44

billion shares.

The company

has produced numerous original films and content, which has been

distributed all over the world. and is now breaking into the upper

echelons after the successful release of “Exposure” and “Bad

Actress” on Amazon Prime Video.

The recent

rise of MoviePass proves that The Movie Studio, Inc. (OTC

Pink: MVES) has the ability to succeed, by comparison of their

technologies within the motion picture and theater industry. After

acquiring Emerging Pictures, The Movies Studio, Inc. (OTC

Pink: MVES) now has a network of 130 theaters and the rights to

distribute 1,800 movies, procuring management’s vision to be a

major player in the commercial-grade video on demand business,

while on track to be a major benefactor from the growing streaming

video industry.

MVES may

not be at these levels much longer.

See the Press Release and more on The Movie Studio, Inc. (OTC

Pink: MVES) at EmergingGrowth.com

http://emerginggrowth.com/?s=mves

Other Companies in the news and featured on

EmergingGrowth.com

Elev8 Brands,

Inc.

Shares of Elev8 Brands, Inc.

(OTC

Pink: VATE) spiked yesterday, up 100% before giving back half

the gain at the close. Candlesticks are indicating a down

turn, however this spike occurred on no new information in the

market, since the company’s press release of December

12th touting a new local roster.

The Movie Studio, Inc. (OTC

Pink: MVES)

Viva Entertainment Group, Inc.

Viva Entertainment Group, Inc. (OTC

Pink: OTTV) just yesterday announced a deal with Luis

Guzman. Shares dipped 5% on the news, continuing the downward

spiral since it traded at .009 earlier in the

quarter.

PDX Partners, Inc.

Portland’s own PDX Partners, Inc. (OTC

Pink: PDXP) just announced the CEO has returned 200,000,000

shares of his common stock to the company’s treasury.

Although the PR does not mention the current outstanding number,

OTC Markets has it at 279,576,750, of which, 278,576,747 is in the

public float. There is plenty of preferred stock though.

The Movie Studio, Inc. (OTC

Pink: MVES)

About

EmergingGrowth.com

EmergingGrowth.com is a leading

independent small cap media portal with an extensive history of

providing unparalleled content for the Emerging Growth markets and

companies. Through its evolution, EmergingGrowth.com found a niche in

identifying companies that can be overlooked by the markets due to,

among other reasons, trading price or market capitalization.

We look for strong management, innovation, strategy, execution, and

the overall potential for long- term growth. Aside from being

a trusted resource for the Emerging Growth info-seekers, we are

well known for discovering undervalued companies and bringing them

to the attention of the investment community. Through our

parent Company, we also have the ability to facilitate road shows

to present your products and services to the most influential

investment banks in the space.

Disclosure:

All information contained

herein as well as on the EmergingGrowth.com website is

obtained from sources believed to be reliable but not guaranteed to

be accurate or all-inclusive. All material is for informational

purposes only, is only the opinion of EmergingGrowth.com and should not

be construed as an offer or solicitation to buy or sell securities.

The information may include certain forward-looking statements,

which may be affected by unforeseen circumstances and / or certain

risks. This report is not without bias. EmergingGrowth.com has motivation

by means of either self-marketing or EmergingGrowth.com has been

compensated by or for a company or companies discussed in this

article. Full details about which can be found in our full

disclosure, which can be found here, http://emerginggrowth.com/726886837-2/.

Please consult an investment professional before investing in

anything viewed within. When EmergingGrowth.com is long shares

it will sell those shares. In addition, please make sure you read

and understand the Terms of Use, Privacy Policy and the Disclosure

posted on the EmergingGrowth.com

website.

CONTACT:

Company: EmergingGrowth.com - http://www.EmergingGrowth.com

Contact

Email: info@EmergingGrowth.com

SOURCE: EmergingGrowth.com

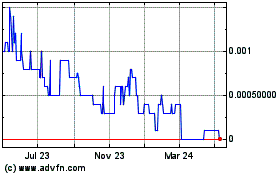

Viva Entertainment (CE) (USOTC:OTTV)

Historical Stock Chart

From Oct 2024 to Nov 2024

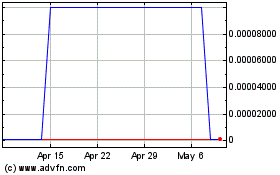

Viva Entertainment (CE) (USOTC:OTTV)

Historical Stock Chart

From Nov 2023 to Nov 2024