SSE Raises Fiscal Year 2023 Adjusted EPS Guidance Again

March 30 2023 - 1:49AM

Dow Jones News

By Elena Vardon

SSE PLC on Thursday raised its adjusted earnings per share

expectations to more than 160 pence ($1.97) in fiscal 2023, up from

the updated 150 pence guidance and backed some of the other targets

it issued in January.

The FTSE 100 energy company said the performance of its flexible

generation plant to support the security of supply has more than

offset lower-than-planned renewables output and associated hedge

buy-back costs, leading to the EPS guidance hike.

The group reiterated it is on track to post capital expenditure

of over GBP2.5 billion in the fiscal year. It said its adjusted net

debt and hybrid capital are expected to be below GBP9 billion at

March 31, adding around 8% of available liquidity had been used as

cash collateral for forward commodity contracts at March 23.

It also backed its full-year dividend of 85.7 pence a share,

plus retail price index, and that the payout would be rebased to 60

pence in fiscal 2024 to support investment and growth plans, and

then increased by at least 5% a year.

"This strong performance leaves us well positioned to continue

our significant investment program and we will update the market

with more detail in May," said Finance Director Gregor

Alexander.

Write to Elena Vardon at elena.vardon@wsj.com

(END) Dow Jones Newswires

March 30, 2023 02:34 ET (06:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

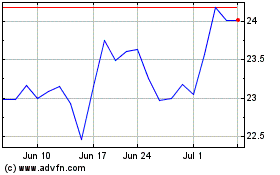

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Nov 2024 to Dec 2024

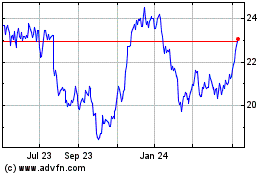

SSE (PK) (USOTC:SSEZY)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about SSE PLC (PK) (OTCMarkets): 0 recent articles

More SSE PLC (PK) News Articles