Report of Foreign Issuer (6-k)

May 07 2019 - 5:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE

13a-16

OR

15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

FOR THE MONTH OF MAY 2019

TIM S.p.A.

(Translation of registrant’s name into English)

Via Gaetano Negri 1

20123 Milan, Italy

(Address of principal executive offices)

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

FORM

20-F ☒ FORM

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the

Form

6-K

in paper as permitted by Regulation

S-T

Rule 101(b)(7): ☐

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule

12g3-2(b)

under the Securities Exchange Act of 1934.

YES ☐ NO ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b):

82-

Press Release

TIM:

Giovanni Ronca joins the Top Management of the Company.

As of 17 June 2019, he will be appointed new Chief Financial Officer

Turin, 6 May 2019

TIM announces that as of 7 May

2019 Giovanni Ronca joins the Group reporting directly to the Chief Executive Officer Luigi Gubitosi, to become, as of 17 June 2019, the new Chief Financial Officer in lieu of Piergiorgio Peluso.

Piergiorgio Peluso, as of 17 June, will report directly to the Chief Executive Officer managing the Group’s strategic projects and extraordinary

operations.

Giovanni Ronca was

co-Head

of UniCredit commercial bank network in Italy and member of the executive

committee of the bank until 31 March 2019. From 2014 to 2016 Ronca was based in New York as Head of UniCredit activities for North and South America. Previously he was Managing Director of the Corporate & Investment Banking Italy

Network and Head of the Corporate Banking for the region.

Ronca started his career in 1996 at Exor as financial analyst and subsequently moved to Fiat

Group where he held different positions in the financial department of the Group, both in Italy and the United States. From 2004 to 2007 he was member of the team led by the CEO Sergio Marchionne, that relaunched the Fiat Group.

Giovanni Ronca is graduated in Economics at the University of Turin.

Giovanni Ronca doesn’t own Telecom Italia shares.

The CV

is attached.

TIM Press Office

+39 06 3688 2610

www.telecomitalia.com/media

Twitter: @TIMnewsroom

TIM Investor Relations

+39 06 3688 2807

www.telecomitalia.com/investor_relations

Until March 31st, 2019 Giovanni Ronca has been

co-head

of UniCredit

commercial banking network in Italy and member of the group executive committee. From 2014 to 2016 he was responsible for UniCredit activities in North and South America, based in New York. Previously, still in UniCredit, he was responsible for the

Corporate & Investment Banking network in Italy and Corporate Banking regional manager.

He started his career in 1996 at Exor as financial

analyst, moving then to the Fiat group where he covered different positions in finance both in Italy and the United States. From 2004 to 2007 he was part of the team led by the Sergio Marchionne that

re-launched

the Fiat group.

He has a bachelor degree in economics at the University of Turin.

Cautionary Statement for Purposes of the “Safe Harbor” Provisions of the United States Private

Securities Litigation Reform Act of 1995.

The Private Securities Litigation Reform Act of 1995 provides a “safe harbor” for forward-looking

statements. The Group’s financial report for the twelve months ended December 31, 2018 included in this Form

6-K

contains certain forward-looking statements. Forward-looking statements are statements

that are not historical facts and can be identified by the use of forward-looking terminology such as “believes,” “may,” “is expected to,” “will,” “will continue,” “should,”

“seeks” or “anticipates” or similar expressions or the negative thereof or other comparable terminology, or by the forward- looking nature of discussions of strategy, plans or intentions.

Actual results may differ materially from those projected or implied in the forward-looking statements. Such forward-looking information is based on certain

key assumptions which we believe to be reasonable but forward-looking information by its nature involves risks and uncertainties, which are outside our control, that could significantly affect expected results.

The following important factors could cause our actual results to differ materially from those projected or implied in any forward-looking statements:

|

|

1.

|

our ability to successfully implement our strategy over the 2019-2021 period;

|

|

|

2.

|

the continuing effects of the global economic crisis in the principal markets in which we operate, including,

in particular, our core Italian market;

|

|

|

3.

|

the impact of regulatory decisions and changes in the regulatory environment in Italy and other countries in

which we operate;

|

|

|

4.

|

the impact of political developments in Italy and other countries in which we operate;

|

|

|

5.

|

our ability to successfully meet competition on both price and innovation capabilities of new products and

services;

|

|

|

6.

|

our ability to develop and introduce new technologies which are attractive in our principal markets, to manage

innovation, to supply value added services and to increase the use of our fixed and mobile networks;

|

|

|

7.

|

our ability to successfully implement our internet and broadband strategy;

|

|

|

8.

|

our ability to successfully achieve our debt reduction and other targets;

|

|

|

9.

|

the impact of fluctuations in currency exchange and interest rates and the performance of the equity markets in

general;

|

|

|

10.

|

the outcome of litigation, disputes and investigations in which we are involved or may become involved;

|

|

|

11.

|

our ability to build up our business in adjacent markets and in international markets (particularly in Brazil),

due to our specialist and technical resources;

|

|

|

12.

|

our ability to achieve the expected return on the investments and capital expenditures we have made and

continue to make in Brazil;

|

|

|

13.

|

the amount and timing of any future impairment charges for our authorizations, goodwill or other assets;

|

|

|

14.

|

our ability to manage and reduce costs;

|

|

|

15.

|

any difficulties which we may encounter in our supply and procurement processes, including as a result of the

insolvency or financial weaknesses of our suppliers; and

|

|

|

16.

|

the costs we may incur due to unexpected events, in particular where our insurance is not sufficient to cover

such costs.

|

The foregoing factors should not be construed as exhaustive. Due to such uncertainties and risks, readers are cautioned not

to place undue reliance on such forward-looking statements, which speak only as of the date hereof. We undertake no obligation to release publicly the result of any revisions to these forward-looking statements which may be made to reflect events or

circumstances after the date hereof, including, without limitation, changes in our business or acquisition strategy or planned capital expenditures, or to reflect the occurrence of unanticipated events.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: May 7, 2019

|

|

|

|

|

|

|

TIM S.p.A.

|

|

|

|

|

BY:

|

|

/s/ Umberto Pandolfi

|

|

|

|

Umberto Pandolfi

|

|

|

|

Company Manager

|

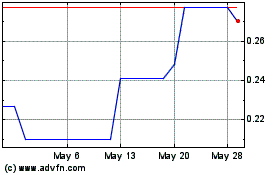

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Nov 2024 to Dec 2024

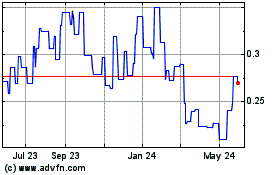

Telcom Italia (PK) (USOTC:TIAOF)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Telcom Italia SPA New (PK) (OTCMarkets): 0 recent articles

More Tim S.p.a. News Articles