UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended September 30,

2012

or

|

o

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number:

333-178437

West Texas Resources, Inc.

(Name of registrant as specified in its

charter)

|

Nevada

|

|

|

|

99-0365272

|

(State or Other Jurisdiction of

Incorporation)

|

|

|

|

(I.R.S. Employer Identification

Number)

|

5729 Lebanon Road, Suite 144

Frisco, Texas 75034

(Address of principal executive offices)

(972) 712-1039

(Registrant’s

telephone number, including area code)

Securities to be registered under Section 12(b) of

the Act:

None

Securities to be registered under Section 12(g) of

the Act:

None

Indicate by check mark if the registrant

is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes

o

No

x

Indicate by check mark if the registrant

is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes

o

No

x

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during

the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject

to such filing requirements for the past 90 days. Yes

x

No

o

Indicate by check mark whether the registrant

has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted

and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or

for such shorter period that the registrant was required to submit and post such files). Yes

x

No

o

Indicate by check mark if disclosure of

delinquent filers in response to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of

the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this

Form 10-K or any amendment to this Form 10-K.

o

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company (as defined in Rule 12b-2

of the Act):

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

|

|

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

x

|

|

(Do not check if a smaller reporting company)

|

|

|

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act)

Yes

o

No

x

State the aggregate market value of voting

and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold,

or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed

second fiscal quarter: $-0-

The number of shares of the registrant’s

common stock outstanding as of January 11, 2013 was 13,256,500.

TABLE OF CONTENTS

|

|

|

|

|

Page

|

|

|

|

PART I

|

|

|

|

Item 1.

|

|

Business

|

|

1

|

|

Item 1A.

|

|

Risk Factors

|

|

7

|

|

Item 1B.

|

|

Unresolved Staff Comments

|

|

13

|

|

Item 2.

|

|

Properties

|

|

13

|

|

Item 3.

|

|

Legal Proceedings

|

|

14

|

|

Item 4.

|

|

Mine Safety Disclosures

|

|

14

|

|

|

|

|

|

|

|

|

|

PART II

|

|

|

|

Item 5.

|

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Repurchases of Equity Securities

|

|

15

|

|

Item 6.

|

|

Selected Financial Data

|

|

15

|

|

Item 7.

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

16

|

|

Item 7A.

|

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

17

|

|

Item 8.

|

|

Financial Statements and Supplementary Data

|

|

18

|

|

Item 9.

|

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

|

19

|

|

Item 9A.

|

|

Controls and Procedures

|

|

19

|

|

Item 9B.

|

|

Other Information

|

|

19

|

|

|

|

|

|

|

|

|

|

PART III

|

|

|

|

Item 10.

|

|

Directors, Executive Officers and Corporate Governance

|

|

20

|

|

Item 11.

|

|

Executive Compensation

|

|

21

|

|

Item 12.

|

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

|

22

|

|

Item 13.

|

|

Certain Relationships and Related Transactions and Director Independence

|

|

23

|

|

Item 14.

|

|

Principal Accountant Fees and Services

|

|

23

|

|

|

|

|

|

|

|

|

|

PART IV

|

|

|

|

Item 15.

|

|

Exhibits and Financial Statement Schedules

|

|

24

|

|

|

|

|

|

|

|

Signatures

|

|

|

|

26

|

CAUTIONARY NOTICE

This annual report

on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Those forward-looking statements include our

expectations, beliefs, intentions and strategies regarding the future. Such forward-looking statements relate to, among other things,

our market, strategy, competition, development plans, financing, revenues, operations and compliance with applicable laws. These

and other factors that may affect our financial results are discussed more fully in “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” included in this report. Market data used throughout

this report is based on published third party reports or the good faith estimates of management, which estimates are presumably

based upon their review of internal surveys, independent industry publications and other publicly available information. Although

we believe that such sources are reliable, we do not guarantee the accuracy or completeness of this information, and we have not

independently verified such information. We caution readers not to place undue reliance on any forward-looking statements. We do

not undertake, and specifically disclaim any obligation, to update or revise such statements to reflect new circumstances or unanticipated

events as they occur, and we urge readers to review and consider disclosures we make in this and other reports that discuss factors

germane to our business. See in particular our reports on Forms 10-K, 10-Q, and 8-K subsequently filed from time to time with the

Securities and Exchange Commission.

PART I

Overview

West Texas Resources,

Inc. (the “company” or “we”) was incorporated under the laws of Nevada on December 9, 2010. The

company was formed for the purpose of oil and gas exploration and development in North America. From inception to date,

our activities have focused on the raising of capital and the investigation of oil and gas properties. As of the date

of this report, we have incurred no revenue from our oil and gas exploration and development activities. In September

2011, we acquired our initial property consisting of a 31.25% working interest in an exploratory oil and gas drilling prospect

covering 120 acres in Eastland County, Texas. The Eastland County prospect includes two exploratory wells that had been

operating at a minimum level required to maintain the lease rights. Subject to our receipt of additional capital, we intend to

pursue the acquisition of additional equity interests in oil and gas properties to be thereafter exploited by us in conjunction

with other oil and gas producers. As of the date of this report, we have no understandings or agreements in place concerning

our acquisition of additional interests in any other properties.

Our Strategy

Our objective is to

become an independent energy company engaged in the acquisition, development and exploitation of oil and gas properties in North

America in partnership with oil and gas producers. We will pursue strategic acquisitions of interests in oil and gas

properties, including prospects with proven and unproven reserves, which we believe to have development potential. We

intend to target both new and existing fields and producing wells to be revitalized.

At the present time,

we have two employees, our chief executive officer and chief financial officer, Stephen Jones and John Kerr, respectively, neither

of whom has any experience in the oil and gas exploration and development business other than as private investors. Subject to

our receipt of significant additional capital, we intend to hire senior management and staff with experience in oil and gas exploration

and development. Until such time, we intend to pursue an operating strategy that is based on our participation in exploration

prospects as a non-operator. Based on that strategy, we intend to pursue the acquisition of oil and natural gas interests

in partnership with other companies with exploration, development and production expertise. We will also pursue alliances

with partners in the areas of geological and geophysical services and prospect generation, evaluation and prospect leasing. Pursuant

to this strategy, we intend to engage and rely on third party geologists and geophysicists, among others, to review the available

data concerning each potential acquisition on our behalf. In each case, we expect that the operator of the prospect

will assemble the appropriate data and conduct the appropriate studies and that our consultants will conduct an independent review

of the operator’s data and studies for purposes of advising us of the merits of each potential acquisition.

Oil and Gas Interests

In September 2011,

we acquired our initial property consisting of a 31.25% working interest in an exploratory oil and gas drilling prospect covering

120 acres in Eastland County, Texas. The operator of the Eastland County prospect is West Texas Royalties, Inc., of

Plainview, Texas, an unaffiliated third party.

The Eastland County

prospect includes two exploratory wells, known as Rutherford #1 and C.M. Knott #1, that had been operating at a minimum level required

to maintain the lease rights. In October 2011, the operator reentered the Rutherford #1 well and conducted drilling

and casing activities, which were completed in November 2011. In January 2012, GasFrac, Inc., of Kilgore, Texas, conducted

the fracture stimulation of the Rutherford #1 and the operator is presently evaluating the results. If the evaluation

of the Rutherford #1 is positive, the operator intends to reenter the C.M. Knott #1 within two to three months and conduct drilling

and casing in preparation for its facture stimulation. The operator expects to engage GasFrac, Inc. to conduct any fracture

stimulation of the C.M. Knott #1. Based on the results of the Rutherford #1 and C.M. Knott #1 fracture stimulations,

the operator expects to drill two to four new wells on the prospect, with such drilling to commence within six to 12 months of

the positive evaluation of the C.M. Knott #1. The lease held by the operator for the Eastland County prospect allows

the operator the right to conduct oil and gas operations on the entire 120 acres for so long as the operator is engaged in continuous

exploration, development or production on the leased acreage.

In addition to our

participation in any continued development of the Eastland County prospect, and subject to our receipt of additional capital, we

intend to pursue the acquisition of additional equity interests in other oil and gas properties in North America. However,

as of the date of this report, we have no understandings or agreements in place concerning our acquisition of an interest in any

other properties.

Marketing and Pricing

We will derive revenue

principally from the sale of oil and natural gas. As a result, our revenues will be determined, to a large degree, by prevailing

prices for crude oil and natural gas. We expect our operating partners to sell our oil and natural gas on the open market

at prevailing market prices. The market price for oil and natural gas is dictated by supply and demand, and we cannot accurately

predict or control the price we may receive for our oil and natural gas.

Price decreases would

adversely affect our revenues, profits and the value of our proved reserves. Historically, the prices received for oil and natural

gas have fluctuated widely. Among the factors that can cause these fluctuations are:

|

|

●

|

The domestic and foreign supply of natural gas and oil

|

|

|

●

|

Overall economic conditions

|

|

|

●

|

The level of consumer product demand

|

|

|

●

|

The price and availability of competitive fuels such as heating oil and coal

|

|

|

●

|

Political conditions in the Middle East and other natural gas and oil producing regions

|

|

|

●

|

The level of oil and natural gas imports

|

|

|

●

|

Domestic and foreign governmental regulations

|

|

|

●

|

Potential price controls

|

We may enter into hedging

arrangements to reduce our exposure to decreases in the prices of oil and natural gas. Hedging arrangements may expose

us to risk of significant financial loss in some circumstances including circumstances where:

|

|

●

|

There is a change in the expected differential between the underlying price in the hedging agreement

and actual prices received

|

|

|

●

|

Our production and/or sales of natural gas are less than expected

|

|

|

●

|

Payments owed under derivative hedging contracts typically come due prior to receipt of the hedged

month’s production revenue

|

|

|

●

|

The other party to the hedging contract defaults on its contract obligations

|

In addition, hedging arrangements limit

the benefit we would receive from increases in the prices for oil and natural gas. We cannot assure you that any hedging

transactions we may enter into will adequately protect us from declines in the prices of oil and natural gas. On the

other hand, we may choose not to engage in hedging transactions in the future. As a result, we may be more adversely affected by

changes in oil and natural gas prices than our competitors who engage in hedging transactions.

Competition

The oil and gas industry

is highly competitive and inherent difficulties exist for any new company seeking to enter an established field. Our proposed business

will encounter numerous companies more experienced, better financed, and operationally organized to conduct acquisitions, development

and exploration activities in the oil and gas industry in North America. Additionally, a small “start-up” such as us,

with insignificant resources, is at a serious disadvantage against established competitors, including major oil companies.

Government Regulations

The following is a

summary of the more significant existing environmental, health and safety laws and regulations applicable to the oil and natural

gas industry and for which compliance may have a material adverse impact on the development or success of our proposed oil and

gas operations.

Federal Income Tax

. Federal

income tax laws will significantly affect our operations. The principal provisions that will affect us are those that

permit us, subject to certain limitations, to deduct as incurred, rather than to capitalize and amortize, our share of the domestic

“intangible drilling and development costs” and to claim depletion on a portion of our domestic oil and natural gas

properties based on 15% of our oil and natural gas gross income from such properties (up to an aggregate of 1,000 Bbls per day

of domestic crude oil and/or equivalent units of domestic natural gas).

Environmental Regulation.

The

exploration, development and production of oil and natural gas are subject to federal, state and local laws and regulations governing

the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations

may, among other things, require permits to conduct drilling, water withdrawal and waste disposal operations; govern the amounts

and types of substances that may be disposed or released into the environment; limit or prohibit construction or drilling activities

in sensitive areas such as wetlands, wilderness areas or areas inhabited by endangered or threatened species; require investigatory

and remedial actions to mitigate pollution conditions arising from oil and gas operations or attributable to former operations;

and impose obligations to reclaim and abandon well sites and pits. Failure to comply with these laws and regulations

may result in the assessment of sanctions, including monetary penalties, the imposition of remedial obligations and the issuance

of orders enjoining operations in affected areas.

The clear trend in

environmental regulation is to place more restrictions and limitations on activities that may affect the environment, and thus,

any changes in environmental laws and regulations or re-interpretation of enforcement policies that result in more stringent and

costly construction, drilling, water management, completion, waste handling, storage, transport, disposal, or remediation requirements

or emission or discharge limits could have a material adverse effect on the development or success of our proposed oil and gas

operations. Moreover, accidental releases or spills may occur in the course of our proposed oil and gas operations,

and there can be no assurance that we will not incur significant costs and liabilities as a result of such releases or spills,

including any third party claims for damage to property and natural resources or personal injury.

Hazardous Substances

and Wastes

. The Comprehensive Environmental Response, Compensation and Liability Act, as amended ("CERCLA"),

also known as the Superfund law and comparable state laws impose joint and several liability, without regard to fault or legality

of conduct, on certain classes of persons who are considered to be responsible for the release of a "hazardous substance"

into the environment. These persons include current and prior owners or operators of the site where the release occurred

and entities that disposed or arranged for the disposal of the hazardous substances found at the site. Under CERCLA,

these "responsible persons" may be subject to strict joint and several liability for the costs of cleaning up the hazardous

substances that have been released into the environment, for damages to natural resources and for the costs of certain environmental

and health studies. In addition, it is not uncommon for neighboring landowners and other third parties to file claims

for personal injury and property damage allegedly caused by the release of hazardous substances into the environment. CERCLA

also authorizes the EPA and, in some instances, third parties to act in response to threats to the public health or the environment

and to seek to recover from the responsible classes of persons the costs they incur. We may generate materials in the

course of our proposed operations that may be regulated as hazardous substances.

We may also generate

wastes that are subject to the requirements of the Resource Conservation and Recovery Act, as amended ("RCRA"), and comparable

state statutes. RCRA imposes strict requirements on the generation, transportation, treatment, storage, disposal and

cleanup of hazardous and non-hazardous wastes. Drilling fluids, produced waters and most of the other wastes associated

with the exploration, production and development of crude oil and natural gas are currently exempt from regulation as hazardous

wastes under RCRA. However, it is possible that certain oil and natural gas exploration and production wastes now classified

as non-hazardous could be classified as hazardous wastes in the future. In September 2010, the Natural Resources

Defense Council filed a petition with the EPA requesting them to reconsider the RCRA exemption for exploration, production, and

development wastes. To date, the EPA has not taken any action on the petition. Any change in the RCRA exemption

for such wastes could result in an increase in costs to manage and dispose of wastes, which could have a material adverse effect

on the development or success of our proposed oil and gas operations.

Air Emissions

. The

Clean Air Act, as amended, and comparable state laws and regulations restrict the emission of air pollutants from many sources

and also impose various monitoring and reporting requirements. These laws and regulations may require our operating

partners to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly

increase air emissions, obtain and strictly comply with air permit requirements or utilize specific equipment or technologies to

control emissions. Obtaining permits has the potential to delay the development of oil and natural gas projects.

Water Discharges

. The

Federal Water Pollution Control Act, as amended ("Clean Water Act"), and analogous state laws impose restrictions and

strict controls regarding the discharge of pollutants into navigable waters. Pursuant to the Clean Water Act and analogous

state laws, permits must be obtained to discharge produced waters and sand, drilling fluids, drill cuttings and other substances

related to the oil and gas industry into onshore, coastal and offshore waters of the United States or state waters. Any

such discharge of pollutants into regulated waters must be performed in accordance with the terms of the permit issued by EPA or

the analogous state agency. Spill prevention, control and countermeasure requirements under federal law require appropriate

containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon

tank spill, rupture or leak. In addition, the Clean Water Act and analogous state laws require individual permits or

coverage under general permits for discharges of storm water runoff from certain types of facilities.

Climate Change

. In

December 2009, the EPA published its findings that emissions of carbon dioxide, methane and certain other GHGs present an

endangerment to public health and the environment because emissions of such gases are, according to the EPA, contributing to warming

of the earth's atmosphere and other climatic changes. These findings allow the EPA to adopt and implement regulations

that restrict emissions of GHGs under existing provisions of the federal Clean Air Act. Accordingly, the EPA has adopted

regulations that require a reduction in emissions of GHGs from motor vehicles and also trigger permit review for GHG emissions

from certain large stationary sources. The EPA's rules relating to emissions of GHGs from large stationary sources of

emissions are currently subject to a number of legal challenges, but the federal courts have thus far declined to issue any injunctions

to prevent the EPA from implementing, or requiring state environmental agencies to implement, the rules. In addition,

Congress has actively considered legislation to reduce emissions of GHGs and almost one-half of the states have begun taking actions

to control and/or reduce emissions of GHGs, primarily through the planned development of GHG emission inventories and/or regional

GHG cap and trade programs. The adoption and implementation of any regulations imposing reporting obligations on, or limiting emissions

of GHG gases from, our equipment and operations could require our operators to incur costs to reduce emissions of GHGs associated

with our proposed operations or could adversely affect demand for the oil and natural gas we produce.

Endangered Species

. The

federal Endangered Species Act ("ESA") restricts activities that may affect endangered or threatened species or their

habitats. The designation of previously unidentified species as endangered or threatened on properties where we operate

could subject us to additional costs or cause our oil and gas activities to be subject to operating restrictions or bans.

Employee Health

and Safety

. Our proposed operations are subject to a number of federal and state laws and regulations, including

the federal Occupational Safety and Health Act, as amended ("OSHA"), and comparable state statutes, whose purpose is

to protect the health and safety of workers. In addition, the OSHA hazard communication standard, the EPA community

right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state

statutes require that information be maintained concerning hazardous materials used or produced in oil and gas operations and that

this information be provided to employees, state and local government authorities and citizens.

State Regulation

. Texas

regulates the drilling for, and the production and gathering of, oil, natural gas and natural gas liquids, including requirements

relating to drilling permits, the location, spacing and density of wells, unitization and pooling of interests, the method of drilling,

casing and equipping of wells, the protection of fresh water sources, the orderly development of common sources of supply of oil,

natural gas and natural gas liquids, the operation of wells, allowable rates of production, the use of fresh water in oil, natural

gas and natural gas liquids operations, saltwater injection and disposal operations, the plugging and abandonment of wells and

the restoration of surface properties, the prevention of waste of oil, natural gas and natural gas liquids resources, the protection

of the correlative rights of oil, natural gas and natural gas liquids owners and, where necessary to avoid unfair, unjust or discriminatory

service, the fees, terms and conditions for the gathering of natural gas. The effect of these regulations may be to

limit the number of wells that our operating partners may drill, impact the locations at which our operating partners may drill

wells, restrict the amounts of oil and natural gas that may be produced from wells drilled by our operating partners and increase

the costs of operations.

Hydraulic

Fracturing

. We expect to participate in exploration and drilling projects that seek to recover oil and natural

gas through the use of hydraulic fracturing. Hydraulic fracturing, which involves the injection of water, sand and

chemicals under pressure into formations to fracture the surrounding rock and stimulate production, is typically regulated by

state oil and gas commissions. However, the EPA recently asserted federal regulatory authority over certain

hydraulic fracturing practices. At the same time, the EPA has commenced a study of the potential environmental

impacts of hydraulic fracturing activities, with initial results of the study anticipated to be available by early 2013

and final results by 2014. Also for the second consecutive session, legislation has been introduced in Congress to

provide for federal regulation of hydraulic fracturing and to require disclosure of the chemicals used in the fracturing

process. In addition, some states have adopted, and other states are considering adopting, regulations that could

restrict hydraulic fracturing in certain circumstances. For instance, in June 2011, Texas adopted a law that

requires disclosure to the Railroad Commission of Texas of the additives and other chemicals contained in hydraulic

fracturing fluids used in the state, subject to certain trade secret protections. If new laws or regulations that

significantly restrict hydraulic fracturing are adopted at the Texas state level, such legal requirements could make it

more difficult or costly for our operating partners to perform fracturing to stimulate production in the play and thereby

affect the determination of whether a well is commercially viable. In addition, if hydraulic fracturing is

regulated at the federal level, fracturing activities could become subject to additional permit requirements or operational

restrictions and also to associated permitting delays and potential increases in costs. Restrictions on hydraulic fracturing

could also reduce the amount of oil or natural gas and natural gas liquids that our operating partners are ultimately able to

produce in commercial quantities from our oil and gas properties.

Employees

As of the date of this

report, we have two employees, our chief executive officer and chief financial officer. For the foreseeable future,

we intend to use the services of independent consultants and contractors to perform various professional services related to our

oil and gas operations. Subject to our receipt of significant additional capital, we intend to hire senior management

and staff with experience in oil and gas exploration and development. Until such time, we intend to rely on third party

consultants to advise and assist us on our oil and gas operations.

Available Information

Our website is located

at www.westtexasresources.com. The information on or accessible through our website is not part of this annual report on Form 10-K.

A copy of this annual report on Form 10-K is located at the SEC’s Public Reference Room at 100 F Street, NE, Washington,

D.C. 20549. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. The

SEC also maintains an internet site that contains reports and other information regarding our filings at www.sec.gov.

There are numerous

and varied risks, known and unknown, that may prevent us from achieving our goals. If any of these risks actually occur,

our business, financial condition or results of operation may be materially adversely affected. In such case, the trading

price of our common stock could decline and investors could lose all or part of their investment.

We are

a development stage company and have limited assets and insignificant revenues.

We were only recently formed and

have no revenues to date from our oil and gas operations. In August 2011, we acquired a water trailer for use in oil and

gas drilling sites, and we placed the trailer into service pursuant to a lease arrangement with an unaffiliated third party

in October 2011. As of June 30, 2012, we have received a total of $19,203 in revenue from our water trailer. In December

2012, we sold the trailer for a cash payment of $25,000. In September 2011, we acquired our initial oil and gas property

consisting of a 31.25% working interest in an exploratory oil and gas drilling prospect covering 120 acres in Eastland

County, Texas, however we have not acquired or developed any additional assets or operations. We are in the development stage

and are subject to all risks inherent in a new venture. The likelihood of our success must be considered in light

of problems, expenses, complications and delays frequently encountered in connection with the development of a

new business. We do not have a significant operating history and, as a result, there is a limited amount

of information about us on which to make an investment decision.

We

will require additional capital in order to achieve commercial success and, if necessary, to finance future losses from operations

as we endeavor to build revenue, but we do not have any commitments to obtain such capital.

The business of oil and gas

acquisition, drilling and development is capital intensive and the level of operations attainable by an oil and gas company is

directly linked to and limited by the amount of available capital. As of September 30, 2012, we had total assets of $179,188 and

a working capital deficit of $(113,092). We believe that our ability to achieve commercial success and our continued growth will

be dependent on our ability to access capital either through the additional sale of our equity or debt securities, bank lines of

credit, project financing or cash generated from oil and gas operations.

Therefore, a principal

part of our plan of operations is to acquire the additional capital required to finance the acquisition of such properties and

our share of the development costs. We will seek additional working capital through the sale of our securities

and, subject to the successful deployment of our cash on hand, we will endeavor to obtain additional capital through bank lines

of credit and project financing.

However, as of the date of this report, we have no commitments for the sale of our securities

or our acquisition of additional capital through any other means nor can there be any assurance that any funds will be available

on commercially reasonable terms, if at all.

Our management

has no prior experience in operating an oil and gas business

. At the present time, we have two employees, our

chief executive officer and our chief financial officer, Stephen Jones and John Kerr, respectively, who also serve as the sole

members of our board of directors. Neither Mr. Jones nor Mr. Kerr has any prior experience in the oil and gas business

other than as private investors. We intend to expand our management team and board of directors with personnel who have experience

in the oil and gas business, however we have no agreements or understandings in place as of the date of this report concerning

the appointment of any additional officers or directors. We do not expect to be able to attract senior management

or directors with significant oil and gas experience until such time as we raise significant additional capital. Until

such time, if ever, as we do, the success of our company will be dependent on the decisions and actions undertaken by Mr. Jones

and Mr. Kerr.

We have limited

management and staff and will be dependent for the foreseeable future upon consultants and partnering arrangements.

At

the present time, we have two employees, our chief executive officer and our chief financial officer, Stephen Jones and John Kerr,

respectively. We have developed an operating strategy that is based on our participation in exploration prospects in

North America as a non-operator for the foreseeable future. We intend to use the services of independent consultants

and contractors to perform various professional services, including reservoir engineering, land, legal, environmental and tax services. We

will also pursue alliances with partners in the areas of geological and geophysical services and prospect generation, evaluation

and prospect leasing. As a non-operator working interest owner, we intend to rely on outside operators to drill, produce

and market our natural gas and oil. Our dependence on third party consultants, service providers and operators creates

a number of risks, including but not limited to:

|

|

●

|

the possibility that such third parties may not be available to us as and when needed; and

|

|

|

●

|

the risk that we may not be able to properly control the timing and quality of work conducted with

respect to our projects.

|

Shortages or

increases in costs of equipment, services and qualified personnel could delay the drilling of exploratory wells and adversely affect

our future results of operations and the price of our common stock.

The demand for qualified and experienced

personnel to conduct field operations, geologists, geophysicists, engineers and other professionals in the oil and natural gas

industry can fluctuate significantly, often in correlation with oil and natural gas prices, causing periodic shortages. Historically,

there have been shortages of drilling rigs and other equipment as demand for rigs and equipment has increased along with the number

of wells being drilled. These factors also cause significant increases in costs for equipment, services and personnel. Higher

oil and natural gas prices generally stimulate demand and result in increased prices for drilling rigs, crews and associated supplies,

equipment and services. Shortages of field personnel and equipment or price increases could significantly hinder the

ability of our operating partners to conduct drilling operations, which could adversely affect our results of operations and stock

price.

Our industry

is highly competitive which may adversely affect our performance, including our ability to participate in ready to drill prospects.

Oil and gas exploration and development companies operate in a highly competitive environment. In addition to

capital, the principal resources necessary for the exploration and production of oil and natural gas are:

|

|

●

|

leasehold prospects under which oil and natural gas reserves may be discovered;

|

|

|

●

|

drilling rigs and related equipment to explore for such reserves; and

|

|

|

●

|

knowledgeable personnel to conduct all phases of oil and natural gas operations.

|

Numerous large, well-financed

firms with large cash reserves are engaged in the acquisition of oil and gas properties in North America. We and our

operating partners will face competition in acquisitions, development, exploration and production from major oil companies,

numerous independents, individual proprietors and others. We expect competition to be intense for available target oil

and gas properties. Such competition could have a material adverse effect on our financial condition and operating results. We

and our operating partners may not be able to compete successfully against current and future competitors and competitive pressures

faced by us may materially adversely affect our business, financial condition, and results of operations.

Drilling for

and producing oil and natural gas are high risk activities with many uncertainties that could delay the anticipated drilling schedule

for exploratory wells and adversely affect our future results of operations and stock price.

The drilling and

completion of exploratory wells are subject to numerous risks beyond our control or the control of our operating partners, including

risks that could delay the proposed drilling schedules and the risk that drilling will not result in commercially viable oil and

natural gas production. Drilling for oil and natural gas can be unprofitable if dry wells are drilled and if productive

wells do not produce sufficient revenues to return a profit. The decisions by us and our operating partners to develop

or otherwise exploit certain prospects will depend in part on the evaluation of data obtained through geophysical and geological

analyses, production data and engineering studies, the results of which are often inconclusive or subject to varying interpretations. The

costs of drilling, completing and operating wells are often uncertain before drilling commences. Overruns in budgeted

expenditures are common risks that can make a particular project uneconomical. Even if an exploratory well is successfully

completed, it may not pay out the capital costs spent to drill it. Drilling and production operations on an exploratory

well may be curtailed, delayed or canceled as a result of various factors, including the following:

|

|

·

|

delays imposed by or resulting from compliance with regulatory requirements including permitting;

|

|

|

·

|

unusual or unexpected geological formations and miscalculations;

|

|

|

·

|

shortages of or delays in obtaining equipment and qualified personnel;

|

|

|

·

|

equipment malfunctions, failures or accidents;

|

|

|

·

|

lack of available gathering facilities or delays in construction of gathering facilities;

|

|

|

·

|

lack of available capacity on interconnecting transmission pipelines;

|

|

|

·

|

lack of adequate electrical infrastructure;

|

|

|

·

|

unexpected operational events and drilling conditions;

|

|

|

·

|

pipe or cement failures and casing collapses;

|

|

|

·

|

pressures, fires, blowouts, and explosions;

|

|

|

·

|

lost or damaged drilling and service tools;

|

|

|

·

|

loss of drilling fluid circulation;

|

|

|

·

|

uncontrollable flows of oil, natural gas and natural gas liquids water or drilling fluids;

|

|

|

·

|

environmental hazards, such as oil, natural gas and natural gas liquids leaks, pipeline ruptures

and discharges of toxic gases or fluids;

|

|

|

·

|

adverse weather conditions such as extreme cold, fires caused by extreme heat or lack of rain,

and severe storms or tornadoes;

|

|

|

·

|

reductions in oil, natural gas and natural gas liquids prices;

|

|

|

·

|

oil and natural gas property title problems; and

|

|

|

·

|

market limitations for oil, natural gas and natural gas liquids.

|

If any of these or other similar industry

operating risks occur, we could have substantial losses. Substantial losses also may result from injury or loss of life,

severe damage to or destruction of property, clean-up responsibilities, regulatory investigation and penalties and suspension of

operations.

Market conditions

for oil and natural gas, and particularly volatility of prices for oil and natural gas, could adversely affect our revenue, cash

flows, profitability and growth.

Our project revenue, cash flows, profitability and future rate of growth depend

substantially upon prevailing prices for oil and natural gas. Prices also affect the amount of cash flow available for

capital expenditures and our ability to borrow money or raise additional capital. Lower prices may also make it uneconomical

for our operating partners to commence or continue production levels of natural gas and crude oil. Prices

for oil and natural gas are subject to large fluctuations in response to relatively minor changes in the supply and demand for

oil and natural gas, market uncertainty and a variety of other factors beyond our control or the control of our operating

partners, including:

|

|

·

|

regional, domestic and foreign supply, and perceptions of supply, of oil, natural gas and natural

gas liquids;

|

|

|

·

|

the price of foreign imports;

|

|

|

·

|

U.S. and worldwide political and economic conditions;

|

|

|

·

|

the level of demand, and perceptions of demand, for oil, natural gas and natural gas liquids;

|

|

|

·

|

weather conditions and seasonal trends;

|

|

|

·

|

anticipated future prices of oil, natural gas and natural gas liquids, alternative fuels and other

commodities;

|

|

|

·

|

technological advances affecting energy consumption and energy supply;

|

|

|

·

|

the proximity, capacity, cost and availability of pipeline infrastructure, treating, transportation

and refining capacity;

|

|

|

·

|

domestic and foreign governmental regulations and taxation;

|

|

|

·

|

energy conservation and environmental measures; and

|

|

|

·

|

the price and availability of alternative fuels.

|

For oil, from 2007 through October 2012,

the highest monthly NYMEX settled price was $140.00 per Bbl and the lowest was $41.68 per Bbl. For natural gas, from 2007 through

October 2012, the highest monthly NYMEX settled price was $13.35 per MMBtu and the lowest was $2.04 per MMBtu. In addition,

the market price of oil and natural gas is generally higher in the winter months than during other months of the year due to increased

demand for oil and natural gas for heating purposes during the winter season.

Lower oil and natural

gas prices will reduce our revenues and may ultimately reduce the amount of oil and natural gas that is economic to produce from

our oil and gas properties. As a result, our operating partners could determine during periods of low oil and natural

gas prices to shut in or curtail production from any operating wells. In addition, our operating partners could determine

during periods of low oil and natural gas prices to plug and abandon marginal wells that otherwise may have been allowed to continue

to produce for a longer period under conditions of higher prices. Specifically, our operating partners may abandon any

well or property if it reasonably believes that the well or property can no longer produce oil or natural gas in commercially economic

quantities. This could result in termination of our portion of the royalty interest relating to the abandoned well or

property.

Investigations

of oil and gas properties do not eliminate the risks associated with the selection and the acquisition of such properties.

Although

we will engage third-party consultants to perform a review of the oil and properties proposed to be acquired, such reviews are

subject to uncertainties. It generally is not feasible to review in detail every individual property involved in an acquisition.

Even a detailed review of all properties and records may not reveal existing or potential problems; nor will it permit our consultants

to become sufficiently familiar with the properties to assess fully their deficiencies and capabilities. Inspections are not always

performed on every well, and potential problems, such as mechanical integrity of equipment and environmental conditions that may

require significant remedial expenditures, are not necessarily observable even when an inspection is undertaken.

Oil and gas exploration

and development is subject to complex federal, state, local and other laws and regulations that could adversely affect the cost,

manner or feasibility of conducting our operations or expose us to significant liabilities

. Our proposed oil

and natural gas exploration and production operations are subject to complex and stringent laws and regulations. In order to conduct

operations in compliance with these laws and regulations, oil and gas operators must obtain and maintain numerous permits, approvals

and certificates from various federal, state and local governmental authorities. Substantial costs may be incurred by

our operating partners in order to maintain compliance with these existing laws and regulations. Further, in light of

the explosion and fire on the drilling rig Deepwater Horizon in the Gulf of Mexico, as well as recent incidents involving the release

of oil and natural gas and fluids as a result of drilling activities in the United States, there has been a variety of regulatory

initiatives at the federal and state level to restrict oil and natural gas drilling operations in certain locations. Any

increased regulation or suspension of oil and natural gas exploration and production, or revision or reinterpretation of existing

laws and regulations, that arises out of these incidents or otherwise could result in delays and higher operating costs, which

will be passed along to us by way of our equity interest in the property. Such costs or significant delays could have

a material adverse effect on our business, financial condition and results of operations.

Laws and regulations

governing oil and natural gas exploration and production may also affect production levels. Oil and gas operators are

required to comply with federal and state laws and regulations governing conservation matters, including provisions related to

the unitization or pooling of the oil, natural gas and natural gas liquids properties; the establishment of maximum rates of production

from wells; the spacing of wells; and the plugging and abandonment of wells. These and other laws and regulations can

limit the amount of oil and natural gas operators can produce from their wells, limit the number of wells they can drill, or limit

the locations at which they can conduct drilling operations, which in turn could negatively impact our business, financial condition

and results of operations.

New laws or regulations,

or changes to existing laws or regulations may unfavorably impact our proposed operations, could result in increased operating

costs and have a material adverse effect on our financial condition and results of operations. For example, Congress is currently

considering legislation that, if adopted in its proposed form, would subject companies involved in oil and natural exploration

and production activities to, among other items, additional regulation of and restrictions on hydraulic fracturing of wells, the

elimination of most U.S. federal tax incentives and deductions available to oil and natural gas exploration and production activities,

and the prohibition or additional regulation of private energy commodity derivative and hedging activities.

These and other potential

regulations could increase operating costs, reduce revenue, delay proposed operations, increase direct and third party post production

costs associated with the oil and gas properties or otherwise alter the proposed operations of oil and gas properties in which

we hold an equity interest, which could have a material adverse effect on our financial condition, results of operations and stock

price.

Oil and gas operations

are subject to environmental laws and regulations that could adversely affect the cost, manner or feasibility of conducting operations

or result in significant costs and liabilities.

Oil and natural gas exploration and production operations are

subject to stringent and comprehensive federal, state and local laws and regulations governing the discharge of materials into

the environment or otherwise relating to environmental protection. These laws and regulations may impose numerous obligations

that are applicable to the operation of the properties in which we hold an interest including the acquisition of a permit before

conducting drilling; water withdrawal or waste disposal activities; the restriction of types, quantities and concentration of materials

that can be released into the environment; the limitation or prohibition of drilling activities on certain lands lying within wilderness,

wetlands and other protected areas; and the imposition of substantial liabilities for pollution resulting from operations. Numerous

governmental authorities, such as the U.S. Environmental Protection Agency ("EPA") and analogous state agencies, have

the power to enforce compliance with these laws and regulations and the permits issued under them, often requiring difficult and

costly actions. Failure to comply with these laws and regulations may result in the assessment of administrative, civil

or criminal penalties; the imposition of investigatory or remedial obligations; and the issuance of injunctions limiting or preventing

some or all of the proposed operations.

There is inherent risk of incurring significant

environmental costs and liabilities in the performance of oil and gas operations due to the handling of petroleum hydrocarbons

and wastes, because of air emissions and wastewater discharges related to such operations, and as a result of historical industry

operations and waste disposal practices. Under certain environmental laws and regulations, our operating partner could

be subject to joint and several strict liability for the removal or remediation of previously released materials or property contamination

regardless of whether our operating partner was responsible for the release or contamination or if the operations were in compliance

with all applicable laws at the time those actions were taken. Private parties, including the owners of properties upon

which our operating partners intend to drill wells and facilities where petroleum hydrocarbons or wastes are taken for reclamation

or disposal may also have the right to pursue legal actions to enforce compliance, as well as to seek damages for contamination

even in the absence of non-compliance, with environmental laws and regulations or for personal injury or property damage. In

addition, the risk of accidental spills or releases could expose our operating partners to significant liabilities. All

of the foregoing costs and liabilities of our operating partners may be passed along to us by way of our equity interest on the

subject oil and gas property, which in turn could have a material adverse effect on our financial condition, results of operations

and stock price. Changes in environmental laws and regulations occur frequently, and any changes that result in more

stringent or costly construction, drilling, water management, completion, waste handling, storage, transport, disposal or cleanup

requirements could require our operating partners to make significant expenditures to attain and maintain compliance. We

would be responsible for our pro rata share of such costs, which may have a material adverse effect on our results of operations,

financial condition or stock price.

Climate change

laws and regulations restricting emissions of "greenhouse gases" could result in increased operating costs and reduced

demand for oil and natural gas while the physical effects of climate change could disrupt production and cause our operating partners to

incur significant costs in preparing for or responding to those effects.

On December 15, 2009, the EPA

published its findings that emissions of carbon dioxide, methane and other greenhouse gases ("GHGs") present a danger

to public health and the environment. These findings allow the agency to adopt and implement regulations that restrict

emissions of GHGs under existing provisions of the federal Clean Air Act. Accordingly, the EPA has adopted regulations

that require a reduction in emissions of GHGs from motor vehicles and also trigger permit review for GHG emissions from certain

large stationary sources. The EPA's rules relating to emissions of GHGs from large stationary sources of emissions are

currently subject to a number of political and legal challenges, but the federal courts have thus far declined to issue any injunctions

to prevent EPA from implementing, or requiring state environmental agencies to implement, the rules. In addition, on

October 30, 2009, the EPA published a final rule requiring the reporting of GHG emissions from specified large GHG emission

sources in the United States, beginning in 2011 for emissions occurring in 2010. On November 30, 2010, the EPA

published a final rule that expands its October 2009 final rule on reporting of GHG emissions to require certain owners and operators

of onshore oil and natural gas production to monitor greenhouse gas emissions beginning in 2011 and to report those emissions beginning

in 2012. Both houses of Congress have from time to time considered legislation to reduce emissions of GHGs and almost

one-half of the states, either individually or through multi-state regional initiatives, already have begun implementing legal

measures to reduce emissions of GHGs. The adoption and implementation of any regulations imposing reporting obligations

on, or limiting emissions of GHGs from the equipment and operations of our operating partners could require our operating partners

to incur costs to reduce emissions of GHGs associated with our operations or could adversely affect demand for the oil and natural

gas. All of the foregoing costs and liabilities of our operating partners may be passed along to us by way of our equity

interest on the subject oil and gas property, which in turn could have a material adverse effect on our financial condition, results

of operations and stock price. Finally, it should be noted that some scientists have concluded that increasing concentrations

of greenhouse gases in the Earth's atmosphere may produce climate change that could have significant physical effects, such as

increased frequency and severity of storms, droughts, and floods and other climatic events; if any such effects were to occur,

they could have an adverse effect on our assets and operations.

Federal and state

legislative and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating

restrictions or delays as well as adversely affect our results of operations, financial condition or stock price.

Our operating partners may from time to time engage in a production technique known as hydraulic fracturing, an important and common

practice used to stimulate production of hydrocarbons from tight formations, such as shales. The process involves

the injection of water or other liquids, sand and chemicals under pressure into formations to fracture the surrounding rock and

stimulate production. The process is typically regulated by state oil and gas commissions. However, the EPA

recently asserted federal regulatory authority over certain hydraulic fracturing practices. At the same time, the EPA

has commenced a study of the potential environmental impacts of hydraulic fracturing activities, with initial results of the study

anticipated to be available by late 2012 and final results by 2014. Also, legislation has been introduced into Congress

to provide for federal regulation of hydraulic fracturing and to require disclosure of the chemicals used in the fracturing process. In

addition, some states have adopted, and other states are considering adopting, regulations that could restrict hydraulic fracturing

in certain circumstances. For instance, in June 2011, Texas adopted a law that requires disclosure to the Railroad Commission

of Texas of the additives and other chemicals contained in hydraulic fracturing fluids used in the state, subject to certain trade

secret protections. If new laws or regulations that significantly restrict or regulate hydraulic fracturing are adopted,

such legal requirements could make it more difficult or costly for our operating partners to perform fracturing to stimulate production

from our oil and gas interests and thereby affect the determination of whether a well is commercially viable. Restrictions on hydraulic

fracturing could also reduce the amount of oil and natural gas our operating partners are ultimately able to produce in commercial

quantities from our oil and gas interests.

Hydraulic fracturing

operations may result environmental contamination and other operational risks that could subject us to significant costs, liabilities

and loss of investment

. Hydraulic fracturing is a process that involves the injection of water or other

liquids, sand and chemicals under pressure into formations to fracture the surrounding rock and stimulate production. The

process involves the risk that liquids and chemicals injected into the well may migrate into and contaminate water aquifers and

wells or surrounding land. The process also involves the risk that water and liquids that are retrieved from the fractured

well may be improperly disposed of, thus creating another potential for water or ground contamination. Our operating

partners face the possibility of significant costs and liabilities in the event of any environmental contamination resulting

from the hydraulic fracturing of wells in which we have an interest, in which event we may become liable for our pro rata share

of such costs and liabilities. Also, even in the absence of any actual contamination, we can face significant costs

if the operator is required to defend any lawsuits or investigations that allege contamination. Finally, any actual

or alleged environmental contamination resulting from a drilling operation on an oil and gas property in which we have an interest

can lead to the suspension or abandonment of that property and the loss of our entire investment in such property.

No Dividends.

We

do not expect to pay cash dividends on our common stock in the foreseeable future.

No Active Trading

market

. Our common shares are traded on the OTC Market under the symbol “WTXR.” However, we consider our common

stock to be “thinly traded” and any last reported sale prices may not be a true market-based valuation of the common

stock. Also, the present volume of trading in our common stock may not provide investors sufficient liquidity in the event you

wish to sell your common shares. There can be no assurance that an active market for our common stock will develop. In addition,

the stock market in general, and early stage public companies in particular, have experienced extreme price and volume fluctuations

that have often been unrelated or disproportionate to the operating performance of such companies. If we are unable to develop

a market for our common shares, you may not be able to sell your common shares at prices you consider to be fair or at times that

are convenient for you, or at all.

Our common stock

may be considered to be a “penny stock” and, as such, any the market for our common stock may be further limited by

certain SEC rules applicable to penny stocks

. To the extent the price of our common stock remains below $5.00

per share or we have a net tangible assets of $2,000,000 or less, our common shares will be subject to certain “penny stock”

rules promulgated by the SEC. Those rules impose certain sales practice requirements on brokers who sell penny stock

to persons other than established customers and accredited investors (generally institutions with assets in excess of $5,000,000

or individuals with net worth in excess of $1,000,000). For transactions covered by the penny stock rules, the broker

must make a special suitability determination for the purchaser and receive the purchaser’s written consent to the transaction

prior to the sale. Furthermore, the penny stock rules generally require, among other things, that brokers engaged in

secondary trading of penny stocks provide customers with written disclosure documents, monthly statements of the market value of

penny stocks, disclosure of the bid and asked prices and disclosure of the compensation to the brokerage firm and disclosure of

the sales person working for the brokerage firm. These rules and regulations adversely the affect the ability of brokers to sell

our common shares and limit the liquidity of our securities.

|

Item 1B.

|

Unresolved Staff Comments

|

Not applicable.

Company Executive Offices

Our

executive offices are located in 5729 Lebanon Road., Suite 144, Frisco, Texas 75034.

We believe that our current facilities

are adequate for our foreseeable needs.

Oil and Gas Interests

In September 2011,

we acquired our initial property consisting of a 31.25% working interest in an exploratory oil and gas drilling prospect covering

120 acres in Eastland County, Texas. The operator of the Eastland County prospect is West Texas Royalties, Inc., of

Plainview, Texas, an unaffiliated third party.

The Eastland County

prospect includes two exploratory wells, known as Rutherford #1 and C.M. Knott #1, that had been operating at a minimum level required

to maintain the lease rights. In October 2011, the operator reentered the Rutherford #1 well and conducted drilling

and casing activities, which were completed in November 2011. In January 2012, GasFrac, Inc., of Kilgore, Texas, conducted

the fracture stimulation of the Rutherford #1 and the operator is presently evaluating the results. If the evaluation

of the Rutherford #1 is positive, the operator intends to reenter the C.M. Knott #1 within two to three months and conduct drilling

and casing in preparation for its facture stimulation. The operator expects to engage GasFrac, Inc. to conduct any fracture

stimulation of the C.M. Knott #1 . Based on the results of the Rutherford #1 and C.M. Knott #1 fracture stimulations,

the operator expects to drill two to four new wells on the prospect, with such drilling to commence within six to 12 months of

the positive evaluation of the C.M. Knott #1. West Texas Royalties estimates that our share of the cost in reentering

and fracture stimulating C.M. Knott #1 will be approximately $125,000 and that our share of the cost in drilling additional new

wells will be approximately $220,000 per well. The lease held by the operator for the Eastland County prospect allows

the operator the right to conduct oil and gas operations on the entire 120 acres for so long as the operator is engaged in continuous

exploration, development or production on the leased acreage.

In connection with

our participation in the Eastland County prospect, we entered into a joint operating agreement with the operator and the other

working interest owners. The joint operating agreement includes standard and customary terms and conditions concerning

the operation of the Eastland County prospect. Under the terms of the agreement, each working interest holder is required

to participate in the exploration and development of the Rutherford #1 well at the level of its working interest, and thereafter

each holder can elect to participate in any further development of the prospect. Any working interest holder electing

not to participate in any further development of the prospect will not receive any proceeds from the sale of oil or gas from such

further development until the participating working interest holders have received the return of their costs in the further development

and a substantial premium. The joint operating agreement also declares an area of mutual interest consisting of 640

acres surrounding and inclusive of the 120 acres making up the Eastland County prospect.

In addition to our

participation in any continued development of the Eastland County prospect, and subject to our receipt of additional capital, we

intend to pursue the acquisition of additional equity interests in other oil and gas properties in North America. However,

as of the date of this report, we have no understandings or agreements in place concerning our acquisition of an interest in any

other properties.

Reserves and Production

There are no reserve

reports with respect to our initial prospect in Eastland County, Texas nor are there any producing wells on such property.

Acreage

The following

tables summarize by geographic area our developed and undeveloped acreage as of September 30, 2012. The term of the undeveloped

leasehold acreage ranges from three to five years.

|

|

|

|

Developed

1

|

|

Undeveloped

2

|

|

State

|

|

|

Gross

3

|

|

Net

4

|

|

Gross

3

|

|

Net

4

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas

|

|

|

--

|

|

--

|

|

120

|

|

37.5

|

|

|

Total

|

|

|

--

|

|

--

|

|

120

|

|

37.5

|

1

Developed acreage is acreage spaced for or assignable

to productive wells.

2

Undeveloped acreage is oil and

gas acreage on which wells have not been drilled or completed to a point that would permit the production of economic quantities

of oil or gas regardless of whether such acreage contains proved reserves.

3

A gross acre is an acre in

which a working interest is owned. The number of gross acres is the total number of acres in which a working interest

is owned.

4

A net acre is deemed to exist

when the sum of fractional ownership working interests in gross acres equals one. The number of acres is the sum of

the fractional working interests owned in acres expressed as whole numbers and fractions thereof.

Drilling and Other Exploratory Activities

We were incorporated

in December 2010 and did not participate in any drilling, or other exploratory or development, activity during the fiscal year

ended September 30, 2011. In October 2011, we participated in our first drilling operation, which took place at our

initial prospect, located in Eastland County, Texas. The Eastland County prospect includes two wells, known as Rutherford

#1 and C.M. Knott #1, that had been operating at a minimum level required to maintain the lease rights. In October 2011,

the operator of the prospect, West Texas Royalties, Inc., reentered the Rutherford #1 well and conducted drilling and casing activities,

which were completed in November 2011. In January 2012, GasFrac, Inc., of Kilgore, Texas, conducted the fracture stimulation

of the Rutherford #1 and the operator is presently evaluating the results. Our activity on the Rutherford #1 represents

our only participation in drilling, exploratory or development activity to date. As of the date of this report, we have

no wells in the process of drilling and we have no wells in the process of completion other than the Rutherford #1.

|

Item 3.

|

Legal Proceedings

|

As of the date of this

report, there are no pending legal proceedings to which we or our properties are subject, except for routine litigation incurred

in the normal course of business.

|

Item 4.

|

Mine Safety Disclosures

|

Inapplicable.

PART II

|

Item 5.

|

Market for Registrant’s Common Equity,

Related Stockholder Matters and Issuer Repurchases of Equity Securities

|

Market Information

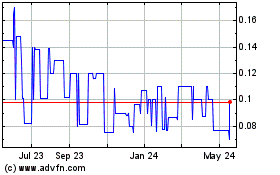

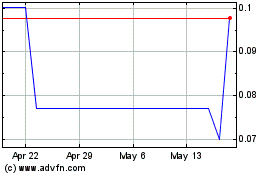

Our common stock has

been quoted on the OTC Market under the symbol “WTXR” since October 24, 2012. The high and low sale prices for our

common shares on the OTC Market between October 24, 2012 and the date of this report is $0.25 and $0.80. However, we consider our

common stock to be “thinly traded” and any reported sale prices may not be a true market-based valuation of the common

stock.

Holders of Record

As of January 14, 2013, there were approximately 119 holders of record of our common stock.

Dividend Policy

We have never declared

or paid cash dividends on our common stock. We presently intend to retain earnings to finance the operation and expansion of our

business.

Equity Compensation Plan Information

We have adopted the

West Texas Resources, Inc. 2011 Stock Incentive Plan providing for the grant of non-qualified stock options and incentive stock

options to purchase shares of our common stock and for the grant of restricted and unrestricted share grants. We have

reserved 3,000,000 shares of our common stock under the plan. All officers, directors, employees and consultants to

our company are eligible to participate under the plan. The purpose of the plan is to provide eligible participants

with an opportunity to acquire an ownership interest in our company.

The following table

sets forth certain information as of September 30, 2012 about our stock plans under which our equity securities are authorized

for issuance.

|

Plan Category

|

|

(a)

Number of Securities to be Issued Upon

Exercise of Outstanding Options

|

|

|

(b)

Weighted-Average Exercise Price of Outstanding

Options

|

|

|

(c)

Number of Securities Remaining Available

for Equity Compensation Plans (Excluding Securities Reflected In Column (a))

|

|

|

Equity compensation plans approved by security holders

|

|

|

400,000

|

|

|

$

|

0.25

|

|

|

|

2,600,000

|

|

|

Equity compensation plans not approved by security holders

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Total

|

|

|

400,000

|

|

|

$

|

0.25

|

|

|

|

2,600,000

|

|

|

Item 6.

|

Selected Financial Data

|

Not applicable.

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition

and Results of Operations

General

|

We were formed

on December 9, 2010 under the laws of Nevada for the purpose of oil and gas exploration and development in North America. From

inception to date, our activities have focused on the raising of capital and the investigation of oil and gas properties. As of

the date of this report, we have incurred no revenue from oil and gas exploration, however we have received revenue from our lease

of a water trailer. In August 2011, we acquired a water trailer for use in hauling water to and from oil and gas drilling sites.

Our purchase price was $35,759. Between October 2011 and June 2012, we placed the trailer into service and received a total of

$19,203 in revenue from our water trailer. In December

2012, we sold the trailer for a cash payment of $25,000.

In September

2011, we acquired our initial property consisting of a 31.25% working interest in an exploratory oil and gas drilling prospect