3i Infrastructure PLC Completion of further investment in WIG (8673A)

January 03 2018 - 7:37AM

UK Regulatory

TIDM3IN

RNS Number : 8673A

3i Infrastructure PLC

03 January 2018

3i Infrastructure plc completes further investment in Wireless

Infrastructure Group

3 January 2018

3i Infrastructure plc ("3i Infrastructure") has completed its

GBP186m further investment in Wireless Infrastructure Group

("WIG"), increasing its ownership to 91% of WIG's equity, with the

balance held by management. The transaction was announced on 27

December 2017.

To fund the transaction, 3i Infrastructure drew on its Revolving

Credit Facility ("RCF"). Following the acquisition, 3i

Infrastructure held GBP68.0 million in cash, including GBP40.3

million to fund the interim dividend, and the undrawn balance of

its RCF was GBP132.7 million. The RCF was GBP367.3 million drawn,

including GBP51.3 million for letters of credit.

-ENDS-

For further information, contact:

Thomas Fodor Tel: +44 7738 345 988

Investor enquiries Email: thomas.fodor@3i.com

Tel: +44 20 7975 3021

Kathryn van der Kroft Email: kathryn.vanderkroft@3i.com

Media enquiries

Notes to editors:

About 3i Infrastructure plc

3i Infrastructure plc is a Jersey-incorporated, closed-ended

investment company, listed on the London Stock Exchange and

regulated by the Jersey Financial Services Commission. The Company

is a long-term investor in infrastructure businesses and assets.

The Company's market focus is on economic infrastructure and

greenfield projects in developed economies, principally in Europe,

investing in operating businesses and projects which generate

long-term yield and capital growth.

3i Investments plc, a wholly-owned subsidiary of 3i Group plc,

is authorised and regulated in the UK by the Financial Conduct

Authority and acts as Investment Adviser to 3i Infrastructure

plc.

About WIG

Following its launch in 2006, WIG has invested in over 2,000

assets including communications towers and other wireless

infrastructure across the UK. WIG's higher capacity infrastructure

enables industry leading levels of mobile and other wireless

connectivity.

The Company has an active investment programme covering:

-- new towers in rural areas (where over 50% of WIG's investments have been made to date);

-- new infrastructure to enable better connectivity across the

UK's major road and rail routes; and

-- small cells to improve mobile coverage in buildings and on city streets.

WIG is the UK market leader for the deployment of neutral host

DAS networks needed to deliver mobile signal to large public venues

and is growing its fibre investments to support the deployment of

outdoor small cells.

WIG is also targeting the acquisition and upgrade of

communication towers owned by UK mobile operators. Over 60% of

communication towers globally and over 80% in the US are now

independently operated. Only one third of UK towers are

independently operated and increasing the role of independent

infrastructure can play a vital part in improving mobile

connectivity.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCBXGDBSXGBGIX

(END) Dow Jones Newswires

January 03, 2018 08:37 ET (13:37 GMT)

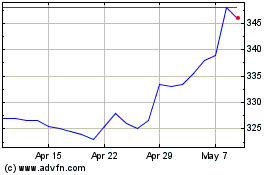

3i Infrastructure (LSE:3IN)

Historical Stock Chart

From Apr 2024 to May 2024

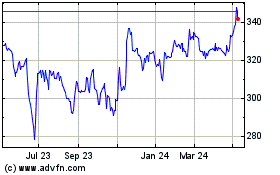

3i Infrastructure (LSE:3IN)

Historical Stock Chart

From May 2023 to May 2024