AEW UK REIT PLC AEW UK REIT acquires Gloucester office block (8980Z)

December 20 2017 - 2:18AM

UK Regulatory

TIDMAEWU

RNS Number : 8980Z

AEW UK REIT PLC

20 December 2017

20 December 2017

AEW UK REIT acquires Gloucester office block for GBP3.1m

AEW UK REIT plc ("the Company"), which directly owns a

diversified portfolio of regional UK commercial property assets, is

pleased to announce the acquisition of Cedar House, Spa Road,

Gloucester for GBP3.1m.

The five-storey office block, which is located within the city

centre adjacent to Gloucester Park, has been acquired for a price

reflecting a low capital value of only GBP80 per sq ft and an

attractive net initial yield of 9.1%. The property is currently let

to the Secretary of State for Communities & Local Government

for use as a Job Centre, with a short unexpired lease term of 0.3

years. However, the tenant has already served a Section 26 notice

to renew the lease and as such the Investment Manager believes that

the income can be extended.

The property is situated within a mixed office and residential

area and as such the Investment Manager believes that it provides

good long-term alternative use potential. Public transport is

easily accessible, with good links to Gloucester Railway Station

and a central bus route.

The asset provides a total floor area of 38,427 sq ft and

includes substantial car parking facilities, with 103 spaces

available.

Alex Short, Portfolio Manager, AEW UK REIT, commented: "We are

delighted to have completed this latest acquisition following our

successful capital raise in October. Heading into 2018, we are

pleased to have an attractive pipeline of investment opportunities

ahead of us and with further assets under offer we expect to make

more acquisition announcements shortly."

On 20 October AEW UK REIT announced that it had raised GBP28.1m

through the initial issue of the Share Issuance Programme, as

described in the prospectus published by the Company on 28

September 2017.

ENDS

About AEW UK REIT

AEW UK REIT plc (LSE: AEWU) aims to deliver an attractive total

return to shareholders by investing predominantly in smaller

commercial properties (typically less than GBP10m), on shorter

occupational leases in strong commercial locations across the

United Kingdom. The Company was listed on the Official List of the

UK Listing Authority and admitted to trading on the Main Market of

the London Stock Exchange on 12 May 2015, raising GBP100.5m. Since

IPO it has raised a further GBP51m.

The Company is currently invested in office, retail, industrial

and leisure assets, with a focus on active asset management,

repositioning the properties and improving the quality of the

income stream.

AEWU is currently paying an annualised dividend of 8p per

share.

www.aewukreit.com

About AEW UK Investment Management LLP

The Investment Manager AEW UK Investment Management LLP is a

50:50 joint venture between the principals of the Investment

Manager and AEW. It employs a well-resourced team comprising 25

individuals covering investment, asset management, operations and

strategy. It is part of AEW Group, one of the world's largest real

estate managers, with EUR57 billion of assets under management as

at 30 September 2017. AEW Group comprises AEW SA and AEW Capital

Management L.P., a U.S. registered investment manager and their

respective subsidiaries. In Europe, as at 30 September 2017, AEW

Group managed EUR26.6 billion in value in properties of all types

located in 15 countries, with close to 400 staff.

AEW UK Enquiries:

Alex Short alex.short@aeweurope.com

+44(0) 207 016 4880

Laura Elkin laura.elkin@aeweurope.com

+44(0) 207 016 4869

Nicki Gladstone nicki.gladstone-ext@aeweurope.com

+44(0) 771 140 1021

Company Secretary

Link Company Matters aewu.cosec@linkgroup.co.uk

+44(0) 207 954 9547

Temple Bar Advisory +44(0) 207 002 1510

Ed Orlebar +44(0) 7738 724 630

Tom Allison +44(0) 7789 998 020

Alycia MacAskill +44(0) 7876 222 703

About AEW Europe

AEW is one of the world's largest real estate asset managers,

with over EUR57bn of assets under management as at 30 September

2017. AEW has over 600 employees, with its main offices located in

Boston, London, Paris and Hong Kong and offers a wide range of real

estate investment products including comingled funds, separate

accounts and securities mandates across the full spectrum of

investment strategies. AEW represents the real estate asset

management platform of Natixis Global Asset Management, one of the

largest asset managers in the world.

As at 30 September 2017, AEW managed EUR26.6bn of real estate

assets in Europe on behalf of a number of funds and separate

accounts. AEW has close to 400 employees based in 10 offices across

Europe and has a long track record of successfully implementing

core, value-add and opportunistic investment strategies on behalf

of its clients. In the last five years, AEW has invested and

divested a total volume of over EUR17.5bn of real estate across

European markets.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQEAPAEAFKXFEF

(END) Dow Jones Newswires

December 20, 2017 03:18 ET (08:18 GMT)

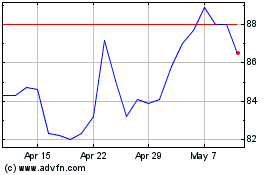

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Apr 2024 to May 2024

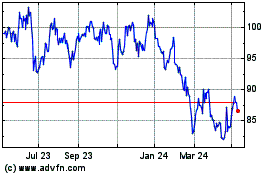

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From May 2023 to May 2024