TIDMAUK

RNS Number : 8432X

Aukett Swanke Group PLC

27 December 2023

27 December 2023

Aukett Swanke Group Plc

("Aukett Swanke", the "Company", or, together with its

subsidiaries, the "Group")

Launch of Employee Share Purchase Plans

Grant of Share Options

Aukett Swanke (AIM: AUK), the group providing Smart Buildings,

Architectural and Design Services, notifies that it has launched

three plans to increase levels of share ownership by management and

staff.

All Employee Share Option Plan

Firstly, the Company has implemented an All Employee Share

Option Plan ("AESOP"). Formally a share incentive plan run by

Equiniti our registrars, the AESOP entitles all employees to invest

between GBP10 and GBP150 per month in purchasing shares in the

Group from their pre-tax salary. The Group will match this

contribution pound-for-pound on the first GBP50 per month by

purchasing Matching Shares for the relevant employee as a staff

retention tool. Employees who leave forfeit the Matching Shares

acquired within the last three years of their departure, save for a

number of specific reasons such as redundancy or ill health.

The Group is delighted to report that approximately 40% of the

workforce have chosen to acquire shares in this manner. Purchases

are being made monthly with the first such purchase already

completed. The rules of the AESOP allow for new shares to be

issued, but for the foreseeable future it is the intention that the

purchases be made on the open market.

It is noted that the members of the concert party established in

March 2023 upon the acquisition of Torpedo Factory Group Ltd ("TFG

Concert Party"), are not for the current time participating in the

AESOP.

Management Share Ownership Plan

Secondly, a Management Share Ownership Plan ("MSOP") has been

created. The Company recognises that the management of the Group's

businesses wish to build an ownership stake greater than the upper

limits of the AESOP. Therefore, it invited 34 members of the senior

management team to commit to purchasing shares beyond the AESOP

limit. 32 of the 34 have made a contractual commitment to spend an

amount equivalent to between 2.5% and 10% of their gross annual

salary on the purchase of Company shares, until such time as each

of them own a minimum of either 0.25% or 0.5% of the Company's

issued share capital - though they are free to acquire larger

stakes if they wish.

Purchases can be made at any time subject to the Group's Share

Dealing Code and applicable securities regulation, but it is

intended that the MSOP purchases will be made approximately

quarterly with most purchases expected to begin in February 2024.

The MSOP shares will be purchased on the open market.

Every single director of the Group's subsidiaries who was

invited has signed up to the MSOP commitment, including all fee

earning architect directors. All who have expressed an intent have

indicated they will be purchasing their shares within their pension

plans, as their investments are intended to build long term stakes

in the business.

Any purchases pursuant to the MSOP by employees who are members

of the TFG Concert Party will need to be considered by such

employees, individually or together, with respect to the provisions

of the UK Takeover Code.

Company Share Option Plan and surrender of existing EMI

options

Finally, the Company has created a Company Share Option Plan

("CSOP"). Pursuant to the CSOP, an aggregate 25,591,666 options

have been granted to the 32 members of the management team who have

made commitments under the MSOP. The CSOP options vest between the

third and tenth anniversary of grant, and are exercisable at 1.0p,

being the nominal value of each share and a 17.6% premium to the

closing mid-market price on 22 December 2023 (save for 1,000,000

CSOP replacement options granted to Tony Barkwith, Director, as

detailed below).

Additionally, the Company has agreed with optionholders in the

Company's existing EMI option scheme for the surrender of their

options, comprising in aggregate 10.4m EMI options. These

replacement options are included within the CSOP grants detailed

above.

A total of 8.4m CSOP options are being granted at an exercise

price of 1.0p per share to Freddie Jenner (Group COO) and Jason

Brameld (Group CTO, a non-board PDMR) to replace 8.4m EMI options

that were issued on the purchase of Torpedo Factory Group Ltd

("TFG"). These in turn replaced previous TFG CSOP options. The EMI

options surrendered had an exercise price of 1p.

Tony Barkwith (Group Finance Director) has surrendered 1,000,000

EMI options with an exercise price of 1.6p which are being replaced

with 1,000,000 CSOP options with an exercise price of 1.6p, and

surrendered 1,000,000 EMI options with an exercise price of 3.6p

which are not being replaced.

Freddie, Jason and Tony are also each receiving CSOP options in

their capacity as parties who have made the MSOP commitment.

CSOP Options being granted to Directors/PDMRs are as

follows:

Name Number of CSOP options Exercise Price Notes

Nick Clark* 2,000,000 1.0p

Freddie Jenner* 4,700,000 1.0p Of which 3.7m replace EMI

Jason Brameld* (PDMR) 5,700,000 1.0p Of which 4.7m replace

EMI

Tony Barkwith 1,000,000 1.0p

1,000,000 1.6p Replacing EMI

The total 25,591,666 CSOP options now in issue represent 8.73%

of the shares in issue. There are no EMI options outstanding, nor

any warrants or convertible instruments.

* Nick Clark, Freddie Jenner and Jason Brameld are members of

the TFG Concert Party.

Related Party Transaction

The CSOP arrangements in relation to Nick Clark, Freddie Jenner

and Tony Barkwith, each a Director of the Company, represent a

related party transaction under the AIM Rules for Companies. The

Directors who are independent of the arrangements, being Clive

Carver, Robert Fry and Tandeep Minhas, having consulted with the

Company's nominated adviser, Strand Hanson, consider that the terms

of the arrangements are fair and reasonable insofar as shareholders

are concerned.

Nick Clark, Chief Executive, commented:

"Collectively these three schemes are transforming the Group's

culture. Last quarter the Group only had six employee shareholders,

now there are 70, and I am delighted the schemes have been

supported by everyone in a senior management role. Moreover, the

commitment to consistent, regular purchases of meaningful amounts

of shares, over the coming years, demonstrates to the market our

conviction in the new strategy. Taken together the share ownership

schemes are, I believe, the most attractive equity prospect for

up-and-coming architects, consultants and engineers in the UK. They

will enable us to attract and retain the brightest and best, and I

look forward to reporting to all shareholders on our progress

through 2024."

Contacts

Aukett Swanke Group Plc +44 (0) 20 7843 3000

Clive Carver, Chairman

Nick Clark, Chief Executive

Strand Hanson Limited, Financial and Nominated Adviser +44 (0)

20 7409 3494

Richard Johnson, James Bellman

Zeus Capital Limited, Broker +44 (0) 20 3829 5000

Simon Johnson, Louisa Waddell

Investor/Media

+ 44 (0) 7979 604 687

Chris Steele

About Aukett Swanke Group plc

Aukett Swanke Group has a strong foundation in architectural

services and is on a transformative journey to become a

London-listed provider of Smart Buildings and related services. ASG

are uniquely positioned to ensure the technical systems that run

modern premises are designed as an integral part of the structure,

from the outset.

For more information go to https://www.aukettswankeplc.com .

The following notifications are being made in accordance with

the requirements of the EU Market Abuse Regulation as part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018,

as amended.

Notification of Transactions of Persons Discharging Managerial

Responsibility and Persons Closely Associated with them.

1. Details of the person discharging managerial responsibilities

/ person closely associated

a. Name 1. Nick Clark

2. Freddie Jenner

3. Tony Barkwith

4. Jason Brameld

---------------------------------- ---------------------------------------------------

2. Reason for the notification

---------------------------------------------------------------------------------------

a. Position/status 1. Director

2. Director

3. Director

4. PDMR

---------------------------------- ---------------------------------------------------

b. Initial notification/Amendment Initial Notification

---------------------------------- ---------------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

---------------------------------------------------------------------------------------

a. Name Aukett Swanke Group plc

---------------------------------- ---------------------------------------------------

b. LEI 213800WWNHLPUBSUK220

---------------------------------- ---------------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

---------------------------------------------------------------------------------------

a. Description of the Financial Options over Ordinary Shares

instrument, type of instrument of 1p

Identification code ISIN: GB0000617950

---------------------------------- ---------------------------------------------------

b. Nature of the transaction Grant of CSOP options

---------------------------------- ---------------------------------------------------

c. Price(s) and volume(s) Exercise Price(s) Volume(s)

1. 1p 1. 2,000,000

2. 1p 2. 4,700,000

3. 1p and 3. 1,000,000

1.6p and

4. 1p 1,000,000

4. 5,700,000

-------------------------

---------------------------------- ---------------------------------------------------

d. Aggregated information

* Aggregated volume 14,400,000 options

* Price

---------------------------------- ---------------------------------------------------

e. Date of the transaction 22 December 2023

---------------------------------- ---------------------------------------------------

f. Place of the transaction Off-exchange

---------------------------------- ---------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPGUUPUPWGRW

(END) Dow Jones Newswires

December 27, 2023 02:00 ET (07:00 GMT)

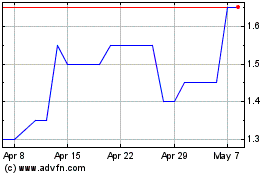

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Mar 2024 to Apr 2024

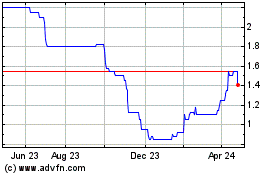

Aukett Swanke (LSE:AUK)

Historical Stock Chart

From Apr 2023 to Apr 2024