Bunzl PLC Trading Statement (0094R)

October 24 2023 - 1:05AM

UK Regulatory

TIDMBNZL

RNS Number : 0094R

Bunzl PLC

24 October 2023

24 October 2023

BUNZL Q3 TRADING STATEMENT

PROFIT IN-LINE WITH EXPECTATIONS; 2023 PROFIT OUTLOOK

MAINTAINED

Bunzl plc, the specialist international distribution and

services Group, today announces its trading statement for the

period since 30 June 2023.

Following Bunzl's strong performance over recent years and

continued resilience, the Group continues to perform well. Adjusted

operating profit over the quarter was in-line with expectations and

the Group reiterates its 2023 adjusted operating profit growth

outlook.

Group revenue in the third quarter declined by 4.8% at constant

exchange rates, with underlying revenue, which is organic growth

adjusted for trading days, declining by 4.7%, driven by a continued

decline in Covid-19 related product sales; a reduced level of

inflation benefit; and wider post-pandemic related normalisation

trends which drove expected volume weakness consistent with the

prior quarter. One fewer trading day than the comparable period

negatively impacted revenue by 0.8%(1) . Acquisitions contributed

growth of 2.0% at constant exchange rates, whilst the disposal of

our UK healthcare business impacted revenue by 1.3%. Overall, at

actual exchange rates, given the weakness of sterling in the prior

year, Group revenue declined by 8.8% over the quarter. Operating

margin over the quarter was very strong, remaining substantially

higher than compared to the pre-pandemic period in 2019, and

slightly ahead of the Group's expectations.

We reiterate our confidence in the Group's 2023 adjusted

operating profit being moderately higher than in 2022 at constant

exchange rates. We expect Group revenue, at constant exchange

rates, to be slightly lower than in 2022, with the benefit of

announced acquisitions offset by some organic decline, following

strong organic growth in recent years, and a small impact from the

UK healthcare disposal. Operating margin in 2023 is now expected to

reach the record level seen in recent years.

In September 2023, Bunzl signed an agreement to acquire CT

Group, a distributor of surgical and medical devices and provider

of value-added logistics services to health providers in Brazil

which will enhance Bunzl's national presence and expand our product

offering. In 2022, the higher margin business generated revenue of

BRL 269 million (c.GBP42 million). Completion of the acquisition is

subject to competition authority clearance.

Towards the end of August 2023, Bunzl completed the acquisition

of Pittman Traffic & Safety Equipment in Ireland, a distributor

of safety and asset protection solutions, such as bollards, speed

bumps and workplace barriers. This acquisition supports the

expansion of our North America based McCue business, which already

has a UK presence. Pittman Traffic & Safety Equipment generated

revenue of EUR 7 million (c.GBP6 million) in 2022.

Commenting on today's announcement, Frank van Zanten, Chief

Executive Officer of Bunzl, said:

"Our performance continues to highlight the strength and

resilience of the Group's business model, with revenue over the

quarter 29% higher, and operating margin substantially higher, than

the comparable period in 2019 at constant exchange rates. I remain

confident in our ability to sustain a higher operating margin

compared to pre-pandemic levels, supported by the acquisitions we

have made over the period. Furthermore, today we announce our

13(th) and 14(th) acquisitions of 2023, with a total year-to-date

committed spend of more than GBP425 million. I remain excited by

the Group's medium-term opportunities, which continue to be driven

by our proven compounding growth strategy and active acquisition

pipeline, supported by a strong balance sheet."

Enquiries:

Bunzl plc Teneo

Frank van Zanten, Chief Executive Martin Robinson

Officer Olivia Peters

Richard Howes, Chief Financial Tel: +44 (0)20 7353 4200

Officer

Sunita Entwisle, Head of Investor

Relations

Tel: +44 (0)20 7725 5000

1. Net of the benefit of growth in excess of 26% per annum in

hyperinflationary economies, largely in Turkey, which contributed a

small increase of 0.1%.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBUBDGIBDDGXX

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

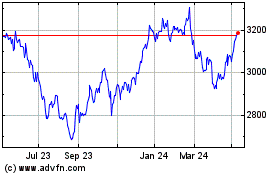

Bunzl (LSE:BNZL)

Historical Stock Chart

From Mar 2024 to Apr 2024

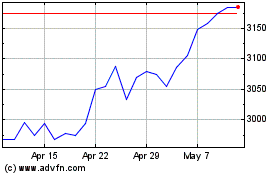

Bunzl (LSE:BNZL)

Historical Stock Chart

From Apr 2023 to Apr 2024