TIDMBRK

RNS Number : 0104P

Brooks Macdonald Group PLC

14 October 2021

14 October 2021

BROOKS MACDONALD GROUP PLC

Quarterly Announcement of Funds under Management

"Growth in FUM to GBP16.8 billion and positive net flows

maintained"

Brooks Macdonald Group plc ("Brooks Macdonald" or "the Group")

today publishes an update on its Funds under Management ("FUM") for

the first quarter of its financial year, the three months ended 30

September 2021.

Total Group FUM at the end of September reached GBP16.8 billion

(30 June 2021: GBP16.5 billion), an overall increase of 2.2% in the

quarter. This reflected continued positive net flows, in line with

the guidance given at the annual results in September, and strong

investment performance.

Highlights for the quarter included:

-- The Group overall had a solid start to the financial year

with positive net flows, in line with the prior quarter and running

at 3.1% on an annualised basis.

-- Overall investment performance for the period was robust at

1.4%, again ahead of the MSCI PIMFA Private Investor Balanced Index

which was up by 0.2%.

-- UKIM discretionary FUM had positive net flows of GBP0.2

billion, an annualised rate of 5.7%. Within that, both the Bespoke

Portfolio Service ("BPS") and the Managed Portfolio Service ("MPS")

had positive net flows, with strong flows in MPS driven in

particular by the continued success of the Group's

business-to-business offering, BM Investment Solutions.

-- Flows in the UKIM Funds business were slightly negative, with

the Defensive Capital Fund continuing to be affected by outflows in

the absolute return sector.

-- The International business saw a sharp reduction in net

outflows during the quarter, with a return to positive net flows

expected from Q2.

The Group has a healthy pipeline with net flows expected to

continue to improve further in line with prior guidance.

Andrew Shepherd, CEO of Brooks Macdonald commented:

"We have made a solid start to the financial year, with positive

net flows in the period contributing to record FUM of GBP16.8bn,

and we have continued to provide benchmark-beating investment

performance for clients. There is a clear energy about the

business, helped by the passion and excitement our team gets from

increasingly meeting face-to-face with advisers and clients again.

We have a strong pipeline and we are confident of further

improvement in net flows over the course of the year."

Analysis of fund flows by service over the period

Quarter to 30 September 2021 (GBPm)

Opening Organic Investment Closing Organic Total

FUM net new performance FUM net new mvmt

1 Jul 21 business in the period 30 Sep 21 business

---------- ---------- --------------- ----------- ---------- ------

BPS 9,460 6 138 9,604 0.1% 1.5%

---------- ---------- --------------- ----------- ---------- ------

MPS 2,411 162 45 2,618 6.7% 8.6%

---------- ---------- --------------- ----------- ---------- ------

UKIM discretionary 11,871 168 183 12,222 1.4% 3.0%

---------- ---------- --------------- ----------- ---------- ------

Funds - DCF 478 (11) 11 478 (2.3)% -%

---------- ---------- --------------- ----------- ---------- ------

Funds - Other 1,598 (15) 15 1,598 (0.9)% -%

---------- ---------- --------------- ----------- ---------- ------

Funds total 2,076 (26) 26 2,076 (1.3)% -%

---------- ---------- --------------- ----------- ---------- ------

UKIM total 13,947 142 209 14,298 1.0% 2.5%

---------- ---------- --------------- ----------- ---------- ------

International 2,512 (14) 18 2,516 (0.6)% 0.2%

---------- ---------- --------------- ----------- ---------- ------

Total 16,459 128 227 16,814 0.8% 2.2%

---------- ---------- --------------- ----------- ---------- ------

Total investment performance 1.4%

-------------------------------------------------------------------------- ------------------

MSCI PIMFA Private Investor Balanced Index(1) 0.2%

-------------------------------------------------------------------------- ------------------

(1) Capital-only index.

Enquiries to:

Brooks Macdonald Group plc www.brooksmacdonald.com

Andrew Shepherd, CEO 020 7659 3492

Ben Thorpe, Chief Financial Officer

Peel Hunt LLP (Nominated Adviser and Broker)

Rishi Shah / Andrew Buchanan / John Welch 020 7418 8900

FTI Consulting brooksmacdonald@fticonsulting.com

Ed Berry / Laura Ewart / Katherine Bell 07703 330199 / 07711

387085 / 07976 870961

Notes to editors

Brooks Macdonald Group plc, through its various subsidiaries,

provides leading investment management services in the UK and

internationally. The Group, which was founded in 1991 and began

trading on AIM in 2005, had discretionary Funds under Management of

GBP16.8 billion as at 30 September 2021.

Brooks Macdonald offers a range of investment management

services to private high net worth individuals, pension funds,

institutions, charities and trusts. The Group also provides

financial planning as well as international investment management,

and acts as fund manager to a range of onshore and international

funds.

The Group has thirteen offices across the UK and the Channel

Islands including London, Cheltenham, East Anglia, Exeter,

Hampshire, Leamington Spa, Leeds, Manchester, Tunbridge Wells,

Scotland, Wales, Jersey, Guernsey.

LEI: 213800WRDF8LB8MIEX37

www.brooksmacdonald.com / @BrooksMacdonald

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPGMUUUPGGMW

(END) Dow Jones Newswires

October 14, 2021 02:00 ET (06:00 GMT)

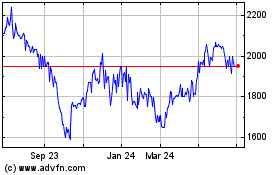

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

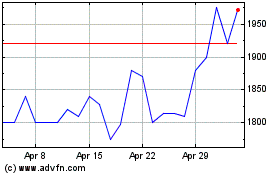

Brooks Macdonald (LSE:BRK)

Historical Stock Chart

From Apr 2023 to Apr 2024