TIDMBWNG

RNS Number : 5025A

Brown (N.) Group PLC

30 September 2020

30(th) September 2020

TRADING UPDATE FOR THE 6 MONTHS TO 29(th) AUGUST 2020

Highlights

-- Improved product revenue trajectory through Q2 with 92% of product revenue now digital

-- Financial services cash collection rates in line with the prior year

-- Continued operating cost reduction reflecting agility of business model

-- Reduction in debt underway and continuing

-- Group continues to trade in line with its expectations

Improved product revenue trajectory

Q1 FY'21 Q2 FY'21 H1 FY'21

Product revenue (28.8%) (12.0%) (20.5%)

--------------- --------------- --------

Financial Services revenue (8.3%) (15.8%) (12.3%)

--------------- --------------- --------

Group revenue (21.9%) (13.4%) (17.6%)

--------------- --------------- --------

Q1 FY'21 is the 13 weeks to 30(th) May 2020, Q2 FY'21 is the 13

weeks to 29(th) August 2020

Product revenue trajectory has continued to improve through the

second quarter from the sudden and significant decline experienced

in the first quarter as Covid-19 lockdown restrictions were

introduced. Apparel sales have continued to recover from mid-March

levels and demand for Home & Gift, supported by the launch of

our new Home Essentials brand on 1(st) April, continued to be well

above the prior year. All Womenswear and Menswear brands performed

better in the second quarter, in particular JD Williams and

Jacamo.

As expected, lower product revenue, regulatory changes and a

smaller debtor book resulted in lower Financial Services revenue. A

very small number of customers required forbearance as a result of

FCA Covid-19 guidance and as at 29(th) August 2020 less than 1% of

debtor balances remained on a Covid-19 related payment holiday,

down from a peak of 3% in May 2020.

Continued focus on operating costs

The Group took swift and decisive action to maximise operating

efficiency and strengthen liquidity following the onset of the

pandemic. The Group has continued to exercise this discipline with

operating costs materially lower in the second quarter compared to

the prior year. This is further demonstration of the Group's agile

and flexible operating cost base. Material volume and cost

efficiency savings were achieved across all areas of the cost base,

with the most material savings in marketing costs. As previously

guided, in this financial year the Group is confident of offsetting

at least 75% of the Group gross profit decline through operational

cost savings.

Reduction in debt underway

Financial Services cash collection rates have continued to

perform and remain in line with the prior year. As a result of our

on-going focus on cash generation, tight cost control, reduction in

capital expenditure and suspension of the dividend, together with a

smaller debtor book, the Group has started its objective of

reducing its level of indebtedness. The Group has reduced net debt

by 17.3% in the half, to GBP411.1m. As previously guided, we expect

our year-end net debt to be in the range of GBP380m to GBP400m.

As at 29(th) August 2020, drawings under the Group's borrowing

facilities stood at GBP455.9m down from GBP544.6m at 29(th)

February 2020. Net cash generation in the period was GBP45.3m and

as at 29(th) August 2020 cash balances stood at GBP44.8m and the

overdraft facility was undrawn.

GBPm 29(th) August 29(th) February Change

2020 2020

Drawings under the RCF (75.0) (125.0) (40.0%)

-------------------- ---------------------- -------

Drawings under the CLBILS(1) (2.0) - n/a

-------------------- ---------------------- -------

Drawings under the overdraft - - -

facility

-------------------- ---------------------- -------

Cash balances 44.8 47.5 (5.7%)

-------------------- ---------------------- -------

Unsecured Net Debt(2) (32.2) (77.5) (58.5%)

-------------------- ---------------------- -------

Drawings under the securitisation

facility (378.9) (419.6) (9.7%)

-------------------- ---------------------- -------

Net Debt(3) (411.1) (497.0) (17.3%)

-------------------- ---------------------- -------

Gross Debtor Book 632.1 656.9 (3.8%)

-------------------- ---------------------- -------

1 Under the terms of the GBP50m CLBILS three-year term loan

facility the Group was required to drawdown a minimum of GBP2m

against the facility in order to maintain access to it

2 Excludes debt securitised against receivables (customer loan

book) of GBP378.9m and lease liabilities of GBP6.0m

3 Total liabilities from financing activities less cash,

excluding lease liabilities

Steve Johnson, Chief Executive, said:

"It is encouraging to see a continued improving trend in trading

following the sharp decline witnessed upon the initial impact of

Covid-19, with trading in-line with expectations. Home & Gift

sales in the first half of our financial year have been

particularly strong and our fashion brands continue to recover,

particularly JD Williams and Jacamo. We have accelerated our

digital transformation and 92% of our product revenue is now

digital.

Our financial services cash collection rates have remained

stable and we continue to offer support and flexibility to those

credit customers who require it. We will continue to implement our

refreshed strategy, and particularly mindful of an uncertain UK

retail environment, we will continue to focus on cost control,

deleveraging and cash generation."

Half year results for the 6 months ended 29 (th) August 2020

N Brown will release its results for the 6 months ended 29(th)

August 2020 on 5(th) November 2020.

For further information:

N Brown Group

Will MacLaren, Director of Investor

Relations and Corporate Communications 07557 014 657

MHP Communications

Andrew Jaques / Simon Hockridge 0203 128 8789

/ James Midmer NBrown@mhpc.com

About N Brown Group:

N Brown is a top 10 UK clothing & footwear digital retailer.

We are size inclusive, focusing on the needs of underserved

customer groups - size 20+ and age 50+. We offer an extensive range

of products, predominantly clothing, footwear and homewares, and

our financial services proposition allows customers to spread the

cost of shopping with us. We have five distinct brands: Simply Be,

JD Williams, Ambrose Wilson, Jacamo and Home Essentials. We are

headquartered in Manchester where we design, source and create our

product offer and we employ over 2,200 people across the UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSDARIAFII

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

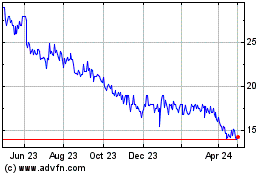

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

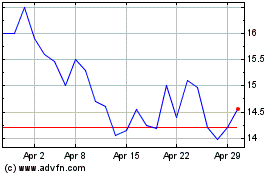

Brown (n) (LSE:BWNG)

Historical Stock Chart

From Apr 2023 to Apr 2024