TIDMCMRS

RNS Number : 0845O

Critical Mineral Resources PLC

29 September 2023

29 September 2023

Critical Mineral Resources PLC

('CMR' or the 'Company')

Interim Results

Critical Mineral Resources plc (LON:CMRS), the exploration and

development company focused on clean energy commodities, is pleased

to announce its unaudited interim results for the six months ended

30 June 2023 ('H1 2023' or the 'Period').

Highlights in H1 2023

-- The Company completed its strategic review of the business,

determining that it would continue to take opportunities arising

from and aligned to supporting the European electric vehicle supply

chain and its compliance with increasing global legislation.

-- The strategic review included a detailed analysis of

appropriate jurisdictions. Following this, Morocco was identified

as a target jurisdiction. With deposits of copper, manganese,

nickel and potentially other clean technology metals and minerals,

Morocco has proven well-mineralised geology yet is under-explored.

Morocco's main trading partner is the European Union, and its

modern infrastructure, proximity to Europe and political stability

make it an excellent country for CMR to operate in.

-- Critically a range of international organisations, including

major car manufacturers and battery materials organisations, have

recently identified Morocco as a key hub to serve international

markets, highlighting the value opportunity for locally sourced

battery commodities.

-- CMR launched its operations into Morocco:

o Acquisition of 80% controlling interest in Atlantic Research

Minerals ('ARM') through a cash consideration of US$10,000.

-- Following the review of the RIWAQ portfolio, the Company

decided not to pursue the opportunity due to the early-stage nature

of the projects and the size of the portfolio.

-- Achieved a reduction in pre-tax losses during H1 2023,

reporting a pre-tax loss of GBP477,328 (H1 2022: GBP1,391,356).

This marked improvement includes a reduced loss from discontinued

operations, which amounted to GBP36,988 (H1 2022: GBP733,126).

-- Operating activities resulted in a net cash outflow of

GBP425,361 during the period. The Company's net cash position

improved, increasing to GBP248,297.

Post Period

-- On 14 September 2023, the Company announced the completion of

the Cyprus Asset Sale. This followed the receipt in September of a

third payment of GBP169,639 (US$213,750). This completion will

result in the removal of approximately GBP1.3m of liabilities from

the Group balance sheet. The final payment of US$214,250 plus

interest is due on 22 December 2023 .

-- The Company has made good operational progress:

o The Company has entered into binding heads of terms on the

Anzar Project, a high-grade sedimentary hosted copper-silver

project in central Morocco.

o The Ighrem Research permit was secured, a 16km(2) area that

contains high-grade manganese and barite mineralisation.

o ARM's Incubator Portfolio continues to advance opportunities

to secure ground in three separate regions.

-- Reflecting its evolved strategy, the Company changed its name

from Caerus Mineral Resources PLC to Critical Mineral Resources

PLC, aligning its brand with its corporate focus, operating

strategy and market position.

-- Morocco has continued to gain significant recognition from

global organisations as a battery commodity and materials hub with

commitments from China's CNGR Advanced Material to build a cathode

materials plant in Morocco to supply the US and European battery

markets as well as South Korea's LG Chem committing to build a

lithium refinery and cathode materials plant in the country.

Charles Long, Chief Executive Officer of CMR PLC, commented:

"We are delighted with the Company's progress against our

targeted strategy of taking opportunities arising from and aligned

to supporting the European electric vehicle supply chain and its

compliance with increasing global regulation.

Following our targeted analysis of Morocco as a jurisdiction

with all the appropriate resource opportunities and market

dynamics, we are pleased with the progress we have made in

acquiring top talent and development opportunities through Atlantic

Research Minerals. We believe the Anzar Project has the potential

to be extremely valuable for CMR shareholders but look forward to

building out our portfolio of development opportunities further. We

are in advanced discussions with a number of parties.

The recognition that Morocco has gained in recent months from

large-scale global stakeholders in the battery materials supply

chain clearly validates our strategy and belief that the country

has a significant opportunity to become a global battery

commodities and materials hub".

For further information, please contact:

Critical Mineral Resources plc info@cmrplc.com

Charles Long, Chief Executive Officer

Novum Securities

Jon Belliss +44 (0) 20 7399 9425

---------------------

Hudson Sandler (Financial PR)

Charlie Jack +44 (0) 207 796 4133

---------------------

Notes To Editors

Critical Mineral Resources (CMR) plc is an exploration and

development company focused on developing assets that produce key

commodities essential for renewable energy, battery storage and

electrification to support the clean energy revolution. These

commodities are widely recognised as being at the start of a supply

and demand supercycle.

CMR is building a diversified portfolio of high-quality metals

exploration and development projects in Morocco, focusing on

copper, nickel, manganese, cobalt, and potentially rare earths. CMR

identified Morocco as an ideal mining-friendly jurisdiction that

meets its acquisition and operational criteria. The country is

perfectly located to supply raw materials to Europe and possesses

excellent prospective geology, infrastructure and attractive

permitting, tax and royalty conditions. In 2023, the Company

acquired an 80% stake in leading Moroccan exploration and

geological services company Atlantic Research Minerals SARL.

Since taking over the CMR in 2022, the current management has

completed a comprehensive strategic review and restructuring of the

business and implemented its clear strategy to maximise exploration

and resource development opportunities for the benefit of all

stakeholders. The Company is listed on the London Stock

Exchange (CMRS.L). More information regarding the Company can be found at www.cmrplc.com

Chairman's Review of Year to date

Dear Shareholders,

I am pleased to present our Interim Results for 2023. This

period has been marked by significant developments that underline

our commitment to sustainable growth and the supply of essential

commodities for the clean energy revolution.

One of the most noteworthy milestones was our strategic decision

to enter Morocco, a jurisdiction teeming with promise. Through the

acquisition of an 80% controlling interest in ARM, we have secured

a strong foothold in Morocco's rich mineral landscape. Since this

acquisition, we've made remarkable progress - secured the Ighrem

Research permit, an area with high-grade manganese and barite

mineral deposits; progressed with advancing the Incubator Portfolio

where we are actively working to secure land in three distinct

prospective regions. The Company has also entered into binding

heads of terms on the Anzar Project, a high-grade, sedimentary

copper-silver project in central Morocco.

These developments underscore the geological potential of the

regions in which we are prospecting. They also highlight the robust

expertise of our Moroccan subsidiary, ARM. Our strategic focus

remains clear: we are committed to harnessing the potential of

these assets to create sustainable value for our stakeholders, even

as we navigate challenging market conditions.

In the pursuit of opportunities, we conducted a thorough review

of the RIWAQ portfolio. Regrettably, we made the difficult decision

not to pursue this opportunity due to the early stage of the

projects and the extensive size of the portfolio.

As we transition to Critical Mineral Resources PLC, we look

forward to an exciting future characterised by continued growth,

exploration, and the pursuit of opportunities that align with our

mission to support the clean energy sector and drive long-term

shareholder value.

Looking ahead, we aim to continue making progress in Morocco

through our ARM portfolio, as well as actively seeking other

licences and opportunities in the country.

Financials

During the period, the Group made a pre-tax loss of GBP477,328

(six months ended 30 June 2022: loss of GBP1,391,356). This

includes the loss from discontinued operation of GBP36,988 (six

months ended 30 June 2022: GBP733,126). The net liabilities of the

Group increased from GBP156,560 as of 31 December 2022 to

GBP647,256 as of 30 June 2023.

During the period, the net cash outflow from operating

activities was GBP425,361, and the net cash position increased by

GBP106,280 to GBP248,297.

I would like to thank our employees, partners and shareholders

for their continued support of Critical Minerals Resources.

Directors' Responsibility Statement

The Directors confirm that these condensed interim financial

statements have been prepared in accordance with UK adopted

International Accounting Standard 34, 'Interim Financial Reporting'

and the Disclosure Guidance and Transparency Rules sourcebook of

the United Kingdom's Financial Conduct Authority and that the

interim management report includes a fair review of the information

required by DTR 4.2.7 and DTR 4.2.8, namely:

-- An indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- Material related-party transactions in the first six months

and any material changes in the related-party transactions

described in the last annual report.

The interim report was approved by the Board of Directors and

the above responsibility statement was signed on its behalf by:

Chris Lambert

Executive Chairman

29 September 2023

Condensed Consolidated Statement of Profit or Loss and Other

Comprehensive Income

Six months Six months

to 31 June to 31 June

2023 (unaudited) 2022* (unaudited)

Note GBP GBP

Continuing operations:

Administrative expenses 3 (439,151) (658,217)

Finance costs (1,189) (13)

------------------- --------------------

Operating loss and loss before

taxation (440,340) (658,230)

Income tax expense - -

------------------- --------------------

Total loss from continuing operations (440,340) (658,230)

Loss from discontinued operations (36,988) (733,126)

------------------- --------------------

Loss for the period (477,328) (1,391,356)

Total loss attributable to:

Owners of Critical Mineral Resources

plc (476,320) (1,370,688)

Non-controlling interests (1,008) (20,668)

------------------- --------------------

(477,328) (1,391,356)

Other comprehensive income:

Items that may be reclassified

subsequently to profit and loss:

Exchange differences on translation

of foreign operations (13,370) (18,932)

------------------- --------------------

Other comprehensive profit (loss)

for the period arising from discontinued

operations (13,370) (18,932)

Total comprehensive loss for the

period (490,698) (1,410,288)

Total comprehensive loss attributable

to:

Owners of Critical Mineral Resources

plc (489,641) (1,389,620)

Non-controlling interests 1,057 (20,668)

------------------- --------------------

(490,698) (1,410,288)

Total comprehensive loss attributable

to Owners of Critical Mineral Resources

plc:

Continuing operations (440,340) (656,494)

Discontinued operations (49,301) (733,126)

------------------- --------------------

(489,641) (1,389,620)

Earnings per share:

Total basic and diluted loss per

share (GBP):

Continuing operations 4 (0.009) (0.011)

Continued and discontinued operations 4 (0.009) (0.023)

*Restated to show continued and discontinued operations as

comparative

The above condensed Consolidated Statement of Profit or Loss and

Other Comprehensive Income should be read in conjunction with the

accompanying notes.

Condensed Consolidated Statement of Financial Position

As at As at

30 June 31 December

2023 2022

Note GBP GBP

ASSETS

Non-current assets

Tangible assets 54,732 83,902

Total non-current assets 54,732 83,902

Current assets

Other receivables 53,827 527,237

Cash and cash equivalents 236,089 115,824

289,916 643,061

Assets classified as held for

sale 533,532 515,796

------------ -------------

Total current assets 832,448 1,158,857

------------ -------------

Total assets 878,180 1,242,759

------------ -------------

LIABILITIES

Non-current liabilities

Lease liabilities (18,756) (23,717)

------------ -------------

Total non-current liabilities (18,756) (23,717)

Current liabilities

Trade and other payables 5 (183,103) (95,826)

Lease liabilities (37,427) (61,718)

------------ -------------

(220,530) (157,544)

Liabilities directly associated

with assets classified as held

for sale (1,286,152) (1,218,058)

Total current liabilities (1,506,682) (1,375,602)

Total liabilities (1,525,438) (1,399,319)

Net liabilities (647,258) (156,560)

============ =============

EQUITY

Share capital 6 612,113 612,113

Share premium 6 5,840,002 5,840,002

Other equity 7 - -

Share-based payment reserve 32,680 68,706

Foreign exchange reserve 197,896 212,323

Retained earnings (7,297,242) (6,856,948)

------------ -------------

Capital and reserves attributable

to owners of Critical Mineral

Resources plc (614,551) 5,018,542

------------ -------------

Non-controlling interests (32,707) (32,756)

------------ -------------

Total equity (647,258) (156,560)

============ =============

The above Condensed Consolidated Financial Statements should be

read in conjunction with the accompanying notes.

The Financial Statements were approved and authorised for issue

by the Board on 29 September 2023 and were signed on its behalf by:

Charlie Long, Director

Condensed Consolidated Statement of Changes In Equity

Share-based Foreign

Share Share payment Retained exchange Non-controlling

capital premium reserve earnings reserve interest Total

GBP GBP GBP GBP GBP GBP GBP

Balance as at

30 June 2022 612,113 5,840,002 215,245 (2,883,579) (38,531) (89,715) 3,655,535

--------- ----------- ----------- ------------- --------- --------------- -----------

Comprehensive

income

Loss for the

6 months - - - (4,140,854) - (7,494) (4,148,348)

Exchange differences

on translation

of foreign operations - - - - 250,854 15,847 266,701

--------- ----------- ----------- ------------- --------- --------------- -----------

Total comprehensive

income for the

6 months - - - (4,140,854) 250,854 8,353 (3,881,647)

Transactions

with owners recognised

directly in equity

Transactions

with NCI - - - - - 48,606 48,606

Share-based payments - - 20,946 - - - 20,946

Cancelled warrants - - (167,485) 167,485 - - -

--------- ----------- ----------- ------------- --------- --------------- -----------

Total transactions

with owners recognised

directly in equity - - (146,539) 167,485 - 48,606 69,552

--------- ----------- ----------- ------------- --------- --------------- -----------

Balance as at

31 December 2022 612,113 5,840,002 68,706 (6,856,948) 212,323 (32,756) (156,560)

--------- ----------- ----------- ------------- --------- --------------- -----------

Comprehensive

income

Loss for the

6 months - - - (476,320) - (1,008) (477,328)

Exchange differences

on translation

of foreign operations - - - - (14,427) 1,057 (13,370)

--------- ----------- ----------- ------------- --------- --------------- -----------

Total comprehensive

income for the

6 months - - - (476,320) (14,427) 49 (490,698)

Transactions

with owners recognised

directly in equity

Lapsed warrants - - (36,026) 36,026 - - -

--------- ----------- ----------- ------------- --------- --------------- -----------

Total transactions

with owners recognised

directly in equity - - (36,026) 36,026 - - -

--------- ----------- ----------- ------------- --------- --------------- -----------

Balance as at

30 June 2022 612,113 5,840,002 32,680 (7,297,242) 197,896 (32,707) (647,258)

--------- ----------- ----------- ------------- --------- --------------- -----------

Condensed Consolidated Statement of Cash Flows

6 month 6 month

period ended period ended

30 June 30 June

2023 2022

Notes GBP GBP

Cash flow from operating activities

Loss for the period before taxation (477,328) (1,391,356)

Adjustments for:

Interest expense 1,189 13

Depreciation 34,866 11,926

Impairment of financial assets - 352,885

Impairment of assets (net of

tax) - 853,989

Write back of contingent consideration - (186,914)

Share-based payment expense - 116,326

Foreign exchange gain on financial

assets (22,252) (44,034)

-------------

Operating cash flows before

movements in working capital (463,525) (287,165)

Increase in trade and other receivables (31,675) (86,043)

Increase in trade and other payables 69,839 29,826

------------- --------------

Net cash used in operating activities (425,361) (343,382)

Cash flow from investing activities

Return of deposit on potential 500,000 -

acquisition

Deposit for sale of subsidiaries 5 88,002 -

Expenditure on intangible assets (29,450) (730,666)

Proceeds/(expenditure) on tangible

assets 6,000 (24,133)

------------- --------------

Net cash flow from investing

activities 564,552 (754,799)

Cash flow from financing activities

Interest paid (1,189) (13)

Finance lease payments (31,723) -

Net cash outflow from financing

activities (32,912) (13)

Net increase/(decrease) in cash

and cash equivalents 106,279 (1,098,194)

------------- --------------

Effect of exchange rates on cash 1 (20,747)

Cash and cash equivalent at beginning

of the half year 142,017 2,508,108

------------- --------------

Cash and cash equivalent at

end of the half year 248,297 1,389,167

============= ==============

The above condensed Consolidated Statement of Cash Flows should

be read in conjunction with the accompanying notes.

Notes to the condensed interim financial statements

1. General information

The principal activity of the Company and its subsidiaries (the

Group) is in mineral exploration and the development of appropriate

exploration projects. The Company's registered office is at

Eccleston Yards, 25 Eccleston Place, London, SW1W 9NF. Its shares

are listed on the Main Market of the London Stock Exchange under

the Standard Segment of the Official List under the ticker

"LSE:CMRS". On 17 August 2023 the Company changed its name from

Caerus Mineral Resources PLC to Critical Mineral Resources PLC.

2. BASIS of PREPARATION

These condensed interim financial statements are for the six

months ended 30 June 2023 and have been prepared in accordance with

the accounting policies adopted in the Group's most recent annual

financial statements for the year ended 31 December 2022.

The Group have chosen to adopt IAS 34 "Interim Financial

Reporting" in preparing this interim financial information. They do

not include all the information required in annual financial

statements, and they should be read in conjunction with the

consolidated financial statements for the year ended 31 December

2022 and any public announcements made by Critical Mineral

Resources Plc ("CMR") during the interim reporting period.

The business is not considered to be seasonal in nature.

The functional currency for each entity in the Group is

determined as the currency of the primary economic environment in

which it operates. The functional currency of the parent company

CMR is Pounds Sterling (GBP) as this is the currency that finance

is raised in. The functional currency of its subsidiaries is the

Euro as this is the currency that mainly influences labour,

material and other costs of providing services. The Group has

chosen to present its consolidated financial statements in Pounds

Sterling (GBP), as the Directors believe it is a more convenient

presentational currency for users of the consolidated financial

statements. Foreign operations are included in accordance with the

policies set out in the Annual Report and Accounts.

The condensed interim financial statements have been approved

for issue by the Board of Directors on 29 September 2023.

New standards, amendments and interpretations adopted by the

Group.

During the current period the Group adopted all the new and

revised standards, amendments and interpretations that are relevant

to its operations and are effective for accounting periods

beginning on 1 January 2023. This adoption did not have a material

effect on the accounting policies of the Group.

New standards, amendments and interpretations not yet adopted by

the Group.

The standards and interpretations that are relevant to the

Group, issued, but not yet effective, up to the date of these

interim Financial Statements have been evaluated by the Directors

and they do not consider that there will be a material impact of

transition on the financial statements.

Going concern

The condensed interim financial statements have been prepared on

the assumption that the Group will continue as a going concern.

Under the going concern assumption, an entity is ordinarily viewed

as continuing in business for the foreseeable future with neither

the intention nor the necessity of liquidation, ceasing trading or

seeking protection from creditors pursuant to laws or regulations.

In assessing whether the going concern assumption is appropriate,

the Directors take into account all available information for the

foreseeable future, in particular for the twelve months from the

date of approval of the condensed interim financial statements.

The Group's assets are not currently generating revenues, an

operating loss has been reported and an operating loss is expected

in the 12 months subsequent to the date of these financial

statements. The Company will be looking to raise further funds/has

the ability to place the approximately 10.7 million Ordinary Shares

held by itself, to raise the additional finance required to fund

the building of its exploration portfolio.

The Board, whilst acknowledging this material uncertainty,

remains confident of raising finance and therefore have concluded

that there is a reasonable expectation that the Company has access

to adequate resources to continue in operational existence for the

foreseeable future. In the event of lack of funds, the Directors

would implement temporary reductions in salaries. For this reason,

the Directors have adopted the going concern basis in preparing the

condensed interim f inancial statements.

Risks and uncertainties

The Directors continuously assess and monitor the key risks of

the business. The key risks that could affect the Group's

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Group's

most recent annual financial statements for the year ended 31

December 2022.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Significant items subject to such estimates are

set out in Group's most recent annual financial statements for the

year ended 31 December 2022. The nature and amounts of such

estimates have not changed during the interim period.

Segmental reporting

For the purpose of IFRS 8, the Chief Operating Decision Maker

"CODM" takes the form of the board of directors. The Directors are

of the opinion that the business of the Group focused on two

reportable segments as follows:

-- (All continued operations) - Head office, corporate and

administrative, including parent company activities of raising

finance and seeking new investment opportunities, all based in the

UK and

-- (All discontinued operations) - Mineral exploration, all

based in Cyprus (all discontinued operations and disclosed in this

note as the CODM have continued to review the results of this

segment for the year).

The separation of these segments are clearly shown on the face

of the consolidated profit and loss account and the consolidated

balance sheet and as such, are not reported separately here.

3. ADMINISTRATIVE EXPENSES

6 months 6 months

to 30 June to 30 June

2023 2022*

GBP GBP

Wages and salaries 207,186 124,655

Regulatory fees 21,729 22,449

Share-based payments - 116,327

Estimated credit loss - 352,886

Depreciation 29,170 -

Foreign exchange - (44,006)

Legal and Professional fees 137,134 58,181

Other 43,932 27,725

------------ ------------

439,151 658,217

------------ ------------

*Restated to only show continuing operations

4. EARNINGS PER SHARE

The calculation for earnings per Ordinary Share (basic and

diluted) is based on the consolidated loss attributable to the

equity shareholders of the Company is as follows:

Period ended Period ended

Continuing operations: 30 June 2023 30 June 2022*

Total loss for the period (GBP) (440,340) (658,230)

-------------- ---------------

Weighted average number of

Ordinary shares** 50,252,945 61,211,258

-------------- ---------------

Total Loss per Ordinary share

(GBP) (0.009) (0.011)

-------------- ---------------

Continuing and discontinued

operations:

Total loss for the period (GBP) (477,328) (1,391,356)

-------------- ---------------

Weighted average number of

Ordinary shares 50,252,945 61,211,258

-------------- ---------------

Total Loss per Ordinary share

(GBP) (0.009) (0.023)

-------------- ---------------

*Restated to show continued and discontinued operations as

comparative

Earnings and diluted earnings per Ordinary share are calculated

using the weighted average number of Ordinary shares in issue

during the period. There were no dilutive potential Ordinary shares

outstanding during the period.

**Shares held by the Company at year end of 10,685,313 have been

excluded from the weighted average number of Ordinary shares

calculation from the date of gift.

5. TRADE AND OTHER PAYABLES

30 June 2023 31 December

2022

GBP GBP

Trade creditors 51,599 21,310

Accruals and other payables 23,933 60,800

Taxes and social security 19,569 13,716

Advanced payment 88,002 -

------------- ------------

183,103 95,826

------------- ------------

The advanced payment relates to the Cyprus Asset Sale and the

first payment made on 17 February 2023 of US$100,000

(GBP88,002).

6. SHARE CAPITAL AND SHARE PREMIUM

Number of Share Capital Share Premium Total

shares - GBP

Ordinary GBP

GBP

As at 31 December

2022 61,211,258 612,113 5,840,002 6,452,115

As at 30 June 2023 61,211,258 612,113 5,840,002 6,452,115

Included in the share premium balance is the cost of shares

issued to date of GBP314,550 (30 June 2022 and 31 December 2022

GBP314,550).

7. OTHER EQUITY

Other equity consists of "Treasury Shares" in Critical Mineral

Resources Plc that are held by the Company. These were gifted back

to the Company for nil consideration and are therefore recognised

in other equity at nil value. These have accounted for as Treasury

shares, though they are not legally considered to be Treasury

Shares as they were not "purchased" by the Company.

The number of shares gifted back to the Company amounts to

10,685,313 Ordinary shares and if recognised at fair value, at the

listed price on day of transfer, would be stated at a fair value of

GBP620,745.

8. WARRANTS and OPTIONS

The following table sets out the movement of warrants during the

period, no warrants were exercised during either period:

Number of warrants Exercise price (pence)

-------------------- ------------------- -----------------------

As at 31 December 8,283,174 5.0p to 30.0p

2022

Expired in the year 3,801,174 12.5p to 17.0p

-------------------- ------------------- -----------------------

As at 30 June 2023 4,482,000 5.0p to 30.0p

-------------------- ------------------- -----------------------

The Group has issued the following warrants, which are still in

force at the balance sheet date.

Date of Reason for issue No. of Exercise Life

Issue warrants price pence in years

per share

------------ -------------------------- ---------- ------------ ---------

Founder warrants - dated

25/01/2018 from Admission 300,000 5.0p 0.7

Placing warrants - Share

05/10/2021 Issue 3,750,000 30.0p 0.3

Broker warrants B - Cost

05/10/2021 of Services 432,000 20.0p 1.3

----------

4,482,000

----------

SHARE OPTIONS

On 25 November 2022, the Company granted options over a total of

4,400,000 Ordinary shares of 1 pence each in the capital of the

Company with an exercise price of 7.5 pence per Ordinary share.

The Options will vest in three instalments and will have an

exercise period of five years. The first tranche will vest when the

closing mid-market share price reaches 7.5 pence or above for three

consecutive trading days. The second tranche will vest when the

share price reaches 12.5 pence. The third tranche will vest when

the share price reaches 17.5 pence.

9. SUBSEQUENT EVENTS

On 3 July 2023, the Company acquired an 80% holding in Atlantic

Research Minerals, a local exploration company registered in

Morocco, for cash consideration of US$10,000.

On 17 August 2023 the Company changed its name from Caerus

Mineral Resources PLC to Critical Mineral Resources PLC.

On 14 September 2023, following receipt of the third payment of

GBP169,639 (US$213,750), the Company announced the completion of

the Cyprus Asset Sale to PM Ploutonic Metals Ltd ('Ploutonic') and

Indo-European Mining PR Ltd ('Indo'). The final payment of

US$214,250 plus interest is due on 22 December 2023. The interest

is calculated at 8% on any outstanding amounts from 12 May to

Completion (13 September) and from Completion to the Final Payment

Date.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

IR UWUARORUKUUR

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

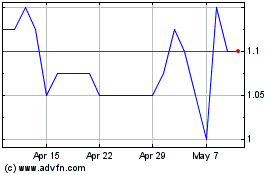

Critical Mineral Resources (LSE:CMRS)

Historical Stock Chart

From Apr 2024 to May 2024

Critical Mineral Resources (LSE:CMRS)

Historical Stock Chart

From May 2023 to May 2024