TIDMCNC

RNS Number : 8393M

Concurrent Technologies PLC

19 September 2023

19 September 2023

Concurrent Technologies PLC

(the "Company")

Interim Results for the six months ended 30 June 2023

Concurrent Technologies PLC (AIM: CNC), a world leading

specialist in high-end embedded computer products for critical

applications, announces its interim results for the six months to

30 June 2023 ("H1 2023").

Financial Performance

Strengthened order intake has translated into record H1 2023

revenue at GBP12.1M (representing a 63% increase on H1 2022, and a

22% increase on H1 2020, which was the best revenue year to date).

Demand for the Company's products remains strong with a H1 order

intake of GBP14.5M (H1 2022: GBP14.2M) and record backlog of GBP29M

(31 December 2022: GBP26.7M). Despite ongoing challenges with

component supply, it is reducing in both difficulty of supply and

lead times, beginning to unlock what had otherwise been a major

constraint to revenue for the previous 2 years, and will ease

further throughout the remainder of this year.

-- Revenue of GBP12.1M (H1 2022: GBP7.4M) - remained constrained

by components, however, represents a record half year, with an

increase of 63% on prior year.

-- Gross profit of GBP6.0M (H1 2022: GBP3.7M); an increase of 62% on prior year.

-- Gross margin of 49.7% (H1 2022: 50.4%) - reduced as the

result of price increases of some components due to high demand and

limited supply, and increased manpower costs.

-- Operating profit of GBP1.0M (H1 2022: GBP0.0M) -

predominantly driven by increase revenue, and hence gross profit

(+GBP2.3M); net costs increased by cGBP1.3M, in line with

investment strategy (Enabling Functions e.g. People, Commercial,

Procurement; Operations e.g. talent, 2 shifts; Engineering talent;

Facilities e.g. Theale office; Leadership team).

-- Profit before tax of GBP1.0M (H1 2022: GBP0.0M).

-- EPS of 1.54 pence (H1 2022: 0.75 pence); increase of 105% on prior year.

-- Cash Balance (including cash deposits) as at 30 June 2023 of GBP3M (31 Dec 2022: GBP4.5M).

o Increased cash from Operations of GBP0.5M (due to a stronger

H1), including increased inventory of GBP1M.

o Decrease of GBP2M from investment activity, predominantly

driven by R&D (GBP1.7M).

Operational Summary

-- Strong order intake of GBP14.5M as at 30 June 2023, with

significant backlog of GBP29M compared to GBP20.3M backlog as at 30

June 2022, up 42%.

-- Revenue defined by components availability in H1.

-- Defence remains the largest market sector at 73% revenue.

-- Global customer base is solid with exports generating +90% of revenue.

-- Investment in R&D costs (talent, improved process &

analysis, materials) have continued (+GBP0.4M), in line with stated

strategy to improve the cadence and time to market of products that

offer the very latest technology.

-- Launched new product Hermes, the latest processer plug-in card.

-- Key Partnership agreement announced with Alpha Data to act as

a reseller of their FPGA (Field Programmable Gate Array) based plug

in card.

-- New distributor agreement with SoC-e to enable the company to

offer the portfolio of Relyum Advanced Networking Solutions.

-- Component shortages have remained challenging, limiting the

company's ability to ship product. This is expected to ease in H2

2023.

-- Major new systems order with FTSE 250 customer for GBP1.25M.

Miles Adcock, CEO of Concurrent Technologies, commented : "We

are delivering on our commitment to transition our core Single

Board Computer business into growth. We maintained focus and

investment throughout a difficult period of component constraints;

and are now seeing the customer demand for our new products

reflected as increased revenues. In parallel we have been

underpinning capability in relation to a wider systems offering,

utilising our own products, but also partners' products for use in

higher value products and services. This progress on multiple

fronts creates the right conditions for our recently announced

equity raise and associated acquisition of Phillips Aerospace to

accelerate our Systems strategy. Together these developments

provide us with confidence for the future."

CHAIRMAN'S STATEMENT

The first half of 2023 has seen a significant recovery in the

trading performance of the Company, with record revenues as the

component shortages ease, although key shortages are still an issue

impacting our ability to convert backlog into revenue. Order intake

remains strong and our improved time to market with new innovative

products will further grow and broaden our customer base.

The acquisition of Phillips Aerospace in September 2023 is an

important step in growing our Systems business, transforming the

Company beyond our historic Single Board focus, with the potential

for a step change in the available market opportunity for the

Company.

Although an interim dividend is not being declared, we are

confident we will continue the recovery in the second half of 2023

which will allow us to consider the re-introduction of a full year

dividend.

CHIEF EXECUTIVE'S REVIEW

Financial Summary

The performance of the Company has remained challenged through

limitations of component supply in H1 2023, resulting in a

restricted, although record, revenue of GBP12.1M (H1 2022 GBP7.4M),

a significant increase of 63% on prior year. The company continues

to have strong backlog (contracted work) at GBP29M at H1 2023 (H1

2022: GBP20.3M), and the Company expects H2 2023 component supply

to be improved over that of H1 2023, following a critical delivery

in July 2023.

Gross margin is 49.7% (H1 2022; 50.4) which is driven primarily

by cost of components. The company has seen a rise in prices during

the period of shortage and high demand.

The Company has delivered an unaudited profit before tax of

GBP1M (H1 2022; GBP0.0M). This is a GBP1M increase on 2022,

represented by the increase revenue (+GBP4.7M on H1 2022) and

corresponding gross profit (+GBP2.3M), however net operating

expenses were up on prior year, in line with the investment

strategy at GBP5.0M (H1 2022: GBP3.7M). This is driven

predominantly by additional investment in talent in R&D

(+GBP0.4M), enabling functions and the Leadership team (+GBP0.7M).

The Company also benefitted from a GBP0.4M foreign exchange rate

gain in H1 2022, not repeated in H1 2023.

The balance sheet remains strong with no debt and GBP3M of cash

balances (including cash deposits) as at 30 June 2023 (31 December

2022: GBP4.5M). Component supply issues have continued to dominate

H1 2023, and this has meant a further investment in inventory and a

restricted level of revenue, resulting in a lower cash profile. The

Company expects to see this start to reverse in H2 2023, as

component supply eases. Inventory holdings have increased to GBP11M

by the end of H1 2023 (H1 2022: GBP9.5M), an increase of a further

GBP1M since 31 December 2022. The Company is confident in the

quality of the inventory held and that it will see a reduction in

the levels during H2 2023. Trade receivables were relatively high

at the end of H1 2023 at GBP5.3M (H1 2022: GBP3.5M) due to the

timing and level of revenue, which was GBP4.7M higher than H1

2022.

With a record order intake in 2022, and further order intake in

H1 2023 of GBP14.5M, and therefore a significant contracted backlog

of GBP29M, plus easing component supply issues, the Company is

confident in its H1 2023 outlook.

Post Interim Close Events

On 6 September 2023 the Company completed the acquisition of

Phillips Aerospace for US$3.4m through a combination of US$1.9m

cash and the issue of equity of $1.5m to the owners of Phillips

Aerospace. Simultaneously the Company raised GBP6.8m through the

issue of fresh equity approved by shareholders at a General Meeting

held on 4 September 2023. These events broaden our product offering

and strengthen the balance sheet to drive further growth.

Current Trading & Outlook

With a record H1 backlog of GBP29M and the component supply

chain issues easing, the Company is in a good position to begin to

revert to strong trading (largely no longer defined by component

availability). The Company continues on its growth journey, with

the underpinning of its systems strategy through the acquisition of

Phillips Aerospace (post H1), and the continued drive in maximising

capacity (additional shifts, maximising space, use of third-party

manufacturer) allowing for further growth into 2024 and beyond. The

product portfolio continues to strengthen with continued investment

in R&D and sales, enabling a strong pipeline of opportunities,

and conversion of these, to underpin future revenue growth.

Together, these strategic developments continue to provide

confidence for the future performance of the Company.

Enquiries:

Concurrent Technologies Plc

Miles Adcock, CEO

Kim Garrod, CFO +44 (0)1206 752626

Newgate (Financial PR) concurrent@secnewgate.co.uk

Bob Huxford +44 (0)20 3757 6880

Alice Cho

Matthew Elliott

Cavendish Securities plc (NOMAD)

Neil McDonald +44 (0)131 220 9771

Peter Lynch +44 (0)131 220 9772

Condensed Consolidated Statement of Comprehensive Income

Unaudited interim results to 30th June 2023

Six months Six months Year

ended ended ended

Note 30/06/23 30/06/22 31/12/22

CONTINUING OPERATIONS GBP GBP GBP

Revenue 12,139,625 7,421,285 18,274,771

Cost of sales (6,100,879) (3,680,258) (9,397,449)

Gross profit 6,038,746 3,741,027 8,877,322

Net operating expenses (5,028,784) (3,688,676) (8,390,682)

Group operating profit 1,009,962 52,351 486,640

Interest Costs (52,871) (26,930) (104,505)

Finance income 16,405 6,992 546

Other Income - - -

Profit before tax 973,496 32,413 382,681

Tax 154,441 518,890 604,344

Profit for the period 1,127,937 551,303 987,025

Other Comprehensive Income

Exchange differences on translating foreign

operations (41,338) 100,789 69,463

Tax relating to components of other - - -

comprehensive income

Other Comprehensive Income for the period, net

of tax (41,338) 100,789 69,463

Total Comprehensive Income for the period 1,086,599 652,092 1,056,488

Profit for the period attributable to:

Equity holders of the parent 1,127,937 551,303 987,025

Total Comprehensive Income attributable

to:

Equity holders of the parent 1,086,599 652,092 1,056,488

Earnings per share

Basic earnings per share 4 1.54p 0.75p 1.35p

Diluted earnings per share 4 1.54p 0.75p 1.35p

Adjusted earnings per share 1.54p 0.75p 1.35p

Condensed Consolidated Balance Sheet

Unaudited interim results to 30th June 2023

As at As at As at

30/06/23 30/06/22 31/12/22

ASSETS GBP GBP GBP

Non-current assets

Property, plant and equipment 2,528,605 2,445,996 2,685,107

Intangible assets 9,843,724 9,058,713 8,807,290

Deferred tax assets 321,577 7,243 350,753

Other Financial Assets - - -

12,693,906 11,511,952 11,843,150

Current assets

Inventories 11,048,329 9,460,432 10,090,437

Trade and other receivables 5,337,017 3,460,344 5,439,912

Current tax assets 1,126,010 597,086 762,545

Other Financial Assets - - -

Cash and cash equivalents 2,976,823 9,265,663 4,512,720

20,488,179 22,783,525 20,805,614

Total assets 33,182,086 34,295,477 32,648,764

----------------- ----------------- -----------------

LIABILITIES

Non-current liabilities

Deferred tax liabilities 2,311,767 2,176,884 2,126,588

Trade and other payables 1,118,819 505,767 1,257,820

Long term provisions 309,735 18,256 304,336

3,740,321 2,700,907 3,688,744

Current liabilities

Trade and other payables 5,165,320 7,119,058 5,765,262

Short term provisions 18,256 18,256 18,256

Current tax liabilities 51,864 15,779 -

5,235,440 7,153,093 5,783,518

Total liabilities 8,975,761 9,854,000 9,472,262

----------------- ----------------- -----------------

Net assets 24,206,325 24,441,477 23,176,502

================= ================= =================

EQUITY

Capital and reserves

Share capital 739,000 739,000 739,000

Share premium account 3,699,105 3,699,105 3,699,105

Capital redemption reserve 256,976 256,976 256,976

Cumulative translation reserve (69,274) 3,390 (27,936)

Profit and loss account 19,580,518 19,743,006 18,509,357

Equity attributable to equity holders of the parent 24,206,325 24,441,477 23,176,502

Total equity 24,206,325 24,441,477 23,176,502

================= ================= =================

Condensed Consolidated Cash Flow Statement

Unaudited interim results to 30th June 2023

Six months Six months Year

ended ended ended

30/06/2023 30/06/2022 31/12/2022

GBP GBP GBP

Cash flows from operating activities

Profit before tax for the period 973,496 32,413 382,681

Adjustments for:

Finance income (16,405) (6,992) (546)

Finance costs 52,871 26,930 104,505

Depreciation 447,858 121,589 422,047

Amortisation 650,862 627,395 1,197,972

Impairment loss - - 327,526

Loss on disposal of property, plant and equipment - - -

(PPE)

Share-based payment 155,603 48,785 219,363

Exchange differences (44,219) 111,153 82,384

(Increase)/decrease in inventories (957,892) (3,034,996) (3,665,001)

(Increase)/decrease in trade and other receivables 102,895 (471,711) (2,451,279)

Increase/(decrease) in trade and other payables (663,334) 2,920,826 2,222,123

Cash generated from operations 701,735 375,392 (1,158,225)

Tax (paid)/received (155,183) 270,780 267,884

Net cash generated from operating activities 546,552 646,172 (890,341)

================= ================= =================

Cash flows from investing activities

Interest received 16,405 6,992 546

Cash placed on deposit - - -

Purchases of property, plant and equipment (PPE) (235,971) (1,124,354) (1,480,394)

Proceeds from sale of PPE - - -

Purchases of intangible assets (1,744,508) (1,993,577) (3,711,617)

Net cash used in investing activities (1,964,074) (3,110,939) (5,191,465)

Cash flows from financing activities

Equity dividends paid - - (1,027,088)

Repayment of leasing liabilities (70,210) (64,809) (94,842)

Interest paid (52,871) (26,930) (104,505)

Cash received from share issue - - -

Purchase of treasury shares - - 2,425

Net cash used in financing activities (123,081) (91,739) (1,224,010)

Effects of exchange rate changes on cash and cash

equivalents 4,707 (17,589) (21,222)

Net increase/(decrease) in cash (1,535,896) (2,574,095) (7,327,038)

Cash at beginning of period 4,512,720 11,839,758 11,839,758

Cash at the end of the period 2,976,824 9,265,663 4,512,720

================= ================= =================

Condensed Consolidated Statement of Changes in Equity

Unaudited interim results to 30th June 2023

Capital Cumulative Profit

Share Share redemption translation and loss Total

capital premium reserve reserve account Equity

GBP GBP GBP GBP GBP GBP

Balance at 1

January 2022 739,000 3,699,105 256,976 (97,399) 18,082,077 22,679,759

Profit for the

period - - - - 551,303 551,303

Exchange

differences

on

translating

foreign

operations - - - 100,789 - 100,789

Total

recognised

comprehensive

income for

the period - - - 100,789 551,303 652,092

Share-based

payment - - - - 48,785 48,785

Deferred tax

on share based

payment - - - - -

Dividends paid - - - - -

Sale of

treasury

shares - - - - - -

Issue of

Ordinary

shares - - - - - -

Balance at 30

June 2022 739,000 3,699,105 256,976 3,390 18,682,165 23,380,636

Total

recognised

comprehensive

income for

the period - - - - 435,722 435,722

Exchange

differences

on

translating

foreign

operations - - - (31,326) - (31,326)

Total

recognised

comprehensive

income for

the period - - - (31,326) 435,722 404,396

Share-based

payment - - - - 170,578 170,578

Deferred tax

on share

based payment - - - - 245,555 245,555

Dividends paid - - - - (1,027,088) (1,027,088)

Sale of

treasury

shares - - - - 2,425 2,425

Balance at 31

December 2022 739,000 3,699,105 256,976 (27,936) 18,509,357 23,176,502

Total

recognised

comprehensive

income for

the period - - - - 1,127,937 1,127,937

Exchange

differences

on

translating

foreign

operations - - - (41,338) - (41,338)

Total

recognised

comprehensive

income for

the period - - - (41,338) 1,127,937 1,086,599

Share-based

payment - - - - 155,603 155,603

Deferred tax

on share

based payment - - - - (212,379) (212,379)

Dividends paid - - - - - -

Issue of

ordinary

shares - - - - - -

Sale of

treasury

shares - - - - - -

Balance at 30

June 2023 739,000 3,699,105 256,976 (69,274) 19,580,518 24,206,325

NOTES TO THE INTERIM REPORT

1. General information

The principal activity of the Group is design, manufacture and

supply of innovative high-end embedded single board computers and

complementary accessories aimed at a wide base of customers within

the defence & aerospace, telecommunications, medical and other

markets.

Concurrent Technologies PLC ("the Company") is the Group's

ultimate parent company. It is incorporated and domiciled in Great

Britain. Concurrent Technologies PLC shares are listed on the

Alternative Investment Market of the London Stock Exchange.

The Group's condensed consolidated interim financial statements

are presented in pounds sterling (GBP), which is also the

functional currency of the parent company.

These condensed consolidated interim financial statements, which

are unaudited, have been approved for issue by the Board of

Directors on 18 September 2023.

The information relating to the six months ended 30 June 2023 is

unaudited and does not constitute statutory accounts within the

meaning of section 434 of the Companies Act 2006. The statutory

accounts for the year ended 31 December 2022, prepared in

accordance with IFRSs (International Financial Reporting Standards)

as adopted by the European Union, have been reported on by the

Group's auditors and delivered to the Registrar of Companies. The

auditor's report was qualified, and this qualification will be

addressed in the statutory accounts for 31 December 2023.

2. Summary of significant accounting policies

2.1 Basis of preparation

These condensed consolidated interim financial statements are

for the six months period ended 30 June 2023. They have been

prepared in accordance with IAS 34 "Interim Financial Reporting".

They do not include all the information required for full annual

financial statements and should be read in conjunction with the

consolidated financial statements of the Group for the year ended

31 December 2022, which have been been prepared in accordance with

adopted IFRSs.

The accounting policies applied, and methods of computation are

consistent with those of the annual financial statements for the

year end 31 December 2022, as described in those financial

statements. The accounting policies have been consistently applied

to all the periods presented.

There are no new IFRSs or IFRIC interpretations that are

effective for the first time for the financial period beginning on

or after 1 January 2023 that would be expected to have a material

impact on the results or financial position of the Group.

2.2 Going Concern

The Directors are satisfied that the Group has sufficient

resources to continue in operation for the foreseeable future, a

period of not less than 12 months from the date of this report.

Accordingly, the continue to adopt the going concern basis in

preparing these condensed financial statements.

2.3 Taxation

Current tax expense is recognised in these condensed

consolidated interim financial statements based on the estimated

effective tax rates for the full year.

3. Segmental reporting

The Directors consider that the Group is engaged in a single

segment of business, being design, manufacture of high-end embedded

computer products and that therefore, the Company has only a single

operating segment. The key measure of performance used by the Board

to assess the Group's performance is the Group's profit before tax,

as calculated under IFRS, and therefore no reconciliation is

required between the measure of profit or loss used by the Board

and that contained in the condensed consolidated interim financial

statements.

4. Earnings per share

Basic earnings per share is calculated by dividing the profit

attributable to ordinary equity holders for the period by the

weighted average number of ordinary shares outstanding during the

period.

Diluted earnings per share is calculated adjusting the weighted

average number of ordinary shares outstanding to assume conversion

of all contracted dilutive potential ordinary shares. The Company

only has one category of dilutive potential ordinary shares, namely

share options.

The inputs to earnings per share calculation are shown

below:

The inputs to the earnings per

share calculation are shown below:

Six months Six months Year

ended ended ended

30/06/23 30/06/22 31/12/22

GBP GBP GBP

Profit attributable to ordinary

equity holders 1,127,937 551,303 987,025

Six months Six months Year

ended ended ended

30/06/23 30/06/22 31/12/22

Ndeg Ndeg Ndeg

Weighted average number of ordinary

shares for basic earnings per

share 73,363,490 73,673,490 73,363,490

Adjustment for share options -

Weighted average number of ordinary

shares for diluted earnings per

share 73,363,490 73,673,490 73,363,490

======================= ================== ==================

5. Shareholder Communication

A copy of these condensed interim financial statements is

available from the Company's Registered office at:

4 Gilberd Court,

Newcomen Way,

Colchester,

Essex, UK

CO4 9WN

They are also available from the Company's website at

www.gocct.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKFBBDBKBCCD

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

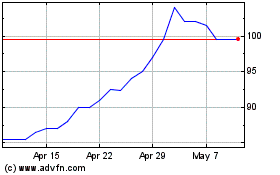

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Concurrent Technologies (LSE:CNC)

Historical Stock Chart

From Dec 2023 to Dec 2024