Coro Energy PLC Completion of Italian Disposal (7858S)

November 08 2023 - 3:15AM

UK Regulatory

TIDMCORO

RNS Number : 7858S

Coro Energy PLC

08 November 2023

8 November 2023

Coro Energy Plc

("Coro" or the "Company")

Completion of Italian Disposal

Coro Energy PLC, the South East Asian energy company with a

natural gas and clean energy portfolio, announces that the sale of

the Italian portfolio has now been approved by the Italian

regulatory authorities and the sale has been completed.

The total consideration for the sale, as previously announced,

is up to Euro 7.4 million which consists of Euro 5.86 million

upfront consideration (comprising Euro 3.86 million payable on

completion plus Euro 2 million payable as soon as practicable after

completion) and a 10% NPI on future profits capped at Euro 1.5

million. The Company has already received Euro 2.5 million of the

upfront consideration by way of advance payment (as announced on 10

August 2023). The Company agreed that the remaining upfront

consideration due by the purchaser at completion would be offset

against: (i) a Euro 99k debt owed by the Italian portfolio to the

Company's subsidiary, repayment of which was procured by the

purchaser at completion; and (ii) the Italian portfolio's Italian

tax liability of Euro 0.69 million. The Company therefore received

Euro 0.67 million in cash at completion in satisfaction of the

upfront consideration then due and repayment of the Italian

portfolio's debt.

The Company will receive a further Euro 0.14 million in cash

from the purchaser in settlement of the balance of the upfront

consideration as soon as practicable after completion. This payment

represents the Euro 2 million balance of upfront consideration less

the Company's debt of Euro 1.86 million owed to the Italian

portfolio, which was novated to the purchaser on completion.

In addition to the above total consideration the sale and

purchase agreement contains a working capital adjustment, which the

Company estimates will result in a payment by the purchaser to Coro

of Euro 1 million to Euro 2 million. The working capital adjustment

will (at the purchaser's discretion) either be settled in cash

within ten business days of determining the working capital

adjustment, or, as is expected, in instalments via the assignment

to Coro of 70% of the distributable annual profits of the Italian

portfolio until such time as the working capital adjustment is paid

in full. If the working capital adjustment is not paid in full by

31 December 2027, the remaining balance will be immediately payable

irrespective of the distributable profits of the Italian

portfolio.

James Parsons, Chairman, commented:

"With the Italian sale now complete, Coro can now focus its

human and financial resources on South East Asia, with its

underpinning core growth and resulting strong energy demand. Our

immediate attention is on the Duyung PSC farm out process.

I would like to thank our team in Italy for their many years of

service to Coro and wish them well under new ownership."

This announcement contains inside information.

For further information please contact:

Coro Energy plc Via Vigo Consulting Ltd

James Parsons, Executive Chairman

Ewen Ainsworth, Chief Financial Officer

Cavendish Capital Markets Limited Tel: 44 (0) 20 7220 0500

(Nominated Adviser)

Adrian Hadden

Ben Jeynes

WH Ireland (Joint Broker) Tel: 44 (0)20 7220 1670 /

Harry Ansell 44 (0)113 946 618

Katy Mitchell

Hybridan LLP (Joint Broker) Tel: 44 (0)20 3764 2341

Claire Louise Noyce

Gneiss Energy Limited (Financial Advisor) Tel: 44 (0)20 3983 9263

Jon Fitzpatrick

Doug Rycroft

Vigo Consulting (IR/PR Advisor) Tel: 44 (0)20 7390 0230

Patrick d'Ancona

Finlay Thomson

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISKVLBBXFLBFBQ

(END) Dow Jones Newswires

November 08, 2023 04:15 ET (09:15 GMT)

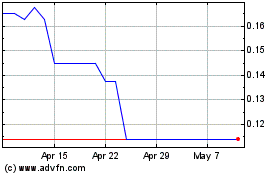

Coro Energy (LSE:CORO)

Historical Stock Chart

From Apr 2024 to May 2024

Coro Energy (LSE:CORO)

Historical Stock Chart

From May 2023 to May 2024