Downing Renewables & Infrastructure DORE acquires UK solar assets for GBP 42 million (9412S)

March 22 2021 - 2:00AM

UK Regulatory

TIDMDORE

RNS Number : 9412S

Downing Renewables & Infrastructure

22 March 2021

22 March 2021

Downing Renewables & Infrastructure Trust plc

("DORE" or "the Company")

DORE acquires portfolio of UK solar assets for GBP 42

million

Downing Renewables & Infrastructure Trust plc (LSE:DORE) is

pleased to announce it has completed the acquisition of a 96MWp

portfolio of c.50 solar PV assets (the "Assets") located in

mainland Great Britain and Northern Ireland for a total

consideration of GBP42 million (including working capital balances

and cash held by the portfolio companies). The transaction was

completed pursuant to an option agreement entered into on 12

November 2020.

The portfolio, described as the "Seed Assets" in the Company's

prospectus published on 12 November 2020, comprises:

-- 13 ground-mounted sites located across mainland GB totalling c.73 MWp;

-- 28 commercial rooftop assets totalling c.10 MWp; and

-- 7 residential rooftop portfolios in Northern Ireland totalling c.13MWp.

The Assets have an average operating track record of around six

years and generated revenue of GBP12.5 million and EBITDA of GBP9.9

million in the year to 31 March 2020. The Assets are expected to

contribute significantly to DORE's target dividend yield going

forward, with a particularly strong contribution to yield in the

calendar year to 31 December 2021.

This is the second acquisition that DORE has announced since its

GBP122.5 million IPO on the London Stock Exchange in December 2020

and a total of GBP102 million has now been deployed. The Company

has also announced that it has entered into exclusivity to acquire

a c.40% stake in a 100MW near-shore windfarm construction asset in

Sweden.

DORE is targeting investment in a diversified portfolio of

renewable energy generating assets and other infrastructure, which

balances higher yielding, lower capital growth of defined life

assets such as solar and wind, with lower yielding, higher capital

growth assets such as hydro, in the UK, Ireland and Northern

Europe.

Tom Williams, Head of Energy & Infrastructure at Downing

LLP, said: "The combination of this solar portfolio, the hydro

portfolio acquisition in January and the wind project under

exclusivity encapsulates DORE's strategy of diversification by

geography, technology, construction stage and revenue. Together, it

provides strong, stable, diversified and high-quality earnings that

will underpin DORE's dividend and NAV for years to come."

www.doretrust.com

Non-material amendment to the investment policy. For the purpose

of acquiring the Assets, the Company's investment policy has

temporarily been amended to permit the Company to invest no more

than 61% of Gross Asset Value in assets located in the UK. The

previous limit was 60%.

This announcement contains inside information for the purposes

of Article 7 of the UK Market Abuse Regulation.

Link Company Matters Limited

Company Secretary

ENDS

Contact details:

Downing LLP - Investment Manager to the Company

+44 (0)20 3954

Tom Williams 9908

N+1 Singer - Corporate Broker

Robert Peel, Alan Ray, Carlo Spingardi (Investment

Banking)

Sam Greatrex, Alan Geeves, James Waterlow, +44 (0)20 7496

Paul Glover (Sales) 3000

TB Cardew - Public relations advisor to the +44 (0)20 7930

Company 0777

Ed Orlebar +44 (0)7738 724

Tania Wild 630 / +44 (0)7425

536 903

DORE@tbcardew.com

About Downing Renewables & Infrastructure Trust plc

(DORE)

DORE is a closed-end investment trust that invests exclusively

in a portfolio of renewable energy and infrastructure assets

located in the UK, Ireland and Northern Europe. DORE's strategy,

which focuses on diversification by geography, technology, stage

and revenue, is designed to increase the stability of revenues,

reduce seasonal variability and enhance returns. For further

details please visit www.doretrust.com

LEI: 2138004JHBJ7RHDYDR62

About Downing LLP

Downing LLP is a London-based investment management firm. It has

over 25,000 investors and has raised over GBP1.7 billion into

businesses across a range of sectors, from renewable energy, care

homes, health clubs, and children's nurseries, to technology and

sports nutrition. Downing has a demonstrable track record in

renewables, having made 119 investments into solar parks, wind

farms and hydroelectric plants since 2010. For further details

please visit www.downing.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQJBMITMTATBRB

(END) Dow Jones Newswires

March 22, 2021 03:00 ET (07:00 GMT)

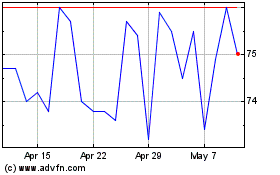

Downing Renewables & Inf... (LSE:DORE)

Historical Stock Chart

From Mar 2024 to Apr 2024

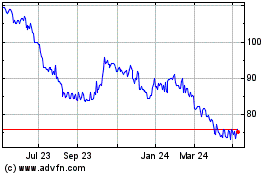

Downing Renewables & Inf... (LSE:DORE)

Historical Stock Chart

From Apr 2023 to Apr 2024