TOC Property Backed Lendng Tst PLC Dividend Declaration (4569Z)

September 03 2018 - 1:00AM

UK Regulatory

TIDMPBLT

RNS Number : 4569Z

TOC Property Backed Lendng Tst PLC

03 September 2018

For release on 3 September 2018

TOC PROPERTY BACKED LENDING TRUST PLC

Dividend Declaration

The Board of Directors (the "Board") of TOC Property Backed

Lending Trust (the "Company" or "PBLT") has declared an interim

dividend of 1.75 pence per Ordinary Share in respect of the period

from 1 June 2018 to 31 August 2018.

Distribution period: 1 June 2018 - 31 August 2018

Distribution amount 1.75 pence

per share:

Ex-dividend date: 13 September 2018

Dividend record date: 14 September 2018

Payment date: 4 October 2018

In the absence of unforeseen circumstances, the Company expects

to declare:

-- quarterly dividends hereafter at an annualised 7% per annum

(calculated with reference to the IPO issue price) in respect of

the financial year.

The above dividend targets are targets only and not profit

forecasts. There can be no assurances that the targets can or will

be met and this should not be taken as an indication of the

Company's expected or future profitability.

Dividends are expected to be paid in the month following their

declaration.

For further information regarding the Company (Ticker: PBLT)

(LEI: 213800EXPWANYN3NEV68) please call:

TOC Property Backed Lending Trust PLC +44 (0) 191 222

Stephen Black 0099

Tier One Capital Ltd (Investment Adviser) +44 (0) 191 222

Ian McElroy 0099

finnCap Ltd (Sponsor, Broker and Financial

Adviser) +44 (0) 207 220

William Marle / Grant Bergman 0500

Maitland Administration Services (Scotland)

Limited (Secretary) +44 (0) 131 550

Martin Cassels 3765

Notes to Editors:

TOC Property Backed Lending Trust PLC is a closed-end investment

company. Its investment objective is to provide shareholders with a

consistent and stable income and the potential for an attractive

total return over the medium to long term while managing downside

risk through: (i) a diversified portfolio of fixed rate loans

predominantly secured over land and/or property in the UK; and (ii)

in many cases, receiving the benefit of an associated profit share

usually obtained by acquiring (at nil cost) a minority equity stake

in the relevant borrower project development vehicle.

The Company's investment adviser is Tier One Capital Limited

("Tier One" or the "Investment Adviser"). Tier One was launched by

former Barclays Wealth and Coutts & Co directors Stephen Black

and Ian McElroy in early 2013. Both Stephen and Ian have extensive

credit experience, much of which was gained in a difficult

financial climate. Tier One has developed a direct lending offering

that provides an opportunity which sits between conventional

lending and the emerging peer-to-peer platform market. Tier One

uses its direct lending and credit expertise to source funds for

borrowers, broker facility agreements and then offer continued

support and guidance to borrowers through the lifespan of their

loan.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DIVPBMITMBMJBFP

(END) Dow Jones Newswires

September 03, 2018 02:00 ET (06:00 GMT)

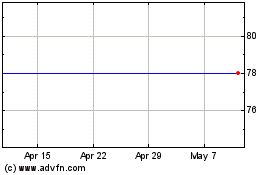

Develop North (LSE:DVNO)

Historical Stock Chart

From Apr 2024 to May 2024

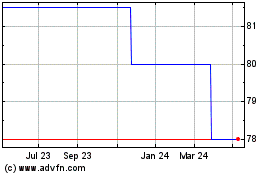

Develop North (LSE:DVNO)

Historical Stock Chart

From May 2023 to May 2024