TIDMEMH

RNS Number : 1249Z

European Metals Holdings Limited

19 May 2021

For immediate release

19 May 2021

EUROPEAN METALS HOLDINGS LIMITED

CONFIRMATION OF REFINING PROCESS

STRONG RESULTS FROM LOCKED-CYCLE TESTS

HIGHLIGHTS

-- Successful locked-cycle test ("LCT") results further support

the Cinovec project's credentials to initially produce

battery-grade lithium carbonate.

-- European Metals has demonstrated that Cinovec battery grade

lithium carbonate can be easily converted into lithium hydroxide

monohydrate with a commonly utilised liming plant process.

-- Six LCTs were planned but testwork was stopped after four

cycles as the main process stream compositions had successfully

stabilised.

-- Battery grade lithium carbonate was produced in every LCT

with lithium recoveries of up to 92.0% achieved in the four LCTs

performed.

-- The LCTs tested zinnwaldite concentrate from the southern

part of Cinovec, representative of the first five years of

mining.

-- Improved fluoride removal process step further enhances

project's economic outcomes as a result of the regeneration and

reuse of the ion exchange resins.

-- Further optimisation work in hydrometallurgy processing steps

expected to improve lithium recoveries from concentrate to

>92.0%.

European Metals Holdings Limited (ASX & AIM: EMH, NASDAQ:

ERPNF) ("EMH", "European Metals" or the "Company") is pleased to

announce results of locked-cycle testwork, a metallurgical

processing assessment conducted on ore concentrate extracted from

the Company's flagship Cinovec lithium project.

The Cinovec project, located on the German border of the Czech

Republic, is the largest hard-rock lithium resource in Europe,

containing lithium-bearing mica known as zinnwaldite which the

Company intends to refine using a number of processes initially

outlined in a Pre-Feasibility Study ("PFS") (see ASX Announcement

dated: 17 June 2019).

Commenting on the results, European Metals Executive Chairman

Keith Coughlan said:

"In a significant vote of confidence for our Pre-Feasibility

Study, the proposed process methodology has been confirmed by

excellent locked-cycle test results which also include new

processes involving recycle streams. The robustness of the process

was further confirmed by the stabilisation of the process streams,

enabling the work to stop after only four of the six test cycles

were completed. The recovery of up to 92% of the lithium in the

zinnwaldite concentrate at this early stage of DFS testwork is very

promising for increased recoveries during the planned process

optimisation work. Further, an improved fluoride removal step which

is cheaper and cleaner represents only the beginning of further

optimisation work which we expect will result in greater lithium

recoveries and even stronger economics for the Cinovec Project.

It is also encouraging to note that the process was as

successful as that conducted during the 2019 PFS on the Central/NW

part of the orebody, further underlying the consistency of the

Cinovec ore body.

We look forward to providing further updates on the Definitive

Feasibility Study work as it unfolds."

LOCKED-CYCLE TEST RESULTS PROVE ABILITY TO PROCESS

ZINNWALDITE

Geomet s.r.o. ("Geomet") commissioned the LCTs with the

principal objective of confirming the flowsheet for the processing

of zinnwaldite concentrate from Cinovec run-of-mine ore.

The LCTs differ from previous proof of concept and optimisation

testwork conducted during the Cinovec PFS by confirming the effect

of recycle streams (which carry some lithium and other alkali

metals) on the overall recovery of lithium from the pregnant leach

solution resulting from the water leaching of the roasted

zinnwaldite concentrate and the ability to produce battery grade

lithium carbonate.

The LCTs have been performed by Dorfner Anzaplan, Germany and

have been supervised by Lithium Consultants Australasia and SMS

group Processing Technologies GmbH ("SMS") in parallel with the

Front-End Engineering Design ("FEED") programme being undertaken by

SMS.

The LCTs have processed zinnwaldite concentrate from drill core

samples taken from the southern part of the Cinovec orebody,

representing ore that will be processed in the first five years of

the mine plan. The recovery of up to 92% of the lithium in the

concentrate sample compares favourably with the similar recovery in

the PFS flowsheet of 91%. However, this new recovery of up to 92%

is before lithium plant DFS/FEED optimisation testwork that will be

targeted in specific process areas and which is expected to

increase hydrometallurgical recovery in the lithium plant to more

than 92%.

Separate metallurgical testwork on the Front-End Comminution and

Beneficiation ("FECAB") circuit is underway and is designed to

improve upon the lithium recovery of 90% from ore to concentrate.

This testwork will be reported at a later date.

PROOF OF PROCESSING STEPS FOR REMOVAL OF FLUORIDE, POTASSIUM AND

RUBIDIUM

Ahead of the LCTs, Geomet tested an alternative process to

remove fluoride in order to meet the Electric Vehicle ('EV') grade

specification of <50ppm in the lithium carbonate. The previously

announced PFS flowsheet proposed the removal of fluoride by the use

of activated alumina, a relatively costly step because the

activated alumina was not considered suitable for regeneration.

This step has been replaced by a cheaper and cleaner two-step

process involving chemical precipitation and ion-exchange. This new

method of fluoride removal has been proven to be highly effective,

easier to implement and is less costly as the ion-exchange resin

can easily be regenerated and re-used many times.

In addition to fluoride, the zinnwaldite mica at Cinovec

contains alkali metals, including potassium, rubidium and caesium,

which are leached into solution and will build up in the plant if

not removed from the circuit.

The LCTs have proven conclusively that unwanted alkali metals

can be removed preferentially by control of temperature, pH,

solution saturation and crystallisation. It has been confirmed that

these alkali metals will not build up due to recycling processes

within the plant. The removal of these deleterious elements within

four LCTs with minor loss of lithium is a major step towards

confirmation of process plant design.

LITHIUM HYDROXIDE PRODUCTION

The current LCTs have been commissioned to confirm the lithium

carbonate processing flowsheet. The Cinovec Project has optionality

to either produce a battery grade lithium carbonate product or to

further process the lithium carbonate to produce battery grade

lithium hydroxide.

As the FEED programme continues, Geomet is expected to

commission testwork to confirm the optimal production route for

lithium hydroxide and to produce marketing samples for prospective

offtake partners and environmental samples to assist in permitting

approvals.

BACKGROUND INFORMATION ON CINOVEC

PROJECT OVERVIEW

Cinovec Lithium/Tin Project

Geomet s.r.o. controls the mineral exploration licenses awarded

by the Czech State over the Cinovec Lithium/Tin Project. Geomet

s.r.o. is owned 49% by European Metals and 51% by CEZ a.s. through

its wholly owned subsidiary, SDAS. Cinovec hosts a globally

significant hard rock lithium deposit with a total Indicated

Mineral Resource of 372.4Mt at 0.45% Li(2) O and 0.04% Sn and an

Inferred Mineral Resource of 323.5Mt at 0.39% Li(2) O and 0.04% Sn

containing a combined 7.22 million tonnes Lithium Carbonate

Equivalent and 263kt of tin reported 28 November 2017 ( Further

Increase in Indicated Resource at Cinovec South ). An initial

Probable Ore Reserve of 34.5Mt at 0.65% Li(2) O and 0.09% Sn

reported 4 July 2017 ( Cinovec Maiden Ore Reserve - Further

Information ) has been declared to cover the first 20 years mining

at an output of 22,500tpa of lithium carbonate reported 11 July

2018 ( Cinovec Production Modelled to Increase to 22,500tpa of

Lithium Carbonate ).

This makes Cinovec the largest hard rock lithium deposit in

Europe, the fourth largest non-brine deposit in the world and a

globally significant tin resource.

The deposit has previously had over 400,000 tonnes of ore mined

as a trial sub-level open stope underground mining operation.

In June 2019 EMH completed an updated Preliminary Feasibility

Study, conducted by specialist independent consultants, which

indicated a return post tax NPV of USD1.108B and an IRR of 28.8%

and confirmed that the Cinovec Project is a potential low operating

cost, producer of battery grade lithium hydroxide or battery grade

lithium carbonate as markets demand. It confirmed the deposit is

amenable to bulk underground mining. Metallurgical test-work has

produced both battery grade lithium hydroxide and battery grade

lithium carbonate in addition to high-grade tin concentrate at

excellent recoveries. Cinovec is centrally located for European

end-users and is well serviced by infrastructure, with a sealed

road adjacent to the deposit, rail lines located 5 km north and 8

km south of the deposit and an active 22 kV transmission line

running to the historic mine. As the deposit lies in an active

mining region, it has strong community support.

The economic viability of Cinovec has been enhanced by the

recent strong increase in demand for lithium globally, and within

Europe specifically.

There are no other material changes to the original information

and all the material assumptions continue to apply to the

forecasts.

BACKGROUND INFORMATION ON CEZ

Headquartered in the Czech Republic, CEZ a.s. is an established,

integrated energy group with operations in a number of Central and

Southeastern European countries and Turkey. CEZ's core business is

the generation, distribution, trade in, and sales of electricity

and heat, trade in and sales of natural gas, and coal extraction.

CEZ Group has 33,000 employees and annual revenue of approximately

EUR 7.24 billion.

The largest shareholder of its parent company, CEZ a.s., is the

Czech Republic with a stake of approximately 70%. The shares of CEZ

a.s. are traded on the Prague and Warsaw stock exchanges and

included in the PX and WIG-CEE exchange indices. CEZ's market

capitalization is approximately EUR 10.08 billion.

As one of the leading Central European power companies, CEZ

intends to develop several projects in areas of energy storage and

battery manufacturing in the Czech Republic and in Central

Europe.

CEZ is also a market leader for E-mobility in the region and has

installed and operates a network of EV charging stations throughout

Czech Republic. The automotive industry in Czech is a significant

contributor to GDP and the number of EV's in the country is

expected to grow significantly in coming years.

CONTACT

For further information on this update or the Company generally,

please visit our website at www.europeanmet.com or see full contact

details at the end of this release.

COMPETENT PERSON

Information in this release that relates to exploration results

is based on information compiled by Dr Pavel Reichl. Dr Reichl is a

Certified Professional Geologist (certified by the American

Institute of Professional Geologists), a member of the American

Institute of Professional Geologists, a Fellow of the Society of

Economic Geologists and is a Competent Person as defined in the

2012 edition of the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves and a Qualified Person

for the purposes of the AIM Guidance Note on Mining and Oil &

Gas Companies dated June 2009. Dr Reichl consents to the inclusion

in the release of the matters based on his information in the form

and context in which it appears. Dr Reichl holds CDIs in European

Metals.

The information in this release that relates to Mineral

Resources and Exploration Targets has been compiled by Mr Lynn

Widenbar. Mr Widenbar, who is a Member of the Australasian

Institute of Mining and Metallurgy, is a full time employee of

Widenbar and Associates and produced the estimate based on data and

geological information supplied by European Metals. Mr Widenbar has

sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity that he is undertaking to qualify as a Competent Person as

defined in the JORC Code 2012 Edition of the Australasian Code for

Reporting of Exploration Results, Minerals Resources and Ore

Reserves. Mr Widenbar consents to the inclusion in this report of

the matters based on his information in the form and context that

the information appears.

CAUTION REGARDING FORWARD LOOKING STATEMENTS

Information included in this release constitutes forward-looking

statements. Often, but not always, forward looking statements can

generally be identified by the use of forward looking words such as

"may", "will", "expect", "intend", "plan", "estimate",

"anticipate", "continue", and "guidance", or other similar words

and may include, without limitation, statements regarding plans,

strategies and objectives of management, anticipated production or

construction commencement dates and expected costs or production

outputs.

Forward looking statements inherently involve known and unknown

risks, uncertainties and other factors that may cause the company's

actual results, performance and achievements to differ materially

from any future results, performance or achievements. Relevant

factors may include, but are not limited to, changes in commodity

prices, foreign exchange fluctuations and general economic

conditions, increased costs and demand for production inputs, the

speculative nature of exploration and project development,

including the risks of obtaining necessary licences and permits and

diminishing quantities or grades of reserves, political and social

risks, changes to the regulatory framework within which the company

operates or may in the future operate, environmental conditions

including extreme weather conditions, recruitment and retention of

personnel, industrial relations issues and litigation.

Forward looking statements are based on the company and its

management's good faith assumptions relating to the financial,

market, regulatory and other relevant environments that will exist

and affect the company's business and operations in the future. The

company does not give any assurance that the assumptions on which

forward looking statements are based will prove to be correct, or

that the company's business or operations will not be affected in

any material manner by these or other factors not foreseen or

foreseeable by the company or management or beyond the company's

control.

Although the company attempts and has attempted to identify

factors that would cause actual actions, events or results to

differ materially from those disclosed in forward looking

statements, there may be other factors that could cause actual

results, performance, achievements or events not to be as

anticipated, estimated or intended, and many events are beyond the

reasonable control of the company. Accordingly, readers are

cautioned not to place undue reliance on forward looking

statements. Forward looking statements in these materials speak

only at the date of issue. Subject to any continuing obligations

under applicable law or any relevant stock exchange listing rules,

in providing this information the company does not undertake any

obligation to publicly update or revise any of the forward looking

statements or to advise of any change in events, conditions or

circumstances on which any such statement is based.

LITHIUM CLASSIFICATION AND CONVERSION FACTORS

Lithium grades are normally presented in percentages or parts

per million (ppm). Grades of deposits are also expressed as lithium

compounds in percentages, for example as a percent lithium oxide

(Li(2) O) content or percent lithium carbonate (Li(2) CO(3) )

content.

Lithium carbonate equivalent ("LCE") is the industry standard

terminology for, and is equivalent to, Li(2) CO(3) . Use of LCE is

to provide data comparable with industry reports and is the total

equivalent amount of lithium carbonate, assuming the lithium

content in the deposit is converted to lithium carbonate, using the

conversion rates in the table included below to get an equivalent

Li(2) CO(3) value in percent. Use of LCE assumes 100% recovery and

no process losses in the extraction of Li(2) CO(3) from the

deposit.

Lithium resources and reserves are usually presented in tonnes

of LCE or Li.

The standard conversion factors are set out in the table

below:

Table: Conversion Factors for Lithium Compounds and Minerals

Convert Convert Convert

from Convert to to

Convert to Li(2) LiOH.H(

to Li Li(2) O CO(3) 2) O

Lithium Li 1.000 2.153 5.325 6.048

----------------- ------------------ ------------------ ------------------ ------------------

Lithium Li(2)

Oxide O 0.464 1.000 2.473 2.809

----------------- ------------------ ------------------ ------------------ ------------------

Lithium Li(2)

Carbonate CO(3) 0.188 0.404 1.000 1.136

----------------- ------------------ ------------------ ------------------ ------------------

LiOH.

Lithium H(2)

Hydroxide O 0.165 0.356 0.880 1.000

----------------- ------------------ ------------------ ------------------ ------------------

Lithium

Fluoride LiF 0.268 0.576 1.424 1.618

----------------- ------------------ ------------------ ------------------ ------------------

AUTHORISATION

This announcement has been authorised for release by Keith

Coughlan, Executive Chairman.

WEBSITE

A copy of this announcement is available from the Company's

website at www.europeanmet.com.

ENQUIRIES:

European Metals Holdings Limited

Keith Coughlan, Executive Chairman Tel: +61 (0) 419 996 333

Email: keith@europeanmet.com

Kiran Morzaria, Non-Executive Director Tel: +44 (0) 20 7440 0647

Dennis Wilkins, Company Secretary Tel: +61 (0) 417 945 049

Email: dennis@europeanmet.com

WH Ireland Ltd (Nomad & Joint Broker)

James Joyce/James Sinclair-Ford Tel: +44 (0) 20 7220 1666

(Corporate Finance)

Harry Ansell/Jasper Berry (Broking

Shard Capital (Joint Broker) Tel: +44 (0) 20 7186 9950

Damon Heath

Erik Woolgar

Blytheweigh (Financial PR) Tel: +44 (0) 20 7138 3222

Tim Blythe

Megan Ray

Chapter 1 Advisors (Financial PR

- Aus) Tel: +61 (0) 433 112 936

David Tasker

The information contained within this announcement is considered

to be inside information, for the purposes of Article 7 of EU

Regulation 596/2014, prior to its release. The person who

authorised for the release of this announcement on behalf of the

Company was Keith Coughlan, Executive Chairman .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGPUBPAUPGUMB

(END) Dow Jones Newswires

May 19, 2021 03:35 ET (07:35 GMT)

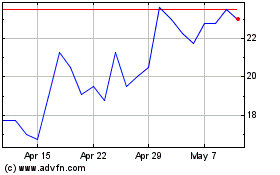

European Metals (LSE:EMH)

Historical Stock Chart

From Mar 2024 to Apr 2024

European Metals (LSE:EMH)

Historical Stock Chart

From Apr 2023 to Apr 2024