RNS Number:1190Y

Eurocity Properties PLC

31 January 2001

www.eurocityproperties.com

Interim Accounts

For the six months ended30th September 2000Company Registration No. 2739940

In the six months ending 30 September, your company recorded a slightly

increased loss of #96,305 compared with #69,353 in 1999. Despite this loss

your directors believe that the company is making progress and continues to

improve the overall quality of its portfolio.A number of acquisitions were

made in the period of commercial properties let to sound covenants in good

locations.Your board is aware of the difficulty in trading in the shares in a

company as small as ours, and realise the need to market the shares to as wide

an audience as possible. Baron Bloom will present to regional and private

client brokers in an attempt to heighten the profile of the company. The

company was recently featured on a Channel 4 business programme where the

shares were picked as a buy. This resulted in significant trading in the

shares, enabling longstanding holders to exit and giving us the benefit of new

and stable holders.Since the end of the half year, the company has completed

the acquisition of three property companies, in a single transaction, at a

cost of #1.8m, of which #200,000 was satisfied by the issue of new shares at a

price of 50p per share. The assets of the companies are residential properties

in Central London. We expect to dispose of some of these properties quickly,

but in the meantime they are income producing. This was an opportunistic

purchase and does not represent a change in the strategic direction of the

company.The company is not yet in a position to pay a dividend.Nicholas

JeffreyChairman

Unaudited Audited

Period Period ended 30th Year ended 31st

ended September 2000 March 2000

30th

September

2000

# # #

Income from properties 251,470 211,328 481,949

Direct property expenses (43,830) (7,644) (16,216)

Operating expenses (210,887) (166,203) (322,446)

Exceptional item 2 --- --- (224,400)

Profit on sale of 54,630 --- ---

properties

Operating profit/(loss) 51,383 37,481 (81,113)

Interest receivable 11,991 5,540 170

Interest payable (159,679) (112,374) (237,286)

Loss on ordinary (96,305) (69,353) (318,229)

activities before

taxation

Taxation 5 --- --- ---

Loss on ordinary (96,305) (69,353) (318,229)

activities after taxation

Loss per share

Basic 3 2.7p 3.4p 13.9p

Fully diluted 3 2.6p 2.8p 11.8p

Unaudited Audited

Period Period ended 30th Year ended

ended September 2000 31st March

30th 2000

September

2000

# # #

Loss for the financial period (96,305) (69,353) (318,229)

Unrealised (deficit)/surplus on --- (44,926) 85,074

revaluation of investment

properties

Total recognised gains and losses (96,305) (114,279) (233,155)

relating to the period

Unaudited Audited

Notes 31st March

30th 2000

September

2000

# #

Fixed assets 6 5,345,991 5,330,000

Tangible assets --- 85,074

Current assets

Investments 7 124,630 ---

Debtors 79,389 29,064

Cash at bank and in hand 425,938 641,101

629,957 670,165

Creditors: Amounts falling due within one year (312,995) (535,756)

Net current assets 316,962 134,409

Total assets less current liabilities 5,662,953 5,464,409

Creditors: Amounts falling due after more than (3,386,630) (3,244,283)

one year

2,276,323 2,220,126

Capital and reserves

Called up share capital 8 1,925,170 1,757,670

Share premium account 9 663,583 678,581

Other reserve 9 53,711 53,711

Revaluation reserve 9 563,555 497,179

Profit and loss account 9 (929,696) (767,015)

Shareholders' funds 2,276,323 2,220,126

Net asset value per share 4 59.1p 63.2p

Unaudited Audited

Period Period ended 30th Year ended

ended September 1999 31st March

30th 2000

September

2000

# #

Cash flow from operating (96,423) 41,446 165,729

activities

Returns on investments and (147,688) (106,834) (237,116)

servicing of finance

Taxation --- --- ---

Capital expenditure and (46,991) (937,174) (937,174)

financial investment

Acquisitions and disposals --- (150,000) (150,000)

Cash outflow before (291,102) (1,152,562) (1,158,561)

financing

Financing 89,348 856,311 1,404,435

(Decrease)/increase in cash (201,754) (296,251) 245,874

in the period

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN DEBT

Period Period ended 30th Year ended 31st

ended September 1999 March 2000

30th

September

2000

# #

(Decrease)/increase in (201,754) (296,251) 245,874

cash in the year

Cash inflow from increase (113,319) (1,427,829) (1,362,278)

in debt

Change in net debt (315,073) (1,724,080) (1,116,404)

resulting from cashflows

Net debt brought forward (2,723,086) (1,606,682) (1,606,682)

Net debt carried forward (3,038,159) (3,330,762) (2,723,086)

1 Basis of preparation The interim financial statements have been prepared

on the basis of the accounting policies as set out in the statutory financial

statements for the year ended 31 March 2000. The interim financial statements,

which were approved by the Directors on 26 January 2001, are unaudited.

2 Exceptional item This relates to a provision of #200,000 in respect of

shares receivable under the directors' incentive scheme (note 11) together

with a provision for employers national insurance of #24,400.

3 Loss per share The calculation of loss per ordinary share is based on the

loss for the period of #96,305 (year to 31 March 2000 -- loss of #318,229;

period to 30 September 1999 -- loss of #69,353) and on the weighted average

number of shares in issue during the period of 3,573,782 shares (31 March 2000

-- 2,290,993 shares; 30 September 1999 -- 2,061,532 shares).

Fully diluted loss per share includes shares held under the directors'

incentive scheme (note 11) and is based on a loss for the period of #96,305

(year to 31 March 2000 -- loss of #318,229; period to 30 September 1999 --

loss of #69,353) and on a weighted average number of shares in issue during

the period of 3,698,782 shares (31 March 2000 -- 2,690,993 shares; 30

September 1999 -- 2,461,532 shares).

4 Net asset value per share The calculation of net asset value per share is

based on net assets of #2,276,323 (31 March 2000 -- #2,220,126) and on the

number of shares in issue at the balance sheet date of 3,850,340 shares (31

March 2000 -- 3,515,340 shares).

5 Taxation There is no charge to corporation tax for the group due to the

trading losses incurred.

6 Tangible assets

Investment properties

#

Valuation

1 April 2000 5,330,000

Additions 965,991

Disposals (950,000)

30 September 2000 5,345,991

7 Investments

Listed Investments

#

Cost

Additions 124,630

30th September 2000 124,630

The listed investment represents ordinary shares in Newport Holdings Plc

acquired as part consideration for the sale of investment properties.

8 Share capital

Unaudited Audited

30th September 31st

2000 March

2000

# #

Authorised:

60,000,000 ordinary shares of 50p each 30,000,000 30,000,000

Allotted, issued and fully paid 1,925,170 1,757,670

3,850,340 (31 March -- 3,515,340) ordinary shares of 50p each

During the period the company issued 60,000 ordinary 50p shares at par as part

consideration for the purchase of an investment property, and also issued

275,000 ordinary 50p shares at par representing bonus shares issued to D Bloom

(note 11).

9 Reserves

Re- Profit

Share Other Valuation and loss Total

premium reserve reserve account

# # # # #

1 April 2000 678,581 53,711 497,179 (767,015) 462,456

Share issue costs (14,998) --- --- --- (14,998)

Transfers of

revaluation on

sale of property --- --- 66,376 (66,376) ---

Loss for the period --- --- --- (96,305) (96,305)

30 September 2000 663,583 53,711 563,555 (929,696) 351,153

10 Cash flows

Unaudited Audited

Period Period ended Year ended

ended 30th September 31st March

30th 1999 2000

September

2000

# # #

(a) Reconciliation of operating

profit to net cash inflow from

operating activities

Operating profit/(loss) 32,993 37,481 (81,113)

Profit on sale of investment properties (54,630) --- ---

Increase in debtors (26,983) (7,485) (15,304)

(Decrease)/increase in creditors (47,803) 11,450 262,146

Net cash (outflow)/inflow from (96,423) 41,446 165,729

operating activities

# # #

(b) Analysis of cash flows for

headings netted in the cash flow

Returns on investments and servicing of

finance

Interest received 11,991 5,540 170

Interest paid (159,679) (112,374) (237,286)

(147,688) (106,834) (237,116)

Capital expenditure and financial

investment

Purchase of tangible fixed assets (926,991) (937,174) (937,174)

Sale of tangible fixed assets 880,000 --- ---

(46,991) (937,174) (937,174)

Acquisitions and disposals

Acquisition of subsidiary --- (150,000) (150,000)

Financing

Issue of shares (23,998) 139,000 728,675

New building society loans

820,000 777,500 777,500

Building society loans repaid (706,654) (60,189) (101,740)

Net cash outflow from financing

89,348 856,311 1,404,435

11 Directors' incentive scheme and warrants The company currently runs an

incentive scheme for certain directors. The scheme provides for certain

directors to be entitled to receive a specified amount, as set out below, to

be satisfied by the issue of new ordinary 50p shares in the company and

triggered by any of the following events:

(a) The company first achieving a net asset value target of 143p per

share, as shown by the audited accounts of the company for any of the

financial years ending in 1999, 2000, 2001, 2002 or 2003.

(b) The admission of the Company's shares to the Official List of the

London Stock Exchange or to trading on the Alternative Investment Market;

or

(c) Control of the company being acquired by another company whose

shares have been so admitted.

The number of shares granted to each of the directors is as follows:

No. of shares

DL Bloom 275,000

BA Bloom 125,000

DSM Glasner LLB ---

N Jeffery LLB ---

Less: shares issued in period (note 8) (275,000)

125,000

The entitlement to these shares has been triggered by the admission of the

company's shares to the Alternative Investment Market, and shares have been

issued to DL Bloom in the period. Full provision has been made in these

accounts for the shares due to BA Bloom.The company has created 2,250,107

warrants each giving the holder thereof the right to subscribe to one ordinary

share at a price of 55p per share at any time during the period of three years

from the date of admission to AIM on 31 March 2000. The warrants were issued

on 31 March 2000 to the holders of ordinary shares on the basis of one warrant

for every two ordinary shares.The directors have been granted warrants,

exercisable on the same terms, as follows:

No. of warrants

N Jeffrey LLB 191,818

BA Bloom 200,000

DSM Glasner 45,454

437,272-

None of these warrants have been exercised.

Introduction We have been instructed by the company to review the financial

information set out on pages 1 to 9 and we have read the other information

contained in the interim report and considered whether it contains any

apparent misstatements or material inconsistencies with the financial

information.

Directors' responsibilities The interim report, including the financial

information contained therein, is the responsibility of, and has been approved

by the directors. The Listing rules of the London Stock Exchange require that

the accounting policies and presentation applied to the interim figures should

be consistent with those applied in preparing annual accounts except where any

changes, and the reasons for them, are disclosed.

Review work performed We conducted our review in accordance with guidelines

contained in Bulletin 1999/4 issued by the Auditing Practices Board. A review

consists principally of making enquiries of group management and applying

analytical procedures to the financial information and underlying financial

data and based thereon, assessing whether the accounting policies and

presentation have been consistently applied unless otherwise disclosed. A

review excludes audit procedures such as tests of controls and verification of

assets, liabilities and transactions. It is substantially less in scope than

an audit performed in accordance with Auditing Standards and therefore

provides a lower level of assurance than an audit. Accordingly we do not

express an audit opinion on the financial information.

Review conclusion On the basis of our review we are not aware of any material

modifications that should be made to the financial information as presented

for the six months ended 30 September 2000.BAKER TILLYChartered Accountants2

Bloomsbury StreetLondonWC1B 3ST

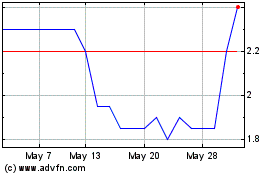

Energypathways (LSE:EPP)

Historical Stock Chart

From Sep 2024 to Oct 2024

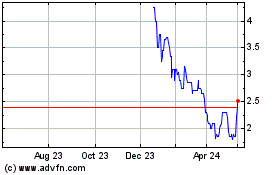

Energypathways (LSE:EPP)

Historical Stock Chart

From Oct 2023 to Oct 2024