TIDMEYE

RNS Number : 5773F

Eagle Eye Solutions Group PLC

19 July 2021

19 July 2021

Eagle Eye Solutions Group plc

("Eagle Eye", the "Group", or the "Company")

FY 2021 Trading Update

Exiting the year with positive momentum

Eagle Eye, a leading SaaS technology company that creates

digital connections enabling personalised, real-time marketing

through coupons, loyalty, apps, subscriptions and gift services, is

pleased to provide an update on the Group's trading for the year

ended 30 June 2021 ("the Year").

Highlights

FY 2021 FY 2020 % Change

---------- ---------- ---------

Group Revenue GBP22.8m GBP20.4m 12%

Recurring revenue ( subscription fees

and transactions) GBP16.9m GBP14.9m 13%

Adjusted EBITDA (1) GBP4.2m GBP3.3m 28%

Cash inflow/ (outflow), excluding

COVID-19 measures GBP0.91m GBP0.78m 17%

Closing net cash position GBP0.8m GBP1.5m -46%

-- Strong close to the financial year, with accelerated revenue

growth of 27% in Q4 compared to the prior year

-- Multiple new customer wins, including Pret a Manger in the

UK, Woolworths in Australia, and Staples US Retail, providing a

strong platform for further growth in FY 2022 and beyond

-- New business pipeline continues to grow at record levels in all regions

-- Considerable increase in adjusted EBITDA(1) to GBP4.2m, 28%

(FY 2020: GBP3.3m), ahead of market expectations

-- Strong cash performance, ahead of market expectations

-- Entered FY 2022 with an expanded underlying business and positive trajectory

Eagle Eye has enjoyed a strong close to the year, delivering 27%

growth in Q4 revenues as a result of the winning of enterprise

customers, 'Deepen' progress with key contracts and the relaxation

of COVID-19 restrictions driving increased transaction levels at

the Group's UK Food & Beverage customers.

The Group delivered a s trong new business 'Win' performance in

the Year, including the launch of the pioneering Pret a Manger

coffee subscription service, the winning of a five-year contract

with Woolworths Group, the largest retailer in Australia, and

securing Staples US Retail, the Group's second US customer.

While COVID-19 measures negatively impacted the Group's UK Food

& Beverage customers and brands for large parts of the year (

c.10% of Group revenue pre-COVID-19) , the Group's high levels of

recurring revenue (approx. 74% of revenues) and increased win rate

in the Year meant Eagle Eye delivered revenue growth of 12% to

GBP22.8m (FY 2020: GBP20.4m). Careful management of the cost base,

in line with our revenue profile, alongside continued investment in

the product and sales & marketing, resulted in an increase in

adjusted EBITDA (1) for the Year of 28% to GBP4.2m (FY 2020:

GBP3.3m), and grew the adjusted EBITDA margin to 17% margin

(FY2020: 16%), ahead of market expectations.

The Group delivered an improved underlying cash performance in

the Year, which saw a cash inflow, excluding COVID-19 related cash

management measures, of GBP0.91m (FY 2020: like-for-like inflow of

GBP0.78m). The Group closed the Year with a net cash position of

GBP0.8m, (FY 2020: GBP1.5m) being ahead of market expectations,

driven by the increase in adjusted EBITDA(1) and management of

working capital, including COVID-19 VAT deferrals of GBP0.4m which

is expected to be paid in the current financial year ending 30 June

2022 (being the only outstanding Government COVID-19 support

received and not yet returned). The Group continues to have access

to its GBP5m banking facility which, combined with the Group's net

cash, is sufficient to support its existing growth plans.

Outlook

Eagle Eye enters FY 2022 with a considerably expanded underlying

business and positive trajectory.

The impact of the pandemic has been to accelerate the digital

engagement strategies of retailers around the world. The proven

enterprise capabilities of the Eagle Eye AIR platform position the

Group well to capture a growing proportion of this expanding

market.

With a growing customer base and record sales pipeline the Board

looks to the future with increased confidence.

Tim Mason, Chief Executive of Eagle Eye , said: "I am proud of

the performance of our team this year; securing fantastic new

retailers around the world and delivering innovative solutions that

add value for our customers, while dealing with the challenges of

the pandemic. This has driven a good financial performance, and

importantly, we have exited the year with strong momentum.

"With the AIR platform sitting at the heart of the digital

marketing programmes at a growing number of the world's largest

retailers, we have demonstrated our credentials in an accelerating

market, providing us with confidence in our ability to continue to

deliver future growth."

Notes:

All financials based on unaudited figures

(1) Adjusted EBITDA has been adjusted for the exclusion of

share-based payment charges along with depreciation, amortisation,

interest and tax from the measure of profit and is reconciled to

the GAAP measure of loss before tax.

For further information, please contact:

Tim Mason, Chief Executive Officer Tel: 0844 824 3686

Lucy Sharman-Munday, Chief Financial

Officer

Investec (Nominated Advisor and Joint Tel: 020 7597 5970

Broker)

Corporate Finance: David Anderson / Sebastian

Lawrence

Corporate Broking: Sara Hale / Will Brinkley

/ Charlotte Young

Shore Capital (Joint Broker) Tel: 020 7408 4090

Corporate Finance: Hugh Morgan/ Daniel

Bush/ Sarah Mather

Corporate Broking: Henry Willcocks

Alma PR

Caroline Forde, Robyn Fisher, Molly Gretton Tel: 020 3405 0205

About Eagle Eye Solutions

Eagle Eye is a leading SaaS technology company transforming

marketing by creating digital connections that enable personalised

performance marketing in real time through coupons, loyalty, apps,

subscriptions and gift services.

Eagle Eye AIR enables the secure issuance and redemption of

digital offers and rewards at scale, across multiple channels,

enabling a single customer view. We create a network between

merchants, brands and audiences to enable customer acquisition,

interaction and retention at lower cost whilst driving marketing

innovation.

The Company's current customer base comprises leading names in

UK Grocery, Retail, Leisure and Food & Beverage sectors,

including Asda, Sainsbury's, Tesco, Waitrose and John Lewis &

Partners, Virgin Red, JD Sports, Pret a Manger, Greggs, Mitchells

& Butlers, Pizza Express; in North America, Loblaws, Shoppers

Drug Mart and Southeastern Grocers and in Australia & New

Zealand, Woolworths Group and The Warehouse Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFRDTIRLIL

(END) Dow Jones Newswires

July 19, 2021 02:00 ET (06:00 GMT)

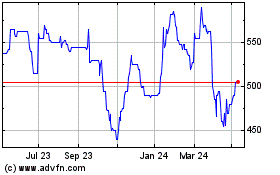

Eagle Eye Solutions (LSE:EYE)

Historical Stock Chart

From Mar 2024 to Apr 2024

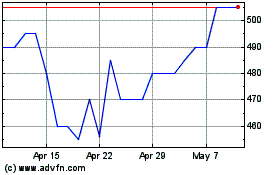

Eagle Eye Solutions (LSE:EYE)

Historical Stock Chart

From Apr 2023 to Apr 2024