TIDMGBP

RNS Number : 0889P

Global Petroleum Ltd

05 June 2020

5 June 2020

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the EU Market Abuse Regulation (596/2014). Upon the publication of

the announcement via a regulatory information service, this

information is considered to be in the public domain.

GLOBAL PETROLEUM LIMITED

Application for Voluntary Removal from the Official List of the

ASX

Global Petroleum Limited ("Global" or "Company") announces that

it has formally applied to ASX Limited ("ASX") requesting the

removal of the Company from the official list of ASX (the "Official

List") pursuant to ASX Listing Rule 17.11 and ASX has accepted its

application and resolved to remove the Company from the Official

List subject to the satisfaction of the conditions set out in the

full ASX decision outlined in Annexure A.

Global's securities are currently listed/quoted on two

securities exchanges - the Official List and AIM.

Following due consideration/and in order to streamline the

Company's listing and compliance costs, the Directors of Global

resolved that the continued listing of the Company's securities on

the Official List was no longer in the best interests of the

Company and its shareholders. Factors the Board considered include

the following:

(a) Predominance of AIM listing : the Company's ordinary shares

were admitted to trading on AIM on 7 March 2005. Over the last five

years there have been approximately 4,830 trades on ASX and

approximately 19,000 trades on AIM. The total number of shares that

are represented by depository interests for trading on AIM is

approximately 75% of the Company's issued shares.

(b) Limited operations in Australia : the Company's current

exploration assets are oil and gas permits offshore in Namibia and

the Company also has permit applications offshore Italy. It is the

Company's current intention to continue to explore these

opportunities. Save for maintaining a registered office in

Australia, the Company does not have any direct Australian

interests and four of its six Board members are now based in the

UK.

(c) Lack of Australian investor interest : Australian

institutional and retail investor interest in the Company is low

and has remained so despite continued efforts by the Company to

attract and retain investors based in Australia.

(d) Costs : maintaining two listings adds additional costs to

the Company's business. Additionally, there are indirect costs

associated with the need to devote management's time to attending

to matters relating to the ASX listing which could be better

directed elsewhere. Accordingly, the Board believes that the

sizeable costs associated with retaining a listing on the Official

List outweigh the benefits of maintaining such a listing

particularly in light of the Company's inability to raise capital

from Australian based investors in recent years.

Accordingly, Global has obtained in-principle advice from ASX in

relation to ASX's position regarding a request from the Company to

be removed from the Official List. ASX has advised Global that it

would be likely to grant such a request and remove the Company from

the Official List on a date to be decided by ASX, subject to the

Company's compliance with the following conditions:

1. Global sending a written or electronic communication in a

form and substance satisfactory to ASX (the "Notice") to all

security holders whose securities are held on the Company's

Australian register (the "Australian Shareholders") detailing the

following:

(a) the nominated time and date at which the entity will be

removed from the Official List (the "Nominated Time");

(b) that Australian Shareholders who wish to sell their

securities on ASX will need to do so before the Nominated Time;

(c) that Australian Shareholders who do not sell their

securities on ASX before the Nominated Time will thereafter only be

able to sell them on-market on AIM; and

(d) generally what Australian Shareholders will need to do if

they wish to sell their securities on AIM.

2. The removal not taking place any earlier than one month after

the date on which the Notice has been sent to all Australian

Shareholders.

3. Global releasing to the market the full terms of ASX's

decision upon formal application being made to delist the Company

from the Official List (see Annexure A).

Global intends to comply in full with the above conditions and

proposes to send the Notice to all Australian Shareholders on or

around 5 June 2020.

Global will seek to maintain its listing on ASX for one month

after the Notice is sent to all Australian Shareholders. On the

basis that the requisite Notice is duly sent to all Australian

Shareholders on 5 June 2020, Global has requested that the

Nominated Time for the Company's removal from the Official List be

4.00 p.m. (AEST) 8 July 2020. Assuming a delisting date of 8 July,

trading in Global's ordinary shares on ASX would continue on an

uninterrupted basis until 6 July 2020 which would be the last

trading date of shares on ASX.

Following the Company's removal from the Official List:

1. Australian Shareholders will have their Global shares held on

the CHESS and issuer sponsored sub-registers converted into

certificated forms on the Australian share register (which will

continue to be maintained on Global's behalf by Computershare

Investor Services Pty Limited). This process will occur

automatically, and no action will be required by an Australian

Shareholder. The Company's Australian share register will now be

unlisted and accordingly the Global shares held by Australian

Shareholders will not be able to be traded on ASX;

2. if the Company has more than 100 shareholders it will be an

"unlisted disclosing entity" under the Corporations Act. As such

the Company will still be required to give continuous disclosure of

material matters in accordance with the Corporations Act by filing

notices with ASIC under section 675 of the Corporations Act and the

Company will be required to lodge annual audited and half-yearly

financial statements in accordance with the requirements of the

Corporations Act. However, if the Company ceases to be an unlisted

disclosing entity there will be no ongoing requirements for the

Company to give continuous disclosure of material matters under

section 675 or lodge half-yearly financial statements reviewed by

an auditor but as a public company it will continue to be required

to lodge annual audited financial statements. In addition, the

Company notes that while its securities are admitted to trading on

AIM, it will also be required to give continuous disclosure of

material matters in accordance with the AIM rules; and

3. in order to trade Global's shares on AIM in the UK,

Australian Shareholders will need to convert their Global shares

into "depository interests" ("Global DIs") to facilitate holding

and trade settlement via CREST. CREST is a UK computerised

paperless share transfer and settlement system which allows shares

and other securities to be held in electronic rather than paper

form and transferred otherwise than by written instrument. CREST is

a voluntary system and those who wish to continue to still hold

their Global shares on the Australian share register, will be able

to do so (although this will preclude the holder from being able to

trade those Global shares on AIM);

The Company's UK share registry, Computershare Investor Services

PLC ("Computershare UK") holds and issues "depository interests" in

respect of, and representing, on a one-for-one basis, Global

shares.

Holders of Global DIs have the same rights as holders of Global

shares, including but not limited to, the right to:

1. receive notices of meetings and other notices issued by Global;

2. exercise the voting rights attached to the underlying Global shares; and

3. receive any dividends paid by Global from time to time to Global's shareholders.

The Global DIs are independent securities and are held on a

Depository register maintained by Computershare UK. The Global DIs

have the same security code and international securities

identification number as the underlying Global shares which they

represent and do not require a separate admission to trading on

AIM.

Australian Shareholders wishing to hold their Global DIs in

CREST and trade Global shares on AIM will be required to wait until

they have received their share certificate for their Global shares

from Computershare Investor Services Pty Limited and then engage

the services of a broker who is able to accept the Global DIs into

CREST, and then proceed to convert those Global shares into Global

DIs.

To assist Australian Shareholders who may wish to trade Global

shares on AIM following Global's removal from the Official List,

Global has appointed Australian Stockbrokers, Argonaut Securities

Pty Ltd ("Argonaut") to facilitate trading on AIM and the holding

and settlement of Global DIs within CREST. Australian Shareholders

requiring assistance should contact Mr Harrison Massey of Argonaut

on:

Mobile: +61 431 447 904

Work: +61 8 9224 6829

Alternatively, Australian Shareholders may wish to appoint a

Stockbroker based in the UK. A list of UK Stockbrokers can be found

via the London Stock Exchange website www.londonstockexchange.com

.

Australian Shareholders who have any questions on converting

Global Shares to Global DIs should contact Computershare Investor

Services Pty Limited on:

1300 850 505 within Australia; or

+61 3 9415 4000 from overseas.

As part of the procedure for delisting from ASX, Global will be

issued with a new International Securities Identification Number

(ISIN), to be provided with a new FISN and CFI code. The Company

will advise of the new ISIN and the new codes in due course, along

with any change in the corporate governance code to be adopted from

the point of the delisting from ASX.

If a Shareholder considers the removal from the Official List to

be contrary to the interests of the Shareholders as a whole or

oppressive to, unfairly prejudicial to, or unfairly discriminatory

against a Shareholder or Shareholders, it may apply to the court

for an order under Part 2F.1 of the Corporations Act. Under section

233 of the Corporations Act, the court can make any order that it

considers appropriate in relation to the Company, including an

order that the Company be wound up or an order regulating the

conduct of the Company's affairs in the future.

If a Shareholder considers that the removal from the Official

List involves "unacceptable circumstances", it may apply to the

Takeovers Panel for a declaration of unacceptable circumstances and

other orders under Part 6.10 Division 2 Subdivision B of the

Corporations Act (refer also to Guidance Note 1: Unacceptable

Circumstances issued by the Takeovers Panel). Under section 657D of

the Corporations Act, if the Takeovers Panel has declared

circumstances to be unacceptable, it may make any order that it

thinks appropriate to protect the rights or interests of any person

or group of persons, where the Takeovers Panel is satisfied that

those rights or interests are being affected, or will be or are

likely to be affected, by the circumstances.

For further information, please visit www.globalpetroleum.com.au

or contact:

Global Petroleum Limited

Peter Hill, Managing Director & CEO +44 (0) 20 3 875 9255

Andrew Draffin, Company Secretary +61 (0)3 8611 5333

Cantor Fitzgerald Europe (Nominated Adviser

& Joint Broker)

David Porter/Rick Thompson +44 (0) 20 7894 7000

Tavistock (Financial PR & IR)

Simon Hudson / Nick Elwes/ Barney Hayward +44 (0) 20 7920 3150

Annexure A

ASX Decision

ASX's decision is as follows:

1. Subject to Resolution 2, and based solely on the information

provided, on receipt of an application for removal from the

official list of ASX Limited ("ASX") under listing rule 17.11 by

Global Petroleum Limited the "Company"), ASX would likely to remove

the Company from the official list of ASX, on the date to be

decided by ASX, subject to compliance with the following

conditions:

1.1 The Company sends written or electronic communications to

all security holders whose securities are held on the Company's

Australian register, in form and substance satisfactory to ASX,

setting out:

1.1.1 the nominated time and date at which the entity will be

removed from the ASX official list and that:

(a) if they wish to sell their securities on ASX, they will need to do so before then; and

(b) if they don't, thereafter they will only be able to sell the

underlying securities on-market on the Alternative Investment

Market ("AIM").

1.1.2 generally what they need to do if they wish to sell their securities on AIM; and

1.2 The removal shall not take place any earlier than one month

after the date the information in Resolution 1.1 has been sent to

security holders.

1.3 The Company releases the full terms of this decision to the

market upon making a formal application to ASX to remove the

Company from the official list of ASX.

2. Resolution 1 applies only until 22 July 2020 and is subject

to any amendment to the listing rules or changes in the

interpretation or administration of the listing rules and policies

of ASX.

3. ASX has considered Listing Rule 17.11 only and makes no

statement as to the Company's compliance with other listing

rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKKPBQPBKKNAK

(END) Dow Jones Newswires

June 05, 2020 02:00 ET (06:00 GMT)

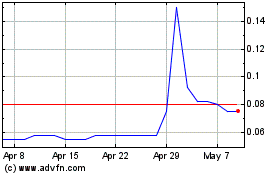

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global Petroleum (LSE:GBP)

Historical Stock Chart

From Apr 2023 to Apr 2024