TIDMHAMA

RNS Number : 0271O

Hamak Gold Limited

28 September 2023

28 September 2023

Hamak Gold Limited

("Hamak Gold" or the "Company")

Interim Results

Hamak Gold Limited (LSE: HAMA) is pleased to announce its

results for the six-month period ending 30 June 2023 (the

"period").

Highlights

-- GBP 295,750 raised (before costs) for continuation exploration at the Nimba licence

-- Consulting group GeoFocus retained to conduct a detailed

Induced Polarisation ("IP") geophysical survey of the Nimba

licence

-- Some 21-line kilometres of geophysical survey successfully

completed over the high-grade Ziatoyah gold discovery and northern

gold in soil anomaly

-- Structural interpretation and evaluation of geology around the Ziatoyah prospect completed

-- Several priority drill targets selected based on geophysical anomalies and structural targets

Highlights Post Period

-- GBP 350,000 raised (before costs) to fund drilling programme at the Nimba Licence

-- 13 holes drilled for 1000.60m to test geophysical and

structural targets, currently awaiting assays and

interpretation

Karl Smithson, Executive Director of Hamak Gold commented:

"The first half of 2023 has seen the team at Hamak Gold focus on

the promising high-grade Ziatoyah gold discovery in the Nimba

licence, where initial drilling has intersected 20m at 7g/t Au near

surface. These developments have included structural mapping and

the completion and interpretation of a detailed geophysical survey

over the immediate area around the discovery. Several drill targets

were selected based on the results and a 1,000m drill programme was

completed over a number of these in the quarter following the

interim report period.

"We are encouraged by the exploration progress being made to

identify extensions to the high-grade gold mineralization

discovered in the Nimba licence. Further work will continue to

focus on detailed mapping, structural interpretation and

investigations into the extensive 3km x 1km gold in soil anomaly

associated with the gold discovery already made."

For further information you are invited to view the company's

website at www.hamakgold.com or please contact:

Hamak Gold Limited

Amara Kamara +231 (0) 77 005 0005

Karl Smithson +44 (0) 77 837 07971

Peterhouse Capital Limited (Broker)

Lucy Williams

Guy Miller +44 (0) 20 7469 0930

Yellow Jersey PR

Sarah Hollins

Annabelle Wills +44 (0) 20 3004 9512

About Hamak Gold Limited

Hamak Gold Limited (LSE: HAMA) is a UK listed company focussed

on gold exploration of two priority exploration licences in highly

prospective areas of Liberia, where significant drilling results

have identified a new high-grade gold discovery with the discovery

hole returning 20m @ 7g/t Au near surface in the Nimba Licence.

INTERIM MANAGEMENT REPORT

Operating Review

The Company's focus during the period was dedicated to the Nimba

Licence and in particular the high-grade Ziatoyah gold discovery,

where in May 2023, the Company announced high priority drill

targets were identified following the competition of a geophysical

survey.

Licence Holdings

Hamak Gold holds two exploration licences, covering a combined

area of 1,115.20 square kilometres ("km"), Nimba and Gozohn.

Bedrock gold discoveries, associated with extensive gold in soil

anomalies, have been made at both licences. Exploration efforts

during the reporting period focussed on the Nimba licence Ziatoyah

gold discovery.

Nimba Licence

The Nimba Licence (MEL7001518) covers an area of 985.60 square

km and is located approximately 120 km to the north-east of the

Gozohn licence and some 25km west of the 3-million-ounce ("Moz")

Ity Gold Mine in neighbouring Cote D'Ivoire.

Since the Company's IPO in March 2022, detailed soil,

trench/channel and rock chip sampling have been completed with

positive results. In late 2022 this culminated in the discovery of

an outcropping (at surface) gold mineralized metadolerite unit at a

site called Ziatoyah, which was subsequently drilled and returned a

best result of 20m at 7g/t Au near surface under the mineralized

outcrop.

The gold in soil anomaly extends over a 3km by 1km northeast

trending area, where outcrop is limited. Streams that dissect the

anomaly are exploited by artisanal gold miners, suggesting that the

extent of the anomaly may be related to an extensive hard rock gold

deposit.

The gold mineralization intersected at Ziatoyah in the first

drilling programme, and observed in outcrop of the mineralized

metadolerite unit, suggests that the gold occurs as free grains

within disseminated crystalline and aggregates of vetiform pyrite

attaining levels of between 1% and 10% of the rock mass which is

dominated by locally carbonatized metadolerites. Microscopic free

gold has also been identified at numerous points within the

mineralized sections of the drill core.

Based on the high percentage of disseminated sulphides (pyrite)

associated with the gold, the Induced Polarisation (IP) geophysical

technique was considered best suited to define the disseminated

sulphide and gold-bearing mineralized units below surface.

International geophysical consulting group Geo Focus was contracted

to undertake the IP survey during the first quarter of 2023.

A total of 21-line km of survey were run along traverses varying

from 800 metres ("m") to 1,200m with line spacings of 100m and

200m. These lines were chosen to cover the Ziatoyah gold discovery

in the vicinity of the significant drill intersection of 20m at 7

grammes per tonne ("g/t") Au as well as the northern part of the

3km x 1km strong gold in soil anomaly. An initial IP

Orientation/Pilot survey block was surveyed (at 25m and 50m

dipole-dipole spacing) directly over the Ziatoyah discovery outcrop

and Drill Holes 1 and 2 to get the "fingerprint" of the gold

discovery and establish the optimal survey parameters to be applied

and conducted over the wider discovery area and northern soil

anomaly during the IP Follow Up survey.

Processing and interpretation of the geophysical data resulted

in the identification of a number of strong IP chargeability and

resistivity anomalies that can be correlated to the Ziatoyah

discovery and the gold in soil anomalies further to the north.

Structural interpretation based on the detailed multi-element

geochemical assays of the soil sampling, surface outcrop and drill

core was also carried out. A number of drill targets were selected

with the objective of defining extensions of the high-grade

Ziatoyah gold discovery.

Post period end, a 1,000m drill programme was carried out. A

total of 12 angled holes and one vertical hole were drilled, core

logged, structural measurements made, core cut and submitted for

assay. The Company is currently awaiting results which it hopes to

share with the market in the second half of 2023.

Gozohn Licence

The Gozohn licence (MEL 7002318) covers an area of 129.60 square

km and is located some 30 km to the south of the high-grade Kokoya

Gold mine operated by MNG Gold. The licence is host to a number of

structurally controlled greenstone belts similar to those at

Kokoya, with strongly deformed amphibolite, quartzite, schist and

banded ironstone formations which generally occur as topographic

highs.

Previous soil, rock and trench sampling has identified a 1,500m

long gold in soil anomalies with rock chip samples returning grades

of 2.56g/t Au and 3.37 g/t Au, which are interpreted as being

related to gold in quartz veins that permeate the greenstone belt

geology.

No exploration was undertaken on Gozohn during the reporting

period as resources were focussed on Nimba as a priority.

Outlook

The Company anticipates receiving the aforementioned drill assay

results for its Ziatoyah site during the next quarter. These

results will subsequently determine Hamak's next steps in its

efforts to further explore the Ziatoyah gold deposit and wider gold

in soil anomalies, which, subject to funding, may involve a more

extensive drill programme to deliver a maiden gold resource for the

Company.

The principal risks identified for the Company in the

forthcoming reporting period include the scheduled elections in

Liberia in the final quarter of 2023. Whilst recent elections in

the Country have passed relatively peacefully, any serious

disturbance or public disorder could adversely affect the

efficiency and continuity of the exploration activities for a

period of time. In addition, the capital markets for junior

exploration companies remains challenging. The Company will seek to

raise further capital going forward and continuation of the

exploration programme will be contingent on the Company being able

to successfully raise funds.

Responsibility Statement

The Directors confirm that to the best of their knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' as

contained in UK-adopted international accounting standards;

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R of the Disclosure and

Transparency Rules (indication of important events during the first

six months and description of principal risks and uncertainties for

the remaining six months of the year; and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R of the Disclosure and

Transparency Rules (disclosure of related parties' transactions and

changes therein).

Karl Smithson

Executive Director

28 September 2023

Hamak Gold Ltd

INTERIM RESULTS

30 June 2023

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2023

6 months 6 months

ended ended

30 June 30 June 2022

Note 2023 Unaudited Unaudited

Continuing operations $000 $000

----------------------------------- ------- ----------------- ---------------

General and administrative

expenses 261 1,489

Operating Loss 261 1,489

----------------------------------- ------- ----------------- ---------------

Loss before taxation 261 1,489

----------------------------------- ------- ----------------- ---------------

Tax charge - -

Loss after taxation 261 1,489

----------------------------------- ------- ----------------- ---------------

Loss for the period 261 1,489

----------------------------------- ------- ----------------- ---------------

Loss per share from continuing

operations in cents per share:

Basic and diluted 6 (0.006) (0.10)

----------------------------------- ------- ----------------- ---------------

Condensed Consolidated Statement of Financial Position

For the six months ended 30 June 2023

Note 6 months Year ended

ended 31 December

30 June 2022

2023 Unaudited Audited

$000 $000

------------------------------- ------- --------- ----------------- ----------------

Non-current assets

Property, plant and equipment 7 28 33

Intangible assets 8 1,502 1,481

------------------------------- ------- --------- ----------------- ----------------

Total non-current assets 1,530 1,514

------------------------------- ------- --------- ----------------- ----------------

Current assets

Trade and other receivables 17 26

Cash and cash equivalents 9 12 12

------------------------------- ------- --------- ----------------- ----------------

Total current assets 29 38

------------------------------- ------- --------- ----------------- ----------------

Total assets 1,559 1,552

------------------------------- ------- --------- ----------------- ----------------

Equity and Liabilities

Equity attributable to owners

of the parent

Share capital 10 5,691 5,147

Share based payment reserve 10 80

Accumulated deficit (4,237) (4,086)

------------------------------- ------- --------- ----------------- ----------------

Total equity 1,464 1,141

------------------------------- ------- --------- ----------------- ----------------

Current liabilities

Trade and other payables 95 411

Unsecured convertible loan - -

Total current liabilities 95 411

------------------------------- ------- --------- ----------------- ----------------

Total equity and liabilities 1,559 1,552

------------------------------- ------- --------- ----------------- ----------------

Condensed Consolidated Statement of Changes in Equity

For the six months ended 30 June 2023

Share

Share based payment Accumulated

capital deficit Total equity

$000 $000 $000 $000

------------------------------------- ---------- ---------------- -------------- -----------------

Balance at 1 January 2022 - - (355) (355)

------------------------------------- ---------- ---------------- -------------- -----------------

Loss for the period - - (1,489) (1,489)

Issue of share capital 2,734 - 2,734

Grant of share-based awards - 1,181 - 1,181

Balance at 30 June 2022 - Unaudited 2,734 1,181 (1,844) 2,071

------------------------------------- ---------- ---------------- -------------- -----------------

Loss for the period - - (2,242) (2,242)

Issue of share capital 239 - - 239

Issue costs (215) - - (215)

Issue of shares on exercise

of share awards 2,389 (3,570) - (1,181)

Grant of share-based awards - 2,469 - 2,469

Balance at 31 December 2022

- Audited 5,147 80 (4,086) 1,141

------------------------------------- ---------- ---------------- -------------- -----------------

Loss for the period - - (261) (261)

Issue of share capital 563 - - 563

Issue costs (19) - - (19)

Share-based awards exercised

or lapsed - (110) 110 -

Share based awards charge - 40 - 40

Balance at 30 June 2023 - Unaudited 5,691 10 (4,237) 1,464

------------------------------------- ---------- ---------------- -------------- -----------------

Unaudited Condensed Consolidated Statement of Cash Flows

For the six months ended 30 June 2023

6 months 6 months

ended ended

30 June 30 June

2023 Unaudited 2022 Unaudited

$000 $000

------- ---------- ----------------- -----------------

Cash flows from operating activities

Operating loss (261) (1,489)

Adjusted for:

Share based payment charge 40 1,181

Directors' fees paid in shares 111 40

Depreciation and amortisatio n 5 2

Unrealised foreign exchange change 2 6

Net cash flow before changes in working

capital (103) (260)

-------------------------------------------------------------------- ----------------- -----------------

Adjusted for by:

Movement in payables (225) (285)

Movement in receivables 8 -

Net cash flow from operating activities (320) (545)

-------------------------------------------------------------------- ----------------- -----------------

Investing activities

Purchase of property, plant and equipment - (26)

Exploration expenditure (21) (336)

Net cash flow from investing activities (21) (362)

-------------------------------------------------------------------- ----------------- -----------------

Cash flow from financing activities

Issue of share capital (net of costs) 341 1,167

Net cash flow from financing activities 341 1,167

-------------------------------------------------------------------- ----------------- -----------------

Net change in cash and cash equivalents

during the year/period - 260

Cash and cash equivalents at beginning

of the period 12 (2)

-------------------------------------------------------------------- ----------------- -----------------

Cash and cash equivalents at end of

the period 12 258

-------------------------------------------------------------------- ----------------- -----------------

Notes to the condensed consolidated interim financial

information

1. GENERAL INFORMATION

Hamak Gold Ltd ("Company") was incorporated on 6 May 2021 and

was incorporated under the BVI Business Companies Act, 2004 (as

amended) of the British Virgin Islands with Company number 2062435.

The Company is limited by shares. The Company's registered office

is Pasea Estate, P.O. Box 958, Road Town, Tortola, VG1110, BVI.

The Company is a public limited company, which is listed on the

Standard Listing of the London Stock Exchange. Admission was

completed on 1 March 2022. The principal activity of the Company is

mineral exploration.

The Company together with its wholly owned subsidiary Hamak Gold

Limited (Liberia) is referred to as the Group.

2. BASIS OF PREPARATION

The consolidated interim financial statements for the six months

ended 30 June 2023 have been prepared in accordance with the

requirements of IAS 34 "Interim Financial Statements". The interim

financial statements should be read in conjunction with the annual

financial statements for the year ended 31 December 2022, which

have been prepared in accordance with the UK-adopted International

Accounting Standards and as applied in accordance with the

provisions of the applicable law. The report of the auditors on

those financial statements was unqualified.

The interim financial statements of the Group are unaudited

financial statements for the six months ended 30 June 2023 have not

been audited or reviewed by the Group's auditors. The financial

statements have been prepared under the historical cost convention.

The consolidated financial statements are presented in United

States Dollars ($), which is the Group's functional and

presentation currency.

Comparatives

The comparatives presented are for the unaudited 6 months period

ended 30 June 2022 for the Condensed Consolidated Statement of

Comprehensive Income, Condensed Consolidated Statement of Changes

in Equity, Condensed Consolidated Statement of Cash Flows and for

the audited year ended 31 December 2022 for the Condensed

Consolidated Statement of financial Position and Condensed

Consolidated Statement of Changes in Equity.

Going concern

The Company is at an early stage in progressing its exploration

assets and has limited overhead costs. Funds raised from the IPO

and subsequent share placements have been used primarily to fund

exploration work on its licences in Liberia. Subsequent to the IPO

in March 2022, in January 2023 the Company raised GBP295,750 before

expenses by the placement of new shares followed after the end of

the reporting period in July 2023 by a further GBP350,000 before

expenses. Additional plans are in place to raise further working

capital to enable the Company to progress its work programmes.

The Directors have a reasonable expectation that the Company

will be able to raise sufficient funds in order to meet planned

expenditure for at least 12 months from the date of approval of

these interim consolidated financial statements and therefore the

interim consolidated financial statement have been prepared on a

going concern basis.

3. SIGNIFICANT ACCOUNTING POLICIES

In preparing these condensed consolidated financial statements,

the Group's accounting policies were consistent with those applied

to the Group's consolidated financial statements for the year ended

31 December 2022.

4. CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities at the end of the

reporting period. Estimates and judgements are continually

evaluated based on historical experience and other factors,

including expectations of future events that are believed to be

reasonable under the circumstances. In the future, actual

experience may differ from these estimates and assumptions.

The judgements, estimates and assumptions applied in the

condensed interim financial statements, including the key sources

of estimation uncertainty, were the same as those applied in the

Group's last annual financial statements for the year ended 31

December 2022.

5. BUSINESS AND GEOGRAPHICAL REPORTING

The Group's chief operating decision maker is considered to be

the executive directors (the 'Executive Board'). The Executive

Board evaluates the financial performance of the Group. During the

period the Group had one activity only. The whole of the value of

the Group's net assets was attributable to mineral exploration.

6. LOSS PER SHARE

Basic earnings per share is calculated by dividing the loss

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the period.

6 months 6 months

ended 30 ended 30

June 2023 June 2022

$000 $000

--------------------------------------- ------------ ------------

Loss from continuing operations

attributable to equity holders

of the company (261) (1,489)

---------------------------------------- ------------ ------------

Weighted average number of ordinary

shares in issue 44,964 14,251

---------------------------------------- ------------ ------------

Basic and fully diluted loss

per share from continuing operations

in cents (0.006) (0.10)

---------------------------------------- ------------ ------------

7. PROPERTY, PLANT AND EQUIPMENT

Plant and

Equipment Total

$000 $000

-------------------------- ----------- --------

Cost

At 1 January 2023 41 41

Additions - -

At 30 June 2023 41 41

-------------------------- ----------- --------

Cost

At 1 January 2022 - -

Additions 41 41

At 31 December 2022 41 41

Accumulated Depreciation

At 1 January 2023 8 8

Depreciation charge 5 5

At 30 June 2023 13 13

-------------------------- ----------- --------

Accumulated Depreciation

At 1 January 2022 - -

Depreciation charge 8 8

At 31 December 2022 8 8

Net book value

-------------------------- ----------- --------

At 30 June 2023 28 28

-------------------------- ----------- --------

At 31 December 2022 33 33

-------------------------- ----------- --------

8. INTANGIBLE ASSETS

Mineral

Properties Licences Total

$000 $000 $000

-------------------------- ------------ ----------- --------

Cost

At 1 January 2023 618 863 1,481

Additions 21 - 21

-------------------------- ------------ ----------- --------

At 30 June 2023 639 863 1,502

-------------------------- ------------ ----------- --------

Cost

At 1 January 2022 - - -

Additions 618 863 1,481

At 31 December 2022 618 863 1,481

Accumulated Amortisation

At 1 January 2023 - - -

Amortisation charge - - -

At 30 June 2023 - - -

Accumulated Amortisation

At 1 January 2022 - - -

Amortisation charge - - -

-------------------------- ------------ ----------- --------

At 31 December 2022 - - -

-------------------------- ------------ ----------- --------

Net book value

-------------------------- ------------ ----------- --------

At 30 June 2023 639 863 1,502

-------------------------- ------------ ----------- --------

At 31 December 2022 618 863 1,481

-------------------------- ------------ ----------- --------

On 1 March 2022, the Group acquired two mineral exploration

licences (MELs), being Nimba and Gozohn and an option to acquire

five other MELs in consideration for $1,355,460.

Following a full review by the Board, certain parts of the

Gozohn licence were relinquished during the period resulting in

$516,000 being part of the licence acquisition and exploration

costs being written off.

9. CASH AND CASH EQUIVALENT

6 months ended Year ended

30 June 2023 31 December

Unaudited 2022

Audited

$000 $000

---------------- --------------- -------------

Cash at bank 12 12

12 12

---------------- --------------- -------------

10. SHARE CAPITAL

Number of

ordinary Share Share premium

shares of capital $000

nil par value $000

--------------------------------------- --------------- ---------- ----------------

Total as at 1 January 2022 50,000 - -

Share issue - licence acquisition 9,283,333 - 1,355

Share issue - placing 9,550,000 - 1,272

Share issue - directors fees 1,230,944 - 148

Share issue - corporate fees 983,000 - 131

Share issue - conversion of

loan notes 666,667 - 67

Share issue - vesting shares 17,940,000 - 2,389

Share issue - costs - - (215)

--------------------------------------- --------------- ---------- ----------------

At 31 December 2022 39,703,944 - 5,147

--------------------------------------- --------------- ---------- ----------------

Share issue - in lieu of services

provide 781,250 - 92

Share issue - placing 3,380,000 - 359

Share issue - directors fee

shares 914,277 - 111

Share issue - exercise of performance

rights 953,107 - -

Share issue - costs - - (19)

Total as at 30 June 2023 45,732,578 - 5,691

--------------------------------------- --------------- ---------- ----------------

For a more detailed description of the share capital movements

for 2022 refer to the audited financial statements for the year

ended 31 December 2023

Placing

In January 2023 the Company raised gross proceeds of GBP295,750

($359,000) issuing 3,380,000 new ordinary shares at GBP0.0875 per

share.

Shares issued for services

In January 2023 the Company issued 781,250 new ordinary shares

at GBP0.10 per share to the directors of Cestos Drilling in lieu of

GBP78,125 payable on completing a 450m drilling programme at

Nimba.

Directors fees

During the period 914,277 new ordinary shares were issued to the

non-executive Directors of the Company at 10p per shares in lieu of

quarterly fees.

Exercise of performance rights

In March 2023 the Group achieved the first drill intersection

showing significant gold mineralisation (as determined by the

Senior Technical Consultant to the Board), triggering the vesting

of 953,107 performance rights. Accordingly, 953,107 new ordinary

shares were issued at NIL cost to directors and others.

Reconciliation of movement of share capital to the movements in

the cashflow statement

Share Share premium

capital $000

$000

--------------------------------------- ----------- ----------------

At 31 December 2022 - 5,147

--------------------------------------- ----------- ----------------

Share capital issued for cash - 341

Share capital issued in settlement of

contractual obligations - 203

Total as at 30 June 2023 - 5,691

--------------------------------------- ----------- ----------------

11. SHARE BASED PAYMENTS

Performance Rights

At 30 June 2023, the Company had outstanding performance rights

to subscribe for ordinary shares as follows:

Weight

average expired

exercise Expiry or

price date At 01/01/203 Issued lapsed At 31/12/2022

Nil 07/07/2032 1,064,924 - (1,064,924) -

Nil 07/07/2032 1,064,924 - (111,817) 953,107

2,129,848 - (1,064,924) 953,107

------------------------ ------------- --------- ------------ --------------

Information on the inputs and fair value calculations relating

to the performance rights are shown in the audited financial

statements for the year ended 31 December 2022

During the period 953,107 performance rights were exercised by

directors and others and 223,634 performance rights lapsed,

relating to Walter McCarthy.

12. RELATED PARTY TRANSACTIONS

During the period certain directors were awarded Ordinary Shares

in the Company. Further details can be found in note 10, Share

Capital.

13. EVENTS AFTER THE REPORTING DATE

In July 2023, the Company raised GBP350,000 before costs from

the placement of 4,000,000 new ordinary shares of no par value at a

price of 8.75 pence per share of which 359,955 were issued in

settlement of third party drilling costs.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEWFSAEDSEIU

(END) Dow Jones Newswires

September 28, 2023 07:09 ET (11:09 GMT)

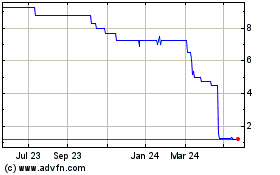

Hamak Gold (LSE:HAMA)

Historical Stock Chart

From Feb 2025 to Mar 2025

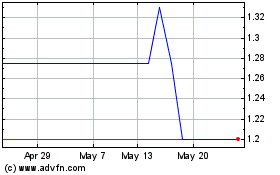

Hamak Gold (LSE:HAMA)

Historical Stock Chart

From Mar 2024 to Mar 2025