Harvest Minerals Limited Notice of AGM (0774U)

October 20 2017 - 1:00AM

UK Regulatory

TIDMHMI

RNS Number : 0774U

Harvest Minerals Limited

20 October 2017

Harvest Minerals Limited / Index: LSE / Epic: HMI / Sector:

Mining

20 October 2017

Harvest Minerals Limited

("Harvest" or the "Company")

Notice of AGM

Harvest Minerals Limited, the AIM listed fertiliser development

company, is pleased to announce that the Annual General Meeting

('AGM') of the Company will be held at 4.00pm (WST) on 21 November

2017 at 22 Lindsay Street, Perth, WA 6000, Australia.

The notice of AGM and form of proxy will be posted to

shareholders today and will be made available on the Company's

website at http://www.harvestminerals.net/.

ENDS

For further information please visit www.harvestminerals.net or

contact:

Harvest Minerals Brian McMaster Tel: +61 8 9200

Limited (Chairman) 1847

Strand Hanson Limited James Spinney Tel: +44 (0)20

(Nominated & Financial Ritchie Balmer 7409 3494

Adviser)

Mirabaud Securities Rory Scott Tel: +44 (0)20

LLP 7878 3360

(Joint Broker)

Beaufort Securities Jon Belliss Tel: +44 (0)20

Ltd 7382 8300

(Joint Broker)

St Brides Partners Isabel de Salis Tel: +44 (0)20

Ltd 7236 1177

Olivia Vita

Notes:

Harvest Minerals (HMI.L) is a South American focused fertiliser

Company targeting low cost, near term development projects. The

Company's primary focus is the development of its 100% owned Arapua

Fertiliser Project from which it produces its KPfértil product, a

proven, multi-nutrient, slow release, organic fertiliser and

remineraliser, which is produced from a weathered potassium and

phosphate rich lava and offers many economic and agronomic

benefits. Covering 14,946 hectares and located in the heart of the

Brazilian agriculture belt in Minas Gerais, Arapua is a shallow,

low cost mine with an indicated and inferred resource of 13.07Mt at

3.1% K(2) O and 2.49% P(2) O(5) . This resource translates into a

mine life of over 100 years at a rate of 450k tonnes per annum and

crucially is based on drilling just 6.7% of the known

mineralisation, leaving significant upside potential. With a trial

mining licence in place allowing Harvest to extract 50kt of product

on a rolling basis, whilst the full mining licence application

process is underway, and official registration of KPfértil as a

remineraliser expected by the end of 2017, Harvest is ideally

placed to address the significant demand for locally produced

fertiliser in Brazil; Brazil has abundant agricultural land but

lacks domestic fertiliser, with the country currently importing 90%

of the potash it uses. Furthermore, the Brazilian government has

set a target to be self-sufficient in fertilisers by 2020, creating

significant market opportunity for Harvest and its KPfértil

product.

The Company has four assets at various stages of development and

continues to explore other opportunities that fit its investment

criteria.

This information is provided by RNS

The company news service from the London Stock Exchange

END

NOAFFESUUFWSEFS

(END) Dow Jones Newswires

October 20, 2017 02:00 ET (06:00 GMT)

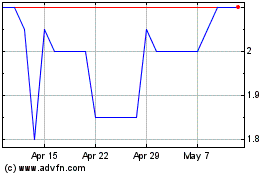

Harvest Minerals (LSE:HMI)

Historical Stock Chart

From Apr 2024 to May 2024

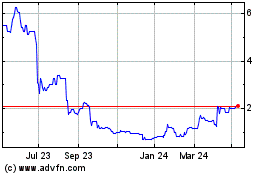

Harvest Minerals (LSE:HMI)

Historical Stock Chart

From May 2023 to May 2024