TIDMIIG

RNS Number : 2901E

Intuitive Investments Group plc

29 June 2023

29 June 2023

Intuitive Investments Group plc

Interim report for the six months to 31 March 2023

Intuitive Investments Group plc (AIM: IIG) ("IIG" or the

"Company"), a closed-end investment company focussed on the life

sciences sector, announces its interim results for the six months

to 31 March 2023.

Financial highlights

31 March 30 September 31 March 30 September

2023 2022 2022 2021

GBP9 .42 GBP12.33

Net Assets million GBP12.93 million million GBP8.14 million

GBP7 .86 GBP10.40

Investments million GBP11.16 million million GBP5.74 million

GBP1 .23

Cash million GBP1.55 million GBP1.91 million GBP2.57 million

NAV per share 1 3.07p 18.00p 18.73p 20.14p

% Increase/(decrease)

from previous

period end ( 27.38)% (3.90)% (6.96)% 2.99%

Highlights

-- Follow-on investment in Yourgene Health plc of GBP150,407 to

acquire 50 million shares at a price of 0.3 pence per share. IIG

holds 51,584,920 ordinary shares, or 1.62%, of the issued share

capital of Yourgene.

-- Reorganisation of investment in Sanondaf, reduction in

deferred consideration and adjustment to fair value.

-- Post period end follow-on investment in Light Science

Technologies Holdings plc of GBP150,000 to acquire 15 million

shares at a price of 1 penny per share. IIG holds 28,280,000

ordinary shares, or 8.49%, of the issued share capital of Light

Science Technologies in total.

Intuitive Investments Group plc www.iigplc.com

Julian Baines, Non-Executive Chairman Via SP Angel

Robert Naylor, CEO

SP Angel Corporate Finance LLP

- Nominated Adviser +44 (0) 20 3470 0470

Jeff Keating / David Hignell / Kasia

Brzozowska

Turner Pope Investments (TPI) Ltd

- Broker +44 (0) 20 3657 0050

Andrew Thacker / James Pope

About Intuitive Investments Group plc

The Company is an investment company seeking to provide

investors with exposure to a portfolio concentrating on fast

growing and/or high potential Life Sciences businesses operating

predominantly in the UK, continental Europe and the US, utilising

the Board's experience and in particular that of the chairman of

the Investment Committee, David Evans, to seek to generate capital

growth over the long term for shareholders.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

Chairman and Chief Executive's Report

We are pleased to present the interim report for Intuitive

Investments Group plc, which covers the six months ended 31 March

2023.

Publicly traded investments

Publicly quoted small-cap healthcare companies continue to

underperform. We perceive there is a value in the Company's

portfolio and the opportunity for high returns if these companies

are allowed to successfully develop and commercialise their

innovative products or services that meet unmet medical needs.

However, without the ability to raise capital, a number are

destined to struggle regardless of the quality of their products or

services.

We made follow-on investments in Yourgene Health plc

("Yourgene") and, post period end, into Light Science Technology

Holdings ("Light Science") of approximately GBP150,000 each. The

discounts on these follow-on investments to the share prices where

we initially invested were brutal. We originally purchased shares

in Yourgene at a price of 15.5 pence and our follow-on investment

was at 0.3 pence, a discount of 98%. Similarly Light Science

floated at a price of 10 pence per share and our follow-on

investment was at 1 penny, a discount of 90%. Of note is the

investment in Midatech Pharma plc whereby the company's initial

proposed transaction was voted down by shareholders and, as a

consequence, the company had to undertake a highly dilutive rescue

fundraising, in effect wiping out the existing shareholders'

equity. The company has been renamed Biodexa Pharmaceuticals

plc.

Valuation as at

31 March 30 September Unrealised

2023 2022 gain/(loss)

GBP GBP GBP

Evgen Pharma plc 80,937 65,625 15,312

Light Science Technologies

Holding plc 531,200 863,200 (332,000)

Microsaic Systems plc 92,160 88,400 3,760

Biodexa Pharmaceuticals plc

(previously Midatech Pharma

plc) 1,365 26,250 (24,885)

Polarean Imaging plc 89,583 175,000 (85,417)

Shield Therapeutics plc 50,000 75,000 (25,000)

Trellus Health plc 27,625 29,750 (2,125)

Yourgene Health plc(.) (bfwd) 4,359 71,321 (66,962)

Yourgene Health plc. (follow

on investment) (1) 137,500 - (12,907)

----------- -------------- --------------

Closing fair value 1,014,729 1,394,546 (530,224)

(1) Follow o n investment of GBP 150,407 made on 12 January

2023

Unquoted companies

Our portfolio of unquoted companies has performed reasonably in

comparison to the publicly quoted portfolio and continues, in the

main, to be held at cost, plus accrued interest if applicable, or

at the valuation of the most recent investment round. Momentum

Limited has raised additional capital post period end at the same

valuation as the round in which IIG participated and therefore

there is no increase or decrease in valuation. We are aware of one

investee companies currently raising capital which may negatively

impact its valuation. Further details of the companies in the

unquoted portfolio are contained at the end of this statement.

Reorganisation of investment in Sanondaf, reduction in deferred

consideration and adjustment to fair value

As announced on 24 May 2023, the Company has reorganised

Touchless Innovation Limited ("Touchless Innovation") and

Touch-Less Hygiene UK Limited ("Touch-Less Hygiene") (together the

"Touchless Group") which trades under the name Sanondaf and the

Board has negotiated a reduction in the deferred consideration

payable to the vendors of the business and assets of Sanoserv

International Franchising Limited. After careful consideration, the

Board is now proposing reducing in the fair value of the Touchless

Group.

The board of Touchless Innovation , with the agreement of the

board of IIG, moved Touch-Less Hygiene from being a wholly owned

subsidiary of Touchless Innovation to beinga wholly owned

subsidiary of IIG. Touchless Innovation and Touch-Less Hygiene have

different business models. Touchless Innovation is an international

franchising business, with master franchise es in 11 countries.

Touch-Less Hygiene is a UK market-leading provider of specialist

disinfection and decontamination services, with 25 regional sites

in the UK and customers that include blue-chip life sciences

companies, essential infrastructure firms and the NHS. Given the

distinct business models, separating and having distinct management

teams will improve both the opportunity for growth and the

potential to attract third party funding.

The consideration payable by Touchless Innovation to the vendors

included GBP900,000 of deferred consideration payable six months

from completion, due on 25 August 2022. In substitution for the

GBP900,000 the Boards of IIG and Touchless Innovation agreed to

issue the vendors 2,000,000 new ordinary shares of 1 penny each in

IIG, as well as allowing the vendors the master franchise for Malta

for nine years. The minimum royalty amount under the master

franchise agreement is US$5,400 per annum. In addition, the vendors

no longer have the right to appoint a director to the Board of

Touchless Innovation.

The Touchless Group continues to trade profitably and make

significant progress:

-- Touch-Less Hygiene, in selling machines and consumable

product alongside the existing extensive franchise network; and

-- Touchless Innovation has an extensive sales pipeline in the

US which the Board believe will convert to sales imminently.

For the year ended 30 September 2022 the Touchless Group

reported unaudited turnover of GBP1.94 million, profit after tax of

GBP142,000, has net assets of GBP2.24 million including cash of

GBP423,000. The Board has therefore taken the prudent view to

reduce the valuation of the investment in the Touchless Group from

GBP6.36 million to GBP3.50 million, split equally for Touchless

Innovation and Touch-Less Hygiene Touch-Less Hygiene.

Financial performance

NAV per Ordinary Share at; flotation: 18.78 pence; 30 September

2022: 18.00 pence; 31 March 2023: 13.07 pence. Absent the write

down in the Touchless Group the NAV per Ordinary Share would have

been 17.05 pence. There are investment losses of GBP3.44 million,

comprising unrealised losses of GBP3.49 million, interest income

from the convertible loan notes of GBP44,000 and management fee

income of GBP12,000. The structure of the Company is purposefully

simple, and the administrative costs of the business were

GBP193,000 for the period. Overall, the loss for the period was

GBP3.51 million.

Outlook

Despite short term headwinds the Board believer there are

significant opportunities to restore shareholder value. We look

forward to updating you as to our progress in the near term.

Later stage investments

BioQ Pharma Incorporated ("BioQ")

Investment of US$1 million by way of unsecured convertible loan

notes and warrants, valued at cost plus accrued interest.

BioQ has raised more than US$30 million in subscription for the

CLN and is looking to prepare for a fundraising in the Series E

ordinary shares.

BioQ is a commercial-stage, medical device and pharmaceutical

company, addressing the infusible drugs market. BioQ's proprietary

Invenious(TM) platform comprises a "connect-and-go" drug-device

system combination, which can be utilised to improve the delivery

of infusible medicines. BioQ's platform includes a bespoke

unit-dose delivery solution for infusible drugs, whereby a diluent

delivery system and administration line are combined in one

self-contained, ready-to-use presentation. The key benefits of the

platform include reduced cost and complexity compared to current

infusion techniques.

Touchless Innovation Ltd ("Sanondaf")

Investment of GBP1.75 million to acquire the entire issued share

capital, held at fair value, for which cost is which is based on

Directors' valuation.

Touchless Innovation is an international licensing and

franchising business, with master franchise agreements in ten

countries. Sanondaf licenses the brands, know-how and intellectual

property of specialist disinfection and decontamination

technology.

Touch-Less Hygiene Ltd ("Touch-Less Hygiene")

Investment of GBP1.75 million to acquire the entire issued share

capital, held at fair value, which is based on Directors'

valuation.

Touch-Less Hygiene is a market-leading provider of specialist

disinfection and decontamination services and has 25 regional sites

in the UK. Treatments are non-corrosive, contain no toxic

ingredients and Sanondaf's application methods ensure they are not

harmful to people, animals or the environment. It is safe for use

in all settings, including operating theatres, critical care units,

and is CASA (Civil Aviation Safety Authority) approved. Sanondaf's

disinfection formula has proven efficacy against pathogens,

included, viruses, mould, bacteria and fungi. Customers include the

blue-chip life sciences companies, essential infrastructure firms

and the NHS. Touchless Hygiene holds a master franchise agreement

from Touchless Innovation Ltd to operate in the UK.

Series A and B investments

Axol Bioscience Ltd ("Axol")

Investment of GBP249,092 in A ordinary shares, held at fair

value, for which cost is deemed the most appropriate basis of

measurement. The company undertook a fundraising in April 2022 at

the same valuation as IIG's investment.

Axol produces high quality human cell products, particularly in

relation to pluripotent stem cell and critical reagents such as

media and growth supplements, which are sold to medical research

and drug discovery organisations. Axol also provides contract

research for example customising cell lines for customers, such as

reprogramming and differentiation. The Chairman of Axol is Jonathan

Milner, who was previously deputy chairman of Abcam plc.

CardiNor AS ("CardiNor")

Investment of GBP112,891 in ordinary shares, held at fair value,

for which cost is deemed the most appropriate basis of

measurement.

CardiNor has made excellent progress particularly with the

amount of money raised, which includes:

-- Elisa test CE marked with clear route to market in the Europe

and next generation magnetic test being developed.

-- RuO in the US, but distribution deal done with IBL and

talking to Labcorp. Going for full FDA approval.

Valuation is 80 million NOK (c.GBP7.0 million). CardiNor is a

Norwegian biotech company established in June 2015 to commercialise

the development of secretoneurin ("SN"), an important new biomarker

for cardiovascular disease ("CVD"). SN is the only biomarker shown

to be associated with biological processes linked to cardiomyocyte

handling. This unique biological function explains why SN presents

as an independent and strong predictor of mortality in all major

patient cohorts, including ventricular arrhythmia, acute heart

failure, acute respiratory failure patients with CVD and severe

sepsis. CardiNor has completed development of a research assay

based on immunoassay technology to measure SN in blood and the

assay is under further clinical development, allowing it to obtain

a CE mark.

The Electrospinning Company Ltd ("TECL")

Investment of GBP500,000 in ordinary shares, held at fair value,

for which cost is deemed the most appropriate basis of

measurement.

Held at cost, TECL is trading in line with management

expectations. TECL has a technology platform built around the

process of electrospinning, a technique for production of micro and

nano-fibre biomaterials from a variety of natural and synthetic

polymers, and a suite of post-processing technologies to convert

the biomaterials into medical device components. The core business

is the sale of product development and manufacturing services to

medical device companies. TECL is also using its know-how to

develop proprietary materials for targeted out-licensing

opportunities, aiming to capture more of the end-market value

created by its innovations and expertise.

Micrima Ltd ("Micrima")

Investment of GBP229,636 by way of convertible loan note held at

fair value, for which cost is deemed the most appropriate basis of

measurement.

Micrima specialises in radiofrequency technology to improve

early diagnosis of breast cancer and measure breast density.

Micrima continues to make progress, but has suffered delays in its

commercial launch and as a consequence is looking to refocus on

breast density measurement.

Momentum Bioscience Ltd ("Momentum")

Investment of GBP125,000 in preferred A ordinary shares, held at

fair value, for which cost is deemed the most appropriate basis of

measurement. Momentum undertook an additional subscription in

September 2022 at the same valuation as IIG's investment.

Momentum is developing a revolutionary rapid diagnostic test for

patients suspected of sepsis, an infection of the blood stream

resulting in symptoms including a drop in a blood pressure,

increase in heart rate and fever. Momentum's SepsiSTAT(R) system

enables reporting of the presence or absence and 'pan gram

identification' of viable organisms in just two hours, helping

direct the right antimicrobials. The system also provides a pure

concentrate of growing organisms for further analysis. Faster

testing in suspected sepsis patients can reduce mortality,

accelerate hospital discharge, lower hospital costs, and reduce the

incidence of antimicrobial resistance. SepsiSTAT(R) is a diagnostic

test that runs from a sample of whole blood before any culturing

steps are taken and is currently being studied in clinical practice

with highly encouraging early results indicating competitive

sensitivity versus the current standard of care. Over 120 million

blood tests for sepsis are run annually representing a market

potential of over GBP1 billion.

Ocutec Ltd ("Ocutec")

Investment of GBP250,000 in ordinary shares, held at fair value,

for which cost is deemed the most appropriate basis of measurement.

Post period Ocutec completed a fundraising of GBP1.2 million. The

price was GBP2.00 per ordinary share which compares to a price of

GBP1.60 per ordinary share at the time of the Company's investment.

Therefore, there is a post period end unrealised gain of GBP62,500,

based on most recent funding round.

Ocutec has patented technology covering the formulation of novel

contact lens products, contact lens comfort solutions and injection

moulding technology for rapid manufacturing. Ocutec is based in

Glasgow, and has been operating since 2006, having been spun out of

the University of Strathclyde.

PneumoWave Ltd ("PneumoWave")

Investment of GBP904,124 in new ordinary shares, held at fair

value, for which last investment round is deemed the most

appropriate basis of measurement.

IIG invested GBP100,000 by way of convertible loan notes which

converts at a 15% discount to the Series A and GBP350,000 in the

pre-series A funding round. The Series A round has completed

leading to an increase in valuation of GBP454,124.

PneumoWave, which was incorporated in February 2018, is

developing an innovative remote respiratory monitoring platform

comprising a small, chest-worn biosensor and AI-driven data

analysis/alerting software for the early detection, prediction, and

prevention of adverse events in respiratory patients, both in

hospitals and at home. In 2020, PneumoWave was awarded Breakthrough

Medical Device designation from the U.S. Food and Drug

Administration for the development of the device, which is designed

to monitor breathing in real-time to a clinical standard of

care.

The specially designed wireless biosensor is one of the smallest

available and transmits data to the cloud using a data hub or

smartphone, alerting the patient, their household members, doctor,

nurse, or emergency services where life-threatening changes occur.

PneumoWave's technology will be able to accurately monitor large

numbers of patients in any location at any time.

Intuitive Investments Group Plc

Statement of Comprehensive Income

For the 6 months to 31 March 2023

6 months to 6 months Year to

31 March to 30 September

2023 31 March 2022

Unaudited 2022 Audited

Unaudited

GBP'000 GBP'000 GBP'000

Investment income

Finance income 44 99 148

Gains on realised investments - 76 76

Unrealised gains/(losses)

due to FX (96) 166

(Losses)/Gains on investments

at fair value (3,395) (889) (1.493)

Management Fees 12 18 30

-------------- -------------- --------------

(3,435) (696) (1,073)

Administrative expenses (193) (195) (494)

-------------- -------------- --------------

(Loss)/Profit before tax (3,628) (891) (1,567)

Corporation tax 114 174 409

-------------- -------------- --------------

(Loss)/Profit for the period (3,514) (717) (1,158)

Other Comprehensive Income - - -

-------------- -------------- --------------

Total comprehensive income

for the period (3,514) (717) (1,158)

Total comprehensive income

attributable to the owners

of the company (3,514) (717) (1,158)

(Loss) per share

Basic - pence 3 (4.9)p (1.49)p (2.01)p

Diluted - pence (4.9)p (1.49)p (2.01)p

Intuitive Investments Group Plc

Statement of Financial Position

As at 31 March 2023

Notes As at As at As at

31 March 31 March 30 September

2023 2022 2022

Unaudited Unaudited Audited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Investments 4 7,863 10,398 11,160

Deferred tax asset 352 94 238

-------------- -------------- --------------

8,215 10,492 11,398

-------------- -------------- --------------

CURRENT ASSETS

Trade and other receivables 22 43 24

Cash and cash equivalents 1,233 1,911 1,553

-------------- -------------- --------------

1,255 1,954 1,577

-------------- -------------- --------------

TOTAL ASSETS 9,470 12,446 12,975

EQUITY

Shareholders' Equity

Called up share capital 5 721 658 721

Deferred shares 48 48 48

Share premium 12,619 11,631 12,619

Other reserves 144 144 144

Accumulated deficit (4,111) (156) (597)

-------------- -------------- --------------

Total Equity 9,421 12,325 12,935

-------------- -------------- --------------

LIABILITIES

Current liabilities

Trade and other payables 49 30 40

Non current liabilities

Deferred tax liabilities - 91 -

-------------- -------------- --------------

TOTAL LIABILITIES 49 121 40

-------------- -------------- --------------

-------------- -------------- --------------

TOTAL EQUITY AND LIABILITIES 9,470 12,446 12,975

Net asset value per share 13.07p 18.73p 18.00p

Intuitive Investments Group Plc

Statement of Changes in Equity

For 6 months to 31 March 2023

Called Deferred Share Other Retained Total

up Shares Premium Reserves Earnings Equity

Share

Capital

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 30

September

2021 404 48 6,986 144 561 8,143

Loss for the

period - - - - (717) (717)

Issued share

during

the period 254 - 4,645 - - 4,899

------------ ------------ -------------- ------------ ------------ --------------

Balance at 31

March

2022 658 48 11,631 144 (156) 12,325

Loss for the

period - - - - (441) (441)

Issued share

during

the period 63 - 988 - - 1,051

------------ ------------ -------------- ------------ ------------ --------------

Balance at 30

September

2022 721 48 12,619 144 (597) 12,935

Loss for the

period - - - - (3,514) (3,514)

------------ ------------ -------------- ------------ ------------ --------------

Balance at 31

March

2023 721 48 12,619 144 (4,111) 9,421

------------ ------------ -------------- ------------ ------------ --------------

Intuitive Investments Group Plc

Statement of Cash Flows

For the 6 months to 31 March 2023

Notes 6 Months 6 Months Year to

to to 30 September

31 March 31 March 2022

2023 2022 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Profit/(loss) before tax from

continuing operations (3,628) (890) (1,567)

Adjusted by:

Interest income (44) (45) (93)

Gain on disposal - - (74)

Fair value movement 3,491 888 1,326

------------ ------------ ------------

(181) (47) (408)

Changes in working capital

(Increase)/decrease in trade and

other receivables 2 - 18

(Decrease)/increase in trade and

other payables 9 (4) 7

------------ ------------ ------------

Net cash outflow from operating

activities (170) (51) (383)

Cash flows from investing activities

Purchase of investments 4 (150) (1,350) (1,450)

Proceeds from sale of investments - 138 212

------------ ------------ ------------

Net cash (outflow)/inflow from

investing activities (150) (1,212) (1,238)

------------ ------------ ------------

Cash flows from financing activities

Net proceeds from share issues - 607 607

------------ ------------ ------------

Net cash inflow from financing

activities - 607 607

------------ ------------ ------------

Increase/(decrease) in cash and

equivalents (320) (656) (1,014)

Cash and cash equivalents at beginning

of period 1,553 2,567 2,567

------------ ------------ ------------

Cash and cash equivalents at end

of period 1,233 1,911 1,553

1. General Information

Intuitive Investments Group Plc is a com pany incorp orated and

d omiciled in England and Wales. The com pany is listed on the AIM

market of the Lo nd on Stock Exchange (ticker: IIG).

The financial information set out in this Half Yearly report

does not constitute statutory accounts as defined in Section 434 of

the Companies Act 2006. The Company statutory financial statements

for the period ended 30 September 2022, prepared under UK-Adopted

International Financial Reporting Standards ("IFRS"), have been

filed with the Registrar of Companies. The auditor's report on

those financial statements was unqualified and did not contain

statements under Sections 498(2) and 498 (3) of the Companies Act

2006.

Copies of the annual statutory accounts and the Half Yearly

report can be found on the Company's website at

http://www.iigplc.com/ .

2. Basis of preparation

This Half- Yearly report has been prepared using the historical

cost convention, on a going concern basis and under IFRS. The

interim financial statements have been prepared in accordance with

the accounting policies set out in the Annual Report and Accounts

for the year ended 30 September 2022.

3. Earnings per Share

Basic earnings per share is calculated by dividing the earnings

attributable shareholders by the weighted average number of

ordinary shares outstanding during the period.

Reconciliations are set out below:

6 Months 6 Months

to to Year to

31 March 31 March 31 September

2023 2022 2022

Unaudited Unaudited Audited

Basic

Earnings attributable to

ordinary shareholders (3,514,054) (716,516) (1,158,483)

Weighted average number of

shares 72,064,551 48,046,357 57,724,661

Earnings (Loss) per-share

- pence (4.90) p (1.49) p (2.00) p

Diluted

Earnings attributable to

ordinary shareholders (3,514,054) (716,516) (1,158,483)

Weighted average number of

shares 72,064,551 48,046,357 57,724,661

Earnings (Loss) per-share

- pence (4.90) p (1.49) p (2.01)p

As at 31 March 2023 there were 1,962,500 (2022: 1,962,500)

outstanding share warrants.

4. Investments

Cost GBP'000

At 30 September 2021 5,737

Additions during 6 months to 31

March 2022 5,642

Disposals (138)

Accrued interest 44

Change in fair value (887)

------------

At 31 March 2022 10,398

Additions during 6 months to 30

September 2022 1,151

Accrued interest 49

Change in fair value (438)

------------

At 30 September 2022 11,160

Additions during 6 months to 31

March 2023 150

Accrued interest 44

Change in fair value (3,491)

------------

At 31 March 2023 7,863

5. Share Capital

Issued share capital comprises:

6 months 6 months Year to

to to to 31 September

to 31 March to 31 March 2022

2023 2022 Audited

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Ordinary shares

of 1p each 721 658 721

-------------- -------------- --------------

721 658 721

There were no shares issued during the period.

6. Post balance sheet events

On 1 April 2023 Ocutec Limited completed a fundraising of GBP1.2

million. The price was GBP2.00 per ordinary share which compares to

a price of GBP1.60 per ordinary share at the time of the Company's

investment. Therefore there is an unrealised gain of GBP62,500,

based on most recent funding round.

On 26 April 2023 a follow-on investment in Light Science

Technologies Holdings plc of GBP150,000 was made to acquire 15

million shares at a price of GBP0.01 per share. IIG holds

28,280,000 ordinary shares of Light Science Technologies in

total.

On 30 May 2023 2,000,000 shares of 1 penny each in the Company

were issued at a value of GBP0.055 per share in settlement of the

GBP900,000 deferred consideration payable as part of the

acquisition of Touchless Innovation.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FPMFTMTBTBIJ

(END) Dow Jones Newswires

June 29, 2023 02:00 ET (06:00 GMT)

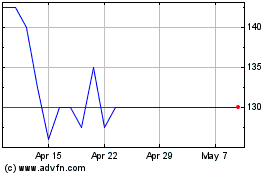

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From Apr 2024 to May 2024

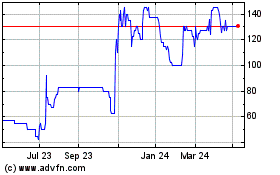

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From May 2023 to May 2024