TIDMIIG

RNS Number : 5695F

Intuitive Investments Group plc

11 July 2023

Intuitive Investments Group plc ("IIG")

Intention to join Specialist Fund Segment and pursue new

investment policy

Notice of General Meeting to approve Proposals

Intuitive Investments Group plc (AIM: IIG) ("IIG" or the

"Company"), a closed-end investment company currently focussed on

the life sciences sector, announces that a Circular (the

"Circular") is being posted to Shareholders setting out the

background to and reasons for a number of proposals (summarised

below) and includes a notice of a General Meeting of the Company

which is being convened for midday on 28 July 2023 at Parklands

Hotel & Country Club Crookfur Park, Ayr Road, Newton Mearns

Glasgow G77 6DT.

The Company will shortly publish a Prospectus which accompanies

the Circular, which will be made available at the Company's website

www.iigplc.com . The Prospectus is required, amongst other things,

to facilitate the admission of the Company's Ordinary Shares to the

Specialist Funds Segment. IIG confirms that it expects new

investments in the near term to be funded from existing cash

resources.

As announced separately today, Sir Nigel Rudd will become IIG's

Independent Non-Executive Chairman subject to admission of the

Company to the Specialist Fund Segment of the London Stock

Exchange's Main Market, which is expected to take place on 8 August

2023.

Summary

-- IIG is seeking shareholder approval for a number of proposals at a General Meeting on 28 July 2023 to support a

shift in strategy to invest in a portfolio concentrating on fast growing and / or high potential Life Sciences,

Healthcare and Technology businesses operating predominantly in the UK, continental Europe, the US and APAC,

targeting an average return to Shareholders of 20 per cent. capital growth per annum.

-- In recognition of the changes resulting from the proposals, the Board is giving Qualifying Shareholders the

ability to realise some or all of their shareholding in the Company through a Tender Offer, under which

approximately 17.4 per cent. of the existing issued ordinary share capital of the Company would be purchased by

Placees procured by Turner Pope at a price of 5.25 pence per Ordinary Share. If the maximum number of Ordinary

Shares under the Tender Offer is acquired, this will result in an amount of GBP675,000 being returned to

Qualifying Shareholders. Due to the high proportion of irremovable undertakings and intentions received, each

Qualifying Shareholder has a basic entitlement to tender 46.1 per cent. of the Ordinary Shares held by them.

-- The Circular includes further detail on the following proposals:

o Appointment of Sir Nigel Rudd as Non-Executive Chairman.

o Change of investment policy.

o Move to the Specialist Fund Segment.

o Authority to allot Ordinary Shares and disapply statutory

pre-emption rights.

o Tender Offer and Placing.

o Shareholder protection of minimum market capitalisation of

GBP100 million otherwise a continuation vote will be proposed at

the Company's next AGM.

o Removal of the performance fee.

-- The Company has irrevocable undertakings and intentions from certain Shareholders, including Directors,

representing approximately 62.4 per cent. of the existing issued ordinary share capital of the Company to vote in

favour or the Resolutions and retain their current shareholdings. They have therefore irrevocably undertaken not

to tender their Ordinary Shares under the Tender Offer.

-- The Directors consider the Resolutions to be proposed at the General Meeting to be in the best interests of the

Company and its Shareholders as a whole and accordingly recommend that Shareholders vote in favour of the

Resolutions.

-- Further details are included below in an extract from the Letter of the Chairman of IIG from the Circular.

Julian Baines, current non-Executive Chairman, said:

"The Board wholeheartedly supports today's Proposals to move IIG

to the Main Market and broaden its investment policy to pursue a

number of exciting opportunities that lie ahead."

Intuitive Investments Group plc www.iigplc.com

Julian Baines, Non-Executive Chairman Via FTI Consulting

Robert Naylor, CEO

----------------------

SP Angel Corporate Finance LLP

- Nominated Adviser +44 (0) 20 3470 0470

----------------------

Jeff Keating / David Hignell / Kasia

Brzozowska

----------------------

Turner Pope Investments (TPI) Ltd

- Broker +44 (0) 20 3657 0050

----------------------

Andrew Thacker / James Pope

----------------------

FTI Consulting

----------------------

Jamie Ricketts / Charlotte Stephen IIG@fticonsulting.com

/ Joshua Ayodele

----------------------

About Intuitive Investments Group plc

The Company is an investment company seeking to provide

investors with exposure to a portfolio concentrating on fast

growing and/or high potential Life Sciences businesses operating

predominantly in the UK, continental Europe and the US, utilising

the Board's experience and in particular that of the chairman of

the Investment Committee, David Evans, to seek to generate capital

growth over the long term for shareholders.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

Terms defined in this Announcement bear the meaning set out in

the Appendix to this Announcement.

Expected timetable of principal events

Announcement of the proposed AIM Cancellation 11 July 2023

and Tender Offer and posting of the Circular

and Form of Proxy to Shareholders

Tender Offer opens 11 July 2023

----------------------

Latest time and date for receipt of Forms Midday on 26 July

of Proxy 2023

----------------------

Latest time and date for receipt of TTE 1.00 p.m. 26 July

Instructions from CREST Shareholders in 2023

relation to the Tender Offer (i.e. close

of Tender Offer)

----------------------

Tender Offer Record Date 6.00 p.m. on 26 July

2023

----------------------

General Meeting Midday on 28 July

2023

----------------------

Announcement of results of the Tender Offer 28 July 2023

(Effective Date)

----------------------

Tendered Ordinary Shares placed with Placees 1 August 2023

----------------------

CREST accounts credited for revised holdings By 1 August 2023

of, and Tender Offer proceeds for, Ordinary

Shares

----------------------

Last day of dealings in the Ordinary Shares 7 August 2023

on AIM

----------------------

Cancellation of admission of the Ordinary 7.00 a.m. on 8 August

Shares to trading on AIM 2023

----------------------

Admission and commencement of dealings 8.00 a.m. on 8 August

in Ordinary Shares on the Specialist Fund 2023

Segment

----------------------

Overseas Shareholders should inform themselves about and observe

any applicable or legal regulatory requirements. If you are in any

doubt about your position, you should consult your professional

adviser in the relevant jurisdiction.

A summary of the taxation consequences for UK resident

Shareholders is also set out in the Circular. However, Shareholders

are advised to consult their own professional adviser regarding

their own tax position.

The Circular and Prospectus will also shortly be available on

the Company's website at www.iigplc.com .

Turner Pope Investments Limited, which is authorised and

regulated in the United Kingdom by the FCA, is acting exclusively

for the Company and no one else in connection with the Proposals

and the other matters referred to in this Announcement, and will

not regard any other person as a client in relation to the

Proposals and will not be responsible to anyone other than the

Company for providing the protections afforded to its clients, nor

for providing advice, in relation to the Proposals, the contents of

this Announcement, the Circular or any other matter referred to in

this Announcement.

Extracts from the Chairman's letter to Shareholders

1. Introduction

The Company is seeking Shareholders' approval of the Proposals

at a General Meeting to be held at Parklands Hotel & Country

Club Crookfur Park, Ayr Road, Newton Mearns Glasgow G77 6DT at

midday on 28 July 2023. The notice of the General Meeting is set

out in Part 5 of the Circular . Shareholders should note that

unless all of the Resolutions are passed at the General Meeting,

the Tender Offer will not take place and the cancellation of

trading on AIM and admission to trading on the Specialist Fund

Segment will not occur as currently proposed.

2. the proposals

Appointment of Sir Nigel Rudd as Non-Executive Chairman

Sir Nigel Rudd will become the Company's Non-Executive Chairman,

subject to Admission.

He is an experienced Chairman of listed businesses and investor

in emerging growth companies and SMEs.

After reversing a South Wales construction company into what was

then a small public company, Williams PLC, he became Chairman in

1982. Within a five year period Williams PLC was admitted to the

FTSE 100 Index. Williams PLC remained one of the largest industrial

holding companies in the UK until its demerger in 2000 into two

separate entities, Chubb and Kidde, both of which were eventually

acquired by UTC, a large US Corporation.

Over the past 25 years, Sir Nigel has chaired some of the

largest UK companies including Pendragon plc, the automotive

retailer; Pilkington, a manufacturer of glass and glazing systems;

Alliance Boots, a global retail pharmacy; Heathrow, the UK airport;

Invensys plc, an engineering firm; Business Growth Fund, an

investor in growth companies; Signature Aviation plc, the aviation

firm; and Meggitt plc, the aerospace and defence firm. Sir Nigel

occupied a seat on the Barclays Bank Board for more than 12 years,

latterly as Deputy Chairman, retiring in 2008.

He is a Deputy Lieutenant of Derbyshire and for five years was

Chancellor of Loughborough University where he holds an honorary

doctorate. He also has a doctorate from the University of Derby,

his home City.

Sir Nigel qualified as a Chartered Accountant at the age of 20.

He spent the next ten years working firstly as an accountant and

latterly as a trouble-shooter at a conglomerate mainly involved in

the construction industry.

Julian Baines, MBE, the current Non-Executive Chairman of the

Company, will step down as a Chairman and will become an

independent non-executive Director of the Company.

Proposed change of investment policy

The revised investment policy broadens the Company's remit to

technology, as well as healthcare and life sciences companies and

the geography where the Company may invest to include APAC. The

Board will seek to exploit the differential in valuations of life

sciences and technology companies in different territories.

There are many examples in which the team have been involved,

for example Sir Nigel Rudd setting up and Chairing the Business

Growth Fund, an equity investor in early stage growth companies,

both private and listed, with a balance sheet of approximately

GBP2.5 billion. David Evans and Julian Baines, working with

companies and partnering with institutions in other jurisdictions,

such as taking UK life sciences intellectual property and

partnering with US healthcare providers leading to the

commercialisation of products. Malcolm Gillies has wide

international experience of working with technology and other

businesses.

It should be noted, under the proposed new investment policy,

there is no specific limit on the amount to be invested in a single

company.

Overall, the Directors believe this change will allow the Board

more flexibility in generating Shareholder returns.

Proposed migration to the Specialist Fund Segment

The Directors believe that the migration of the Company from AIM

to the Specialist Fund Segment will:

-- further enhance the Company's profile and brand recognition with investee companies;

-- extend the Company's shareholder base to a wider group of institutional shareholders;

-- assist in the recruitment, retention and incentivisation of employees; and

-- support the Company's growth strategy.

The Specialist Fund Segment is intended for institutional,

professional, professionally advised and knowledgeable investors

who understand, or who have been advised of, the potential risk

from investing in companies admitted to the Specialist Fund

Segment. The Specialist Fund Segment is only suitable for

investors: (i) who understand the potential risk of capital loss

and that there may be limited liquidity in the underlying

investments of the Company; (ii) for whom an investment in

securities admitted to trading on the Specialist Fund Segment is

part of a diversified investment programme; and (iii) who fully

understand and are willing to assume the risks involved in such an

investment portfolio. It should be remembered that the price of the

Ordinary Shares can go down as well as up.

Proposed grant of general authority to allot Ordinary Shares and

proposed disapplication of statutory pre-emption rights

The Directors consider that further share issuance will have the

following benefits:

-- enhance the Net Asset Value per Ordinary Shares through the issuance of Ordinary Shares at a premium to the

prevailing published Net Asset Value per Ordinary Share;

-- grow the Company, thereby spreading operating costs over a larger capital base which should reduce the ongoing

charges ratio;

-- the Company will be able to raise additional capital promptly, allowing it to take advantage of future investment

opportunities as and when they arise;

-- further diversifying the Company's portfolio of investments; and

-- improve liquidity in the market for Ordinary Shares.

The minimum price at which Ordinary Shares will be issued

pursuant to the Placing Programme or in consideration for

investments, will be equal to the prevailing published Net Asset

Value per Share at the time of issue together with a premium to at

least cover the costs and expenses of the relevant Placing of

Ordinary Shares (including, without limitation, any placing

commissions). Any Ordinary Shares issued for non-cash consideration

may be subject to a third-party valuation from an appropriate

qualified independent adviser.

Proposed Tender Offer and Placing

The Board recognises that, following the Company's AIM

Cancellation, the Company will no longer be subject to the AIM

Rules for Companies or be required to retain the services of an

independent nominated adviser. The Specialist Fund Segment will

provide a more flexible regulatory regime than AIM.

The Board therefore intends to provide Qualifying Shareholders

with the ability to realise some or all of their shareholding in

the Company through a Tender Offer, under which up to 12,857,142

Ordinary Shares (representing approximately 17.4 per cent. of the

existing issued ordinary share capital of the Company) held by

Qualifying Shareholders would be purchased by Placees procured by

Turner Pope at a price of 5.25 pence per Ordinary Share. If the

maximum number of Ordinary Shares under the Tender Offer is

acquired, this will result in an amount of approximately GBP675,000

million being returned to Qualifying Shareholders.

The Company has received irrevocable undertakings and intentions

from Shareholders, including Directors, holding in aggregate

46,194,279 Ordinary Shares (representing approximately 62.4 per

cent. of the existing issued ordinary share capital of the Company)

not to tender their Ordinary Shares under the Tender Offer.

Therefore, each Qualifying Shareholder is entitled to tender 46.1

per cent. of the Ordinary Shares held by them at the Record Date,

rounded down to the nearest whole number of Ordinary Shares at a

price of 5.25 pence per Ordinary Share ("Basic Entitlement").

Financing of the Tender Offer

The Company has sufficient cash resources to undertake the

Tender Offer, however, as a relatively new company investing in

early-stage healthcare companies, the Company has no distributable

reserves from which to repurchase its own Ordinary Shares.

Therefore, Turner Pope has conditionally placed GBP675,000 Ordinary

Shares with Placees. The demand generated by Turner Pope, under the

Placing, will firstly be used to purchase existing Ordinary Shares

validly tendered under the Tender Offer, and secondly, the Company

will issue new Ordinary Shares to satisfy any remaining demand not

able to be met by existing Ordinary Shares tendered under the

Tender Offer. If the demand generated by Turner Pope, under the

Placing is less than Ordinary Shares validly tendered under the

Tender Offer, Qualifying Shareholders will be scaled back and no

new Ordinary Shares will be issued.

Each Qualifying Shareholder will be entitled to sell to placees

procured by Turner Pope a number of Ordinary Shares up to their

Basic Entitlement. If the aggregate value at the Tender Price of

all Ordinary Shares validly tendered by Qualifying Shareholders

exceeds GBP675,000, then not all of the Ordinary Shares validly

tendered will be accepted and purchased and, in these

circumstances, tenders will be accepted (or, as the case may be,

rejected) as follows: firstly all Ordinary Shares validly tendered

by any Shareholder up to their Basic Entitlement will be accepted

and purchased in full; and, secondly all Ordinary Shares validly

tendered by Shareholders in excess of their Basic Entitlements will

be scaled down pro rata to the total number of such Ordinary Shares

tendered in excess of their Basic Entitlement.

Minimum market capitalisation

Although there is no specific rule in respect of minimum market

capitalisation in the London Stock Exchange's Admission and

Disclosure Standards, to give added investor protection and to

ensure that the Company is not subscale, the Board will undertake

to propose to continue as an investment company, by ordinary

resolution, at each Annual General Meeting, if the Company's market

capitalisation is less than GBP100 million. The market

capitalisation is to be calculated on the Company's average closing

share price in the 30 trading days prior to the Company's year

end.

Removal of the performance fee

As set out in the Company's AIM admission document dated 8

December 2020, the Company had a performance fee, payable to the

Investment Team, based on 20 per cent. of realised profits

calculated on an annual basis once the initial IPO proceeds of

GBP7.85 million have been doubled by way of cash realisations. In

agreement with members of the Investment Team, the Remuneration

Committee has cancelled the performance fee and will look to

establish new incentivisation for key members on the Investment

Team once the Company has migrated to the Specialist Fund Segment.

These arrangements may include share options, warrants and cash

payments.

3. GENERAL MEETING

Notice convening the General Meeting to be held at Parklands

Hotel & Country Club Crookfur Park, Ayr Road, Newton Mearns

Glasgow G77 6DT at midday on 28 July 2023, at which the Resolutions

will be proposed. The Proposals are conditional, amongst other

things, upon the Resolutions being duly passed.

4. Irrevocable undertakings and intentions of the Directors relating to the Tender Offer

The Company has received irrevocable undertakings and intentions

from Shareholders including Directors holding in aggregate

46,194,279 Ordinary Shares (representing approximately 62.4 per

cent. of the existing issued ordinary share capital of the Company)

to vote in favour or the Resolutions. These Shareholders also wish

to continue to support the Company's growth strategy on the

Specialist Fund Segment as ongoing Shareholders and therefore do

not wish to sell their current shareholdings. They have therefore

irrevocably undertaken not to tender their Ordinary Shares under

the Tender Offer.

5. Action to be taken

A Form of Proxy for use by Shareholders in connection with the

General Meeting accompanies the Circular . Shareholders are

requested to return the Forms of Proxy. To be valid, the Forms of

Proxy must be completed and returned in accordance with the

instructions printed thereon so as to be received by Neville

Registrars Limited, Neville House, Steelpark Road, Halesowen B62

8HD as soon as possible but, in any event, so as to arrive by noon

on 26 July 2023 (being 48 hours (excluding weekends and any bank

holiday) before the time of the meeting to which the Form of Proxy

relates).

Alternatively, Shareholders who hold their Ordinary Shares in

uncertificated form (i.e. in CREST) may vote using the CREST

electronic voting service in accordance with the procedure set out

in the CREST Manual. Proxies submitted via CREST for the General

Meeting must be transmitted so as to be received by the Registrar

(ID: 7RA11) as soon as possible and, in any event, by no later than

48 hours (excluding weekends and any bank holiday) before the time

of the General Meeting.

If you wish to participate in the Tender Offer

If you are a Qualifying Shareholder and you wish to tender some

or all of your Ordinary Shares, you should send a TTE Instruction

and follow the procedures set out in Part 3 of the Circular in

respect of tendering uncertificated Ordinary Shares.

If you have any questions about the procedure for tendering

Ordinary Shares or making a TTE Instruction please telephone the

Shareholder Helpline on +44 (0) 121 585 1131. Lines are open from

9.00 a.m. to 5.00 p.m. (London time) Monday to Friday (except

public holidays in England and Wales). Please note that calls to

these numbers may be monitored or recorded for security and

training purposes.

6. Recommendation

The Directors consider the Resolutions to be proposed at the

General Meeting to be in the best interests of the Company and its

Shareholders as a whole and accordingly recommend that Shareholders

vote in favour of the Resolutions, as I intend to do so in respect

of my shareholding of 249,896 Ordinary Shares (equivalent to

approximately 0.35 per cent. of the existing issued Ordinary

Shares).

If you are in any doubt as to the action you should take, you

are recommended to seek your own independent advice.

Yours faithfully

Julian Baines

Non-Executive Chairman

Definitions

The following definitions apply throughout this Announcement,

unless stated otherwise:

"Admission" admission of the Ordinary Share Capital

to trading on Specialist Fund Segment of

the Main Market, becoming effective in

accordance with the admission and disclosure

standards of the London Stock Exchange

"AIM Cancellation" the cancellation of admission of the Ordinary

Shares to trading on AIM

---------------------------------------------------

"AIM Rules" the rules applicable to companies governing

their admission to AIM, and following admission

their continuing obligations to AIM, as

set out in the AIM Rules for Companies

published by the London Stock Exchange

from time to time

---------------------------------------------------

"APAC" the Asia-Pacific region

---------------------------------------------------

"Basic Entitlement" as the meaning given to that term in Part

I (Letter from the Chairman of the Company)

paragraph 2 of the Circular

---------------------------------------------------

"Board" the board of the Company comprising the

Directors

---------------------------------------------------

"certificated form" Ordinary Shares not recorded on the Register

or "certificated" as being in uncertificated form in CREST

---------------------------------------------------

"Company" or "IIG" Intuitive Investments Group PLC, a company

incorporated in England and Wales with

registered number 12664320, whose registered

office is at One St. Peters Square, Manchester,

England, M2 3DE, United Kingdom

---------------------------------------------------

"CREST manual" the manual, as amended from time to time,

produced by Euroclear describing the CREST

system and supplied by Euroclear to users

and participants thereof

---------------------------------------------------

"CREST Member" a person who has been admitted by Euroclear

as a system member (as defined in the CREST

Regulations)

---------------------------------------------------

"CREST Participant" a person who is, in relation to CREST,

a system participant (as defined in the

CREST Regulations)

---------------------------------------------------

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001 No. 3755), as amended from

time to time

---------------------------------------------------

"CREST Sponsor" a CREST Participant admitted to CREST as

a CREST sponsor

---------------------------------------------------

"CREST Sponsored Member" a CREST Member admitted to CREST as a sponsored

member

---------------------------------------------------

"CREST" the system of paperless settlement of trades

in securities and the holding of uncertificated

securities operated by Euroclear in accordance

with the CREST Regulations

---------------------------------------------------

"Directors" the directors of the Company, whose names

are set out in the Circular

---------------------------------------------------

"Euroclear" Euroclear UK & International Limited, the

operator of CREST

---------------------------------------------------

"FCA" the Financial Conduct Authority

---------------------------------------------------

"Form of Proxy" the form of proxy accompanying the Circular

to be used in connection with the General

Meeting

---------------------------------------------------

"General Meeting" the general meeting of the Company to be

held at midday on 28 July 2023 at the Parklands

Hotel & Country Club Crookfur Park, Ayr

Road, Newton Mearns, Glasgow G77 6DT ,

or any adjournment thereof, notice of which

is set out in Part VI of the Circular

---------------------------------------------------

"Investment Team" the team which will be responsible for

managing the analysis of the Company's

pipeline of investment opportunities, identifying

new potential investment opportunities

and proposing investments to the Board.

The team will comprise David Evans, Robert

Naylor and Dr Stewart White

---------------------------------------------------

"London Stock Exchange" London Stock Exchange plc

---------------------------------------------------

"Market Abuse Regulation" EU Market Abuse Regulation (594/2014)

or "MAR"

---------------------------------------------------

"Net Asset Value" the value, as at any date, of the assets

or "NAV" of the Company after deduction of all liabilities

determined in accordance with the accounting

policies adopted by the Company from time

to time

---------------------------------------------------

"Notice of General the notice of the General Meeting which

Meeting" appears in the Circular

---------------------------------------------------

"Ordinary Shares" the ordinary shares of GBP0.01 each in

the capital of the Company

---------------------------------------------------

"Overseas Shareholders" a Shareholder who is a resident in, or

a citizen of, a jurisdiction outside the

United Kingdom

---------------------------------------------------

"Placees" subscribers for tendered Ordinary Shares

and/or new Ordinary Shares procured by

the Company's broker Turner Pope

---------------------------------------------------

"Placing" the placing of Ordinary Shares at the Tender

Price by Turner Pope as agent for and on

behalf of the Company pursuant to the terms

of the Placing Agreement

---------------------------------------------------

"Proposals" the conditional appointment of the new

Chairman, the AIM Cancellation and Admission,

the grant of general authority to allot

Ordinary Shares, the disapplication of

statutory pre-emption rights and the Tender

Offer and Placing all as described in the

Circular

---------------------------------------------------

"Prospectus" the Prospectus published by the Company

required, amongst other things, to facilitate

the admission of the Company's Ordinary

Shares, as well as the further admission

of Ordinary Shares by both a placing programme

and to acquire new investments, on to the

Specialist Fund Segment

---------------------------------------------------

"Qualifying Shareholder" Shareholders who are entitled to participate

in the Tender Offer, being those who are

on the Register on the Tender Offer Record

Date and excluding those with registered

addresses in a Restricted Jurisdiction

---------------------------------------------------

"Register" the Company's register of members

---------------------------------------------------

"Regulatory Information as defined in the AIM Rules

Service"

---------------------------------------------------

"Resolutions" the resolutions numbered 1 to 4 to be proposed

at the General Meeting, as set out in the

Notice of General Meeting

---------------------------------------------------

"Restricted Jurisdiction" each of the United States, Australia, Canada,

Japan, New Zealand, South Africa and the

European Union and any other jurisdiction

where the mailing of the Circular or the

accompanying documents into or inside such

jurisdiction would constitute a violation

of the laws of such jurisdiction

---------------------------------------------------

"Shareholder Helpline" the helpline available to Shareholders

in connection with the Tender Offer in

respect of Ordinary Shares

---------------------------------------------------

"Shareholders" the holders of the Ordinary Shares

---------------------------------------------------

"Specialist Fund Segment" the Specialist Fund Segment of the London

Stock Exchange's Main Market

---------------------------------------------------

"Tender Offer and (1) the Company, and (2) Turner Pope, relating

Placing Agreement" to the terms and conditions upon which

Turner Pope is engaged by the Company for

the purposes of the Tender Offer and Placing

---------------------------------------------------

"Tender Offer Record 6.00 p.m. on 26 July 2023

Date"

---------------------------------------------------

"Tender Offer" the invitation to Qualifying Shareholders

to tender Ordinary Shares persons procured

by Turner Pope, on the terms and conditions

set out in the Circular

---------------------------------------------------

"Tender Price" 5.25 pence, being the price per Ordinary

Share at which Ordinary Shares will be

purchased pursuant to the Tender Offer

---------------------------------------------------

"TTE Instruction" a transfer to escrow instruction (as defined

by the CREST manual)

---------------------------------------------------

"Turner Pope" Turner Pope Investments Limited, the Company's

Broker

---------------------------------------------------

"Uncertificated" form recorded on the register as being

held in uncertificated form in CREST and

title to which, by virtue of the Uncertified

Securities Regulations, may be transferred

by means of CREST

---------------------------------------------------

"United Kingdom" or the United Kingdom of Great Britain and

"UK" Northern Ireland

---------------------------------------------------

"United States" or the United States of America, its territories

"US" and possessions, any state of the United

States and the District of Columbia

---------------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGDBGDRBBBDGXG

(END) Dow Jones Newswires

July 11, 2023 02:00 ET (06:00 GMT)

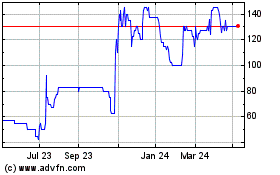

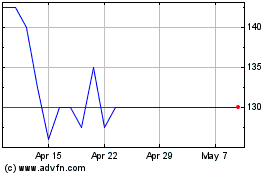

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From Apr 2024 to May 2024

Intuitive Investments (LSE:IIG)

Historical Stock Chart

From May 2023 to May 2024