Infrastructure India plc Debt Facilities Update (8465K)

August 31 2023 - 1:00AM

UK Regulatory

TIDMIIP

RNS Number : 8465K

Infrastructure India plc

31 August 2023

31 August 2023

Infrastructure India plc

("IIP" or the "Company" or, together with its subsidiaries, the

"Group")

Debt Facilities Update

Infrastructure India plc, an AIM quoted infrastructure fund

investing directly into assets in India, announces that it has

agreed an extension to the maturity dates of all its debt

facilities, being the term loan provided by IIP Bridge Facility LLC

(the "Term Loan"), the working capital loan provided by GGIC, Ltd.

(the "Working Capital Loan") and the bridging loan provided by

Cedar Valley Financial (the "Bridging Loan").

The Term Loan is a US$119 million principal secured facility

provided to IIP's wholly owned Mauritian subsidiary, Infrastructure

India Holdco, originally announced in April 2019. The loan carries

an interest rate of 15% per annum, calculated in a manner that

yields a 15% IRR for the lender and is secured on all assets of

Infrastruture India Holdco, including 100% of the issued share

capital of Distribution Logistics Infrastructure India, DLI's

parent company. The current amount of interest accrued is

approximately US$82 million. The maturity date of 31 August 2023

has been extended to 31 October 2023 (the "Maturity Extensions"

applying collectively to all loan maturity extensions set out in

this announcement).

The unsecured Working Capital Loan was originally provided to

the Group in April 2013 by GGIC, Ltd. in an amount of US$17 million

and increased to US$21.5 million in September 2017. The Working

Capital Loan carried an interest rate of 7.5% per annum on its

principal amount. The Group and GGIC, Ltd. agreed to increase its

interest rate to 15% per annum from 1 April 2019. The current

amount of interest accrued is approximately US$27 million. The

maturity date of 31 August 2023 has been extended to 31 October

2023 (a "Maturity Extension").

The unsecured Bridging Loan was originally provided to the Group

in June 2017 by Cedar Valley Financial and was subsequently

increased in multiple tranches to US$64.1 million in March 2019.

The Bridging Loan carried an interest rate of 12.0% per annum on

its principal amount. The Group and Cedar Valley Financial

previously agreed to increase its interest rate to 15% per annum

from 1 April 2019. The current amount of interest accrued is

approximately US$55 million. The maturity date of 31 August 2023

has been extended to 31 October 2023 (a "Maturity Extension").

As announced on 28 February 2022 and periodically thereafter,

IIP is engaged in advanced discussions with several third parties

(including advanced discussions with Pristine Logistics &

Infraprojects Ltd) regarding the potential sale of its largest

asset, Distribution Logistics Infrastructure Limited, although no

definitive agreements have yet been signed. The Maturity Extensions

enable IIP to continue working towards completing a

transaction.

Related Party Transaction

IIP Bridge Facility LLC and Cedar Valley Financial are

affiliates of GGIC,Ltd., which is, directly and indirectly,

interested in 75.4% of the Company's issued share capital. Under

the AIM Rules for Companies (the "AIM Rules"), IIP Bridge Facility

LLC, Cedar Valley Financial and GGIC, Ltd. are each, therefore,

deemed to be related parties of the Company and the Maturity

Extensions are related party transactions pursuant to Rule 13 of

the AIM Rules.

The independent directors of IIP, being M.S. Ramachandran and

Graham Smith, consider, having consulted with Strand Hanson Limited

in its capacity as the Company's nominated adviser, that the terms

of the Maturity Extensions are fair and reasonable insofar as the

shareholders of IIP are concerned.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended.

- Ends -

Enquiries:

Infrastructure India plc www.iiplc.com

Sonny Lulla Via Novella

Strand Hanson Limited

Nominated Adviser

James Dance / Richard Johnson +44 (0) 20 7409 3494

Singer Capital Markets

Broker

James Maxwell - Corporate Finance

James Waterlow - Investment Fund Sales +44 (0) 20 7496 3000

Novella

Financial PR

Tim Robertson / Safia Colebrook +44 (0) 20 3151 7008

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCNKKBPNBKDOFN

(END) Dow Jones Newswires

August 31, 2023 02:00 ET (06:00 GMT)

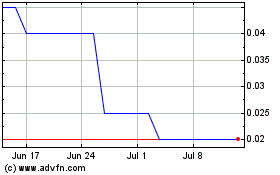

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

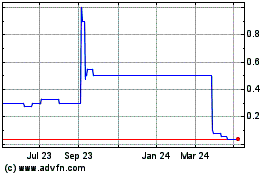

Infrastructure India (LSE:IIP)

Historical Stock Chart

From Apr 2023 to Apr 2024