TIDMLIO

RNS Number : 9047Z

Liontrust Asset Management PLC

17 January 2024

LEI: 549300XVXU6S7PLCL855

For immediate release

17 January 2024

Stock Exchange Announcement

LIONTRUST ASSET MANAGEMENT PLC

Trading Update

Liontrust Asset Management Plc ("Liontrust", the "Company", or

the "Group"), the specialist independent fund management group,

today issues its trading update for the three months ended 31

December 2023 (the "Period").

Highlights

-- Net outflows of GBP1.7 billion in the Period.

-- Assets under management and advice ("AuMA") were GBP27.8

billion as at 31 December 2023, an increase of 0.6% over the

Period.

-- AuMA as at 12 January 2024 were GBP27.2 billion.

-- Two new senior hires: Mark Hawtin - and his three-strong team

- to join in May as Head of Global Growth Equities and Jeremy

Roberts to join in April as Head of Global Distribution

(ex-UK).

-- Appointment of Kristian Cook as Head of UK Distribution and

bringing single strategy and multi-asset distribution into one UK

sales team.

Commenting, John Ions, Chief Executive, said:

"We continue to develop the business to ensure it is well

positioned to deliver our strategic objectives. This includes the

appointment of Heads of Global Growth Equities and Global

Distribution (ex-UK), the enhancement of the UK Distribution team,

expanding our fund offering and a strong focus on client

engagement.

Among the drivers of the net outflows in the last quarter,

totalling GBP1.7 billion, were the ongoing negative sentiment among

investors and the current challenges facing active asset managers.

These challenges include the fact active managers have never been

confronted by such a competitive environment to attract and retain

assets as is the case now, both from within and outside the

sector.

But there are still strong long-term tailwinds behind asset

management. People's need to save and invest for the future has

never been greater. And equity markets are currently offering the

chance to invest in some quality companies at attractive entry

points, especially among small and mid-caps. This is perfect

territory for active managers, and an opportunity to attract

assets.

The strength of our investment teams and their long-term

processes is demonstrated by the fact that 68% of Liontrust's

UK-domiciled retail funds were in the first or second quartile of

their respective IA sectors since launch or the current manager

being appointed to 31 December 2023(1) .

We have highlighted before that Liontrust's bias towards quality

growth investing and small and mid-caps, along with a significant

proportion of our AuMA being invested in UK equities, has impacted

performance and flows. Liontrust's improving UK retail fund

performance is shown by the number of funds in the first or second

quartile increasing to 66% over one year to 31 December 2023 from

50% to 30 September 2023(1) . This includes the Global Technology

Fund being ranked first in its IA sector over one year, Edinburgh

Investment Trust being ranked second and Global Dividend Fund and

UK Focus Fund both ranked third(1) . The Sustainable Future Managed

and Managed Growth funds are also both first quartile over one

year.

Key pillars of our strategy are to broaden our fund range, asset

classes and geographical distribution to increase sales and to

ensure we can perform through the cycle of demand. In pursuit of

these two strategic objectives, we have recruited Mark Hawtin as

Head of Global Growth Equities and Jeremy Roberts as Head of Global

Distribution (ex-UK), who will join Liontrust in May and April

respectively.

Mark Hawtin and his team are an important addition to Liontrust

given the strong demand for global equities across distribution

channels in the UK and internationally. Mark has a strong track

record in managing long only and long/short equity funds at

Marshall Wace Asset Management and then GAM Investments and will

help us to attract assets and build our client base.

We will also broaden our fund offering in the first quarter of

this year through the launch of the GF Pan-European Dynamic Fund to

be managed by the Cashflow Solution team. This Fund will be managed

using the same investment process as the European Dynamic Fund,

which is the best performing fund in its IA sector over five years

and is ranked second over three years.

Jeremy Roberts is a key appointment in enabling us to achieve

the strategic objective of broadening our distribution

internationally. Jeremy has extensive experience and knowledge

having been Co-Head of EMEA Retail Sales and Head of UK Retail

Business at BlackRock and then Global Head of Distribution at GAM .

Jeremy will help us build our client relationships and partnerships

in Continental Europe and South America.

We have also strengthened our sales capability with the internal

appointment of Kristian Cook as Head of UK Distribution and

bringing single strategy and multi-asset sales into one team in the

UK to enhance further the levels of service we provide clients. The

new structure provides greater focus and clarity of

responsibilities and will broaden the product range for each

salesperson.

I look forward to this year with confidence. We are broadening

our distribution, driving forward sales and expanding our

investment talent to build on our robust investment processes and

strong brand."

(1) Source: Financial Express to 31 December 2023, unless

otherwise stated, and Liontrust. See UK Retail Fund Performance

table below for further details.

Mark Hawtin and Jeremy Roberts

Mark Hawtin has 37 years of investment experience and is

currently an Investment Director and leads the Global Growth Equity

team at GAM Investments. He is responsible for running global long

only and long/short funds investing in disruptive growth and

technology. Prior to joining GAM in 2008, Mark was a partner and

portfolio manager with Marshall Wace Asset Management for eight

years, including managing one of Europe's largest technology, media

and telecoms hedge funds. David Goodman, Kevin Kruczynski and

Pieran Maru, who work for Mark at GAM Investments, will also be

joining Liontrust.

Jeremy Roberts was Global Head of Distribution at GAM

Investments. Prior to joining GAM in 2020, he was Co-Head of EMEA

Retail Sales and Head of UK Retail Business at BlackRock. He has

over 20 years of experience in the Investment Management industry

and has worked extensively with clients across the UK, Europe, Asia

and the Middle East. Jeremy will be responsible for further

developing our Global Distribution capability with an initial focus

on Germany, Switzerland, Italy, the Nordics, Iberia and Latin

America, Benelux and France.

Assets under management and advice

On 31 December 2023, our AuMA stood at GBP27,812 million and

were broken down by type and investment process as follows:

Process Total Institutional Investment UK Retail Alternative International

Accounts Trusts Funds & Funds Funds

& Funds MPS & Accounts

(GBPm) (GBPm) (GBPm) (GBPm) (GBPm) (GBPm)

Sustainable

Investment 10,456 300 0 9,673 0 483

Economic Advantage 6,978 447 0 6,352 0 179

Multi-Asset 4,459 0 0 4,309 150 0

Global Innovation 699 0 0 699 0 0

Cashflow Solution 1,753 539 0 1,099 109 6

Global Fundamental 3,236 437 1,115 1,647 0 37

Global Fixed

Income 231 0 0 45 0 186

Total 27,812 1,723 1,115 23,824 259 891

AuMA as at 12 January 2024 were GBP27,221 million.

Flows

The net outflows over the Period were GBP1,664 million (2022:

GBP632 million). A reconciliation of fund flows and AuMA over the

Period is as follows:

Institutional Investment UK Retail Alternative International

Accounts Trusts Funds Funds Funds

Total & Funds & MPS & Accounts

(GBPm) (GBPm) (GBPm) (GBPm) (GBPm) (GBPm)

Opening AuMA - 1

October 2023 27,650 1,932 1,122 23,393 292 911

Net flows (1,664) (131) (33) (1,367) (49) (84)

Market and Investment

performance 1,826 (78) 26 1,798 16 64

Closing AuMA - 31

December 2023 27,812 1,723 1,115 23,824 259 891

UK Retail Fund Performance (Quartile ranking)

Quartile Quartile Quartile Quartile Launch

ranking ranking ranking ranking Date/ Manager

- Since - 5 year - 3 year - 1 year Appointed

Launch/Manager

Appointed

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Economic Advantage funds

----------------------------------------------------------------------------------------------------

Liontrust UK Growth

Fund 1 2 2 4 25/03/2009

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Special

Situations Fund 1 2 3 3 10/11/2005

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust UK Smaller

Companies Fund 1 1 2 3 08/01/1998

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust UK Micro

Cap Fund 1 1 1 2 09/03/2016

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Sustainable Future funds

----------------------------------------------------------------------------------------------------

Liontrust SF Monthly

Income Bond Fund 1 1 1 1 12/07/2010

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF Managed

Growth Fund 2 1 3 1 19/02/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF Corporate

Bond Fund 1 2 2 1 20/08/2012

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF Cautious

Managed Fund 1 3 4 2 23/07/2014

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF Defensive

Managed Fund 1 2 4 2 23/07/2014

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF European

Growth Fund 3 4 4 4 19/02/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF Global

Growth Fund 3 1 4 2 19/02/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF Managed

Fund 1 1 4 1 19/02/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust UK Ethical

Fund 3 4 4 4 01/12/2000

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust SF UK Growth

Fund 3 4 4 4 19/02/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Global Innovation funds

----------------------------------------------------------------------------------------------------

Liontrust Global Dividend

Fund 2 1 3 1 20/12/2012

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Global Innovation

Fund 1 3 4 1 31/12/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Global Technology

Fund 2 2 1 1 15/12/2015

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Global Fundamental Global Equity funds

----------------------------------------------------------------------------------------------------

Liontrust Balanced

Fund 1 1 3 1 31/12/1998

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust China Fund 4 4 3 3 31/12/2004

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Emerging

Market Fund 3 4 4 3 30/09/2008

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Global Smaller

Companies Fund 1 2 4 1 01/07/2016

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Global Alpha

Fund 1 1 4 1 31/12/2001

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust India Fund 4 2 1 2 29/12/2006

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Japan Equity

Fund 3 1 3 3 22/06/2015

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Latin America

Fund 3 4 4 4 03/12/2007

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Cashflow Solution funds

----------------------------------------------------------------------- ---------- ---------------

Liontrust European

Dynamic Fund 1 1 1 1 15/11/2006

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Global Fixed Income

funds

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Strategic

Bond Fund 3 3 3 2 08/05/2018

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Global Fundamental

funds

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust UK Equity

Fund 1 3 3 1 27/03/2003

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust UK Focus

Fund 1 4 3 1 29/09/2003

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Income Fund 1 2 2 2 31/12/2002

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust UK Equity

Income Fund 2 4 4 3 19/12/2011

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust US Opportunities

Fund 2 2 4 3 31/12/2002

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Edinburgh Investment

Trust Plc 1 1 1 27/03/2020

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Global Equity

Fund 1 1 3 1 30/06/2014

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust Global Focus

Fund 2 2 3 2 30/06/2014

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust GF US Equity

Fund 2 2 2 1 26/06/2014

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust GF UK Equity

Fund 4 4 3 1 03/03/2014

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Liontrust GF International

Equity Fund 4 - 4 4 17/12/2019

----------------------------- ---------------- ---------- ---------- ---------- ---------------

Source: Financial Express to 31 December 2023 as at 4 January

2024, bid-bid, total return, net of fees , based on primary share

classes. Past performance is not a guide to future performance,

investments can result in total loss of capital. The above funds

are all UK authorised unit trusts, OEICs, Irish authorised OEICs

(primary share class) or UK listed investment trusts. Liontrust

Russia Fund is not included as it is currently suspended and in an

IA sector that is not rankable (e.g., Specialist) so it would not

be a fair comparison to make. The onshore and offshore Tortoise

funds are not included as they are not in IA sectors. Edinburgh

Investment Trust Plc uses the IT UK Equity Income sector.

For further information please contact:

Teneo (Tel: 020 7353 4200, Email: liontrust@teneo.com)

Tom Murray, Colette Cahill

Liontrust Asset Management Plc (Tel: 020 7412 1700, Website:

liontrust.co.uk)

Stephen Corbett: Head of Investor Relations

Simon Hildrey: Chief Marketing Officer

Singer Capital Markets (Tel: 020 7496 3000)

Corporate Broking: Charles Leigh-Pemberton

Corporate Finance: James Moat

Panmure Gordon (Tel: 020 7886 2500)

Corporate Broking: David Watkins

Corporate Advisory: Atholl Tweedie

HSBC Bank plc (Tel: 020 7991 8888)

Corporate Broking: Sam McLennan, James Hopton

Corporate Advisory: Alexander Paul

Forward Looking Statements

This announcement contains certain forward-looking statements

with respect to the financial condition, results of operations and

businesses and plans of Liontrust. These statements and forecasts

involve risk and uncertainty because they relate to events and

depend upon circumstances that have not yet occurred. There are a

number of factors that could cause actual results or developments

to differ materially from those expressed or implied by these

forward-looking statements and forecasts. As a result, the

Liontrust's actual future financial condition, results of

operations and business and plans may differ materially from the

plans, goals and expectations expressed or implied by these

forward-looking statements. Liontrust undertakes no obligation

publicly to update or revise forward-looking statements, except as

may be required by applicable law and regulation (including the

Listing Rules of the Financial Conduct Authority). Nothing in this

announcement should be construed as a profit forecast or be relied

upon as a guide to future performance.

Other information

The release, publication, transmission or distribution of this

announcement in, into or from jurisdictions other than the United

Kingdom may be restricted by law and therefore persons in such

jurisdictions into which this announcement is released, published,

transmitted or distributed should inform themselves about and

observe such restrictions. Any failure to comply with the

restrictions may constitute a violation of the securities laws of

any such jurisdiction.

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDZGMMNVMGDZM

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

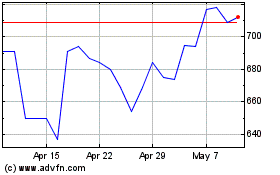

Liontrust Asset Management (LSE:LIO)

Historical Stock Chart

From Apr 2024 to May 2024

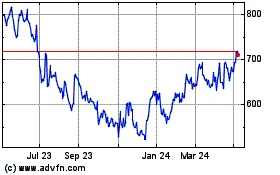

Liontrust Asset Management (LSE:LIO)

Historical Stock Chart

From May 2023 to May 2024