TIDMLND

RNS Number : 5875Y

Landore Resources Limited

04 January 2024

Landore Resources Limited

GBP600,000 Equity fundraise, board changes and operational

update

London, United Kingdom - 4 January 2024 - Landore Resources

Limited (AIM : LND) ("Landore Resources" or the "Company")

announces that it has conditionally raised GBP600,000 before

expenses by way of a placing (the "Placing") and a subscription

(the "Subscription") of, in aggregate, 25,000,000 new ordinary

shares of nil par value each in the capital of the Company

("Ordinary Shares") at a price of 2.4 pence per share (the "New

Ordinary Shares") (together, the "Fundraising").

The New Ordinary Shares will represent approximately 17.01 per

cent. of the Company's enlarged issued share capital. The

Fundraising price of 2.4 pence (the "Fundraising Price") represents

a discount of approximately 22.58 per cent. to the mid-market

closing price on AIM of 3.1 pence per Ordinary Share on 3 January

2024, being the latest practicable business day prior to the

publication of this announcement.

Of the, in aggregate, 25,000,000 New Ordinary Shares, 14,700,000

New Ordinary Shares have been placed utilising the Company's

existing authority to allot shares for cash on a non-pre-emptive

basis (the "Firm Placing Shares"). The issue of the balance of

10,300,000 New Ordinary Shares (comprising 7,383,333 New Ordinary

Shares to be issued pursuant to the Placing (the "Conditional

Placing Shares") and 2,916,667 New Ordinary Shares to be issued

pursuant to the Subscription (the "Subscription Shares"), together

the "Conditional Fundraising Shares") is conditional, inter alia,

on the Company obtaining the requisite shareholder approvals in

respect of the issue of such shares from its Shareholders at a

forthcoming general meeting to be convened shortly (the "General

Meeting").

Novum Securities Limited ("Novum") has entered into an agreement

with Landore Resources (the "Placing Agreement") pursuant to which,

subject to the conditions set out therein, Novum has been

instructed by Landore Resources to assume the duties of placing

agent to procure subscribers for the Firm Placing Shares and the

Conditional Placing Shares. The Placing Agreement contains

customary provisions including that the Placing Agreement can be

terminated, inter alia, if (i) there is a breach of any material

warranty, or any of the other obligations on the Company which is

material in the context of the Placing; (ii) in the reasonable

opinion of Novum there has occurred a material adverse change in

the business of, or the financial or trading position of, the

Company, or (iii) the name or reputation of Novum is likely to be

prejudiced if it continues to act as placing agent. In addition,

the Company has entered into subscription letters with certain

individuals in respect of the issue of the Subscription Shares. The

Company has also agreed, subject to shareholder approval at the

General Meeting, to issue 1,500,000 'broker' warrants to Novum,

giving them the right to acquire such number of new Ordinary Shares

at an exercise price of 2.4 pence for a period of three years from

the date of admission of the Conditional Fundraising Shares.

The net proceeds of the Fundraising will be used for general

working capital purposes and to progress the Company's strategy of

focusing on the advancement of its flagship BAM Gold Project at the

Junior Lake property in Northwestern Ontario.

Directors' Participation in the Fundraising

The following directors of the Company are participating in the

Subscription for an investment, in aggregate, of GBP40,000.

Director No . of Subscription Resulting holding Resulting percentage

Shares subscribed of Ordinary Shares of enlarged share

for pursuant capital held

to the Fundraising on completion

of the Fundraising

Helen Green 416,667 664,307 0.45

--------------------- -------------------- ---------------------

Glenn Featherby 1,250,000 4,976,053 3.38

--------------------- -------------------- ---------------------

Related Party Transactions

Helen Green and Glenn Featherby have subscribed for, in

aggregate, 1,666,667 new Ordinary Shares pursuant to the

Subscription as set out above. In addition, William Humphries, a

former director of the Company within the last 12 months, has

subscribed for 1,250,000 new Ordinary Shares pursuant to the

Subscription. The participation in the Subscription by Helen Green

and Glenn Featherby, as directors of the Company, and William

Humphries as a former director of the Company, are deemed to

constitute related party transactions under the AIM Rules for

Companies. Accordingly, the independent director, being Huw Salter,

having consulted with the Company's Nominated Adviser, Strand

Hanson Limited, considers the terms of such participations to be

fair and reasonable insofar as the Company's shareholders are

concerned.

Circular

A circular relating to the Fundraising (the "Circular") will be

posted to shareholders shortly, and a further announcement will be

made in due course in this regard. The Circular will contain formal

notice convening the requisite General Meeting to approve, inter

alia, issue of the Conditional Fundraising Shares. The General

Meeting is currently expected to be held in late January 2024 at La

Tonnelle House, Les Banques, St Sampson, Guernsey, GY1 3HS which

shareholders will also be permitted to attend online in accordance

with the instructions to be set out in the notes to the formal

notice. The Circular will be made available to view on the

Company's

website at: www.landore.com once published.

Board Changes

In light of the termination of the proposed non-brokered private

placement in Canada and postponement of the proposed dual listing

on the TSX Venture Exchange, as announced on 8 December 2023, and

in order to reduce costs and maximise deployment of cash resources

on operational activities, the Company's CEO, Claude Lemasson, and

Non-Executive Director, Larry Strauss, have resigned from their

respective positions effective immediately. Accordingly, Glenn

Featherby has assumed the role of interim CEO with Helen Green and

Huw Salter continuing to serve as Non-Executive Directors. Michele

Tuomi will continue as CEO of Landore Resources Canada Inc. and

will be responsible for the Company's project operations. The

composition of the Board will be reviewed on a regular basis and it

is currently intended to appoint an additional Non-Executive

Director with technical expertise to strengthen the Board in due

course. The Board would like to thank Claude and Larry for their

efforts.

Operational Update

During 2023 an infill and extension soil sampling programme was

conducted over 17 kilometres of the Junior Lake shear zone, from

the Placer Dome Gold prospect in the west to east of the BAM Gold

Deposit. This regional shear zone has previously proven to be

highly prospective for gold and battery metals hosting the 1.5

million ounce BAM Gold Deposit, the B4-7 Nickel-Copper-Cobalt-PGE

Deposit, and the VW Nickel Deposit. Preliminary results from the

2023 soil sampling programme have been encouraging and will be

reported once fully collated and interpreted. In addition, a drill

core infill sampling programme was also carried out in 2023 on an

area from the BAM Gold Deposit through to the Lamaune Gold Prospect

approximately 11 kilometres along strike west of the BAM Gold

Deposit. This programme was designed to further test for gold

mineralisation and refine the Junior Lake geological model by

obtaining further mineralisation, lithology and structural data.

Results of the infill core sampling programme will also be reported

in due course. The Company expects all of the results from the

abovementioned work to be received and reported on during Q1

2024.

A drilling programme to advance the Company's flagship BAM Gold

Project has been prepared for implementation in 2024. Accordingly,

the Company will be exploring additional funding options to enable

it to, inter alia, proceed with such drilling campaign at the

earliest opportunity in 2024, as well as exploring potential

strategic investor, merger or sale opportunities in relation to its

Canadian subsidiary. The Company will provide further updates in

due course as appropriate.

Admission and Total Voting Rights

Application will be made to the London Stock Exchange for

admission of the Firm Placing Shares to trading on AIM

("Admission"). The Firm Placing Shares will rank pari passu with

the existing Ordinary Shares and it is expected that Admission will

become effective and dealings commence at 8.00 a.m. on or around 18

January 2024.

On Admission, the Company's issued share capital will consist of

136,713,058 Ordinary Shares with voting rights. Landore Resources

does not hold any Ordinary Shares in treasury. This figure of

136,713,058 may therefore be used by shareholders in the Company

following Admission as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the share capital of

the Company under the UK Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

A further announcement will be made in due course with respect

to application for admission of the Conditional Fundraising Shares

which will, inter alia, be conditional on the receipt of

shareholder approval at the forthcoming General Meeting.

Interim Chief Executive Officer, Glenn Featherby, said :

"Despite a period of significant challenges and difficult market

conditions, I believe the opportunity exists for the Company to

reset its goals and restore value for shareholders. The Board of

Directors are confident that we will have a year of progress in

2024, with our operational focus being on the Company's highly

prospective BAM Gold Deposit, seeking to bring the Resource to the

development stage. We appreciate the continued patience and support

of our shareholders during this transition period."

For further information, please contact :

Landore Resources Limited

Glenn Featherby (Interim CEO)

Tel + 44 7730420318

Strand Hanson Limited (Nominated Adviser and Joint Broker)

James Dance/Matthew Chandler/Robert Collins

Tel: 020 74093494

Novum Securities Limited (Joint Broker)

Jon Belliss/Colin Rowbury

Tel: 020 73999402

About Landore Resources

Landore Resources Limited is an exploration/development company

that seeks to grow shareholder value through the advanced

exploration and development of precious and battery metals projects

in eastern Canada. The Company is primarily focused on the

development of its 100% owned BAM Gold Project, located on the

Junior Lake Property in Northwestern Ontario.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019.

PDMR Notification Forms

1. Details of the person discharging managerial responsibilities

/ person closely associated

a) Name 1. Helen Green

2. Glenn Featherby

-------------------------------- -------------------------------------------

2. Reason for the Notification

-----------------------------------------------------------------------------

a) Position/status 1. Non-Executive Director

2. Chief Executive Officer

-------------------------------- -------------------------------------------

b) Initial notification/amendment Initial notification

-------------------------------- -------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------------

a) Name Landore Resources Limited

-------------------------------- -------------------------------------------

b) LEI 21380019CJ5T1PNY3Q69

-------------------------------- -------------------------------------------

4. Details of the transaction(s):section to be repeated for

(i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv)each place where transactions have

been conducted

-----------------------------------------------------------------------------

a) Description of the Financial Ordinary shares of nil par value each

instrument, type of instrument in the share capital of Landore Resources

Limited

-------------------------------- -------------------------------------------

Identification code GG00BMX4VR69

-------------------------------- -------------------------------------------

b) Nature of the Transaction Participation in Subscription for

new Ordinary Shares

-------------------------------- -------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1. 2.4p 1. 416,667

2. 2.4p 2. 1,250,000

--------------

-------------------------------- -------------------------------------------

d) Aggregated information Aggregate volume: 1,666,667

Aggregated volume Price Aggregate price: 2.4 p

-------------------------------- -------------------------------------------

e) Date of the transaction 3 January 2024

-------------------------------- -------------------------------------------

f) Place of the transaction Outside of an exchange

-------------------------------- -------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZZGGMMFVGDZZ

(END) Dow Jones Newswires

January 04, 2024 02:00 ET (07:00 GMT)

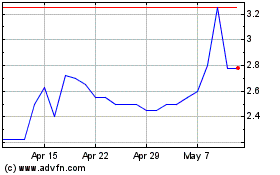

Landore Resources (LSE:LND)

Historical Stock Chart

From Mar 2024 to Apr 2024

Landore Resources (LSE:LND)

Historical Stock Chart

From Apr 2023 to Apr 2024