TIDMLOOP

RNS Number : 8746B

LoopUp Group PLC

07 June 2023

7 June 2023

LOOPUP GROUP PLC

("LoopUp Group" or the "Group")

Unaudited preliminary results for the year ended 31 December

2022

Significant uplift in Q4 revenue run-rate and strong Cloud

Telephony traction

LoopUp Group plc (AIM: LOOP), the cloud platform for premium

hybrid communications, is pleased to announce its preliminary

unaudited results for the year ended 31 December 2022.

Financial Highlights:

FY-22 H1-22 FY-21

GBP million (unaudited) (unaudited) (audited)

-------------------------- -------------- -------------- ------------

Revenue 16.5 6.6 19.5

Gross margin 69% 67% 69%

Adjusted EBITDA (1) (0.9) (1.5) 1.2

Group operating loss (2) (8.0) (5.1) (6.1)

Period end gross cash 1.7 0.7 5.5

Period end net debt 5.8 8.0 2.4

-------------------------- -------------- -------------- ------------

Operating Highlights:

-- Group revenue run-rate:

- 166% growth in Group quarterly revenue run-rate from GBP2.7

million in Q3-22 to GBP7.2 million in Q4-22 following the PGi

Connect agreement announced in September 2022

-- Cloud Telephony:

- 169% growth in customers from 29 at end FY21 to 78 at end

FY-22

- 227% growth in contracts from 51 contracts at end FY21 to 167

at end FY-22

- 188% growth in Booked ARR(3) from GBP0.57 million at end FY21

to GBP1.65 million at end FY-22

- Zero gross churn in FY-22 and Net Revenue Retention (NRR)(4)

of 159%

-- Meetings and Virtual Events:

- c.7,000 new customers transitioned to LoopUp Meetings under

the PGi Connect transaction

Post Period Highlights

-- Preliminary Q1-23 Group revenue of c.GBP6.5 million

-- Booked Cloud Telephony ARR has increased to c.GBP2.50

million, an increase of 51% from GBP1.65 million at the

end of FY22, and a year-on-year increase of 215% from

GBP0.8 million at the end of May 2022

-- LoopUp has been certified onto Microsoft's Operator Connect

partner program with Cloud Telephony service availability

in 48 countries, the broadest geographic coverage amongst

all c.65 global partners in the Operator Connect program

-- Scheduled repayment of GBP0.85 million in June 2023 reduces

outstanding debt with Bank of Ireland to GBP6.0 million

(31 Dec 2022: GBP6.8m)

Number Booked

Number of Individual ARR (GBP

of customers Contracts million)

-------------- --------------- ----------

At end FY-21 29 51 0.57

FY-22 increase from base at

end FY-21 42 0.34

FY-22 increase from new customer

wins 49 74 0.74

-------------- --------------- ----------

At end FY22 78 167 1.65

YTD-23 increase from base

at end FY-22 61 0.40

YTD-23 increase from new customer

wins 22 28 0.45

-------------- --------------- ----------

Current 100 256 2.50

Outlook

-- Notwithstanding the expected continued decline in its

Meetings business, the Group is confident both in its

ability to deliver continued strong growth in its primary

Cloud Telephony business and in its ability to meet FY-23

market expectations.

-- The Group's outstanding debt with Bank of Ireland is due

for repayment, extension or refinancing in September 2023.

Steve Flavell and Michael Hughes, co-CEOs of LoopUp Group,

commented:

"We are delighted to have finished last year and entered this

year strongly on two fronts. First, we have seen a material jump in

revenue run-rate and cash generation delivered from the PGi Connect

agreement. Second, we have achieved strong commercial traction in

our primary Cloud Telephony growth business. Cloud Telephony is a

$31 billion (5) and growing market opportunity. We believe the

combination of our technology assets built over 20 years, together

with our team's expertise transcending software,

telecommunications, and unified communications, positions the Group

with material differentiation and barriers to entry for our

multinational Cloud Telephony strategy."

(1) Earnings before interest, tax, depreciation, and amortisation,

excluding share-based payments charges

(2) Adjusted to exclude amortisation of acquired intangibles

and share-based payment charges

(3) Booked Annual Recurring Revenue: minimum contracted annual

revenue during the initial term of the customer contract

(4) NRR is calculated as the ratio of booked ARR at the end of

FY22 to booked ARR at the end of FY21 from the cohort of

customers in place at the end of FY21

(5) Source: Gartner 2023

Market abuse regulation:

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act

2018.

LoopUp Group plc via FTI

Steve Flavell, co-CEO

+44 (0) 20 7886

Panmure Gordon (UK) Limited 2500

Dominic Morley / Ivo Macdonald (Corporate

Finance)

+44 (0) 20 7397

Cenkos Securities Limited 8900

Giles Balleny / Dan Hodkinson (Corporate Finance)

Alex Pollen (Sales)

+44 (0) 20 3727

FTI Consulting, LLP 1000

Matt Dixon / Jamille Smith / Tom Blundell

About LoopUp Group plc

LoopUp (LSE AIM: LOOP) is a cloud platform for premium hybrid

communications. The Group's flagship Cloud Telephony solution for

Microsoft Teams enables multinational enterprises to consolidate

their global telephony provision into a single, consistently

managed cloud implementation rather than disparate implementations

from multiple carriers. The Group is listed on the AIM market of

the London Stock Exchange and is headquartered in London, with

offices in the US, Spain, Germany, Hong Kong, Barbados and

Australia. For further information, please visit:

www.loopup.com.

Chief Executive Officers' Business Review

Continued execution on our strategic transition

Commercially, the Group turned a corner during FY-22, following

a challenging transition period since the COVID-19 pandemic. We

made strong commercial progress in our primary Cloud Telephony

business and benefitted from a material injection of new business

into our otherwise generally declining Meetings business.

On the surface, Group revenue of GBP16.5 million marked a 15%

reduction from GBP19.5 million in FY-21. However, we saw a material

improvement in the second half of the year with GBP9.9 million

revenue in H2-22 compared to GBP6.6 million revenue in H1-22

(GBP8.0 million in H2-21). More precisely, the change in run-rate

hit in October 2022 following the 'Revenue Sharing and Customer

Transfer Agreement' with PGi Connect. This saw more than 7,000

customers transition from PGi Connect onto the LoopUp Meetings

platform, and a 167% increase in Q4-22 revenue over Q3-22 as a

result.

While our now materially larger Meetings business will

inevitably continue to decline over time in the face of customers

switching to broader UC platforms such as Microsoft Teams, our

Meetings business nevertheless represents a valuable source of cash

generation to fund the growth of our relatively young, but

fast-growing and exciting Cloud Telephony business that we launched

in September 2020.

We achieved strong commercial progress in Cloud Telephony during

FY-22 with triple digit growth in both customer numbers and booked

Annual Recurring Revenue (ARR). Furthermore, Microsoft has since

certified our product onto its Operator Connect partner program

with differentiated country coverage of regulated/licensed service

provision over all of the c.65 certified telecommunications

partners globally. This has enhanced our proposition to

multinational target market customers and we have seen accelerating

ARR growth during FY-23 to date.

Strong commercial momentum in Cloud Telephony

The Group's flagship Cloud Telephony solution is integrated into

Microsoft Teams and enables users to make phone calls to external

phone numbers and receive phone calls to their own work phone

numbers, all seamlessly via their Teams-enabled devices. Our

platform targets multinational mid-market and enterprise

organisations with the value proposition of consolidating their

global telephony procurement with one vendor partner - LoopUp -

rather than from multiple geographic-specific carriers.

Cloud Telephony now sits squarely at the heart of the Group's

forward-looking growth strategy, and we achieved strong operational

progress and commercial traction during FY-22. Customer numbers

grew by 169%, a growth of 49 customers from the 29 at the end of

FY-21 to 78 at the end of FY-22.

Given the geographic rollouts generally associated with

multinational customer deployments, customer wins often comprise

multiple individual contracts over time. In FY-22, individual

contract numbers grew from the 51 contracts with the Group's 29

customers at the end of FY-21 to 167 with the Group's 79 customers

at the end of FY-22, a growth of 116 contracts or 227%.

Booked ARR from these 78 customers stood at GBP1.65 million at

the end of FY-22, a 188% increase from GBP0.57 million at the end

of FY-21. This represents the minimum contractually guaranteed

level of won ARR, and the Group realistically expects the ARR from

these 78 customers to progress to c.GBP3.2 million as rollouts

progress, materially above the minimum contracted level.

Nearly all of the Group's Cloud Telephony customers are on

3-year initial term licence contracts. To date, the Group is proud

to have experienced zero gross customer churn since entering the

market and very strong Net Revenue Retention (NRR). NRR was 159% in

FY-22, this being the ratio of booked ARR at the end of FY-22 to

booked ARR at the end of FY-21 from the cohort of 29 customers in

place at the end of FY-21.

Late stage sales cycles in Cloud Telephony often involve a Proof

of Concept (POC), which enables prospective customers to test our

technology in their own IT environment. At the end of FY-22, our

success rate in POCs stood at 95%, with 19 out of 20 POC projects

completed by the Group having successfully converted into customer

wins.

The Group maintains a strong pipeline of future Cloud Telephony

sales opportunities (c.GBP100 million ARR). We are confident in our

continued Cloud Telephony growth prospects and are excited by the

traction and potential of our differentiated multinational solution

in this large Cloud Telephony market, which is forecast to grow

from GBP21.2 billion in 2022 to GBP31.4 billion by 2027(6) .

Meetings and PGi Connect transaction

The Group's Meetings business remains structurally in decline,

primarily due to customers switching to Microsoft Teams meetings as

part of a broader unified communications strategy on that

platform.

However, our Meetings business received a substantial boost in

September 2022, when the Group announced a 'Revenue Sharing and

Customer Transfer Agreement' with PGi Connect. The agreement gave

LoopUp the rights to onboard materially all of PGi Connect's

conferencing services customers. While no initial or fixed

consideration was payable, the Group agreed to pay PGi Connect a

share of invoiced and received revenue(7) from successfully

transferred customers for a period of three years.

Since October 2021, LoopUp has transitioned approximately 7,000

former PGi Connect customers onto its Meetings platform. This led

to Meetings revenue increasing from c.GBP2.7 million in Q3-22 to

c.GBP7.2 million in Q4-22, an increase of c.167%.

While this transitioned Meetings business is expected to decline

over time, it is nevertheless highly cash generative, with a gross

margin of 65-70% (after LoopUp COGS and PGi Connect revenue share)

and just c.GBP0.3 million in incremental quarterly staff and

overheads costs.

Hybridium

Following the acquisition of SyncRTC Inc. in October 2021, the

Group has since rebranded this line of business to Hybridium (

www.hybridium.com ) as a hybrid events business. The solution is

focused on relatively large-scale corporate events that have a mix

of in-room and remote guests and/or a mix of in-room and remote

hosts/presenters, such as management onsites, departmental

kick-offs, capital markets days and thought leadership

seminars.

Events with Hybridium's video wall technology benefit from

ultra-low latency at ultra-high resolution, with full video wall

layout flexibility facilitating any content on any section of the

wall. In April 2022, Hybridium signed a landmark deal with

Telefónica, which has deployed the solution at its 'Universitas'

global innovation and talent hub, located at its Madrid

headquarters in Distrito Telefónica.

The majority of 2022 product development time has been spent

materially reworking the platform from its legacy education focus

to a next generation version for large scale hybrid corporate

training and events. The Group is currently reviewing its

go-to-market strategy with a view to the scalable growth potential

of this differentiated technology, and will make further market

announcements in due course.

Outlook

While the Directors expect the Group's Meetings business to

continue to decline over time, this is now from a materially larger

base following the transition of former PGi Connect customers.

Combined with the fast and accelerating growth in its primary

forward-looking Cloud Telephony business, the Directors are

confident in the Group's ability to meet FY-23 market

expectations.

The Directors also draw attention to the Group's senior debt

arrangements with Bank of Ireland, where GBP6.8 million was

outstanding at 31 December 2022 (c.GBP6.0 million following a

repayment in June 2023) of an original principal of GBP17 million

borrowed in 2018. This debt facility comes around for repayment,

extension or refinancing in September 2023, and while the Directors

are confident in the Group's ability to do so, this is nevertheless

a project that needs to be successfully executed.

Steve Flavell Michael Hughes

co-CEO co-CEO

(6) Source: Gartner 2023

(7) Approximately 13% on a weighted average basis

ss

Chief Financial Officer's Review

During 2022, the Group has continued to make good progress in

its strategic transition towards hybrid communications and

collaboration. The PGi Connect agreement, which took effect from 1

October 2022, has significantly bolstered the Group's financial

position and returned the Group to a positive EBITDA run-rate.

Operating Results

The Group's primary segment is LoopUp Platform Capabilities

(LPC), which includes Meetings, Virtual Events and Cloud Telephony.

The structural decline in the Meetings business that began in

lockdown continued throughout FY-22. The PGi Connect agreement

brought a significant boost to Meetings and Virtual Events revenue

in Q4. In addition, the Cloud Telephony business grew 62% to GBP1.2

million (FY-21: GBP0.74 million). As a whole, LPC revenue fell by

12% to GBP13.0 million (FY-21: GBP14.8 million)., reflecting the

historically stronger Meetings business and the fact that the PGi

Connect agreement only came into effect in Q3-22.

The Group's revenue from Hybridium in the year was GBP0.6

million (2021 post acquisition revenue: GBP0.2 million).

Revenue from low margin third party resale services declined by

32% to GBP3.0 million (FY-21: GBP4.4 million).

The Group's overall gross profit decreased by 15% to GBP11.4

million (FY-21: GBP13.5 million), which reflects the reduction in

revenue as gross margin increased to 69.3% (FY-21: 69.0%). This

slight improvement in margin represents a significant shift in

revenue mix away from the low margin resale services, towards the

higher margin Meetings and Cloud Telephony business.

The gross profit on LPC business fell by 16% to GBP9.8 million

(FY-21: GBP11.7 million), at a lower gross margin of 75.9% (FY-21:

79.1%). The reduction in margin is a result of the revenue share

payable on PGi Connect transitioned business (around 13% on amounts

invoiced and paid by customers).

The administrative costs of the Group in 2022 were stable at

GBP12.3 million (FY-21: GBP12.3 million). This results from

management's focus on cost control as the nature of the Group's

business continues to change. The modest increase in staffing and

overhead levels necessitated by the increased volume of Meetings

and Virtual Events activity arising from the PGi Connect agreement

has been successfully accommodated without increasing the overall

cost-base of the Group.

Assets and Cash Flows

The Group had an operating cash outflow after capital

expenditure of GBP6.0 million (FY-21: GBP11.1 million). This was

partly offset by the proceeds of a placing in October 2022, which

raised GBP3.1 million net of costs.

Net debt (ie total debt, less cash balances) has risen to GBP5.8

million as at 31 December 2022 (2021: GBP2.4 million).

In 2018, the Company entered into a term loan with Bank of

Ireland for GBP17.0 million, which has since reduced to GBP6.8

million as at 31 December 2022 (balance at 31 December 2021: GBP6.8

million). During the year, the Group successfully renegotiated and

amended this senior debt with Bank of Ireland to reflect the

Group's ongoing strategic transition plan. Key elements of the

amended arrangements include:

-- a holiday on planned principal repayments through to June

2023, representing GBP1.7 million in aggregate deferred

payments;

-- a margin increase of 2.0 percent, taking the total interest

rate to 4.5 percent above the Sterling Overnight Index

Average (SONIA);

-- an extension of the term through to September 2023;

-- a revised set of financial covenants which are more concerned

with sufficient ongoing cash liquidity, EBITDA, and the

growth objectives for Cloud Telephony;

-- the Group's undrawn revolving credit facility of GBP1.5

million, which was drawn in the year, was repaid, and

terminated.

The loan matures in September 2023, and the Group is in the

process of seeking to refinance or extend this facility.

Notwithstanding the fact that this has not been successfully

completed to date, the Board is confident that this will be

achieved.

Simon Sacerdoti

CFO

Unaudited Consolidated Statement of Comprehensive income

For the year ended 31 December

2022

2022 2021

Note GBP000 GBP000

Revenue 16,480 19,526

Cost of sales (5,060) (6,058)

--------- ---------

Gross profit 2 11,420 13,468

Adjusted administrative expenses(i) (12,287) (12,272)

--------- ---------

Adjusted EBITDA (ii) (867) 1,196

Depreciation (1,556) (1,760)

Amortisation of development costs (5,542) (5,582)

Adjusted operating loss (iii) (7,965) (6,146)

Exceptional reorganisation and

tax charge (633) (392)

Exceptional impairment charge - (19,597)

Amortisation of acquired intangibles (1,849) (2,211)

Share-based payments charges (1,142) (2,208)

Operating loss (11,589) (30,554)

Finance costs (719) (465)

--------- ---------

Loss before income tax (12,308) (31,019)

Income tax (406) 6,052

--------- ---------

Loss for the year (12,714) (24,967)

--------- ---------

Currency translation (loss) 209 (340)

--------- ---------

Total comprehensive loss for

the year attributable to the

equity holders of the parent (12,505) (25,307)

========= =========

Loss per share (pence): 3

Basic (7.5) (39.0)

Diluted (7.5) (39.0)

========= =========

(i) Total administrative expenses excluding depreciation, amortisation

of development costs and acquired intangibles, non-recurring

transaction costs, exceptional reorganisation costs, exceptional

impairment charges and share

based payments charges.

(ii) Adjusted EBITDA is operating (loss) / profit stated before

depreciation, amortisation of development costs and acquired

intangibles, non-recurring transaction costs, exceptional

reorganisation and tax charge, exceptional impairment charges

and share based payments charges.

(iii) Before amortisation of other intangible assets, non-recurring

transaction costs, exceptional reorganisation costs, exceptional

impairment charges and share based payments charges.

Unaudited Consolidated Statement of Financial Position

As at 31 December 2022

2022 2021

GBP000 GBP000

Assets:

Property, plant and equipment 1,626 2,368

Right of use assets 779 2,130

Development costs 12,896 12,726

Other intangible assets 4,020 5,638

Goodwill and other intangibles 35,425 35,425

Total non-current assets 54,746 58,287

--------- ---------

Trade and other receivables 8,173 3,608

Cash and cash equivalents 1,661 5,465

Current tax 178 1,862

Total current assets 10,012 10,935

--------- ---------

Total assets 64,758 69,222

--------- ---------

Liabilities:

Trade and other payables (6,313) (3,384)

Accruals and deferred income (3,914) (2,036)

Lease liabilities (819) (956)

Borrowings (6,772) (1,700)

Total current liabilities (17,818) (8,076)

--------- ---------

Net current (liabilities)/assets (7,806) 2,859

Non-current liabilities:

Borrowings (686) (6,181)

Lease liabilities (897) (1,463)

Deferred tax (1,851) (1,721)

Provisions (178) (172)

--------- ---------

Total non-current liabilities (3,612) (9.537)

--------- ---------

Total liabilities (21,430) (17,613)

Net assets 43,328 51,609

========= =========

Equity

Share capital 881 485

Share premium 74,055 70,860

Other reserve 12,691 12,691

Foreign currency translation

reserve (2,540) (2,749)

Share-based payment reserve 4,028 3,395

Retained loss (45,787) (33,073)

--------- ---------

Shareholders' funds attributable

to equity owners of parent 43,328 51,609

========= =========

Unaudited Consolidated Statement of Changes in Equity

For the year ended 31 December 2022

Share Share Other Foreign Share-based Retained Shareholders

capital premium reserve currency payment profit funds/

translation reserve / (loss) (deficit)

reserve attributable

to equity

owners

of parent

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

As at 1 January

2021 277 60,677 12,691 (2,409) 1,354 (8,106) 64,484

--------- --------- --------- ------------- ------------ ---------- --------------

Loss for the year - - - - - (24,967) (24,967)

Other comprehensive

income - - - (340) - - (340)

Total comprehensive

loss for the year - - - (340) - (24,967) (25,307)

--------- --------- --------- ------------- ------------ ---------- --------------

Transactions with

owners of parent

in their capacity

as owners:

Equity share-based

payment compensation 4 163 - - 2,041 - 2,208

Share issues 204 10,020 - - - - 10,224

As at 31 December

2021 485 70,860 12,691 (2,749) 3,395 (33,073) 51,609

--------- --------- --------- ------------- ------------ ---------- --------------

As at 1 January

2022 485 70,860 12,691 (2,749) 3,395 (33,073) 49,179

--------- --------- --------- ------------- ------------ ---------- --------------

Loss for the year - - - - - (12,714) (12,714)

--------- --------- --------- ------------- ------------ ---------- --------------

Other comprehensive

income - - - 209 - - 209

--------- --------- --------- ------------- ------------ ---------- --------------

Total comprehensive

(loss) / profit

for the year - - - 209 - (12,714) (12,505)

--------- --------- --------- ------------- ------------ ---------- --------------

Transactions with

owners of parent

in their capacity

as owners:

--------- --------- --------- ------------- ------------ ---------- --------------

Equity share-based

payment compensation 46 460 - - 633 - 1,139

--------- --------- --------- ------------- ------------ ---------- --------------

Share issues 350 2,735 - - - - 3,085

--------- --------- --------- ------------- ------------ ---------- --------------

As at 31 December

2022 881 74,055 12,691 (2,540) 4,028 (45,787) 43,328

--------- --------- --------- ------------- ------------ ---------- --------------

Unaudited Consolidated Statement of Cash Flows

For the year ended 31 December 2022

2022 2021

Net cash flows from operating

activities

Loss before income tax (12,308) (31,019)

Non-cash adjustments

Depreciation and amortisation 8,947 9,548

Share-based payments charges 1,142 2,208

Impairment charge - 19,597

Interest payable 502 465

Working capital adjustments

Decrease in trade and other receivables (3,214) 3,377

Increase / (decrease) in trade

and other payables 4,214 (4,864)

Tax received 1,280 1,194

Net cash generated by operations 563 506

--------- ---------

Cash flows from investing activities

Purchase of property, plant and

equipment (39) (586)

Addition of intangible assets (5,942) (6,919)

Payment for acquisition of subsidiary - (3,574)

Net cash used in investing activities (5,981) (11,079)

--------- ---------

Cash flows from financing activities

Proceeds from share issue net of

issue costs 3,085 10,391

Repayment of loans (424) (5,839)

Payments in respect of leases (885) (840)

Loans acquired on acquisition - 971

Interest and finance fees paid (400) (365)

Net cash generated from financing

activities 1,376 4,318

--------- ---------

Net decrease in cash and equivalents (4,042) (6,255)

Cash and cash equivalents brought

forward 5,465 12,086

Effect of foreign exchange rate

changes 238 (366)

--------- ---------

Cash and cash equivalents carried

forward 1,661 5,465

========= =========

Notes to the Financial Statements

1. Background and basis of preparation

The principal activity of the Group is a premium cloud

communications platform for hybrid and remote communications.

LoopUp Group plc ('the Group') is a limited liability company

incorporated and domiciled in England and Wales, with company

number 09980752. Its registered office is 9 Appold Sreet, London

EV2A 2AP.

The unaudited summary financial information set out in this

announcement does not constitute the Group's consolidated statutory

accounts for the years ended 31 December 2022 or 31 December 2021.

The results for the year ended 31 December 2022 are unaudited. The

statutory accounts for the year ended 31 December 2022 will be

finalized on the basis of the financial information presented by

the Directors in this preliminary announcement, and will be

delivered to the Registrar of Companies in due course. The

statutory accounts are subject to completion of the audit and may

also change should a significant adjusting event occur before the

approval of the Annual Report.

The unaudited summary financial information set out in this

announcement has been prepared using the accounting policies as

described in the 31 December 2021 audited year end statutory

accounts and have been consistently applied.

The preliminary announcement for the year ended 31 December 2022

was approved by the Board for release on 7 June 2022.

2. Revenue and segmental reporting

The Directors have identified the segments by reference to the

principal groups of services offered and the geographical

organisation of the business as reported to the chief operating

decision-maker (CODM).

The segments adopted in 2022 were the same as those in 2021.

Segmental revenues are external and there are no material

transactions between segments.

The Group's largest customer represented less than 5% of total

revenue in both years.

No segmental balance sheet was presented to the CODM. Overheads

are not presented to the CODM on a segmental basis.

The Group's revenue disaggregated by primary geographical

markets is as follows:

LoopUp Third party

Platform Resale

Capabilities Services Hybridium Total

GBP000 GBP000 GBP000 GBP000

------------------------------------------------- ------------ ----------- --------- ------

For the year ended 31 December 2022 (unaudited):

UK 2,801 995 - 3,796

EU 1,503 811 468 2,782

North America 8,194 1,165 161 9,520

Rest of World 471 - - 471

------------------------------------------------- ------------ ----------- --------- ------

Total (unaudited) 12,969 2,971 629 16,569

------------------------------------------------- ------------ ----------- --------- ------

For the year ended 31 December 2021:

UK 7,027 1,624 13 8,664

EU 2,181 1,136 138 3,455

North America 5,363 1,684 61 7,108

Rest of World 269 - 30 299

------------------------------------------------- ------------ ----------- --------- ------

Total 14,840 4,444 242 19,526

------------------------------------------------- ------------ ----------- --------- ------

The Group's revenue disaggregated by pattern of revenue

recognition is as follows:

LoopUp Third party

Platform Resale

Capabilities Services Hybridium Total

GBP000 GBP000 GBP000 GBP000

------------------------------------------------- ------------ ----------- --------- ------

For the year ended 31 December 2022 (unaudited):

Services transferred at a point in time 10,995 - - 10,995

Services transferred over time 1,974 2,971 629 5,574

Total (unaudited) 12,969 2,971 629 16,569

------------------------------------------------- ------------ ----------- --------- ------

For the year ended 31 December 2021:

Services transferred at a point in time 12,740 10 - 12,750

Services transferred over time 2,100 4,434 242 6,776

------------------------------------------------- ------------ ----------- --------- ------

Total 14,840 4,444 242 19,526

------------------------------------------------- ------------ ----------- --------- ------

The Group's gross profit disaggregated by segment is as

follows:

2022 2021

unaudited

GBP000 GBP000

------------------------------ ----------- --------

LoopUp Platform Capabilities 9,838 11,740

Third party resale services 953 1,487

Hybridium 629 241

------------------------------- ----------- --------

11,420 13,468

------------------------------ ----------- --------

The Group's non-current assets disaggregated by primary

geographical markets are as follows:

2022 2021

unaudited

GBP000 GBP000

--------------- ----------- --------

UK 52,394 56,851

Other EU 237 253

North America 2,113 1,181

Rest of world 2 2

---------------- ----------- --------

54,746 58,287

--------------- ----------- --------

3. Loss / earnings per share

The basic earnings per share is calculated by dividing the net

loss attributable to equity holders of the Group by the weighted

average number of ordinary shares in issue during the year.

12 months

to 12 months

31 December to

2022 31 December

unaudited 2021

------------------------------------- ------------- -------------

Loss attributable to equity

holders (GBP000) (12,714) (24,967)

Adjusted profit attributable

to equity holders (GBP000)* (9,090) (4,938)

Weighted average number of ordinary

shares in issue (000) 120,522 63,992

Basic loss per share (pence):

* Basic adjusted* (7.5) (7.7)

* Basic (10.5) (39.0)

`

====================================== ============= =============

* - Calculated using the loss attributable to equity holders

adjusted for exceptional reorganisation costs, exceptional

impairment charges, amortisation of acquired intangibles and share

based payment charges.

The diluted loss per share in 2022 and 2021 were equal to the

basic loss per share, as no potentially dilutive shares were deemed

not to be anti-dilutive.

4. Dividends

The Directors do not recommend the payment of a dividend (2021:

GBPnil) .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR EAFKKEEFDEAA

(END) Dow Jones Newswires

June 07, 2023 02:00 ET (06:00 GMT)

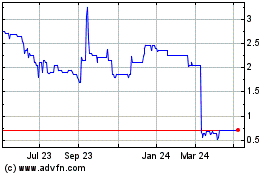

Loopup (LSE:LOOP)

Historical Stock Chart

From Apr 2024 to May 2024

Loopup (LSE:LOOP)

Historical Stock Chart

From May 2023 to May 2024