TIDMLOOP

RNS Number : 3782M

LoopUp Group PLC

14 September 2023

14 September 2023

LOOPUP GROUP PLC

("LoopUp" or the "Group")

Interim results for the period ended 30 June 2023

Continued strong traction in Cloud Telephony

LoopUp Group plc (AIM: LOOP), the cloud platform for premium

hybrid communications, is pleased to announce its unaudited interim

results for the six months ended 30 June 2023 ("H1-23").

Financial Highlights:

H1-23 H1-22

GBP million (unaudited) (unaudited)

----------------------- -------------- --------------

Revenue 12.2 6.6

Gross margin 76% 67%

Adjusted EBITDA (1) 2.5 (1.5)

Period end gross cash 0.9 0.7

Period end net debt 5.6 8.0

----------------------- -------------- --------------

-- Improved key financial metrics year-on-year

-- Extension of senior debt facilities with Bank of Ireland by twelve months to 30 September 2024

-- Reduction of outstanding Bank of Ireland debt to GBP6.0

million (31 Dec 2022: GBP6.8m) following scheduled repayment of

GBP0.85 million in June 2023

Operating Highlights:

-- Cloud Telephony - Our primary focus - securing customers and strong pipeline building:

- LoopUp was certified onto Microsoft's Operator Connect partner

program, and now has Cloud Telephony service availability in 54

countries, the broadest geographic coverage amongst all c.70

partners in the Operator Connect program globally

- 118% growth in customers from 50 at end H1-22 to 109 at end

H1-23

- 176% growth in contracts from 102 contracts at end H1-22 to

282 at end H1-23

- 154% growth in Booked ARR(3) from GBP1.0 million at end H1-22

to GBP2.5 million at end H1-23

- Zero gross churn in FY-22 and Net Revenue Retention (NRR)(4)

of 155%

-- Meetings and Virtual Events ("Event"):

- Material increase in H1-23 Meetings and Event revenue to

c.GBP9.4 million (H1-22: c.GBP3.6 million), driven by the

transition of PGi Connect customers in October 2022

- However, as expected and previously guided, these lines of

business are in progressive structural decline, as shown in the

following quarterly revenue profile:

c.GBP million Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q2-23

-------------------------- ------ ------ ------ ------ ------ ------

Meetings & Event revenue 2.0 1.6 1.4 5.8 5.3 4.0

Post Period Highlights:

-- Cloud Telephony Booked ARR currently at c.GBP2.7 million, an

increase of 70% from GBP1.6 million at the end of FY22, and a

year-on-year increase of 145% from GBP1.1 million in August

2022

-- Strong pipeline of future Cloud Telephony sales opportunities (c.GBP100 million ARR)

Number Booked

Number of Individual ARR

of customers Contracts (GBP million)

-------------- --------------- ---------------

At end H1-22 50 102 0.98

Increase from base (12 month

to end H1-23) 87 0.54

New customer wins (12 month

to end H1-23) 59 93 0.96

-------------- --------------- ---------------

At end H1-23 109 282 2.49

Increase from base (since end

H1-23) 41 0.19

New customer wins (since end

H1-23) 18 19 0.04

-------------- --------------- ---------------

Current 127 342 2.72

Outlook:

-- Based on current year-to-date trading, the positive

trajectory in Cloud Telephony and the as expected declining

trajectory in Meetings and Event, the Group is confident of broadly

meeting current market expectations for FY-23.

Steve Flavell and Michael Hughes, co-CEOs of LoopUp Group,

commented:

"Today we report results demonstrating improved financials

year-on-year, boosted by the cash generation associated with last

year's PGi Connect transaction. We are pleased with the continued

strong commercial traction in our primary Cloud Telephony business,

executing on our strategy of enabling multinational enterprises to

consolidate their telephony procurement and management

globally.

Cloud Telephony has seen triple digit growth in both customers

and booked ARR, and we are proud to offer the broadest geographic

licensed coverage on Microsoft's Operator Connect program. Combined

with our global technology platform and team expertise across

telecommunications, unified communications and software

development, we are well placed with a building pipeline to become

a future winner in the multinational segment of the $31 billion (5)

Cloud Telephony market opportunity."

(1) Earnings before interest, tax, depreciation, and amortisation,

excluding share-based payments charges

(2) Adjusted to exclude amortisation of acquired intangibles

and share-based payment charges

(3) Booked Annual Recurring Revenue: minimum contracted annual

revenue during the initial term of the customer contract

(4) NRR is calculated as the ratio of booked ARR at the end of

H1-23 to booked ARR at the end of H1-22, from the cohort

of customers in place at the end of H1-22

(5) Source: Gartner 2023

Market abuse regulation:

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act

2018.

LoopUp Group plc via FTI

Steve Flavell, co-CEO

+44 (0) 20 7886

Panmure Gordon (UK) Limited 2500

Dominic Morley / Ivo Macdonald (Corporate

Finance)

+44 (0) 20 7397

Cavendish Securities plc 8900

Giles Balleny / Dan Hodkinson (Corporate Finance)

Dale Bellis (Sales)

+44 (0) 20 3727

FTI Consulting, LLP 1000

Emma Hall / Jamille Smith / Tom Blundell

About LoopUp Group plc

LoopUp (LSE AIM: LOOP) is a cloud platform for premium hybrid

communications. The Group's flagship Cloud Telephony solution for

Microsoft Teams enables multinational enterprises to consolidate

their global telephony provision into a single, consistently

managed cloud implementation rather than disparate implementations

from multiple carriers. The Group is listed on the AIM market of

the London Stock Exchange and is headquartered in London, with

offices in the US, Spain, Germany, Hong Kong, Barbados and

Australia. For further information, please visit:

www.loopup.com.

Chief Executive Officers' Business Review

Continued execution on our strategic transition

Boosted by the material additional cash generation in our

Meetings and Event businesses following the PGi Connect

transaction, as announced in September 2022, the Group has

continued to forge further strong commercial progress in our

primary Cloud Telephony growth business.

At a Group level, all key financials improved year-on-year, with

H1-23 revenue 84% higher than the prior year, gross profit 109%

higher, gross margin 9 percentage points better, profitable at an

adjusted EBITDA level, and an 81% reduction in operating loss.

Our primary Cloud Telephony growth business continued its strong

growth profile since launch in H2-20, with triple digit growth in

customers, contracts, Booked ARR and revenue, and very strong churn

and retention metrics. Our strategy of enabling multinational

enterprises to consolidate their telephony procurement and

management globally has been strengthened by the Group's leading

global coverage on Microsoft's Operator Connect cloud telephony

partner program.

Revenue from our Meetings and Event business was 160% higher in

the period than prior year due to the PGi Connect transaction, but

as expected, continues to decline due to the global trend of these

capabilities being fulfilled by broader Unified Communications

platforms, such as Microsoft Teams and Zoom.

Strong commercial momentum in Cloud Telephony

The Group's flagship Cloud Telephony solution is integrated into

Microsoft Teams and enables users to make phone calls to external

phone numbers and receive phone calls to their own work phone

numbers, all seamlessly via their Teams-enabled devices. Our

platform targets multinational mid-market and enterprise

organisations with the value proposition of consolidating their

global telephony procurement with one vendor partner - LoopUp -

rather than from multiple geographic-specific carriers.

Cloud Telephony now sits squarely at the heart of the Group's

forward-looking growth strategy, and we achieved further strong

operational progress and commercial traction during H1-23.

LoopUp was certified onto Microsoft's Operator Connect partner

program in April 2023. Importantly for our multinational

go-to-market strategy, our service availability in 54 countries is

the broadest geographic coverage amongst all c.70 partners in the

Operator Connect program globally.

Customer numbers grew by 118%, a growth of 59 customers from the

50 at the end of H1-22 to 109 at the end of H1-23.

Given the geographic rollouts generally associated with

multinational customer deployments, customer wins often comprise

multiple individual contracts over time. Individual contract

numbers grew from the 102 contracts with the Group's 50 customers

at the end of H1-22 to 282 with the Group's 109 customers at the

end of H1-23, a growth of 180 contracts or 176%.

Booked ARR from these 180 customers stood at GBP2.5 million at

the end of H1-23, a 154% increase from GBP1.0 million at the end of

H1-22. This represents the minimum contractually guaranteed level

of won ARR, and the Group realistically expects the ARR from these

109 customers to progress to c.GBP3.9 million as rollouts progress,

materially above the minimum contracted level.

Nearly all of the Group's Cloud Telephony customers are on

3-year initial term licence contracts. To date, the Group is proud

to have experienced zero gross customer churn since entering the

market and very strong Net Revenue Retention (NRR). NRR was 155% in

the twelve months to end H1-23, this being the ratio of booked ARR

at the end of H1-23 to booked ARR at the end of H1-22 from the

cohort of 50 customers in place at the end of H1-22.

The Group maintains a strong pipeline of future Cloud Telephony

sales opportunities (c.GBP100 million ARR). We are confident in our

continued Cloud Telephony growth prospects and are excited by the

traction and potential of our differentiated multinational solution

in this large Cloud Telephony market, which is forecast to grow

from GBP21.2 billion in 2022 to GBP31.4 billion by 2027(6) .

Meetings and Event

The Group's Meetings and Event businesses remain structurally in

decline, primarily due to customers switching to broader Unified

Communications platforms such as Microsoft Teams that include

similar features and capabilities.

However, our Meetings and Event businesses received a

substantial boost in September 2022, when the Group announced a

'Revenue Sharing and Customer Transfer Agreement' with PGi Connect.

The agreement gave LoopUp the rights to onboard materially all of

PGi Connect's conferencing services customers. While no initial or

fixed consideration was payable, the Group agreed to pay PGi

Connect a share of invoiced and received revenue(7) from

successfully transferred customers for a period of three years.

Meetings and Event revenue was c.GBP9.3 million in H1-23, an

increase of 160% over c.GBP3.6 million in H2-22. However, the

underlying structural decline is demonstrated in the quarterly

revenue profile as below:

c.GBP million Q1-22 Q2-22 Q3-22 Q4-22 Q1-23 Q2-23

-------------------------- ------ ------ ------ ------ ------ ------

Meetings & Event revenue 2.0 1.6 1.4 5.8 5.3 4.0

Recent churn was amplified by a major collections initiative

beginning in Q2 across the thousands of new accounts transitioned

from PGi Connect, and the Group believes this churn rate will

settle at a lesser but nevertheless still material level in due

course.

Notwithstanding the structural decline, Meetings and Event are

highly cash generative for the Group.

Hybridium

Following the acquisition of SyncRTC Inc. in October 2021, the

Group's Hybridium ( www.hybridium.com ) solution is focused on

relatively large-scale corporate events that have a mix of in-room

and remote guests and/or a mix of in-room and remote

hosts/presenters, such as management onsites, departmental

kick-offs, capital markets days and thought leadership

seminars.

Events with Hybridium's video wall technology benefit from

ultra-low latency at ultra-high resolution, with full video wall

layout flexibility facilitating any content on any section of the

wall. The Group is currently reviewing its go-to-market strategy

for Hybridium and will make further market announcements in due

course.

Bank of Ireland debt arrangements

In June 2023, the Group successfully extended its debt

facilities with Bank of Ireland by twelve months, such that the

facilities will now mature on 30 September 2024. The financial

covenants to this facility were extended through to the updated

maturity date, on the same essential basis as prior to the

extension. There were no material changes to key commercial terms

in connection with the facility .

Outlook

While the Directors expect the Group's Meetings business to

continue to decline over time, this is now from a materially larger

base following the transition of former PGi Connect customers.

Combined with the fast and accelerating growth in its primary

forward-looking Cloud Telephony business, the Group is confident of

broadly meeting current market expectations for FY-23.

Steve Flavell Michael Hughes

co-CEO co-CEO

(6) Source: Gartner 2023

(7) Approximately 13% on a weighted average basis

Unaudited consolidated statement of comprehensive income for the

six months to 30 June 2023

Six months Six months

to to Year to

30 June 30 June 31 December

GBP'000 2023 2022 2022

--------------------------------------- ----------- ----------- -------------

Revenue 12,218 6,632 16,480

Cost of sales (2,975) (2,211) (5,060)

---------------------------------------- ----------- ----------- -------------

Gross profit 9,243 4,421 11,420

Adjusted operating expenses

(1) (6,769) (5,967) (12,287)

---------------------------------------- ----------- ----------- -------------

Adjusted EBITDA (2) 2,474 (1,546) (867)

Depreciation (579) (806) (1,556)

Amortisation of development

costs (2,880) (2,722) (5,495)

Adjusted operating profit

/ (loss)(3) (985) (5,074) (7,918)

Exceptional reorganisation

costs - (259) (633)

Exceptional impairment charge - - (13,560)

Amortisation of acquired intangibles - (925) (1,846)

Share-based payment charges (300) (602) (1,142)

---------------------------------------- ----------- ----------- -------------

Total administrative expenses (10,528) (11,281)

---------------------------------------- ----------- ----------- -------------

Operating profit / (loss) (1,285) (6,860) (25,102)

Finance costs (269) (212) (766)

Profit / (loss) before income

tax (1,554) (7,072) (25,868)

Income tax (113) (121) 4,066

Profit / (loss) for the period (1,667) (7,193) (21,802)

Other comprehensive income

and loss

Currency translation gain

/ (loss) (374) 27 209

Total comprehensive income

/ (loss) for the period attributable

to the equity holders of the

parent (2,041) (7,166) (21,593)

======================================== =========== =========== =============

Earnings / (loss) per share

(pence) - Note 4

* Basic and diluted adjusted (4) (1.1) (5.4) (6.9)

* Basic and diluted (1.4) (7.1) (18.1)

======================================== =========== =========== =============

(1.) Total administrative expenses excluding depreciation,

amortisation of development costs and acquired intangibles,

exceptional reorganisation costs, exceptional impairment

charge and share-based payment charges.

(2.) Adjusted EBITDA is operating profit/(loss) stated before

depreciation, amortisation of development costs and acquired

intangibles, exceptional reorganisation costs, exceptional

impairment charge and share-based payment charges.

(3.) Adjusted operating profit/(loss) is operating profit/(loss)

stated before amortisation of acquired intangibles, exceptional

reorganisation costs, exceptional impairment charge and

share-based payment charges.

(4.) Basic adjusted and diluted adjusted earnings per share

are calculated using profit/(loss) attributable to equity

holders adjusted for exceptional reorganisation costs,

exceptional impairment charges, amortisation of acquired

intangibles and share based payment charges.

Unaudited consolidated statement of financial position at 30

June 2023

30 June 30 June 31 December

GBP'000 2023 2022 2022

---------------------------------- --------- --------- ------------

Assets

Non-current assets

Property, plant and equipment 1,307 1,985 1,626

Right of use assets 532 1,717 780

Intangible assets:

* Development costs 12,779 12,384 13,126

* Other intangible assets - 5,397 -

* Goodwill 25,649 35,425 25,654

* Deferred tax 1,974 - 1,974

Total non-current assets 42,241 56,908 43,160

----------------------------------- --------- --------- ------------

Current assets

Trade and other receivables 6,170 3,632 8,173

Cash and cash equivalents 885 662 1,661

Current tax 712 2,063 825

----------------------------------- --------- --------- ------------

Total current assets 7,767 6,357 10,659

----------------------------------- --------- --------- ------------

Total assets 50,008 63,265 53,819

----------------------------------- --------- --------- ------------

Liabilities

Trade and other payables (5,715) (3,796) (6,313)

Accruals and deferred income (3,846) (1,659) (3,914)

Lease liabilities (835) (762) (819)

Borrowings (1,700) (1,700) (6,772)

Total current liabilities (12,096) (7,917) (17,818)

----------------------------------- --------- --------- ------------

Net current assets/(liabilities) (4,329) (1,560) (7,159)

Non-current liabilities

Borrowings (4,742) (6,948) (686)

Lease liabilities (674) (1,468) (897)

Deferred tax liability - (1,721) -

Provisions - (172) (178)

Total non-current liabilities (5,416) (10,309) (1,761)

Total liabilities (17,512) (18,226) (19,579)

----------------------------------- --------- --------- ------------

Net assets 32,496 45,039 34,240

=================================== ========= ========= ============

Equity

Share capital 881 518 881

Share premium 74,055 71,129 74,055

Other reserve 12,691 12,691 12,691

Foreign currency translation

reserve (2,914) (2,722) (2,540)

Share based payment reserve 4,325 3,689 4,028

Retained loss (56,542) (40,266) (54,875)

Shareholders' funds attributable

to equity owners of parent 32,496 45,039 34,240

=================================== ========= ========= ============

Unaudited consolidated statement of changes in equity at 30 June

2023

Shareholders'

funds /

(deficit)

Foreign Share attributable

currency based to equity

Share Share Other translation payment Retained owners of

GBP'000 capital premium reserve reserve reserve loss parent

------------------------ --------- --------- --------- ------------- --------- --------- --------------

Balance at 1 January

2022 485 70,860 12,691 (2,749) 3,395 (33,073) 51,609

Total comprehensive

income / (loss) - - - 27 - (7,193) (7,166)

Equity share-based

payment compensation 33 269 - - 294 - 596

Balance at 30 June

2022 518 71,129 12,691 (2,722) 3,689 (40,266) 45,039

Total comprehensive

income / (loss) - - 182 - (14,609) (14,427)

Equity share-based

payment compensation 13 191 - - 339 - (517)

Proceeds from share

issues 350 2,735 - - - - 3,085

Balance at 31 December

2022 881 74,055 12,691 (2,540) 4,028 (54,875) 34,240

Total comprehensive

income / (loss) - - - (374) - (1,667) (2,041)

Equity share-based

payment compensation - - - - 297 - 297

Balance at 30 June

2023 881 74,055 12,691 (2,914) 4,325 (56,542) 32,496

------------------------ --------- --------- --------- ------------- --------- --------- --------------

Unaudited consolidated statement of cash flows for the six

months to 30 June 2023

Six months Six months

to to Year to

30 June 30 June 31 December

GBP'000 2023 2022 2022

----------------------------------- ----------- ----------- -------------

Operating activities

(Loss) before tax (1,554) (7,072) (25,868)

Non-cash adjustments:

Depreciation and amortisation 3,465 4,413 8,900

Share based payment charge 300 602 1,145

Impairment charges - - 13,560

Interest payable 269 212 502

Working capital adjustments:

Decrease/(increase) in trade

and other receivables 2,260 (24) (3,170)

(Decrease)/increase in trade

and other payables (811) 34 4,214

Net income tax received /

(paid) 113 (302) 1,280

----------------------------------- ----------- ----------- -------------

Cash generated from/(used

in) operations 4,042 (2,137) 563

----------------------------------- ----------- ----------- -------------

Cash flows from investing

activities

Purchase of property, plant

and equipment (13) (38) (39)

Development expenditure (2,533) (3,000) (5,942)

Net cash used in investing

activities (2,546) (3,038) (5,981)

----------------------------------- ----------- ----------- -------------

Cash flows from financing

activities

Proceeds from share issues - - 3,085

Repayment of loans (1,015) - (424)

Payments for leased assets (648) (379) (885)

Credit facility - 930 -

Interest and finance fees paid (235) (152) (400)

Net cash generated from/(used

in) financing activities (1,898) 399 1,376

----------------------------------- ----------- ----------- -------------

Net (decrease) in cash and

cash equivalents (402) (4,776) (4,042)

Cash and cash equivalents brought

forward 1,661 5,465 5,465

Effect of foreign exchange

rate changes (374) (27) 238

Cash and cash equivalents

carried forward 885 662 1,661

=================================== =========== =========== =============

Notes to the financial information for the six months ended 30

June 2023

1. General information

LoopUp Group plc (AIM: "LOOP", "LoopUp Group", or the "Group")

is a global provider of hybrid communication software and services.

It is a public limited company incorporated and domiciled in

England and Wales, with company number 09980752. Its registered

office is 9 Appold Street, London EC2A 2AP.

2. Basis of preparation and significant accounting policies

These consolidated interim financial statements have been

prepared in accordance with UK adopted International Accounting

Standards ("IFRS") and IFRS Interpretations Committee (formerly

IFRIC) interpretations in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006. This results announcement does not constitute statutory

accounts of the Group within the meaning of sections 434(3) and

435(3) of the Companies Act 2006. The balance sheet at 31 December

2022 has been derived from the full Group accounts published in the

Annual Report and Accounts 2022, which has been delivered to the

Registrar of Companies and on which the report of the independent

auditors was unqualified and did not contain a statement under

either section 498(2) or section 498(3) of the Companies Act

2006.

The results have been prepared in accordance with the accounting

policies set out in the Group's 31 December 2022 statutory

accounts, which are based on the recognition and measurement

principles of IFRS.

These unaudited interim results have been prepared on the going

concern basis. At the balance sheet date, the Group had cash of

GBP0.9m and net assets of GBP32.5m. Based on detailed forecasts

prepared by management, the Directors have a reasonable expectation

that the Group has adequate resources to continue operations for

the next twelve months, and as such these results have been

prepared on a going concern basis.

The results for the six months ended 30 June 2023 were approved

by the Board on 13 September 2023. A copy of these interim results

will be available on the Group's web site www.loopup.com from 14

September 2023.

The principal risks and uncertainties faced by the Group have

not changed from those set out in the Annual Report and Accounts

2022.

No impact is anticipated from new standards coming into effect

from 1 January 2023.

3. Revenue and segmental reporting

IFRS 8 Operating Segments requires operating segments to be

identified on the same basis as is used internally for the review

of performance and allocation of resources by the CODM. The

Directors have identified the segments by reference to the

principal groups of services offered and the geographical

organisation of the business as reported to the CODM.

The primary segment is that of LoopUp Platform Capabilities

(LPC), and includes global cloud voice services via Direct Routing

and Operator Connect integration with Microsoft Teams (known as

Cloud Telephony), as well as the Group's longstanding Remote

Meetings and Managed Events capabilities. Revenue from resale of

Cisco WebEx services is categorised as 'third party resale

services'. A third segment exists as a result of the acquisition of

SyncRTC in October 2021, that of Hybridium.

Segmental revenues are external and there are no material

transactions between segments. The Group's largest customer

represented less than 5% of total revenue in both years.

No segmental balance sheet was presented to the CODM. It is not

possible to allocate overheads, and therefore profits, by segment

due to the pooled nature of the overhead base and the capital

structure. Overheads are not presented to the CODM on a segmental

basis.

The Group's revenue disaggregated by primary geographical

markets is as follows:

6 months 6 months 12 months

to 30 June to 30 June to 31 December

GBP'000 2023 2022 2022

--------------- ------------ ------------ ----------------

UK 1,517 2,674 3,783

EU 1,049 1,058 2,781

North America 9,189 2,813 9,453

Rest of world 463 87 463

--------------- ------------ ------------ ----------------

12,218 6,632 16,480

--------------- ------------ ------------ ----------------

The Group's revenue disaggregated by pattern of revenue

recognition is as follows:

6 months 6 months 12 months

to 30 June to 30 June to 31 December

GBP'000 2023 2022 2022

--------------------------------- ------------ ------------ ----------------

Services transferred at a point

in time 9,666 4,237 10,995

Services transferred over time 2,552 2,395 5,485

--------------------------------- ------------ ------------ ----------------

12,218 6,632 16,480

--------------------------------- ------------ ------------ ----------------

The Group's revenue disaggregated by segment is as follows:

6 months 6 months 12 months

to 30 June to 30 June to 31 December

GBP'000 2023 2022 2022

------------------------------ ------------ ------------ ----------------

LoopUp Platform Capabilities 10,877 4,590 12,880

Third party resale services 1,127 1,642 2,971

Hybridium 214 400 629

------------------------------ ------------ ------------ ----------------

12,218 6,632 16,480

------------------------------ ------------ ------------ ----------------

The Group's non-current assets disaggregated by primary

geographical markets are as follows:

6 months 6 months 12 months

to 30 June to 30 June to 31 December

GBP'000 2023 2022 2022

--------------- ------------ ------------ ----------------

UK 39,090 55,222 40,055

EU 565 170 237

North America 2,585 1,513 1,866

Rest of world 1 3 2

--------------- ------------ ------------ ----------------

43,241 56,908 43,160

--------------- ------------ ------------ ----------------

4. Earnings per share

The basic earnings per share is calculated by dividing the net

profit attributable to equity holders of the Group by the weighted

average number of ordinary shares in issue during the year.

6 months 6 months 12 months

to 30 June to 30 June to 31 December

2023 2022 2022

------------------------------------- ------------ ------------ ----------------

Profit / (loss) attributable

to equity holders (GBP'000) (1,667) (7,193) (21,802)

Adjusted profit attributable

to equity holders (GBP'000)

(1) (1,367) (5,407) (9,090)

Weighted average number of ordinary

shares in issue ('000) 120,522 100,783 120,522

Basic earnings per share (pence):

* Basic adjusted (1) (1.1) (5.4) (6.9)

- Basic (1.4) (7.1) (18.1)

===================================== ============ ============ ================

(1.) Calculated using profit / (loss) for the period, adjusted

for exceptional reorganisation costs, exceptional impairment

charges, amortisation of acquired intangibles and share

based payment charges.

Since the Group made a loss in each of the periods above, there

were no potentially dilutive shares that were not anti-dilutive,

and the diluted earnings per share is identical to the basic

earnings per share.

5. Dividends

The directors did not recommend the payment of a dividend for

the years ended 31 December 2022 or 2021, or the six month periods

ended 30 June 2023 or 2022.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KXLFFXKLXBBB

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

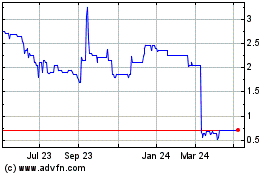

Loopup (LSE:LOOP)

Historical Stock Chart

From Apr 2024 to May 2024

Loopup (LSE:LOOP)

Historical Stock Chart

From May 2023 to May 2024