TIDMMAB1

RNS Number : 6003N

Mortgage Advice Bureau (Hldgs) PLC

26 September 2023

MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

("MAB" or "the Group")

26 September 2023

Interim Results for the six months ended 30 June 2023

Mortgage Advice Bureau (Holdings) Plc (AIM: MAB1.L) is pleased

to announce its interim results for the six months ended 30 June

2023.

Financial summary

H1 2023 H1 2022 Change vs

H1 2022

Revenue GBP117.5m GBP96.5m +22%

---------- --------- ----------

Gross profit GBP32.9m GBP25.4m +30%

---------- --------- ----------

Gross profit margin 28.0% 26.4% +1.6pp(1)

---------- --------- ----------

Adjusted EBITDA(*) GBP10.5m GBP12.0m -13%

---------- --------- ----------

Adjusted EBITDA margin(*) 8.9% 12.4% -3.5pp

---------- --------- ----------

Adjusted profit before tax(*) GBP8.8m GBP11.5m -24%

---------- --------- ----------

Statutory profit before tax GBP7.6m GBP10.1m -25%

---------- --------- ----------

Adjusted profit before tax

margin(*) 7.5% 12.0% -4.5pp

---------- --------- ----------

Adjusted profit before tax

as a percentage of net revenue(*) 19.3% 38.6% -19.3pp

---------- --------- ----------

Reported profit before tax

margin 6.4% 10.5% -4.1pp

---------- --------- ----------

Adjusted EPS(*) 11.8p 16.4p -28%

---------- --------- ----------

Basic EPS 11.3 p 14.0 p -19%

---------- --------- ----------

Adjusted cash conversion(*) 131 % 124% +7pp

---------- --------- ----------

Interim dividend 13.4p 13.4p -

---------- --------- ----------

Operational highlights

-- Market share of new mortgage lending (2) up 19% to 8.1

% (H1 2022: 6.8%)

-- Gross mortgage completions(2) (including product transfers)

flat at GBP12.1bn (H1 2022: GBP12.2bn)

-- Gross new mortgage completions(2) (excluding product

transfers) down 13% to GBP9.0bn (H1 2022: GBP10.3bn)

-- Adviser numbers down 6% to 2,109 (3) at 30 June 2023

(31 December 2022: 2,254)

-- Average number of mainstream advisers(4) up 4% to 1,966

(H1 2022: 1,890)

-- Revenue per mainstream adviser(4) up 17% following the

acquisition of Fluent

-- Proportion of revenue from re-financing at 36% (H1 2022:

30%)

Post period end

-- 2,114 advisers at 22 September 2023, including 129 advisers

from Fluent

* In addition to statutory reporting, MAB reports alternative

performance measures ("APMs") which are not defined or specified

under the requirements of International Financial Reporting

Standards ("IFRS"). The Group uses these APMs to improve the

comparability of information between reporting periods, by

adjusting for certain items which impact upon IFRS measures, to aid

the user in understanding the activity taking place across the

Group's businesses. APMs are used by the Directors and management

for performance analysis, planning, reporting and incentive

purposes. A summary of APMs used and their closest equivalent

statutory measures is given in the Glossary of Alternative

Performance Measures.

Peter Brodnicki, Chief Executive, commented:

"It has been an exceptionally challenging year with interest

rates continuing to rise. This has clearly impacted consumer

confidence, resulting in many people deciding to delay their house

purchase, whilst for others there is understandably a reduced level

of urgency. This has created a toughening market for mortgage

brokers as the year has progressed, compounding the damaging impact

of the mini-budget last September.

"However, against this difficult backdrop I am pleased with how

MAB has significantly outperformed the market, with the organic

business performing above expectations. To ensure we are in the

best possible shape when market conditions improve we have

continued to carefully invest across the entire Group to deliver

optimal business and adviser efficiency. This has also been a

priority with Fluent, where the short-term impact of such a

significant downturn has been more strongly felt, and indeed

magnified due to the business having been in such a strong growth

phase at the point it was acquired by MAB.

"MAB has an exceptionally strong track record of outperformance,

and the progress made this year in the development of new lead

opportunities for Fluent and the rest of the Group will underpin

our plans to deliver continued market share growth in 2024, even if

difficult market conditions continue to prevail.

"There is a great deal to be positive about and our lead

initiatives, including the addition of Fluent to the Group, will

continue to strengthen our addressable market and growth plans,

whilst offsetting the potential impact of any downward cycles in

the future."

Current Trading and Outlook

Following a difficult Q1 2023, with activity levels still

affected by the fall in mortgage approvals post the September 2022

mini-budget, we saw an improvement in Q2 2023 and ended the half

year modestly ahead of the Board's original expectations.

However, market conditions have toughened again in Q3 2023,

impacting both purchase and re-financing activity. Expectations

that the Bank of England base rate might be peaking coincided with

a downward movement in mortgage rates, changing the behaviour of

customers in terms of the timing and their urgency to commit to a

new fixed mortgage rate, whether that be a product transfer or

re-mortgage. In addition, the summer months saw a sharper than

usual seasonal fall in mortgage financed house purchases.

This has prompted the Board to take a more cautious view on

expected activity levels in Q4 2023 and hence the outlook for the

full year. Although the Board still expects the MAB Group excluding

Fluent to be at least in line with its original expectations for

the year, it now expects the Group to report an adjusted profit

before tax of not less than GBP22m for the 2023 financial year,

with some upside likely to materialise should market conditions

normalise.

The underlying level of demand for home ownership and home moves

remains strong, and we are confident that once inflation is under

control and the Bank of England base rate has peaked or started to

fall back, we will see demand and activity strengthen again. When

they do MAB will be in a very strong position to capitalise on the

recovery and the inevitable catch-up in house purchase transactions

that will follow. This will be boosted by continued increases in

operational efficiency and market share, and the momentum that is

building in our lead generation and retention initiatives.

Our new AR pipelines continue to build strongly and are expected

to do so for the remainder of H2. Organic adviser growth will

return when the economic outlook is more certain and our AR firms

are able to plan with far more confidence.

For further information please contact:

Mortgage Advice Bureau (Holdings) Plc +44 (0)1332 525 007

Peter Brodnicki - Chief Executive Officer

Ben Thompson - Deputy Chief Executive Officer

Lucy Tilley - Chief Financial Officer

Nominated Adviser and Joint Broker:

Numis Securities Limited

Stephen Westgate / Giles Rolls +44 (0)20 7260 1000

Joint Broker:

Peel Hunt LLP

Andrew Buchanan / Mike Burke +44 (0)20 7418 8900

Media enquiries: investor.relations@mab.org.uk

Analyst presentation

There will be an analyst presentation to discuss the results at

9:30am today.

Those analysts wishing to attend are asked to contact

investor.relations@mab.org.uk

Copies of this interim results announcement are available at

www.mortgageadvicebureau.com/investor-relations

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

(1) Percentage points.

(2) Based on first charge mortgage completions, excluding

secured personal loans (second charge mortgages), later life

lending mortgages and bridging finance, and, for H1 2022, including

completions from associates in the process of being onboarded under

MAB's AR arrangements.

(3) Includes 139 Fluent advisers as at 30 June 2023 (74 advisers

in the first charge mortgages division, 54 in the secured personal

loans division, 5 in the later life division, and 6 in the bridging

finance division). Includes a total of 188 advisers at 30 June 2023

who are later life advisers or advisers in directly authorised

firms that use MAB's subsidiary, Auxilium, a specialist protection

service provider, for protection. For both later life and directly

authorised advisers the fees received by MAB represent the net

income received by MAB as there are no commission payouts made by

MAB.

(4) Excludes directly authorised advisers, MAB's later life

advisers and, for H1 2022, advisers from associates in the process

of being onboarded under MAB's AR arrangements. Includes Fluent's

second charge, later life and bridging advisers who have a higher

revenue per adviser than first charge advisers.

Chief Executive's Review

H1 2023 was a very challenging period for the mortgage and

housing markets, as inflationary pressures and rising interest

rates significantly impacted consumer confidence and affordability,

with lending criteria being tightened, and ultimately the demand

and commitment to proceed with mortgaged property purchases.

Property transactions overall during the period fell by 18%

compared to H1 2022. However the contraction in first charge

mortgage lending in the purchase segment was much sharper at 30%,

as the proportion of property purchase completions by cash buyers

increased. Overall, gross new mortgage completions in the UK fell

by GBP40.1bn, or 27%, to GBP110.5bn in H1 2023 (H1 2022:

GBP150.6bn). Affordability constraints drove customers more towards

lower margin product transfers, which saw a GBP24.7bn, or 28%,

increase to GBP114.1bn.

Despite all this, Group revenue for the period was up 22% to

GBP117.5m (H1 2022: GBP96.5m), with organic growth (excluding the

Fluent, Auxilium and Vita acquisitions) of 1%, and Group first

charge mortgage completions remained flat at GBP12.1bn (H1 2022:

GBP12.2bn). Re-financing transactions accounted for 53% of the

Group's first charge mortgage completions by lending value (H1

2022: 43%), driven by a 61% increase in the Group's product

transfer completions to GBP3.1bn (H1 2022: GBP1.9bn). MAB's market

share of new first charge mortgage lending grew by 19% to 8.1% (H1

2022: 6.8%). This outperformance of the market once again

demonstrates the strength and resilience of MAB's business

model.

MAB's first charge mortgage completions are analysed as

follows:

H1 2023 H1 2022 vs 2022

GBPbn GBPbn

-------- -------- --------

New mortgage lending 9.0 10.3 -13%

-------- -------- --------

Product Transfers 3.1 1.9 +61%

-------- -------- --------

Gross mortgage lending 12.1 12.2 -1%

-------- -------- --------

Adjusted EBITDA on an organic basis was down by 11% to GBP10.7m

(H1 2022: GBP12.0m), primarily due to a GBP3.3m/23% increase in

administrative expenses reflecting the planned continued investment

in the Group's growth strategy despite these challenging market

conditions. Including recent acquisitions, the Group's adjusted

EBITDA was down by 13% to GBP10.5m (H1 2022: GBP12.0m), reflecting

Fluent's underperformance driven by the significant market

downturn, as set out in more detail below. MAB's core model and

First Mortgage have both outperformed the Board's original

expectations for H1 2023.

Delivering our growth strategy

Due to the market downturn that followed the mini-budget, the

Group entered 2023 with lower than expected pipelines of written

mortgages and new Appointed Representative ("AR") firms. In

addition, our existing AR firms have focused on efficiency and

paused recruitment, leading to a reduction in adviser numbers. The

total adviser number at 30 June 2023 was down 6%, as expected, to

2,109(1) (31 December 2022: 2,254).

Despite a 30% drop in higher margin purchase-related mortgage

transactions compared to H1 2022 in the UK, MAB's average adviser

productivity held up very well, with a 5% increase in organic

revenue per mainstream adviser in the period, in part benefitting

from a lower number of new advisers, who typically take a while to

reach full productivity. This is testament to the quality of the

firms we work with and how we support them, which is what

differentiates us from the wider market.

Against the backdrop of a very challenging market, we have

continued successfully to deliver our strategy to drive operational

improvements within the Group and maximise opportunities for our

advisers and ARs in terms of lead generation and productivity. Our

technology platform continues to support the Group's outperformance

of the market, and during the period we also made important strides

in terms of optimising our addressable market.

H1 2023 has seen our recruitment pipelines for new AR firms

build back to pre-mini-budget levels and we expect this strong

activity to continue into 2024. With increasing expectations and

even higher standards of consumer protection expected from the

regulator, more directly authorised firms are seeking greater

support from a strategic partner like MAB. Organic adviser growth

will return when the economic outlook is more certain, which will

enable our AR firms to plan with far greater confidence and the

Group to further accelerate its growth.

We are confident that once market conditions normalise, we will

be in an even stronger position to build on the significant market

share gains we have made and realise our medium to long term growth

objectives.

Fluent

Fluent experienced significant growth in lead flow from price

comparison websites and other national lead sources right through

to the point of the mini-budget. Accordingly, the business had

continued to scale up its adviser base and fulfilment capabilities

in anticipation of a consistent and sustained growth path.

The significant market downturn has hit Fluent hard across all

product lines, and unlike more mature first charge mortgage

businesses, they have not had the benefit of a significant client

bank to counter this effect. Fluent's existing major lead sources

have also been adversely affected in the short term both in terms

of lead numbers and conversion potential.

In response to these market conditions, management took decisive

action due to the negative short-term outlook and implemented a

programme of "right-sizing" the cost base, which was substantially

completed in Q1 2023.

Once inflation is brought under control and interest rates are

at or close to their peak levels, consumer demand will recover, and

we are confident that Fluent will return to its historic growth

path. In the meantime, we have implemented new ways to leverage

MAB's expertise and significant fulfilment capabilities to help

Fluent optimise peaks and troughs in demand and drive further

efficiencies, so that the impact of any future extreme market

downturn, such as this one, will be greatly mitigated.

MAB's expertise and solutions in terms of customer protection

and retention are now embedded within Fluent. These improvements

which we are now seeing will further enhance Fluent's revenues and

profit margins.

Fluent's performance to date has been below our original

expectations due to the timing of completion of the acquisition

relative to the onset of the market downturn. However, the

compelling strategic rationale for acquiring the business remains.

Fluent is the leading intermediary dealing with the fast-growing

national lead source sector and has continued to grow its new lead

sources in H1 2023 with notable blue-chip additions in the first

charge mortgages division.

Both Fluent and MAB continue to have a strong pipeline of

further new national lead sources, that seek to partner with firms

that have the market leading processes, technology, and quality of

service and that can drive the best consumer outcomes. The Group is

ideally positioned to capitalise on this momentum, and in the

meantime we will continue to drive further efficiencies within

Fluent in H2 2023 and into 2024 which will benefit the Group's

future profitability.

Customer lead generation

The last few years have seen MAB put major focus and investment

in early customer capture and nurture, optimising opportunities

from existing lead sources, and ensuring high levels of retention

of existing customers.

This has included building new proprietary software, featuring a

lead management system that can enable significant lead volumes to

be ingested, distributed immediately to advisers across our Group,

and then progressed under strict SLAs and reported on both

internally and externally to third party introducers. MAB has built

multiple lead sources into this new system and continues to focus

on increasing the overall lead flow to ARs.

Lead generation initiatives also include MAB rolling out its

Mortgage Monitoring Tool and enhancing the functionality on its

Home Buying App. The former delivers personalised monthly

communications enabling a far richer engagement with existing

customers and homeowners in early stages of research, and the

latter has enabled us to support future First Time Buyers preparing

for their first purchase.

As a result of these nurture initiatives, we expect further

improvements in customer retention, whilst helping our partner

firms to build a client base of potential new customers from their

existing lead sources. These initiatives will ultimately help us

drive productivity and further market share growth in all market

conditions, with the first meaningful benefits of this strategy

expected to be seen in 2024.

In addition, we continue to pursue increased lead flow into

Fluent, as well as exploring new processes that can drive higher

conversion rates and even better customer outcomes.

Optimising our addressable market

Our plans to leverage our acquisition of Aux Group Ltd

("Auxilium"), the specialist protection platform servicing directly

authorised firms, have progressed well. Access to the protection

expertise MAB has developed over the last two decades will greatly

benefit the forward-thinking and ambitious directly authorised

firms of scale that the Auxilium proposition is aimed at.

In addition, our leading protection and general insurance advice

firm Vita Financial Ltd is launching a new proposition to access

the largely untapped UK business protection market and leverage the

Group's significant distribution in this area.

In Australia, the technology integration with our joint venture

partner, Australian Finance Group Ltd, is expected to complete in

the second half of this year, allowing us to further progress our

growth plans there.

The FCA's New Consumer Duty (NCD) implementation

All the FCA's NCD requirements have been owned and considered

across each area of MAB's business by the business leaders,

ensuring full coverage and a detailed focus on making sure that MAB

delivers the best possible outcomes across the customer journey. In

addition, the MAB team engaged with external parties and trade

associations to ensure the right approach was taken and validated

along the way.

The Board was actively engaged throughout the project, from

approving the project plan and approach on 31 October 2022 to the

31 July 2023 implementation deadline. Ongoing engagement with the

Board now continues as "business-as-usual".

MAB's Vision, Mission, and Cultural values, embedded in the

business since 2021, are closely aligned with Consumer Duty and

have supported the delivery of good outcomes for consumers. As part

of the NCD project, we mapped the existing customer journey,

including how we communicate with customers before, during and

after the sales process, to identify potential gaps and areas where

the standards of customer outcomes could be further strengthened.

Important deliverables that resulted from this analysis included

our bespoke vulnerable customers workstream.

Summary

Despite these extreme market conditions, MAB has delivered

another period of strong market share growth and we are better

positioned than ever to keep doing so.

On an organic basis, the Group is performing ahead of the

Board's original expectations for 2023. Our acquisition of Fluent

will bring significant earnings enhancement to the Group when

market conditions improve. We continue to make good progress with

Fluent to help them maximise profitability through driving further

efficiencies as part of the wider MAB Group, including sharing best

practice in customer retention and the provision of protection.

The longer-term fundamentals for the property and mortgage

markets remain strong, and our strategy underpins our confidence in

the outlook when market conditions improve, with the significant

progress made in terms of customer retention and lead generation

further supporting that confidence.

Market review

The fall in new mortgage approval volumes in the aftermath of

the September 2022 mini-budget continued throughout much of H1 2023

as rising costs of living and higher interest rates created further

affordability constraints and reduced consumer confidence. New

mortgage approvals in Q1 2023 were 40% down year-on-year, and

despite a slightly improving picture in Q2 2023, new mortgage

approvals were still 25% down year-on-year.

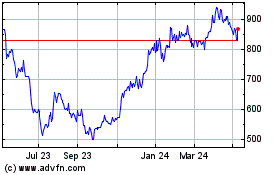

This led to gross new mortgage completions being down 27% to

GBP110.5bn in H1 2023 (H1 2022: GBP150.6bn). The purchase segment

was down 30% and the re-mortgaging segment down 24%, as illustrated

in the table and graph below.

UK Gross new mortgage lending by segment, GBPbn

----------------------------------------------------------

H1 2023 H1 2022 %

-------------------------------- -------- -------- ----

Residential purchase 55.4 77.3 -28

Buy-to-let purchase 4.2 8.4 -50

Purchase segment 59.6 85.7 -30

-------- -------- ----

Residential re-mortgage 34.9 41.1 -15

Buy-to-let re-mortgage 10.4 18.7 -44

Re-mortgage segment 45.3 59.8 -24

-------- -------- ----

Buy-to-let segment 14.6 27.1 -46

-------------------------------- -------- -------- ----

Source: UK Finance

http://www.rns-pdf.londonstockexchange.com/rns/6003N_1-2023-9-25.pdf

Source: UK Finance

Whilst affordability pressures restricted the external

re-mortgaging sector during the period, Product Transfers saw a 28%

increase by value.

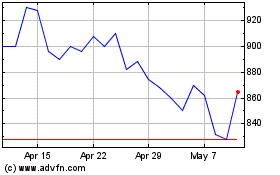

Property transactions were down 18% in H1 2023 compared to H1

2022, as illustrated in the graph below. The smaller contraction

relative to mortgage lending volumes indicates an increasing

proportion of cash buyers, with higher interest rates putting cash

buyers in an increasingly favourable position to those taking out a

mortgage.

http://www.rns-pdf.londonstockexchange.com/rns/6003N_2-2023-9-25.pdf

Source: UK Finance

The value of mortgage lending was also impacted by average house

prices starting to fall from the peak reached in 2022. Average

house prices fell 1.8% in the period compared to H2 2022, and we

expect this trend to continue in the short term. However, average

house prices in H1 2023 were still up 3.3% compared to H1 2022.

The share of UK residential mortgage transactions via

intermediaries (excluding buy to let, where intermediaries have a

higher market share, and product transfers where intermediaries

have a lower market share) continued to grow to 87% (H1 2022: 84%),

with consumers increasingly needing choice, advice, and support in

a more complex and uncertain macro environment. We expect this

increased intermediary market share to remain stable in the short

term and that house prices will stabilise once affordability and

consumer confidence improve.

In December 2022 UK Finance predicted GBP275bn of gross new

mortgage lending in 2023. IMLA's estimate was GBP265bn. Gross new

mortgage lending in H1 2023 amounted to GBP110.5bn, and we expect

the actual figure for the full year to fall well short of those

estimates. However, re-financing activity should continue to

perform strongly, driven by product transfers as fewer customers

are able to move away from their existing lender.

Despite the current headwinds, the underlying level of demand

for home ownership and mortgages remains strong, and we expect

activity levels to strengthen again once inflation is under control

and mortgage rates have peaked or start to fall back.

Financial review

We measure the development, performance, and position of our

business against several key indicators.

http://www.rns-pdf.londonstockexchange.com/rns/6003N_3-2023-9-25.pdf

Revenue

Group revenue for the six months ended 30 June 2023 increased by

22% to GBP117.5m (H1 2022: GBP96.5m), with organic(1) growth of 1%

despite the market seeing a 40% drop in new mortgage approvals

following the mini-budget in September 2022.

Following the Group's acquisition of Fluent, the average number

of mainstream advisers(2) during the period increased by 4% to

1,966 (H1 2022: 1,890). On an organic basis we saw a 4% reduction

in the average number of mainstream advisers to 1,814 (H1 2022:

1,890), as our existing AR firms paused recruitment and focused on

efficiency following the impacts of the mini-budget. This led to a

circa 5% increase in organic revenue per adviser, though this

figure is somewhat flattered by a lower proportion of new advisers

in the period. In addition, we entered 2023 with a

lower-than-expected pipeline of written mortgages and new AR

firms.

The Group continued to generate revenue from three core areas,

summarised as follows:

Group revenue

Income source H1 2023 H1 2022 Change vs

2022

-------- -------- ----------

GBPm GBPm %

-------- -------- ----------

Mortgage Procuration Fees 48.4 44.9 +8%

-------- -------- ----------

Protection and General Insurance

Commission 44.9 37.2 +21%

-------- -------- ----------

Client Fees 21.9 11.8 +86%

-------- -------- ----------

Other Income 2.3 2.6 -12%

-------- -------- ----------

Total 117.5 96.5 +22%

-------- -------- ----------

MAB's organic revenue(1) across the three core areas was as

follows:

Organic revenue

Income source H1 2023 H1 2022 Change vs

2022

-------- -------- ----------

GBPm GBPm %

-------- -------- ----------

Mortgage Procuration Fees 42.1 44.9 -6%

-------- -------- ----------

Protection and General Insurance

Commission 42.7 37.2 +15%

-------- -------- ----------

Client Fees 10.9 11.8 -7%

-------- -------- ----------

Other Income 1.8 2.6 -27%

-------- -------- ----------

Total 97.5 96.5 +1%

-------- -------- ----------

In this period of market downturn, MAB's organic first charge

banked mortgage mix saw a lower proportion of house purchase

business compared to the prior period with an increase in

re-financing. In particular, the proportion of product transfer

completions, which have a lower average procuration fee and

typically have lower protection, general insurance and client fee

attachment rates, further increased to 29% (H1 2022: 18%).

Consequently, while the Group's organic gross first charge

mortgage completions by value (excluding GBP0.5bn of completions

that did not generate procuration fees for the Group in H1 2022

from ARs in the process of being onboarded) remained stable,

mortgage procuration fees decreased by 6% and client fees decreased

by 7% as a result of the higher proportion of product transfers.

However, the Group's organic protection and general insurance

commissions increased by 15%, which reflects the strong focus of

MAB's advisers on protection when the mortgage market falls,

particularly in our invested businesses, and the strength of MAB's

proposition and support in these areas.

Fluent's revenue contribution across the Group's three core

revenue streams in H1 2023 was as follows, with GBP0.4m of revenue

synergies realised:

Income source (GBPm) H1 2023

Mortgage procuration fees 6.4

---------

Protection and General Insurance Commission 1.7

---------

Client Fees 11.0

---------

Other Income 0.4

---------

Total 19.5

---------

Auxilium, a specialist protection service provider, contributed

revenue of GBP0.5m for H1 2023. Auxilium's revenues represent the

total income received and accordingly are classified under

Protection and General Insurance Commission , with no commission

payouts to the directly authorised entities serviced by the

business.

MAB's average first charge mortgage size decreased by 5.3%

compared to the prior period, with average house prices increasing

by 3.3% compared to H1 2022, reflecting the increased proportion of

re-financing completions where the average mortgage size is lower

than for purchase transactions.

MAB's overall revenue from re-financing (including both

re-mortgages and product transfers) represented circa 36% of total

revenue (H1 2022: 30%).

The proportion of organic revenue derived from each of the

Group's core revenue streams has changed slightly as summarised

below, with the movements reflecting the change in banked mortgage

mix, and in particular the large increase in product transfers

during the period, and also the increase in protection

revenues.

Income source H1 2023 H1 2022

Mortgage Procuration Fees 43% 47%

-------- --------

Protection and General Insurance Commission 44% 38%

-------- --------

Client Fees 11% 12%

-------- --------

Other Income 2% 3%

-------- --------

Total 100% 100%

-------- --------

The proportion of total revenue derived from each of the Group's

core revenue streams has also changed, affected by the dynamics as

set out above for organic revenue, but also by client fees as a

proportion of Fluent's revenue being higher than the organic

Group's proportion due to client fees on second charge mortgages,

and conversely by protection and general insurance commission being

a lower proportion of total revenue for Fluent due to lower

attachment rates on second charge mortgages, as summarised

below.

Income source H1 2023 H1 2022

Mortgage Procuration Fees 41% 47%

-------- --------

Protection and General Insurance Commission 38% 38%

-------- --------

Client Fees 19% 12%

-------- --------

Other Income 2% 3%

-------- --------

Total 100% 100%

-------- --------

In first charge mortgages we expect client fees to become

increasingly dependent upon the type and complexity of the mortgage

transaction, as well as the delivery channel, leading to a broader

spread of client fees on first charge mortgage transactions, which

represent the organic Group's lowest margin revenue stream.

Gross profit margin

The Group's gross profit margin increased to 28.0% (H1 2022:

26.4%) and MAB's organic gross profit margin also increased to

28.3% (H1 2022: 26.4%). This is due to the increased proportion of

protection revenue in the organic Group in H1 2023. The network

organic business of the Group receives slightly reduced revenue

share as existing ARs grow organically by increasing their adviser

numbers. In addition, larger new ARs typically join the Group on

lower-than-average margins due to their existing scale, hence a

degree of erosion is expected in MAB's underlying gross profit

margin due to the continued growth of our existing ARs and the

addition of new larger ARs.

Looking ahead, we expect any further erosion in underlying

organic gross margin to be offset by operational leverage reducing

the Group's administrative expenses ratio(*) .

Administrative expenses

Group administrative expenses increased by GBP9.5m (+67%) to

GBP23.7m, mainly reflecting the impact of the acquisitions of

Fluent and Vita. Organic administrative expenses increased by

GBP3.3m (+23%) to GBP17.5m, reflecting MAB's continued investment

in growth, and specifically in its technology platform and

marketing team through a mix of employee and third-party costs,

which we expect to drive enhanced lead generation opportunities and

future revenue growth. Head office costs, including those of First

Mortgage, also increased to support the Group's growth strategy.

MAB's Head office refurbishment at the end of 2022 led to a GBP0.3m

increase in the depreciation charge. All development work on MAB's

MIDAS platform continues to be fully expensed. The Group's

administrative expenses ratio was 20.2% (H1 2022: 14.7%), and the

organic administrative expenses ratio* increased to 17.9% (H1 2022:

14.7%) reflecting the adverse impact of the market downturn on

revenue growth in a period where the Board originally expected to

deliver operational leverage.

The Group expects to continue to benefit from the relatively

fixed cost nature of much of its cost base, where those costs

typically rise at a slower rate than revenue, with the operational

leverage offsetting the expected slight erosion of MAB's underlying

organic gross margin as the business continues to grow.

Associates and investments

MAB's share of profits from associates was GBP0.1m (H1 2022:

GBP0.3m) with a slower start to the year for the Group's associates

resulting from the market downturn.

MAB considers the value of a number of these investments exceeds

their balance sheet value as accounted for using the equity

accounting method under IAS 28.

Adjusted EBITDA, profit before tax and margin thereon

Adjusted EBITDA(*) was down 13% to GBP10.5m (H1 2022: GBP12.0m),

with the reduction in the margin thereon to 8.9% (H1 2022: 12.4%)

primarily reflecting the impact of the current market conditions,

particularly on the Fluent acquisition, and lower revenue growth

than originally anticipated.

Organic adjusted EBITDA(*) was GBP10.7m (H1 2022: GBP12.0m),

with the margin thereon of 11.0% (H1 2022: 12.4%).

Fluent, Vita and Auxilium contributed adjusted EBITDA of

-GBP0.5m, GBP0.0m(3) and GBP0.3m respectively in H1 2023. These

figures exclude the impact of any non-cash charges associated with

the put and call options for Fluent and Auxilium.

Adjusted profit before tax(*) as a percentage of net revenue(*)

reduced to 19.3% (H1 2022: 38.6%).

Adjusted profit before tax(*) was GBP8.8m (H1 2022: GBP11.5m),

with the margin thereon being 7.5% (H1 2022: 12.0%). Organic

adjusted profit before tax(*) was GBP9.6m (H1 2022: GBP11.5m), with

the margin thereon of 9.8% (H1 2022: 12.0%). Statutory profit

before tax was GBP7.6m (H1 2022: GBP10.1m) with the margin thereon

being 6.4% (H1 2022: 10.5%).

Finance income and expense

Finance income of GBP0.1m (H1 2022: GBP0.04m) reflects interest

income accrued or received on loans to associates and other

appointed representatives. Finance expenses of GBP(2.4)m (H1 2022:

GBP0.1m) includes GBP0.7m of interest and non-utilisation fees

payable on MAB's new debt facilities and the interest expense on

lease liabilities, a GBP3.5m gain relating to the remeasurement of

the redemption liability relating to the Fluent Option and a

GBP0.4m charge relating to the unwinding of the redemption

liability of the Fluent Option.

Taxation

The effective tax rate on adjusted profit before tax(*)

increased to 20.6% (H1 2022: 19.8%) and the effective rate of tax

on reported profit before tax reduced to 15.2% (H1 2022: 21.9%),

despite the increase in the prevailing UK corporation tax rate from

1 April 2023. This was primarily due to the large movement in

deferred tax resulting from the unwinding of the acquired

intangibles deferred tax liability relating to Fluent and also the

deferred tax asset arising from losses within Fluent. We expect the

effective tax rate on adjusted PBT in future years to be in line

with the prevailing UK corporation tax rate.

Earnings per share and dividend

Adjusted earnings per share(*) was 11.8p (H1 2022: 16.4p) and

adjusted earnings per share* on an organic basis (also excluding

the impact of the increased share capital as a result of the

placing) was 13.5p (H1 2022: 16.9p). Basic earnings per share fell

to 11.3p (H1 2022: 14.0p) due to acquisition-related costs,

amortisation of acquired intangibles and non-cash operating

expenses associated with the put and call option agreements on

recent acquisitions.

The Board is pleased to confirm an interim dividend for the year

ending 31 December 2023 of 13.4p per share (H1 2022: 13.4p per

share), reflecting the Group's dividend policy based on a minimum

payout ratio of 75% of the Group's annual adjusted post-tax and

minority interest profits. This represents a cash outlay of GBP7.7m

(H1 2022: GBP7.6m). Following payment of the dividend, the Group

will continue to maintain significant surplus regulatory

reserves.

The record date for the interim dividend is 6 October 2023 and

the payment date is 3 November 2023. The ex-dividend date will be 5

October 2023.

Balance sheet

In connection with the acquisitions of Fluent, Vita and Auxilium

in 2022, the Group recognised separately identifiable intangible

assets with a fair value at 30 June 2023 of GBP50.7m and goodwill

totalling GBP38.7m. Redemption liabilities of GBP3.8m and GBP0.2m

in respect of the put and call options relating to the Fluent and

Auxilium acquisitions respectively, are included in other payables

as at 30 June 2023.

In March 2022, the Group entered into an agreement with NatWest

for a new term loan of GBP20m and a revolving credit facility of

GBP15m, to part fund the cash consideration on the acquisition of

Fluent. As at 30 June 2023, the Group had drawn down GBP6.0m on the

revolving credit facility, in addition to an outstanding balance of

GBP18.1m on the term loan, and had GBP0.3m of accrued interest net

of prepaid loan arrangement fees. Net debt (adjusting only for

unrestricted cash balances of GBP5.0m) was GBP19.4m.

Cash flow and cash conversion

The Group's operations produce positive cash flow. This is

reflected in the net cash generated from operating activities of

GBP8.8m (H1 2022: GBP11.5m).

Adjusted cash conversion(*) was:

H1 2023 131%

H1 2022 124%

-----

Other than the GBP2.8m refurbishment of the Group's head office

in Derby in Q4 2022, the Group's operations are typically

capital-light, with the most significant ongoing capital investment

being in computer equipment. Only GBP0.3m of general capital

expenditure on office and computer equipment was required during

the period (H1 2022: GBP0.1m), with a further GBP0.4m spent on the

finalisation of the refurbishment of the Group's head office in

Derby. Group policy is not to provide company cars and no other

significant capital expenditure is foreseen.

The Group has a regulatory capital requirement amounting to 2.5%

of regulated revenue. At 30 June 2023 this regulatory capital

requirement was GBP5.6m (31 December 2022: GBP5.5m), with the Group

having a surplus of GBP23.4m (31 December 2022: GBP26.8m).

The following table demonstrates how cash generated by the Group

was applied:

GBPm

Unrestricted bank balances at the beginning of the year 7.2

Cash generated from operating activities excluding movements in restricted balances and dividends

received from associates 11.7

Dividends paid (8.4)

Dividends paid to minority interest (0.3)

Tax paid (3.3)

Investment in subsidiary, associates and minority interests (0.7)

Proceeds from borrowings 2.8

Repayment of borrowings (1.9)

Net interest paid and principal element of lease payments (0.9)

Capital expenditure (1.2)

Unrestricted bank balances at the end of the period 5.0

-------------------------------------------------------------------------------------------------- -----

* In addition to statutory reporting, MAB reports alternative

performance measures ("APMs") which are not defined or specified

under the requirements of International Financial Reporting

Standards ("IFRS"). The Group uses these APMs to improve the

comparability of information between reporting periods, by

adjusting for certain items which impact upon IFRS measures, to aid

the user in understanding the activity taking place across the

Group's businesses. APMs are used by the Directors and management

for performance analysis, planning, reporting and incentive

purposes. A summary of APMs used and their closest equivalent

statutory measures is given in the Glossary of Alternative

Performance Measures.

(1) Organic means the Group before the impact of the

acquisitions made in 2022 (Fluent, July 2022; Vita, July 2022; and

Auxilium, November 2022).

(2) Excludes directly authorised advisers, MAB's later life

advisers and advisers from associates in the process of being

onboarded under MAB's AR arrangements. Includes Fluent's second

charge, later life and bridging advisers who have a higher revenue

per adviser than first charge advisers.

(3) Vita's revenue, being protection and general insurance

commission only, has been incorporated into the Group's figures

since 2016 when it became an AR of the Group.

Cautionary Statement

Certain statements included or incorporated by reference within

this announcement may constitute "forward-looking statements" in

respect of the Group's operations, performance, prospects and/or

financial condition. Forward-looking statements are sometimes, but

not always, identified by their use of a date in the future or such

words and words of similar meaning as "aims", "anticipates",

"believes", "continues", "could", "due", "estimates", "expects",

"goal", "intends", "may", "objectives", "outlook", "plans",

"potential", "probably", "project", "seeks", "should", "targets",

or "will" or, in each case, their negative or other variations or

comparable terminology.

By their nature, forward-looking statements involve a number of

risks, uncertainties and assumptions and actual results or events

may differ materially from those expressed or implied by those

statements. Accordingly, no assurance can be given that any

particular expectation will be met and reliance should not be

placed on any forward-looking statement. Additionally,

forward-looking statements regarding past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. Except as required by

applicable law or regulation, no responsibility or obligation is

accepted to update or revise any forward-looking statement

resulting from new information, future events or otherwise. Nothing

in this announcement should be construed as a profit forecast.

This announcement does not constitute or form part of any offer

or invitation to sell, or any solicitation of any offer to purchase

any shares or other securities in the Company, nor shall it or any

part of it or the fact of its distribution form the basis of, or be

relied on in connection with, any contract or commitment or

investment decisions relating thereto, nor does it constitute a

recommendation regarding the shares or other securities of the

Company. Past performance cannot be relied upon as a guide to

future performance and persons needing advice should consult an

independent financial adviser authorised under the Financial

Services and Markets Act 2000 (as amended). Statements in this

announcement reflect the knowledge and information available at the

time of its preparation. Liability arising from anything in this

announcement shall be governed by English law. Nothing in this

announcement shall exclude any liability under applicable laws that

cannot be excluded in accordance with such laws.

INDEPENT REVIEW REPORT TO MORTGAGE ADVICE BUREAU (HOLDINGS) PLC

("the Company") AND ITS GROUP

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2023 is not prepared, in all material respects, in accordance

with UK adopted International Accounting Standard 34 and the London

Stock Exchange AIM Rules for Companies.

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2023 which comprises the interim condensed

consolidated statement of financial position, interim condensed

consolidated statement of comprehensive income, interim condensed

consolidated statement of changes in equity and interim condensed

consolidated statement of cash flows.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ("ISRE (UK) 2410"). A review of interim financial

information consists of making enquiries, primarily of persons

responsible for financial and accounting matters, and applying

analytical and other review procedures. A review is substantially

less in scope than an audit conducted in accordance with

International Standards on Auditing (UK) and consequently does not

enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with UK adopted international

accounting standards. The condensed set of financial statements

included in this half-yearly financial report has been prepared in

accordance with UK adopted International Accounting Standard 34,

"Interim Financial Reporting".

Conclusions relating to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

conclusion section of this report, nothing has come to our

attention to suggest that the directors have inappropriately

adopted the going concern basis of accounting or that the directors

have identified material uncertainties relating to going concern

that are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with

the London Stock Exchange AIM Rules for Companies which require

that the half-yearly report be presented and prepared in a form

consistent with that which will be adopted in the Company's annual

accounts having regard to the accounting standards applicable to

such annual accounts.

In preparing the half-yearly financial report, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the Company a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

BDO LLP

Chartered Accountants

London

United Kingdom

25 September 2023

BDO LLP is a limited liability partnership registered in England

and Wales (with registered number OC305127).

Interim condensed consolidated statement of comprehensive income

for the six months ended 30 June 2023

Six months ended

30 June

Note 2023 2022

Unaudited Unaudited

GBP'000 GBP'000

-------------------------------------- ----- ----------- -----------

Revenue 2 117,545 96,468

Cost of sales 3 (84,601) (71,032)

-------------------------------------- ----- ----------- -----------

Gross profit 32,944 25,436

Administrative expenses (23,713) (14,214)

Costs relating to First Mortgage,

Fluent and Auxilium options 4 (1,081) (423)

Amortisation of acquired intangibles 4 (2,580) (183)

Acquisition costs 4 (148) (1,453)

Restructuring costs (238) -

Net gains on fair value measurement

of deferred consideration 10 - 650

Net fair value losses on fair value

measurement of derivative financial

instruments 10 (214) (25)

Share of profit of associates 10 75 314

Profit on sale of non-listed equity

investment 11 - 59

Operating profit 5,045 10,161

-------------------------------------- ----- ----------- -----------

Finance income 5 130 42

Finance expense 5 2,404 (96)

Profit before tax 7,579 10,107

Tax expense 6 (1,149) (2,214)

-------------------------------------- ----- ----------- -----------

Profit for the period 6,430 7,893

-------------------------------------- ----- ----------- -----------

Total comprehensive income 6,430 7,893

-------------------------------------- ----- ----------- -----------

Profit is attributable to:

Equity owners of Parent Company 6,423 7,698

Non-controlling interests 7 195

-------------------------------------- ----- ----------- -----------

6,430 7,893

-------------------------------------- ----- ----------- -----------

Earnings per share attributable

to the owners of the Parent Company

Basic 7 11.3p 14.0p

Diluted 7 11.2p 13.8p

Interim condensed consolidated statement of financial

position

as at 30 June 2023 and 31 December 2022

30 June 2023 31 Dec

Note Unaudited 2022

GBP'000 Audited

GBP'000

---------------------------------- ------ ------------- ---------

Assets

Non-current assets

Property, plant and equipment 6,227 6,128

Right of use assets 3,442 3,872

Goodwill 9 53,885 53,885

Other intangible assets 53,629 55,823

Investments in associates and

joint venture 10 11,931 11,387

Derivative financial instruments 274 320

Other receivables 12 682 831

Deferred tax asset 2,551 1,797

---------------------------------- ------ ------------- ---------

Total non-current assets 132,621 134,043

---------------------------------- ------ ------------- ---------

Current assets

Trade and other receivables 12 13,974 10,288

Corporation tax 812 -

Cash and cash equivalents 13 23,642 25,462

---------------------------------- ------ ------------- ---------

Total current assets 38,428 35,750

---------------------------------- ------ ------------- ---------

Total assets 171,049 169,793

---------------------------------- ------ ------------- ---------

Interim condensed consolidated statement of financial

position

as at 30 June 2023 and 31 December 2022 (continued)

Note 30 June 2023 31 Dec

Unaudited 2022

GBP'000 Audited

GBP'000

---------------------------------- ----- ------------- ---------

Equity and liabilities

Share capital 17 57 57

Share premium 48,155 48,155

Capital redemption reserve 20 20

Share option reserve 5,718 4,511

Retained earnings 13,616 15,154

---------------------------------- ----- ------------- ---------

Equity attributable to owners

of Parent Company 67,566 67,897

Non-controlling interests 7,058 7,548

---------------------------------- ----- ------------- ---------

Total equity 74,624 75,445

---------------------------------- ----- ------------- ---------

Liabilities

Non-current liabilities

Trade and other payables 14 5,230 9,438

Provisions 8,554 8,038

Lease liabilities 2,605 3,014

Derivative financial instruments 178 10

Loans and other borrowings 15 14,270 16,598

Deferred tax liability 14,181 14,659

---------------------------------- ----- ------------- ---------

Total non-current liabilities 45,018 51,757

---------------------------------- ----- ------------- ---------

Current liabilities

Trade and other payables 14 40,334 34,397

Lease liabilities 903 933

Loans and other borrowings 15 10,170 6,809

Corporation tax - 452

---------------------------------- ----- ------------- ---------

Total current liabilities 51,407 42,591

---------------------------------- ----- ------------- ---------

Total liabilities 96,425 94,348

---------------------------------- ----- ------------- ---------

Total equity and liabilities 171,049 169,793

---------------------------------- ----- ------------- ---------

Interim condensed consolidated statement of changes in equity

for the six months ended 30 June 2023

Attributable to the holders of the

Parent Company

----------------------------------------------------------------------

Share

Capital option Non-controlling

Share Share redemption reserve Retained Interest Total

capital premium reserve GBP'000 earnings Total GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Balance at

1 January

2022 53 9,778 20 3,523 25,408 38,782 2,205 40,987

Profit for the

period - - - - 7,698 7,698 195 7,893

Total

comprehensive

income - - - - 7,698 7,698 195 7,893

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Transactions

with owners

Issue of

shares 4 38,377 - - - 38,381 - 38,381

Share based

payment

transactions - - - 532 - 532 - 532

Deferred tax

asset

recognised

in equity - - - 25 - 25 - 25

Dividends paid - - - - (8,382) (8,382) (415) (8,797)

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Total

transactions

with owners 4 38,377 - 557 (8,382) 30,556 (415) 30,141

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Balance at

30 June 2022

(unaudited) 57 48,155 20 4,080 24,724 77,036 1,985 79,021

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Balance at

1 January

2023 57 48,155 20 4,511 15,154 67,897 7,548 75,445

Profit for the

period - - - - 6,422 6,422 7 6,429

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Total

comprehensive

income - - - - 6,422 6,422 7 6,429

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Transactions

with owners

Share based

payment

transactions - - - 1,289 - 1,289 - 1,289

Deferred tax

asset

recognised

in equity - - - 296 - 296 - 296

Acquisitions - - - - 46 46 (140) (94)

Reserve

transfer - - - (378) 378 - - -

Dividends paid - - - - (8,384) (8,384) (357) (8,741)

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Total

transactions

with owners - - - 1,207 (7,960) (6,753) (497) (7,250)

Balance at

30 June 2023

(unaudited) 57 48,155 20 5,718 13,616 67,566 7,058 74,624

--------------- --------- ---------- ------------ --------- ---------- ---------- ----------------- ----------

Interim condensed consolidated statement of cash flows for the

six months ended 30 June 2023

Six months ended

30 June

Note 2023 2022

Unaudited Unaudited

GBP'000 GBP'000

------------------------------------------ ----- ------------ -----------

Cash flows from operating activities

Profit for the period before tax 7,578 10,107

Adjustments for

Depreciation of property, plant

and equipment 621 175

Depreciation of rights of use assets 443 198

Amortisation of intangibles 2,693 282

Profit on sale of non-listed equity

investment 11 - (59)

Share-based payments 1,473 532

Share of profit from associates,

net of tax 10 (75) (314)

Dividends received from associates 10 - 600

Net gains on fair value measurement

of deferred consideration 10 - (650)

Net losses on fair value movements

taken to profit and loss 214 25

Finance income 5 (130) (42)

Finance expense 5 (2,404) 96

10,413 10,950

Changes in working capital

Increase in trade and other receivables 12 (3,529) (1,086)

Increase in trade and other payables 14 4,721 3,120

Increase in provisions 516 687

Cash generated from operating activities 12,121 13,671

Income taxes paid (3,308) (2,141)

------------------------------------------ ----- ------------ -----------

Net cash generated from operating

activities 8,813 11,530

------------------------------------------ ----- ------------ -----------

Cash flows from investing activities

Purchase of property, plant and

equipment (720) (77)

Purchase of intangibles (498) (151)

Acquisition of minority interest (189) -

Acquisition of associates 10 (469) (457)

Proceeds from sale of non-listed

equity investment 11 - 114

Net cash used in investing activities (1,876) (571)

------------------------------------------ ----- ------------ -----------

Cash flows from financing activities

Proceeds from borrowings 2,800 -

Repayment of borrowings (1,875) -

Interest received 5 122 32

Interest paid 5 (608) (48)

Principal element of lease payments (455) (195)

Issue of shares 17 - 40,000

Costs relating to issue of shares 17 - (1,619)

Dividends paid 8 (8,384) (8,382)

Dividends paid to minority interest (357) (415)

------------------------------------------ ----- ------------ -----------

Net cash (used)/generated in financing

activities (8,757) 29,373

------------------------------------------ ----- ------------ -----------

Net (decrease)/increase in cash

and cash equivalents (1,820) 40,332

Cash and cash equivalents at the

beginning of the period 25,462 34,411

------------------------------------------ ----- ------------ -----------

Cash and cash equivalents at the

end of the period 23,642 74,743

------------------------------------------ ----- ------------ -----------

Notes to the interim condensed consolidated financial statements

for the six months ended 30 June 2023

1 Accounting policies

Corporate information

The interim condensed consolidated financial statements of

Mortgage Advice Bureau (Holdings) plc and its subsidiaries

(collectively, "the Group") for the six months ended 30 June 2023

were authorised for issue in accordance with a resolution of the

directors on 25 September 2023.

Mortgage Advice Bureau (Holdings) plc ("the Company") is a

limited company incorporated and domiciled in England whose shares

are publicly traded on the Alternative Investment Market ("AIM").

The registered office is located at Capital House, Pride Place,

Pride Park, Derby, DE24 8QR. The Group's principal activity is the

provision of financial services.

Basis of preparation

These condensed consolidated interim financial statements for

the six months ended 30 June 2023 have been prepared in accordance

with IAS 34 'Interim financial reporting' and also in accordance

with the measurement and recognition principles of UK adopted

international accounting standards. They do not include all of the

information required for full annual financial statements and

should be read in conjunction with the 2022 Annual Report and

Accounts, which were prepared in accordance with UK - adopted

international accounting standards.

The comparative figures for the six months ended 30 June 2022

are not the Group's statutory accounts for that financial period.

The accounts for the year ended 31 December 2022 have been reported

on by the Group's auditors and delivered to the registrar of

companies. There are no changes in the basis of preparation

adopted, which remains in line with the 2022 audited accounts.

Following the acquisitions of Project Finland Topco Limited, Vita

Financial Limited and AUX Group Limited in 2022, these entities are

now included in the consolidated accounts for the period.

Going concern

The Directors have assessed the Group's prospects until 31

December 2024, taking into consideration the current operating

environment, including the impact of the ongoing geopolitical and

macroeconomic uncertainty and inflationary pressures on property

and lending markets. The Directors' financial modelling considers

the Group's profit, cash flows, regulatory capital requirements,

borrowing covenants and other key financial metrics over the

period.

These metrics are subject to sensitivity analysis, which

involves flexing a number of key assumptions underlying the

projections, including the effect of the ongoing geopolitical and

macroeconomic uncertainty and inflationary pressures and their

impact on the UK property and lending markets and the Group's

revenue mix, which the Directors consider to be severe but

plausible stress tests on the Group's cash position, banking

covenants and regulatory capital adequacy. The Group's financial

modelling shows that the Group should continue to be cash

generative, maintain a surplus on its regulatory capital

requirements and be able to operate within its current financing

arrangements.

Based on the results of the financial modelling, the Directors

expect that the Group will be able to continue in operation and

meet its liabilities as they fall due over the 12 months from the

approval of the financial statements. Accordingly, the Directors

continue to adopt the going concern basis for the preparation of

the financial statements.

Significant estimates and judgements

The judgements, estimates and assumptions applied in the interim

financial statements, including the key sources of estimation

uncertainty, were the same as those applied in the Group's last

annual financial statements for the year ended 31 December 2022.

There have been no material revisions to the nature and amount of

estimates of amounts reported in prior period.

Significant accounting policies

The accounting policies applied are consistent with those

described in the Annual Report and Group financial statements for

the year ended 31 December 2022. New or amended standards effective

in the period have not had a material impact on the condensed

consolidated interim financial statements.

The Group has not early adopted any standards, interpretations

or amendments that have been issued but are not yet effective.

New standards with limited impact on the Group

-- Amendments to IAS 1 and IAS 8 IFRS Practice Statement 2 -

Disclosure of accounting policies. In February 2021, the IASB

issued amendments to IAS 1 'Presentation of Financial Statements'

and IFRS Practice Statement 2 'Making Materiality Judgements'

aiming to improve accounting policy disclosures. This amendment is

applicable for annual reporting periods beginning on or after 1

January 2023, with early application permitted.

-- Amendments to IAS 8 - Definition of accounting estimates. In

February 2021, the IASB issued amendments to IAS 8 to clarify how

reporting entities distinguish changes in accounting policies from

changes in accounting estimates. This amendment is applicable for

annual reporting periods beginning on or after 1 January 2023, with

early application permitted.

-- Amendments to IAS 12 - Deferred tax related to assets and

liabilities arising from a single transaction. In May 2021, the

IASB issued an amendment to IAS 12 which provides clarification on

the existing exemption from recognising deferred tax in specific

circumstances where this arises from a single transaction. This

amendment is applicable for annual reporting periods beginning on

or after 1 January 2023, with early application permitted.

-- IFRS 17 - Insurance contracts. In May 2017, the IASB

published IFRS 17 Insurance contracts to replace IFRS 4. IFRS 17

applies to all insurance contracts that an entity issues, detailing

the method of measuring insurance contracts, distinguishing between

types of contracts, the measurement of insurance contract revenue

and presentation in the financial statements. This standard is

applicable for annual reporting periods beginning on or after 1

January 2023, with early application permitted.

Future new standards and interpretations

A number of new standards and amendments to standards and

interpretations will be effective for future annual and interim

periods, and therefore have not been applied in preparing these

condensed consolidated interim financial statements. At the date of

authorisation of these financial statements, the following

standards and interpretations, which have not been applied in these

financial statements, were in issue but not yet effective:

Periods commencing

Standard or Interpretation on or after

Amendments to IFRS 16 Leases - Additional requirements 1 January

for the accounting of sale and leaseback transactions 2024

Amendments to IAS 1 Presentation of financial statements 1 January

- On classification of liabilities 2024

Amendments to IAS 1 Presentation of financial statements 1 January

- Treatment of non-current liabilities with covenants 2024

Other than to expand certain disclosures within the Financial

Statements, the Directors do not expect the adoption of these

standards and interpretations listed above to have a material

impact on the Financial Statements of the Group in future

periods.

Basis of consolidation

Where the Company has control over an investee, it is classified

as a subsidiary. The Company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

The consolidated financial statements present the results of the

Company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method. In the

statement of financial position, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained. They are deconsolidated from the date on which control

ceases.

Entities that are not subsidiaries but where the Group has

significant influence (i.e. the power to participate in the

financial and operating policy decisions) are accounted for as

associates. The results and assets and liabilities of the

associates are included in the consolidated accounts using the

equity method of accounting.

Segment reporting

An operating segment is a distinguishable segment of an entity

that engages in business activities from which it may earn revenues

and incur expenses and whose operating results are reviewed

regularly by the entity's chief operating decision maker ("CODM").

The Board reviews the Group's operations and financial position as

a whole and therefore considers that it has only one operating

segment, being the provision of financial services operating solely

within the UK. The information presented to the CODM directly

reflects that presented in the financial statements and they review

the performance of the Group by reference to the results of the

operating segment against budget.

Operating profit is the profit measure, as disclosed on the face

of the consolidated statement of comprehensive income, that is

reviewed by the CODM.

During the six month period to 30 June 2023, there have been no

changes from the prior year in the measurement methods used to

determine operating segments and reported segment profit or

loss.

2 Revenue

The Group operates in one segment being that of the provision of

financial services in the UK. Revenue is derived as follows:

Six months ended 30

June

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

Mortgage procuration fees 48,456 44,928

Protection and general insurance commission 44,913 37,197

Client fees 21,899 11,766

Other income 2,277 2,577

--------------------------------------------- ----------- -----------

117,545 96,468

--------------------------------------------- ----------- -----------

3 Cost of sales

Costs of sales are as follows:

2023 2022

Unaudited Unaudited

GBP'000 GBP'000

Commissions paid 65,556 66,573

Fluent affinity partner payments 6,660 -

Impairment of trade receivables - 9

Other cost of sales 644 -

Wages and salary costs 11,741 4,450

---------------------------------- ------------ ------------

84,601 71,032

---------------------------------- ------------ ------------

4 Acquisition related costs, acquisition of minority interests and redemption liability

Acquisition related costs

First Mortgage Direct Limited

On 2 July 2019 Mortgage Advice Bureau Limited, a subsidiary of

Mortgage Advice Bureau (Holdings) plc acquired 80 per cent of First

Mortgage Direct Limited ("First Mortgage" or the "Business"). The

option (comprising the put and the call option) over the remaining

20% of the issued share capital of First Mortgage has been

accounted for under IAS 19 Employee Benefits and IFRS 2 Share-based

Payments due to its link to the service of First Mortgage's

Managing Director.

The costs relating to this acquisition for the period are made

up as follows:

Six months ended 30 June

2023 2022

Unaudited Unaudited

GBP000 GBP000

-------------------------------------- ------------- ------------

Amortisation of acquired intangibles 183 183

Option costs (IAS19) 224 218

Option costs (IFRS2) 205 205

-------------------------------------- ------------- ------------

Total costs 612 606

-------------------------------------- ------------- ------------

The Fluent Money Group Limited

On 28 March 2022 Mortgage Advice Bureau (Holdings) plc announced

that it had agreed to acquire 75.4% of Project Finland Topco

Limited, which indirectly owns 100% of The Fluent Money Group

Limited ("Fluent" or the "Business"), from its shareholders

including Beech Tree Private Equity and founders for a total cash

consideration of GBP72.7 million (the "Acquisition"). The

Acquisition completed on 12 July 2022. On 6 April 2023, Mortgage

Advice Bureau Limited, a subsidiary of Mortgage Advice Bureau

(Holdings) plc acquired a further 0.8% of Project Finland Topco

Limited, thereby increasing its stake to 76.2%.

There is a put and call option over the remaining 23.8% of the

issued share capital of Fluent which has been accounted for under

IAS 32 and IFRS 2 Share-based Payments, as respectively a

proportion is treated as consideration under IAS 32, with the

balance treated as remuneration under IFRS 2, because the amount

payable on exercise of the option consists of a non-contingent

element, and an element that is contingent upon continued

employment of the option holders within the Group. The put and call

option over certain growth shares that were issued to Fluent's

wider management team has been accounted for under IFRS 2

Share-based Payments as exercise is solely contingent upon

continued employment.

The costs relating to this acquisition for the period are made

up as follows:

Six months ended 30 June

2023 2022

Unaudited Unaudited

GBP000 GBP000

-------------------------------------- ------------- ------------

Amortisation of acquired intangibles 2,199 -

Option costs (IFRS2) 630 -

Acquisition related costs 128 1,453

-------------------------------------- ------------- ------------

Total costs 2,957 1,453

-------------------------------------- ------------- ------------

Vita Financial Limited

On 12 July 2022, Mortgage Advice Bureau Limited, a subsidiary of