Mode Global Holdings PLC Mode Bitcoin trading volumes increase 316% in Q1 (2172V)

April 13 2021 - 1:00AM

UK Regulatory

TIDMMODE

RNS Number : 2172V

Mode Global Holdings PLC

13 April 2021

Mode Bitcoin trading volumes increase 316% in Q1

Highlights

-- Bitcoin trading volumes up 316% vs Q4 2020

-- New customers increased 200% over same period

-- Bullish sentiment continues with majority of investors buying and holding Bitcoin

London, 13 April - Mode Global Holdings, the LSE-listed fintech

group, reports another quarter of strong growth with trading

volumes and new customer numbers jumping 316% and 200% respectively

compared to Q4 2020, as the price of Bitcoin hit a new record.

Bitcoin continued to climb over the quarter and surged past

$60,000 for the first time in March. Mode's trading levels tracked

the record highs almost exclusively driven by 'buys' and spiked

around specific market news events, including an 81% jump in

trading after Tesla announced it had invested $1.5bn in Bitcoin in

early February, and a 62% surge after Bitcoin dropped $10K from

$57,000 to $48,000. In line with Bitcoin's strong performance,

Mode's customers remain bullish on the currency with over 66% of

traded volumes allocated to 'buys' across the quarter.

In October last year, and in keeping with its fundamental belief

in Bitcoin, Mode became the first publicly listed company in the UK

to adopt Bitcoin as a treasury reserve asset as it decided to

invest up to 10% of its cash reserves into Bitcoin. Since then,

Mode has raised an additional GBP6M in a recent oversubscribed

placing and has been continuously adding Bitcoin to its balance

sheet.

Janis Legler, Chief Product Officer, Mode: "Following a

record-breaking December, it's fantastic to see continued

triple-digit growth in Bitcoin trading volumes and new user

onboardings over Q1. We continue to see strong uptake from our new

customers who enjoy how seamless it is to open their accounts in

minutes and start buying Bitcoin 24/7 - any day of the week. We've

had a particularly successful launch on Android, the app has been

very well received by the community and continues to rise through

the ranks of the Google Play store. Retail customers continue to

remain bullish. Even in short term corrections, our customers love

to buy the dip."

Jonathan Rowland, Executive Chairman, Mode, said: "Bitcoin

continues to outperform all major asset classes this year and is

attracting a growing number of institutions, funds, banks and

corporates. Investors are seeking credible ways to get exposure and

Mode remains to be one of only a handful options in UK public

markets."

"Since listing on the LSE main market in October 2020, we've

seen consistent strong growth. But this is only the start and we

are focused on building on this momentum with the launch of our new

Open Banking powered payments and loyalty features, which will see

higher volumes of customers and businesses sign up to Mode."

+++

Media contact:

Maitland/AMO

James Isola/Kate Pledger

Tel: +44 (0)207 379 5151

Mode@maitland.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAELAFDPFEAA

(END) Dow Jones Newswires

April 13, 2021 02:00 ET (06:00 GMT)

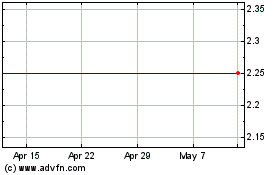

R8 Capital Investments (LSE:MODE)

Historical Stock Chart

From Mar 2024 to Apr 2024

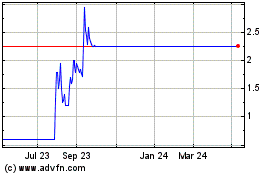

R8 Capital Investments (LSE:MODE)

Historical Stock Chart

From Apr 2023 to Apr 2024