TIDMMTRO

RNS Number : 9909E

Metro Bank PLC

02 November 2022

Metro Bank PLC (LSE: MTRO LN)

2 November 2022

Third Quarter 2022 Trading Update

-- Profitable on both an underlying and statutory basis for

September, ahead of previous guidance

-- September performance is encouraging given it is driven by

margin improvement and cost discipline

-- Active balance sheet management and prevailing interest rates supported exit NIM of 2.04%

-- Expect NIM to improve through 2023 given evolving balance

sheet composition, base rate increases and deposit pricing

discipline

-- The pace of NIM improvements will be impacted by capital constraints limiting lending growth

30 30 Change 30 Change

GBP in millions September June from September from

2022 2022 H1 2022 2021 Q3 2021

Assets GBP22,553 GBP22,555 0% GBP22,767 (1%)

Loans GBP12,830 GBP12,364 4% GBP12,315 4%

Deposits GBP16,371 GBP16,514 (1%) GBP16,412 0%

Loan to deposit ratio 78% 75% 3pp 75% 3pp

----------------------- ----------- ---------- --------- ----------- ---------

For the month of September the Bank recorded a profit on both an

underlying and statutory basis, ahead of expectations, driven by

assertive balance sheet action, strong NIM expansion to 2.04% and

continued cost discipline.

Q3 total deposits of GBP16,371 million were broadly flat

reflecting ongoing close management of deposits . The Bank

continues to attract low-cost high-quality deposits, evidenced by

growth in the underlying deposit franchise (low-cost demand current

and savings accounts) now 96% of the deposit base, offset by a

targeted reduction in higher-cost fixed term deposits.

Q3 total net loans of GBP12,830 million increased 4% both QoQ

and YoY, with a continued mix shift in line with strategy.

Residential mortgages and consumer unsecured lending grew,

partially offset by repayments of government-backed lending and

reduction in Commercial real estate lending. The Bank is

appropriately positioned, with a loan to deposit ratio of 78% and

55% of the loan portfolio being Residential mortgages. Over 90% of

the Retail mortgage portfolio is fixed, with an average repricing

duration of 2.1 years, and the average DTV of 56% remains stable.

In aggregate only 5% of Retail mortgages now have a DTV of over

80%.

Margin metrics Q3 2022 Q2 2022 Change Q3 2021 Change

from from

Q2 2022 Q3 2021

Lending yield 3.66% 3.56% 10bps 3.10% 56bps

Cost of deposits 0.19% 0.15% 4bps 0.20% (1bps)

Net interest margin 1.98% 1.81% 17bps 1.46% 52bps

--------------------- -------- -------- --------- -------- ---------

ECL Charge of GBP10 million in the quarter. There has been no

deterioration in early warning indicators and no signs of stress or

increased delinquency across the customer base. The Bank continues

to monitor all of its portfolios closely and remains watchful of

changes in economic conditions that may impact provisioning, such

as material movements in unemployment from its current historically

low point. Post model adjustments and overlays continue to be more

than 24% of total provision stock.

Following a profitable month in September and positive

underlying business momentum, going forward, the main driver of

capital consumption is likely to be loan related RWA growth, which

is currently being assertively managed to ensure the Bank continues

to operate within buffers and remains above regulatory capital

minima. Although mindful of the macro environment, minimum

regulatory capital requirements are expected to be met without

needing to take any market-dependent balance sheet action. The Bank

will continue to review market-dependent options to manage

regulatory capital and MREL and enhance its medium-term earnings

potential, such as loan sales and securitisations as well as MREL

qualifying debt issuance should market conditions be attractive.

Management continues to engage with key stakeholders around the

Tier 2 instrument. In all cases the goal is to create a more

efficient balance sheet. Additionally, the Bank's AIRB application

continues to progress.

Daniel Frumkin, Chief Executive Officer at Metro Bank, said:

"I am really pleased to see the business return to profit in

September on both an underlying and statutory basis. This

performance reflects our tight control of both costs and risk,

close management of our deposit franchise and lending channels, and

the supportive prevailing interest rate environment, all of which

help build a balance sheet that delivers sufficient margin to cover

costs. Whilst we remain watchful of economic conditions and

continue to monitor our credit metrics closely, our book remains in

good health. The underlying potential of our business is

encouraging and, though the tight capital position currently

constrains RWA growth, the business still seeks to grow margins

with ongoing optimisation and discipline. We remain focused on

generating a sustainable business supported by the commitment and

engagement of our tremendous colleagues who continue to be there

for our customers and communities."

For more information, please contact:

Metro Bank PLC Investor Relations

Jo Roberts

+44 (0) 20 3402 8900

IR@metrobank.plc.uk

Metro Bank PLC Media Relations

Mona Patel

+44 (0) 7815 506845

pressoffice@metrobank.plc.uk

Teneo

Charles Armitstead / Haya Herbert Burns

+44 (0)7703 330269 / +44 (0) 7342 031051

Metrobank@teneo.com

ENDS

About Metro Bank

Metro Bank services 2.6 million customer accounts and is

celebrated for its exceptional customer experience. It is the

highest rated high street bank for overall service quality for

personal customers and the best bank for service in-store for

personal and business customers, in the Competition and Market

Authority's Service Quality Survey in August 2022. This year it has

been awarded "Best Mortgage Provider of the Year" in 2022 MoneyAge

Mortgage Awards, "Best Business Credit Card" in 2022 Moneynet

Personal Finance Awards and "Best Current Account for Overseas Use"

by Forbes 2022 and accredited as Most Loved Workplace 2022. It was

"Banking Brand of The Year" at the Moneynet Personal Finance Awards

2021 and received the Gold Award in the Armed Forces Covenant's

Employer Recognition Scheme 2021.

The community bank offers retail, business, commercial and

private banking services, and prides itself on giving customers the

choice to bank however, whenever and wherever they choose, and

supporting the customers and communities it serves. Whether that's

through its network of 76 stores open seven days a week, 362 days a

year; on the phone through its UK-based contact centres; or online

through its internet banking or award-winning mobile app, the bank

offers customers real choice.

Metro Bank PLC. Registered in England and Wales. Company number:

6419578. Registered office: One Southampton Row, London, WC1B 5HA.

'Metrobank' is the registered trademark of Metro Bank PLC.

It is authorised by the Prudential Regulation Authority and

regulated by the Financial Conduct Authority and Prudential

Regulation Authority. Most relevant deposits are protected by the

Financial Services Compensation Scheme. For further information

about the Scheme refer to the FSCS website www.fscs.org.uk . All

Metro Bank products are subject to status and approval.

Metro Bank PLC is an independent UK bank - it is not affiliated

with any other bank or organisation (including the METRO newspaper

or its publishers) anywhere in the world. Please refer to Metro

Bank using the full name.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZMGMLMDGZZM

(END) Dow Jones Newswires

November 02, 2022 03:01 ET (07:01 GMT)

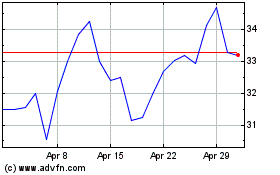

Metro Bank (LSE:MTRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Metro Bank (LSE:MTRO)

Historical Stock Chart

From Apr 2023 to Apr 2024