TIDMNET

RNS Number : 5259A

Netcall PLC

23 January 2024

23 January 2024

NETCALL PLC

("Netcall", the "Company" or the "Group")

Acquisition of Skore Labs Limited

Enhancing the Liberty digital transformation platform,

increasing market opportunity and cross-sale potential

Netcall plc (AIM: NET), a leading provider of intelligent

automation and customer engagement software, is pleased to announce

the acquisition of Skore Labs Limited ("Skore"), a cloud-based

process improvement software company (the "Acquisition").

Key points:

-- Highly complementary bolt-on solution, enhancing and broadening

Netcall's offering as a one-stop-shop digital transformation

toolkit

-- Provides increased cross-selling potential and expanded market

opportunity and reach

-- Brings new customers across industries and a compatible cloud

recurring revenue model

-- Initial consideration of GBP2 million, with additional earnout

resulting in a maximum consideration of up to GBP6.225 million

About Skore

Skore (www.getskore.com) is a UK company that provides a

cloud-based software solution for business process discovery,

mapping, analysis and management. As an intuitive and collaborative

solution, users can rapidly identify process problems as well as

opportunities for optimisation to drive operational improvement,

innovation and efficiencies.

Based in Portsmouth, Skore was established in 2014 and has c.120

customers across a range of industries, including Ashford Borough

Council, Cielo, Holland & Barrett, Northrop Grumman and

University College London NHS Trust. All of the current team will

remain with the Netcall group.

For the year ended 31 December 2023, Skore's revenues have grown

96% to GBP449k (2022: GBP229k) with an adjusted EBITDA loss of

GBP55k (2022: loss of GBP159k) (figures from unaudited managements

accounts). Annual recurring revenue (ARR) from cloud subscriptions

increased by 179% to GBP651k (2022: GBP233k).

Acquisition Rationale

Process mapping is a foundation capability that enhances

Netcall's current product portfolio. With the expanded Liberty

platform that incorporates Skore's process mapping solution with

Liberty's low-code, robotic process automation and AI solutions,

customers will be able to build solutions, streamline and automate

processes faster and easier, to improve operational effectiveness

and efficiency.

The expanded Liberty platform also allows Netcall customers to

add process mapping to their subscriptions, creating cross-selling

potential and new customer opportunities for organisations that

want a comprehensive all-in-one process solution.

Consideration for the Acquisition

The total consideration for the Acquisition, including earnout,

is up to GBP6.225 million, of which up to GBP4.225 million is

dependent on the performance of Skore. The initial consideration is

GBP2.0 million, payable in cash from Netcall's existing cash

resources, with GBP1.8 million payable on completion and GBP0.2

million is held back and deferred for 12 months.

Up to GBP4.0 million of the earnout consideration is payable

subject to Skore achieving contracted annualised value of software

subscriptions ("Annualised Subscription Value") growth from GBP0.6

million to GBP2.0 million within three years of acquisition. The

payment will be pro-rata, measured annually, and paid 50% in cash

and 50% in Netcall shares with elements of both deferred until the

end of the earnout period. Any Netcall shares issued will be

subject to a 12 month lock-in for the management shareholders of

Skore. The balance of the earnout contingent consideration is

payable in cash and is dependent on achieving a minimum level of

Annualised Subscription Value in the earnout period.

James Ormondroyd, CEO of Netcall plc commented: "The acquisition

of Skore fits excellently within our stated acquisition rationale,

bringing a highly complementary technology offering. Business

process improvement is seen as an increasingly important part of

the puzzle for companies wishing to improve their interactions with

customers, and we believe this acquisition accelerates our position

in a rapidly growing market for digital transformation and

automation.

"We have a successful track record in growing our market

opportunity and cross-sell potential through organic and

acquisitive product expansion, and the addition of the Skore

process mapping capabilities is a step forward in this journey. We

look forward to welcoming the Skore team to Netcall."

For further enquiries, please contact:

Netcall plc Tel. +44 (0) 330

333 6100

James Ormondroyd, CEO

Henrik Bang, Non-Executive Chair

Richard Hughes, CFO

Canaccord Genuity Limited (Nominated Adviser Tel. +44 (0) 20 7523

and Broker) 8000

Simon Bridges / Andrew Potts

Singer Capital Markets (Joint Broker) Tel. +44 (0) 20 7496

3000

Harry Gooden / Asha Chotai

Alma Strategic Communications Tel. +44 (0) 20 3405

0205

Caroline Forde / Hilary Buchanan / Matthew

Young

About Netcall

Netcall's Liberty software platform with Intelligent Automation

and Customer Engagement solutions helps organisations digitally

transform their businesses faster and more efficiently, empowering

them to create a leaner, more customer-centric organisation.

Netcall's customers span enterprise, healthcare and government

sectors. These include two-thirds of the NHS Acute Health Trusts

and leading corporates including Legal and General, Lloyds Banking

Group, Aon and Santander.

For further information, please go to www.netcall.com.

Prior to publication the information communicated in this

announcement was deemed by the Company to constitute inside

information for the purposes of article 7 of the Market Abuse

Regulations (EU) No 596/2014 as amended by regulation 11 of the

Market Abuse (Amendment) (EU Exit) Regulations No 2019/310 ('MAR').

With the publication of this announcement, this information is now

considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQVLLFLZFLLBBL

(END) Dow Jones Newswires

January 23, 2024 02:01 ET (07:01 GMT)

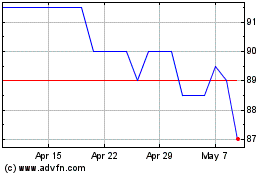

Netcall (LSE:NET)

Historical Stock Chart

From Mar 2024 to Apr 2024

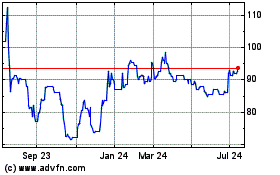

Netcall (LSE:NET)

Historical Stock Chart

From Apr 2023 to Apr 2024