TIDMOPTI

RNS Number : 7262N

OptiBiotix Health PLC

27 September 2023

27 September 2023

OptiBiotix Health plc

("OptiBiotix" or the "Company" or the "Group")

Half Year Report

OptiBiotix Health p lc (AI M: OPTI), a life sciences busi ness d

eveloping compou n ds to tackle obesity, cardiovascular disease,

diabetes and skincare, a nnounces its unaudited results for the six

months ended 30 June 2023.

Highlights

-- Strong first half of trading with sales of GBP351k (2022:

GBP119k), a 195% increase over H1 2022. Given H1 2022 included

GBP19.5k from Probiotic sales up to March 30 2022, the 'like for

like' increase is 251%. 85% of this sales income was received in Q2

2023

-- A 154% increase in gross profit from GBP62k in H1 2022 to GBP158k in H1 2023

-- A 17.3% reduction in administrative expenses from GBP1,108k to GBP918k

-- Sales from existing partners slowly returning to forecast

with new orders from both The Hut Group (THG) and Holland &

Barrett

-- Improved sales performance in H1 2023 by Apollo Pharmacies

(up 500%) in India and Nahdi Medical (up 30%) in Saudi Arabia

following more active account management. These increased sales are

not reflected in H1 but impact on restocking requirements in H2

2023

-- Three new partners in Asia who have all placed initial orders for SlimBiome(R)

-- Strong sales growth of own brand products on e-commerce channel

-- A large first order from a new partner of GBP116k for

SlimBiome (R) from a contract manufacturer of a leading weight

management and sports nutrition brand in the USA

-- The listing of SlimBiome(R) Medical and Gofigure(R) products

on Amazon UK in February 2023, and Slimbiome(R) Medical on Amazon

Germany and Walmart USA in May 2023. We anticipate further

international listings on Amazon throughout 2023 including Amazon

India, the Gulf States, and Amazon USA. This is all part of a

strategy to increase the internationalisation of our own brand

products online in 2023

-- Published the results of a third human study on SlimBiome(R)

demonstrating statistically significant benefits to appetite and

hunger regulation with a single dose of SlimBiome(R)

-- The launch of our gut and digestive health WellBiome(R)

product as part of a strategy to enhance our range of product

offerings and to mitigate the seasonal variations in the sale of

weight management products. The product has received excellent

reviews on Amazon with growing month on month sales (125% increase

July to August) and a high number of repeat orders (63% in August).

We will increase our marketing on WellBiome(R) and extend its

availability to other Amazon international channels in Q4 2023

-- Significant progress in the manufacturing scale up of our microbiome modulators: a range of second-generation products which selectively enhance the growth rate of specific types of bacteria and create the potential for targeted treatment of a range of human diseases

-- Good progress from both partners in the commercial scale up

and testing of our second-generation SweetBiotix(R) family of

products offering exciting potential for future growth

-- No debt with valuable assets in SkinBioTherapeutics plc and

ProBiotix Health plc providing a strong balance sheet

Post Period

-- As announced on 29 August 2023, one of our partners has

secured an international listing for products containing SlimBiome

(R) with Costco, the fifth largest retailer in the world

-- Q3 saw our first new customer in Canada, Prairie Naturals,

who will launch a SlimBiome (R) based powder in Q4 2023

-- We have reached agreement with Boots pharmacies to launch

SlimBiome (R) products online in Q1 2024 (announced on 21 September

2023)

-- A further 9.7 metric tonnes of SlimBiome (R) has been taken

from stock held by distributors for our two largest partners up to

August 2023. Once this stock overhang is cleared this should have a

material impact on reportable revenue

Stephen O'Hara, CEO of OptiBiotix, commented: "The focus for

2023 has been on moving the business to profitability by a

reduction in costs, a focus on existing partners returning to

forecast, bringing in new partners particularly in the USA and

Asia, and expanding e-commerce channels to reduce partner

dependency. Good progress has been made in each of these areas.

This is all part of plans for each business unit (USA, India,

Ecommerce, B2B) to reach profitability, at least on a monthly basis

by the end of the calendar year.

"The aim for the second half of the year is to maintain our

focus on managing costs, growing sales and closing out ongoing

discussions with a number of larger partners across first and

second-generation products to ensure a return on investment from

the expansion of our commercial and business development teams. We

are particularly excited about our second-generation products

approaching commercialisation given their uniqueness in the

marketplace. Our sweet prebiotic fibres, called SweetBiotix(R)

create the opportunity to replace unhealthy calorific and

cariogenic sugars with healthy fibres in a wide range of food and

beverage products. With growing health concerns over traditional

sugars and sweeteners, the commercialisation of SweetBiotix(R)

meets a large global market need. After many years of hard work we

are equally pleased at the s ignificant progress we have made in

2023 in the manufacturing scale up our microbiome modulators which

selectively enhance the growth rate of specific types of bacteria

and create the potential for targeted treatment of a range of human

diseases. We believe these unique products, individually and

collectively, offer shareholders the potential for a significant

enhancement in the value of the Company.

"The Group has no debt, a strong balance sheet, and retains

significant exposure to the considerable growth potential of the

microbiome through its shareholdings in ProBiotix Health plc and

SkinBioTherapeutics plc."

This announcement contains information which, prior to its

disclosure, was considered inside information for the purposes of

the UK Market Abuse Regulation and the Directors of the Company are

responsible for the release of this announcement.

Forward-Looking Statements

Certain statements made in this announcement are forward-looking

statements. These forward-looking statements are not historical

facts but rather are based on the Company's current expectations,

estimates, and projections about its industry; its beliefs; and

assumptions. Words such as 'anticipates,' 'expects,' 'intends,'

'plans,' 'believes,' 'seeks,' 'estimates,' and similar expressions

are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties, and other factors, some

of which are beyond the Company's control, are difficult to

predict, and could cause actual results to differ materially from

those expressed or forecasted in the forward-looking statements.

The Company cautions security holders and prospective security

holders not to place undue reliance on these forward-looking

statements, which reflect the view of the Company only as of the

date of this announcement. The forward-looking statements made in

this announcement relate only to events as of the date on which the

statements are made. The Company will not undertake any obligation

to release publicly any revisions or updates to these

forward-looking statements to reflect events, circumstances, or

unanticipated events occurring after the date of this announcement

except as required by law or by any appropriate regulatory

authority.

For further information, please contact:

OptiBiotix Health plc www.optibiotix.com

Neil Davidson, Chairman Contact via Walbrook below

Stephen O'Hara, Chief Executive

Cairn Financial Advisers LLP (NOMAD) Tel: 020 7213 0880

Liam Murray / Jo Turner / Ludovico Lazzaretti

Peterhouse Capital Limited (Broker) Tel: 020 7220 9797

Duncan Vasey / Lucy Williams

Walbrook PR Ltd Mob: 07876 741 001

Anna Dunphy

Chairman's and Chief Executive's Statement

After a challenging 2022 our focus in 2023 has been on moving

the Company towards profitability. We believe we will achieve this

by a reduction in central costs and by the promotion of sales, both

direct to consumers via e-commerce channels and through our

existing partners delivering on forecasts and bringing in new

customers, particularly in the USA and Asian markets. There has

been progress in each of these areas in the first six months of

2023, and in particular since March 2023 when we initiated a number

of changes to the management team.

This focus has resulted in a substantial increase in turnover

(195%) and gross profit (154%) and a reduction in administration

expenses (17.3%). This has led to a fall in our operating loss

(28%) for the first six months of the year. Whilst encouraging,

it's only a first step, and our focus remains on reaching

profitability by broadening our customer base in more territories,

building new partnerships with larger companies particularly in the

USA and Asia, and controlling costs. This will create a more robust

business for the future and will reduce the risk of revenues in

future accounting periods being impacted by individual partners

delaying launches, or by timing differences in restocking.

Strategic overview

Whilst our immediate focus is on reaching profitability this

takes place within a strategic framework of:-

-- Focusing on a number of large partners in key strategic

markets, particularly the USA and Asia;

-- Improving our sales mix and margins by moving increasingly

from ingredient sales to the sale of finished products, both

through larger partners and direct-to-consumer through our own

online store and other outlets such as Tmall.com in Asia and

Amazon;

-- Building first-generation product portfolio in weight

management and extending our technology into new channels such as

sports nutrition with LeanBiome(R), and new product areas such gut

and digestive health with WellBiome(R);

-- Progressing the commercialisation of our second-generation

products, SweetBiotix(R) and Microbiome Modulators

The first phase of strategy was to establish the credibility of

our science and brands and the sustainability of the business

through an initial focus on building sales of our first-generation

products ( SlimBiome(R), LP(LDL) (R)) through business-to-business

deals with multiple partners principally in Europe. The Company

made rapid sales progress with combined sales of prebiotic and

probiotic first-generation products of GBP1.5m (2020) and GBP2.2m

(2021) and both the Probiotic (now ProBiotix Health plc) and

Prebiotic trading businesses being EBITDA profitable in both years.

SlimBiome(R) now has three clinical studies, health claims in

numerous territories around the world, an extensive international

IP portfolio, multiple awards, and accounts with well-known

national (Holland and Barrett), and international brands

(Myprotein). This has allowed us to extend our SlimBiome(R) brand

into new territories (Asia, USA), expand into the sports nutrition

channel, and launch a patented gut and digestive health product,

WellBiome(R).

Our strategic focus is now turning to the approaching

commercialisation of the SweetBiotix(R) and Microbiome modulator

family of products which offers shareholders the potential for

significant value enhancement. 2023 has seen significant progress

by both partners in the commercial scale production of

SweetBiotix(R), with final product taste tested and accepted by our

US partner. Liquid and freeze-dried products are undergoing

independent structural analysis and expert panel taste testing to

determine sweetness, off tastes, aftertastes etc when compared to

sucrose and other products after which we can start partner

application development and launch plans. In the meantime, our

partners are undergoing early consumer testing as they prepare for

launch.

All these actions increase the scale of the opportunity within

OptiBiotix and our ability to deliver sustained growth for

shareholders in the years ahead.

Commercial and scientific overview

Since the beginning of the current financial year we have:-

-- Invested significantly in new e-commerce channels, including

Amazon in the UK, and Walmart in the USA, as well as Tmall.com in

China. This has led to good sales growth which with continued

investment we anticipate will continue throughout 2023 and

beyond.

-- Shifted our commercial focus to selling SlimBiome(R) Medical

sachets in Europe and SlimBiome(R) shots in India and the Gulf

states. These are designed to be consumed before meals and help

users manage their weight by making consumers feel fuller for

longer and reducing cravings for sweet and savoury snacks. This is

a highly differentiated product which leverages growing market

interest in injectable appetite control drugs like semaglutide.

SlimBiome(R) Medical can be used with any weight management plan or

calorie restriction plan and complements rather than competes in a

crowded marketplace. The product enjoys high margins and became a

top-selling line on Amazon UK in 2023 within its market

segment.

-- Re-engaged with major partners that underperformed against

our sales expectations in 2022, leading to:

-- A significant new investment in marketing by Optipharm in

Australia, coupled with the launch online of their Optislim and

Optiman ranges containing our OptiBiome (R) prebiotic fibre.

-- New orders from both The Hut Group and Holland & Barrett in the UK.

-- A substantial increase in the number of Apollo pharmacies in

India and Nahdi pharmacies in Saudi Arabia selling GoFigure(R)

products.

-- Successfully launched new products, including our

reformulated gut and digestive health WellBiome(R) functional fibre

and mineral blend, which has been made available via our own online

store and more recently on Amazon UK.

-- Recruited three new partners in Asia who have all placed

initial orders for SlimBiome and a major US weight management

brand, with which we will be launching during the second half of

2023, initially in Europe and later in the USA.

-- Published the results of a third human study on SlimBiome(R)

which demonstrated statistically significant benefits to appetite

and hunger regulation, with no safety, compliance or tolerance

issues reported by the participating volunteers. This study

underlines the effectiveness of a single dose of SlimBiome(R) in

delivering hunger-free weight loss by non-invasive means. This

study was timely given the growing consumer, media and

pharmaceutical company interest in this field following NICE'S

approval of the injectable drug semaglutide.

North America Sales and Business Development

We have a strong sales pipeline in North America and the USA

made up of small, medium size, and a number of large US corporates

(including a GBP9bn Muliti Level Marketing company -MLM) that offer

opportunities for sales growth in 2023 and beyond. The Company has

received a number of orders from USA and Canadian partners who are

owners of leading weight management or sports nutrition brands in

the USA. We expect further orders in H2 from our pipeline of

interested partners.

We continue to advance projects and expand our pipeline with

North American companies with the US business looking to contribute

$287k of sales in its first full year of commercial operation. The

Company will be exhibiting its SlimBiome(R), LeanBiome(R), and

Wellbiome(R) products at Supply Side West, USA, in November 2023

with a view to progressing further opportunities in this

market.

Consumer Health and Ecommerce sales

The Consumer Health Division is growing rapidly increasing sales

by 65% in Q2 compared to Q1 and in the first 6 months of 2023 has

already achieved higher sales than FY 2022. Amazon UK has been

instrumental in achieving such success due to the increase in the

customer base. The Company has successfully moved to Fulfilment By

Amazon model (FBA). This model has allowed customers to receive

faster delivery through Prime accounts. Slimbiome (R) is

consistently in the top best sellers for anti-appetite-suppressants

and achieved the highest sales in online history during Prime month

in July 2023.

The key to growth is to expand our reach to customers via

various channels globally (Amazon Germany, United Arab Emirates

(UAE) and India) and to widen our product portfolio and increase

brand awareness.

New customers such as Amazon UAE terms have been agreed and

Slimbiome (R) , and Wellbiome (R) , and our gummies are being

listed. Amazon Kingdom of Saudia Arabia (KSA) will follow suit as

they have observed our strong presence in Nahdi Pharmacies in the

territory. Amazon India has been identified as a huge potential and

the Amazon account has been created. Next steps include getting the

products listed ready for a strong sales push in Q4.

Our China business has seen our highest month of sales on Tmall

in August 2023 and we envisage an even higher month in September

2023. This can be attributed to the work done with local KOL

influencers in the region and a strategic move to sell more on the

TikTok platform. Tmall has a large event in November 2023 which

OptiBiotix will be participating in and should encourage further

sales.

To widen our product portfolio, in Q4 2023 will bring new

products including soups and porridges onto our own platform and

subsequently to Amazon. By adding further to the range, this will

allow an increase in average order value online and compensate for

the peaks and troughs in the weight management cycle.

Competitor analysis of our WellBiome(R) product has indicated

the Consumer Health Division needs to increase awareness through

social channels and is currently focusing on recruiting

influencers. With the increased awareness, our division will have

more visits, brand recognition and most importantly sales.

Competitors such as Symprove have sales of up to GBP15 million per

annum with a heavy reliance on Influencers/social media. Based on

our analysis we have competitive advantage on price and product

including on pack health claims.

A competitor analysis for Wellbiome (R) has indicated value in a

change in positioning from healthy ageing to gut and digestive

health which will allow us to attract more customers. We have

already begun targeting competitors with keywords/ads and have

listed successfully with Amazon UK on FBA. We will follow a similar

path with Slimbiome (R) in the months ahead.

The Consumer Health Division has the advantage of receiving

online sales income immediately and allows more control of our

brand/IP/messaging and less reliance on distributors to grow the

brand.

OptiBiotix Health India

OptiBiotix Health India ("OHI") was formed in November 2021 as a

mid to long term strategic investment in the world's most populous

nation forecast to have the highest population of medium to high

level income customers in the world. The formation of OHI has

helped OptiBiotix avoid high import taxes and control the purchase

and sale of ingredients (SlimBiome(R)) and final product

(GoFigure(R)) manufactured and sold in India.

After a slow start following the launch of products with Apollo

in September 2022 we are now seeing momentum increase with 529

stores in major cities now selling GoFigure products with the aim

of 1000 stores by year end. This has helped sales grow by by 500%

in the last 5 months. These increased sales will not be reflected

in H1 but will impact on restocking requirements in H2 when Apollo

have agreed to extend the product range. Apollo carried out a

consumer survey which showed:-

-- There was a 87% customer return rate of customers buying GoFigure(R) products

-- There were 23% new customers to Apollo pharmacies who just bought GoFigure(R) products

This customer feedback is consistent with feedback from THG who

gained 40% new customers with the introduction of LeanBiome (R) to

their Myprotein (R) product range. These launch experiences

transform the proposition in commercial discussions with new

partners as it demonstrates our products customer appeal and its

ability to attract new and returning customers.

The business in India has a strong pipeline with emerging and

leading players in weight management and sports nutrition and if

launches go to plan, we would anticipate sales in the region of

GBP130k this financial year.

Results

OptiBiotix results for the six months ended June 30 2023 are set

out below. These results are for the Group's new structure

following the listing of ProBiotix Health (PBX) plc on the AQSE

Growth Market on 31 March 2022 with PBX costs and revenues no

longer included from that date. When making comparisons with 2022,

it should be noted that H1 2022 accounts included costs and

revenues for the combined group (ProBiotix and OptiBiotix) up to

the end of March 2022.

The results show revenue from continuing operations for the six

months of GBP351k (H1 2022: GBP119k), a 195% increase in sales. 85%

of this income was received in the second quarter (April to June

2023) following changes to the leadership team. Administration

expenses are down 17% (H1 2023: GBP918k, H1 2022: GBP1,108k)

reflecting cost saving measures and recovery of some of the debt

provision reported in 2022 accounts. This includes a proportional

settlement payment to the departing CEO, Rene Kamminga. There is a

GBP286k (28%) reduction in operating loss, from GBP1,046k in 2022

to GBP760k in 2023 which will reduce further with the full year

effect of cost improvement measures including removing Cenkos as

joint broker, the departure of Rene Kamminga in March 2023, and the

reduction of the board from four to two non-executives in July

2023. As in previous years, there was no contribution in this

period from licence or royalty payments which tend to be received

in the second half of the year.

The Company has a healthy balance sheet with gross assets of

GBP9.9m (31 December 2022: GBP11.5m) with circa GBP893k cash (31

December 2022: GBP1.1m) at the end of June 2023. Once R&D tax

credits are claimed and recoverable VAT repayments are added, the

balance would be GBP1.02m (31 December 2022: GBP1.24m).

Post period end, the Group generated gross proceeds of GBP399k

from the sales of SBTX shares.

The Board senior management and advisers

The Board took decisive action in December 2022 and in H1 2023

to reduce Board, management and advisory costs in order to ensure

each part of the business and subsequently the Group achieve

operational profitability as soon as possible. These actions

included the termination of joint brokerage with Cenkos Securities

plc at the end of March 2023, the stepping down of Rene Kamminga,

CEO of OptiBiotix Ltd, who left the business on 28 February 2023,

and a voluntary 20% reduction in all directors' salaries from 1

January 2023. With twice as many non-executive directors as

executive directors Stephen Hammond and Chris Brinsmead agreed to

step down as Non-executive directors at the Company's Annual

General Meeting in July 2023. The overall aim of the measures was

to reduce cost throughout 2023 and beyond.

We anticipate further restructuring of the board and management

team of OptiBiotix as ProBiotix Health plc develops its

independence and we reduce the number of senior employees currently

shared with ProBiotix Health plc under shared service

agreements.

Looking ahead, the focus of the Company will be on investing in

areas that offer the highest return. To support that process and

ensure a focus on profitability the Company is developing profit

and loss metrics for each part of the business with the aim of each

area (USA, India, Ecommerce, B2B) reaching profitability, at least

on a monthly basis by the end of the calendar year.

Outlook

After a challenging 2022 the Company took decisive action to

reduce costs and focus on sales and bringing in new customers,

particularly in the USA and Asian markets. There has been progress

in each of these areas which has been reflected in much improved

results. These changes, further sales growth, full year cost

reductions, and income from licence or royalty payments which tend

to be received in the second half of the year should help the

Company on its path to return to the levels of growth and EBITDA

profitability achieved in 2020 and 2021. However, this is only the

start and the Company must continue to bring in new partners, build

on line sales in more territories, and launch its second generation

products if it is to continue this upward trajectory.

The Board recognises that whilst sales in H1 were strong it is

working in a very volatile external environment and until it

increases its number of partners it is very reliant on sales

performance of a limited number of large partners where timing

differences in restocking large orders can have a material impact

on reporting revenues in that accounting period. To mitigate this

risk the Company has sought to increase the number of partners

buying its products, of which Boots and Costco are good examples,

and build its e-commerce presence in multiple territories to create

a more robust business for the future.

OptiBiotix is operating in an exciting and evolving market place

with gut health and modulation of the human microbiome attracting

ever-increasing interest as the potential solution to a wide and

growing range of life-style related health challenges. Unique,

innovative products take time to gain market acceptance and our

products are no exception. We believe their strong science,

clinical studies, and broad IP portfolio together with the industry

awards and great customer reviews are starting to attract growing

international recognition and with this more sales opportunities.

Successful launches with established national and international

retailers such as Holland and Barett, Europe's largest health and

wellness retailer with over 1,600 stores in 18 countries across the

world, gives our product credibility furthering sales opportunities

in other territories. This has changed discussions from the science

to commercial discussions on which products to launch and timings

of launch. The agreements with Boots, Costco, and a large USA

sports nutrition brand in the last few months are good examples of

this and if successful have the potential to contribute

significantly to revenues in 2024 and beyond.

Our early success in the USA and Asian markets with new

customers support this proposition with initial sales suggesting

high growth potential in these markets. This is supported by the

credibility of our science and success stories with partners like

THG and Apollo which demonstrates our products customer appeal and

its ability to attract new and returning customers.

We are confident that our strategy will continue to deliver

sales growth in 2023 whilst the approaching commercialisation of

our second-generation SweetBiotix (R) family of products and

microbiome modulators offer exciting potential for future growth.

We believe the launch of either of these products will be

transformational for the Company and offer shareholders the

potential for a significant enhancement in the value of the

Company.

This is in addition to the Company having a continued exposure

to the considerable growth potential in probiotics and skincare

through the Group's shareholdings in ProBiotix Health plc and

SkinBioTherapeutics plc.

N Davidson and S O'Hara

27 September 2023

Consolidated Statement of Comprehensive Income

For the six months to 30 June 2023

6 months to 6 months to Year to

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Continuing operations GBP'000 GBP'000 GBP'000

Revenue 351 119 457

Cost of sales (193) (57) (213)

-------------- -------------- --------------

Gross Profit 158 62 244

Share based payments - (6) (11)

Depreciation and amortisation (93) (117) (224)

Other administrative costs (825) (985) (2,498)

-------------- -------------- --------------

Total administrative expenses (918) (1,108) (2,733)

-------------- -------------- --------------

Operating loss (760) (1,046) (2,489)

Finance income / (costs) - - -

Share of (loss)/profit

from associate (226) 91 (83)

Loss on fair value of investments (1,066) (6,788) (8,620)

Profit on disposal of investments 198 - 16

Profit on disposal of subsidiary - 21,647 21,647

Provision against associate

valuation - - (8,030)

-------------- -------------- --------------

Profit/(Loss) before Income

tax (1,854) 13,904 2,441

Income tax 8 12 146

-------------- -------------- --------------

(Loss)/Profit for the

period (1,846) 13,916 2,587

Other Comprehensive Income - - -

-------------- -------------- --------------

Total comprehensive income

for the period (1,846) 13,916 2,587

Total comprehensive income

attributable to the owners

of the group (1,846) 13,916 2,587

Dividends - (10,258) -

(1,846) 3,658 2,587

Earnings/(loss) per share

Basic & Diluted - pence 4 (2.09)p 4.15p 2.93p

Consolidated Statement of Financial Position

As at 30 June 2023

Notes As at As at As at

30 June 2023 30 June 2022 31 December

Unaudited Unaudited 2022

Audited

ASSETS GBP'000 GBP'000 GBP'000

Non-current assets

Intangibles 1,463 2,233 1,540

Property, plant & equipment - 2 -

Investments 5 3,711 6,761 5,022

Investment is associate 5 2,903 11,333 3,129

-------------- -------------- --------------

8,077 20,329 9,691

-------------- -------------- --------------

CURRENT ASSETS

Inventories 179 128 178

Trade and other receivables 666 434 521

Current tax asset 106 68 106

Cash and cash equivalents 893 1,509 1,052

-------------- -------------- --------------

1,844 2,139 1,857

-------------- -------------- --------------

TOTAL ASSETS 9,921 22,468 11,548

EQUITY

Shareholders' Equity

Called up share capital 6 1,824 1,760 1,824

Share premium 2,958 2,545 2,958

Share based payment reserve 939 933 939

Merger relief reserve 1,500 1,500 1,500

Retained Earnings 1,838 15,014 3,684

-------------- -------------- --------------

Total Equity 9,059 21,752 10,905

-------------- -------------- --------------

LIABILITIES

Current liabilities

Trade and other payables 514 255 278

-------------- -------------- --------------

514 255 278

-------------- -------------- --------------

Non - current liabilities

Deferred tax liability 348 461 365

-------------- -------------- --------------

348 461 365

-------------- -------------- --------------

TOTAL LIABILITIES 862 716 643

-------------- -------------- --------------

TOTAL EQUITY AND LIABILITIES 9,921 22,468 11,548

Consolidated Statement of Changes in Equity

For six months to 30 June 2023

Called Share Share-based Non Merger Retained Convertible Total

up premium Payment controlling Relief Earnings Loan note Equity

Share reserve Interest Reserve

Capital

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ -------------- -------------- ------------ ------------ ------------ -------- --------------

Balance at

31 December

2021 1,759 2,537 927 35 1,500 11,320 93 18,172

Profit for

the period - - - - - 13,916 - 13,916

Dividends - - - - - (10,258) - (10,258)

Transfer on

loss of

control - - - - - - (93) (93)

Share issues 1 8 - - - - - 9

Transfer

within

reserves - - - (35) - 35 - -

Share based

payment - - 6 - - - - 6

------------ -------------- -------------- ------------ ------------ ------------ ------------ --------------

Balance at

30 June

2022 1,760 2,545 933 - 1,500 15,014 - 21,752

------------ -------------- -------------- ------------ ------------ ------------ ------------ --------------

Loss for the

period - - - - - (11,330) - (11,330)

Fundraising

commission - (24) - - - - - (24)

Share issues 64 437 - - - - - 501

share based

payment - - 6 - - - - 6

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Balance at

31 December

2022 1,824 2,958 939 - 1,500 3,684 - 10,905

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Loss for the

period - - - - - (1,846) - (1,846)

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Balance at

30 June

2023 1,824 2,958 939 - 1,500 1,838 - 9,059

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Consolidated Statement of Cash Flows

For the six months to 30 June 2023

Notes 6 months 6 months Year

to to to

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Reconciliation of loss

before income tax to cash

outflow from operations

Operating loss (760) (1,046) (2,489)

Decrease/ (Increase) in

inventories (1) (36) (76)

(Increase)/decrease in trade

and other

receivables (144) 658 1,116

(Decrease)/increase in trade

and other

payables 236 (211) (19)

Share Option expense - 6 11

Amortisation of patents 92 118 224

------------ ------------ ------------

Net cash outflow from operations (577) (512) (1,233)

Tax paid (9) 98 124

------------ ------------ ------------

Net cash outflow from operating

activities (586) (414) (1,109)

Cash flows from investing

activities

Purchase of intangible assets (15) (58) (168)

Net cashflow re disposal

of subsidiary - (35) (188)

Proceeds on disposal of

investments 442 - 25

------------ ------------ ------------

Net cash (outflow)/inflow

from investing activities 427 (507) (331)

------------ ------------ ------------

Cash flows from financing

activities

Share issues - 9 485

------------ ------------ ------------

Net cash inflow from financing

activities - 9 485

------------ ------------ ------------

Increase/(decrease) in

cash and equivalents (159) (498) (955)

Cash and cash equivalents

at beginning of year 1,052 2,007 2,007

------------ ------------ ------------

Cash and cash equivalents

at end of year 893 1,509 1,052

Notes to the Half Yearly Report

For the six months to 30 June 2023

1. General Information

Optibiotix Health Plc is a com pany incorp orated and d omiciled

in England and Wales. The com pan y 's registered office is in

York. The com pany is listed on the AIM market of the Lo nd on

Stock Exchange (ticker: OPTI).

The financial information set out in this Half Yearly report

does not constitute statutory accounts as defined in Section 434 of

the Companies Act 2006. The group's statutory financial statements

for the period ended 31 December 2022, prepared under UK - adopted

International Financial Reporting Standards ("IFRS"), have been

filed with the Registrar of Companies. The auditor's report on

those financial statements was unqualified and did not contain

statements under Sections 498(2) and 498 (3) of the Companies Act

2006.

Copies of the annual statutory accounts and the Half Yearly

report can be found on the Company's website at

http://www.optibiotix.com/ .

2. Basis of preparation and significant accounting policies

This Half Yearly report has been prepared using the historical

cost convention, on a going concern basis and in accordance with UK

- adopted International Financial Reporting Standards ("IFRS") as

adopted by the United Kingdom.

The interim financial statements have been prepared in

accordance with the accounting policies set out in the Annual

Report and Accounts for the year ended 31 December 2022.

3. Segmental Reporting

In the opinion of the directors, the Group has one class of

business, in three geographical areas being that of identifying and

developing microbial strains, compounds and formulations for use in

the nutraceutical industry. The Group sells into four highly

interconnected markets, all costs assets and liabilities are

derived from the UK location.

Revenue analysed by market

6 months to 6 months Year ended

30 June to 31 December

2023 30 June 2022

2022

GBP'000 GBP'000 GBP'000

Probiotics - 24 24

Functional Fibres 351 95 433

------------ ------------ ------------

351 119 457

Following the loss of control of Probiotix Health plc on 31

March 2022, all group revenues since then have been derived from

functional fibres.

Revenue analysed by geographical market

Period ended 6 months Year ended

30 June to 31 December

2022 30 June 2022

2022

GBP'000 GBP'000 GBP'000

UK 142 48 136

US - 15 100

India - - 61

Rest of world 209 56 160

------------ ------------ ------------

351 119 457

During the reporting period one customer represented GBP116,256

(33.1%) of Group revenues. (June 2022: one customer generated

GBP49,668 representing 41.8% of Group revenues)

4. Earnings per Share

Basic earnings per share is calculated by dividing the earnings

attributable shareholders by the weighted average number of

ordinary shares outstanding during the period.

Reconciliations are set out below:

6 months to

30 June 2023

Basic and diluted EPS Earnings Weighted average Profit per-share

Number of shares

GBP'000 No. Pence

Basic and diluted EPS (1,846) 88,279,952 2.09

6 months to

30 June 2022

Earnings Weighted average Profit per-share

Number of shares

GBP'000 No. Pence

Basic and diluted EPS 3,658 88,047,596 4.15

Year to 31

December 2022

Earnings Weighted average Profit per-share

Number of shares

GBP'000 No. Pence

Basic and diluted EPS 2,587 88,279,952 2.93

As at 30 June 2023 there were 7,182,907 outstanding share

options.

5. Investments

Available for sale investments

Carrying value GBP'000

At 31 December 2021 13,651

Revaluations (6,890)

------------

Carrying amount

At 30 June 2022 6,761

Revaluations (1,730)

Disposal of shares (9)

------------

Carrying amount

At 31 December 2022 5,022

Disposal of shares (244)

Revaluations (1,067)

------------

3,711

Investment in associates

Carrying value GBP'000

At 31 December 2021 -

Additions 11,242

Share of profit 91

------------

Carrying amount

At 30 June 2022 11,333

Share of loss (174)

Impairment in the period (8,030)

------------

Carrying amount 3,129

At 31 December 2022

Share of loss (226)

------------

Carrying amount 2,903

At 30 June 2023

Total value of investments at 30

June 2023 6,614

6. Share Capital

Issued share capital comprises:

6 months 6 months Year to

to 30 June to 30 June 31

2023 2022 December

Unaudited Unaudited 2022

Audited

GBP'000 GBP'000 GBP'000

Ordinary shares of 2p

each

87,940,601 1,824 - 1,824

Ordinary shares of 2p - 1,760 -

each

88,065,601

-------------- -------------- --------------

1,824 1,760 1,824

7. Post balance sheet events

On 26 July 2023 Stephen Hammond and Chris Brinsmead stepped down

from the Board.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEMFIMEDSESU

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

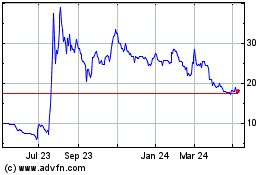

Optibiotix Health (LSE:OPTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

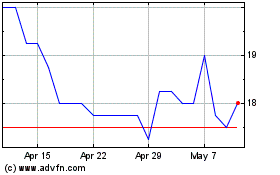

Optibiotix Health (LSE:OPTI)

Historical Stock Chart

From Apr 2023 to Apr 2024