TIDMPALM

Panther Metals PLC

15 January 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN,

THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

PANTHER METALS PLC

("Panther" or the "Company")

(Incorporated in the Isle of Man with company number

009753V)

15 January 2024

Fulcrum Metals: Update on Saskatchewan Uranium Projects

Panther Metals PLC (LSE:PALM) the company focused on mineral

exploration in Canada, is pleased to note the Fulcrum Metals PLC

("Fulcrum", LON: FMET) announcement updating the market on

significant progress from its uranium projects, Charlot-Neely and

Fontaine Lake, in Saskatchewan, Canada .

Panther currently holds a total of 9,971,839 ordinary shares in

Fulcrum representing a 19.99% interest in the entire issued share

capital of Fulcrum, plus 714,286 warrants exercisable at 17.5p with

a two-year life from 14 February 2023 and a further 476,190

warrants exercisable at 26.25p with a three-year life. Panther also

retains a 2% net smelter return ("NSR") royalty over the Big Bear

Project.

CEO, Darren Hazelwood, commented :

"Our exposure to uranium via our holding in Fulcrum Metals is

largely lost by the market but its significance is growing as we

witness a bullish uranium market combined with Fulcrum expanding

its own footprint.

I'm looking forward to seeing how the team develop the portfolio

via a spin-out or partnership deal that has the potential to

benefit Panther at a time we are accelerating our own business

model."

Fulcrum News Highlights

-- A total of 62 rock samples collected across Charlot-Neely and Fontaine Lake properties:

-- Charlot-Neely Project

o 48 rock samples assaying up to 5,680 ppm Uranium (U).

o Identified vein-hosted uranium mineralisation characteristic

of the Beaverlodge area, home to several historic uranium

mines.

o Potential for unconformity-style uranium mineralisation,

deposits that are known to be larger and high grade uranium.

-- The Fontaine Lake Property

o 14 rock samples assaying up to 7,130ppm U

o Uranium mineralisation indicates potential for lower grade,

higher tonnage deposit, comparable to the geological setting of the

Rossing deposit in Namibia.

Ryan Mee, Chief Executive Office of Fulcrum Metals plc,

commented:

"The first phase exploration of both the Charlot-Neely and

Fontaine Lake uranium properties has been very successful with

extensive radioactivity and mineralisation confirming the positive

potential for discovery. Since the completion of the fieldwork, we

have over the last few months substantially and cost effectively

increased the Athabasca uranium portfolio from 13,612 hectares to

59,310 hectares, inclusive of the properties under option, and

doubled the size of the Charlot-Neely project from 7,625 hectares

to 16,372 hectares and the addition of Snowbird and South Pendleton

to our projects portfolio.

"We are excited by our Athabasca uranium portfolio which targets

major structures, on trend with historic mines and on trend with

projects attracting significant investment. This strategic move has

proved to be prudent, as the price of uranium continues to rise and

M&A activity in the sector increases. Deals of note include the

recently announced such as Fortune Bay option agreement for the

Murmac and Strike uranium projects totalling CAD$3.4m in cash and

shares and funding CAD$6m in exploration expenditures(1) just south

of our Charlot-Neely property along the Black Bay fault and

significant land staking along the major structures on which our

projects sit.

"With an exciting and attractive uranium portfolio in what is

considered one of the leading uranium districts worldwide, Fulcrum

is well positioned to capitalise on any potential opportunities. As

previously announced, Fulcrum continues to review spin-out and

partnership opportunities with interested parties."

The full Fulcrum announcement is available to view at:

https://fulcrummetals.com/news/

For further information please contact:

Panther Metals PLC:

Darren Hazelwood, Chief Executive Officer: +44(0) 1462 429

743

+44(0) 7971 957 685

Brokers:

Tavira Financial Limited

Christopher James Kipling +44(0) 203 833 3743

SI Capital Limited

Nick Emerson +44(0) 1438 416 500

Axis Capital Markets Limited

Ben Tadd

Lewis Jones +44 (0)20 3026 0449

Notes to Editors

Panther Metals PLC is an exploration company listed on the main

market of the London Stock Exchange. Panther is focussed on the

discovery of commercially viable mineral deposits. The Company's

operational focus is on established mining jurisdictions with the

capacity for project scalability. Drill targets are assessed

rapidly utilising a combination of advanced technologies and

extensive geological data to decipher potential commercial

viability and act accordingly. Panther's current geological

portfolio comprises of three highly prospective properties in

Ontario, Canada while the developing investment wing focuses on the

targeting of nickel and gold in Australia.

Obonga Project

Panther Metals acquired the Obonga Greenstone Belt in July 2021

and have already identified five prospective primary targets:

Wishbone, Awkward, Survey, Ottertooth and Silver Rim. A successful

Phase 1 drilling campaign at Wishbone in Autumn 2021 revealed the

presence of significant VMS-style mineralised systems on the

property - the first such discovery across the entire greenstone

belt. Intercepts include 27.3m of massive sulphide in hole one, and

51m of sulphide-dominated mineralisation in hole two. Both drill

holes contained multiple lenses. Anomalous high-grade copper in

lake sediment close to the target area has also been identified,

increasing confidence in the prospectivity of the location.

Awkward is a highly anomalous magnetic target, interpreted to be

a layered mafic intrusion and magmatic conduit based on mapped

geology and airborne geophysics. Historic sampling in the area

returned anomalous platinum and palladium (Pt, Pd) values, while

historic drilling on the periphery of the target intersected

non-assayed massive sulphide and copper (assumed to be

chalcopyrite), non-assayed disseminated pyrite and chalcopyrite in

coarse gabbro, and non-assayed 'marble cake' gabbro (matching the

description of the Lac des Iles Mine varitexture gabbro ore

zone).

Two additional named targets, Survey and Ottertooth, both

displays further coincident magnetic and electromagnetic anomalies

and are adjacent to the contact between intrusive and extrusive

mafic rocks. Historic drilling at Survey intersected several meters

of massive sulphides in multiple intersections (main parts of the

anomaly remain untested) while Ottertooth remains untested in its

entirety.

Dotted Lake Project

Panther Metals acquired the Dotted Lake Project in July 2020, it

is situated approximately 16km from Barrick Gold's renowned Hemlo

Gold Mine. An extensive soil programme conducted in 2021 identified

numerous gold and base metal targets, all within the same

geological footprint. Following the installation of a new trail

providing direct access to the target location, an initial drilling

programme in Autumn 2021 confirmed the presence of gold

mineralisation within this system with anomalous gold continuing

along strike and present within the surrounding area.

Manitou Lakes Project

The Manitou Lakes gold project is located approximately 300km's

east of Thunder Bay, Ontario and covers a total area of around 98sq

km's.

There are over 200 known gold occurrences on the Manitou Lakes

project area with the wider Eagle/Manitou Lakes greenstone belt

hosting numerous historic gold producers and is prospective for

Archean age orogenic gold and associated base metal deposits.

Exploration work conducted by Shear Gold on the Project to date

has identified numerous gold bearing structures and favourable

geological host rocks through early-stage mapping and surface

sampling. The work has focussed on two target areas, being the West

Limb Gold Property and the Glass Reef Gold Property, both of which

host historic gold mines which have never been systematically

explored using modern techniques or drill tested

Fulcrum Metals Plc

Fulcrum Metals PLC (LON: FMET) is an AIM listed exploration

company which finances and manages exploration projects focused on

Canada, widely recognised as a top mining jurisdiction.

FMET currently holds a beneficial 100% interest in highly

prospective gold and base metals projects in Ontario and Uranium

projects in Saskatchewan.

Fulcrum's strategy is to focus on discovery and

commercialisation of its Projects through targeted exploration

programmes. The primary focus is to make an economic discovery on

the flagship Schreiber-Hemlo Properties and establishing the

prospectivity of its wider Ontario and Saskatchewan portfolio with

a view to securing potential joint venture and/or acquisition

interest.

Panther Metals Plc own 20% of the issued share capital of

Fulcrum Metals Plc and a 2% NSR on the Big Bear project.

Panther Metals Australia

Following the listing of Panther Metals' Australian assets on

the Australian Securities Exchange ("ASX") in December 2021. The

ASX listing has provided the Australian projects with the necessary

capital to advance drill-ready targets focused on nickel and gold

(within the Tier 1 Mining Districts of Laverton WA and in the NT).

Through this spin-out Panther holds an attractive investment

prospect, without any disruption to the Company's capital structure

and without any financial obligations.

Conclusion

Panther Metals understand that the commercial realities of

building an exploration company requires expertise in geology,

finance, and the markets within which they operate. The Company's

extensive network of industry leaders allows it to meet these

objectives. Ultimately however, drilling success is the only route

to discovery: the fundamental objective of any exploration company.

Once Panther's world-class geological team identify the anomalies,

they work hard to get drilling. The drill hole is the only place

where substantial and sustained capital growth originates and it's

with that operational focus Panther Metals will continue to

advance.

This information is provided by Reach, the non-regulatory press

release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NRAGPUUCGUPCPPC

(END) Dow Jones Newswires

January 15, 2024 02:00 ET (07:00 GMT)

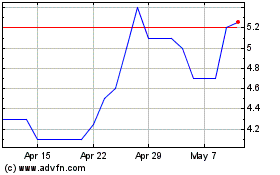

Panther Metals (LSE:PALM)

Historical Stock Chart

From Mar 2024 to Apr 2024

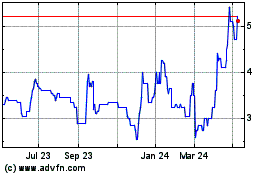

Panther Metals (LSE:PALM)

Historical Stock Chart

From Apr 2023 to Apr 2024