TIDMPSDL

RNS Number : 1261I

Phoenix Spree Deutschland Limited

03 August 2023

03 August 2023

Phoenix Spree Deutschland Limited

(the "Company", the "Group" or "PSD")

Portfolio valuation and business update for the six months ended

30 June 2023

Phoenix Spree Deutschland (LSE: PSDL.LN), the UK listed

investment company specialising in Berlin residential real estate,

announces the valuation for the portfolio of investment properties

held by the Company and its subsidiaries (the "Portfolio") as at 30

June 2023 and an update on business activity.

Financial Summary:

Financial metric: 30 June 30 June 31 December

2023 2022 2022

Portfolio Valuation, as at (EUR

million) EUR714.3 EUR812.4 EUR775.9

--------- --------- ------------

Valuation per square metre, as

at (EUR) EUR3,808 EUR4,318 EUR4,082

--------- --------- ------------

Condominium notarisations during

period (EUR million) EUR2.0 EUR3.0 EUR4.7

--------- --------- ------------

Portfolio valuation impacted by interest rate rises and yield

expansion

During the first half of the financial year, buyer sentiment and

transaction volumes within the Berlin residential market continued

to be affected by historically high inflation and interest rates.

These weaker market conditions have negatively impacted the

valuation of the Portfolio.

As at 30 June 2023, the Portfolio, including investment

properties under construction valued at EUR4.3m, was valued at

EUR714.3 million. This valuation represents an average value per

square metre of EUR3,808 and a gross fully occupied yield of 3.3

per cent. Included within the Portfolio are seven multi-family

properties valued as condominiums, with an aggregate value of

EUR39.2 million (30 June 2022: six properties; EUR32.3

million).

On a like-for-like basis, after adjusting for the impact of

acquisitions net of disposals, the Portfolio valuation declined by

6.9 per cent during the half year to 30 June 2023.

Rental market remains robust

Rental market conditions remain strong. During the first half of

the financial year, supply-demand imbalances within the Berlin PRS

market have widened. Further net inward migration and higher home

ownership costs, which have forced potential buyers to remain

within the rental system for longer, continue to increase demand.

At the same time, supply continues to be constrained by higher

funding and construction costs. Against this backdrop, new lettings

in Berlin were signed at an average premium of 31 per cent to

passing rents.

The Company welcomed the release by The Senate Department for

Urban Development, Building and Housing of a new transitional

Berlin Mietspiegel (rent index). Announced on 15 June 2023, this

replaces the previous rent index of 2021 and applies until a new

qualified rent index is published in the first half of 2024. On

average, the new index permits an increase in rental values of 5.4

per cent versus 2021.

Where applicable, the Company has notified qualifying tenants of

any adjustments to future monthly rental payments, which will

become effective from October 2023. Although this is not the

primary driver of PSD's rent growth, it is anticipated that it will

be accretive to rental income in the second half of the financial

year.

Upturn in condominium buyer interest

During the six months to 30 June 2023, eight condominium units

were notarised for sale for an aggregate value of EUR2.0 million

(H1 2022: EUR 3.0 million). The average achieved notarised value

per sqm for the residential units was EUR5,715, representing an

average 68 per cent premium to 31 December 2022 carry value.

Since the half year end, the Company has notarised a further

three condominiums for EUR1.0m. The valuation represents a 2.2 per

cent premium to 31 December 2022 carry value, reflecting the fact

that these units were occupied. June 2023 book values have been

adjusted to reflect the agreed sales prices.

Reservations on a further seven units have been received and are

pending notarisation. Combined, these have a value of EUR2.6

million, representing a gross premium of 5.1% per cent to carry

value as at 30 June 2023. Of the seven reservations, three units

are currently occupied and therefore carry lower premiums.

Outlook

Against a backdrop of higher inflation and interest rates,

rental yields in the Berlin residential market have risen and

values of rental properties have correspondingly fallen. However,

condominium values remain well supported, as evidenced by the

premia to carry values that the Company continues to achieve on

sales. Although 93 per cent of the Company's portfolio is currently

valued on a rental property basis, it has over 78 per cent of its

properties split as condominiums.

The Property Advisor has produced a detailed analysis of the

entire Portfolio of assets to identify individual properties,

portfolios as well as additional condominiums for sale and

continues to actively market a wide range of properties. Given that

the Company's share price remains at a material discount to NTA,

disposals at a discount to current carry value are under

consideration. Any surplus cash generated over amounts required to

reinstate dividends on a sustainable basis will be returned to

shareholders or used to reduce debt levels.

Buyer interest in the condominium market has shown early signs

of recovery and supply-demand imbalances within the Berlin PRS

market remain firmly supportive of rental values. Given the strong

rental market backdrop and the positive effect of the new

Mietspiegel , it is anticipated that annualised like-for-like

rental growth will accelerate from 5.5 per cent as a 30 June 2023

to approximately 6.5 per cent over the next 12 months.

Interim results

The Company intends to publish its interim results for the six

months to 30 June 2023 at the end of Septembe r 2023.

Legal Entity Identifier: 213800OR6IIJPG98AG39

For Further Information, Please Contact:

Phoenix Spree Deutschland Limited +44 (0) 20 3937 8760

Stuart Young

Numis Securities Limited (Corporate Broker) +44 (0) 20 7260 1000

David Benda

Teneo (Financial PR) +44 (0) 20 7353 4200

Olivia Peters

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKPAELXDEFA

(END) Dow Jones Newswires

August 03, 2023 02:00 ET (06:00 GMT)

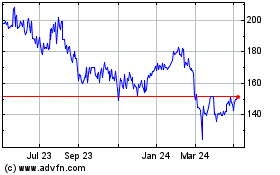

Phoenix Spree Deutschland (LSE:PSDL)

Historical Stock Chart

From Oct 2024 to Nov 2024

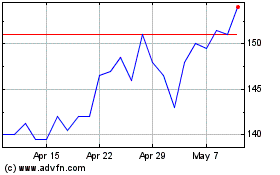

Phoenix Spree Deutschland (LSE:PSDL)

Historical Stock Chart

From Nov 2023 to Nov 2024