TIDMREAT

RNS Number : 0900P

React Group PLC

07 February 2023

7 February 2023

REACT Group plc

("REACT", the "Group" or the "Company")

REACT (AIM: REAT.L), the leading specialist cleaning, hygiene,

and decontamination company, is pleased to announce its final

results for the year ended 30 September 2022.

Financial Performance

Summary FY 2022 FY 2021 Change

'000 '000

------------------ ------------ ----------- --------

Revenue GBP13,700 GBP7,700 +78%

Gross profit GBP3,260 GBP2,370 +37%

Adjusted EBITDA GBP953 GBP795 +20%

Net cash GBP979 GBP567 +73%%

Note: The table above reflects the contribution of LaddersFree

since acquisition in May 2022

Highlights

* Revenue increased by 78% at GBP13.70m (2021:

GBP7.70m)), including a contribution of c. GBP1.6m

from LaddersFree post acquisition

* Gross profit up 37% at GBP3.26m (2021: GBP2.37m)

* Adjusted EBITDA up 20% at GBP953k (2021: GBP795k)

* Strong like-for-like organic revenue growth of c.17%

* Recurring revenue of 83% at year end

* Successful acquisition of LaddersFree Ltd, an

established nationwide commercial window, gutter and

cladding cleaning business, for a total consideration

of up to GBP8.5 million on a debt-free and cash-free

basis

* Post period end contract win of c.GBP800k per year to

provide services from all three segments of the

business through a coordinated programme to a large

fast-service food restaurant across all its sites in

the UK

* Positive outlook for the business following the first

quarter delivering a record performance for the Group

Commenting on the results Shaun Doak, Chief Executive Officer of

REACT, said:

"We are delighted to report a strong financial performance for

the year. The acquisition of LaddersFree has been transformational

as it continues to win new blue chip clients. The transaction has

not only broadened the Group's offering but has enabled the

business to cross sell other business services into existing and

new customers. This was evident in the recent new GBP800k contract

win to provide services from all three segments of the business

through a coordinated programme to a large fast-service food

restaurant across all its sites in the UK. Strong demand for the

Group's services has continued into the current year and as a

result the Board is confident of the outlook for the business."

For more information:

REACT Group Plc Tel: +44 (0) 1283 550

Shaun Doak, Chief Executive Of cer 503

Andrea Pankhurst, Chief Financial Officer

Mark Braund, Chairman

Singer Capital Markets Tel: +44 (0) 207 496

(Nominated Adviser / Broker) 3000

James Moat / Philip Davies

IFC Advisory Tel: +44 (0) 20 3934

(Financial PR / IR) 6630

Graham Herring / Zach Cohen

Executive Chairman's Statement

For the year ended 30 September 2022

The Board of the REACT Group is pleased to report the Group

continues to deliver significant growth in the period under review,

both organically and as a result of the acquisition of LaddersFree,

thereby continuing to deliver material improvements in operational

performance and profit contribution.

The acquisition of LaddersFree in May 2022 creates yet another

step-change in the make-up of the Group's business, augmenting the

unique strengths of REACT's emergency cleaning services, Fidelis's

contract cleaning and facilities management services with

LaddersFree, one of the largest commercial window cleaning

businesses in the UK. As a result, the Group has strengthened its

capability across a number of important specialist cleaning

disciplines and has materially improved its financial operating

model through the addition of a high-margin, working capital-light,

rich seam of long-term contracted recurring revenues.

Details of the Group's performance is set out in reviews by the

Chief Executive and the Chief Financial Officer.

For the year ended 30 September 2022 (FY 22), Adjusted EBITDA1

on a consistent accounting basis was GBP953,000, up +20% on the

prior year, (2021: GBP795,000), on sales revenue of GBP13.70

million, up +78% on the prior year (2021: GBP7.70 million).

The Group performance represents strong like-for-like organic

growth of c.17% enhanced by the acquisition of LaddersFree in May

2022, which contributed to the second half of the financial

year.

Each segment of the business provides opportunities and

challenges, yet together they provide a unique value proposition;

that of a unique business providing a broad spectrum of specialist

cleaning services, to a consistently high standard across all

locations in the UK. This creates potential for upsell and

cross-sell, providing customers that require a quality solution

delivered across multiple locations at a cost-effective price with

a solution that is difficult to otherwise solve. An example of this

is demonstrated by the recent contract win announcement of

c.GBP800k per year to provide services from all three segments of

the business through a coordinated programme to a large

fast-service food chain across all its sites in the UK.

The financial model of the REACT Group has evolved from one of a

predominantly project orientated business with high margin but

inconsistent revenue flows to one that now has greater than 80% of

its revenues contracted and recurring alongside a balanced margin

that remains above market average. To this we add a consistent

ability to generate organic growth and with it, scale.

Our strategy for growth is clear; we will continue to build a

leading position across our business through fast-paced organic

growth and if the right opportunities present themselves, via

strategic acquisitions, to support our goal of becoming the

country's most trusted name in the provision of specialist

cleaning, decontamination, and hygiene services.

Mark Braund

Chairman

7 February 2023

1.- Adjusted EBITDA represents earnings before separately

disclosed acquisition and other restructuring costs (as well as

before interest, tax, depreciation and amortisation). This is a

non-IFRS measure.

Chief Executive Officer's Report and Strategic Review

I am pleased to report excellent progress in FY22.

REACT Group has delivered significant growth, both organically

and as a result of the acquisition of LaddersFree, whilst

continuing to deliver improvements in operational performance and

profit contribution.

We have materially improved our value proposition and our go to

market strategy.

We have made good progress in the reported period. Since the

acquisition of Fidelis in FY21, we have succeeded in growing the

business organically and have been awarded a number of new

contracts both large and small.

Organic growth for the Group during the period on a

like-for-like basis was 17%. As we have grown we have added

additional sales resource, specifically two senior sales people,

one of whom, Sam Haywood, has been recently promoted to Group Sales

Director.

The acquisition of LaddersFree has provided a step-change in

performance; a profitable, working capital-light business, with an

impressive client base, with almost all of its revenue being

contracted and recurring. With LaddersFree we see a material

opportunity to improve our go to market model, leveraging the

channels it sells and delivers through to provide additional value

add services to Customers.

A great example of this is the post period announcement of a

multi-year contract awarded to the Group worth GBP800k per year to

provide a twice yearly deep cleaning service to all the UK sites of

a well know fast service food chain, announced on 5th January

2023.

Like many others in this business environment, and despite the

strong performance, the business has witnessed certain headwinds,

which are being addressed. The reactive business slowed down coming

out of the prior year, FY21, which continued through to the

beginning of H2 22. We believe it to have been a post Covid issue,

a combination of two factors; opportunistic competition that had

temporarily entered the market to deal with demand for

decontaminations and, customer budget-fatigue where budgets had

been spent and in many cases over-spent during the worst period of

the pandemic. We are pleased to report that much of this disruption

has disappeared, demand has risen again as we returned to more

normal levels of reactive business towards the end of the year.

Importantly we continue to refine and improve the financial

model of our business, focusing sales and acquisitions on the

growth of profitable long term recurring revenue contracts.

The business model has advanced significantly form of 3-4 years

ago, which was predominantly reactive, less profitable and with

little in the way of recurring revenue contracts, to a business

where our recurring revenues in FY22 were c83% of total Group

revenue.

With a full year of contribution from LaddersFree included in

the new financial year we anticipate this to improve further to

greater than 86%.

As we develop our unique proposition, we continue to build a

number of compelling customer case studies in our most important

market sectors. These help verify the quality of our work and

provide reassurance to new customers who place trust in our

capability.

I am pleased to report excellent progress in FY22.

Strategy

Our strategy for growth is clear; we will continue to build a

leading position across our business through fast-paced organic

growth and if the right opportunities present themselves, via

strategic acquisitions to support our goal of becoming the

country's most trusted name in the provision of specialist

cleaning, decontamination, and hygiene services.

Whilst we actively pursue opportunities across each sector of

our business, we continue to focus on enhancing our financial

operating model by securing recurring revenue from contracted

relationships.

We continue to invest in sales and marketing to engage with the

large addressable market for our services. This includes further

developing our use of the right sales and marketing tools.

The successful acquisition of LaddersFree presents further

opportunities for the Group to grow;

1. By applying the Group's disciplined outbound sales &

marketing engine to the core LaddersFree business, which had

previously grown with limited outbound sales & marketing effort

prior to acquisition.

2. By cross-selling and up-selling within the Group's extended

list of customers (including those of LaddersFree) the range of

specialist cleaning services that the Group can uniquely deploy on

a nationwide basis.

In addition to scaling the business we continue to look at

operational efficiencies as a means to improve operating margins.

We see opportunities to add better technology and automation to

further simplify operational procedures at the same time as

improving scalability and resilience.

Key Performance Indicators (KPIs)

Financial : The key financial indicators are as follows:

2022 2021

Revenue GBP13.67m GBP7.70m

Gross margin 23.8% 30.8%

Earnings before Interest, Tax, Depreciation GBP410,000 GBP378,000

& Amortisation (EBITDA)

(Loss)/Profit from continuing operations (GBP158,000) GBP806,000

before acquisition and restructuring costs

Acquisition and restructuring costs GBP543,000 GBP417,000

(Loss)/Profit from continuing operations (GBP701,000) GBP389,000

after acquisition and restructuring

costs

Cash and cash equivalents GBP979,000 GBP633,000

============== ============

The Board recognises the importance of KPIs in driving

appropriate behaviours and enabling the monitoring of Group

performance.

The Group reports three main areas of business; firstly,

Contract Maintenance, where the Company delivers regular cleaning

regimes, (such as in the healthcare, education, retail and public

transport sectors); secondly Contract Reactive, where the Company

is the first responder to an on-call emergency response service

operating under a formal contract or framework agreement, typically

24-hours a day, 7-days per week, 365-days of the year. These two

areas together are recurring in nature, have continued to grow at

pace and represented c83% of revenue in FY22.

The third area is Ad Hoc, where REACT provides a solution to

one-off situations outside a framework agreement, such as for fly

tipping, void clearance, and decontaminations.

Contract maintenance represents strong recurring revenue and

income streams from typically long-term contracts. This is a key

area of strategic growth for the Group, one from which most of our

organic growth during the period has come from. It remains our

focus as we continue to drive long-term value and resilience in our

financial operating model.

Non-financial: The Board continues to monitor and improve

customer relationships, the motivation and retention of employees

as well as service quality and brand awareness.

Outlook

Momentum from the final few months of the previous year has

continued into the new financial year, and despite the usual slow

down across the festive period, the first quarter has delivered a

record performance for the Group.

Our value proposition has materially expanded and improved, as

has our access to market.

We are ambitious, aiming to continue our drive towards a

high-performance culture placing our colleagues and customers at

the heart of our business. Our go to market model continues to

evolve. We continue to develop a strong data base of prospective

customers using highly efficient sales & marketing tools.

Through our focused efforts and competitive service proposition

the business remains committed to leveraging both existing

relationships and new ones to help underpin our ambitious growth

strategy and upward trend of sustainable profitability. We believe

the Group is well placed to deliver another exciting year of

growth.

I would like to thank our customers for their continued support

and confidence in the Group to deliver the services they need, when

and where they are needed.

Finally, and on behalf of the Board, I wish to thank all of my

colleagues across the Group, including our new colleagues from

LaddersFree, for their dedication, hard work and tenacity. Our

performance as a team is a reflection of their commitment and

talent. I very much look forward to working with them in 2023 and

beyond.

Shaun D Doak

Chief Executive Officer

7 February 2023

Chief Financial Officer's Report

Revenue and profitability

Revenue for year ended 30 September 2022 was GBP13.7m, +78% up

on the prior year (2021: GBP7.7m). The current year figures include

a full 12 months' results from Fidelis, (2021: 6 months) and 4 1/2

months' results from LaddersFree following its acquisition in May

2022. Taking into account the performance of both trading companies

for the full prior year period, this represents like-for-like

organic growth of approximately +17%.

These revenues generated a gross profit contribution of GBP3.3m,

up +37% on the prior year (2021: GBP2.4m). On a like-for-like

basis, there was a reduction in gross profit of approximately (8)%

which is due to a change in the mix of work, as the group is

focusing more on winning longer term Contract Maintenance work,

rather than relying on higher margin (but less predictable) Ad Hoc

work.

The financial statements are prepared according to the

accounting standards and regulations that apply to the Group. Some

additional measures are also included that are not defined by

International Financial Reporting Standards (IFRS). The directors

believe that these measures, together with comparable IFRS measures

provide additional meaningful information for communicating the

year-on-year underlying performance of the Group. Non-IFRS measures

should not be considered as a substitute for the financial

information presented in compliance with IFRS.

Adjusted EBITDA on a consistent accounting basis was GBP953,000,

up +20% on the prior year (2021: GBP795,000). Adjusted EBITDA is a

non-IFRS measure and means operating profit before interest, tax,

depreciation and amortisation and excludes separately disclosed

acquisition and other costs. The directors believe that adjusted

EBITDA and adjusted measures of earnings per share provide

shareholders with a meaningful representation of the underlying

earnings arising from the Group's core business.

The acquisition costs include the costs incurred in the

acquisition of LaddersFree and write-backs relating to the latest

calculation of deferred consideration for the acquisition of

Fidelis. As part of the annual review of goodwill values, it was

decided that an impairment of the purchased goodwill of Fidelis

would be prudent and this goodwill has been impaired by

GBP567,000.

Reconciliation of Profit before Tax to Adjusted EBITDA

2022 2021

GBP'000 GBP'000

(Loss)/Profit before Interest

and Tax (511) 114

Depreciation & Amortisation 921 264

EBITDA 410 378

Acquisition costs/write backs (24) 323

Impairment charge 567 -

Restructuring costs - 94

Adjusted EBITDA 953 795

========== ==========

Cash flow

Net cash at the year end totalled GBP979,000 (2021: GBP633,000).

During the year, consideration payments were made relating to both

the Fidelis and LaddersFree acquisitions. In addition to the funds

raised from the share issue in May 2022, the group also secured a 5

year GBP1.0m loan. Together with the invoice discounting facility

that is still in place, the Group now has sufficient flexibility to

deal with both normal fluctuations in business working capital and

to fund the future deferred consideration payments relating to the

two acquisitions. The terms of both deals include the payment of

deferred consideration amounts subject to certain financial

performance hurdles being met.

Based on the trading outlook for the next 12 months, it is not

anticipated that any further funding will be required. However, the

Board will continue to regularly monitor the Group's performance

and its overall cash position.

Cash flow

Net cash at the year end totalled GBP979,000 (2021: GBP633,000).

During the year, consideration payments were made relating to both

the Fidelis and LaddersFree acquisitions. In addition to the funds

raised from the share issue in May 2022, the Group also secured a 5

year GBP1.0m loan. Together with the invoice discounting facility

that is still in place, the Group now has sufficient flexibility to

deal with both normal fluctuations in business working capital and

to fund the future deferred consideration payments relating to the

two acquisitions. The terms of both deals include the payment of

deferred consideration amounts subject to certain financial

performance hurdles being met.

Based on the trading outlook for the next 12 months, it is not

anticipated that any further funding will be required. However, the

Board will continue to regularly monitor the Group's performance

and its overall cash position.

Taxation

The Group has reported a taxable loss but, has confidence that

there will be sufficient future taxable profits in the foreseeable

future to utilise its historic tax losses. It has retained its

deferred tax asset of GBP0.3m (2021: GBP0.3m).

Statement of financial position

The Group's balance sheet has strengthened with net assets at

the year end of GBP8,339,000 (2021: GBP2,788,000). The net assets

of LaddersFree at the point of acquisition totalled

GBP2,655,000.

Andrea Pankhurst

Chief Financial Officer

7 February 2023

Consolidated Statement of Comprehensive Income

For the year ended 30 September 2022

2022 2021

GBP'000 GBP'000

Continuing Operations

Revenue 13,671 7,701

Cost of sales (10,414) (5,332)

Gross profit 3,257 2,369

Other operating income - 19

Administrative expenses (3,768) (2,274)

Acquisition and restructuring income/costs

included in

administrative expenses (543) (417)

---------------------------------------------- ---------- ----------------

Operating (loss)/profit (511) 114

Finance (cost)/income (56) 16

Corporation tax (charge)/credit (134) 259

(Loss)/Profit for the year (701) 389

Other comprehensive Income - -

Total comprehensive (loss)/profit

for the year attributable to the equity

holders of the company (701) 389

========== ================

Basic and diluted earnings per share

- pence

Basic (loss)/earnings per share (0.09)p 0.08p

========== ================

Diluted (loss)/earnings per share (0.09)p 0.07p

========== ================

Consolidated Statement of Financial Position

As at 30 September 2022

2022 2021

ASSETS GBP'000 GBP'000

Non-current assets

Intangible assets - Goodwill 4,209 1,940

Intangible assets - Other 5,680 1,028

Property, plant & equipment 203 176

Right-of-use assets 100 95

Deferred tax asset 244 244

10,436 3,483

Current assets

Stock 11 12

Trade and other receivables 4,254 2,099

Cash and cash equivalents 979 633

5,244 2,744

TOTAL ASSETS 15,680 6,227

========= =========

EQUITY

Shareholders' Equity

Called-up equity share capital 2,624 1,270

Share premium account 10,905 6,028

Reverse acquisition reserve (5,726) (5,726)

Capital redemption reserve 3,337 3,337

Merger relief reserve 1,328 1,328

Share-based payments 44 23

Accumulated losses (4,173) (3,472)

Total Equity 8,339 2,788

--------- ---------

LIABILITIES

Current liabilities

Trade and other payables 4,391 2,598

Lease liabilities within one year 57 54

Corporation tax 271 80

4,719 2,732

Non-current liabilities

Lease liabilities after one year 53 49

Other creditors after one year 2,569 658

2,622 707

TOTAL LIABILITIES 7,341 3,439

--------- ---------

TOTAL EQUITY AND LIABILITIES 15,680 6,227

========= =========

These financial statements were approved and authorised for

issue by the Board of Directors on 7 February 2023.

.

Consolidated Statement of Changes in Equity

For the year ended 30 September 2022

Share Share Merger Capital Reverse Share-Based Accumulated Total

capital Premium Relief Redemption Acquisition Payments Deficit Equity

Reserve Reserve Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 October

2020 1,246 5,852 1,328 3,337 (5,726) 15 (3,861) 2,191

Issue of

shares 24 176 - - - - - 200

Share-based

payments - - - - - 8 - 8

Effect of - - - - - - - -

adoption

of IFRS16

Profit for the

year - - - - - - 389 389

At 30

September

2021 1,270 6,028 1,328 3,337 (5,726) 23 (3,472) 2,788

========== ========== ========== ============= ============== ============== ============== =========

Issue of

shares 1,354 4,877 - - - - - 6,231

Share-based

payments - - - - - 21 - 21

Effect of - - - - - - - -

adoption

of IFRS16

(Loss)/Profit

for the year - - - - - - (701) (701)

At 30

September

2022 2,624 10,905 1,328 3,337 (5,726) 44 (4,173) 8,339

========== ========== ========== ============= ============== ============== ============== =========

Share capital is the amount subscribed for shares at nominal

value. Share premium represents amounts subscribed for share

capital in excess of nominal value.

Share premium represents the amount subscribed for shares in

excess of the nominal value, net of any directly attributable issue

costs.

Merger relief reserve arises from the 100% acquisition of REACT

SC Holdings Limited and REACT Specialist Cleaning Limited in August

2015 whereby the excess of the fair value of the issued ordinary

share capital issued over the nominal value of these shares is

transferred to this reserve in accordance with section 612 of the

Companies Act 2006.

Accumulated deficit represents the cumulative losses of the

Group attributable to the owners of the company.

Reverse acquisition reserve is the effect on equity of the

reverse acquisition of REACT Specialist Cleaning Limited.

The capital redemption reserve represents the value of deferred

shares cancelled as a result of a share buyback.

The share-based payments reserve represents the cumulative

expense in relation to the fair value of share options and warrants

granted.

Consolidated Statement of Cash Flows

For the year ended 30 September 2022

2022 2021

GBP'000 GBP'000

Cash flows from operating activities

Cash generated by operations (773) 432

Net cash outflow)/inflow from operating

activities (773) 432

--------- ---------

Cash flows from financing activities

Proceeds of share issue 6,500 200

Expenses of share issue (269) -

Lease liability payments (80) (39)

Bank loans 902 67

Interest paid (56) -

Net cash inflow from financing activities 6,997 228

--------- ---------

Cash flows from investing activities

Disposal of fixed assets 20 6

Capital expenditure (115) (71)

Acquisition of subsidiary (7,776) (1,930)

Exceptional acquisition costs paid (543) (200)

Net cash outflow from investing activities (8,414) (2,195)

--------- ---------

(Decrease)/Increase in cash, cash

equivalents and overdrafts (2,190) (1,535)

Cash, cash equivalents and overdrafts

at beginning of year 633 1,783

Cash on acquisition of subsidiaries 2,536 385

Cash, cash equivalents and overdrafts

at end of year 979 633

========= =========

Notes to the Consolidated Statement of Cash Flows

For the year ended 30 September 2022

1. Reconciliation of profit for the year to cash outflow from operations

2022 2021

GBP'000 GBP'000

(Loss)/Profit after taxation (701) 389

Decrease/(Increase) in stocks 1 (12)

(Increase) in trade and other

receivables (2,155) (1,010)

Increase in trade and other payables 374 655

Depreciation and amortisation

charges 921 264

Impairment charge 567 -

Finance costs/(income) 56 (16)

Tax charge/(credit) 134 (259)

Acquisition assets acquired (excluding

cash) 119 95

Exceptional acquisition costs (24) 323

Loss/(Profit) on disposal of

fixed assets (6) (5)

Share based payment 21 8

Tax paid (80) -

Net cash (outflow)/inflow from

operations (773) 432

========== ==========

2. Cash and cash equivalents

2022 2021

GBP'000 GBP'000

Cash at bank and in hand 979 633

=========== ===========

Notes to the Financial Statements

For the year ended 30 September 2022

1. General Information

Basis of preparation and consolidation

The Company is a public company, limited by shares, based in the

United Kingdom and incorporated in England and Wales. Details of

the registered office, the officers and advisors to the Company are

presented on the Company Information page at the start of this

report.

The consolidated financial statements present the results of the

company and its subsidiaries ('the Group') as if they formed a

single entity. Intercompany transactions and balances between Group

companies are therefore eliminated in full. Where the company has

control over an investee, it is classified as a subsidiary. The

company controls an investee if all three of the following elements

are present: power over the investee, exposure to variable returns

from the investee, and the ability of the investor to use its power

to affect those variable returns. Control is reassessed whenever

facts and circumstances indicate that there may be a change in any

of these elements of control.

The functional and presentational currency of the Group is

pounds sterling. The figures presented have been rounded to the

nearest one thousand pounds.

The equity structure appearing in the Group financial statements

reflects the equity structure of the legal parent, REACT Group PLC,

including the equity instruments issued in order to effect reverse

acquisition accounting. The merger relief reserve represents a

premium on the issue of the ordinary shares for the acquisition of

subsidiary undertakings. The relief is only available to the

issuing company securing at least a 90% equity holding in the

acquired undertaking in pursuance of an arrangement providing for

the allotment of equity shares in the issuing company on terms that

the consideration for the shares allotted is to be provided by the

issue of equity shares in the other company.

2. Accounting Policies

Statement of compliance

The consolidated financial statements of REACT Group PLC have

been prepared in accordance with UK adopted International Financial

Reporting Standards (IFRSs), International Accounting Standards

(IASs) and International Financial Reporting Interpretations

Committee (IFRIC) interpretations (collectively 'IFRSs') and as

issued by the International Accounting Standards Board and with

those parts of the Companies Act 2006 applicable to companies

reporting under IFRS.

Basis of preparation

The financial statements have been prepared under the historical

cost convention. The principal accounting policies are summarised

below. They have all been applied consistently throughout the year

under review.

Going concern

Following its review of the Group's financial plans and forecast

growth, the cash balance held at the year end and the management

team currently in place, the Board has a good expectation that the

Group has adequate resources to continue in operational existence

for the foreseeable future. Therefore, the financial statements do

not include any adjustments that would result if the Group was

unable to continue as a going concern.

New , amended standards, interpretations not adopted by the

Group

Th e following Adopted IFRSs have been issued but have not been

applied by the Group in these Financial Statements. The full impact

of their adoption has not yet been fully assesse d; however,

management do not expect the changes to have a material effect on

the Financial Statements unless otherwise indicated:

-- IAS37 amendments regarding onerous contracts (1 January 2023)

-- IAS16 amendments regarding proceeds before intended use (1 January 2023)

-- IFRS17 Insurance contracts (1 January 2023)

-- IAS1 amendments on classification (1 January 2023)

-- IAS8 amendments on accounting estimates (1 January 2023)

-- IAS12 amendments on deferred tax (1 January 2023)

Revenue recognition

Revenue is recognised in accordance with the requirements of

IFRS 15 'Revenue from Contracts with Customers'. The Company

recognises revenue to depict the transfer of promised goods and

services to customers in an amount that reflects the consideration

to which the entity expects to be entitled in exchange for those

goods or services. This core principle is delivered in a five-step

model framework:

1. Identify the contract(s) with the customer;

2. Identify the performance obligations in the contract;

3. Determine the transaction price;

4. Allocate the transaction price to the performance obligations

in the contract; and

5. Recognise revenue when (or as) the entity satisfy a

performance obligation.

The Group recognises revenue in the accounting period in which

its services are rendered, by reference to stage of completion of

the specific transaction and assessed on the basis of the actual

service provided as a proportion of the total services to be

provided. Revenues exclude intra-group sales and value added taxes

and represent net invoice value less estimated rebates, returns and

settlement discounts. The net invoice value is measured by

reference to the fair value of consideration received or receivable

by the Group for goods supplied.

3. Segmental Reporting

In the opinion of the Directors, the Group has one class of

business, being that of specialist cleaning and decontamination

services, including both contracted commercial cleaning and

specialist emergency decontamination work . Although the Group

operates in only one geographic segment, which is the UK, it has

also analysed the sources of its business into the segments of

Contract Maintenance, Contract Reactive or Ad Hoc work

2022 2021

Contract Contract Ad Hoc Total Contract Contract Ad Hoc Total

Maintenance Reactive Work Maintenance Reactive Work

Work Work Work Work

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 8,939 2,499 2,233 13,671 3,992 1,587 2,122 7,701

Cost of Sales (6,809) (2,007) (1,598) (10,414) (3,101) (1,072) (1,159) (5,332)

Gross Profit 2,130 492 635 3,257 891 515 963 2,369

Other Operating

Income - - - - 17 1 1 19

Administrative

Expenses (2,171) (703) (894) (3,768) (814) (557) (903) (2,274)

Operating

(Loss)/Profit

for the year (41) (211) (259) (511) 94 (41) 61 114

============= ========== ========= ========== ============= ========== ========= =========

Adjusted EBITDA

(1) 866 30 57 953 660 (290) 425 795

Total Assets 14,257 486 938 15,681 2,327 1,366 2,534 6,227

============= ========== ========= ========== ============= ========== ========= =========

Total

Liabilities (6,767) (230) (445) (7,442) (1,340) (707) (1,392) (3,439)

============= ========== ========= ========== ============= ========== ========= =========

1. Adjusted EBITDA represents earnings before separately

disclosed acquisition and other restructuring costs (as well as

before interest, tax, depreciation and amortisation). This is a

non-IFRS measure.

4. Business Combinations during the period

On 11 May 2022, the Group acquired 100% of the issued share

capital and voting rights of LaddersFree Ltd ('LaddersFree'), an

established nationwide commercial window, gutter and cladding

cleaning business headquartered in Devon providing services to

customers across the entire UK. The acquisition is expected to

diversify the group's service offering and reduce costs through

economies of scale.

LaddersFree was acquired for an initial consideration of

GBP5.65m, payable as GBP4.65m cash and GBP1.0m through the issue of

new ordinary shares, with contingent consideration of up to

GBP2.85m payable subject to LaddersFree fulfilling certain profit

criteria. Surplus cash balances on acquisition totalled

GBP2.54m.

The fair value of the acquired customer list and customer

contracts has been assessed as at 30 September 2022. The goodwill

that arose on the combination can be attributed to the synergies

expected to be derived from the combination and the value of the

workforce of LaddersFree which cannot be recognised as an

intangible asset. The fair value of the contingent consideration

arrangement was estimated calculating the present value of the

future expected cash flows.

Acquisition costs of GBP455,000 are not included as part of the

consideration transferred and have been recognised as an expense in

the Consolidated Statement of Comprehensive Income.

a) Subsidiaries acquired

Name LaddersFree Ltd

Principal activity Commercial window, gutter

and cladding cleaning services

Date of acquisition 11 May 2022

Proportion of voting equity interests

Acquired 100%

Consideration transferred GBP10,885,584

GBP'000

b) Consideration transferred

Cash 7,186

Equity issued 1,000

Contingent consideration arrangement (included

in Other Creditors) 2,700

Total consideration transferred 10,886

--------------------

Assets and liabilities recognised on the date

c) of acquisition

Separately identifiable intangible assets arising

on business combination 5,395

Non-current assets 13

Current assets 3,308

Non-current liabilities -

Current liabilities (666)

Net assets acquired 8,050

--------------------

d) Goodwill arising on acquisition

Consideration transferred 10,886

Fair value of identifiable net assets acquired (8,050)

Goodwill acquired 2,836

--------------------

e) Net cash outflow on acquisition

Consideration paid in cash 7,186

Less: cash balances acquired (2,536)

4,650

--------------------

f) Impact of acquisition on the results of the Group

The acquired business contributed revenues of GBP1,629,000

and net profit of GBP585,000 to the group for the period

from 11 May 2022 to 30 September 2022.

If the acquisition had occurred on 1 October 2021, pro-forma

revenue and net profit contributions to the Group for the

year ended 30 September 2022 would have been GBP4,042,000

and GBP1,075,000 respectively. These amounts have been calculated

using the subsidiary's results and adjusting them for differences

in the accounting policies between the group and the subsidiary.

5. Income Tax

2022 2021

GBP'000 GBP'000

Current tax charge 134 -

Deferred tax credit - 259

Tax credit/(charge) 134 259

========= =========

Analysis of tax expense:

2022 2021

GBP'000 GBP'000

(Loss)/Profit on ordinary activities before income tax (567) 130

========== ==========

(Loss)/Profit on ordinary activities multiplied by the standard rate of corporation

tax in

UK of 19% (2021: 19%) (108) 25

Effects of:

Fixed asset differences 21 (4)

Amortisation and depreciation not deductible for tax - -

(Decrease)/Increase in net losses carried forward 221 (280)

Corporation tax charge/(credit) 134 (259)

========== ==========

The Group has estimated excess management expenses carried forward of GBP1.3m (2021: GBP1.3m)

and trading losses of approximately GBP0.9m (2021: GBP0.6m) available to use against future

profits. The tax losses have resulted in a deferred tax asset of approximately GBP0.3m (2021:

GBP0.3m) being as the positive trading outlook for the Group means that there is likely to

be sufficient future taxable profits to utilise the losses. The remaining losses of GBP884,000

resulting in a deferred tax asset of GBP221,000 have not been recognised in order to be prudent.

6. Earnings per Share (basic and adjusted)

The calculations of earnings per share (basic and adjusted) are

based on the net profit and adjusted profit respectively and the

ordinary shares in issue during the year. The adjusted profit

represents the EBITDA for the year. For diluted earnings per share,

the weighted average number of shares is adjusted to assume

conversion of all dilutive potential ordinary shares.

2022 2021

GBP'000 GBP'000

Net (loss)/profit for year (701) 389

============= =============

Adjustments:

Interest 56 (16)

Depreciation & amortisation 921 264

Tax 134 (259)

Adjusted profit for the year 410 378

============= =============

Number Number

Weighted average shares in issue

for basic earnings per share 718,622,464 503,348,752

Weighted average dilutive share

options and warrants 62,247,272 62,247,272

Average number of shares used for

dilutive earnings per share 780,869,736 565,596,024

============= =============

Pence Pence

Basic (loss)/earnings per share (0.09)p 0.08p

============= =============

Diluted (loss)/earnings per share (0.09)p 0.07p

============= =============

Adjusted basic earnings per share 0.06p 0.08p

============= =============

Adjusted diluted earnings per share 0.05p 0.07p

============= =============

7. Intangible assets

Group Goodwill Customer List Total

GBP'000 GBP'000 GBP'000

Cost

At 1 October 2020 1,280 - 1,280

Additions 1,766 1,175 2,941

Disposals - - -

As at 30 September 2021 3,046 1,175 4,221

Additions 2,836 5,395 8,231

Disposals - - -

As at 30 September 2022 5,882 6,570 12,452

---------- --------------- ---------

Amortisation and impairment

As at 1 October 2020 1,106 - 1,106

Amortisation charge for the year - 147 147

Disposals - - -

As at 30 September 2021 1,106 147 1,253

Amortisation charge for the year - 743 743

Impairment charge 567 - 567

Disposals - - -

As at 30 September 2022 1,673 890 2,563

---------- --------------- ---------

Carrying amount

As at 1 October 2020 174 - 174

========== =============== =========

As at 30 September 2021 1,940 1,028 2,968

========== =============== =========

As at 30 September 2022 4,209 5,680 9,889

========== =============== =========

The goodwill relates to intangible assets that do not qualify

for separate recognition on the acquisition of LaddersFree during

the year, Fidelis during the prior year and previously, the REACT

specialist cleaning services business, an unincorporated division

of Autoclenz Limited.

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired, by considering the net

present value of discounted cash flow forecasts. Goodwill has been

allocated for impairment testing purposes to the individual

businesses acquired which are also the cash--generating units

("CGU") identified. The recoverable amount of a CGU is determined

based on value in use calculations using cash flow projections

based on financial budgets approved by the Directors. The

projections are based on the assumption that the company can

realise projected sales. A prudent approach has been applied with

no residual value being factored into these calculations. If the

projected sales do not materialise there is a risk that the total

value of the intangible assets shown above would be impaired. A

pre-tax discount rate of 15% per annum has been applied to the

cashflow projections, taking into consideration the expected rate

of return and various risks relating to the CGU.

As at 30 September 2022 management judged that an impairment was

required in respect of the goodwill of Fidelis. A write-down of

GBP567,000 is considered prudent in light of the medium-term growth

outlook for this business.

The key assumptions used in the estimation of the revised value

of Purchased Goodwill are set out below. The values assigned to the

key assumptions represent management's assessment of future

revenues and cash flows of the CGU. The most recent financial

results and forecast approved by management for the next five years

were used and a nil terminal growth rate thereafter. The projected

results were discounted at a rate which is a prudent evaluation of

the time value of money and the risks specific to the CGU.

Key assumptions used:

%

Average revenue growth rate (of next five

years) 5

Terminal value growth rate 0

Discount rate 15

8. Investment in subsidiary undertakings

Company

Cost

At 1 October 2021 1,560

Additions -

At 30 September 2022 1,560

=======

Impairment

At 1 October 2021 1,386

Impairment charge for the year -

At 30 September 2022 1,386

=======

Carrying amount

At 30 September 2021 174

=======

At 30 September 2022 174

=======

9. Trade and other receivables

Current Note Group Group Company Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Trade receivables 3,522 1,702 - -

Provision for impairment 15 (5) (5) - -

Net trade receivables 3,517 1,697 - -

Amounts owed by Group undertakings - - 10,138 2,846

Prepayments and accrued income 702 378 9 13

Other debtors 35 24 27 19

4,254 2,099 10,174 2,878

========= ========= ========= =========

Trade receivables are amounts due from customers for services

performed in the ordinary course of business. The Group's

impairment and other accounting policies for trade and other

receivables are outlined in note 2.

10. Provision for impairment of receivables

Provision for impairment of receivables Group Group

Relating to debt over 3 months past due

2022 2021

GBP'000 GBP'000

Opening provision 5 42

Amounts released in the year - (36)

Amounts utilised in the year - (1)

Closing provision 5 5

========= =========

There are no receivables in the Company, as all are held by the

trading subsidiaries, REACT Specialist Cleaning Limited, Fidelis

Contract Services Ltd and LaddersFree Ltd.

As at 30 September 2022, excluding balances provided for by the

impairment provision, GBP560,000 (2021: GBP174,000) of trade

receivables were past their due settlement date but not

impaired.

The ageing analysis of these trade receivables is as

follows:

2022 2021

GBP'000 GBP'000

Up to 3 months past due 175 87

3 to 6 months past due 96 27

Over 6 months past due 289 60

560 174

=============== ===============

The expected credit loss is respect of debt not due and past due

is considered immaterial.

11. Cash and cash equivalents

Group Group Company Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Cash and bank balances 979 633 4 22

========= ========= ========= =========

12. Trade and other payables

Group Group Company Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Current:

Trade payables 1,284 378 34 35

* Accrued expenses 664 639 39 21

Social security and

other taxes 852 523 30 23

Lease liability <12

months 57 54 9 28

Other creditors 1,430 991 - 5

Loans 161 67 161 -

Corporation tax payable 271 80 - -

4,719 2,732 273 112

Non-current:

Lease Liability >12

months 53 49 17 26

Loans 808 - 808

Other liabilities

>12 months - Deferred

Consideration 1,761 658 - -

Deferred Tax - - - -

2,622 707 825 26

7,341 3,439 1,098 138

========= ========= ========= =========

13. Deferred Tax

Deferred tax is provided, using the liability method, on

temporary differences at the statement of financial position date

between the tax base of assets and liabilities and their carrying

amounts for financial reporting purposes. Deferred tax is

calculated in full on temporary differences under the liability

method using a tax rate of 25% (2021:19%), the movement on the

deferred tax liability is as shown below:

Group Group Company Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

At 1 October 244 - 152 -

Income credit - 259 - 152

Liability acquired - (15) - -

At 30 September 244 244 152 152

========= ========= ========= =========

The deferred taxation asset is made up as follows:

Group Group Company Company

2022 2021 2022 2021

GBP'000 GBP'000 GBP'000 GBP'000

Accelerated capital

allowances (32) (5) - -

Tax losses carried forward 262 110 - -

Other short-term timing

differences 14 139 152 152

244 244 152 152

========= ========= ========= =========

14. Annual Report

The annual report and accounts for the year ended 30 September

2022 will be posted to shareholders in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UPURPPUPWPPQ

(END) Dow Jones Newswires

February 07, 2023 02:00 ET (07:00 GMT)

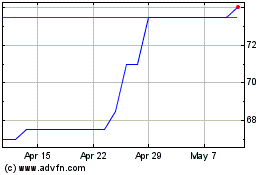

React (LSE:REAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

React (LSE:REAT)

Historical Stock Chart

From Jul 2023 to Jul 2024