TIDMRKH

RNS Number : 6743J

Rockhopper Exploration plc

09 April 2015

9 April 2015

Rockhopper Exploration plc

("Rockhopper" or the "Company")

Final Results for the Nine Months Ended 31 December 2014

Rockhopper Exploration plc (AIM: RKH), the oil and gas

exploration and production company with interests in the North

Falkland Basin and the Greater Mediterranean region, is pleased to

announce its final results for the nine months ended 31 December

2014.

Highlights

During the Period:

-- Rig secured for four well exploration drilling campaign in the North Falkland Basin

-- Phased, lower cost development solution adopted for the Sea Lion field

-- Revised commercial arrangements agreed with Premier Oil

(subject to negotiation of fully termed documentation)

-- Completion of recommended offer for Mediterranean Oil & Gas plc

-- Progressing recently acquired Greater Mediterranean portfolio

o Plans advancing to increase production at Guendalina

o Civita onshore gas project sanctioned

o Award of acreage in first Croatian offshore licensing

round

-- Cash resources at 31 December 2014 of $200 million

Post 31 December 2014:

-- North Falkland drilling campaign commenced

o Exploration success at Zebedee well

o Isobel Deep well spudded

-- Confirmation of Falkland Island Capital Gains Tax Liability Deferment

Pierre Jungels, Chairman of Rockhopper, commented:

"The Zebedee well result represents a fantastic start to the

2015 Falklands drilling campaign and provides early proof of the

significant remaining potential in the North Falkland Basin.

The adoption of a phased, lower cost development solution for

Sea Lion significantly de-risks the project and should allow us to

capture further cost savings as we progress through the FEED and

draft FDP submission processes in 2015 and early 2016.

Since the acquisition of Mediterranean Oil & Gas plc, steady

progress has been made in advancing the Mediterranean portfolio.

Our recent Croatian offshore licence award represents an

outstanding low cost opportunity to increase our acreage position

in an area with proven hydrocarbons.

Rockhopper's balance sheet remains strong and the Company is

well placed to take advantage of potential growth opportunities

which may present themselves as a result of the current market

environment."

For further information, please contact:

Rockhopper Exploration plc

Tel: (via Vigo Communications) - 020 7016 9571

Sam Moody - Chief Executive

Fiona MacAulay - Chief Operating Officer

Stewart MacDonald - Chief Financial Officer

Canaccord Genuity Limited (NOMAD and Joint Broker)

Tel: 020 7523 8000

Henry Fitzgerald-O'Connor

Liberum Capital (Joint Broker)

Tel: 020 3100 2227

Clayton Bush

Vigo Communications

Tel: 020 7016 9571

Peter Reilly

Patrick d'Ancona

Chairman and Chief Executive Officer's Review

Despite a difficult commodity price backdrop, Rockhopper has had

a busy period both in building up to a new exploration campaign in

the Falklands whilst continuing to further progress the Sea Lion

development.

The dramatic fall in the global price of oil during the second

half of 2014 introduced significant risks and challenges for the

wider industry with a resultant impact on sentiment towards the

listed oil & gas sector.

However, Rockhopper responded quickly to the changing market

environment, most notably, through the adoption of a revised

development concept on Sea Lion and is now well placed to capture

the opportunities that are likely to emerge as a result. Such

opportunities include capturing lower costs for the Sea Lion

project and leveraging our relative balance sheet strength to

target value accretive growth opportunities.

Our long anticipated exploration campaign has now commenced and

Rockhopper will participate in all four wells drilled in the North

Falkland Basin. This campaign, which we believe is probably one of

the most exciting taking place across the industry in 2015,

commenced with the successful Zebedee well which initial management

estimates suggest discovered in excess of 50 mmbbls recoverable oil

in the Zebedee reservoir alone. Work is ongoing to determine the

upside in the Hector and Ninky South reservoirs.

In addition, we were pleased to finalise our tax deferral

arrangements with the Falkland Island Government which is addressed

in more detail in the Chief Financial Officer's Review.

North Falkland Exploration Campaign commenced

Having retained the subsurface lead for exploration in our joint

venture with Premier, we are delighted that our 2015 North Falkland

exploration campaign, which has been years in the planning, has now

commenced.

In June 2014, we announced that the Eirik Raude drilling unit

had been contracted for a joint campaign across the North and South

Falkland Basins. A temporary dock facility located in Stanley

Harbour has been built to support the exploration campaign. The rig

commenced mobilisation from West Africa in late January 2015 and

arrived in Falklands water in late February, ahead of schedule.

The exploration campaign will consist of at least four wells in

the North Falkland Basin ("NFB"), with each well targeting multiple

stacked fans in licences PL004 and PL032.

Planned drilling order

Well RKH% Location

------------------------ ------ ----------------------

1 Zebedee 24.0% NFB, Licence PL004b

------------------------ ------ ----------------------

2 Isobel Deep 24.0% NFB, Licence PL004a

------------------------ ------ ----------------------

3 Humpback 0.0% SFB, southern licence

area

------------------------ ------ ----------------------

4 Jayne East 24.0% NFB, Licence PL004c

------------------------ ------ ----------------------

5 Chatham 40.0% NFB, Licence PL032

------------------------ ------ ----------------------

6 Second Noble operated 0.0% South or East FB,

well to be decided

------------------------ ------ ----------------------

On 2 April 2015, we were delighted to announce that the Zebedee

well had successfully made an oil & gas discovery, encountering

27.9 metres of net oil pay and 18.5 metres of net gas pay. The

second well in the program, Isobel Deep, was spudded on 8

April.

As a result of accessing the full Exploration Carry from

Premier, Rockhopper's expected share of costs for the four wells in

PL004 and PL032 is estimated at $25 million.

Phased, lower cost development concept for Sea Lion

In November 2014, the company announced that a phased, lower

cost development solution for Sea Lion with the initial phase

targeting the commercialisation of approximately 160 mmbbls in the

North East segment of the field over a 15 year period.

The concept is likely to consist of 14 wells (comprising 8

producers, 5 water injectors and 1 gas producer/injector) with

production via a leased floating, production, storage and

offloading vessel ("FPSO") and will target a gross plateau of

50,000 to 60,000 barrels of oil per day from a single subsea drill

centre.

Based on cost analysis as at November 2014, the capital

expenditure to first oil for the initial phase is anticipated at

approximately $1.8 billion, significantly less than previous

estimates for the Tension Leg Platform ("TLP") concept. One direct

impact of the fall in oil prices is the reduction in the cost of

services to the industry - a good example of this is the day rate

for drilling rigs. Based on the November analysis, approximately a

third of Sea Lion project costs are estimated to be drilling costs

and we have seen these costs fall by between 30% and 40% since mid

2014. As the Sea Lion project progresses towards sanction over the

course of 2015 and early 2016 we anticipate taking advantage of the

weaker supply and service market to negotiate further cost savings

prior to project sanction.

Phase 1A cost estimates (Nov US$bn

2014)

------------------------------ ------

Pre-sanction 0.1

------------------------------ ------

SURF and installation 0.7

------------------------------ ------

Project management 0.4

------------------------------ ------

Pre-first oil drillex 0.6

------------------------------ ------

Total (pre-first oil) 1.8

------------------------------ ------

The project continues to make good progress through the pre-FEED

stage with over 80 people within the operator's Falkland Island

Business Unit contributing to various aspects of the project's

development. The joint venture partners approved a budget for

pre-sanction spend on Sea Lion during 2015 of $70 million

gross.

Looking ahead, a FEED contract award is expected in the second

quarter of 2015 with the submission of a draft Field Development

Plan ("FDP") to the Falkland Island Government ("FIG") anticipated

around the end of the year. Project sanction for the first phase of

development is targeted during mid 2016 and the precise timing will

be driven by not just the cost reductions that can be achieved but

the long-term oil price outlook at that time.

Premier has confirmed that while a project of this size could

likely be funded from existing facilities and cash flows, they will

continue to seek a partner for the Sea Lion development.

Revised commercial terms

In light of the move to a phased development, Rockhopper and

Premier have agreed to amend their commercial arrangements, under

which:

-- Rockhopper to access the full $48 million Exploration Carry for the 2015 drilling campaign

-- Rockhopper to fund its share of pre-sanction costs, currently

estimated at $100 million gross ($40 million net to Rockhopper)

-- Rockhopper to retain $337 million Development Carry for the

initial phase; a further $337 million Development Carry deferred to

the next phase of development

-- Existing Standby Finance arrangements to be simplified to a

more traditional loan of up to $750 million

The amendments outlined above are subject to negotiating fully

termed agreements but importantly, Rockhopper remains fully funded

through a combination of Development Carry and amended loan from

Premier.

As a consequence of the move to a phased development Rockhopper

and Premier have made a request to FIG to extend the validity of

the Discovery Area in PL032 to October 2016. Such request has been

approved by FIG and the Secretary of State and is currently being

documented.

Building a second core area in the Greater Mediterranean / North

Africa Region

In August 2014 we completed the acquisition of AIM listed

Mediterranean Oil & Gas plc ("MOG"). Through MOG, Rockhopper

acquired a portfolio of production, development and exploration

interests in Italy, Malta and France with a combined 2C contingent

resource of over 32 million barrels of oil equivalent. The

acquisition price represented less than $1 per barrel of oil

equivalent.

Since the acquisition of MOG, steady progress has been made in

advancing the portfolio and new legislation passed through the

Italian Parliament suggests that development projects in the

country should now be easier to progress.

Technical work on the Monte Grosso prospect in the Southern

Appennine confirms our view that this remains a highly attractive

exploration target, on trend with the world class Val D'Agri and

Tempa Rossa oil fields. Discussions continue with a wide variety of

stakeholders to expedite the planning and drilling process.

In addition, in January 2015 we were pleased to be awarded an

offshore Block in the Croatian licencing round in partnership with

Eni.

Outlook

The Zebedee well result represents a fantastic start to the 2015

Falklands drilling campaign and provides early proof of the

significant remaining potential of the North Falkland Basin.

The adoption of a phased, lower cost development solution for

Sea Lion significantly de-risks the project and should allow us to

capture further cost savings as we progress through the FEED and

draft FDP submission processes in 2015 and early 2016.

While the spot price for Brent oil today is below $60 per

barrel, when assessing the economics of projects such as Sea Lion

it is the long-term price outlook which is most important. We could

well find ourselves in a position that we will sanction Sea Lion in

a low oil price-low cost environment but start producing oil in

2019 or 2020 when the oil price could be materially higher.

Rockhopper's balance sheet remains strong with cash resources of

$200 million as at 31 December 2014 and the company is well placed

to take advantage of potential growth opportunities which may

present themselves as a result of the current market

environment.

Dr Pierre Jungels CBE Samuel Moody

Chairman Chief Executive Officer

8 April 2015

Chief Operating Officer's Review

NFB Exploration Commenced

Rockhopper were delighted to be able to announce in early April

2015 the results of the Zebedee Well (the first well of 2015

exploration programme in the North Falklands Basin) as a successful

oil and gas discovery.

Having retained the sub-surface lead for exploration in the farm

out to Premier Oil in 2012, Rockhopper had proposed a series of

well locations of which Zebedee was the first to be drilled. All

seven reservoir targets were penetrated on or close to prognosis

with an eighth reservoir (Ninky South) being tagged at its

margin.

Three of the eight sands were proven to be hydrocarbon bearing

through wireline logging and formation testing. A total of 18.5m of

net gas pay and 27.9m of net oil pay were encountered in the well

in sands of the F2 stratigraphic interval and good oil shows were

recorded throughout the deeper F3 stratigraphic section.

Hector

The Hector sand was encountered on prognosis near the crest of

the structure and penetrated a gross reservoir package of 27.6m.

Net gas pay was 18.5m and initial indications are of good reservoir

properties.

No gas oil contact was observed within the reservoir, and

pressure data indicates that the gas gradient is offset from the

gas gradient observed previously in the Beverley and Casper South

reservoirs. Hector therefore may be oil bearing in a downdip

location (the Hector 'oil rim') and potential oil volumes are being

generated. The well also proved an additional Pmean recoverable gas

resource of approximately 280bcf (approximately 50mmboe).

Zebedee

The Zebedee sand was encountered on prognosis, penetrating a

gross reservoir package of 29.3m with net oil pay of 25.3m. This

reservoir was the principal target of the well, and proves the

presence of a further fan system to the south of Sea Lion and the

previously discovered satellites.

The reservoir quality is amongst the best encountered to date

and no oil water contact was observed in the well. The entire

section of the Zebedee formation was cored and the results of core

data analyses will benefit the planning of the future

development.

Initial management estimates of discovered recoverable resources

in the Zebedee reservoir are in excess of 50 mmbbls.

Ninky South

In addition to the two principal reservoirs a further F2

reservoir was encountered above the Zebedee fan at 2,436.6m

measured depth which was also oil bearing. The well gross reservoir

thickness was 6.4m and net oil pay was 2.6m.

The sand, which Rockhopper currently map to form part of the

Ninky South prospect which is fully developed south of the well,

was tagged in a very marginal position and was not therefore

included in the pre-drill stack prognosis but which has the

potential to contain recoverable resources (within the better

developed reservoir area) of around 20mmbbls.

F3 Reservoirs

Whilst good oil shows were recorded throughout the F3 sequence

and the Parker, Catriona and Jayne West (Orinoco) reservoirs were

all penetrated, the reservoir quality at this location means that

only limited oil pay was measured. Wireline logs indicate 1.4m of

net oil pay developed in the Jayne West reservoir. The Company were

however much encouraged that there is an apparent deeper

hydrocarbon system operating to the south of Sea Lion.

Operations

The Zebedee well has now been plugged and abandoned as a

successful exploration well. The rig has now moved to the second

well of the campaign, the Isobel Deep well, which spudded on 8

April 2015.

The Isobel Deep well is located on licence PL004a in which

Rockhopper has a 24% working interest and is an exploration well on

the Isobel Deep prospect. This well will be the first test of the

F3 fan system entering the basin from the South East margin and

developed as a sequence of stacked reservoirs. This well will be

targeting the Isobel Deep fan in an area of maximum mapped

reservoir thickness and has a GCoS of 20%. The well is targeting

Gross Pmean resources of 72mmbbls (range 9 - 207mmbbls) although

the complex as a whole in this area has gross Pmean prospective

resources of just over 500mmbbls.

Drilling operations are expected to take approximately 30 days

and no coring or testing is planned for this well.

Success at Isobel Deep could, subject to partner agreement, lead

to a follow-on appraisal well on the wider Elaine/Isobel

complex.

Impact of exploration campaign on Sea Lion development

While the outcome of this exploration campaign, which has the

potential to significantly increase the discovered resource in the

North Falkland Basin, will have limited impact on the initial phase

of Sea Lion development, it will determine the shape of subsequent

development phases in the area.

In particular, in the event that the Chatham/West Flank gas cap

well is successful, we would expect to add at least 60 million

barrels gross to the already discovered 160 million barrels that we

expect to commercialise through Phase 1b.

The Phase 2 development will be impacted by success at Jayne

East while success at Isobel Deep expands the development area

significantly.

Building a Greater Mediterranean presence

In May 2014, Rockhopper announced a recommended cash and share

offer to acquire AIM listed Mediterranean Oil & Gas plc. The

transaction completed in August 2014.

Through the acquisition Rockhopper acquired 2P/2C resource base

of 32.5 million barrels of oil equivalent and a material portfolio

of producing, development, appraisal and exploration assets. Key

assets in the portfolio include:

Guendalina, Italy (Rockhopper 20%)

Operated by Eni, the Guendalina gas field, located in the

Northern Adriatic, has been on production since 25 October

2011.

Rockhopper are working closely with Eni to sidetrack one of the

two gas production wells on the Guendalina field that has been shut

in following damage to the wellbore experienced in 2012. The

sidetrack is anticipated to enhance production levels and is

currently scheduled to commence in Q4 2015.

Ombrina Mare, Italy (Rockhopper 100%)

Operated by Rockhopper, the Ombrina Mare oil & gas discovery

is an appraisal/development project located off the Abruzzo region

in the shallow waters of the Central Adriatic. Subject to necessary

approvals and the granting of the field concession permit,

Rockhopper would be hoping to be in a position to drill an

appraisal well on the field by the end of 2016 following which it

would be able to optimise the development plans for the asset.

Monte Grosso, Italy (Rockhopper 23%)

Operated by Rockhopper, the Monte Grosso oil prospect is located

in the Southern Appennine thrust-fold belt on trend with the

largest on shore oil production and development area in Western

Europe of Val D'Agri and Tempa Rossa. Monte Grosso remains one of

the largest undrilled prospects onshore in Western Europe and, with

its partners Eni and Total, Rockhopper is progressing the

permitting process to enable drilling.

Civita, Italy (Rockhopper 100%)

Operated by Rockhopper, the Civita gas field development is

located onshore Abruzzo in the Aglavizza concession. Development

activities are commencing for the pipeline and site facilities

construction, with the aim of production commencing in Q4 2015.

Area 3, Malta (Rockhopper 40%)

A 2D seismic survey was completed in April 2014 and the

processing of such seismic has recently been completed. The seismic

has identified a number of leads of sufficient size to potentially

be of interest. The joint venture has agreed to request a one year

extension of the Exploration Study Agreement prior to making a

decision to enter a Production Sharing Contract.

Block 9, Croatia (Rockhopper 40%)

In January 2015, Rockhopper was awarded a 40% interest in

offshore Block 9 in Croatia in partnership with Eni (60% interest

and operator). The block is located in the relatively shallow water

of the prolific Northern Adriatic gas province and contains the

previously discovered Ksenija accumulation along with the Klaudija

prospect. The anticipated work programme consists of seismic

acquisition, processing and re-processing during the first

exploration phase (3 years) with the drilling of a well in the

second exploration phase (if Rockhopper elects to proceed to the

second phase). Signature of a Production Sharing Contract with the

Croatian Hydrocarbon Authority is now expected in mid 2015.

Montenegro licensing round

Rockhopper has applied for acreage in the first offshore

licensing round in Montenegro. Rockhopper awaits the outcome of

such application but to date no awards have been made.

Fiona MacAulay

Chief Operating Officer

8 April 2015

Chief Financial Officer's Review

From a finance perspective, the most significant events of the

year include:

- Revision of the commercial terms for Sea Lion with Premier

- Confirmation of Falkland Island Capital Gains Tax Liability Deferment

- The acquisition of Mediterranean Oil & Gas plc ("MOG")

Revised commercial terms on Sea Lion

As outlined in the Chairman's and CEO's review, in light of the

move to a phased development, Rockhopper and Premier have agreed,

subject to negotiation of fully termed documentation and respective

board approvals, to amend their commercial arrangements, under

which:

-- Rockhopper to access the full $48 million Exploration Carry for the 2015 drilling campaign

-- Rockhopper to fund its share of pre-sanction costs, currently

estimated at $100 million gross ($40 million net to Rockhopper)

-- Rockhopper to retain $337 million Development Carry for the

initial phase; a further $337 million Development Carry deferred to

the next phase of development

-- Existing Standby Finance arrangements to be simplified to a

more traditional loan of up to $750 million

Documentation of the revised commercial arrangements is

progressing.

Based on the Operator's November 2014 cost estimates, capital

expenditure to first oil on Sea Lion is expected to be $1.8 billion

gross ($720 million net to Rockhopper). As such, Rockhopper remains

fully funded through a combination of the $337 million Development

Carry and simplified $750 million loan from Premier.

Tax settlement with Falkland Island Government

Rockhopper has agreed binding documentation with the Falkland

Island Government ("FIG") in relation to the tax arising from the

Company's 2012 farm-out to Premier.

The Tax Settlement Deed confirms the quantum and deferment of

the outstanding tax liability and reflects the principles agreed

between Rockhopper and FIG in December 2013 and is made under

Falkland Islands Extra Statutory Concession 16. The highlights of

which include:

-- Outstanding tax liability confirmed at GBP64.4 million

(approximately $95.7 million) and payable on the first royalty

payment date on Sea Lion (or earlier subject to certain events)

-- First royalty payment date anticipated to occur within six

months of first oil production which itself is estimated to occur

in late 2019 (assuming Sea Lion project sanction in mid 2016)

-- Outstanding tax liability amount may be revised downwards if

the Falkland Islands' Commissioner of Taxation is satisfied that

either (i) the Exploration Carry from Premier is used to fund

exploration activities in the Falkland Island license areas; or

(ii) any element of the Development Carry from Premier becomes

"irrecoverable"

-- Rockhopper provides certain "creditor protection"

undertakings to FIG while the tax liability remains outstanding

including (i) restriction on dividends or distributions; (ii)

granting of first ranking security over Rockhopper assets; and

(iii) while such security is in place, restrictions, subject to

conventional carve outs, on granting further security

-- Intention that at the point Rockhopper is able to secure

senior debt for the Sea Lion project, the security provided to FIG

will be released and FIG will be provided with a standby letter of

credit to preserve its creditor position

Under the amended commercial arrangements with Premier,

Rockhopper intend to access the full $48 million of Exploration

Carry during the 2015 drilling campaign. In the event that the full

Exploration Carry is utilised, under the terms of the Tax

Settlement Deed we expect the outstanding tax liability to reduce

by up to GBP4.7 million (approximately $7.0 million).

Further details of the Tax Settlement Deed

Quantum

-- Total Tax Liability agreed at GBP90.3 million with GBP26.0

million already paid by Rockhopper resulting in a Outstanding Tax

Liability of GBP64.4 million (figures subject to rounding)

-- Outstanding Tax Liability intended to be binding and final,

subject to the satisfaction of the Falkland Islands' Commissioner

of Taxation as to the following:

o If as anticipated the Exploration Carry is used to fund

exploration work or appraisal work in the Falkland Island licences,

Rockhopper will be entitled to make a deduction from the

computation of the Outstanding Tax Liability

o If any part of the Development Carry from Premier becomes

"irrecoverable", Rockhopper will be entitled to make an adjustment

to the Outstanding Tax Liability

Timing

-- Outstanding Tax Liability payable on the earlier of:

o First royalty payment date, which is expected to occur within

six months of the date of first oil (first oil anticipated in late

2019)

o The date on which Rockhopper disposes of all or a substantial

part of the Company's remaining interest in the Licences, or

otherwise realises value from the Licences

o A change of control of Rockhopper Exploration plc

Security and undertakings

-- Rockhopper to grant to FIG fixed and floating security over

all of its assets (with limited carve outs where such security

would conflict with applicable law or the terms of an existing

agreement)

-- While such security is in place, restrictions, subject to

conventional carve outs, on granting further security

-- Such security to be terminated upon earlier of:

o The Outstanding Tax Liability being paid

o Rockhopper procuring a standby letter of credit in an amount

equal to the full amount of the then outstanding Deferred Tax

Liability from a bank or other corporate entity

-- Rockhopper agrees to maintain a minimum 20% interest in licence PL032

-- Rockhopper undertakes not to make any dividends or

distributions while the tax liability remains outstanding (in whole

or in part)

As a result of the tax settlement, the tax liability will be

re-classified as a non-current liability in the Group's next

balance sheet and discounted.

Acquisition of Mediterranean Oil & Gas plc ("MOG")

The acquisition of MOG completed in August 2014. Through MOG,

Rockhopper acquired a portfolio of production, development and

exploration interests across Italy, Malta and France with a

combined 2C contingent resources of over 32 mmboe at an acquisition

price of less than $1 per barrel.

Under the terms of the agreement announced on 23 May 2014,

shareholders of MOG received 4.875 pence in cash and 0.0172 shares

of the company per MOG share.

The transaction has been accounted for by the purchase method of

accounting with an effective date of 11 August 2014 being the date

on which the group gained control of MOG. Information in respect of

the assets and liabilities acquired and the fair value allocation

to the MOG assets in accordance with the provisions of "IFRS3 -

Business Combinations" has been determined and is as follows:

Recognised values

on acquisition

$'000

------------------------------------ ------------------

Intangible exploration and

appraisal assets 30,288

------------------------------------ ------------------

Property, plant and equipment 15,663

------------------------------------ ------------------

Long term other receivables 625

------------------------------------ ------------------

Inventories 2,683

------------------------------------ ------------------

Trade and other receivables 4,634

------------------------------------ ------------------

Restricted cash 268

------------------------------------ ------------------

Trade and other payables (6,845)

------------------------------------ ------------------

Long-term provisions (23,872)

------------------------------------ ------------------

Net identifiable assets and

liabilities 23,444

------------------------------------ ------------------

Goodwill 12,074

------------------------------------ ------------------

Satisfied by:

------------------------------------ ------------------

Cash ($35,700,000 less $11,663,000

of cash acquired) 24,037

Equity instruments 7,481,816

ordinary shares 11,481

------------------------------------ ------------------

Total consideration 35,518

------------------------------------ ------------------

The fair value of equity instruments has been determined by

reference to the closing share price on the trading day immediately

prior to the completion of the acquisition.

Goodwill arises due to the difference between the fair value of

the net assets and the consideration transferred and relates to the

portfolio of exploration and appraisal assets, which together have

the optionality and potential to provide value in excess of this

fair value as well as the strategic premium associated with a

significant presence in a new region.

Since the acquisition date, MOG has contributed $1.9 million to

group revenues and added $4.4 million to the group loss. This

contribution to group loss includes depreciation and impairments.

The EBITDA of MOG since acquisition is actually a much smaller loss

of $0.5 million.

Impairment testing

Given recent declines in oil and gas prices, Rockhopper has

tested the carrying value of our assets for impairment. Carrying

values are compared to the fair value of the assets based on

discounted cash flow models.

With no cash flow generation from Sea Lion anticipated until

2019, the impact of the current low oil price environment on the

fair value calculations is limited as Rockhopper has maintained its

longer-term oil price assumption on the basis of the current oil

futures market. As such, no impairment arises on the Group's Sea

Lion project.

A modest impairment of $1.5 million has been recognised on the

Mediterranean portfolio acquired through MOG. The impairment

relates to the expected reduction in price realised from the sale

of gas as well as a small increase in expected capital costs and

revised production outlook for Guendalina.

Cash and cash movement

Rockhopper's cash resources at the year end are $200 million (31

March 2014: $247 million). The Group has no borrowings.

$m

------------------------------------- -----

Opening cash balance (1 April

2014) 247

------------------------------------- -----

MOG acquisition consideration

and costs (26)

------------------------------------- -----

NFB exploration and pre-development

spend (10)

------------------------------------- -----

Admin and miscellaneous expenses (11)

------------------------------------- -----

Closing cash balance (31 December

2014) 200

------------------------------------- -----

Outlook

With $200 million of cash on our balance sheet, Rockhopper is

well positioned to fund its share of expenditure on the North

Falkland exploration campaign and Sea Lion pre-sanction costs,

which are estimated at $25 million and $28 million respectively

during 2015. Capital expenditure on the Mediterranean portfolio is

estimated at approximately $10 million primarily related to the

side-track well on Guendalina and the completion of the Civita

onshore gas development, both of which are expected to be completed

during Q4 2015 and have a positive impact on the group's revenue

and cash flow generation going forward.

As a result of the tax settlement, Rockhopper now has much

greater certainty in respect of both the quantum and timing of the

tax liability. The security arrangements and undertakings agreed

provide credit protection to FIG while preserving Rockhopper's

strong balance sheet and ability to obtain senior debt for the Sea

Lion development on a cost effective basis.

As we progress towards the award of the FEED contract during Q2

2015 and now that we have the certainty of the tax settlement in

place, our ability to progress discussions with external debt

providers (as an alternative to the standby loan from Premier) for

our uncarried portion of Sea Lion development costs is

significantly enhanced.

Stewart MacDonald

Chief Financial Officer

8 April 2015

Group income statement

for the nine months ended 31 December 2014

Nine months

ended Year

ended

31 December 31 March

2014 2014

$'000 $'000

-------------------------------------------- ------------ ---------

Revenue 1,910 -

Other cost of sales (554) -

Depreciation and impairment of oil and (3,416) -

gas assets

Total cost of sales (3,970) -

-------------------------------------------- ------------ ---------

Gross profit (2,060) -

Exploration and evaluation expenses (1,782) (1,461)

Administrative expenses (10,033) (12,341)

Charge for share based payments (672) (797)

Foreign exchange movement 6,516 (2,631)

--------------------------------------------- ------------ ---------

Results from operating activities (8,031) (17,230)

Finance income 657 1,499

Finance expense (209) -

-------------------------------------------- ------------ ---------

Loss before tax (7,583) (15,731)

Tax (5) (62,542)

--------------------------------------------- ------------ ---------

Loss for the year attributable to the

equity shareholders of the parent company (7,588) (78,273)

--------------------------------------------- ------------ ---------

Loss per share: cents (basic & diluted) (2.63) (27.54)

--------------------------------------------- ------------ ---------

All operating income and operating gains and losses relate to

continuing activities.

Group statement of comprehensive income

for the nine months ended 31 December 2014

Nine months

ended Year

ended

31 December 31 March

2014 2014

$'000 $'000

------------------------------------------- ------------ ---------

Loss for the period

Items that may be reclassified to profit

and loss (7,588) (78,273)

Exchange differences on translation (4,217) -

of foreign operations

------------------------------------------- ------------ ---------

Total comprehensive loss for the period (11,805) (78,273)

------------------------------------------- ------------ ---------

Group balance sheet

as at 31 December 2014

31 December 31 March

2014 2014

$'000 $'000

----------------------------------------- ------------ ----------

Non-current assets

Exploration and evaluation assets 204,164 153,656

Property, plant and equipment 12,146 353

Goodwill 10,940 -

Other receivables 566 -

Current assets

Inventories 2,188 -

Other receivables 4,681 1,932

Restricted cash 1,384 309

Term deposits 100,000 185,000

Cash and cash equivalents 99,726 62,482

------------------------------------------ ------------ ----------

Total assets 435,795 403,732

------------------------------------------ ------------ ----------

Current liabilities

Other payables 19,358 3,084

Tax payable 100,439 107,056

Non-current liabilities

Provisions 21,816 -

Deferred tax liability 39,144 39,137

------------------------------------------ ------------ ----------

Total liabilities 180,757 149,277

------------------------------------------ ------------ ----------

Equity

Share capital 4,854 4,711

Share premium 662 170

Share based remuneration 4,960 4,597

Own shares held in trust (628) (354)

Merger reserve 11,112 (243)

Foreign currency translation reserve (4,217) 4,123

Special reserve 536,976 541,964

Retained losses (298,681) (300,513)

------------------------------------------ ------------ ----------

Attributable to the equity shareholders

of the company 255,038 254,455

------------------------------------------ ------------ ----------

Total liabilities and equity 435,795 403,732

------------------------------------------ ------------ ----------

These financial statements were approved by the directors and

authorised for issue on 8 April 2015 and are signed on their behalf

by:

Stewart MacDonald

Chief Financial Officer

Group statement of changes in equity

for the nine months ended 31 December 2014

Foreign

currency

Share Share Share Shares Merger translation Special Retained Total

based held

capital premium remuneration in reserve reserve reserve losses equity

trust

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance

at 31 March

2013 4,710 578,754 3,999 (212) (243) 4,123 - (259,234) 331,897

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Total

comprehensive

loss for

the year - - - - - - - (78,273) (78,273)

Share based

payments - - 797 - - - - - 797

Share issues

in relation

to SIP 1 175 - (142) - - - - 34

Cancellation

of share

premium

account - (578,759) - - - - 541,964 36,795 -

Exercise

of SARs - - (199) - - - - 199 -

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance

at 31 March

2014 4,711 170 4,597 (354) (243) 4,123 541,964 (300,513) 254,455

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Total

comprehensive

loss for

the period - - - - - (4,217) - (7,588) (11,805)

Acquisition

of subsidiary 127 - - - 11,355 - - - 11,482

Share based

payments - - 672 - - - - - 672

Share issues

in relation

to SIP 1 77 - (49) - - - - 29

Exercise

of share

options 15 415 (309) - - - - 309 430

Purchase

of own shares - - - (225) - - - - (225)

Other

transfers - - - - - (4,123) (4,988) 9,111 -

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Balance

at 31

December

2014 4,854 662 4,960 (628) 11,112 (4,217) 536,976 (298,681) 255,038

--------------- -------- ---------- ------------- ------- -------- ------------ -------- ---------- ---------

Group cash flow statement

for the nine months ended 31 December 2014

Nine months

ended Year

ended

31 December 31 March

2014 2014

$'000 $'000

--------------------------------------------- ------------ ----------

Cash flows from operating activities

Net loss before tax (7,583) (15,731)

Adjustments to reconcile net profits/losses

to cash utilised:

Depreciation 2,186 282

Impairment on property, plant and 1,465 -

equipment

Share based payment charge 672 797

Exploration impairment expenses 258 2

Loss on disposal of tangible fixed

assets 3 13

Finance expense 208 -

Interest (470) (1,003)

Foreign exchange (6,349) 2,672

---------------------------------------------- ------------ ----------

Operating cash flows before movements

in working capital (9,610) (12,968)

Changes in:

Inventories 495 -

Other receivables 1,682 (325)

Payables (3,812) 459

Movement on other provisions 8 -

--------------------------------------------- ------------ ----------

Cash utilised by operating activities (11,237) (12,834)

---------------------------------------------- ------------ ----------

Cash flows from investing activities

Capitalised expenditure on exploration

and evaluation assets (10,150) (2,485)

Purchase of equipment (1,111) (65)

Acquisition of subsidiary, net of (24,037) -

cash acquired

Proceeds on disposal of exploration

and evaluation assets - 665

Interest 673 955

Taxation - (40,382)

Investing cash flows before movements

in capital balances (34,625) (41,312)

Changes in:

Restricted cash (953) -

Term deposits 85,000 (104,623)

Cash flow by investing activities 49,422 (145,935)

---------------------------------------------- ------------ ----------

Cash flows from financing activities

Share options exercised 430 -

Share incentive plan 29 34

Purchase of own shares (225) -

Finance expense (20) -

--------------------------------------------- ------------ ----------

Cash flow from financing activities 214 34

---------------------------------------------- ------------ ----------

Currency translation differences relating

to cash and cash equivalents (1,155) 3,853

Net cash flow 38,399 (158,735)

Cash and cash equivalents brought forward 62,482 217,364

---------------------------------------------- ------------ ----------

Cash and cash equivalents carried forward 99,726 62,482

---------------------------------------------- ------------ ----------

The financial information set out above does not constitute the

group's statutory accounts for the nine months ended 31 December

2014 or the year ended 31 March 2014, but is derived from those

accounts. Statutory accounts for 31 December 2014 will be available

towards the end of April 2015. The auditors have reported on those

accounts: their report was unqualified and did not draw attention

to any matters by way of emphasis.

Note regarding Rockhopper oil and gas disclosure

This announcement has been approved by Rockhopper's geological

staff who include Fiona MacAulay (Chief Operating Officer), who is

a Fellow of the Geological Society of London and a Member of the

Petroleum Exploration Society of Great Britain and American

Association of Petroleum Geologists with over 25 years of

experience in petroleum exploration and management, and who is the

qualified person as defined in the Guidance Note for Mining, Oil

and Gas Companies issued by the London Stock Exchange in respect of

AIM companies. In compiling its resource estimates, Rockhopper has

used the definitions and guidelines as set forth in the 2007

Petroleum Resources Management System approved by the Society of

Petroleum Engineers.

Glossary

All hydrocarbon volumes quoted are Rockhopper Management initial

estimates and in the case of oil volumes utilise a 30% RF on STOIIP

volumes. Gas volumes converted at 5.6 bcf = 1 mmboe

bcf : billions of standard cubic feet

GIIP : Gas Initially in Place

mmbbls : millions of barrels of oil

Pmean : average (mean) probability of occurrence

Prospective resource : the resource estimated to exist in

prospect areas considered viable to drill, but which have not yet

been proven by drilling

RF : Recovery Factor

STOIIP : Stock Tank Oil Initially In Place

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UWUKRVNASRAR

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Mar 2024 to Apr 2024

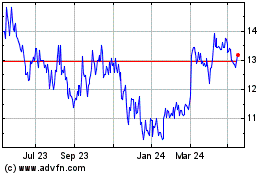

Rockhopper Exploration (LSE:RKH)

Historical Stock Chart

From Apr 2023 to Apr 2024