Urban Logistics REIT PLC GBP22m of Acquisitions and Rent Collection Update (5910U)

April 07 2021 - 1:00AM

UK Regulatory

TIDMSHED

RNS Number : 5910U

Urban Logistics REIT PLC

07 April 2021

Urban Logistics REIT plc

("Urban Logistics" or the "Company")

GBP22 Million of Acquisitions and Rent Collection Update

Urban Logistics, (AIM: SHED) the specialist UK logistics REIT,

announces the acquisition of two assets for a total consideration

of GBP21.7 million at a 6.14% NIY.

Richard Moffitt, Chief Executive, commented:

"We are delighted to announce the acquisition of these

high-quality assets in Warrington and Edinburgh which are well

positioned to deliver essential goods that "last mile" to customers

and businesses in two important local markets. In line with our

strategic focus of value enhancement, both assets offer asset

management opportunities in the short to medium term given the low

passing rents."

The Acquisitions

Warrington

On 6 April 2021, the Company acquired a well-specified and

recently refurbished 110,859 sq ft distribution unit for GBP8.5

million at a 6.05% NIY. It is let to Mark Thompson Transport, part

of Kinaxia Logistics, for a term of 10 years through to 2030. The

rent is GBP4.94 per sq ft and there is an open market rent review

in 2025. This asset is close to the arterial M6/M56

interchange.

Edinburgh

The Company has exchanged contracts on an asset in Milton Link,

Edinburgh. The 7-acre site comprises a 75,478 sq ft warehouse,

which trades as 'The Range', and a 'drive-through' of 1,845 sq ft

let to Costa Coffee. The asset is to be purchased for GBP13.2

million at a 6.2% NIY and is located 5km east of Edinburgh city

centre. The rent for the warehouse is GBP10.51 per sq ft and is let

through to 2033 with 5 yearly rent reviews. The 'drive-through'

rent is GBP40.65 per sq ft and the building is let through to 2034.

This asset has reversionary long-term income and asset management

potential.

Rent Collection Update

The Company has received 99% of rent due for the quarter to

June. The remaining 1% is expected to be collected imminently.

M1 Agency Fees

The Company has incurred, on an arm's length and commercial

basis, property agency fees from M1 Agency LLP of GBP85,000 for the

Warrington acquisition. M1 Agency LLP is a partnership in which

Richard Moffitt is a designated member. In accordance with Rule 16

of the AIM Rules, fees payable in respect of the acquisition have

been aggregated with all fees paid to M1 Agency LLP since 1 March,

being the date of the Company's last related party disclosure and

associated fairness opinion, in respect of M1 Agency LLP. These

aggregated fees total GBP511,000 and are considered a related party

transaction for the purposes of the AIM Rules.

The independent Directors, having consulted with N+1 Singer

Advisory LLP, consider the terms of the related party transaction

fair and reasonable insofar as the Company's shareholders are

concerned.

- Ends -

For further information contact:

Urban Logistics REIT plc

Richard Moffitt +44 (0)20 7591 1600

Buchanan +44 (0)20 7466 5000

Helen Tarbet +44 (0) 7872 604453

Henry Wilson +44 (0) 7788 528143

George Beale +44 (0) 7450 295099

---------------------

N+1 Singer - Nominated Adviser and Broker

James Maxwell / James Moat (Corporate

Finance)

Alan Geeves / James Waterlow / Sam Greatrex

(Sales) +44 (0)20 7496 3000

---------------------

Panmure Gordon (UK) Limited - Joint Broker

Chloe Ponsonby (Corporate Broking)

Emma Earl (Corporate Finance) +44 (0)20 7886 2500

---------------------

About Urban Logistics REIT

Urban Logistics REIT plc is a property investment company,

quoted on the AIM market of the London Stock Exchange, (AIM:

SHED).

The Company has been established to invest in UK-based logistics

properties with the objective of generating attractive dividends

and capital returns for its shareholders. Its investment strategy

focuses on strategically located smaller single let properties

servicing high-quality tenants. Investment returns will be

generated by an experienced management team focusing on quality

stock selection and active asset management.

A number of structural and commercial factors currently support

the attractive opportunity in the last mile/regional industrial and

logistics real estate sub-sectors targeted by the Company,

including: strong occupier demand, (driven by the growth of

e-commerce and investment by retailers in their associated supply

chain) and a decline in the supply of smaller sized lettable space

in industrial and logistics real estate across the UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCMZGGDLVNGMZM

(END) Dow Jones Newswires

April 07, 2021 02:00 ET (06:00 GMT)

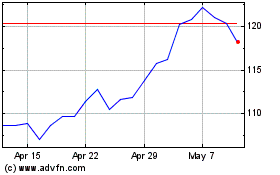

Urban Logistics Reit (LSE:SHED)

Historical Stock Chart

From Mar 2024 to Apr 2024

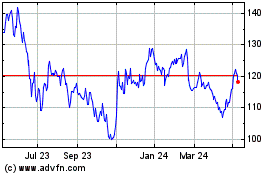

Urban Logistics Reit (LSE:SHED)

Historical Stock Chart

From Apr 2023 to Apr 2024