TIDMSIV

RNS Number : 9205X

Sivota PLC

28 April 2023

Sivota Plc

Annual Report and Financial Statements

For the year ended 31 December 2022

1

Sivota Plc

Table of Contents

Company Information 2

Chief Executive Officer report 3

Strategic report 6

Directors' report 18

Directors' remuneration report 31

Report of the Independent Auditors 37

Consolidated Statement of Comprehensive

Income 43

Consolidated Statement of Financial Position 44

Parent Statement of Financial Position 45

Consolidated Statement of Changes in Shareholders'

Equity 46

Parent Statement of Changes in Shareholders'

Equity 48

Consolidated Statement of Cash Flows 50

Parent Statement of Cash Flows 52

Notes to the Financial Statements 54

2

Sivota Plc

Company Information

For the year ended 31 December 2022

Directors Registered Office

Tim Weller - Non-Executive Chairman New London House,

Ziv Ben-Barouch - CEO 172 Drury Lane

Neil Jones - Non-Executive Director, London, England

Secretary WCB 5QR

Auditors Register

Crowe UK LLP Computershare Investor

55 Ludgate Hill Services PLC

London, England The Pavilions

EC4M 7JW Bridgwater Rd

Bristol

BS13 8AE

Financial Adviser & Broker

Canaccord Genuity Limited

88 Wood Street

London, England

EC2V 7QR

3

Sivota Plc

Chief Executive Officer's report for the year ended 31 December

2022

Dear Shareholders,

I am pleased to present the annual report of Sivota Plc for the

year ended 31 December 2022.

Sivota was established to acquire controlling interests in a

diverse range of businesses operating or founded in Israel, with a

focus on across the technology sector.

In May 2022, the Company successfully completed its first major

transaction with the acquisition of a majority stake in Apester, an

innovative Israeli business that provides digital experience

software platforms to brands, publishers, and creators to enable

them to publish and monetise interactive digital experiences on

their sites and apps.

The acquisition agreement provided the Company with preferred

seed shares in Apester's capital for a total price of $12.0

million, representing 57.5% of the company's voting rights. In

addition, the Company entered into convertible loan assignment

agreements with lenders to Apester, resulting in an assignment of

$1.7 million in convertible loans, including accrued interest. The

preferred seed shares resulting from this conversion represent

approximately 7.1% of Apester's share capital.

The cash consideration for the acquisition was funded through a

gross placing and direct subscription of 11,500,000 new ordinary

shares of Sivota at one pence each, totalling $14.2 million. In

September 2022, the Company successfully completed its readmission

to the London Stock Exchange.

Since the acquisition, the Company has been active implementing

various strategic and operational changes within Apester. This

includes appointing a new CEO, board members and key executives.

These changes reflect the Company's commitment to driving growth

and enhancing value for its stakeholders.

Additionally, Apester has achieved several significant

operational developments including the appointment of a new Chief

Technology Officer to lead its technology strategy, ensuring it

remains at the forefront of the industry.

In line with its growth strategy, Apester has signed a

cooperation agreement with iDigital, a leading media agency in

Brazil, to drive expansion in the Brazilian media market. In

addition, Apester has signed several agreements with prominent US

and UK publishers, which are set to launch in the first half of

2023.

Furthermore, Apester has completed integration with Permutive, a

privacy-safe infrastructure that helps publishers and advertisers

reach their target audiences. This integration represents a

critical step in leveraging Apester's data capabilities, in keeping

with the market trend of collecting and

4

Sivota Plc

Chief Executive Officer's report for the year ended 31 December

2022

utilising 1st party data as a substitute for 3rd party platform

cookies, such as Google and iOs. Lastly, Apester completed a

collaboration with global publisher ReedPop's ENGAGE platform, to

leverage Apester's unique data capabilities for first-party

data.

Financially, Apester has demonstrated strong progress in Q4

2022. Apester's revenues have grown while losses have been reduced,

as management closed deals with new customers and improved the

optimisation of yields on its media assets. These positive results

are a testament to the effectiveness and focus of the new

management team and their strategic plan. Moving forward into 2023,

we anticipate continued progress and expansion in Apester's

business.

Moreover, Sivota remains well-positioned to capitalise on new

and attractive investment opportunities within the Israeli tech

marketplace. Although, we remain cognisant of the heightened risk

in tech markets in general and the Company's target market.

I would like to extend my gratitude to the board, management,

and Apester's team for their diligent efforts, as well as to our

shareholders for their ongoing trust and support. We remain

committed to delivering value and growth, and I look forward to

providing you with further updates on our progress in the coming

year.

Ziv Ben-Barouch,

Chief Executive Officer

28 April 2023

5

Sivota Plc

Strategic report for the year ended 31 December 2022

The Directors present the Strategic Report of Sivota ("the

Company") for the year ended 31 December 2022.

The Group's business strategy and execution

Israeli Technology

Israel boasts one of the most entrepreneurial and multi-cultural

workforces in the world, producing technologies, innovations, and

research adopted around the globe and across various sectors. Its

competitive edge is due to its informal, but effective,

get-down-to-business culture, exceptional ingenuity and

entrepreneurial spirit. Recent decades have witnessed a flourishing

of Israeli hi-tech that is expressed by the widespread activity of

multinational corporations, innovative start-up companies, and

Israeli growth companies.

Israel is well-known for being the source of many modern

innovations that now characterise daily life across the world, such

as instant messaging, firewalls, disk-on-keys and innovations in

such fields as agriculture, digital health, fintech, and

cybersecurity. Israel came in 7th on Bloomberg's list of the

World's Most Innovative Countries for 2021, ahead of the US (10th

place).

In 2019 Israel was ranked 1st in venture capital investments per

capita with over $410 raised, followed by the US, with $282 ([i]) .

The high percentage of capital from foreign investors (estimated at

85%) indicates the power of the local market and its excellent

reputation. Furthermore, investor interest in later rounds and in

later-stage companies is becoming more and more prominent as the

risks associated with such companies (as opposed to start-up

entities) are generally considered to be more ascertainable.

Israel's high-tech funding in 2022 amounted to $15 billion

invested across 663 deals ([ii]) .

6

Sivota Plc

Strategic report for the year ended 31 December 2022

The source -

https://www.ivc-online.com/LinkClick.aspx?fileticket=H1_uQBYFEkg%3d&portalid=0×tamp=1673356983470

Foreign investment into the Israeli technology sector

Israeli tech companies have raised $74 billion since 2015 with

the majority of that capital (73%) deployed by foreign investors.

In 2022, foreign investors invested in Israeli tech companies a

total of $10.9 billion, 74% of the total raised funds.

The majority of these non-Israeli financial investors are

predominantly from the United States who, in leveraging

well-established US-Israeli connections, have made numerous

investments into the Israeli technology market, with a considerable

degree of success. However, European/UK investors have had less

exposure and have not necessarily had the right connections to

participate in this segment to this date.

The Company seeks to bridge that gap by using the experience,

connections and local knowhow of the Directors, in particular that

of the CEO.

7

Sivota Plc

Strategic report for the year ended 31 December 2022

The source -

https://www.ivc-online.com/LinkClick.aspx?fileticket=H1_uQBYFEkg%3d&portalid=0×tamp=1673356983470

Market Opportunities

The large number of innovative, later stage, tech companies

present in Israel offers foreign investors a broad selection of

investment opportunities. In addition, there may be opportunities

to acquire controlling stakes in companies that have not taken

advantage of technology that could help transition a traditional

business model to drive further growth. In particular, the

Directors believe that sectors such as logistics, retail and

finance which predominantly remain offline businesses in Israel

could produce potential target companies which could greatly

benefit from Sivota's approach and ability to introduce them to

potential technology solutions.

There may also be opportunities to acquire a controlling

interest in non-Israeli founded or related companies that are

seeking to benefit from the technology solutions that Sivota may be

able to offer. The Directors will consider such opportunities on a

case-by-case basis and Investors should note that the Company may

therefore acquire controlling stakes in businesses which are not

non-Israeli founded or related.

8

Sivota Plc

Strategic report for the year ended 31 December 2022

The Company believes there will be an opportunity to invest in

businesses that have stalled in a challenging financial situation,

however, that under new leadership and strategic plan can rebuild

their valuation. The Directors also expect to see an increase in

M&A activities, mainly by companies looking to acquire

competitors to increase their market share, create economies of

scale or add new products and services to their existing

offerings.

It is considered by the Board that the new landscape created by

the COVID-19 pandemic and followed by the war in Ukraine will

create a number of investment opportunities.

Acquisition Targets, Sourcing and Execution

Sivota, through the Directors, has a strong local presence and a

significant business network in Israel. The Company believes these

networks, relationships, and partnerships are all essential for

identifying future investments and developing a robust investment

pipeline.

The Company looks to acquire companies with strong fundamentals

that the Directors believe will reward Investors over time. The

general investment strategy is to acquire controlling stakes in

underperforming, later stage Israeli-related technology companies

to ensure fast, ambitious and sustainable scale. The Directors

intend to function as a key partner to the target companies during

both the acquisition process, and in the implementation of the

growth plan post-acquisition.

Although the Company evaluates a range of technology companies,

a particular areas of focus is in relation to companies already

involved in data (artificial intelligence, machine learning, Big

Data), digital marketing, and eCommerce.

The Directors believe that they have a competitive advantage in

the Israeli market, both in terms of deal flow and the ability to

overcome the culture gap which foreign investors can face while

working with Israeli founders and management teams.

Sivota's strategy is to seek investment opportunities in

companies which have most, if not all, of the following

attributes:

-- later stage of growth;

-- organic and/or external growth potential;

-- unique technology;

-- Israeli-related/founded companies;

-- international exposure/potential; and

-- target opportunities where management execution and a focused

strategy will deliver significant valuation uplift.

9

Sivota Plc

Strategic report for the year ended 31 December 2022

Turning around an underperforming company and regaining the

trust of every stakeholder is a job that requires decisive action.

In order to achieve this, Sivota will roll out a methodology based

on enhanced transparency and involvement within each target

company. Sivota starts with the preparation of an objective and

uncompromising diagnostic plan (which will be capable of being

amended from time to time to take into account any changing

circumstances). This strategic, operational and financial

diagnostic is the basis of the turnaround plan, which sets the

goals and changes required to be executed in order to achieve these

goals.

Any company in which Sivota acquires controlling stakes will

regularly communicate the progress of its turnaround to all its

stakeholders.

In putting the diagnostic plan into practice, Sivota seeks

to:

-- build a growth plan with the Company's management to leverage

opportunity, securing the financing of investments

-- communicate the strategy, plan and its progress on a regular and clear basis

-- be thorough with its analysis and due diligence, and present

a pragmatic approach to the implementation

-- implement the plan with transparency including engaging in

discussions with employee representatives

-- help to grow the organisational culture through leadership

The Directors all have hands-on operational as well as

investment and M&A experience in various jurisdictions, having

worked for small and medium-sized businesses, both as managers and

as owners. The management team has therefore experienced the

financial and operational issues frequently encountered by

companies, and knows where to go and how to find, clear unbiased

advice for specific business needs.

10

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

Strategy execution during 2022

In May 2022, Sivota has completed its first acquisition, being a

majority stake 57.5% in Apester Ltd, a digital marketing engagement

platform. Since the acquisition, Sivota has been implementing

strategic and operational changes within Apester.

Apester's strategy

Overview

Apester is an innovative digital experience software platform

that enables brands, publishers and e-commerce businesses to create

and distribute interactive digital experiences and collect the

resultant first party data to better understand their customers and

accelerate their business performance.

Apester provides enterprises with interactive engagement with

customers. Apester's software platform enables a number of

engagement tools, including customer surveys, mobile dynamic

landing pages, onboarding forms, interactive videos, stories, polls

and quizzes. Apester allows publishers and brands to create an

authentic, visual, interactive experience to engage with their

customers.

Apester's technology optimises customer experiences and

applications to ensure compatibility with a number of digital media

platforms, allowing customers to publish engaging experiences and

distribute them across multiple digital assets in a consistent

format.

Apester's platform also includes a Data Management layer that

allows customers to collect, store and 'own' Zero-Party and

First-Party engagement data generated from experiences and

applications created by Apester. AI-driven analytics deliver

valuable insight into customer segmentations - trends, sentiments

and preferences, empowering brands and publishers to personalise

their offering, target their messaging, and convert engagement into

sales.

Apester's customers include businesses such as NBC, Kicker, RTL,

NME and Reedpop.

Market positioning

Apester's consolidated, all-inclusive, digital engagement

platform provides a genuine 'one-stop shop' for brands and

publishers supporting mobile and desktop on web and social

platforms carries its offering with a streamlined creation,

distribution and analysis benefiting its customers with community

engagement growth and audience segmentation at a granular level

with the information provided by actual users' indications and

actions.

11

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

Customers who have implemented Apester's engagement solutions

either on desktop or mobile reported significantly improved

engagement of their users, measured through multiple KPIs such as

time on site, click-through rate (CTR), registrations, deposits and

more.

Apester believes that its platform has a competitive

technological advantage. Apester's DMP allows its customers to

collect, store and 'own' Zero-Party and First-Party engagement data

which is generated from experiences and applications created on

Apester. This gives Apester's customers ' valuable insights into

customer segmentations such as trends, sentiment and preferences,

empowering brands and publishers to engage audiences in scale with

a personalised offering, target their messaging, and convert

engagement into sales.

In summary, the Company believes that Apester's platform is a

simple, cost-effective and scalable technology, built for the next

phase of digital business. Code free, it allows untrained users to

create interactive experiences in a matter of minutes through

Apester Studio. This personalised content can then be distributed

across multiple digital media channels, at scale and through a

single cloud-based, self-serve platform, and later gather data and

analyse to improve performance.

Revenue Model

Apester operates a blended SaaS and Performance revenue model

based on subscription fees, usage, self-serve and pre-packaged

models. Apester also operates revenue share models allowing Apester

to grow with its top-tier publishers, applying its own media

management and yield optimisation capabilities.

Market overview

Apester operates within the digital experience platform market,

which is expected to grow at a CAGR of c. 13.4% [iii] per annum to

reach $43 billion by 2028. Apester aims to increase its market

share and therefore has the potential to deliver very high growth

rates from the $9.1 million of revenue generated in 2022.

The COVID-19 pandemic has undoubtedly accelerated digital

transformation globally, and the digital experience market is no

exception. Online businesses continue to seek out tools that

improve their customer experience whilst increasing engagement and

delivering meaningful ROI. In addition, with greater emphasis on

consumer privacy and the growing momentum for greater

12

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

levels of compliance, the Company believes that Apester's

ability to generate First-Party data has never been more critical

in the marketplace.

The promise of data

In the post-cookie era, where 3rd party data is less available,

the advertising world will have to find a new source for reliable

targeting and personalisation. Enter First-party data that puts

publishers and App owners back in control. IAB reports that around

50% of the 3rd party signal fidelity is lost, mainly on iOs but

also Android and Web platforms [iv] . This is a major driver for

Apester sales these days and it has announced key partnerships in

the data space recently.

Growth strategy

Online customer engagement is now a necessity for brands and

publishers in what is a highly crowded digital space. Generating

high-quality and sustained customer interaction across the customer

journey is central to driving performance and ensuring enterprises

remain competitive. Apester's end-to-end platform facilitates

conversational marketing, providing an open stream of communication

between customers and marketers that results in brand uplift and

higher conversion rates.

Apester's strategy is to focus on publishers and the e-commerce

sector, which is looking to engage its customers in a competitive

marketplace. Apester's platform enables businesses to better engage

with their audience simultaneously via different platforms,

creating an improved experience for customers. Apester's platform

further enables businesses to analyse engagement and performance

for business optimisation.

In order to accelerate growth in this sector, Apester plans to

invest in the following areas:

-- continued development of the platform so that it becomes the

leading first-party data platform, for collection and analysis of

customer insights and preferences in a compliant and regulated

manner;

-- focusing on publishers, brands and the performance marketing

sector, identifying businesses that could benefit from Apester's

engagement capabilities. Branded campaigns are a leading use case

for the platform as well as lead generation for online

businesses.

An important technological competitive advantage is Apester's

data layer which allows customers to collect, store, and 'own'

Zero-Party and First-Party engagement data generated from

13

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

experiences and applications created on Apester. This highly

benefits Apester's customers and offers valuable insights into

customer segmentations such as trends, sentiment and

preferences,

empowering brands and publishers to personalise their offering,

target their messaging, and convert engagement into sales.

Apester's data capabilities are a key competitive factor, allowing

customers to use publishers' own data without any reliance on

cookies, which is in accordance with the latest evolution of online

data collection methods and privacy regulations.

Apester plans to continue developing these capabilities to

integrate with complementary data collection tools and CRMs which

will provide customers a full suite of data and CRM capabilities

that will provide Apester's customers with tools for improving

their performance and enabling them to better interact with their

own customers.

Apester's strategy is to focus on the publishers and performance

marketing sectors, while enabling brands to run effective campaigns

on its platform. Apester's platform also enables e-commerce

businesses to better engage with their audience simultaneously via

different platforms, creating an improved experience for

customers.

Key performance indicators (KPIs)

At this stage in its development, the Group is focusing on

financing and operating KPI's.

Funding

In May 2022, the Company raised $14.2 million (gross) through

placing and direct subscription of 11,500,000 new ordinary shares

of Sivota of one pence each. In September 2022 the Company

completed its readmission to the London Stock Exchange.

Revenues and Expenditure

During the period from the Apester acquisition in May 2022 to 31

December 2022 the Group generated revenue of $5.9 million, with

gross profit of $1.6 million.

The Group had a loss before tax of $5.1 million for the year

ended December 2022, when Apester's financial results are included

from the date of its Acquisition.

Liquidity, cash and cash equivalents

At 31 December 2022 the Group had a cash balance of $4.4 million

and a debt of $1.4 million.

14

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

Apester

Apester's management team is mainly focusing on gross margin and

monthly EBITDA at this stage of its development.

Gross margin

Given the indirect operational expenses are relatively not

variable during short periods of time, the management uses gross

margin indicator to maximise the profitability of the Company.

EBITDA

The management regularly reviews the EBITDA of Apester with the

goal to minimise operating costs when possible and prudently manage

its cash resources.

Employees

With the exception of the Directors, the Group has 30

employees.

All current members of the Board, including the Chief Executive

Office, are key managers. For more information about the Company's

directors see the director's remuneration report and Note 10 to the

financial statements. For more information about key management

personnel other than directors of the Company see Note 11 to the

financial statements.

The average number of persons of each sex who were directors and

employees of the Group during the reported period:

Male Female Total

Directors of the Company 3 - 3

---- ------ -----

Other key management personnel, other than directors

of the Company 1 1 2

---- ------ -----

Other employees of the Group 13 15 28

---- ------ -----

Social, Community and Human Rights Issues

The Group is still at an early stage of development and further

consideration will need to be given to social, community and human

rights issues affecting its business.

15

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

Principal risks and uncertainties and risk management

The Group operates in an uncertain environment and is subject to

a number of risk factors. The Directors have carried out an

assessment of the principal risks facing the Group, including those

that threaten its business model, future performance, solvency or

liquidity.

The Group continues to monitor the principal risks and

uncertainties to ensure that any emerging risks are identified,

managed, and mitigated.

Keeping pace with technological developments

Apester's ability to attract new customers and increase revenue

from existing customers largely depends on its ability to enhance

and improve its existing solutions and introduce compelling new

technology products. The success of any enhancement to its

solutions depends on several factors, including timely completion

and delivery, competitive pricing, adequate quality testing,

integration with other technologies and the Apester platform, and

overall market acceptance. Apester seeks to mitigate this risk by

continuing to improve its solutions and products.

Concentration of key clients

Apester has significant contracts and relationships with a

number of key customers. Although the Company knows of no reason

why such contracts should be terminated or will not be renewed on

the same or more favorable terms, the Directors cannot guarantee

such relevant parties' commercial position or market conditions

will not alter their position. Should any of these contracts be

terminated or not be renewed, it could have a material adverse

effect on the financial position and future prospects of the Group.

Apester seeks to mitigate this risk by increasing the number of

customers.

Changes to the digital advertising landscape

Apester's current revenues are derived partly from revenue

sharing agreements for advertising space sold through its platform.

Such revenues are dependent on the worldwide demand and ask prices

for advertising, which are mainly controlled by large market

participants, such as search engines. If a search engine decides to

reduce its pricing or demand for advertising space is depressed,

this will adversely affect Apester's revenues.

Funding

Although the Directors have confidence in the future revenue

earning potential of the Group from its interests in Apester, there

can be no certainty that the Group will achieve or sustain

profitability or positive cash flow from its operating activities.

If Apester does not meet its targets the Group may not be able to

obtain additional external financing. The board regularly reviews

the revenues, KPIs and expenditures of Apester and continues to

prudently manage its cash resources and has minimised ongoing

operating costs.

16

Sivota Plc

Strategic report for the year ended 31 December 2022

(continued)

Additionally, if the Group intends to acquire further businesses

th e Company will likely need to raise further funds.

Difficulties in acquiring suitable targets

The Company's strategy and future success are dependent to a

significant extent on its ability to identify sufficient suitable

acquisition opportunities and to execute these transactions on

terms consistent with the Company's strategy. If the Company cannot

identify suitable acquisitions, or execute any such transactions

successfully, this will have an adverse effect on its financial and

operational performance.

Security, political and economic instability in Israel and the

Middle East

Apester is incorporated under the laws of the State of Israel,

and its principal offices and research and development facilities

are located in Israel. In addition, Sivota seeks additional target

companies based in Israel. Therefore, security, political and

economic conditions in the Middle East, particularly in Israel, may

affect Group's business directly.

Taxation

The Group will be subject to taxation in several different

jurisdictions, and adverse changes to the taxation laws of such

jurisdictions could have an adverse effect on its

profitability.

Tim Weller

Non-Executive Chairman

28 April 2023

17

Sivota Plc

Directors' report for the year ended 31 December 2022

The Directors submit their report with the audited Financial

Statements for the year ended 31 December 2022.

General information

Sivota ("the Company"), was incorporated as a public Limited

Company under the laws of England and Wales with registered number

12897590 on 22 September 2020.

Sivota was established in order to acquire controlling stakes

and then act as a holding company for various target businesses

operating or founded in Israel, predominantly in the technology

sector

In July 2021 the Company completed a placing of 1,085,000

ordinary shares for a consideration of a $1.4 million (gross) and

was listed on the Main Market (Standard Segment) of the LSE.

In May 2022 the Company completed the Acquisition of a majority

stake in Apester, an Israeli-incorporated business which operates

an innovative digital experience software platform that enables

brands, publishers and creators to publish and monetise new

interactive digital experiences on their sites and apps.

In May 2022 the Company completed the fundraising by placing and

direct subscription of 11,500,000 of its new ordinary shares for a

consideration of $14.2 million (gross).

In September 2022 the Company completed its readmission to the

London Stock Exchange.

Since Apester's acquisition, the Company has been implementing a

number of strategic and operational changes within Apester,

including the appointment of a new CEO, new board members and key

executives. The directors believe the new management team will lead

the business to fully exploit a number of near-term growth

initiatives.

The Company continues to seek additional investment

opportunities. The directors believe with the border macroeconomic

environment weakening, seed investment will become harder to

source, creating more opportunities for the Company's team.

Results for the year and distributions

The Group results are set out in the Statement of Comprehensive

Income.

Since the completion of the Acquisition in May 2022, the Group

generated revenues of $5.9 million, with a gross profit of $1.6

million.

18

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

The total comprehensive loss for the year 2022 was $5.1 million,

including Apester's loss from the completion of the Acquisition in

May 2022.

The Board regularly reviews the revenues, KPIs and expenditures

of the Group and continues to prudently manage its cash resources

and to minimise its ongoing operating costs.

The Company paid no distribution or dividends during the

period.

The Board of Directors

Active directors:

The Directors who held office during the financial year and to

the reporting date, together with details of their interest in the

shares of the Company at the reporting date were:

Number of Ordinary Percentage

Shares of Ordinary

shares

------------------- ------------

Tim Weller - Non-Executive Chairman 400,000 3.18%

Ziv Ben-Barouch - CEO 531,396 4.22%

Neil Jones - Non-Executive Director 17,100 0.14%

Tim Weller - Non-Executive Chairman

Tim Weller is a successful entrepreneur. He is the founder of

Incisive Media and was Chairman until its successful sale to

EagleTree Private Equity in March 2022. He successfully floated

Incisive on the Main Market of the London Stock Exchange in 2000.

In 2006 he led the GBP275 million management buyout which took the

company private again. Tim has more than 15 years' experience

chairing and investing in public and private equity backed

businesses. He was Non-Executive Director and Chairman of RDF Media

from 2005-2010 and was also Non-Executive Chairman of Polestar from

2009-2011 until its sale to Sun European Partners LLP. Tim was

Independent Non-Executive Director and Chairman of Tremor

International between 2014 and August 2020. He was Chairman of TI

Media, one of the largest consumer magazine and digital publishers

in the UK from April 2019 to May 2020 following its sale to Future

Plc. He is also Chairman of Trustpilot, a leading provider of

trusted company reviews and led its $1.4 billion IPO in March 2021.

Tim was Chairman of Superawesome, a leading technology company that

powers the global kids' digital media ecosystem until its sale to

Epic Games in September 2020. Mr Weller was a member of the Shadow

Cabinet New Enterprise Council, which advised the then Shadow

Chancellor of the Exchequer, George Osborne, on business and

enterprise prior to the 2010 General Election, and was voted Ernst

& Young

19

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

Entrepreneur of the Year - London in 2001. In 2005, he received

the publishing industry's top honour - the Marcus Morris award.

Ziv Ben-Barouch - CEO

Ziv Ben-Barouch is an experienced operator and leader with

decades of experience in finance and investments within technology

companies. He has a proven track record of leading corporate

turnarounds, M&A, IPOs, and strategically guiding companies as

they build their business. Ziv is the co-founder and managing

partner of Pereg Ventures, a US-Israeli Venture Capital Firm

focused on B2B data companies which is backed by investments from

Nielsen, a world leader in marketing intelligence, the Tata Group,

and other leading financial institutions. At Pereg, Ziv has led and

participated in the direct investment of 13 early stage technology

companies that have raised in combined excess of $250M in follow-on

investments from leading investors and led on the disposal of two

portfolio companies to NYSE listed counterparties. Prior to

founding Pereg, he was Senior Principal and CFO at Viola, a

technology-focused investment group with over $3 billion in assets

under management. Before joining Viola, Ziv was the CFO of SpaceNet

Inc, a specialty telecommunications company providing managed

network solutions by satellite and terrestrial technologies for

business, government and residential users in North America. He led

SpaceNet's turnaround and participated in SpaceNet's parent

company's $70 million NASDAQ listing. Ziv has key relationships

with Israeli and international investment firms in the technology

space which he will be able to leverage to assist Sivota. Ziv is an

Israeli Certified Public Accountant.

Neil Jones - Non-Executive Director

Neil has held Board positions in UK multi-national public &

private companies for over 20 years. He has a deep understanding of

the UK Corporate Governance code and Board procedures from these

and other NED positions. He is currently Group Corporate

Development Director at Inizio an international healthcare and

communications group formed by the combination of Huntsworth PLC

and UDG PLC both of which were taken private by Private Equity

Group Clayton, Dubilier & Rice in 2020 & 2021, having

previously held the position of COO & CFO at Huntsworth since

February 2016. Prior to Huntsworth he was CFO of ITE Group plc (Now

Hyve plc), a FTSE listed international organiser of exhibitions and

conferences and before that he was Group Finance Director of Tarsus

Group plc, another international trade exhibition organiser. He is

also the Senior Independent Director of Tremor International, a

dual listed (Nasdaq & AIM) Ad-Tech company. Neil is a member of

the ICAEW, qualifying with PWC in 1990.

20

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

Policy for new appointments and amendments to articles

Without prejudice to the power of the Company to appoint any

person to be a Director pursuant to the Articles the Board shall

have power at any time to appoint any person who is willing to act

as a Director, either to fill a vacancy or as an addition to the

existing Board, but the total number of Directors shall not exceed

any maximum number fixed in accordance with the Articles. Pursuant

to the Companies Act 2006, the Company may amend its Articles of

Association via special resolution, achieved by way of a vote at a

General Meeting of the shareholders.

Share capital and substantial shareholders

The issued share capital of the Company consists of 12,585,000

ordinary shares and 4,950,000 deferred shares. The ordinary shares

carry one vote per ordinary share and each ordinary share carries

an equal right to dividends declared on the ordinary shares. The

ordinary shares have equal voting rights and rank pari-passu for

the distribution of dividends and repayment of capital. The

deferred shares carry no voting rights, no rights to dividends and

on a return of capital are only entitled to a return once a sum of

GBP1,000,000 has been paid on each ordinary share. Further details

of the Company's share capital are given in Note 18 to the

financial statements

As far as the Company is aware, there are no agreements between

holders of securities that may restrict the transfer of securities

or voting rights however the Board may, in its absolute discretion,

refuse to register any transfer of a share in certificated form

only in certain circumstances which do not prohibit the transfer of

a single class of share which is fully paid up.

No single person directly or indirectly, individually or

collectively, exercises control over the Company and the Company

has not issued any class of share carrying special rights regarding

control of the Company.

21

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

The Directors are aware of the following persons, who had an

interest in 3% or more of the issued ordinary share capital of the

Company as at 28 April 2023:

Percentage

Number of Ordinary of ordinary

Shareholder Shares shares

Prytek Investment Holdings

Pte Ltd 1,787,950 14.21%

------------------ ------------

Ophir Yahalom 1,670,020 13.27%

------------------ ------------

Ronen Kirsh 1,418,728 11.27%

------------------ ------------

Schroders Investment Management

Ltd 1,247,750 9.91%

------------------ ------------

Trico Fuchs Ltd 1,213,392 9.64%

------------------ ------------

Ehud Levy 1,023,167 8.13%

------------------ ------------

Hagai Tal 606,207 4.82%

------------------ ------------

Ziv Ben-Barouch 531,396 4.22%

------------------ ------------

Herald Investment Management 500,000 3.97%

------------------ ------------

Tim Weller 400,000 3.18%

------------------ ------------

Financial risk management

The Group's principal financial instruments comprise mainly

cash, trade receivables, trade and other payables and convertible

loans. It is, and has been throughout the year under review, the

Group's policy that no trading in financial instruments shall be

undertaken. The main risks arising from the Group's financial

instruments are credit risk, liquidity risk and foreign exchange

risk. The board reviews and agrees on policies for managing each of

these risks and they are summarised below.

Credit risk

The Group usually extends 30-60-day term to its customers. The

Group regularly monitors the credit extended to its customers and

their general financial condition but does not require collateral

as security for these receivables. Given the payment history of the

Group's customers, the risk is not material.

22

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

Liquidity risk

Prudent liquidity risk management implies maintaining sufficient

cash reserves to fund the Group's operating activities. Management

prepares and monitors forecasts of the Group's cash flows and cash

balances monthly and ensures the Group maintains sufficient liquid

funds to meet its expected future liabilities.

Foreign exchange risk

The Group operates in a number of overseas jurisdictions and

carries out transactions in a number of currencies. Part of the

Group's revenues is received in GBP, EURO and in New Israeli

Shekels ("NIS"). A significant portion of the Group's expenses is

paid NIS and GBP. Therefore, the Group is exposed to fluctuations

in the foreign exchange rates in USD against the GBP, EURO and NIS.

The Group does not have a policy of using hedging instruments but

will continue to keep this under review. The Group operates foreign

currency bank accounts to help mitigate the foreign currency

risk.

Section 172(1) Statement - Promotion of the Company for the

benefit of the members as a whole

The Board believes they have acted in a way most likely to

promote the success of the Company for the benefit of its members

as a whole, as required by section 172.

This section serves as the Company's section 172 statement and

should be read in conjunction with the Strategic report and the

Directors' report. Section 172 of the Companies Act 2006 requires

Directors to act in a way that they consider, in good faith, would

most likely promote the success of the Company for the benefit of

its members as a whole, taking into account the factors listed in

s172 in regard to:

-- the likely consequences of any decision in the long term;

-- the interests of the Company's employees;

-- the need to foster the Company's business relationships with suppliers, customers and others;

-- the impact of the Company's operations on the community and the environment;

-- the desirability of the Company's maintaining a reputation

for high standards of business conduct; and

-- the need to act fairly between members of the Company.

The following table acts as Sivota's 172(1) statement by setting

out the key stakeholder groups, their interests and how the Company

has engaged with them over the reporting period:

23

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

Stakeholder Their interest Engagement method

Investors * Business sustainability * Annual and Interim reports

* High standard of governance * Regular operations and trading updates

* Comprehensive review of financial performance of the * RNS Announcements

business

* Investor relations section on website

* Ethical behaviour

* AGM

* Awareness of long term strategy and direction

* Shareholder circulars

* Continual approval of market perception of the

business

* Shareholder liaison through board which encourages

open dialogue with the Company's investors

* Delivering long term value

* Board encourages open dialogue with the Company's

investors

* Social media

----------------------------------------------------------------- ---------------------------------------------------------------------

Regulatory * Compliance with regulations * Annual report

bodies

* Worker pay and conditions * Website

* Health & Safety * Direct contact with regulators

* Insurance * Compliance update at board meetings

* Regular communications with relevant governments

----------------------------------------------------------------- ---------------------------------------------------------------------

Responsibility statement

The Directors are responsible for preparing the Directors'

Report and the Financial Statements in accordance with applicable

law and regulations. In addition, the Directors have elected to

prepare the Financial Statements in accordance with International

Financial Reporting Standards ("IFRSs") in conformity with the

requirements of the UK Companies Act 2006.

The Financial Statements are required to give a true and fair

view of the state of affairs of the Group and the profit or loss of

the Group for that period.

In preparing these Financial Statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

24

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

-- present information and make judgements that are reasonable,

prudent and provide relevant, comparable and understandable

information;

-- provide additional disclosures when compliance with the

specific requirements in IFRS is insufficient to enable users to

understand the impact of particulars transactions, other events and

conditions on the entity's financial position and financial

performance; and

-- make an assessment of the Group's ability to continue as a going concern.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group's

transactions and disclose with reasonable accuracy at any time the

financial position of the Group to enable them to ensure that the

financial statements comply with the requirements of the Companies

Act 2006. They have general responsibility for taking such steps as

are reasonably open to them to safeguard the assets of the Group

and to prevent and detect fraud and other irregularities.

The Directors are responsible for the maintenance and integrity

of the corporate and Financial Statements. Legislation governing

the preparation and dissemination of Financial Statements may

differ from one jurisdiction to another.

We confirm that to the best of our knowledge:

-- the Financial Statements, prepared in accordance with

International Accounting Standards in conformity with the

requirements of the UK Companies Act 2006, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Group for the period;

-- the Director's report includes a fair review of the

development and performance of the business and the position of the

Group, together with a description of the principal

risks and uncertainties that they face;

-- the annual report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the company's performance,

business model and strategy.

The Directors are responsible for maintaining the Group's

systems of controls and risk management in order to safeguard its

assets.

25

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

Corporate governance

The Board supports high standards of corporate governance. The

Group complies with the Quoted Companies Alliance Corporate

Governance Code (the "QCA Code").

The QCA Code applies the key elements of good corporate

governance in a manner that is consistent with the different needs

of growing companies and therefore is suitable to the Group's

current status.

The Group is still at an early stage of development and is in

the process of developing its systems, strategy and standards to

permit the Group to comply with the QCA Code.

Subject to the Companies Act 2006, the Company's Articles and to

any directions given by special resolution of the Company, the

business of the Company will be managed by the Board, which may

exercise all the powers of the Company, whether relating to the

management of the business or not. No alteration of the Company's

Articles and no such direction given by the Company shall

invalidate any prior act of the Board which would have been valid

if such alteration had not been made or such direction had not been

given.

The Board meets regularly to review, formulate and approve the

Group's strategy, budgets, and corporate actions and oversee the

Group's progress toward its goals.

The Directors shall devote as much time as is necessary for the

proper performance of their duties.

The Chairman's main responsibility is the leadership and

management of the Board's business and its governance. The Chairman

meets regularly and separately with the CEO and the Directors to

discuss matters for the Board.

The Board established an Audit Committee and a Remuneration and

Nomination Committee with

effect from the Company's admission to trading on the Main

Market. In addition, the Board established an Acquisitions

Committee which will consider potential targets where a Director

has

a potential conflict and, following the completion of

readmission in September 2022 the Board established a risk

committee that monitors the financial and commercial performance of

investments.

Detail of Directors remuneration is given in the Directors'

remuneration report.

Audit Committee

The Audit Committee consists of Neil Jones and Tim Weller, each

of whom has recent and relevant financial experience. The Audit

Committee will normally meet at least twice a year at the

26

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

appropriate times in the reporting and audit cycle. The

committee has responsibility for, amongst other things, the

monitoring of the financial integrity of the financial statements

of the Group and

the involvement of the Group's auditors in that process. It will

focus in particular on compliance with accounting policies and

ensuring that an effective system of internal financial control is

maintained. The ultimate responsibility for reviewing and approving

the annual report and accounts and the half-yearly reports, remains

with the Board.

The terms of reference of the Audit Committee cover such issues

as membership and the frequency of meetings, as mentioned above,

together with requirements of any quorum for and the right to

attend meetings. The duties of the Audit Committee covered in the

terms of reference

are: financial reporting, internal controls, internal audit,

external audit and reserving. The terms of reference also set out

the authority of the committee to carry out its duties.

In addition, the Audit Committee considers the nature and extent

of the non-audit services provided by the auditors. During the

reported period the non-audit services were provided to support the

admission and readmission processes.

During the reporting period the Audit Committee held meetings on

28 June and 29 September 2022 which were chaired by Tim Weller and

were attended by all Directors.

Remuneration and Nomination Committee

The Remuneration and Nomination Committee consists of Tim Weller

and Neil Jones. The Remuneration and Nomination Committee will meet

at least once a year. It will have responsibility for the

determination of specific remuneration packages for executive

directors and any senior executives or managers of the Group,

including pension rights and any compensation payments,

recommending and monitoring the level and structure of remuneration

for senior management, and the implementation of share option, or

other performance-related, schemes. No remuneration consultants

provided advice or services about directors' remuneration during

the course of the latest reporting period.

The Remuneration and Nomination Committee will also be

responsible for considering and making recommendations to the Board

with respect of appointments to the Board, the board committees and

the chairmanship of the board committees. It is also responsible

for keeping the structure, size and composition of the Board under

regular review, taking into account the Company's commitment to

developing a diverse pipeline of directors and for making

recommendations to the Board with regard to any changes necessary.

The Remuneration and Nomination Committee also considers succession

planning, taking into account the skills and expertise that will be

needed on the Board in the future.

27

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

The terms of reference of the Remuneration and Nomination

Committee cover such issues as membership and frequency of

meetings, as mentioned above, together with the requirements for a

quorum and the right to attend meetings. The duties of the

Remuneration and Nomination Committee covered in the terms of

reference relate to the following: determining and monitoring

policy on and setting level of remuneration, early termination,

performance-related pay, pension arrangements, authorising claims

for expenses from the chief executive officer and chairman,

reporting and disclosure, share schemes and appointment of

remuneration consultants. The terms of reference also set out the

reporting responsibilities and the authority of the committee to

carry out its duties.

The first Remuneration and Nomination Committee meeting was held

in January 2023 and was attended by all Directors.

Acquisitions Committee

The Acquisitions Committee consists of all Independent

Directors, in the event of a potential acquisition target being

introduced to the Group by a Director where that Director has an

interest or other conflict of interest. In such circumstances, the

Acquisitions Committee will have a full remit to negotiate the

terms of such transaction (including engaging and liaising with

professional advisers) and the conflicted or interested Director

will not be invited to join or attend any meetings of the

committee. No committee meetings were held during the reporting

period.

Risk Committee

The Risk Committee consists of Tim Weller and Neil Jones. The

Risk meets at least once a year. It monitors Group compliance with

statutory obligations and its internal policies, and confirms that

the Group's management has appropriate controls in place to

identify, prepares for and implement legislative and regulatory

changes which affect its operations.

The Risk Committee also is responsible for reviewing the

significant identified risks (principal risks) of the Group and

ensuring that there is the risk management process in place that

measure, monitor, manage and mitigate the Group's principal risk

exposures.

During the reporting period the Risk Committee held a meeting on

19 December 2022 that was chaired by Tim Weller. The meeting was

attended by all Directors.

Role of the Board

The Board sets the Group's strategy, ensuring the necessary

resources are in place to achieve the agreed priorities. It is

accountable to shareholders for the creation and delivery of

long-term

28

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

shareholder value. To achieve this, the Board directs and

monitors the Group's affairs within a framework of control which

enables risk to be reviewed and managed effectively.

Board meetings

The core activities of the Board are carried out in scheduled

meetings and regular reviews of the business are conducted.

Additional meetings and conference calls are arranged to consider

matters which would require discussions outside of scheduled

meetings. The Directors maintain frequent contact with each other

to discuss issues of concern and keep them fully briefed to the

Group's operations. All Directors attended all Board meetings held

during the reported period except for one meeting.

Directors' indemnities

To the extent permitted by law and the Articles, the Company has

made qualifying third-party indemnity provisions for the benefit of

its directors during the year, which remain in force at the date of

this report.

Employee and greenhouse gas (GHG) emissions

The Company currently has no trade or employees located in the

UK. Therefore, the Company has minimal carbon or greenhouse gas

emissions as it is not practical to obtain emissions data at this

stage. It does not have responsibility for any emissions producing

sources under the Companies Act 2006.

Climate-related financial disclosures

The Group does not trade or has no employees located in UK and

its sole executive director is not located in the UK. The Company

therefore not made any disclosures consistent with TCFD

recommendations and recommended disclosures.

Going forward, as the Company grows and if starts or acquires

operations in the UK, it will take steps and develop plans to

enable the Directors to make consistent disclosures in the future,

which will include relevant timeframes for being able to make those

disclosers.

The Company is headquartered in the UK, which has made a

commitment to reaching a net-zero economy. The Company has not

considered that commitment in developing a transition plan because,

as the Company does not trade in the UK nor has any employees

located in the UK, it does not contribute any carbon emissions to

the economy. The Company's main operating subsidiary, Apester, is

based in Israel, which has also made a commitment to reaching a

net-zero economy. The Company has not considered that commitment in

developing a transition plan in Israel as Apester's carbon

emissions are minimal.

29

Sivota Plc

Directors' report for the year ended 31 December 2022

(continued)

Going concern

The Group has raised finance during the year, to fund the

acquisition of Apester and the Group's working capital management.

The Group projects that it will need to raise further debt or

equity finance to fund the planned development. Group is expected

to further generate losses from operations during 2023 which will

be expressed in negative cash flows from operating activity. Hence

the continuation of Group's operations depends on raising the

required financing resources or reaching profitability, which are

not guaranteed at this point. Whilst the directors are confident

they will be able to realise the additional finance required, this

is not guaranteed and hence there is a material uncertainty in

respect of going concern. However, the directors have, at the time

of approving the financial statements, a reasonable expectation

that the Group will have adequate resources to continue in

operational existence for the foreseeable future, which is defined

as twelve months from the signing of this report. For this reason,

the directors continue to adopt the going-concern basis of

accounting in preparing the financial statements.

Internal auditors

The internal auditors of the Company are Chaikin Cohen Rubin

& Co, appointed by the Company in December 2022. The internal

auditors provide their audit based on an audit plan. Each year

specific topics will be identified by the Audit Committee for audit

during that year. Each report of the internal auditors will be

discussed by the Audit Committee and if necessary by the Board and

its results will be learned from and implemented as required.

External Auditors

So far as the directors are aware, there is no relevant audit

information of which the Group's auditors are unaware, and they

have taken all steps that they ought to have taken as directors in

order to make themselves aware of any relevant audit information

and to establish that the Group's auditors are aware of that

information.

The auditors, Crowe U.K. LLP, have expressed their willingness

to continue in office and a resolution to reappoint them will be

proposed at the Annual General Meeting.

By Order of the Board

Tim Weller, Chairman

28 April 2023

30

Sivota Plc

Directors' remuneration report for the year ended 31 December

2022

The Remuneration and Nomination Committee have responsibility

for the determination of specific remuneration packages for

executive directors.

The current directors' remuneration comprises a basic fee or

salary and at present there is no long-term incentive plan or share

option package for the directors.

Directors' remuneration

Neil Jones

According to the appointment letter signed on in July 2021, Neil

Jones agreed not to be paid any fees until the Company had

undertaken a fundraising of at least GBP8,000,000. Following the

completion of fundraising by the Company in May 2022 he is paid

GBP22,500 per annum to act as a non-executive director of the

Company.

According to the appointment letter, Neil will be eligible for

participation in the Company's share option plan when adopted.

In addition, Neil agreed to subscribe at 1.71% of the Company's

issued share capital at the admission in July 2021. These ordinary

shares will be subject to lock-in pursuant to which Neil will not

be able to sell or dispose of such ordinary shares for a period of

4 years.

Neil's appointment was for an initial period of 12 months from

admission and will continue unless terminated by either party

giving to the other not less than 3 months' notice or without

notice in cases the Company can terminate the appointment

immediately.

Tim Weller

According to the appointment letter signed in July 2021, Tim

Weller agreed not to be paid any fees until the Company had

undertaken a fundraising of at least GBP8,000,000. Following the

completion of fundraising by the Company in May 2022 he is paid

GBP70,000 per annum to act as a non-executive director of the

Company.

If the Company's market capitalisation exceeds GBP100,000,000

the Board will consider an increase in the fee.

According to the appointment letter, Tim will be eligible for

participation in the Company's share option plan when adopted.

In addition, Tim agreed to subscribe GBP100,000 for the

Company's issued share capital at the admission in July 2021.

31

Sivota Plc

Directors' remuneration report for the year ended 31 December

2021 (continued)

Tim's appointment will continue unless terminated by either

party giving to the other not less than 6 months' notice or without

notice in certain circumstances where the Company can terminate the

appointment immediately.

Ziv Ben-Barouch

According the employment agreement signed in July 2021 Ziv

Ben-Barouch was paid a salary of GBP18,000 per annum to act as

chief executive officer. Following the completion of fundraising by

the Company in May 2022 he is paid a salary of GBP70,000 per

annum.

The Company may, in its absolute discretion pay a bonus of such

amount, at such intervals and subject to such conditions as the

Company may in its absolute discretion determine taking into

account specific performance targets.

Ziv's appointment commenced on the admission in July 2021 and

shall continue until terminated by either party giving to the other

not less than 6 months' written notice or without notice in cases

the Company can terminate the appointment immediately.

Remuneration paid to the Directors:

For the period from incorporation

on

For the year ended 22 September 2020 to

31 December 2022 31 December 2021

--------------------------------- ---------------------------------------

Base Base Other(*) Base Base

fee Salary Total fee Salary Other(*) Total

---- ------- --------- ------- ----- --------- ----------- --------

in U.S dollars in thousands in U.S dollars in thousands

--------------------------------- ---------------------------------------

Tim Weller 54 - - 54 - - - -

Neil Jones 17 - - 17 - - - -

Ziv Ben-Barouch - 59 - 59 - 13 - 13

---- ------- --------- ------- ----- --------- ----------- --------

Total 71 59 - 130 - 13 - 13

==== ======= ========= ======= ===== ========= =========== ========

(*) there are no remunerations other than base fee or

salary.

There were no performance measures associated with any aspect of

Directors' remuneration during the year.

32

Sivota Plc

Directors' remuneration report for the year ended 31 December

2022 (continued)

Other matters

The Company currently does not have any annual or long-term

incentive schemes in place for any of the Directors and as such

there are no disclosures in this respect.

The Company does not have any pension plans for any of the

Directors and does not pay pension amounts in relation to their

remuneration.

The Company has not paid out any excess retirement benefits to

any Directors or past Directors. The Company has not paid any

compensation to past Directors.

The Company has not paid any payments for loss of office during

the year.

Directors' interests in shares as at 28 April 2023:

Number of Percentage

ordinary shares of ordinary

shares

Neil Jones 17,100 0.14%

---------------- ------------

Tim Weller 400,000 3.18%

---------------- ------------

Ziv Ben-Barouch 531,396 4.22%

---------------- ------------

The Company does not currently have in place any requirements or

guidelines for any directors to own shares.

The Company is not aware of any changes in the interests of each

director that have occurred between the end of the period of review

and the date of the AGM notice.

The Company is not aware of any disclosures made to the Company

in accordance with DTR 5.

33

Sivota Plc

Directors' remuneration report for the year ended 31 December

2022 (continued)

Total Shareholder Return

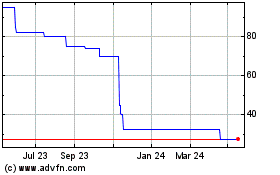

The table above illustrates the total return of Sivota

shareholders over the period from the first listening in July 2021

to 31 December 2022 compared to the FTSE 350, when Sivota's shares

were suspended from the trading at the London Stock Exchange as a

result of the readmission process that began in December 2021 and

was completed in September 2022.

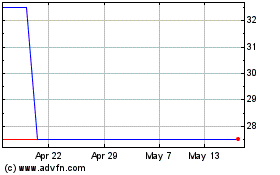

The table above illustrates the total return of Sivota

shareholders over the period from the readmission completed in

September 2022 to 31 December 2022 compared to the FTSE 350.

34

Sivota Plc

Directors' remuneration report for the year ended 31 December

2022 (continued)

Changes in the Company employees' remuneration

The changes in Director remuneration are reflected in the table

above. Neil Jones and Tim Weller did not receive a fee prior to the

completion by the Company of a fundraise of at least GBP8,000,000.

Following the completion of fundraise in May 2022 Neil Jones

receives fees of GBP22,500 per annum, and Tim Weller receives fees

of GBP70,000 per annum.

Similarly, the remuneration paid to the Chief Executive Officer,

Ziv Ben-Barouch increased in May 2022 following the completion of

the fundraising from GBP18,000 per annum to GBP70,000 per annum.

This represents an increase of 288.89%.

The remuneration of the CEO, being the only executive director

of the Company, for the year 2023 to which the Remuneration Policy

will apply, will be only his salary in accordance with his service

agreement. There will be no elements of such remuneration which are

subject to any performance measures and so the salary is fixed.

Below is a table summarising the main aspects of the

remuneration framework for the executive director:

Maximum potential Performance

Fixed element and purpose Operation salary/opportunity metrics

Base salary and related statutory cost

To provide a basic salary Salary is reviewed and not applicable not applicable

commensurate with role approved annually by the

and experience which is Company's Remuneration

comparable with that for Committee and the Shareholders.

similar companies of a

similar size. The quantum

of salary is also traded

off against the Company's

financial resources and

its ability to pay salary

for a sustainable period.

----------------------------------- ------------------------ ------------------

Pensions

----------------------------------- ------------------------ ------------------

The aim at present is to Paid to in accordance according to the not applicable

comply with current with local legislation. current legislation

legislation.

----------------------------------- ------------------------ ------------------

Incentives/bonuses

----------------------------------- ------------------------ ------------------

not applicable not applicable not applicable not applicable

----------------------------------- ------------------------ ------------------

Share option schemes

----------------------------------- ------------------------ ------------------

not applicable not applicable not applicable not applicable

----------------------------------- ------------------------ ------------------

35

Sivota Plc

Directors' remuneration report for the year ended 31 December

2022 (continued)

Since its incorporation, the Company has employed one employee,

other than the directors, whose employment began in March 2022.

There has been no change to this individual's remuneration during

the reporting period. However, the Company will ensure any

subsequent changes are reflected in ongoing annual reports.

Remuneration policy

The Remuneration Policy the main aspects of which set out below

will be put for approval to Shareholders at the Company's Annual

General Meeting to be held in 2023. The effective date of this

Policy is the date on which the Policy is approved by shareholders.

No remuneration or loss of office payment may be made to a director

unless they are consistent with the policy once approved by

Shareholders. Any loss of office payment will be made in accordance

with the existing letters of appointment or service contract.

The Remuneration Policy is designed to reflect remuneration

trends and employment conditions across the Company, to support the

Company's business strategy and to help the Company promote and

attain its objective of long-term success. No remuneration

consultants provided advice or services about the Remuneration

Policy and the Company did not consult with employees.

The Remuneration Committee intends the Remuneration Policy to

apply for one year and will undertake an annual review of the

policy to ensure the content continues to reflect the Company's

business strategy.

If the Company seeks to appoint further directors, it will seek

to align any remuneration package with the Company's growth aims

for the Group. The Company has no specific policy on the setting of

notice periods under directors' service contracts.

Shareholders' views have not been taken into account in relation

to the directors' remuneration policy, however as the Company and

its Group grow and any changes are required to the policy, the

Company will consider doing so.

By Order of the Board

Tim Weller

Chairman

28 April 2023

36

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF SIVOTA PLC

Opinion

We have audited the financial statements of Sivota Plc (the

"company") and its subsidiaries (the "group") for the year ended 31

December 2022 which comprise the consolidated statement of

comprehensive income, the consolidated and company statements of

financial position, the consolidated and company statements of

changes in equity, the consolidated and company statements of cash

flows and notes to the financial statements, including significant

accounting policies. The financial reporting framework that has

been applied in preparation of the group and parent company

financial statements is applicable law and UK-adopted international

accounting standards.

In our opinion:

-- the financial statements give a true and fair view of the

state of the group and company's affairs as at 31 December 2022 and

of the group's loss for the year then ended;

-- the group and company financial statements have been properly

prepared in accordance with UK-adopted international accounting

standards; and

-- the financial statements have been prepared in accordance

with the requirements of the Companies Act 2006.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the group

and the company in accordance with the ethical requirements that

are relevant to our audit of the financial statements in the UK,

including the FRC's Ethical Standard as applied to listed public

interest entities, and we have fulfilled our other ethical

responsibilities in accordance with these requirements. We believe

that the audit evidence we have obtained is sufficient and