TIDMSPX

RNS Number : 2933Y

Spirax-Sarco Engineering PLC

12 May 2021

News Release

Wednesday 12(th) May 2021

AGM TRADING UPDATE

Strong start to the year, improved outlook for 2021

Thermal energy management and niche pumping specialist,

Spirax--Sarco Engineering plc, issues the following trading update

in respect of the four months ended 30(th) April 2021.

Economic environment

As anticipated, the global macro-economic environment continued

to improve during the first quarter of the year. Compared with the

same period of 2020, global Industrial Production (IP)* expanded

7.4%, up from 6.1% forecasted at the time of our preliminary

results in March.

Trading

Organic sales growth in the four months to the end of April was

ahead of global IP. Watson-Marlow continued to experience

exceptional COVID-19 vaccine related demand from its customers in

the Pharmaceutical & Biotechnology sector. In the first four

months of the year, organic growth of Watson-Marlow's sales to the

Pharmaceutical & Biotechnology sector outperformed our

anticipated growth of 35% for 2021. Across the Group's other

revenue streams in Steam Specialties, Electric Thermal Solutions

and Watson-Marlow's Process Industries sectors, organic sales

growth was ahead of IP over the same period.

COVID-19 continues to disrupt global supply chains, leading to

escalation in raw material and freight costs, although both remain

within our expectations. During the first four months of the year,

we accelerated our revenue investments to support future organic

growth and trading margin expansion, although the increase in

expenditure lagged sales growth over the period. The Group

operating profit margin in the first four months of the year was

higher than previously anticipated for the full year 2021,

supported by the strong sales growth and higher operational

gearing.

Currency effects continued to have an adverse impact on sales

and operating profit, compared to the same period of 2020, as

sterling strengthened against our basket of trade currencies. We

continue to anticipate a headwind effect on full year sales and

profit of less than 4% and more than 4%, respectively.

Financial position

Our business remains highly cash generative and we maintain a

strong balance sheet. Excluding leases, our net borrowings at

30(th) April 2021 were GBP173 million, down from GBP229 million on

31(st) December 2020. The final dividend of 84.5p per share will be

paid on 21(st) May** with a cash impact of GBP62 million.

Outlook

The world is recovering faster than previously anticipated from

the adverse economic effects of the COVID-19 pandemic, supported by

sizeable fiscal stimulus packages. Macroeconomic forecasts have

improved consistently since the beginning of the year, with global

IP now forecasted to expand 8.5% in 2021, which compares to a

forecast of over 7% growth at the time of our preliminary results

in March. However, given the difficulties faced by many emerging

economies in implementing their vaccination plans and the continued

uncertainty surrounding the ability to resume normal international

trading activities, it is plausible that these forecasts could be

subject to revisions over the coming months.

We now anticipate Watson-Marlow's organic growth in sales to the

Pharmaceutical & Biotechnology sector will be over 55% in 2021

due to continuing strong COVID-19 related demand. This sector

accounted for over 55% of Watson-Marlow's sales in 2020. We

anticipate the Group's other revenue streams will deliver organic

sales growth in 2021 above the increased forecast for global IP

growth. Additionally, Electric Thermal Solutions ended 2020 with a

higher than-normal order book, which should add at least a further

GBP8 million to sales in the year.

We are accelerating capacity expansion initiatives in

Watson-Marlow and we continue to step-up our revenue investments,

with these increased expenditures weighted towards the second half

of the year. Taken together with higher sales growth and the impact

of operational gearing, we anticipate the full year drop-through

from the organic increase in sales to operating profit to be close

to 35%, which is above our previous guidance.

Spirax-Sarco Engineering plc expects to publish its 2021

half-year results on 11(th) August 2021.

Enquiries:

Nimesh Patel, Chief Financial Officer

Shaun Laubscher, Head of Investor Relations

Tel: 01242 535234

*Source for industrial production data: Oxford Economics, 26(th)

April 2021.

**Subject to shareholder approval

Note: Operating profit refers to adjusted operating profit and

organic performance measures are expressed at constant currency,

excluding contributions from acquisitions and disposals, as

explained in Note 2 to the Consolidated Financial Statements for

the period ended 31(st) December 2020.

About Spirax--Sarco Engineering plc

Spirax--Sarco Engineering plc is a thermal energy management and

niche pumping specialist. It comprises three world--leading

businesses: Steam Specialties, for the control and management of

steam; Electric Thermal Solutions, for advanced electrical process

heating and temperature management solutions; and Watson-Marlow,

for peristaltic pumping and associated fluid path technologies. The

Steam Specialties and Electric Thermal Solutions businesses provide

a broad range of fluid control and electrical process heating

products, engineered packages, site services and systems expertise

for a diverse range of industrial and institutional customers. Both

businesses help their end users to improve production efficiency,

meet their environmental sustainability targets, improve product

quality and enhance the safety of their operations. Watson--Marlow

Fluid Technology Group provides solutions for a wide variety of

demanding fluid path applications with highly accurate,

controllable and virtually maintenance-free pumps and associated

technologies.

The Group is headquartered in Cheltenham, UK, has strategically

located manufacturing plants around the world and employs over

7,900 people, of whom close to 1,900 are direct sales and service

engineers. Its shares have been listed on the London Stock Exchange

since 1959 (symbol: SPX) and it is a constituent of the FTSE 100

and the FTSE4Good indices.

Further information can be found at

www.spiraxsarcoengineering.com

RNS filter: Inside information prior to release

LEI 213800WFVZQMHOZP2W17

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBRGDUXXBDGBB

(END) Dow Jones Newswires

May 12, 2021 02:00 ET (06:00 GMT)

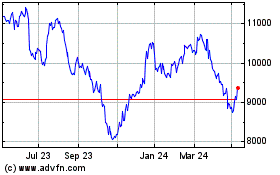

Spirax-sarco Engineering (LSE:SPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Spirax-sarco Engineering (LSE:SPX)

Historical Stock Chart

From Apr 2023 to Apr 2024